Global Mobile Virtual Network Operator Mvno Market

Market Size in USD Billion

CAGR :

%

USD

84.43 Billion

USD

156.74 Billion

2024

2032

USD

84.43 Billion

USD

156.74 Billion

2024

2032

| 2025 –2032 | |

| USD 84.43 Billion | |

| USD 156.74 Billion | |

|

|

|

|

Mobile Virtual Network Operator (MVNO) Market Size

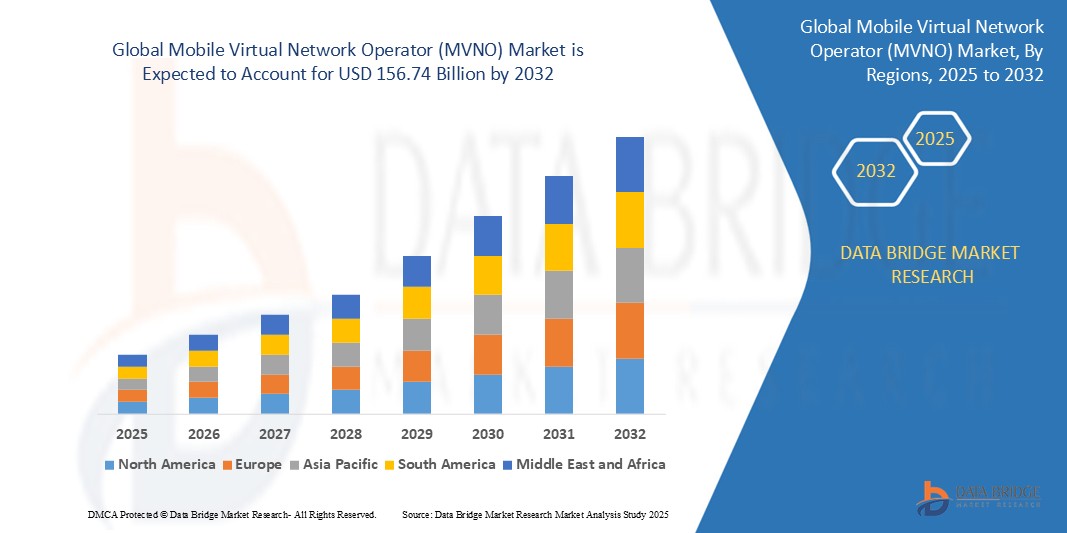

- The global mobile virtual network operator (MVNO) market size was valued at USD 84.43 billion in 2024 and is expected to reach USD 156.74 billion by 2032, at a CAGR of 8.04% during the forecast period

- The market growth is largely fueled by rising consumer demand for affordable mobile communication services, especially in price-sensitive regions. Increasing smartphone adoption and data consumption continue to support this shift toward low-cost operators

- MVNOs are gaining traction due to their flexible business models and personalized offerings tailored to specific user groups. Services such as no-contract plans, international roaming packages, and niche-targeted data solutions are enhancing customer appeal

Mobile Virtual Network Operator (MVNO) Market Analysis

- The mobile virtual network operator market is witnessing a consistent rise in demand due to the growing popularity of customized service offerings that cater to specific consumer needs across sectors such as retail, media, and transportation

- Operators are focusing on service differentiation through flexible pricing, data-centric plans, and value-added features that appeal to niche audiences, for instance, youth-centric plans with gaming and streaming benefits

- Asia-Pacific dominates the mobile virtual network operator (MVNO) market with the market share of 9.09% in 2024, driven by the region's rapid adoption of 5G technology and the proliferation of affordable smartphones

- Europe is expected to be the fastest growing region in the mobile virtual network operator (MVNO) market during the forecast period, with market share of 47.05% driven by favorable regulatory frameworks and widespread broadband access

- The discount model holds the largest market share of 24.05% in 2024, primarily due to strong demand for low-cost plans in price-sensitive markets and among budget-conscious consumers

Report Scope and Mobile Virtual Network Operator (MVNO) Market Segmentation

|

Attributes |

Mobile Virtual Network Operator (MVNO) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Mobile Virtual Network Operator (MVNO) Market Trends

“Personalized Mobile Plans Reshape Telecom Service Models”

- The mobile virtual network operator market is experiencing strong growth due to increasing demand for personalized mobile service plans across diverse consumer segments

