Global Modulators Market

Market Size in USD Billion

CAGR :

%

USD

1.45 Billion

USD

2.53 Billion

2024

2032

USD

1.45 Billion

USD

2.53 Billion

2024

2032

| 2025 –2032 | |

| USD 1.45 Billion | |

| USD 2.53 Billion | |

|

|

|

|

Modulators Market Size

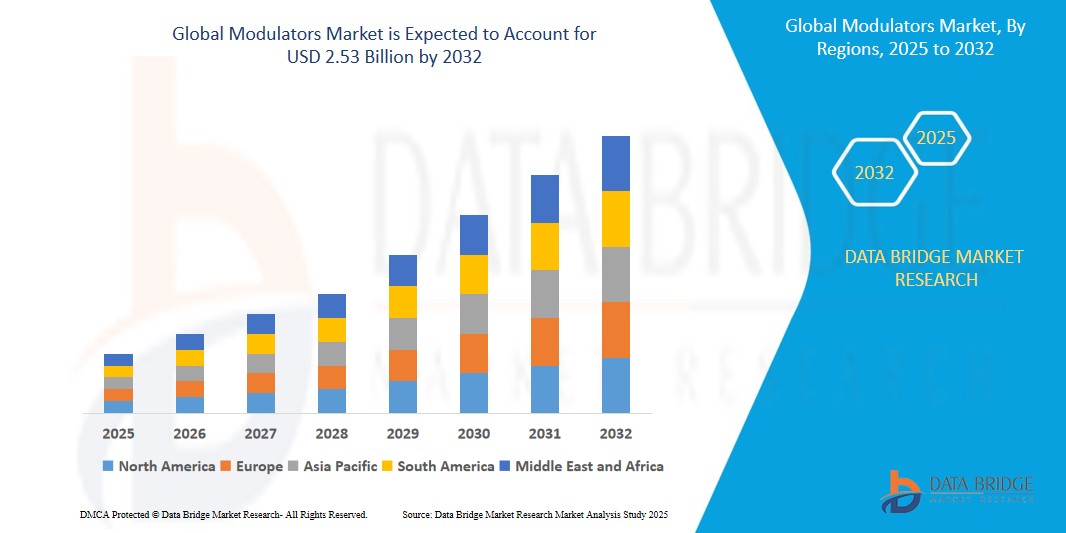

- The global Modulators market size was valued at USD 1.45 billion in 2024 and is expected to reach USD 2.52 billion by 2032, at a CAGR of 7.20% during the forecast period

- The market growth is largely fueled by the expanding demand for high-speed data transmission across telecom, data centers, and defense sectors. The growing implementation of 5G networks, increasing optical fiber deployments, and the rising consumption of high-bandwidth content have directly contributed to the widespread use of optical and electro-optic modulators.

- Furthermore, technological advancements in photonic integrated circuits (PICs) and electro-optic materials, such as lithium niobate and indium phosphide, have significantly improved modulation efficiency, paving the way for faster, compact, and cost-effective modulator solutions.

Modulators Market Analysis

- Modulators, including optical, RF, and electro-optic types, are increasingly becoming foundational technologies for high-speed data transmission and signal processing across telecom, data centers, military, and industrial applications. Their ability to convert electrical signals into optical or RF formats makes them critical for ensuring seamless, high-bandwidth communication in modern digital infrastructure.

- The escalating demand for Modulators is primarily driven by the rapid rollout of 5G networks, expanding fiber optic infrastructure, and growing reliance on cloud-based applications, all of which require advanced modulation schemes such as QAM (Quadrature Amplitude Modulation) and coherent modulation to achieve higher data throughput and spectrum efficiency.

- North America dominates the Modulators market with the largest revenue share of 38.0% in 2025, characterized by early adoption of next-generation communication technologies, increasing government investments in 5G and defense modernization, and a strong concentration of leading companies such as Lumentum Holdings, II-VI Incorporated (now Coherent), and Analog Devices. The U.S. is witnessing strong growth in optical and RF modulator adoption in telecom backhaul, aerospace applications, and data center interconnects.

- Asia-Pacific is expected to be the fastest growing region in the Modulators market during the forecast period, fueled by massive infrastructure development in China, Japan, South Korea, and India, increased spending on telecommunication upgrades, and the emergence of regional photonics and semiconductor companies. The region’s push for self-reliance in chip manufacturing and smart city initiatives are further accelerating market growth.

