Global Modular Instruments Market Segmentation, By Platform Type (PXI Platform, VXI Platform, and AXIe Platform), Industry Verticals (Aerospace and Defence, Semiconductor and Electronics, and Telecommunication), Application (Research and Development, Manufacturing, and Installation) – Industry Trends and Forecast to 2032

Modular Instruments Market Analysis

The modular instruments market has experienced significant growth due to the increasing demand for flexible and scalable testing solutions across various industries, including telecommunications, defense, aerospace, and automotive. These instruments, which include devices such as oscilloscopes, signal generators, and spectrum analyzers, are designed for high-precision testing and measurement, offering advantages such as customization, ease of integration, and adaptability to complex systems. Technological advancements, such as the development of software-defined instruments and automated testing solutions, are driving the market forward. These innovations enable faster testing cycles, improved accuracy, and cost-efficiency, benefiting sectors such as wireless communications and electronics manufacturing. Companies such as Key sight Technologies, National Instruments, and VIAVI Solutions are at the forefront, introducing cutting-edge solutions that support 5G testing, automated production lines, and advanced radar systems. The demand for modular instruments is further fueled by the growing need for high-frequency testing in telecommunications and the increasing complexity of systems in industries such as aerospace and defense. As these sectors expand, the market is set for continuous growth, with innovations that enhance performance and support the next generation of technologies.

Modular Instruments Market Size

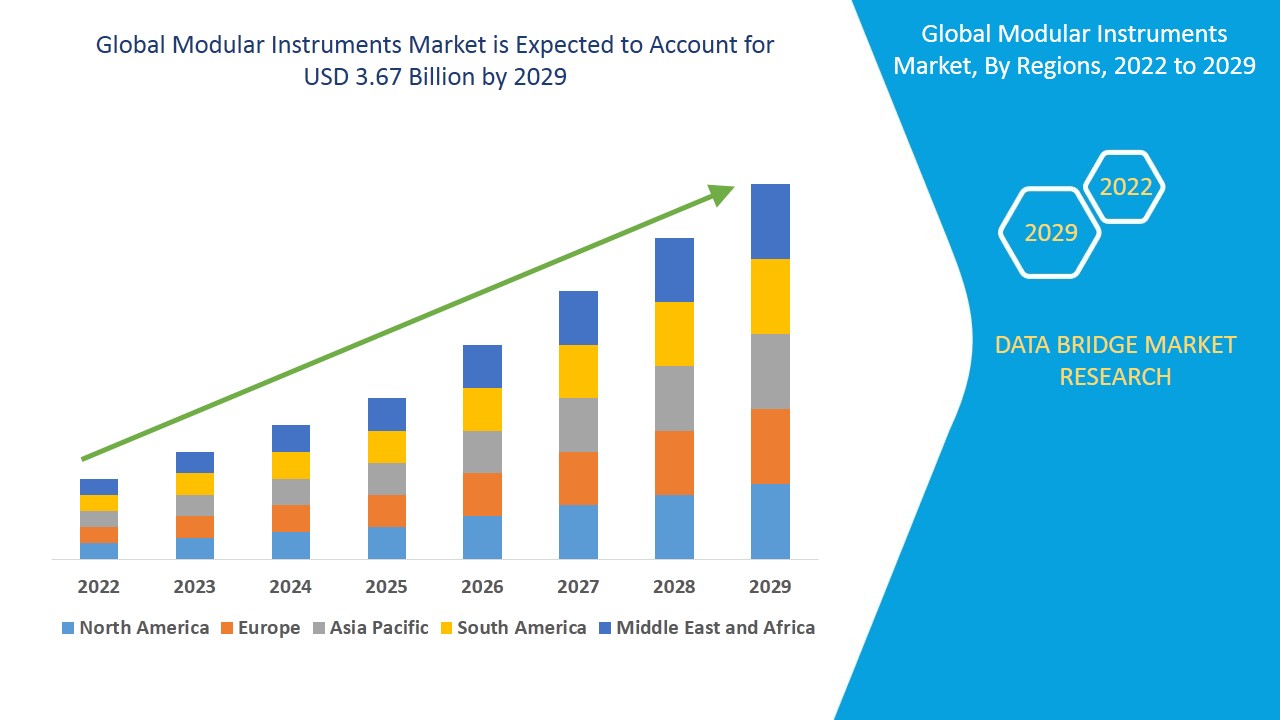

The global Modular Instruments market size was valued at USD 2.64 billion in 2024 and is projected to reach USD 4.47 billion by 2032, with a CAGR of 6.80% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Modular Instruments Market Trends