- Consumers are opting for tailored voice and data packages that match their specific usage habits rather than standard plans from traditional telecom providers

- Operators are expanding their offerings to include streaming, gaming, and social media bundles designed for younger audiences and tech-savvy users

- Some providers are launching influencer-branded mobile services that align with lifestyle preferences and include exclusive content or perks

- The ability to quickly adapt to consumer trends through digital platforms allows these operators to stay relevant in a highly competitive landscape

- In conclusion, by focusing on customer-specific value rather than a one-size-fits-all approach, the market continues to evolve and attract new users seeking more control and flexibility over their mobile plans

Mobile Virtual Network Operator (MVNO) Market Dynamics

Driver

“Growing Demand for Customized Mobile Services”

- The mobile virtual network operator market is seeing rapid growth as users move away from rigid traditional plans toward customized mobile service options that align with their individual data, calling, and entertainment preferences

- Consumers such as frequent streamers or remote workers now prefer data-heavy packages that support uninterrupted usage across multiple apps and platforms without overage charges

- For instance, operators such as Google Fi and Lycamobile offer flexible international calling plans specifically designed for migrants who need affordable communication with family abroad

- Some operators collaborate with influencers and digital brands to create lifestyle-oriented plans that include exclusive access to concerts, streaming content, and shopping perks

- The availability of pay-as-you-go and subscription-based models also allows users to control expenses while enjoying value-rich services, reinforcing their preference for flexibility over long-term telecom contracts

- In conclusion, personalized plans continue to redefine customer expectations, making this approach a key growth pillar for mobile virtual network operators

Restraint/Challenge

“Limited Network Infrastructure Ownership”

- Mobile virtual network operators face operational limitations due to their reliance on third-party telecom providers for network infrastructure, reducing control over service quality and response times

- Service disruptions, bandwidth congestion, or slow speeds are often beyond the control of virtual operators, especially when primary networks prioritize their own subscribers during peak periods

- Smaller operators may struggle to offer reliable 5G services or high-speed data packages without incurring premium costs or accepting lower margins

- Limited access to advanced technologies, coupled with restricted customization of core network functions, makes it difficult for these operators to stand out in terms of performance

- These challenges in infrastructure dependency can hinder customer satisfaction and innovation, restricting long-term competitiveness and scalability in a saturated market

- In conclusion, without direct control of core systems, mobile virtual network operators remain vulnerable to the priorities and pricing models set by primary carriers

Mobile Virtual Network Operator (MVNO) Market Scope

The market is segmented on the basis of service, infrastructure, operational model, subscriber, business model, and organization size.

- By Service

On the basis of service, the mobile virtual network operator (MVNO) market is segmented into network routing, customer care, handset management and marketing and sales, postpaid, and prepaid. The prepaid segment captures the largest market share in 2024, driven by its affordability, flexibility, and ease of activation without long-term contracts

Customer care segment is projected to witness the fastest growth rate and consumers prefer prepaid services for better spending control, especially in emerging digital economies and youth demographics with budget-conscious usage patterns. The postpaid segment is expected to grow steadily due to its appeal among enterprise users and high-data users who seek uninterrupted connectivity and bundled service options

- By Infrastructure

On the basis of infrastructure, the mobile virtual network operator (MVNO) market is segmented into skinny mobile virtual network operator (MVNO), thin mobile virtual network operator (MVNO), and thick mobile virtual network operator (MVNO). The thin MVNO segment dominates the largest market share in 2024 due to its cost-effectiveness and operational flexibility, making it an ideal choice for new entrants. These operators typically rely on host mnos for network infrastructure, enabling faster market entry with lower capital investment.

The thick MVNO segment is projected to witness the fastest growth rate in 2024 to 2032, driven by the growing demand for enhanced service control and brand differentiation. Thick MVNOs invest in their own core network infrastructure, offering greater customization and control over offerings, particularly in enterprise and niche segments.

- By Operational Model

On the basis of operational model, the mobile virtual network operator (MVNO) market is segmented into reseller, service operator and full mobile virtual network operator (MVNO). The full mobile virtual network operator (MVNO) segment holds the largest share of 60.05% in 2024, owing to its low-risk, low-investment entry model that allows businesses to focus on customer acquisition without managing complex operations.

