Global Motion Control Market

Market Size in USD Million

CAGR :

%

USD

885.72 Million

USD

1,070.77 Million

2024

2032

USD

885.72 Million

USD

1,070.77 Million

2024

2032

| 2025 –2032 | |

| USD 885.72 Million | |

| USD 1,070.77 Million | |

|

|

|

|

Motion Control Market Analysis

The motion control market is experiencing growth as industries focus on automation and precision. The rising demand for efficient and reliable systems drives the adoption of motion control solutions. Technological advancements, such as AI integration, are improving system performance and reliability. Industries such as manufacturing, robotics, and automotive are increasingly implementing these systems to streamline operations. These systems enable higher productivity, accuracy, and energy efficiency. With increasing reliance on automation, the market is expected to expand in the coming years. Furthermore, motion control solutions are becoming essential for achieving cost-effective and precise control across various applications.

Motion Control Market Size

The motion control market size was valued at USD 885.72 million in 2024 and is projected to reach USD 1070.77 million by 2032, with a CAGR of 2.40% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Motion Control Market Trends

“Rising Demand for Industrial Robots in Manufacturing”

The rising demand for industrial robots in manufacturing is a key trend in the motion control market. As automation becomes more prevalent, industries are seeking precision and efficiency in production. Industrial robots require advanced motion control systems for accurate movements and task execution. For instance, automotive manufacturers are increasingly using robotic arms for assembly and welding, improving productivity and reducing errors. This trend is further fueled by the need for cost reduction and enhanced operational efficiency. Consequently, motion control solutions, including motors, drives, and controllers, are experiencing high demand. The growing adoption of robotics is reshaping industries such as automotive, electronics, and packaging. This trend is expected to drive the motion control market's growth during the forecast period.

Report Scope and Motion Control Market Segmentation

|

Attributes |

Motion Control Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

ABB (Switzerland), PARKER HANNIFIN CORP (U.S.), Rockwell Automation, Inc. (U.S.), Schneider Electric (France), Siemens (Germany), FANUC (Japan), Yaskawa Electric Corporation (Japan), Mitsubishi Electric Corporation (Japan), Bosch Rexroth AG (Germany), General Electric (U.S.), MKS Instruments (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Motion Control Market Definition

A motion control system is a technology that directs and initiates the movement of machinery or loads to perform specific tasks. It ensures precise control over speed, position, and torque, making it essential for applications that require accurate movement and synchronization of separate components. These systems are typically composed of three primary components: a controller, a motor, and a drive or amplifier. The controller processes input commands, the motor generates the motion, and the drive amplifies the signals to control the motor's behaviour. Motion control systems are widely used in industries such as manufacturing, robotics, and material handling, where high precision and reliability are required. The systems enable smooth and efficient operation, increasing productivity while minimizing errors and downtime. As industries continue to prioritize automation, the demand for advanced motion control systems is expected to grow, making them a vital component in modern manufacturing processes.

Motion Control Market Dynamics

Drivers

- Rise in Safety-Driven Productivity Due to Stringent Regulations

The rise in safety-driven productivity due to stringent regulations is a key driver for the motion control market. Governments worldwide are implementing stricter safety standards, promoting workplace safety. Motion control systems help ensure precise, automated operations while minimizing human error. For instance, industries such as automotive and manufacturing increasingly use these systems to comply with safety laws. These systems provide reliable monitoring and control, improving operational safety and efficiency. The need for automation to meet safety regulations is boosting the adoption of motion control technologies. As safety requirements become more stringent, industries rely on motion control to enhance productivity without compromising safety. This trend is shaping the motion control market's growth and driving innovations in system designs.

- Increase in IIoT Integration with Motion Control Systems

The integration of IIoT with motion control systems is driving market growth as IIoT enables real-time data exchange, enhancing efficiency and control. Manufacturers are increasingly adopting this technology for smarter, automated operations. IIoT-powered motion control systems offer predictive maintenance, reducing downtime and improving overall productivity. The ability to monitor and optimize systems remotely adds significant value. For instance, the combination of IIoT and motion control improves precision in robotics, enhancing manufacturing processes. This integration supports faster decision-making and greater operational flexibility. As industries focus on digital transformation, the demand for IIoT-integrated systems continues to grow, further expanding the motion control market.

