Global Mining Automation Market

Market Size in USD Billion

CAGR :

%

USD

6.75 Billion

USD

12.69 Billion

2025

2033

USD

6.75 Billion

USD

12.69 Billion

2025

2033

| 2026 –2033 | |

| USD 6.75 Billion | |

| USD 12.69 Billion | |

|

|

|

|

Global Mining Automation Market Size

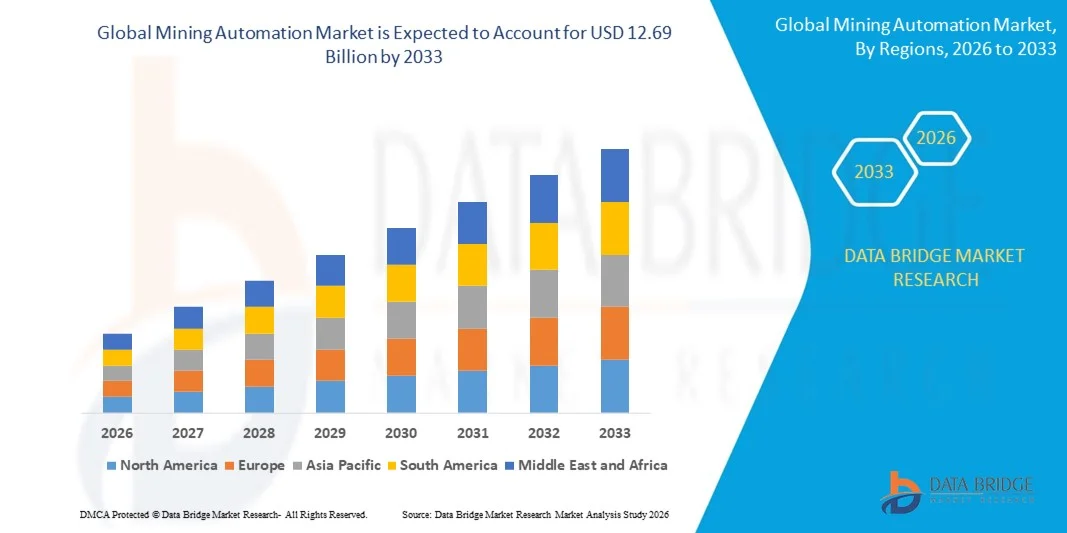

- The Global Mining Automation Market was valued at USD 6.75 billion in 2025 and is projected to reach USD 12.69 billion by 2033, expanding at a CAGR of 8.20% over the forecast period.

- Market expansion is primarily driven by the increasing deployment of advanced automated equipment, robotics, and AI-enabled systems across mining operations, supporting higher productivity, improved safety, and reduced operational costs.

- Additionally, rising demand for reliable, data-driven, and remote-operable mining solutions is positioning automation as a core enabler of modern mining workflows. These converging trends are accelerating the adoption of mining automation technologies, thereby significantly propelling industry growth.

Global Mining Automation Market Analysis

- Mining automation systems, encompassing autonomous equipment, remote monitoring platforms, and AI-driven control technologies, are becoming increasingly essential in modern mining operations due to their ability to enhance worker safety, improve productivity, enable remote operations, and seamlessly integrate with digital mine ecosystems.

- The rising demand for mining automation is primarily driven by the widespread adoption of digital mining technologies, growing safety concerns in hazardous mining environments, and a strong industry shift toward reducing operational costs through autonomous and data-intelligent solutions.

- Asia-Pacific dominated the Global Mining Automation Market with the largest revenue share of 35% in 2025, supported by early adoption of advanced mining technologies, high capital investment capacity, and the strong presence of leading automation providers, with the U.S. experiencing substantial growth in autonomous haulage and drilling systems driven by innovation from major mining and technology companies.

- North America is expected to be the fastest-growing region in the Global Mining Automation Market during the forecast period due to rapid industrialization, increasing mining output, and rising investments in smart mining infrastructure across developing economies.

