Global Mobile Robots Market

Market Size in USD Billion

CAGR :

%

USD

21.60 Billion

USD

43.90 Billion

2024

2032

USD

21.60 Billion

USD

43.90 Billion

2024

2032

| 2025 –2032 | |

| USD 21.60 Billion | |

| USD 43.90 Billion | |

|

|

|

|

Global Mobile Robots Market Size

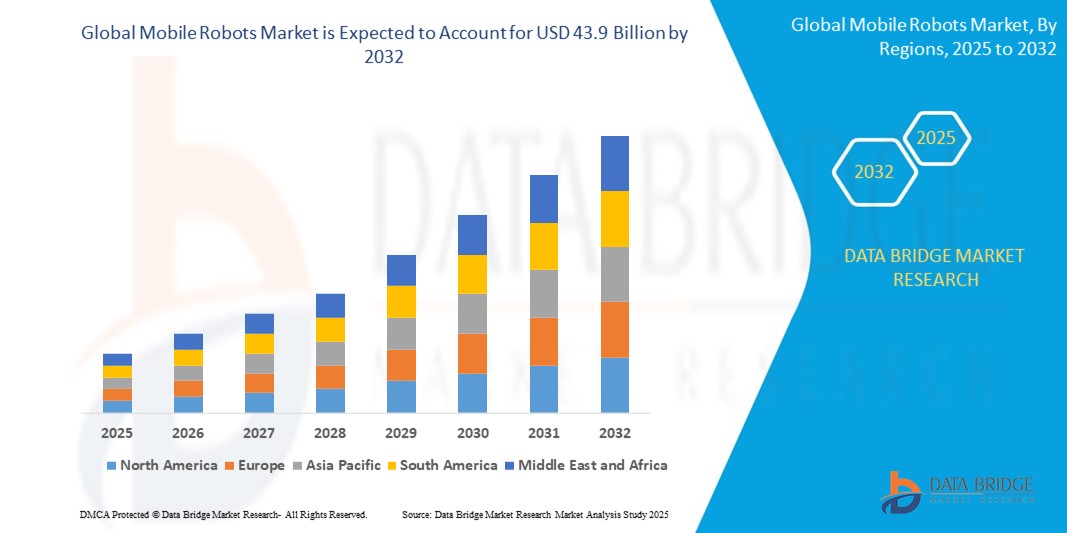

- The Global Mobile Robots Market size was valued at USD 21.6 billion in 2024 and is expected to reach USD 43.9 billion by 2032, at a CAGR of 10.7% during the forecast period.

- This growth is driven by E-commerce Boom Driving Warehouse Automation.

Global Mobile Robots Market Analysis

- With Industry 4.0 adoption accelerating across China, Japan, and South Korea, IoT-enabled mobile robots are revolutionizing smart manufacturing. In 2023, FANUC deployed IoT-integrated robotic transport units across multiple Japanese automotive plants to automate internal logistics.

- The booming online retail sector in countries like India and Southeast Asia is driving demand for smart warehouse automation. In 2024, Alibaba’s Cainiao expanded its IoT-based robotic systems to handle last-mile logistics in its regional distribution centers.

- Asia-Pacific is expected to dominate the mining equipment market due to Countries such as Japan and South Korea are facing labor constraints, especially in logistics and healthcare, prompting the adoption of autonomous mobile robots (AMRs). LG Electronics launched IoT-connected hospital delivery robots in Seoul in 2023 to support staff.

- North America is projected to be the fastest-growing region in the mining equipment market during the forecast period, supported by Rapid E-commerce Growth.

- The Domestic segment is expected to dominate the market with the market share of 20.41% owing to its the need for mobile robots in disaster response and hazardous zones is rising. Panasonic released IoT-powered mobile robots for radiation and debris inspection at disaster-affected sites in Japan in 2024.

Report Scope and Global Mobile Robots Market Segmentation

|

Attributes |

Global Mobile Robots Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Mobile Robots Market Trends

“AI and IoT Integration”

- The convergence of AI and IoT within mobile robots is enhancing real-time decision-making capabilities. AI algorithms analyze data from IoT devices to provide insights, enabling robots to perform tasks such as predictive maintenance and autonomous navigation.

- The shift towards cloud deployment offers enhanced scalability, flexibility, and cost-efficiency. Cloud-based solutions allow organizations to rapidly adjust resources in response to changing demands, ensuring optimal performance and reliability.

- Industries undergoing rapid digital transformation, such as logistics and manufacturing, are increasingly adopting mobile robots integrated with IoT and AI to facilitate process automation and efficiency.

- In February 2023, Geek+ and Starlings launched Saudi Arabia's first robotic fulfillment center, deploying 250 robots for picking and sorting tasks.

- The rollout of 5G across Asia-Pacific is enabling ultra-fast, low-latency robot communication. Hyundai Robotics began 5G trials with its mobile robots in smart factories in South Korea in 2024.

Global Mobile Robots Market Dynamics

Driver

“Reduced Dependency on IT Teams”

- Modern mobile robot platforms enable business users to define and manage operations without extensive IT involvement, accelerating deployment and reducing time-to-market.

- With the increasing complexity of regulatory environments, mobile robot solutions provide a framework for automated compliance monitoring, ensuring adherence to current regulations.

- For instance, In April 2023, ABB introduced Visual SLAM technology to enhance autonomous mobile robot (AMR) navigation.