“Increasing Demand for Flexible and Scalable Testing Solutions”

The modular instruments market is witnessing significant growth driven by the increasing demand for flexible and scalable testing solutions across sectors such as telecommunications, aerospace, and automotive. One notable trend is the rise of software-defined instruments, which offer enhanced customization and adaptability to meet the complex requirements of modern testing. For instance, companies such as Key sight Technologies and National Instruments are advancing their product offerings to support next-generation technologies such as 5G networks and autonomous vehicles. These innovations allow for quicker and more precise measurements, which is crucial for high-performance testing environments. The ability to reconfigure instruments through software reduces costs and improves operational efficiency, making them ideal for industries that require frequent updates and custom setups, such as electronics manufacturing and defense. As industries continue to evolve, the demand for modular instruments capable of supporting cutting-edge technologies is expected to rise, further propelling market growth.

Report Scope and Modular Instruments Market Segmentation

|

Attributes

|

Modular Instruments Key Market Insights

|

|

Segments Covered

|

|

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America

|

|

Key Market Players

|

ADLINK Technology Inc. (Taiwan), Astronics Corporation (U.S.), Cobham Limited (U.K.), Rhode & Schwarz (Germany), NATIONAL INSTRUMENTS CORP. (U.S.), Keysight Technologies (U.S.), Teradyne Inc. (U.S.), VIAVI Solutions Inc. (U.S.), AMETEK, Inc. (U.S.), EXFO Inc. (Canada), Aplab Limited (India), Fortive (U.S.), Qmax Systems (India), SPX TECHNOLOGIES (U.S.), The Anritsu Corporation (Japan), Lumentum Operations LLC (U.S.), Scientech Technologies Pvt. Ltd. (India), Premier Measurement Solutions Pvt Ltd. (India), and Yokogawa India Ltd. (India)

|

|

Market Opportunities

|

Rising Focus on Research and Development (R&D) Across Sectors

|

|

Value Added Data Infosets

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

|

Modular Instruments Market Definition

Modular instruments are test and measurement devices designed with a flexible, customizable architecture that allows users to configure and reconfigure components as needed for various testing applications. These instruments typically consist of individual modules, such as oscilloscopes, signal generators, spectrum analyzers, and power supplies, which can be easily integrated into a central chassis or platform. This modularity enables users to select and combine different modules to meet specific testing requirements, providing a scalable and cost-effective solution for industries.

Modular Instruments Market Dynamics

Drivers

- Rising Demand from the Aerospace and Defense Industry

The rising demand from the aerospace and defense industry is a significant driver of the modular instruments market. As technological advancements in areas such as satellite communication, military defense systems, and avionics become more complex, the need for precision testing solutions has increased. Modular instruments offer the flexibility to test a wide range of systems, from radar and communication devices to avionics equipment. For instance, companies such as Keysight Technologies and National Instruments are providing modular solutions that are crucial in the development and testing of next-generation radar systems and military communication networks. The growing investment in 5G infrastructure, military aircraft development, and defense technologies further fuels the demand for high-accuracy, customizable test solutions. With increasing defense budgets worldwide, particularly in countries such as the U.S. and China, the aerospace and defense sector continues to be a major contributor to the market's growth. This trend is expected to accelerate as new aerospace technologies and advanced defense systems require more sophisticated, adaptable testing methods.

- Growing Numbers of Small and Medium-Scale Manufacturing Industries

Growing numbers of small and medium-scale manufacturing industries is a key driver for the modular instruments market. As these industries expand, they require cost-effective, scalable, and versatile testing solutions to ensure the quality and performance of their products. Modular instruments, due to their flexibility and modularity, allow smaller manufacturers to access advanced testing technologies without the need for large upfront investments. For instance, industries in electronics, automotive, and consumer goods are increasingly adopting modular testing platforms to ensure product reliability and comply with stringent industry standards. In addition, National Instruments and AMETEK are offering customized, scalable solutions that cater specifically to these industries, allowing them to compete more effectively in a global market. This trend of adopting modular instruments for efficient and precise testing is expected to accelerate as more small and medium enterprises emerge worldwide, particularly in Asia-Pacific and Latin America.

