Global Mucopolysaccharidosis Market

Market Size in USD Billion

CAGR :

%

USD

2.47 Billion

USD

4.88 Billion

2024

2032

USD

2.47 Billion

USD

4.88 Billion

2024

2032

| 2025 –2032 | |

| USD 2.47 Billion | |

| USD 4.88 Billion | |

|

|

|

|

Mucopolysaccharidosis Market Size

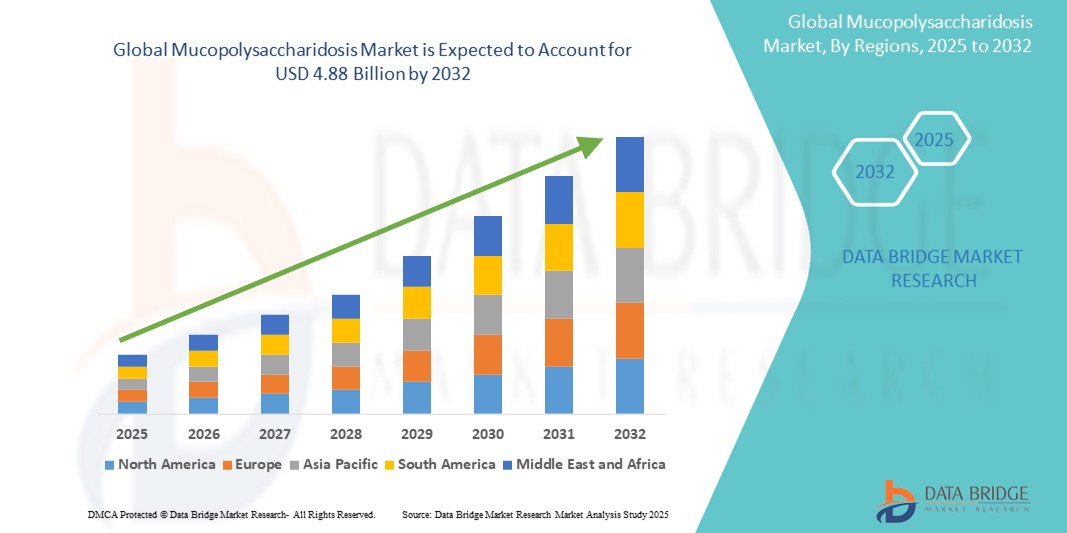

- The global mucopolysaccharidosis market size was valued at USD 2.47 billion in 2024 and is expected to reach USD 4.88 billion by 2032, at a CAGR of 8.90% during the forecast period

- The market growth is largely driven by increasing awareness, advancements in diagnostic techniques, and the introduction of novel enzyme replacement and gene therapies targeting rare genetic disorders

- Furthermore, supportive regulatory frameworks and growing investment in orphan drug development are establishing mucopolysaccharidosis treatment as a key focus in the rare disease therapeutics segment. These combined factors are accelerating research initiatives and access to treatment options, thereby significantly propelling the market’s expansion

Mucopolysaccharidosis Market Analysis

- Mucopolysaccharidosis (MPS), a group of rare lysosomal storage disorders caused by the absence or malfunctioning of specific enzymes, is gaining increasing attention due to advancements in diagnostics and therapeutic interventions, particularly in enzyme replacement therapies and gene-based approaches

- The escalating demand for effective MPS treatments is primarily fueled by increasing awareness among healthcare providers, enhanced newborn screening programs, and supportive government initiatives for orphan drug development

- North America dominated the mucopolysaccharidosis market with the largest revenue share of 39.2% in 2024, supported by well-established healthcare infrastructure, significant R&D investments, and favorable regulatory pathways, with the U.S. at the forefront owing to its proactive rare disease research ecosystem and availability of FDA-approved therapies

- Asia-Pacific is expected to be the fastest growing region in the mucopolysaccharidosis market during the forecast period due to expanding healthcare access, growing awareness, and rising investments in rare disease diagnostics and treatment

- The Mucopolysaccharidosis Type I, segment dominated the mucopolysaccharidosis market with a market share of 35% in 2024, driven by early disease identification, availability of specific enzyme replacement therapies, and focused clinical research on improving long-term patient outcomes

Report Scope and Mucopolysaccharidosis Market Segmentation

|

Attributes |

Mucopolysaccharidosis Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Mucopolysaccharidosis Market Trends

“Advancement in Enzyme Replacement and Gene Therapy Technologies”

- A significant and accelerating trend in the global mucopolysaccharidosis (MPS) market is the development and integration of next-generation enzyme replacement therapies (ERTs) and gene therapy solutions. These novel approaches aim to address the root cause of MPS, offering improved efficacy, longer-lasting benefits, and reduced treatment burden