- The Amplitude Modulation segment is expected to dominate the market with a share of 40.0% in 2025 due to its widespread use in telecommunications and fiber optic networks.

Report Scope and Modulators Market Segmentation

|

Attributes |

Modulators Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

|

Modulators Market Trends

“Enhanced Convenience Through AI and Voice Integration”

- A prominent trend reshaping the global Modulators market is the integration of AI and voice assistant technology, enabling seamless user interaction and smarter access control. Leading products now support platforms such as Amazon Alexa, Google Assistant, and Apple HomeKit, empowering users to control locks using voice commands.

- For instance, the August Wi-Fi Smart Lock enables voice-based control across all three major digital assistants, streamlining user convenience. Similarly, Level Lock+, which works with Apple HomeKit and Siri, exemplifies the shift toward discreet, voice-responsive locking systems.

- AI-enhanced features are also evolving; Ultraloq smart locks have introduced AI-powered fingerprint recognition that improves accuracy over time and sends alerts for anomalous activity. This blend of biometric intelligence and proactive alerts offers greater security and personalization.

- Smart home synchronization is also deepening—users can now control Modulators alongside lighting, security cameras, and HVAC systems from a single interface. For example, WELOCK has launched AI-enabled Modulators that automatically lock/unlock using authorized presence detection and support Google Assistant and Alexa voice controls.

- These advancements are driving demand across both residential and commercial sectors, as consumers increasingly seek hands-free operation, remote access, and integrated smart home ecosystems

Modulators Market Dynamics

Driver

“Growing Need Due to Rising Security Concerns and Smart Home Adoption”

- The convergence of rising security threats and the surging adoption of connected home devices is a major growth catalyst for the Modulators market. Users are looking beyond traditional keys to smarter, more responsive solutions.

- In April 2024, Onity, Inc. (a Honeywell company) unveiled advancements in IoT-based self-storage security with enhanced sensors embedded in the Passport locking solution, highlighting industry commitment to advanced access control through connected infrastructure.

- Modulatorss offer critical advantages such as remote locking, access logs, and tamper alerts, which are increasingly demanded by both residential and commercial consumers. With mobile app control and instant access sharing, these systems are replacing mechanical locks in smart homes and office spaces.

- The trend is also supported by growing DIY smart home installations and the wider availability of user-friendly, interoperable Modulators systems, such as those from Wyze and eufy, helping to reduce dependency on professional installations and drive mainstream adoption.

Restraint/Challenge

“Concerns Regarding Cybersecurity and High Initial Costs”

- Despite their benefits, Modulatorss face adoption barriers due to cybersecurity risks associated with connected devices. Incidents of IoT device hacking have raised public concerns about the safety of smart lock systems and personal data.

- High-profile vulnerabilities have been documented in several smart home devices, reinforcing consumer hesitation. To mitigate this, companies such as August Home and Level market their systems with bank-grade encryption and robust two-factor authentication protocols to ensure data security.

- Another challenge is the higher upfront cost of Modulatorss versus traditional mechanical locks. While basic smart locks like Wyze Lock Bolt are becoming more affordable, advanced features—such as built-in cameras or biometric sensors—remain premium, limiting their appeal to budget-conscious buyers or emerging markets.

- As prices gradually decline and consumers become more educated on security best practices, industry players must prioritize cybersecurity transparency and cost-effective innovation to encourage broader adoption.

Modulators Market Scope

The market is segmented on the basis type, techniques, and application.

By Type

The global Modulators market is segmented into Amplitude Modulation, Frequency Modulation, Phase Modulation, Polarization Modulation, and Pulse-Code Modulation.

Amplitude Modulation (AM) holds a notable market share owing to its simplicity, cost-effectiveness, and historical prevalence in analog broadcasting, particularly in AM radio and shortwave communications. While its use has declined in consumer broadcasting, it remains relevant in legacy aerospace and military communication systems.

Frequency Modulation (FM) continues to be widely adopted due to its superior noise resistance and broader bandwidth efficiency, making it highly suitable for audio broadcasting and high-fidelity communication systems. FM is still dominant in radio transmission and short-range wireless communication.

Phase Modulation (PM) is gaining attention, especially in modern wireless communication systems and satellite telemetry, due to its efficient data encoding and bandwidth optimization features. It's frequently used in digital radio and telemetry systems.

Polarization Modulation is a niche yet growing segment, primarily used in advanced optical communication systems and satellite technologies, where polarization diversity is leveraged to increase spectral efficiency and signal clarity.

