Global Mono And Diglycerides And Derivatives Market

Market Size in USD Million

CAGR :

%

USD

2.40 Million

USD

16.08 Million

2024

2032

USD

2.40 Million

USD

16.08 Million

2024

2032

| 2025 –2032 | |

| USD 2.40 Million | |

| USD 16.08 Million | |

|

|

|

|

What is the Global Mono and Diglycerides and Derivatives Market Size and Growth Rate?

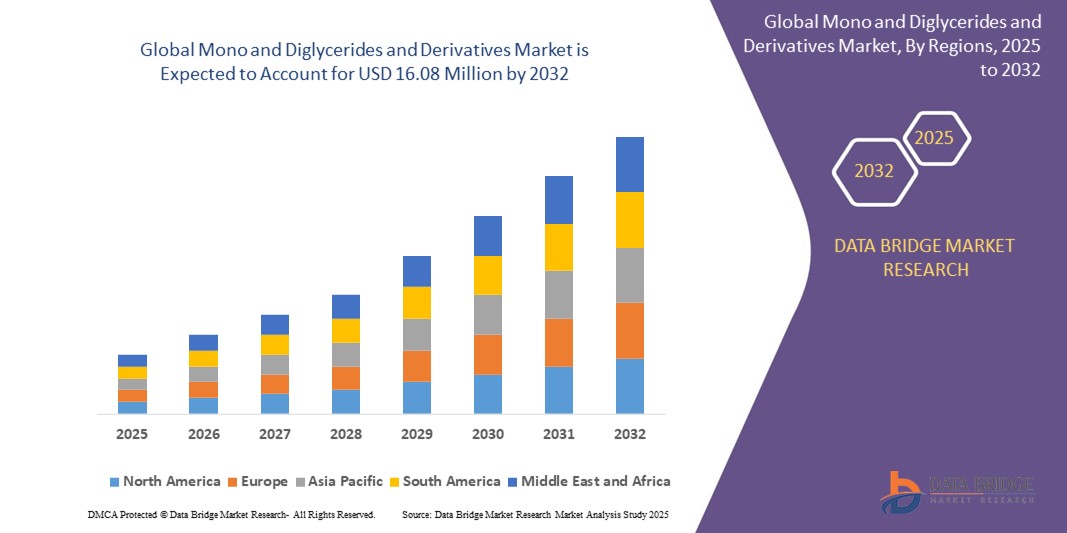

- The Global mono and diglycerides and derivatives market size was valued at USD 2.40 million in 2024 and is expected to reach USD 16.08 million by 2032, at a CAGR of 26.80% during the forecast period

- In the mono and diglycerides and derivatives market, technological advancements enhance production processes, ensuring higher purity and functionality of products. This fosters widespread applications across food, pharmaceuticals, and personal care sectors, benefiting manufacturers with increased efficiency, improved product quality, and expanded market opportunities

- For instance, the U.S. FDA closely regulates emulsifier safety, restricting their usage to specific foods and beverages in precise quantities. This stringent oversight boosts the country's market for emulsifiers, ensuring compliance and consumer trust while driving innovation in product formulations

What are the Major Takeaways of Mono and Diglycerides and Derivatives Market?

- Rising disposable incomes worldwide fuel a preference for convenient and indulgent foods such as baked goods and ready-to-eat meals. Mono and diglycerides, essential for enhancing texture and stability, meet consumer demands for quality. With greater purchasing power, consumers prioritize premium products, driving demand for mono and diglycerides across various processed foods

- North America dominated the mono and diglycerides and derivatives market with the largest revenue share of 38.4% in 2024, driven by strong demand for clean-label, plant-based emulsifiers and functional food ingredients

- Asia-Pacific mono and diglycerides and derivatives market is expected to grow at the fastest CAGR of 22.7% from 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and increased consumption of processed and convenience foods

- The Mono and Diglycerides segment dominated the market with the largest revenue share of 41.3% in 2024, owing to their widespread application as emulsifiers and stabilizers in bakery, confectionery, dairy, and processed foods

Report Scope and Mono and Diglycerides and Derivatives Market Segmentation

|

Attributes |

Mono and Diglycerides and Derivatives Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Mono and Diglycerides and Derivatives Market?