- For instance, therapies such as Aldurazyme and Elaprase have set the foundation for ERTs, while clinical-stage gene therapies such as RGX-111 and ABO-102 are demonstrating promise in treating MPS subtypes with potential for durable, one-time treatments

- Gene therapy platforms targeting MPS I and MPS IIIA are now leveraging adeno-associated viral (AAV) vectors to enable targeted delivery of functional genes to central nervous system tissues, aiming to overcome the blood-brain barrier—a long-standing challenge in MPS treatment

- The use of advanced technologies in these therapies not only improves the bioavailability and half-life of enzymes but also expands treatment access to neurological symptoms, which were previously less responsive to conventional ERTs

- This evolution in treatment methodology is reshaping patient care, offering better disease management and potential long-term remission, particularly in pediatric cases.

- Companies such as Sangamo Therapeutics, REGENXBIO, and Lysogene are actively investing in these advanced therapeutics, indicating strong momentum in R&D efforts and partnerships. The ongoing clinical success and regulatory support for such innovations are driving robust growth in the MPS treatment landscape across global healthcare markets

Mucopolysaccharidosis Market Dynamics

Driver

“Rising Awareness, Early Diagnosis, and Orphan Drug Incentives”

- The Increasing global awareness of rare diseases, supported by early diagnostic initiatives and newborn screening programs, is significantly accelerating the identification and treatment of mucopolysaccharidosis disorders

- For instance, expanded newborn screening panels in regions such as North America and Europe are enabling earlier intervention, which is critical for slowing disease progression and improving long-term outcomes in MPS patients

- Regulatory agencies such as the U.S. FDA and EMA have prioritized rare diseases under orphan drug frameworks, offering incentives such as market exclusivity, tax credits, and faster approval timelines—thus motivating pharmaceutical companies to invest in MPS therapies

- Moreover, the rise in patient advocacy groups and non-profit organizations is facilitating access to care and increasing participation in clinical trials, thereby enhancing the commercial viability of MPS treatments

- As demand grows for targeted, personalized treatments in rare diseases, the MPS market is witnessing expanding clinical pipelines and global outreach programs, especially in high-income and urbanizing regions. These developments collectively underscore the market's growth trajectory

Restraint/Challenge

“High Treatment Costs and Limited Accessibility in Developing Regions”

- The high cost associated with enzyme replacement and gene therapies for MPS remains a significant barrier to widespread adoption, particularly in low- and middle-income countries where healthcare budgets are constrained

- For instance, annual treatment costs for approved therapies such as Naglazyme or Vimizim can exceed several hundred thousand dollars per patient, posing affordability and reimbursement challenges for healthcare systems and insurers

- In addition, the complex infrastructure required for administering ERTs or conducting gene therapy trials—such as specialized infusion centers and neurology support—limits access in regions lacking advanced medical facilities

- These disparities in availability and affordability hinder early diagnosis and continuous treatment, leading to unequal health outcomes across geographic regions

- To overcome these barriers, stakeholders are exploring innovative models such as global access programs, localized manufacturing, and public-private partnerships to improve affordability and reach. Addressing cost and infrastructure limitations will be essential to unlock the full potential of MPS treatments globally

Mucopolysaccharidosis Market Scope

The market is segmented on the basis of treatment, disease type, route of administration, and end user.

- By Treatment

On the basis of treatment, the mucopolysaccharidosis market is segmented into enzyme replacement therapy (ERT) and stem cell therapy. The enzyme replacement therapy segment dominated the market with the largest market revenue share in 2024, owing to the presence of several FDA- and EMA-approved therapies such as Aldurazyme (for MPS I), Elaprase (for MPS II), and Vimizim (for MPS IV A). These therapies have become the cornerstone of MPS management by supplementing deficient enzymes and slowing disease progression. The growing clinical success of ERTs, supported by strong reimbursement frameworks in developed markets, continues to drive their dominance.

The stem cell therapy segment is expected to witness the fastest growth rate from 2025 to 2032, driven by emerging clinical research and its potential to address both somatic and neurological symptoms of MPS. Hematopoietic stem cell transplantation (HSCT) is gaining attention in MPS I and MPS VII, especially for pediatric patients diagnosed early, where it can offer longer-term therapeutic benefits.