Pulse-Code Modulation (PCM) is the dominant type in digital signal processing, widely used in telecommunications, VoIP, and audio signal transmission. PCM's prevalence in digital telephony and data centers continues to drive this segment, particularly with the expansion of IP-based communications.

By Techniques

The Modulators market by techniques includes Phase-Shift Keying (PSK), Frequency-Shift Keying (FSK), Amplitude-Shift Keying (ASK), Quadrature Amplitude Modulation (QAM), and Others.

Quadrature Amplitude Modulation (QAM) leads the market share due to its widespread usage in broadband communication systems, including 4G, 5G, and cable television networks. Its ability to transmit high data rates over constrained bandwidths makes it indispensable in modern digital communication. For example, 64-QAM and 256-QAM are standard in 5G infrastructure deployments.

Phase-Shift Keying (PSK) is a widely used technique in satellite communication and wireless LANs, owing to its bandwidth efficiency and robustness in noisy environments. Techniques like BPSK and QPSK are commonly employed in aerospace and defense communication systems.

Frequency-Shift Keying (FSK) is essential for low-data-rate wireless communication, such as RFID, IoT, and industrial automation, due to its simplicity and resistance to signal degradation. Its use in emerging low-power wide-area networks (LPWANs) continues to support its growth.

Amplitude-Shift Keying (ASK), while more susceptible to noise, is still utilized in short-range communication devices and RFID applications, particularly where cost and simplicity are prioritized over performance.

The “Others” category includes newer and hybrid techniques like Minimum Shift Keying (MSK) and Orthogonal Frequency Division Multiplexing (OFDM), which are gaining traction with advancements in 5G, fiber optics, and high-speed data communication.

By Application

The Modulators market is segmented by application into Telecommunications, Data Centers, Aerospace and Defense, Industrial, and Others.

The Telecommunications segment dominates the market with the largest revenue share, driven by the explosive growth of mobile networks (4G/5G), fiber-optic communication, and internet traffic. Modulators are key enablers of signal encoding and efficient data transmission in this sector. Notably, 5G rollouts across North America and Asia-Pacific have significantly accelerated demand for advanced modulation techniques like QAM and OFDM.

Data Centers are expected to witness the fastest growth rate during the forecast period. The surging demand for high-speed data transmission and low-latency computing is driving the adoption of modulators in optical interconnects and transceivers. For example, coherent optical modulators are increasingly used in hyperscale data centers to manage exponential bandwidth demands.

The Aerospace and Defense segment continues to be a steady contributor, with modulators being integral to satellite communication, radar systems, and secure military transmissions. The sector demands high-reliability and rugged modulation systems, often relying on PSK and PCM for critical applications.

The Industrial segment is growing due to the expansion of industrial IoT (IIoT), automation, and remote control systems. In this domain, modulators are key to enabling robust machine-to-machine (M2M) communication, especially in harsh environments where FSK and ASK dominate.

The Others segment includes applications such as broadcasting, academic research, and niche optical communications, which continue to contribute to the demand for varied modulation formats based on unique performance requirements.

Modulators Market Regional Analysis

- North America dominates the Modulators market with the largest revenue share of 40.01% in 2024, driven by strong demand for high-speed data transmission, the proliferation of 5G infrastructure, and expanding cloud data centers. The region’s technological leadership in optical communication, military-grade RF systems, and satellite networks further reinforces market dominance.

- Additionally, the presence of major industry players like Analog Devices, Texas Instruments, and Qorvo, along with strong R&D funding from defense and telecom sectors, sustains innovation in modulation technologies across RF and optical platforms.

U.S. Modulators Market Insight

The U.S. accounted for over 81% of North America’s Modulators market in 2025, owing to its early adoption of next-gen communication standards, including mmWave 5G, LiDAR-based automotive systems, and coherent optical modulators for long-haul fiber networks.

According to recent announcements, Intel and Broadcom completed a successful 800 Gbps optical link demonstration in 2023, showcasing high-performance modulators designed for hyperscale data centers, which is a key driver of U.S. market growth.

Europe Modulators Market Insight

The European Modulators market is forecasted to expand at a substantial CAGR, fueled by advancements in satellite communications, defense modernization programs, and smart manufacturing initiatives such as Industry 4.0.

Regulatory mandates such as the European Green Deal and increasing demand for low-latency, energy-efficient data transmission are propelling investment in optical and RF modulator technologies.

U.K. Modulators Market Insight

The U.K. market is anticipated to grow significantly, driven by increased deployment of 5G infrastructure, telehealth expansion, and automated defense communication networks.