The full MVNO segment is expected to grow at the fastest rate during the forecast period, driven by increased interest from tech-savvy enterprises seeking full control over network components and customer experience. This model allows for innovation in pricing, services, and network management.

- By Subscriber

On the basis of subscriber, the mobile virtual network operator (MVNO) market is segmented into consumer and enterprise. The consumer segment leads in market revenue in 2024, attributed to the mass adoption of cost-effective and customizable mobile plans, particularly among price-sensitive users.

The enterprise segment is forecasted to register the fastest growth at a CAGR from 2025 to 2032, driven by increasing demand for private networks, IOT connectivity, and tailored telecom solutions among businesses, especially in logistics, retail, and manufacturing sectors.

- By Business Model

On the basis of business model, the mobile virtual network operator (MVNO) market is segmented into discount, specialist data, ethnic, business, international, youth/media, bundled and others. The discount model holds the largest market share of 24.05% in 2024, primarily due to strong demand for low-cost plans in price-sensitive markets and among budget-conscious consumers.

The specialist data segment is projected to grow at the highest CAGR from 2025 to 2032, fueled by the rising consumption of mobile data, especially among users seeking data-only plans for iot devices, tablets, and secondary lines.

- By Organization Size

On the basis of organization size, the mobile virtual network operator (MVNO) market is segmented into small and medium-sized enterprise and large enterprise. The large enterprise segment dominates the market in 2024, benefiting from established infrastructure, advanced analytics, and broader customer reach to scale MVNO operations.

The small and medium-sized enterprises (SMEs) segment is anticipated to grow at the fastest rate during the forecast period, driven by increased adoption of MVNO models by startups and SMEs aiming to serve niche markets and offer customized telecom services with minimal upfront investment.

Mobile Virtual Network Operator (MVNO) Market Regional Analysis

- Asia Pacific dominates the Mobile Virtual Network Operator (MVNO) market with the market share of 9.09% in 2024, driven by the region's rapid adoption of 5G technology and the proliferation of affordable smartphones

- The widespread deployment of 5G networks, particularly in countries such as China, Japan, and South Korea, has enabled MVNOs to offer high-speed connectivity and innovative digital services, such as cloud gaming and IoT-based applications, enhancing their market presence

- In addition, the increasing availability of low-cost smartphones has expanded the customer base for MVNOS, allowing them to provide flexible and affordable mobile data plans to a broader segment of the population, especially in emerging markets such as india and Indonesia

U.S. Mobile Virtual Network Operator (MVNO) Market Insight

The U.S. MVNO market demonstrates strong growth potential due to its mature telecommunications infrastructure, high mobile penetration, and competitive pricing strategies. MVNOs in the U.S. Are leveraging advanced technologies such as ESIMS and 5g networks to offer flexible and scalable services. Increasing demand for customized plans among niche user groups, including seniors, budget-conscious consumers, and travelers, continues to fuel expansion. Regulatory support and favorable wholesale agreements with MNOS further enhance market scalability for new entrants.

Europe Mobile Virtual Network Operator (MVNO) Market Insight

The Europe MVNO market is characterized by a diverse and highly competitive landscape, with market share of 47.05% driven by favorable regulatory frameworks and widespread broadband access. MVNOs benefit from supportive policies by the European commission that promote market liberalization and consumer choice. Operators are targeting niche segments such as ethnic communities, travelers, and data-centric users with tailored offerings. The increasing focus on green connectivity and digital inclusion across EU nations is expected to support continued MVNO adoption in both urban and rural areas.

U.K. Mobile Virtual Network Operator (MVNO) Market Insight

In the U.K., the MVNO market is thriving with market share of 21.05% due to growing demand for affordable mobile services, particularly among youth, international students, and digital-native users. The country’s advanced telecom environment and high smartphone usage create fertile ground for innovation in pricing and service delivery. U.K.-based MVNOs are increasingly adopting digital-only platforms to reduce costs and enhance customer experience. Continued 5g rollout and the push toward virtualized services are expected to support long-term growth.