“Clean Label and Functional Ingredient Demand”

- A significant trend driving the global mono and diglycerides and derivatives market is the increasing demand for clean label, plant-based, and multifunctional food ingredients. Consumers are showing a clear preference for sustainable, minimally processed emulsifiers that enhance both product quality and health profiles, in line with the global movement toward transparent and natural food products

- For instance, Kerry Group (Ireland) offers clean label emulsifier solutions, including Mono and Diglycerides that cater to the growing need for natural, non-GMO, and allergen-free ingredients across bakery, dairy, and confectionery sectors. Similarly, DuPont (U.S.) focuses on plant-based mono and diglycerides offerings with an emphasis on label-friendly and functional performance

- Mono and Diglycerides and their derivatives are increasingly incorporated into mainstream food products, including bakery goods, dairy alternatives, frozen desserts, and processed foods, where they provide essential emulsification, texture enhancement, and shelf-life extension

- This evolving focus on clean label and functional benefits is reshaping product development, with companies emphasizing plant-derived, non-trans-fat mono and diglycerides that align with consumer expectations for health, sustainability, and ingredient transparency

- The demand for multifunctional emulsifiers is also driving innovation in food formulations, with manufacturers such as BASF SE (Germany) investing in sustainable production processes and bio-based derivatives to meet both regulatory and market demands

- As health-conscious consumers worldwide continue to prioritize natural ingredients and clean-label claims, the mono and diglycerides and derivatives market is poised for steady growth, particularly across North America, Europe, and Asia-Pacific food and beverage industries

What are the Key Drivers of Mono and Diglycerides and Derivatives Market?

- The increasing use of mono and diglycerides and derivatives as essential emulsifiers and stabilizers across food, personal care, and pharmaceutical industries is a primary driver of market growth. These ingredients enhance product texture, consistency, and shelf life while supporting clean-label and functional product claims

- For instance, in April 2024, Evonik Industries AG (Germany) introduced a new line of sustainable Mono and Diglycerides for food and cosmetic applications, focusing on plant-derived raw materials and eco-friendly processing, reflecting strong demand for ethical and sustainable ingredient sourcing

- The expanding demand for bakery products, convenience foods, and plant-based alternatives globally is further accelerating market growth. Mono and Diglycerides provide critical functionality in gluten-free, dairy-free, and reduced-fat formulations, aligning with evolving dietary trends

- In addition, increasing regulatory support for food-grade emulsifiers, especially in developed markets, is enabling broader adoption of Mono and Diglycerides across food, nutraceutical, and personal care industries. The trend toward healthier, clean-label, and sustainable products continues to drive the integration of these ingredients across multiple applications

Which Factor is challenging the Growth of the Mono and Diglycerides and Derivatives Market?

- Regulatory complexities related to ingredient labeling, permissible inclusion rates, and varying international standards present challenges for global market expansion. Disparities between regions such as the U.S., E.U., and Asia regarding additive approvals and labeling requirements create uncertainty for manufacturers

- For instance, differing clean-label definitions across countries and inconsistent enforcement of trans-fat bans lead to market fragmentation, complicating product development and global distribution strategies

- Furthermore, growing consumer scrutiny of food additives, even natural or plant-based ones, adds to the challenge. Despite their functional role, some consumers remain cautious about emulsifiers such as Mono and Diglycerides, associating them with highly processed foods

- Price volatility of plant-based raw materials, such as vegetable oils used for Mono and Diglycerides production, also impacts overall product costs, especially for premium, organic, or non-GMO variants. This limits affordability in price-sensitive markets and among smaller food manufacturers

- Addressing these challenges will require greater regulatory harmonization, transparent consumer communication, and continuous innovation to develop sustainable, competitively priced, and consumer-accepted Mono and Diglycerides and Derivatives solutions globally

How is the Mono and Diglycerides and Derivatives Market Segmented?

The market is segmented on the basis of type, application, source, hydrophilic groups, and origin.

- By Type

On the basis of type, the mono and diglycerides and derivatives market is segmented into Mono and Diglycerides, Monoglyceride Derivatives, Fatty Acid Derivatives, Lecithin, and Others. The Mono and Diglycerides segment dominated the market with the largest revenue share of 41.3% in 2024, owing to their widespread application as emulsifiers and stabilizers in bakery, confectionery, dairy, and processed foods. Their ability to improve texture, shelf life, and product consistency makes them essential ingredients across the food industry.

The Fatty Acid Derivatives segment is projected to witness the fastest growth from 2025 to 2032, driven by increasing use in personal care, industrial, and pharmaceutical formulations, along with growing demand for bio-based and multifunctional ingredients.

- By Application

On the basis of application, the market is segmented into Bakery and Confectionery, Dairy Products, Convenience Foods, and Others. The Bakery and Confectionery segment accounted for the largest market revenue share of 46.7% in 2024, fueled by the critical role of Mono and Diglycerides in enhancing dough stability, texture, and shelf life of bakery goods and confectionery products.

The Convenience Foods segment is anticipated to grow at the fastest CAGR from 2025 to 2032, driven by the rising consumption of ready-to-eat meals, frozen foods, and processed snacks, where Mono and Diglycerides help improve emulsification, mouthfeel, and product stability.