- The surface mining technique dominated the market with the largest revenue share of 58.4% in 2025, driven by the extensive deployment of autonomous haulage systems, drilling rigs, and fleet management solutions in large open-pit mines.

Report Scope and Global Mining Automation Market Segmentation

|

Attributes |

Mining Automation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Caterpillar Inc. (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Global Mining Automation Market Trends

Enhanced Efficiency Through AI, Automation, and Autonomous Systems

- A significant and accelerating trend in the Global Mining Automation Market is the deep integration of artificial intelligence (AI), machine learning, and autonomous technologies across mining operations. This fusion is substantially enhancing operational efficiency, real-time decision-making, and overall mine productivity.

- For instance, autonomous haulage systems (AHS) from companies such as Caterpillar and Komatsu leverage AI-driven navigation to enable driverless trucks to operate safely and continuously, reducing downtime and human-related errors. Similarly, AI-enabled drilling solutions from Epiroc and Sandvik allow mines to optimize drill patterns and improve precision in blasting operations.

- AI integration enables advanced features such as predictive maintenance, where equipment health is monitored continuously to anticipate failures and suggest optimal maintenance schedules. Some next-generation systems also use AI to detect anomalies in real time, such as unusual vibration or temperature shifts, enhancing safety by identifying risks before they escalate. Additionally, autonomous and semi-autonomous machinery provides hands-free operation, allowing mining companies to manage critical equipment remotely from centralized control centers.

- The seamless integration of AI-powered platforms with digital mine ecosystems and IoT-enabled sensors supports centralized monitoring and control of hauling, drilling, ventilation, and fleet management systems. Through a single digital interface, operators can oversee multiple mining functions, optimize workflows, and enhance safety compliance across the entire mining site.

- This growing trend toward more intelligent, autonomous, and interconnected mining systems is reshaping operational standards across the industry. As a result, companies such as Hexagon, ABB, and Siemens are developing advanced AI-enabled mining solutions featuring automated decision support, remote operation capabilities, and integrated fleet management technologies.

- Demand for mining automation technologies with seamless AI and autonomous functionality is rising rapidly across both surface and underground mining operations, as companies prioritize safety, productivity, and cost efficiency in increasingly complex mining environments.

Global Mining Automation Market Dynamics

Driver

Growing Need Due to Rising Safety Requirements and Autonomous Technology Adoption

- The increasing emphasis on worker safety, operational reliability, and productivity across mining sites—combined with the accelerating adoption of autonomous and digital mining technologies—is a major driver of the rising demand for mining automation solutions.

- For instance, in 2025, major industry players such as Caterpillar and Komatsu announced advancements in autonomous haulage and drilling systems, integrating enhanced sensor networks and AI-powered navigation to improve safety and operational precision. Such initiatives are expected to further propel the mining automation market during the forecast period.

- As mining companies confront hazardous working conditions, labor shortages, and mounting pressure to improve operational efficiency, automated systems offer advanced capabilities such as real-time monitoring, collision avoidance, and predictive analytics—representing a significant upgrade over traditional manual processes.

- Moreover, the growing adoption of digital mine technologies and IoT-based platforms is making automation an essential component of modern mining operations, enabling seamless integration with fleet management, ventilation control, and centralized command systems.

- The rising need for remote operations, reduced downtime, and improved equipment utilization is fueling the deployment of autonomous haul trucks, automated drilling rigs, and AI-driven optimization tools across both surface and underground mining environments. This trend is further supported by the increasing adoption of modular and scalable automation solutions that simplify integration into existing mine infrastructure.

Restraint/Challenge

Concerns Regarding Cybersecurity Vulnerabilities and High Initial Implementation Costs

- Concerns surrounding the cybersecurity risks associated with connected and automated mining systems pose a significant challenge to wider market adoption. As digital mining platforms rely heavily on network connectivity, sensors, and centralized software systems, they become potential targets for cyberattacks, raising apprehensions among mining companies regarding data breaches and operational disruptions.