Opportunities

- Increasing Technological Advancements in Modular Instruments

Technological advancements in the modular instruments market, such as the development of software-defined instruments and automated testing solutions, are unlocking new opportunities for industries seeking high-performance testing capabilities. Software-defined instruments, which allow users to configure and control instruments via software rather than hardware, provide enhanced flexibility and scalability, enabling faster adaptation to changing testing requirements. For instance, Keysight Technologies offers a range of software-defined test systems that can be reprogrammed to meet the demands of 5G network testing and automotive electronics. Similarly, the integration of automated testing solutions is reducing human error and improving test throughput, making these instruments ideal for industries such as electronics manufacturing and automotive development, where precision and speed are critical. These innovations increase testing accuracy and drive cost-effectiveness by eliminating the need for frequent hardware upgrades. As industries push toward faster product development cycles, the demand for modular instruments equipped with cutting-edge technologies is expected to grow, presenting a significant market opportunity.

- Rising Focus on Research and Development (R&D) Across Sectors

The rising focus on research and development (R&D) across sectors, particularly in electronics manufacturing and defense, is significantly driving the demand for modular instruments capable of providing precise and reliable testing. As industries invest heavily in developing new technologies such as 5G networks, autonomous vehicles, and advanced military systems, there is a greater need for highly adaptable, high-performance testing solutions. For instance, National Instruments and Keysight Technologies are playing key roles by offering modular test systems that can be tailored for semiconductor testing and radar system development. The demand for advanced testing solutions is further fueled by the rapid advancements in artificial intelligence (AI), Internet of Things (IoT), and quantum computing, all of which require continuous innovation and validation. As R&D efforts intensify, especially with governments and private companies boosting their defense and electronics R&D budgets, modular instruments offer the flexibility, scalability, and accuracy needed to support complex projects. This growing emphasis on innovation and advanced testing presents a significant market opportunity for modular instrument providers.

Restraints/Challenges

- High Initial Investment Costs

High initial investment costs represent a significant market challenge for the modular instruments sector, as these systems typically require substantial upfront capital, which can be a barrier for many potential customers. The cost of individual modules, integration with existing systems, and customization to meet specific application needs can quickly accumulate, making modular instrumentation an expensive option compared to traditional, off-the-shelf equipment. For instance, a laboratory or an electronics manufacturer looking to implement a modular test system for quality control might face significant costs for the modules themselves and for software licenses, calibration, and system integration. While modular systems offer long-term flexibility and scalability, the high initial outlay can be a deterrent for companies with tight budgets or those that do not anticipate a quick return on investment. This challenge is particularly acute in industries such as aerospace or telecommunications, where high-end testing equipment can cost several hundred thousand dollars, thus limiting market penetration to only well-funded enterprises. As such, the high initial investment remains a critical hurdle, preventing wider adoption and posing a barrier to the market's expansion, particularly in price-sensitive regions or sectors.

- Regulatory and Compliance Challenges

Regulatory and compliance challenges are a significant market hurdle for the modular instruments sector, particularly in industries such as healthcare, aerospace, and telecommunications, where stringent standards must be met to ensure safety, quality, and accuracy. For instance, modular instruments used in medical applications must comply with strict regulations such as the FDA's 21 CFR Part 820 for medical device manufacturing, as well as ISO 13485 certifications for quality management systems. These regulations necessitate extensive testing, documentation, and traceability, adding complexity and cost to the design, production, and marketing of modular instrumentation. In aerospace, systems must meet rigorous standards set by bodies such as the Federal Aviation Administration (FAA), which can delay product development and approval. The challenge is further compounded by varying regulations across different regions, as modular systems sold globally must comply with local standards in the U.S., Europe, and Asia, creating additional layers of complexity. For manufacturers, ensuring that their products meet all applicable standards in different markets requires substantial investment in compliance efforts, testing, and certification processes. This can increase the cost of production and slow down time to market, making it a significant barrier to growth and a challenge in capturing new market opportunities.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Modular Instruments Market Scope

