Global Mobile Virtual Network Operator (MVNO) Market, By Service (Network Routing, Customer Care, Handset Management and Marketing and Sales, Postpaid, and Prepaid), Infrastructure (Skinny Mobile Virtual Network Operator (MVNO), Thin Mobile Virtual Network Operator (MVNO), and Thick Mobile Virtual Network Operator (MVNO)), Operational Model (Reseller, Service Operator and Full Mobile Virtual Network Operator (MVNO)), Subscriber (Consumer and Enterprise), Business Model (Discount, Specialist Data, Ethnic, Business, International, Youth/Media, Bundled and Others), Organization Size (Small and Medium-Sized Enterprise and Large Enterprise) – Industry Trends and Forecast to 2031.

Mobile Virtual Network Operator (MVNO) Market Analysis and Size

International roaming represents a key application of mobile virtual network operator (MVNO) market. MVNOs leverage their partnerships with multiple mobile network operators worldwide to offer competitive roaming services to their customers. Providing affordable roaming plans with transparent pricing and convenient activation processes, MVNOs cater to the needs of travelers and businesses requiring seamless connectivity abroad. Through their flexible business models and specialized offerings, MVNOs enhance the accessibility of international roaming services, empowering consumers to stay connected while traveling without incurring exorbitant charges.

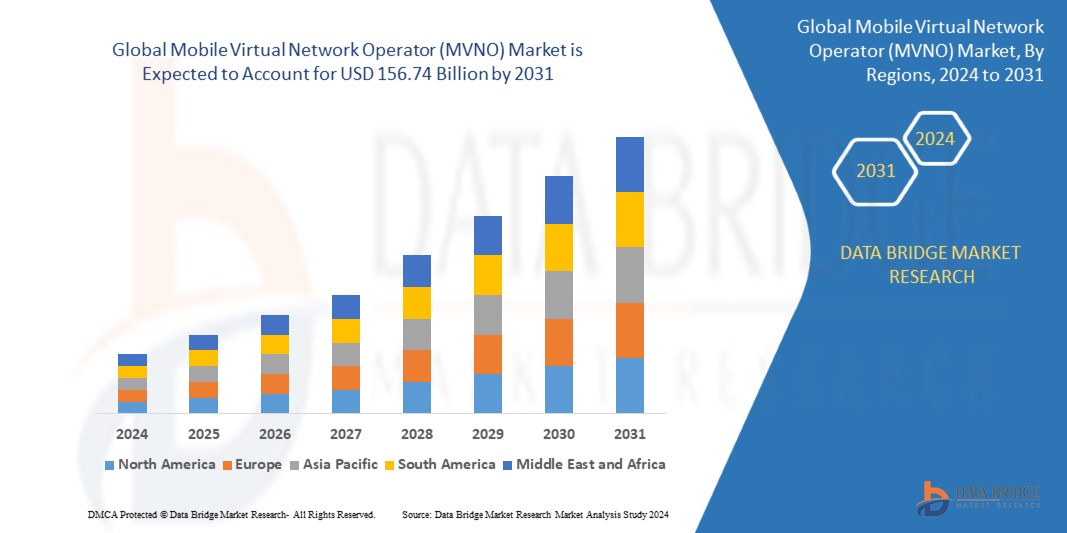

Global mobile virtual network operator (MVNO) market size was valued at USD 84.43 billion in 2023 and is projected to reach USD 156.74 billion by 2031, with a CAGR of 8.04% during the forecast period of 2024 to 2031. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

|

Forecast Period

|

2024-2031

|

|

|

Base Year

|

2023

|

|

|

Historic Years

|

2022 (Customizable to 2016-2021)

|

|

|

Quantitative Units

|

Revenue in USD Billion, Volumes in Units, Pricing in USD

|

|

|

Segments Covered

|

Service (Network Routing, Customer Care, Handset Management and Marketing and Sales, Postpaid, and Prepaid), Infrastructure (Skinny Mobile Virtual Network Operator (MVNO), Thin Mobile Virtual Network Operator (MVNO), and Thick Mobile Virtual Network Operator (MVNO)), Operational Model (Reseller, Service Operator and Full Mobile Virtual Network Operator (MVNO)), Subscriber (Consumer and Enterprise), Business Model (Discount, Specialist Data, Ethnic, Business, International, Youth/Media, Bundled and Others), Organization Size (Small and Medium-Sized Enterprise and Large Enterprise)

|

|

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa Brazil, Argentina, and Rest of South America.

