Global Modular Chillers Market, By Type (Water-Cooled Modular Chillers, Air-Cooled Modular Chillers), Application (Commercial, Residential, Industrial, Others) – Industry Trends and Forecast to 2031.

Modular Chillers Market Analysis and Size

The modular chiller market continues to thrive, driven by the surge in global commercial construction projects. The demand for energy-efficient buildings, propelled by growing environmental awareness and government incentives such as tax rebates, fuels market growth. Stringent regulations and increasing awareness about energy-efficient systems further stimulate innovation. Modular chillers, known for their advantages over traditional models, witness high adoption rates. Rapid industrialization and significant investments in the construction sector contributed to this growth. In addition, technological advancements and chiller replacements open new opportunities for market players.

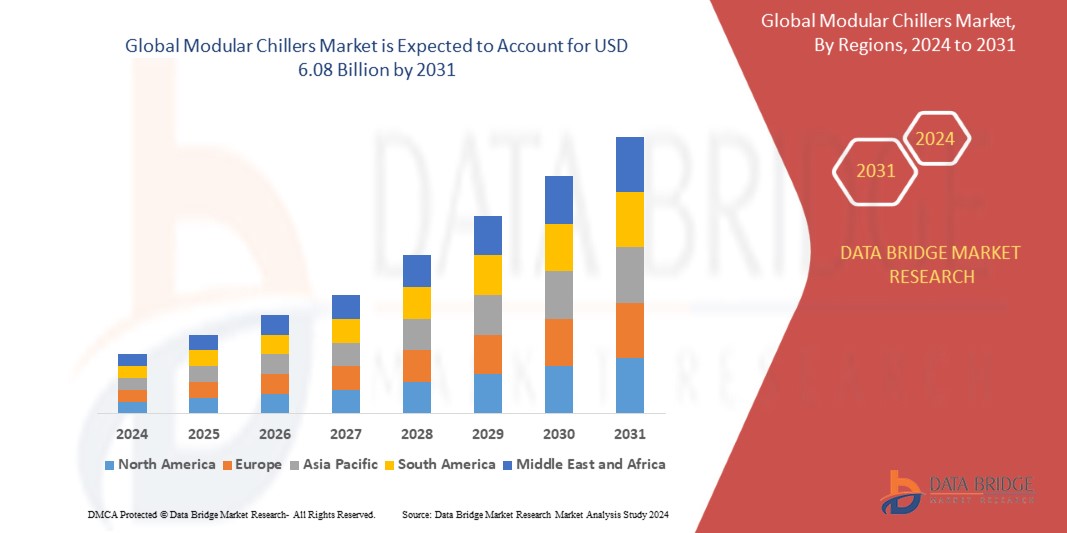

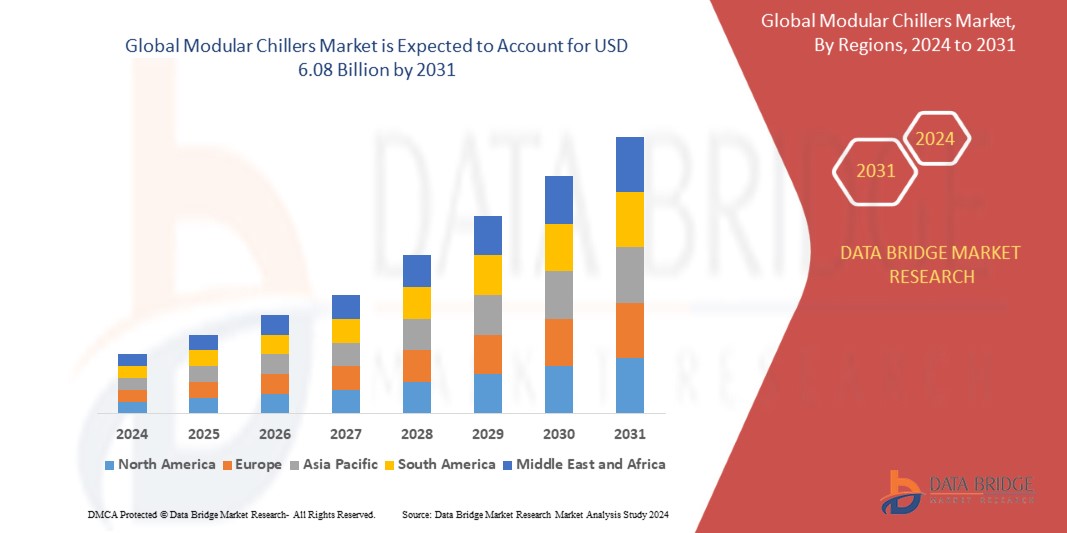

Data Bridge Market Research analyzes the global modular chiller market which was USD 3.91 billion in 2023, is expected to reach USD 6.08 billion by 2030, and is growing at a CAGR of 5.67% in the forecasted period of 2023 to 2031. "Water-cooled modular chillers" dominate the type segment of the market due to their high efficiency, making them a preferred choice for various industrial and commercial applications, including data centers and manufacturing facilities. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Modular Chillers Market Scope and Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2024 to 2031

|

|

Base Year

|

2023

|

|

Historic Years

|

2022 (Customizable to 2016-2021)

|

|

Quantitative Units

|

Revenue in USD Million, Pricing in USD

|

|

Segments Covered

|

Type (Water-Cooled Modular Chillers, Air-Cooled Modular Chillers), Application (Commercial, Residential, Industrial, Others)

|

|

Countries Covered

|

U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, U.A.E., Saudi Arabia, Egypt, South Africa, Israel, Rest of Middle East and Africa

|

|

Market Players Covered

|

Trane Technologies (Ireland), Daikin Industries (Japan), Johnson Controls International (Ireland), Carrier Global Corporation (U.S.), Broad Group (China), Mitsubishi Electric Corporation (Japan), York International (U.S.), Blue Star Limited (India), GREE Electric Appliances Inc. (China), Lennox International Inc. (U.S.), Hitachi Appliances, Inc. (Japan), Thermax Limited (India), Bosch Thermotechnology (Germany), Climaveneta S.p.A. (Italy), Climacool Corp (U.S.)