- By Source

On the basis of source, the mono and diglycerides and derivatives market is segmented into Animal, Plant, and Biochemicals. The Plant segment dominated the market with the largest revenue share of 59.5% in 2024, driven by the increasing consumer demand for plant-based, sustainable, and allergen-free emulsifier solutions, especially across food and personal care industries.

The Biochemicals segment is expected to experience the fastest growth from 2025 to 2032, as manufacturers adopt innovative bio-based production processes to meet sustainability goals and regulatory requirements for clean-label ingredients.

- By Hydrophilic Groups

On the basis of hydrophilic groups, the market is segmented into Cationic, Non-ionic, Anionic, and Amphoteric. The Non-ionic segment held the largest market share of 54.2% in 2024, owing to its versatility, compatibility with a wide range of formulations, and broad application across food, cosmetics, and pharmaceutical products. Non-ionic emulsifiers are favored for their stability and mildness in formulations.

The Amphoteric segment is projected to witness the fastest growth rate, driven by its increasing use in specialized personal care, industrial, and pharmaceutical applications that require pH-sensitive, multifunctional emulsifier systems.

- By Origin

On the basis of origin, the mono and diglycerides and derivatives market is segmented into Synthetic and Natural. The Natural segment dominated the market with the largest revenue share of 63.8% in 2024, driven by growing consumer preference for clean-label, plant-derived, and minimally processed ingredients, particularly across food, cosmetic, and wellness sectors.

The Synthetic segment is expected to witness moderate growth, offering cost-effective and standardized solutions for industrial, pharmaceutical, and food processing applications where consistent performance is essential.

Which Region Holds the Largest Share of the Mono and Diglycerides and Derivatives Market?

- North America dominated the mono and diglycerides and derivatives market with the largest revenue share of 38.4% in 2024, driven by strong demand for clean-label, plant-based emulsifiers and functional food ingredients

- The region's well-established food and beverage industry, along with rising consumer awareness of product quality, transparency, and sustainability, fuels market expansion

- Growing adoption of mono and diglycerides in bakery, confectionery, dairy, and personal care applications, supported by advanced manufacturing infrastructure and favorable regulatory frameworks, solidifies North America's leadership position

U.S. Mono and Diglycerides and Derivatives Market Insight

U.S. mono and diglycerides and derivatives market captured the largest revenue share within North America in 2024, supported by the rising demand for clean-label, non-GMO, and plant-based food ingredients. The rapid expansion of the processed food, functional beverage, and personal care sectors, combined with increasing consumer focus on product transparency and wellness, is accelerating adoption. In addition, key manufacturers in the U.S. are heavily investing in sustainable sourcing and bio-based production technologies to meet evolving market demands.

Europe Mono and Diglycerides and Derivatives Market Insight

Europe mono and diglycerides and derivatives market is projected to expand at a robust CAGR throughout the forecast period, driven by stringent food safety regulations and the growing preference for sustainable, plant-derived emulsifiers. European consumers prioritize eco-friendly, natural, and clean-label products across bakery, dairy, and confectionery sectors. Increasing demand for vegan, allergen-free, and organic formulations is propelling market growth, particularly in countries such as Germany, France, and the U.K.

U.K. Mono and Diglycerides and Derivatives Market Insight

U.K. market is expected to grow at a notable CAGR during the forecast period, supported by the rising popularity of plant-based and functional food products. Heightened health awareness, regulatory emphasis on clean-label ingredients, and increasing demand for transparent, sustainable food formulations drive the integration of Mono and Diglycerides in bakery, convenience foods, and personal care products. The U.K.'s evolving consumer preferences for natural emulsifiers contribute significantly to market growth.

Germany Mono and Diglycerides and Derivatives Market Insight

Germany market is projected to expand considerably during the forecast period, fueled by strong demand for high-performance, sustainable emulsifiers and growing applications in food, personal care, and industrial products. Germany’s emphasis on technological innovation, coupled with a focus on sustainability, is accelerating the adoption of plant-based Mono and Diglycerides. The market is further supported by increased consumer interest in functional foods, clean-label cosmetics, and environmentally conscious product choices.

Which Region is the Fastest Growing in the Mono and Diglycerides and Derivatives Market?

Asia-Pacific mono and diglycerides and derivatives market is expected to grow at the fastest CAGR of 22.7% from 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and increased consumption of processed and convenience foods. Emerging markets such as China, India, and Southeast Asian countries are witnessing growing demand for food additives, plant-based ingredients, and sustainable emulsifiers. Government initiatives promoting food safety, coupled with expanding local manufacturing and improving distribution networks, further enhance market accessibility.

