Global Military Robots Market

Market Size in USD Billion

CAGR :

%

USD

22.37 Billion

USD

44.26 Billion

2024

2032

USD

22.37 Billion

USD

44.26 Billion

2024

2032

| 2025 –2032 | |

| USD 22.37 Billion | |

| USD 44.26 Billion | |

|

|

|

|

Military Robots Market Size

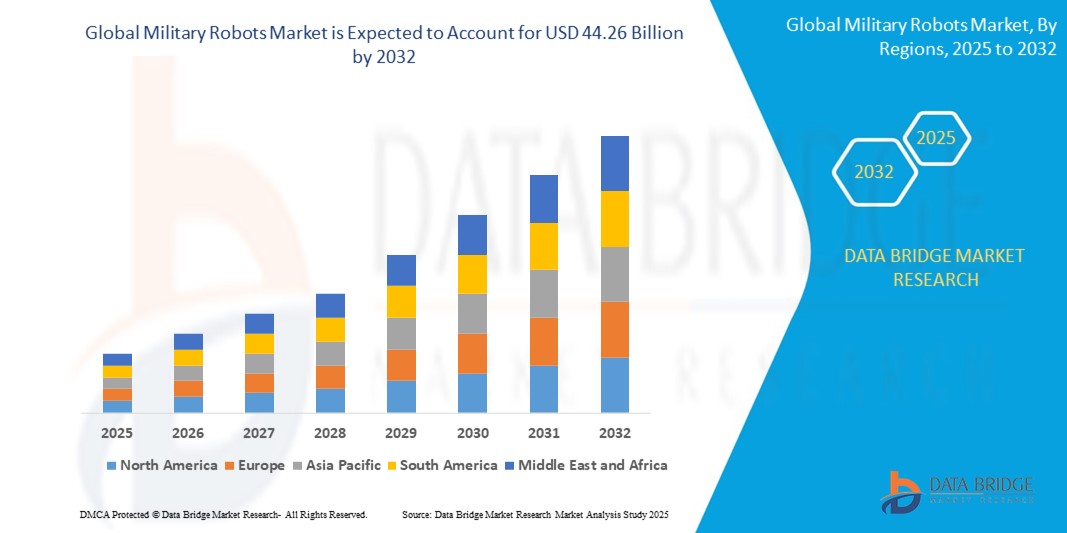

- The global military robots market size was valued at USD 22.37 billion in 2024 and is expected to reach USD 44.26 billion by 2032, at a CAGR of 8.90% during the forecast period

- The market growth is largely fuelled by the rising demand for unmanned systems, enhanced defense capabilities, and growing military modernization initiatives across key nations

- Advancements in artificial intelligence and robotics technologies are enabling the development of more autonomous, efficient, and mission-adaptable military robots, accelerating their adoption across various defense operations

Military Robots Market Analysis

- The military robots market is witnessing growing adoption due to the increasing focus on automation in combat and surveillance missions, enhancing operational precision and safety for soldiers

- Continuous technological advancements are allowing military robots to perform more complex tasks with greater autonomy, improving their role in both land and marine defense strategies

- North America dominated the global military robots market by holding a market share of 40.6% in 2024, supported by substantial defense budgets and early adoption of robotics and autonomous technologies

- The Asia-Pacific region is expected to witness the highest growth rate in the global military robots market, driven by rising defense budgets, regional security concerns, and increasing investments in autonomous military technologies

- The land segment held the largest market revenue share of approximately 47.6% in 2024, driven by its extensive usage in logistics, surveillance, and combat missions across difficult terrains. Land robots such as unmanned ground vehicles are increasingly deployed for bomb disposal and reconnaissance, improving operational safety

Report Scope and Military Robots Market Segmentation

|

Attributes |

Military Robots Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Military Robots Market Trends

“Integration of Artificial Intelligence in Military Robotics”

- AI enables military robots to operate autonomously and make decisions without continuous human oversight, enhancing responsiveness during missions

- Integration of AI in reconnaissance robots helps them identify threats and navigate challenging terrain more effectively