|

|

Market Opportunities

|

|

Market Definition

Modular chillers are specialized cooling systems used in various industrial and construction applications. They are designed to efficiently cool brine and water and dehumidify the surrounding air. Modular chillers can operate independently or in conjunction with other chiller modules to provide the required cooling capacity. These versatile units offer cooling capabilities and feature either internal or remote condensers. There are two main types of modular chillers: water-cooled and air-cooled, each with distinct applications and advantages.

Global Modular Chillers Market Dynamics

Drivers

- Increasing Commercial Construction Projects

The modular chiller market is experiencing robust growth due to the escalating number of commercial construction projects worldwide. These systems play a vital role in providing efficient and scalable cooling solutions for large-scale buildings, which are in high demand.

- Demand for Energy-Efficient Solutions

Growing environmental awareness and government incentives to promote energy-efficient technologies have driven the adoption of modular chillers in the construction industry. These chillers offer enhanced energy performance, reducing the carbon footprint and operational costs for end-users.

Opportunities

- Favouring Stringent Government Regulations

Governments worldwide are implementing and promoting regulations that favor energy-efficient and environmentally friendly technologies, including modular chillers. These regulations create a conducive environment for the adoption of modular chillers, as they align with sustainability goals, reduce carbon emissions, and help organizations meet compliance requirements. The backing of such regulations enhances the market's growth potential by encouraging businesses and industries to invest in more eco-friendly and energy-efficient cooling solutions.

- Advantages Over Traditional Chillers

Modular chillers offer several benefits over conventional chiller systems. Their flexibility, scalability, and enhanced energy efficiency make them a preferred choice in various applications. These advantages drive market growth by meeting the increasing demand for energy-efficient and adaptable cooling solutions. Modular chillers are well-suited for addressing the challenges of modern cooling needs while aligning with sustainability goals and government regulations, creating significant opportunities for the market.

Restraints/Challenges

- Limited Replacement Market

In some regions, the market for replacing existing chiller systems may be limited. This constraint can hinder the widespread adoption of modular chillers, as the demand for replacements is not as extensive as in new construction projects.

- High Initial Costs

Despite their long-term cost-saving benefits, modular chiller systems often require a substantial initial investment. This upfront expense can deter potential users and slow down adoption, especially in cost-sensitive markets.

Recent Development

- In September 2023, Trane has introduced two new products to enhance energy efficiency. Trane Autonomous Control, powered by BrainBox AI, optimizes system performance through AI, reducing energy consumption and carbon emissions. Additionally, Trane in Server Row Solutions offer energy-efficient cooling for data centers. These innovations align with decarbonization goals and promote efficient building performance

- In August 2023, Daikin Industries, Ltd. will establish a new air conditioner production base in Tsukubamirai City, Ibaraki, Japan, to enhance product supply capabilities in the Kanto region. This expansion focuses on boosting supply capabilities, driving technological innovation, and reducing supply risks in the region. The new factory will become Daikin's first air conditioning plant in the Kanto region, aligning with its goal to strengthen domestic production

Global Modular Chillers Market Scope

The modular chillers market is segmented on the basis of type and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Water-Cooled Modular Chillers

- Air-Cooled Modular Chillers

Application

- Commercial

- Residential

- Industrial

- Others

Global Modular Chillers Market regional analysis/insights

The modular chillers market is analyzed and market size insights and trends are provided by country, type, and application as referenced above.

The countries covered in the market report are the U.S., Canada, Mexico, Germany, U.K., France, Italy, Spain, Russia, Poland, Switzerland, Netherlands, Hungary, Austria, Norway, Ireland, Turkey, Lithuania, rest of Europe, China, Japan, India, Australia, South Korea, Singapore, Thailand, Malaysia, Indonesia, Philippines, Vietnam, rest of Asia-Pacific, Brazil, Argentina, Peru, rest of South America, South Africa, Saudi Arabia, U.A.E., Israel, Egypt, and rest of Middle East & Africa.

Asia-Pacific is expected to dominate and also witness significant growth in the market due to robust industrialization, increasing construction activities, and a growing focus on energy-efficient solutions in countries like China and India, contributing to the market's significant growth in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Modular Chillers Market Share Analysis

The modular chillers market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies’ focus related to modular chillers market.

Some of the major players operating in the modular chillers market are:

- Trane Technologies (Ireland)

- Daikin Industries (Japan)

- Johnson Controls International (Ireland)

- Carrier Global Corporation (U.S.)

- Broad Group (China)

- Mitsubishi Electric Corporation (Japan)

- York International (U.S.)

- Blue Star Limited (India)

- GREE Electric Appliances Inc. (China)

- Lennox International Inc. (U.S.)

- Hitachi Appliances, Inc. (Japan)

- Thermax Limited (India)

- Bosch Thermotechnology (Germany)

- Climaveneta S.p.A. (Italy)

- Climacool Corp (U.S.)

SKU-