- By Disease Type

On the basis of disease type, the mucopolysaccharidosis market is segmented into Mucopolysaccharidosis Type I, Type II, Type IV A, Type VI, Type VII, and Others. Mucopolysaccharidosis Type I (MPS I) held the largest market share of 35% in 2024, driven by robust treatment availability, early screening inclusion, and the relatively higher prevalence of MPS I among diagnosed cases. Products such as Aldurazyme have provided a therapeutic benchmark in this segment, and the extensive clinical research pipeline for MPS I continues to reinforce its market leadership.

The MPS II segment is expected to witness the fastest growth rate from 2025 to 2032, due to rising global incidence rates, increasing awareness, and the availability of targeted ERTs such as Elaprase. In addition, advancements in newborn screening programs and disease-specific registries are contributing to more accurate diagnoses and timely treatment

- By Route Of Administration

On the basis of route of administration, the mucopolysaccharidosis market is segmented into intravenous (IV) and intracerebroventricular (ICV). The intravenous segment dominated the market in 2024, as most currently approved enzyme replacement therapies are administered via IV infusion, typically on a weekly or biweekly basis. The established infrastructure for IV administration in hospitals and specialty clinics supports broad accessibility and patient compliance.

The ICV segment is expected to grow at the fastest CAGR from 2025 to 2032, spurred by the development of therapies designed to bypass the blood-brain barrier and address central nervous system involvement in MPS. Early clinical studies have demonstrated the promise of ICV administration, particularly for MPS III and MPS II with neurological symptoms.

- By End User

On the basis of end user, the mucopolysaccharidosis market is segmented into hospitals, specialty clinics, and others. Hospitals accounted for the largest revenue share in 2024, due to their capacity to manage long-term infusion therapies and conduct complex genetic diagnostics. Hospitals also serve as primary centers for early diagnosis, especially in newborns and pediatric cases.

The specialty clinics segment is anticipated to witness the fastest growth during the forecast period as they offer tailored treatment plans, genetic counseling, and improved patient engagement for chronic rare diseases such as MPS. These clinics are increasingly equipped with facilities for advanced administration routes such as ICV and support participation in global clinical trials.

Mucopolysaccharidosis Market Regional Analysis

- North America dominated the mucopolysaccharidosis market with the largest revenue share of 39.2% in 2024, supported by well-established healthcare infrastructure, significant R&D investments, and favorable regulatory pathways, with the U.S. at the forefront owing to its proactive rare disease research ecosystem and availability of FDA-approved therapies

- The region benefits from favorable regulatory policies, including orphan drug designations by the U.S. FDA, which incentivize pharmaceutical companies to develop treatments for rare diseases such as MPS

- In addition, heightened awareness among healthcare professionals, comprehensive newborn screening programs, and the availability of disease-specific support networks contribute to early diagnosis and consistent treatment access, firmly positioning North America as the leading market for MPS therapies across both pediatric and adult populations

U.S. Mucopolysaccharidosis Market Insight

The U.S. mucopolysaccharidosis market captured the largest revenue share of 83% in 2024 within North America, driven by a robust healthcare infrastructure, early disease screening programs, and a strong focus on rare disease research. The presence of key biopharmaceutical companies and active clinical trials for advanced therapies—including gene and stem cell treatments—bolsters the market. In addition, the U.S. benefits from favorable regulatory incentives under the Orphan Drug Act, enabling faster approvals and encouraging investment in MPS treatment development.

Europe Mucopolysaccharidosis Market Insight

The Europe mucopolysaccharidosis market is projected to expand at a substantial CAGR throughout the forecast period, supported by the increasing inclusion of MPS disorders in newborn screening programs and the growing availability of enzyme replacement therapies. Regulatory support from the European Medicines Agency and strong public healthcare systems across the region are key growth drivers. European countries are also investing in cross-border rare disease networks to facilitate early diagnosis and treatment access across both pediatric and adult populations.

U.K. Mucopolysaccharidosis Market Insight

The U.K. mucopolysaccharidosis market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by government-backed rare disease frameworks and growing awareness among clinicians. The National Health Service (NHS) plays a critical role in delivering timely diagnoses and covering the high costs of orphan therapies. In addition, the increasing participation in global clinical trials and gene therapy research initiatives is positioning the U.K. as a significant contributor to innovation in the MPS landscape.

Germany Mucopolysaccharidosis Market Insight

The Germany mucopolysaccharidosis market is expected to expand at a considerable CAGR during the forecast period, driven by high healthcare spending, a strong biotech industry, and access to innovative therapies. Germany’s emphasis on early detection through genetic screening and its support for decentralized clinical trials are encouraging advancements in MPS treatment. Furthermore, collaborations between hospitals, research institutes, and pharmaceutical companies are enhancing access to cutting-edge therapies and personalized care pathways.