- For Instance, high-profile reports of cyber vulnerabilities in industrial IoT and OT (operational technology) systems have made some operators cautious about rapidly deploying fully automated mining technologies.

- Addressing these cybersecurity risks through advanced encryption, secure communication protocols, multi-layer authentication, and continuous software updates is crucial for ensuring operational integrity. Leading companies such as ABB, Siemens, and Hexagon highlight their robust cybersecurity frameworks to strengthen customer confidence.

- Additionally, the high initial investment required for automation—covering autonomous machinery, advanced sensors, software platforms, and workforce training—remains a significant barrier, particularly for small and mid-sized mining operators or companies in developing regions. While modular automation solutions are helping reduce costs, premium autonomous systems still require substantial capital expenditure.

- Although prices may gradually decline as technologies mature, the perception of high upfront costs can hinder adoption among cost-sensitive operators who may not yet recognize the long-term value of automation.

- Overcoming these challenges through stronger cybersecurity measures, enhanced workforce training, flexible financing models, and more affordable automation packages will be essential for sustaining the long-term growth of the Global Mining Automation Market.

Global Mining Automation Market Scope

Mining automation market is segmented on the basis of technique, workflow and type.

- By Technique

On the basis of technique, the Global Mining Automation Market is segmented into surface mining and underground mining automation. The surface mining technique dominated the market with the largest revenue share of 58.4% in 2025, driven by the extensive deployment of autonomous haulage systems, drilling rigs, and fleet management solutions in large open-pit mines. Surface operations benefit significantly from automation due to their wider operating areas, predictable routes for autonomous vehicles, and greater feasibility for integrating advanced sensors and AI-driven monitoring systems. Mining companies continue to prioritize automation in surface mines to reduce fuel consumption, enhance operator safety, and optimize production cycles.

The underground mining technique is expected to witness the fastest CAGR from 2026 to 2033, fueled by rising demand for deep mineral extraction, increasing safety regulations, and growing adoption of autonomous loaders, remote drilling systems, and real-time ventilation monitoring. Advancements in communication networks, such as LTE and private 5G systems, further support the rapid expansion of underground automation.

- By Workflow

On the basis of workflow, the Global Mining Automation Market is segmented into mine development, mining process, and mine maintenance. The mining process segment dominated the market with the largest share of 46.9% in 2025, driven by high adoption of autonomous haulage, drilling, blasting optimization, and real-time ore grade analysis. Automation in the mining process directly enhances productivity and safety, making it the focal point of investment among leading mining companies. Integrated automation platforms help optimize extraction, reduce operational delays, and provide continuous monitoring of equipment performance.

The mine maintenance segment is projected to experience the fastest CAGR from 2026 to 2033, supported by the rising use of predictive maintenance tools, AI-based diagnostics, and automated inspection drones. As equipment failures contribute heavily to operational downtime and costs, companies increasingly adopt automated maintenance solutions to extend asset life and minimize unplanned shutdowns. The mine development segment also sees steady adoption due to rising demand for safer excavation and tunnel-construction technologies.

- By Type

On the basis of type, the Global Mining Automation Market is segmented into equipment, software, and communications system. The equipment segment dominated the market with a revenue share of 52.7% in 2025, owing to widespread investment in autonomous haul trucks, drilling rigs, loaders, and robotic mining tools. Mining companies prioritize automation equipment to enhance productivity, reduce human exposure to hazardous environments, and improve operational efficiency. Continuous advancements in sensors, GPS, LiDAR, and AI navigation systems further strengthen the dominance of this segment.

The software segment is anticipated to witness the fastest CAGR from 2026 to 2033, supported by increasing reliance on real-time data analytics, fleet optimization platforms, predictive maintenance algorithms, and autonomous control software. As mines transition toward fully connected digital ecosystems, software becomes central to orchestrating autonomous operations. The communications system segment also shows strong growth as high-bandwidth networks such as private 5G and industrial IoT become essential for enabling real-time automation across remote mining locations.