The 2024 announcement of a joint initiative between BT Group and Cambridge Consultants to trial quantum communication networks is expected to elevate demand for advanced phase and amplitude modulators.

Germany Modulators Market Insight

Germany is a leading hub in the European Modulators market due to its strong industrial base, especially in automotive and smart manufacturing sectors. The integration of modulators in factory automation, coupled with rising demand from electric vehicle (EV) charging networks and machine vision systems, is contributing to the country's robust market performance.

Asia-Pacific Modulators Market Insight

Asia-Pacific is poised to witness the fastest CAGR of over 24% in 2025, driven by 5G rollouts, increased fiber-optic deployments, and government-backed digital transformation initiatives in countries like China, Japan, South Korea, and India.

Regional electronics and semiconductor giants like Huawei, Samsung, and Murata Manufacturing are aggressively investing in modulator innovation, particularly in QAM and OFDM techniques.

Japan Modulators Market Insight

The Japan Modulators market is expanding steadily, supported by the country's leadership in optical electronics, automotive radar, and RF system design.

In 2024, NTT and Fujitsu announced a joint venture to commercialize all-photonics network modulator chips for ultra-high-speed broadband services, signaling strong industry growth.

China Modulators Market Insight

China holds the largest share in Asia-Pacific, backed by its position as the world’s largest telecom and manufacturing hub.

Massive investments in 5G base stations, satellite internet constellations, and state-sponsored smart city programs are driving high-volume demand for both RF and optical modulators.

Companies like HiSilicon and Accelink are expanding their domestic footprint and exporting cost-effective modulation solutions, further propelling China's leadership in this market..

Modulators Market Share

The Modulators industry is primarily led by well-established companies, including:

- Thorlabs, Inc. (U.S.)

- Jenoptik AG (Germany)

- Lumentum Holdings Inc. (U.S.)

- Hamamatsu Photonics K.K. (Japan)

- VIAVI Solutions Inc. (U.S.)

- iXblue (France)

- EOSPACE, Inc. (U.S.)

- Agiltron (Photonwares) (U.S.)

- QUBIG GmbH (Germany)

- Lightwave Logic, Inc. (U.S.)

Latest Developments in Global Modulators Market

- In April 2024, Lumentum Holdings Inc., a key player in optical and photonic products, announced the release of its 400G and 800G coherent optical modulator solutions tailored for next-generation data center interconnects. These high-speed modulators support advanced quadrature amplitude modulation (QAM) formats and are designed to improve data transmission efficiency and minimize latency, particularly within hyperscale cloud environments.

- In March 2024, Analog Devices Inc. unveiled its wideband RF modulator chipset specifically optimized for 5G massive MIMO base stations. The new solution supports phase and amplitude modulation schemes with higher power efficiency and reduced distortion, thereby enhancing signal quality across mid- and high-band spectrums in telecom infrastructure deployments.

- In February 2024, Qorvo Inc. launched a series of ultra-linear GaN-based modulators and amplifiers targeting defense and aerospace radar systems. These modulators offer advanced frequency-shift keying (FSK) and phase-shift keying (PSK) capabilities, providing military-grade performance in electronic warfare and airborne surveillance applications.

- In January 2024, Nokia Bell Labs demonstrated a new probabilistic constellation shaping (PCS) modulation technique integrated with its optical modulators, which successfully achieved 1.2 Tbps transmission over a single wavelength during live trials. This advancement aims to meet the surging data demands of 6G-ready infrastructure and long-haul fiber networks.

- In October 2023, Infineon Technologies AG introduced a new line of modulators and demodulators (modem SoCs) optimized for automotive radar and V2X (Vehicle-to-Everything) communication. The launch supports amplitude and phase modulation with ultra-low latency performance, meeting the high-speed requirements of autonomous vehicle systems.

- In September 2023, Mitsubishi Electric Corporation launched its next-gen satellite modulators equipped with dynamic polarization and phase modulation techniques. These were deployed as part of Japan’s national satellite communication program to enhance disaster recovery and rural connectivity infrastructure.

- In July 2023, MaxLinear Inc. released its DOCSIS 4.0-compatible digital RF modulator chipset, which supports higher-order modulation formats such as 4096-QAM. This innovation is aimed at cable network operators upgrading their hybrid fiber-coaxial (HFC) systems to deliver multi-gigabit broadband services.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Modulators Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Modulators Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Modulators Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.