China Mono and Diglycerides and Derivatives Market Insight

China market accounted for the largest revenue share within Asia-Pacific in 2024, supported by the booming food processing industry, rising middle-class population, and increasing demand for functional food ingredients. The push towards modernization in food manufacturing, coupled with government efforts to promote food safety and quality, is accelerating the adoption of Mono and Diglycerides in bakery, dairy, and convenience foods. In addition, China's growing personal care and cosmetics industries contribute to market expansion.

Which are the Top Companies in Mono and Diglycerides and Derivatives Market?

The mono and diglycerides and derivatives industry is primarily led by well-established companies, including:

- Kerry Group (Ireland)

- Evonik Industries AG (Germany)

- DuPont (U.S.)

- BASF SE (Germany)

- Clariant (Switzerland)

- Koninklijke DSM N.V. (Netherlands)

- Akzonobel N.V. (Netherlands)

- Cargill Incorporated (U.S.)

- Lonza (Switzerland)

- Stepan Company (U.S.)

- The Lubrizol Corporation (U.S.)

What are the Recent Developments in GLOBAL Mono and Diglycerides and Derivatives Market?

- In March 2023, BASF introduced a new line of sustainably sourced mono- and diglycerides, aiming to expand its portfolio of eco-friendly and plant-based emulsifiers. This move reinforces the company's focus on sustainability and product innovation

- In September 2020, ADM announced a significant investment to expand its production capacity for mono- and diglycerides, enabling the company to meet increasing global demand for high-quality emulsifiers and strengthen its market presence

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL MONO AND DIGLYCERIDES DERIVATIVES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL MONO AND DIGLYCERIDES DERIVATIVES MARKETSIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 DEMAND AND SUPPLY-SIDE VARIABLES

2.2.8 TOP TO BOTTOM ANALYSIS

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL MONO AND DIGLYCERIDES DERIVATIVES MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 VALUE CHAIN ANALYSIS