Germany Mobile Virtual Network Operator (MVNO) Market Insight

Germany’s MVNO market is expanding steadily with market share of 23.05%, supported by strong consumer demand for alternative mobile service providers and a well-established mobile infrastructure. The market benefits from regulatory measures promoting fair access to wholesale network services and transparent pricing. German MVNOs often focus on sustainability, security, and privacy—values highly regarded by local consumers. The growth of industrial iot and connected ecosystems is also opening up new enterprise opportunities for MVNOs in the region.

Asia-Pacific Mobile Virtual Network Operator (MVNO) Market Insight

The Asia-pacific MVNO market holds immense growth potential, driven by rising mobile subscriptions, increasing internet penetration, and government-backed digital transformation initiatives. Countries such as India, China, and Indonesia are key growth engines, with MVNOs addressing diverse needs such as rural connectivity, data-only services, and low-cost plans. The presence of a large unbanked and underconnected population presents opportunities for financial inclusion and digital services through MVNO platforms. The rapid 5g rollout and growing IoT ecosystem further support market expansion.

Japan Mobile Virtual Network Operator (MVNO) Market Insight

Japan’s MVNO market is evolving rapidly with market share of 14.08%, supported by a tech-savvy population, regulatory encouragement for competition, and demand for flexible mobile solutions. Japanese MVNOs are focusing on low-data plans, elderly-friendly services, and integration with lifestyle apps to cater to unique consumer needs. High-speed connectivity, efficient network sharing agreements, and strong demand for mobile payment and streaming services continue to drive market development. The shift toward digital onboarding and remote services is further streamlining operations and customer acquisition.

China Mobile Virtual Network Operator (MVNO) Market Insight

China’s MVNO market remains the largest in Asia-pacific by volume, backed by strong government support, rapid urbanization, and high smartphone adoption. The country’s robust manufacturing ecosystem enables MVNOs to offer affordable devices bundled with services. Chinese MVNOs are increasingly exploring vertical-specific applications, including logistics, e-commerce, and smart city services, as part of the broader digital economy. With the continued push for 5g expansion and ai-powered telecom solutions, China’s MVNO sector is poised for sustained growth.

Mobile Virtual Network Operator (MVNO) Market Share

The mobile virtual network operator (MVNO) industry is primarily led by well-established companies, including:

- Virgin Media Business Ltd (U.K.)

- DataXoom (U.S.)

- Lebara. (U.K.)

- KDDI CORPORATION (Japan)

- Asahi Net, Inc. (Japan)

- Tesco (U.K.)

- Virgin Plus (Canada)

- TracFone Wireless, Inc. (U.S.)

- Verizon (U.S.)

- DISH Wireless LLC (U.S.)

- Lyca Mobile Group (U.K.)

- Poste Italiane (Italy)

- Airvoice Wireless (U.S.)

- giffgaff (U.K.)

- Kajeet, Inc. (U.S.)

- Enreach (Netherlands)

- Ting (Canada)

- Red Pocket Mobile (U.S.)

- Consumer Cellular (U.S.

Latest Developments in Global Mobile Virtual Network Operator (MVNO) Market

- In March 2023, KDDI collaborated with Rakuten Mobile to launch KDDI Rakuten Mobile Business, an MVNO service targeting businesses. This venture aimed to offer tailored mobile plans to meet the diverse needs of businesses, enhancing their communication infrastructure

- In May 2023, KDDI collaborated with NTT Docomo to introduce KDDI Docomo Student, an MVNO service catering exclusively to students. Named for its target demographic, the service provided specialized mobile plans designed to meet the communication needs of students attending participating universities

- In November, 2023, KDDI and China Mobile Japan collaborated to launch KDDI China Mobile Japan, an MVNO service targeting Chinese tourists visiting Japan. This collaboration aimed to offer mobile plans tailored to enhance the connectivity and communication experience of Chinese tourists during their travels

- In July, 2022, PeP acquired Simapka to bolster mobile services in Poland and facilitate a broader range of additional services, particularly focused on payments. This acquisition aimed to create an ecosystem that promotes payment digitization, with Simapka's mobile application serving as a key tool for retail outlets across Europe

- In December, 2022, Cricket Wireless LLC collaborated with the Southern Intercollegiate Athletic Conference (SIAC) to offer exclusive opportunities to SIAC fans at Historically Black Colleges and Universities (HBCUs). This collaboration aimed to enhance engagement and connectivity within the HBCU community, leveraging Cricket's services to provide unique benefits to fans

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.