Opportunities

- Integration of Motion Control Systems with Human–Machine Interface

The integration of motion control systems with human-machine interfaces (HMIs) presents a significant opportunity in the market. HMIs allow operators to interact seamlessly with motion control systems, enhancing user experience and operational efficiency. By providing intuitive graphical interfaces, HMIs simplify system monitoring, control, and diagnostics. This integration allows for faster response times and improved accuracy in operations. For instance, manufacturers can adjust motion parameters in real-time, enhancing production efficiency. Additionally, HMIs provide real-time feedback, allowing operators to detect and address potential issues quickly. The growing adoption of automated processes in industries such as automotive and robotics further accelerates this opportunity, driving demand for integrated motion control solutions. The growing adoption of automated processes in industries such as automotive and robotics boosts this opportunity, fostering increased demand for integrated motion control solutions.

- Rise in the Research & Development Activities

The rise in research and development (R&D) activities presents significant opportunities for the motion control market. Increased R&D investments drive technological advancements in motion control systems. For instance, companies such as Siemens and FANUC are focusing on developing systems with improved precision and energy efficiency. These innovations help meet the growing demand for smarter, more efficient solutions across industries. In the automotive sector, advanced motion control systems enable precise robotic automation for assembly lines, improving productivity. Additionally, R&D is leading to the development of systems with enhanced integration capabilities. For instance, the integration of motion control with AI and IoT is enabling real-time data analysis, improving operational efficiency. These advancements are creating new opportunities for motion control systems to support industries in achieving higher productivity and lower operational costs.

Restraints/Challenges

- Increase in the Replacement & Maintenance Cost

The increase in replacement and maintenance costs poses a significant restraint for the motion control market. As motion control systems age, the cost of maintenance, repairs, and replacements increases over time. For instance, upgrading legacy systems to incorporate newer technologies such as AI and IoT can be costly. In addition, spare parts for specialized motion control components often come with high price tags, further escalating operational expenses. The need for regular maintenance to ensure the system’s precision and efficiency also adds to ongoing costs. These higher costs may deter some companies, particularly small and medium-sized businesses, from investing in advanced motion control systems. As a result, companies may face challenges in maintaining profitability and expanding their operations.

- Complexity of System Integration

The complexity of system integration poses a significant challenge in the motion control market. Integrating advanced motion control systems with existing machinery can be difficult. Compatibility issues often arise between new technologies and older infrastructure, requiring tailored solutions. For instance, integrating motion control systems with legacy equipment may need custom software or hardware adjustments. This integration process often requires specialized expertise, adding time and cost. Additionally, it can disrupt manufacturing operations, leading to delays. These challenges can discourage companies from adopting cutting-edge motion control systems, limiting market growth. Ensuring smooth integration requires continuous research and development to enhance compatibility and simplify integration efforts.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Motion Control Market Scope

The market is segmented on the basis of technology, components, application, and industry. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Technology