5.2 SUPPLY CHAIN ANALYSIS

5.3 IMPORT-EXPORT ANALYSIS

5.4 PORTER’S FIVE FORCES ANALYSIS

5.4.1 BARGAINING POWER OF SUPPLIERS

5.4.2 BARGAINING POWER OF BUYERS/CONSUMERS

5.4.3 THREAT OF NEW ENTRANTS

5.4.4 THREAT OF SUBSTITUTE PRODUCTS

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

5.5 RAW MATERIAL SOURCING ANALYSIS

5.6 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

5.7 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

5.8 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

5.9 FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

6 IMPACT OF ECONOMIC SLOW DOWN ON MARKET

6.1 IMPACT ON PRICE

6.2 IMPACT ON SUPPLY CHAIN

6.3 IMPACT ON SHIPMENT

6.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

7 REGULATORY FRAMEWORK AND GUIDELINES

8 PRICING INDEX (PRICE AT B2B END & PRICES AT FOB)

9 PRODUCTION CAPACITY OF KEY MANUFACTURERES

10 BRAND OUTLOOK

10.1 COMPARATIVE BRAND ANALYSIS

10.2 PRODUCT VS BRAND OVERVIEW

11 GLOBAL MONO AND DIGLYCERIDES DERIVATIVES MARKET, BY TYPE, 2022-2031 (USD MILLION) (KILO TONS)

11.1 OVERVIEW

11.2 MONOGLYCERIDES

11.2.1 ACETYLATED MONOGLYCERIDES (ACETEM)

11.2.2 LACTYLATED MONOGLYCERIDES (LACTEM)

11.2.3 DIACETYL TARTARIC ACID MONOGLYCERIDES (DATEM)

11.2.4 CITRIC ACID ESTERS OF MONOGLYCERIDES (CITREM)

11.3 DIGLYCERIDE

11.3.1 1,2-DIACYLGLYCEROLS

11.3.2 1,3-DIACYLGLYCEROLS

12 GLOBAL MONO AND DIGLYCERIDES DERIVATIVES MARKET, BY SOURCE, 2022-2031 (USD MILLION) (KILO TONS)

12.1 OVERVIEW

12.2 ANIMAL

12.3 PLANT

12.4 ALGAE

12.5 BIOCHEMICALS

13 GLOBAL MONO AND DIGLYCERIDES DERIVATIVES MARKET, BY ORIGIN, 2022-2031 (USD MILLION) (KILO TONS)

13.1 OVERVIEW

13.2 NATURAL

13.3 SYNTHETIC

14 GLOBAL MONO AND DIGLYCERIDES DERIVATIVES MARKET, BY PRODUCTION PROCESS, 2022-2031 (USD MILLION) (KILO TONS)

14.1 OVERVIEW

14.2 CHEMICAL GLYCEROLYSIS

14.3 BIOLOGICAL OR ENZYMATIC PROCESS

14.4 OTHERS

15 GLOBAL MONO AND DIGLYCERIDES DERIVATIVES MARKET, BY FORM , 2022-2031 (USD MILLION) (KILO TONS)

15.1 OVERVIEW

15.2 POWDER

15.3 LIQUID

16 GLOBAL MONO AND DIGLYCERIDES DERIVATIVES MARKET, BY CATEGORY , 2022-2031 (USD MILLION) (KILO TONS)

16.1 OVERVIEW

16.2 REGULAR

16.3 DISTILLED

17 GLOBAL MONO AND DIGLYCERIDES DERIVATIVES MARKET, BY GMO CATEGORY, 2022-2031 (USD MILLION) (KILO TONS)

17.1 OVERVIEW

17.2 GMO

17.3 NON-GMO

18 GLOBAL MONO AND DIGLYCERIDES DERIVATIVES MARKET, BY FUNCTION, 2022-2031 (USD MILLION) (KILO TONS)

18.1 OVERVIEW

18.2 FAT REDUCTION

18.3 THAW STABILITY

18.4 IMPROVED AERATION

18.5 REDUCED STICKINESS

18.6 EMULSION

18.7 ANTISTICKINESS

18.8 OTHERS

19 GLOBAL MONO AND DIGLYCERIDES DERIVATIVES MARKET, BY APPLICATION, 2022-2031 (USD MILLION) (KILO TONS)

19.1 OVERVIEW

19.2 FOOD

19.2.1 FOOD, BY TYPE

19.2.1.1. BAKERY

19.2.1.1.1. BAKERY, BY TYPE

19.2.1.1.1.1 BREAD & ROLLS

19.2.1.1.1.2 CAKES, PASTRIES & TRUFFLE

19.2.1.1.1.3 BISCUIT

19.2.1.1.1.4 TART & PIES

19.2.1.1.1.5 BROWNIES

19.2.1.1.1.6 COOKIES & CRACKERS

19.2.1.1.1.7 TORTILLA