Global Mining Automation Market Regional Analysis

- Asia-Pacific dominated the Global Mining Automation Market with the largest revenue share of 35% in 2025, driven by strong investment in advanced mining technologies, early adoption of autonomous equipment, and the presence of major industry leaders specializing in automation, robotics, and digital mine solutions.

- Mining companies in the region increasingly prioritize enhanced safety, operational efficiency, and real-time monitoring, leading to widespread adoption of autonomous haulage systems, automated drilling rigs, and AI-enabled fleet management platforms.

- This rapid uptake is further supported by high capital availability, a skilled technologically oriented workforce, and stringent safety regulations that encourage the transition toward automation. These factors collectively position North America as a leading hub for the deployment of cutting-edge mining automation technologies across both surface and underground operations.

U.S. Mining Automation Market Insight

The U.S. mining automation market captured the largest revenue share of 81% in 2025 within North America, driven by rapid adoption of autonomous mining equipment, digital control systems, and AI-powered fleet optimization technologies. Mining operators increasingly prioritize enhanced safety, lower operational costs, and improved productivity, fueling the demand for autonomous haulage, automated drilling, and real-time monitoring solutions. The strong push toward digital transformation across mining operations—along with advancements in private 5G networks, sensor technologies, and remote operations centers—further accelerates market expansion. Moreover, key industry players such as Caterpillar, Komatsu, and Hexagon continue to innovate in autonomous mobility, predictive maintenance, and integrated fleet management, strengthening the U.S. position in mining automation.

Europe Mining Automation Market Insight

The Europe mining automation market is projected to grow at a substantial CAGR throughout the forecast period, driven by stringent worker safety regulations, sustainability requirements, and the need to increase productivity across mature mining regions. The rise in automation is further supported by the region’s strong industrial infrastructure and increasing digitalization initiatives. European mining companies are rapidly adopting autonomous equipment, remote operation technologies, and advanced data analytics to enhance efficiency and reduce environmental impact. Mining automation is gaining traction across both surface and underground operations, with greater integration of electric autonomous fleets and low-emission mining technologies, particularly in countries focusing on green transition strategies.

U.K. Mining Automation Market Insight

The U.K. mining automation market is expected to expand at a noteworthy CAGR during the forecast period, driven by rising investments in digital mining technologies and increasing pressure to modernize extraction processes. Although the U.K. has a smaller mining footprint compared to other regions, its strong emphasis on safety, operational optimization, and environmental compliance encourages adoption of automated drilling, robotics, and real-time monitoring systems. The growing demand for minerals needed for renewable energy technologies, combined with support for digital innovation and AI integration, is further boosting automation adoption across U.K. mining operations.

Germany Mining Automation Market Insight

The Germany mining automation market is anticipated to grow at a considerable CAGR during the forecast period, fueled by strong awareness of digital transformation and an increasing focus on high-tech, sustainable mining solutions. Germany’s advanced industrial ecosystem and emphasis on precision engineering support the adoption of robotics, autonomous equipment, and smart monitoring technologies. As Germany continues investing in renewable energy and eco-friendly industrial processes, mining companies are modernizing operations with data-driven management systems, automated machinery, and energy-efficient technologies. The integration of mining automation within wider Industry 4.0 frameworks is further accelerating market momentum.

Asia-Pacific Mining Automation Market Insight

The Asia-Pacific mining automation market is poised to grow at the fastest CAGR of 24% from 2026 to 2033, driven by accelerating industrialization, rising mineral demand, and significant investments in mining modernization across China, Australia, India, and Japan. Growing urbanization and increasing mining activities to support infrastructure development are encouraging adoption of autonomous trucks, robotic drilling systems, and AI-powered monitoring solutions. Government initiatives promoting digital mining and smart industrialization further enhance market growth. As APAC strengthens its position as a global mining and mineral processing hub, automation technologies are becoming increasingly affordable and accessible.