The market is segmented on the basis of platform type, industry verticals, and application. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Platform Type

- PXI Platform

- VXI Platform

- AXIe Platform

Industry Verticals

- Aerospace and Defence

- Semiconductor and Electronics

- Telecommunication

Application

- Research and Development

- Manufacturing

- Installation

Modular Instruments Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, platform type, industry verticals, and application as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America continues to lead the modular instruments market and is expected to maintain this dominance throughout the forecast period. This growth is driven by significant technological advancements in the manufacturing sector, where modular instruments are increasingly being adopted for their flexibility and scalability. Furthermore, the growing demand for modular instruments in critical industries such as telecommunications, defence, and aerospace further strengthens the market’s expansion. As industries in these sectors require more precise and adaptable testing solutions, the market in North America is set to continue flourishing.

Asia-Pacific is poised to achieve the highest growth rate in the modular instruments market, driven by rapid infrastructure development across key economies. The increasing adoption of wireless communication devices is fueling the demand for modular instruments to support advanced testing and measurement needs. In addition, the growing number of manufacturing industries in countries such as China, India, and South Korea is further propelling the demand for efficient and scalable testing solutions. As these sectors continue to expand, the region is expected to experience robust growth in the modular instruments market.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Modular Instruments Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Modular Instruments Market Leaders Operating in the Market Are:

- ADLINK Technology Inc. (Taiwan)

- Astronics Corporation (U.S.)

- Cobham Limited (U.K.)

- Rhode & Schwarz (Germany)

- NATIONAL INSTRUMENTS CORP. (U.S.)

- Keysight Technologies (U.S.)

- Teradyne Inc. (U.S.)

- VIAVI Solutions Inc. (U.S.)

- AMETEK, Inc. (U.S.)

- EXFO Inc. (Canada)

- Aplab Limited (India)

- Fortive (U.S.)

- Qmax Systems (India)

- SPX TECHNOLOGIES (U.S.)

- The Anritsu Corporation (Japan)

- Lumentum Operations LLC (U.S.)

- Scientech Technologies Pvt. Ltd. (India)

- Premier Measurement Solutions Pvt Ltd. (India)

- Yokogawa India Ltd. (India)

Latest Developments in Modular Instruments Market

- In August 2024, Astronics Corporation introduced its next-generation handheld radio test set, the CTS-3000. This device is designed to provide field technicians with a portable, advanced tool for testing land mobile radios (LMR) across various frequency bands, including those used by military, civil aviation, and public safety sectors. In addition, the CTS-3000 enhances efficiency and reduces downtime for communication systems

- In October 2023, AMETEK, Inc. acquired Amplifier Research Corp. (AR), a company specializing in high-performance RF and microwave amplifiers for electromagnetic compatibility (EMC) testing, communications, and defense applications. This acquisition strengthens AMETEK’s Electronic Instruments Group and broadens its offerings in the radio frequency and microwave sectors

- In November 2022, Teledyne LeCroy launched the SimPASS USB platform, supporting USB4 with up to 80Gbps of bandwidth. This platform enhances the simulation environment through the integration of Teledyne LeCroy’s data traffic analysis capabilities, offering advanced insights for USB applications

- In April 2022, Keysight Technologies unveiled a PCIe test solution that supports the latest technologies in simulation, characterization, compliance, and validation testing. This solution enables clients to interconnect physical layers and optimize their transmitter and receiver capabilities to drive business growth

- In March 2020, Viavi Solutions Inc. launched a complete portfolio of test and measurement solutions aimed at accelerating high-speed network tests throughout the product lifecycle. One of the key products was the VIAVI ONT 800G FLEX DCO Module, a fully integrated test pluggable digital coherent module for the development, validation, and integration of 400G CFP2-DCO and 400GE QSFP-DD transponders, including 400ZR

- In January 2020, Teledyne Technologies Incorporated acquired OakGate Technology, a provider of software and hardware solutions for testing electronic data storage devices throughout development, manufacturing, and end-use applications. This acquisition enhances Teledyne’s ability to offer comprehensive solutions to the semiconductor, data center, and consumer electronics industries

SKU-