19.2.1.1.1.8 OTHERS

19.2.1.2. DAIRY PRODUCTS

19.2.1.2.1. DAIRY PRODUCTS, BY TYPE

19.2.1.2.1.1 YOGURT

19.2.1.2.1.1.1. FRESH

19.2.1.2.1.1.2. FROZEN

19.2.1.2.1.2 ICE CREAM

19.2.1.2.1.3 CHEESE

19.2.1.2.1.4 OTHERS

19.2.1.3. PROCESSED FOOD

19.2.1.3.1. PROCESSED FOOD, BY TYPE

19.2.1.3.1.1 READY MEALS

19.2.1.3.1.2 SAUCES, DRESSINGS AND CONDIMENTS

19.2.1.3.1.3 SOUPS

19.2.1.3.1.4 JAMS, PRESERVES & MARMALADES

19.2.1.3.1.5 CANNED FRUITS & VEGETABLES

19.2.1.3.1.6 FRUIT & VEGETABLE PUREE

19.2.1.3.1.7 PICKLES

19.2.1.3.1.8 OTHERS

19.2.1.4. CONFECTIONERY

19.2.1.4.1. CONFECTIONERY, BY TYPE

19.2.1.4.1.1 HARD-BOILED SWEETS

19.2.1.4.1.2 MINTS

19.2.1.4.1.3 GUMS & JELLIES

19.2.1.4.1.4 CHOCOLATE

19.2.1.4.1.5 CHOCOLATE SYRUPS

19.2.1.4.1.6 CARAMELS & TOFFEES

19.2.1.4.1.7 OTHERS

19.2.1.5. FROZEN DESSERTS

19.2.1.5.1. FROZEN DESSERTS, BY TYPE

19.2.1.5.1.1 GELATO

19.2.1.5.1.2 CUSTARD

19.2.1.5.1.3 SORBET

19.2.1.5.1.4 OTHERS

19.2.1.6. INFANT FORMULA

19.2.1.6.1. INFANT FORMULA, BY TYPE

19.2.1.6.1.1 FIRST INFANT FORMULA

19.2.1.6.1.2 ANTI-REFLUX (STAYDOWN) FORMULA

19.2.1.6.1.3 COMFORT FORMULA

19.2.1.6.1.4 HYPOALLERGENIC FORMULA

19.2.1.6.1.5 FOLLOW-ON FORMULA

19.2.1.6.1.6 OTHERS

19.2.1.7. FUCNTIONAL FOOD

19.2.1.8. MEAT & MEAT PRODUCTS

19.2.1.8.1. POULTRY PRODUCTS

19.2.1.8.2. BEEF PRODUCTS

19.2.1.8.3. PORK PRODUCTS

19.2.1.8.4. OTHERS

19.2.1.9. PLANT-BASED DAIRY ALTERNATIVES

19.2.1.9.1. PLANT-BASED DAIRY ALTERNATIVES, BY TYPE

19.2.1.9.1.1 PLANT-BASED CHEESE

19.2.1.9.1.2 PLANT-BASED BUTTER

19.2.1.9.1.3 PLANT-BASED YOGURT

19.2.1.9.1.4 OTHERS

19.2.1.10. PLANT-BASED MEAT ALTERNATIVES

19.2.1.10.1. PLANT-BASED MEAT ALTERNATIVES, BY TYPE

19.2.1.10.1.1 PLANT-BASED NUGGETS

19.2.1.10.1.2 PLANT-BASED BURGER PATTIES

19.2.1.10.1.3 PLANT-BASED SAUSAGES

19.2.1.10.1.4 OTHERS

19.2.1.11. CONVENIENCE FOOD

19.2.1.11.1. CONVENIENCE FOOD, BY TYPE

19.2.1.11.1.1 INSTANT NOODLES

19.2.1.11.1.2 PIZZA & PASTA

19.2.1.11.1.3 SANCKS& EXTRUDED SNACKS

19.2.1.11.1.4 REGULAR

19.2.1.11.1.5 FROZEN

19.2.1.11.1.6 BITES

19.2.1.11.1.7 WEDGES

19.2.1.11.1.8 FRENCH FRIES

19.2.1.11.1.9 NUGGETS

19.2.1.12. SPORTS NUTRITION

19.2.1.12.1. SPORTS NUTRTION, BY TYPE

19.2.1.12.1.1 SPORT DRINKS

19.2.1.12.1.2 PROTEIN POWDERS

19.2.1.12.1.3 OTEHRS

19.2.2 FOOD, BY MONO AND DIGLYCERIDES TYPE

19.2.2.1. MONOGLYCERIDES

19.2.2.1.1. ACETYLATED MONOGLYCERIDES (ACETEM)

19.2.2.1.2. LACTYLATED MONOGLYCERIDES (LACTEM)

19.2.2.1.3. DIACETYL TARTARIC ACID MONOGLYCERIDES (DATEM)

19.2.2.1.4. CITRIC ACID ESTERS OF MONOGLYCERIDES (CITREM)

19.2.2.2. DIGLYCERIDE

19.2.2.2.1. 1,2-DIACYLGLYCEROLS

19.2.2.2.2. 1,3-DIACYLGLYCEROLS

19.3 BEVERAGES

19.3.1 BEVERAGES, BY TYPE

19.3.1.1. SMOOTHIES

19.3.1.2. JUICES

19.3.1.3. DAIRY BASED DRINKS

19.3.1.3.1. REGULAR PROCESSED MILK

19.3.1.3.2. FLVORED MILK

19.3.1.3.3. MILK SHAKES

19.3.1.3.4. FUNCTIONAL BEVERAGES

19.3.1.4. FORTIFIED BEVERAGES

19.3.1.5. PLANT-BASED MILK

19.3.1.5.1. SOY MILK