Japan Mining Automation Market Insight

The Japan mining automation market is gaining momentum due to rising technological innovation, strong digital infrastructure, and the country’s long-standing focus on robotics and automation. Japan’s mining sector increasingly adopts AI-driven systems, automated drilling technology, and advanced sensing equipment to enhance precision and safety. The aging workforce also contributes to demand for autonomous machinery and remote-controlled operations, reducing reliance on manual labor. Furthermore, Japan’s push toward smart industrial systems, combined with integration of IoT-enabled devices and data analytics, is promoting more efficient and intelligent mining operations.

China Mining Automation Market Insight

The China mining automation market accounted for the largest regional revenue share in Asia Pacific in 2025, driven by the country’s vast mining output, rapid technological adoption, and strong government backing for digital transformation. China’s mining sector is undergoing significant modernization with widespread deployment of autonomous haul trucks, smart ventilation systems, and real-time monitoring platforms. The push toward smart cities and intelligent industrial ecosystems also supports automation uptake. Additionally, China hosts numerous domestic manufacturers offering cost-effective automation solutions, making advanced mining technologies more accessible for both large and mid-sized mining operations.

Global Mining Automation Market Share

The Mining Automation industry is primarily led by well-established companies, including:

• Caterpillar Inc. (U.S.)

• Komatsu Ltd. (Japan)

• Sandvik AB (Sweden)

• Epiroc AB (Sweden)

• Hitachi Construction Machinery (Japan)

• Hexagon AB (Sweden)

• ABB Ltd. (Switzerland)

• Siemens AG (Germany)

• Rockwell Automation (U.S.)

• RPMGlobal (Australia)

• Wenco International Mining Systems (Canada)

• Mine Site Technologies (Australia)

• Trimble Inc. (U.S.)

• Autonomous Solutions Inc. (U.S.)

• 3D-P (Canada)

• Liebherr Group (Germany)

• Rajant Corporation (U.S.)

• Orica (Australia)

• RoboVent (U.S.)

• Modular Mining (U.S.)

What are the Recent Developments in Global Mining Automation Market?

- In April 2024, Caterpillar Inc., a global leader in heavy machinery and mining solutions, launched a strategic initiative in South Africa aimed at modernizing large-scale mining operations through autonomous haulage systems and AI-powered fleet management. This initiative demonstrates the company’s commitment to delivering efficient, safe, and digitally integrated mining solutions tailored to regional operational challenges. By leveraging its global expertise and advanced automation technologies, Caterpillar reinforces its leadership position in the rapidly expanding Global Mining Automation Market.

- In March 2024, Hexagon AB, a global provider of digital solutions for industrial sectors, introduced its next-generation autonomous drilling and monitoring platform designed for complex underground mines. The innovative system enhances operational precision, safety, and real-time data analytics, underscoring Hexagon’s dedication to advancing intelligent mining technologies that improve productivity and reduce human exposure to hazardous environments.

- In March 2024, Honeywell International Inc. successfully deployed the Bengaluru Smart Mine Project, focused on integrating advanced automation, real-time monitoring, and predictive maintenance systems across multiple mining sites. The project highlights Honeywell’s commitment to leveraging digital mining technologies to create safer, more efficient, and resilient mining operations, supporting the broader adoption of mining automation.

- In February 2024, RPMGlobal, a leading provider of mining software and automation solutions, announced a strategic partnership with major Australian mining firms to implement a centralized autonomous operations control platform. This collaboration aims to optimize fleet management, reduce downtime, and enhance safety standards, reflecting RPMGlobal’s focus on driving innovation and operational efficiency in the mining industry.

- In January 2024, Komatsu Ltd., a prominent manufacturer of mining equipment, unveiled its FrontRunner Autonomous Haulage System (AHS) Upgrade at the Mining & Exploration Expo 2024. The upgraded system features enhanced AI navigation, predictive maintenance analytics, and remote fleet monitoring capabilities. Komatsu’s new autonomous haulage solution exemplifies the company’s commitment to integrating advanced technology into mining operations, delivering improved productivity, safety, and operational control.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Mining Automation Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Mining Automation Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Mining Automation Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.