Asia-Pacific Mucopolysaccharidosis Market Insight

The Asia-Pacific mucopolysaccharidosis market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, due to increasing healthcare expenditure, rising awareness of rare diseases, and improving diagnostic capabilities in countries such as China, Japan, and India. Government initiatives aimed at rare disease management, alongside collaborations with international research bodies, are expanding access to therapies. Moreover, growing clinical trial activity and local manufacturing efforts are contributing to regional growth.

Japan Mucopolysaccharidosis Market Insight

The Japan mucopolysaccharidosis market is gaining momentum due to its advanced healthcare infrastructure, early adoption of diagnostic technologies, and prioritization of rare disease care under national health programs. The country’s well-established patient registries and supportive reimbursement policies enable timely access to enzyme and gene therapies. Continued investment in biopharma innovation and cross-sector collaboration are expected to sustain growth and improve long-term outcomes for MPS patients in Japan.

India Mucopolysaccharidosis Market Insight

The India mucopolysaccharidosis market accounted for the largest market revenue share in Asia-Pacific in 2024, owing to increasing awareness, growing healthcare investments, and the presence of government-led initiatives targeting rare diseases. As diagnostic services expand in urban centers, early identification of MPS disorders is becoming more feasible. In addition, partnerships between global biotech firms and domestic manufacturers are improving the affordability and accessibility of therapies, supporting broader market expansion across India’s diverse population.

Mucopolysaccharidosis Market Share

The Mucopolysaccharidosis industry is primarily led by well-established companies, including:

- BioMarin Pharmaceutical Inc. (U.S.)

- REGENXBIO Inc. (U.S.)

- Ultragenyx Pharmaceutical Inc. (U.S.)

- Sangamo Therapeutics, Inc. (U.S.)

- Orchard Therapeutics plc (U.K.)

- Denali Therapeutics Inc. (U.S.)

- Takeda Pharmaceutical Company Limited (Japan)

- Sanofi (France)

- ArmaGen Inc. (U.S.)

- Abeona Therapeutics Inc. (U.S.)

- JCR Pharmaceuticals Co., Ltd. (Japan)

- Chiesi Farmaceutici S.p.A. (Italy)

- Green Cross Corporation (South Korea)

- Avrobio, Inc. (U.S.)

- Esteve Pharmaceuticals S.A. (Spain)

- MedGenesis Therapeutix Inc. (Canada)

- uniQure N.V. (Netherlands)

- LG Chem Ltd. (South Korea)

- Evox Therapeutics Ltd. (U.K.)

- Idorsia Ltd (Switzerland)

What are the Recent Developments in Global Mucopolysaccharidosis Market?

- In April 2023, REGENXBIO Inc. announced promising interim data from its Phase I/II clinical trial evaluating RGX-111, an investigational gene therapy for Mucopolysaccharidosis Type I (MPS I). The therapy utilizes AAV9 vectors to deliver functional copies of the IDUA gene to the central nervous system, addressing neurological symptoms. This development reflects a growing shift toward durable, one-time treatments in the MPS space, offering new hope for patients with severe forms of the disorder

- In March 2023, Sangamo Therapeutics, Inc. advanced its investigational gene therapy ST-920 into clinical trials targeting MPS II (Hunter Syndrome). This AAV-based therapy aims to achieve sustained enzyme expression through liver-targeted gene transfer. The trial progression emphasizes Sangamo’s commitment to expanding the therapeutic frontier for lysosomal storage diseases using in vivo genome editing technologies

- In February 2023, Ultragenyx Pharmaceutical Inc. initiated the Phase I/II study of UX111, a gene therapy developed in partnership with Abeona Therapeutics for MPS IIIA (Sanfilippo Syndrome). UX111 is designed to address the underlying genetic cause by enabling long-term enzyme expression in the brain. This move reinforces Ultragenyx’s strategic focus on CNS-targeted therapies and innovation in rare disease treatment

- In January 2023, BioMarin Pharmaceutical Inc. reported long-term outcomes data for Aldurazyme (laronidase), demonstrating sustained benefits in MPS I patients over a 10-year period. The findings underscore the long-term value of enzyme replacement therapy in managing MPS symptoms and improving quality of life, solidifying BioMarin’s position as a pioneer in the MPS treatment landscape

- In January 2023, Orchard Therapeutics plc expanded its clinical development pipeline with investigational hematopoietic stem cell gene therapies for MPS disorders, including preclinical programs targeting MPS IIIA and IIIB. By leveraging its ex vivo gene therapy platform, Orchard is aiming to provide curative potential for severe, neurodegenerative forms of MPS, reflecting the industry's push toward transformative genetic treatments in rare disease therapy

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.