19.3.1.5.2. ALMOND MILK

19.3.1.5.3. OAT MILK

19.3.1.5.4. CASHEW MILK

19.3.1.5.5. RICE MILK

19.3.1.5.6. OTHERS

19.3.1.6. OTHERS

19.3.2 BEVERAGE, BY MONO AND DIGLYCERIDES TYPE

19.3.2.1. MONOGLYCERIDES

19.3.2.1.1. ACETYLATED MONOGLYCERIDES (ACETEM)

19.3.2.1.2. LACTYLATED MONOGLYCERIDES (LACTEM)

19.3.2.1.3. DIACETYL TARTARIC ACID MONOGLYCERIDES (DATEM)

19.3.2.1.4. CITRIC ACID ESTERS OF MONOGLYCERIDES (CITREM)

19.3.2.2. DIGLYCERIDE

19.3.2.2.1. 1,2-DIACYLGLYCEROLS

19.3.2.2.2. 1,3-DIACYLGLYCEROLS

19.4 COSMETIC

19.4.1 COSMETIC, BY MONO AND DIGLYCERIDES TYPE

19.4.1.1. MONOGLYCERIDES

19.4.1.1.1. ACETYLATED MONOGLYCERIDES (ACETEM)

19.4.1.1.2. LACTYLATED MONOGLYCERIDES (LACTEM)

19.4.1.1.3. DIACETYL TARTARIC ACID MONOGLYCERIDES (DATEM)

19.4.1.1.4. CITRIC ACID ESTERS OF MONOGLYCERIDES (CITREM)

19.4.1.2. DIGLYCERIDE

19.4.1.2.1. 1,2-DIACYLGLYCEROLS

19.4.1.2.2. 1,3-DIACYLGLYCEROLS

19.5 DIETARY SUPPLEMENTS

19.5.1 DIETARY SUPPLEMENTS, BY MONO AND DIGLYCERIDES TYPE

19.5.1.1. MONOGLYCERIDES

19.5.1.1.1. ACETYLATED MONOGLYCERIDES (ACETEM)

19.5.1.1.2. LACTYLATED MONOGLYCERIDES (LACTEM)

19.5.1.1.3. DIACETYL TARTARIC ACID MONOGLYCERIDES (DATEM)

19.5.1.1.4. CITRIC ACID ESTERS OF MONOGLYCERIDES (CITREM)

19.5.1.2. DIGLYCERIDE

19.5.1.2.1. 1,2-DIACYLGLYCEROLS

19.5.1.2.2. 1,3-DIACYLGLYCEROLS

19.6 OTHERS

20 GLOBAL MONO AND DIGLYCERIDES DERIVATIVES MARKET, COMPANY LANDSCAPE

20.1 COMPANY SHARE ANALYSIS: GLOBAL

20.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

20.3 COMPANY SHARE ANALYSIS: EUROPE

20.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

20.5 MERGERS & ACQUISITIONS

20.6 NEW PRODUCT DEVELOPMENT & APPROVALS

20.7 EXPANSIONS & PARTNERSHIP

20.8 REGULATORY CHANGES

21 GLOBAL MONO AND DIGLYCERIDES DERIVATIVES MARKET, BY GEOGRAPHY, 2022-2031 (USD MILLION) (KILO TONS)

21.1 OVERVIEW (ALL SEGMENTATION PROVIDED ABOVE IS REPRESNTED IN THIS CHAPTER BY COUNTRY)

21.2 NORTH AMERICA

21.2.1 U.S.

21.2.2 CANADA

21.2.3 MEXICO

21.3 EUROPE

21.3.1 GERMANY

21.3.2 U.K.

21.3.3 ITALY

21.3.4 FRANCE

21.3.5 SPAIN

21.3.6 SWITZERLAND

21.3.7 NETHERLANDS

21.3.8 BELGIUM

21.3.9 RUSSIA

21.3.10 TURKEY

21.3.11 REST OF EUROPE

21.4 ASIA-PACIFIC

21.4.1 JAPAN

21.4.2 CHINA

21.4.3 SOUTH KOREA

21.4.4 INDIA

21.4.5 AUSTRALIA

21.4.6 SINGAPORE

21.4.7 THAILAND

21.4.8 INDONESIA

21.4.9 MALAYSIA

21.4.10 PHILIPPINES

21.4.11 REST OF ASIA-PACIFIC

21.5 SOUTH AMERICA

21.5.1 BRAZIL

21.5.2 ARGENTINA

21.5.3 REST OF SOUTH AMERICA

21.6 MIDDLE EAST AND AFRICA

21.6.1 SOUTH AFRICA

21.6.2 UAE

21.6.3 SAUDI ARABIA

21.6.4 KUWAIT

21.6.5 REST OF MIDDLE EAST AND AFRICA

22 GLOBAL MONO AND DIGLYCERIDES DERIVATIVES MARKET, SWOT & DBMR ANALYSIS

23 GLOBAL MONO AND DIGLYCERIDES DERIVATIVES MARKET, COMPANY PROFILES

23.1 LONZA

23.1.1 COMPANY OVERVIEW

23.1.2 REVENUE ANALYSIS

23.1.3 PRODUCT PORTFOLIO

23.1.4 RECENT DEVELOPMENTS

23.2 UNIVAR SOLUTIONS LLC.

23.2.1 COMPANY OVERVIEW

23.2.2 REVENUE ANALYSIS

23.2.3 PRODUCT PORTFOLIO