- Pneumatic

- Electromechanical Actuation

- Hydraulic

Components

- Controller

- Drives

- Motors

- Software

Application

- Inspection

- Material handling

- Packaging

Industry

- Manufacturing

- Healthcare

- Automotive

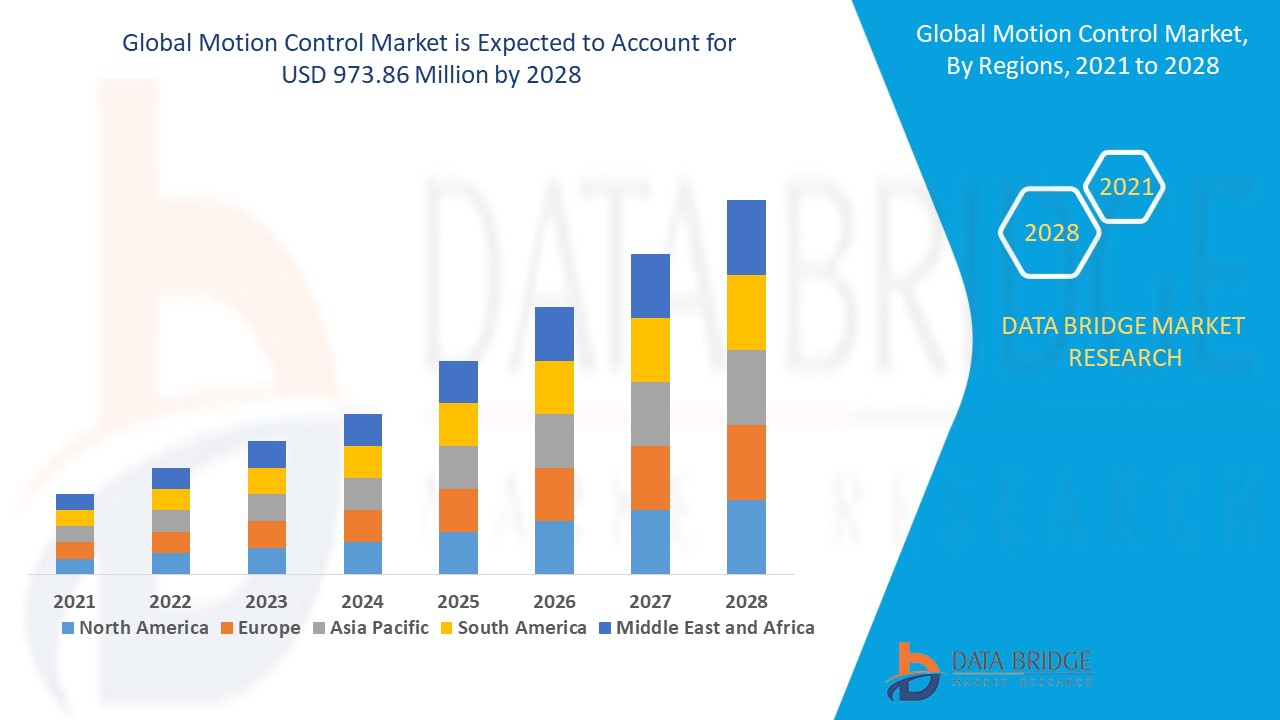

Motion Control Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, technology, components, application, and industry as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

Asia-Pacific region is expected to dominate the motion control market during the forecast period of 2025-2032 due to significant increases in safety-enabled productivity across industries. Stringent safety regulations imposed by governments in countries such as China, Japan, and South Korea have driven the adoption of motion control systems that ensure compliance with safety standards.

Europe is projected to witness significant growth in the motion control market during the forecast period of 2025-2032 driven by the increasing demand for industrial robots in manufacturing processes. Countries such as Germany and Italy are major contributors to this trend, where robotics and automation are being integrated into a wide array of industries, including automotive, electronics, and consumer goods. The growing need for advanced motion control systems to support industrial robots' performance further accelerates market growth in Europe.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Motion Control Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Motion Control Market Leaders Operating in the Market Are:

- ABB (Switzerland)

- PARKER HANNIFIN CORP (U.S.)

- Rockwell Automation, Inc. (U.S.)

- Schneider Electric (France)

- Siemens (Germany)

- FANUC (Japan)

- Yaskawa Electric Corporation (Japan)

- Mitsubishi Electric Corporation (Japan)

- Bosch Rexroth AG (Germany)

- General Electric (U.S.)

- PARKER HANNIFIN CORP (U.S.)

- MKS Instruments (U.S.)

Latest Developments in Motion Control Market

- In August 2023, Siemens launched its latest servo offering for the North American manufacturing industry. The new SINAMICS servosystem, which includes the SINAMICS drive and SIMOTICS S-1FL2 motor, is available with both flexible and standard cable options. This innovative offering is expected to enhance operational efficiency, streamline production processes, and drive growth in the motion control market by meeting the growing demand for more versatile and precise automation solutions

- In May 2023, Mitsubishi Electric of Japan and MOVENSYS Inc. of Korea formed a strategic partnership to enhance their motion control and AC servo businesses. By integrating MOVENSYS' advanced technologies and manufacturing capabilities, the partnership expected to drive innovation and provide more efficient, high-performance solutions. This move poised to boost Mitsubishi Electric's market presence and accelerate the growth of the motion control sector, catering to the increasing demand for precision and automation in various industries

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Motion Control Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Motion Control Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Motion Control Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.