Global Molecular Crop Breeding Market

Market Size in USD Billion

CAGR :

%

USD

1.33 Billion

USD

4.44 Billion

2025

2033

USD

1.33 Billion

USD

4.44 Billion

2025

2033

| 2026 –2033 | |

| USD 1.33 Billion | |

| USD 4.44 Billion | |

|

|

|

|

Molecular Crop Breeding Market Size

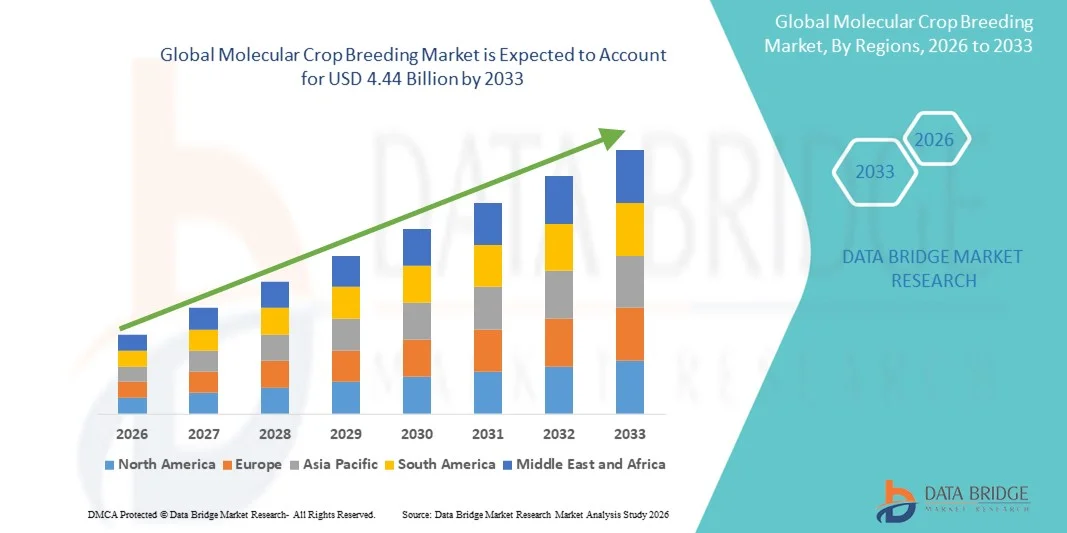

- The global molecular crop breeding market size was valued at USD 1.33 billion in 2025 and is expected to reach USD 4.44 billion by 2033, at a CAGR of 16.20% during the forecast period

- The market growth is largely fuelled by the increasing adoption of advanced genetic technologies, growing demand for high-yield and climate-resilient crops, and rising investment in agricultural R&D

- Expansion in precision agriculture and the use of marker-assisted selection techniques are further driving the need for molecular crop breeding solutions

Molecular Crop Breeding Market Analysis

- The market is witnessing significant growth due to the rising need for genetically improved crops with enhanced resistance to diseases, pests, and environmental stresses

- Technological advancements such as CRISPR, genomic selection, and high-throughput genotyping are enhancing breeding efficiency, reducing crop development time, and improving overall productivity

- North America dominated the molecular crop breeding market with the largest revenue share in 2025, driven by growing adoption of advanced breeding technologies, government support for agricultural innovation, and increasing demand for high-yield and climate-resilient crop varieties

- Asia-Pacific region is expected to witness the highest growth rate in the global molecular crop breeding market, driven by rapid population growth, expanding arable land cultivation, and increasing adoption of molecular breeding technologies across emerging economies such as China and India

- The Marker-Assisted Selection (MAS) segment held the largest market revenue share in 2025, driven by its proven efficiency in selecting desirable traits and accelerating crop improvement cycles. MAS enables breeders to identify and propagate elite cultivars with enhanced yield, disease resistance, and stress tolerance, making it a preferred method in commercial breeding programs

Report Scope and Molecular Crop Breeding Market Segmentation

|

Attributes |

Molecular Crop Breeding Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Illumina, Inc. (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Molecular Crop Breeding Market Trends

Rise of Genomic Selection and Precision Breeding in Crops

- The growing adoption of molecular crop breeding is transforming agriculture by enabling precise selection and development of high-yield, disease-resistant, and climate-resilient crop varieties. These advanced breeding techniques accelerate crop improvement cycles, reducing time-to-market for new cultivars and increasing farm productivity. In addition, the integration of big data analytics and AI-driven prediction models is enhancing selection accuracy and optimizing breeding strategies across diverse environments

- The high demand for genetically superior seeds in emerging and developed markets is driving the use of molecular markers, genome sequencing, and CRISPR-based technologies. These tools are particularly effective in addressing abiotic and biotic stresses, ensuring consistent crop performance under varying climatic conditions. The rising need for drought, heat, and pest-resistant crops in regions prone to climate variability further fuels technology adoption