23.2.4 RECENT DEVELOPMENTS

23.3 ZANYU TECHNOLOGY GROUP CO., LTD

23.3.1 COMPANY OVERVIEW

23.3.2 REVENUE ANALYSIS

23.3.3 PRODUCT PORTFOLIO

23.3.4 RECENT DEVELOPMENTS

23.4 HANGZHOU FUCHUN FOOD ADDITIVES CO., LTD

23.4.1 COMPANY OVERVIEW

23.4.2 REVENUE ANALYSIS

23.4.3 PRODUCT PORTFOLIO

23.4.4 RECENT DEVELOPMENTS

23.5 CORBION

23.5.1 COMPANY OVERVIEW

23.5.2 REVENUE ANALYSIS

23.5.3 PRODUCT PORTFOLIO

23.5.4 RECENT DEVELOPMENTS

23.6 OLEON

23.6.1 COMPANY OVERVIEW

23.6.2 REVENUE ANALYSIS

23.6.3 PRODUCT PORTFOLIO

23.6.4 RECENT DEVELOPMENTS

23.7 ALFA CHEMISTRY

23.7.1 COMPANY OVERVIEW

23.7.2 REVENUE ANALYSIS

23.7.3 PRODUCT PORTFOLIO

23.7.4 RECENT DEVELOPMENTS

23.8 SOLUTEX

23.8.1 COMPANY OVERVIEW

23.8.2 REVENUE ANALYSIS

23.8.3 PRODUCT PORTFOLIO

23.8.4 RECENT DEVELOPMENTS

23.9 CALDIC

23.9.1 COMPANY OVERVIEW

23.9.2 REVENUE ANALYSIS

23.9.3 PRODUCT PORTFOLIO

23.9.4 RECENT DEVELOPMENTS

23.1 PURATOS

23.10.1 COMPANY OVERVIEW

23.10.2 REVENUE ANALYSIS

23.10.3 PRODUCT PORTFOLIO

23.10.4 RECENT DEVELOPMENTS

23.11 HANGZHOU GENGYANG CHEMICAL MATERIALS CO., LTD

23.11.1 COMPANY OVERVIEW

23.11.2 REVENUE ANALYSIS

23.11.3 PRODUCT PORTFOLIO

23.11.4 RECENT DEVELOPMENTS

23.12 BUNGE LIMITED

23.12.1 COMPANY OVERVIEW

23.12.2 REVENUE ANALYSIS

23.12.3 PRODUCT PORTFOLIO

23.12.4 RECENT DEVELOPMENTS

23.13 PARCHEM

23.13.1 COMPANY OVERVIEW

23.13.2 REVENUE ANALYSIS

23.13.3 PRODUCT PORTFOLIO

23.13.4 RECENT DEVELOPMENTS

23.14 ESTELLE CHEMICALS

23.14.1 COMPANY OVERVIEW

23.14.2 REVENUE ANALYSIS

23.14.3 PRODUCT PORTFOLIO

23.14.4 RECENT DEVELOPMENTS

23.15 MUSIM MAS

23.15.1 COMPANY OVERVIEW

23.15.2 REVENUE ANALYSIS

23.15.3 PRODUCT PORTFOLIO

23.15.4 RECENT DEVELOPMENTS

23.16 MUBY CHEMICALS

23.16.1 COMPANY OVERVIEW

23.16.2 REVENUE ANALYSIS

23.16.3 PRODUCT PORTFOLIO

23.16.4 RECENT DEVELOPMENTS

23.17 PALSGAARD A/S

23.17.1 COMPANY OVERVIEW

23.17.2 REVENUE ANALYSIS

23.17.3 PRODUCT PORTFOLIO

23.17.4 RECENT DEVELOPMENTS

23.18 ZHENGZHOU YIZELI INDUSTRIAL CO.,LTD

23.18.1 COMPANY OVERVIEW

23.18.2 REVENUE ANALYSIS

23.18.3 PRODUCT PORTFOLIO

23.18.4 RECENT DEVELOPMENTS

23.19 HENAN CHEMSINO INDUSTRY CO., LTD

23.19.1 COMPANY OVERVIEW

23.19.2 REVENUE ANALYSIS

23.19.3 PRODUCT PORTFOLIO

23.19.4 RECENT DEVELOPMENTS

23.2 MASSON TECHNOLOGY

23.20.1 COMPANY OVERVIEW

23.20.2 REVENUE ANALYSIS

23.20.3 PRODUCT PORTFOLIO

23.20.4 RECENT DEVELOPMENTS

23.21 BUSS-SMS-CANZLER GMBH

23.21.1 COMPANY OVERVIEW

23.21.2 REVENUE ANALYSIS

23.21.3 PRODUCT PORTFOLIO

23.21.4 RECENT DEVELOPMENTS

23.22 REJOICE LIFE INGREDIENTS

23.22.1 COMPANY OVERVIEW

23.22.2 REVENUE ANALYSIS

23.22.3 PRODUCT PORTFOLIO

23.22.4 RECENT DEVELOPMENTS

23.23 LASENOR EMUL, S.L.

23.23.1 COMPANY OVERVIEW

23.23.2 REVENUE ANALYSIS

23.23.3 PRODUCT PORTFOLIO

23.23.4 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

24 RELATED REPORTS

25 CONCLUSION

26 QUESTIONNAIRE

27 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.