|

|

|

Market Players Covered

|

Virgin Media Business Ltd (U.K.), DataXoom (U.S.), Lebara. (U.K.), KDDI CORPORATION (Japan), Asahi Net, Inc. (Japan), Tesco (U.K.), Virgin Plus (Canada), TracFone Wireless, Inc. (U.S.), Verizon (U.S.), DISH Wireless LLC (U.S.), Lyca Mobile Group (U.K.), Poste Italiane (Italy), Airvoice Wireless (U.S.), giffgaff (U.K.), Kajeet, Inc. (U.S.), Enreach (Netherlands), Ting (Canada), Red Pocket Mobile (U.S.), and Consumer Cellular (U.S.)

|

|

|

Market Opportunities

|

|

|

Market Definition

A mobile virtual network operator (MVNO) is a company that offers mobile phone services without owning the wireless infrastructure. Instead, MVNOs lease network access from traditional mobile network operators and then repackage and resell it to consumers under their own brand. This allows MVNOs to enter the market without investing in costly infrastructure.

Mobile Virtual Network Operator (MVNO) Market Dynamics

Drivers

- Growing Collaborations leads to the High Demand for MVNOs

Collaboration between MVNOs and traditional mobile network operators provide access to network infrastructure, allowing virtual carriers to offer competitive services while minimizing operational costs. Additionally, collaborations with technology providers, content creators, and other industry stakeholders facilitate the development of innovative mobile solutions and value-added services. These collaboration expand market reach, enhance service offerings, and foster ecosystem growth, driving increased competition and innovation within the MVNO market.

The collaboration between Virgin Mobile and T-Mobile exemplifies how partnerships drive the MVNO market. Leveraging T-Mobile's extensive network infrastructure, Virgin Mobile can provide cost-effective wireless services tailored to specific demographics such as youth and budget-conscious consumers. This collaboration showcases how MVNOs can access essential resources and broaden their market reach through strategic partnerships, ultimately enhancing competition and innovation within the industry.

- Growing Regulatory Environment Expands the Demand of MVNOs

Favorable regulations, such as mandated wholesale access to network infrastructure, lower barriers to entry for MVNOs, enabling them to compete with established operators. Additionally, regulations promoting fair competition and consumer protection encourage innovation and investment in the MVNO sector. Clear and predictable regulatory frameworks provide certainty for MVNOs, attracting investors and facilitating market entry and expansion. Overall, a conducive regulatory environment fosters a competitive marketplace, stimulating MVNOs to offer diverse and innovative services to consumers.

Opportunities

- Expanding Technological Advancements Enhances Customer Convenience

As new technologies emerge, such as 5G networks, Internet of Things (IoT), and digital payment solutions, MVNO providers leverage these innovations to offer differentiated services and enhance their value proposition. For instance, MVNOs can capitalize on the increased bandwidth and lower latency of 5G networks to deliver high-quality, high-speed mobile services to their customers. IoT connectivity enables MVNOs to provide specialized solutions for connected devices, catering to industries such as healthcare, transportation, and smart cities. Moreover, advancements in digital payment solutions enable MVNOs to integrate mobile financial services into their offerings, expanding their revenue streams and enhancing customer convenience.

For instance, In July 2023, Mobile X Global, Inc., a U.S.-based MVNO, embraced technological advancements by integrating AI and cloud technology into its operations. Leveraging AI, the company aims to enhance service quality and customer experience, while adopting a cloud-native platform ensures scalability and agility in its offerings. This initiative aligns with the broader trend of technological innovation driving the growth and differentiation of MVNOs in the telecommunications market.

- Rising Consumer Demand Increases the Adoption of Mobile Virtual Network Operator

With a growing preference for flexible contracts, transparent pricing, and personalized services, consumers seek alternatives to traditional mobile operators. MVNOs capitalize on this demand by offering customizable plans, niche services, and innovative features tailored to specific demographics or market segments. Consumers increasingly prioritize affordability and value, prompting MVNOs to provide cost-effective solutions without compromising quality. As consumer preferences evolve, MVNOs remain agile, adapting their offerings to meet changing demands and preferences, driving competition and innovation in the telecommunications industry.

Restraints/Challenges

- Limited Infrastructure Control limits the Adoption of MVNOs

Unsuch as traditional operators, MVNOs rely on leasing network infrastructure from host operators, which restricts their ability to directly manage network quality, coverage, and reliability. This dependence on third-party infrastructure can lead to challenges in delivering consistent and competitive services to customers, as MVNOs have little control over network upgrades, maintenance, and optimization. Moreover, in situations where host operators prioritize their own subscribers or make changes to their networks, MVNOs may experience service disruptions or limitations, impacting their ability to meet customer expectations and compete effectively in the market.