- National strategies like “Made in China 2025” and “Digital India” are incentivizing industrial IoT and robotics. In 2023, Toshiba introduced IoT-connected security and inspection robots under a smart facility initiative in Tokyo.

Opportunity

“Expansion in Emerging Markets”

- Rapid digitalization in regions like Asia-Pacific is propelling the adoption of mobile robots. Governments are investing in digital transformation initiatives, creating opportunities for vendors to offer solutions that streamline operations and enhance decision-making.

- The incorporation of analytics capabilities such as predictive analytics and data mining into mobile robot platforms enables organizations to derive actionable insights from vast datasets.

- For instance, In March 2024, ABB launched the Flexley Tug T702 AMR, equipped with AI-based Visual SLAM for improved operational efficiency.

- The need for mobile robots in disaster response and hazardous zones is rising. Panasonic released IoT-powered mobile robots for radiation and debris inspection at disaster-affected sites in Japan in 2024.

Restraint/Challenge

“Resistance to Technological Change”

- Some organizations exhibit reluctance in adopting modern technologies due to concerns over complexity, required training, and potential disruptions to existing workflows.

- The initial investment required for mobile robot solutions, including software, hardware, and professional services, can be substantial. This financial barrier may deter small and medium-sized enterprises (SMEs) from adoption.

- In November 2024, India's Addverb Technologies announced plans to develop humanoid robots in collaboration with Reliance Industries, leveraging Jio's AI and 5G platforms.

- IoT-connected robots pose risks related to data interception and hacking. In 2024, South Korea's CERT issued warnings about network vulnerabilities in autonomous delivery robots.

Global Mobile Robots Market Scope

The market is segmented on the basis of Application, Operating Environment, Component, Type.

|

Segmentation |

Sub-Segmentation |

|

By Application |

|

|

By Operating Environment |

|

|

By Component |

|

|

By Type |

|

In 2025, the Domestic is projected to dominate the market with a largest share in equipment category segment

The Domestic segment is expected to dominate the mining equipment market with the largest share of 30.42% in 2025 due to Rapid digitalization in regions like Asia-Pacific is propelling the adoption of mobile robots. Governments are investing in digital transformation initiatives, creating opportunities for vendors to offer solutions that streamline operations and enhance decision-making.

The Software is expected to account for the largest share during the forecast period in industry market

In 2025, the Software segment is expected to dominate the market with the largest market share of 60.9% due to A limited skilled workforce in robotics and IoT technologies continues to hamper optimal implementation, especially in developing nations like India and the Philippines.

“Asia-Pacific Holds the Largest Share in the Global Mobile Robots Market”

- Asia-Pacific dominates the Global Mobile Robots Market with market share of 34.71%, driven by Rapid digitalization in regions like Asia-Pacific is propelling the adoption of mobile robots. Governments are investing in digital transformation initiatives, creating opportunities for vendors to offer solutions that streamline operations and enhance decision-making.

- China holds a dominant share in the region, supported by the incorporation of analytics capabilities such as predictive analytics and data mining into mobile robot platforms enables organizations to derive actionable insights from vast datasets.

- IoT-linked mobile robots for patient support and contactless services gained traction post-COVID-19. In 2023, Keenon Robotics deployed service robots in Thai hotels for food and room delivery.

- IoT mobile robots for soil analysis, irrigation, and crop health monitoring are expanding in countries like Japan and Australia. Kubota launched autonomous farming robots in 2023, equipped with IoT sensors.

“North America is Projected to Register the Highest CAGR in the Global Mobile Robots Market”

- North America is expected to witness the highest growth rate in the mining equipment market, fueled by Industrial Automation Surge.

- The U.S. and Canada are emerging as key markets, supported by Rapid E-commerce Growth.

- The U.S. market continues to grow due to Government Support for Smart Infrastructure.

- The integration of IoT data with digital twins is enabling simulation-based optimization of robotic operations. Siemens piloted digital twin-enabled mobile robot systems in APAC logistics parks in early 2024..

Global Mobile Robots Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Northrop Grumman Corporation,

- Kuka AG,

- Honda Motor Co., Ltd,

- SoftBank Corp.,

- Irobot, DJI,

- Lockheed Martin Corporation,

- Kongsberg Maritime,

- General Dynamics Mission Systems, Inc.,

- Samsung Electronics,

- Parrot Drones SAS.,

- 3DR,

- GeckoSystems Intl. Corp.,

- LG Electronics,

- Amazon Robotics,

- Mayfield Robotics,

- Promobot LLC,

- BLUE FROG ROBOTICS & BUDDY,

- LEGO System A/S

- ECA GROUP

Latest Developments in Global Mobile Robots Market

- In July 2021, ABB acquired Spain-based ASTI Mobile Robotics for $190 million to expand its mobile robotics offerings.

- In January 2024, ABB acquired Sevensense Robotics AG, enhancing its AMR capabilities with AI-driven 3D vision navigation technology.

- China's government has significantly increased procurement of humanoid robots, from 4.7 million yuan in 2023 to 214 million yuan in 2024, emphasizing their strategic importance.

- In February 2023, Geek+ and Starlings launched Saudi Arabia's first robotic fulfilment centre, deploying 250 robots for picking and sorting tasks.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Mobile Robots Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Mobile Robots Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Mobile Robots Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.