- The affordability and accessibility of modern breeding technologies are making them attractive for both large agribusinesses and smallholder farmers. Breeders benefit from improved accuracy, faster selection, and reduced field trial costs, ultimately supporting sustainable agriculture. Collaborative platforms and public-private partnerships are also helping smaller players access cutting-edge breeding tools at reduced costs

- For instance, in 2023, several seed companies in North America and Europe reported the successful development of drought-tolerant maize and disease-resistant wheat varieties using marker-assisted selection, enhancing yield stability and farmer profitability. In parallel, pilot programs in Africa and Asia demonstrated significant improvements in crop resilience and local food security

- While precision breeding is driving efficiency and crop resilience, market growth depends on continued R&D, regulatory approvals, and farmer awareness. Companies must focus on innovation, local adaptation, and technology dissemination to fully capitalize on the growing demand. Education and training programs for breeders and farmers are becoming increasingly critical to ensure correct adoption and maximize technology benefits

Molecular Crop Breeding Market Dynamics

Driver

Rising Need for High-Yield and Climate-Resilient Crop Varieties

- Increasing global population and food demand are driving the adoption of molecular crop breeding to develop high-yield and stress-tolerant crops. Precision breeding ensures better resource use, improved crop performance, and enhanced food security. The rising prevalence of climate-related challenges, including erratic rainfall and soil degradation, further underscores the importance of advanced breeding solutions

- Governments and research organizations are investing in genomics and biotechnology programs to support sustainable agriculture and address challenges posed by climate change. This has led to greater availability and application of molecular breeding tools in both major and specialty crops. Subsidies, grants, and research collaborations are incentivizing innovation and reducing financial barriers for breeding initiatives

- Technological advancements in genomics, phenotyping, and bioinformatics are enabling breeders to accelerate crop improvement while maintaining genetic diversity. These innovations help in the rapid identification of desirable traits and reduce breeding cycles. In addition, digital breeding platforms are streamlining data collection, analysis, and decision-making for faster development of elite cultivars

- For instance, in 2022, several agricultural research institutes in Asia and Europe integrated genome editing and marker-assisted selection in rice and soybean breeding programs, resulting in varieties with improved yield, pest resistance, and nutritional quality. Field trials also confirmed enhanced adaptation to local climatic conditions and reduced dependency on chemical inputs

- While demand for resilient crops is driving market growth, continuous innovation, regulatory harmonization, and farmer training are crucial to maintain adoption and maximize benefits. Strengthening collaborations between private breeders, research institutes, and governmental agencies is key to scaling advanced crop breeding programs efficiently

Restraint/Challenge

High Research Costs and Regulatory Hurdles

- The high cost of implementing molecular breeding programs, including genomics, genome editing, and phenotyping infrastructure, limits adoption among smaller seed companies and research institutions. Cost remains a significant barrier, particularly in developing regions. Furthermore, high initial capital investment for lab equipment, software, and skilled personnel further deters market entry for small and medium-scale players

- In many countries, stringent regulatory frameworks and lengthy approval processes for genetically modified or edited crops hinder the commercialization of new varieties, delaying market entry and return on investment. Additional delays arise from multi-stage field trials, biosafety evaluations, and compliance reporting, which can significantly extend development timelines

- Limited awareness and technical expertise among farmers and breeders in emerging regions restrict the utilization of molecular breeding technologies. This often leads to slower adoption and underutilization of advanced crop varieties. Training programs, workshops, and extension services are critical to bridge knowledge gaps and ensure proper utilization of breeding innovations

- For instance, in 2023, several small-scale seed producers in Sub-Saharan Africa reported challenges in accessing molecular breeding tools due to high costs and regulatory uncertainties, impacting the introduction of improved crop varieties. Similar challenges were observed in parts of Southeast Asia, where fragmented supply chains and limited technical guidance restricted adoption

- While molecular breeding technologies continue to advance, addressing cost, regulatory, and knowledge barriers is essential. Market stakeholders must focus on cost-effective solutions, capacity building, and regulatory compliance to unlock long-term growth potential. Strategic public-private partnerships and international funding support can also play a significant role in mitigating these challenges and expanding market reach

Molecular Crop Breeding Market Scope

The market is segmented on the basis of process and marker.

- By Process

On the basis of process, the molecular crop breeding market is segmented into QTL Mapping, Marker-Assisted Selection (MAS), Marker-Assisted Backcrossing (MABC), Genomic Selection, and Others. The Marker-Assisted Selection (MAS) segment held the largest market revenue share in 2025, driven by its proven efficiency in selecting desirable traits and accelerating crop improvement cycles. MAS enables breeders to identify and propagate elite cultivars with enhanced yield, disease resistance, and stress tolerance, making it a preferred method in commercial breeding programs.

The Genomic Selection segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its ability to predict complex traits using genome-wide markers, reducing breeding cycle time and increasing selection accuracy. Genomic selection is particularly attractive for crops with long generation times and polygenic traits, allowing for faster development of high-performing varieties.