- Intense Competition Hampers the Growth of MVNOs

With numerous MVNOs and traditional operators vying for market share, competition can lead to price wars and shrinking profit margins. MVNOs face challenges in differentiating their offerings amidst this fierce competition, often struggling to establish unique value propositions that resonate with consumers. Moreover, competing against well-established operators with strong brand recognition and customer loyalty poses additional hurdles for MVNOs seeking to gain traction in the market. This intense competitive environment can inhibit MVNOs' growth prospects and hinder their ability to sustainably capture market share and profitability.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Developments

- In 2023, KDDI collaborated with Rakuten Mobile to launch KDDI Rakuten Mobile Business, an MVNO service targeting businesses. This venture aimed to offer tailored mobile plans to meet the diverse needs of businesses, enhancing their communication infrastructure

- In 2023, KDDI collaborated with NTT Docomo to introduce KDDI Docomo Student, an MVNO service catering exclusively to students. Named for its target demographic, the service provided specialized mobile plans designed to meet the communication needs of students attending participating universities

- In 2023, KDDI and China Mobile Japan collaborated to launch KDDI China Mobile Japan, an MVNO service targeting Chinese tourists visiting Japan. This collaboration aimed to offer mobile plans tailored to enhance the connectivity and communication experience of Chinese tourists during their travels

- In 2022, PeP acquired Simapka to bolster mobile services in Poland and facilitate a broader range of additional services, particularly focused on payments. This acquisition aimed to create an ecosystem that promotes payment digitization, with Simapka's mobile application serving as a key tool for retail outlets across Europe

- In 2022, Cricket Wireless LLC collaborated with the Southern Intercollegiate Athletic Conference (SIAC) to offer exclusive opportunities to SIAC fans at Historically Black Colleges and Universities (HBCUs). This collaboration aimed to enhance engagement and connectivity within the HBCU community, leveraging Cricket's services to provide unique benefits to fans

Mobile Virtual Network Operator (MVNO) Market Scope

The market is segmented on the basis of service, infrastructure, operational model, subscriber, business model, and organization size. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Service

- Network Routing

- Customer Care

- Handset Management and Marketing and Sales

- Postpaid

- Prepaid

Infrastructure

- Skinny Mobile Virtual Network Operator (MVNO)

- Thin Mobile Virtual Network Operator (MVNO)

- Thick Mobile Virtual Network Operator (MVNO)

Operational Model

- Reseller

- Service Operator

- Full Mobile Virtual Network Operator (MVNO)

Subscriber

- Consumer

- Enterprise

Business Model

- Discount

- Specialist Data

- Ethnic

- Business

- International

- Youth/Media

- Bundled

- Others

Organization Size

- Small and Medium-Sized Enterprise

- Large Enterprise

Mobile Virtual Network Operator (MVNO) Market Region Analysis/Insights

The market is analyzed and market size insights and trends are provided service, infrastructure, operational model, subscriber, business model, and organization size as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

Asia-Pacific dominates in the MVNO market due to its vast population and rapid urbanization, there is a substantial and growing market for mobile services. The increasing adoption of smartphones, coupled with an expanding middle-class population, further fuels demand. Additionally, regulatory reforms have facilitated the entry of MVNOs into the market, while partnerships with established players have enabled rapid expansion, contributing to the region's leadership in terms of revenue and market share.

Europe is expected to experience rapid growth in the mobile sector due to rising mobile subscriber numbers indicate a growing market potential, while increasing demand for customizable and cost-effective mobile services drives innovation and competition among providers. Favorable regulatory environments foster market expansion and investment, encouraging new entrants and stimulating growth. Moreover, the widespread adoption of smartphones and mobile internet services further propels the demand for mobile offerings, creating opportunities for both traditional operators and MVNOs to thrive in the region.

The country section of the global sales force automation software market report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as consumption volumes, production sites and volumes, import export analysis, price trend analysis, cost of raw materials, down-stream and upstream value chain analysis are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Mobile Virtual Network Operator (MVNO) Market Share Analysis

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to the market.

Some of the major players operating in the market are:

- Virgin Media Business Ltd (U.K.)

- DataXoom (U.S.)

- Lebara. (U.K.)

- KDDI CORPORATION (Japan)

- Asahi Net, Inc. (Japan),

- Tesco (U.K.)

- Virgin Plus (Canada)

- TracFone Wireless, Inc. (U.S.)

- Verizon (U.S.)

- DISH Wireless LLC (U.S.)

- Lyca Mobile Group (U.K.)

- Poste Italiane (Italy)

- Airvoice Wireless (U.S.)

- giffgaff (U.K.)

- Kajeet, Inc. (U.S.)

- Enreach (Netherlands)

- Ting (Canada)

- Red Pocket Mobile (U.S.)

- Consumer Cellular (U.S.)

SKU-