- By Marker

On the basis of marker, the market is segmented into Single Nucleotide Polymorphism (SNP), Simple Sequence Repeats (SSR), and Others. The Single Nucleotide Polymorphism (SNP) segment held the largest market revenue share in 2025 due to its high throughput, accuracy, and suitability for large-scale genotyping. SNP markers facilitate precise trait mapping and selection, supporting advanced breeding strategies and improving genetic gain.

The Simple Sequence Repeats (SSR) segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by its cost-effectiveness, reproducibility, and utility in genetic diversity studies. SSR markers are widely used in smaller breeding programs and for characterizing germplasm collections, further expanding their adoption in molecular crop breeding.

Molecular Crop Breeding Market Regional Analysis

- North America dominated the molecular crop breeding market with the largest revenue share in 2025, driven by growing adoption of advanced breeding technologies, government support for agricultural innovation, and increasing demand for high-yield and climate-resilient crop varieties

- Farmers and agribusinesses in the region highly value precision breeding techniques such as marker-assisted selection, genomic selection, and QTL mapping for developing superior crop varieties with improved yield, disease resistance, and stress tolerance

- This widespread adoption is further supported by strong research infrastructure, high investment in agricultural biotechnology, and increasing awareness of sustainable and climate-smart farming practices, establishing molecular crop breeding as a key solution for food security and productivity

U.S. Molecular Crop Breeding Market Insight

The U.S. molecular crop breeding market captured the largest revenue share in 2025 within North America, fueled by advanced genomics programs, growing private sector investments, and the adoption of precision breeding technologies. Farmers and seed companies are increasingly leveraging molecular markers and genome editing tools to accelerate crop improvement. Government initiatives supporting biotech research and sustainable agriculture, coupled with strong R&D infrastructure, are significantly contributing to market expansion.

Europe Molecular Crop Breeding Market Insight

The Europe molecular crop breeding market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by stringent regulations promoting sustainable agriculture, the growing focus on climate-resilient crops, and high adoption of innovative breeding techniques. The region is experiencing growth across major crops such as wheat, maize, and barley, with molecular breeding integrated into both commercial seed programs and public research initiatives.

U.K. Molecular Crop Breeding Market Insight

The U.K. molecular crop breeding market is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing investments in genomics and precision agriculture, rising demand for high-quality crop varieties, and supportive government policies. Research institutions and private companies are adopting advanced molecular techniques to develop stress-tolerant and high-yield crops, enhancing the efficiency of breeding programs and farmer profitability.

Germany Molecular Crop Breeding Market Insight

The Germany molecular crop breeding market is expected to witness the fastest growth rate from 2026 to 2033, fueled by the country’s strong agricultural R&D ecosystem, focus on sustainable crop production, and high adoption of biotechnological tools. German farmers and seed developers are increasingly integrating molecular markers, genome sequencing, and CRISPR-based technologies to develop high-performing, disease-resistant varieties, supporting both local and export-oriented agriculture.

Asia-Pacific Molecular Crop Breeding Market Insight

The Asia-Pacific molecular crop breeding market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising population, increasing food demand, technological advancements, and government initiatives promoting modern agriculture. Countries such as China, India, and Japan are adopting genomic selection, marker-assisted selection, and other molecular breeding techniques to develop high-yield, stress-resistant, and climate-resilient crops. The region’s growing research capabilities and public-private collaborations are accelerating market adoption.

Japan Molecular Crop Breeding Market Insight

The Japan molecular crop breeding market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s technologically advanced agriculture sector, high adoption of precision breeding tools, and demand for sustainable crop production. Japanese seed companies are increasingly using genomic and marker-assisted techniques to improve crop yield, disease resistance, and quality, contributing to the expansion of molecular crop breeding applications across the country.

China Molecular Crop Breeding Market Insight

The China molecular crop breeding market accounted for the largest revenue share in Asia Pacific in 2025, attributed to the country’s expanding population, rapid agricultural modernization, and strong government focus on food security. Molecular breeding techniques, including marker-assisted selection and genomic selection, are being widely implemented to develop superior crop varieties. The push for climate-resilient crops, growing private sector involvement, and availability of advanced breeding technologies are key factors propelling the market in China.

Molecular Crop Breeding Market Share

The Molecular Crop Breeding industry is primarily led by well-established companies, including:

• Illumina, Inc. (U.S.)

• Eurofins Scientific (Luxembourg)

• Thermo Fisher Scientific (U.S.)

• SGS SA (Switzerland)

• LGC Limited (U.K.)

• DanBred P/S (Denmark)

• Intertek Group plc (U.K.)

• LemnaTec GmbH (Germany)

• Charles River Laboratories (U.S.)

• Slipstream Automation (U.S.)

• Syngenta (Switzerland)

• Bayer AG (Germany)

• DuPont (U.S.)

• KWS SAAT SE & Co. KGaA (Germany)

• Equinom (Israel)

• Hudson River Biotechnology (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.