- Machine learning algorithms allow aerial drones to detect and track moving targets in real time, boosting situational awareness during surveillance

- AI-driven military robots adapt across air, land, and sea domains, offering flexible support for coordinated, multi-domain defense strategies

- For instance, China is investing heavily in AI-enhanced robotic systems to improve battlefield intelligence and reduce soldier exposure to direct combat

Military Robots Market Dynamics

Driver

“Rising Demand for Autonomous Combat Systems”

- Growing demand for autonomous combat systems is reducing human exposure in high-risk zones and improving operational safety

- Defense forces are deploying unmanned systems for tasks such as reconnaissance, surveillance, target acquisition, and logistical support

- These robots are particularly valuable in hazardous environments including urban warfare and explosive ordnance disposal

- For instance, the U.S. military uses unmanned ground vehicles such as the PackBot for bomb detection and neutralization

- Integration of robotics with artificial intelligence enhances real-time decision-making and coordination in network-centric warfare systems

Restraint/Challenge

“High Development and Maintenance Costs”

- High costs of developing and maintaining advanced military robots limit widespread adoption, especially for smaller or developing nations

- Integration of technologies such as AI, LIDAR, GPS, and smart sensors makes systems effective but financially demanding

- Skilled personnel, technical training, and continuous system upgrades increase operational expenses

- For instance, autonomous aerial drones and robotic combat vehicles require specialized infrastructure and ongoing technical support

- Interoperability issues with existing defense systems further raise costs and complicate deployment efforts

Military Robots Market Scope

The military robots market is segmented on the basis of type, platform, propulsion, range, system, deployment method, application, payout, mode of operation, and end user.

- By Type

On the basis of type, the military robots market is segmented into land, marine, and airborne. The land segment held the largest market revenue share of approximately 47.6% in 2024, driven by its extensive usage in logistics, surveillance, and combat missions across difficult terrains. Land robots such as unmanned ground vehicles are increasingly deployed for bomb disposal and reconnaissance, improving operational safety.

The airborne segment is expected to witness fastest growth rate from 2025 to 2032, spurred by advancements in UAV technology used in surveillance and strike missions, particularly by the U.S. and Israel.

- By Platform

On the basis of platform, the military robots market is segmented into land robots, marine robots, and airborne robots. Land robots segment dominated the market share in 2024 due to their significant use in explosive ordnance disposal and tactical logistics. These systems reduce the need for direct soldier engagement in hazardous conditions.

The airborne robots segment is expected to witness fastest growth rate from 2025 to 2032, due to their flexibility in intelligence, surveillance, and reconnaissance operations across borders and hostile areas.

- By Propulsion

On the basis of propulsion, the military robots market is segmented into electric, mechanical, and hybrid. The electric segment accounted for the largest share in 2024, due to increasing adoption of quieter and energy-efficient robots for stealth operations. Systems using battery-powered drives are preferred in ISR applications where low acoustic signature is critical.

The hybrid segment is expected to witness fastest growth rate from 2025 to 2032, combining long operational hours and powerful performance ideal for extended combat support.

- By Range

On the basis of range, the military robots market is segmented into land range, marine range, and airborne range. The land range segment led the market in 2024 due to the deployment of robots in extended patrolling missions, mine clearance, and forward operating bases.

The airborne range segment is expected to witness fastest growth rate from 2025 to 2032, owing to drones with long-endurance capabilities being used for high-altitude and cross-border surveillance, particularly in Asia-Pacific and Middle Eastern regions.

- By System

On the basis of system, the military robots market is segmented into land system, marine system, and airborne system. Land systems segment held the largest revenue share in 2024, attributed to the demand for tactical unmanned ground vehicles in combat and engineering support roles.

The airborne systems segment is expected to witness fastest growth rate from 2025 to 2032, due to their expanding role in real-time imagery, communication relay, and precision strike missions.

- By Deployment Method

On the basis of deployment method, the military robots market is segmented into land deployment, marine deployment, and airborne deployment. Land deployment segment accounted for the largest market share in 2024, supported by regular use in counter-insurgency and perimeter security missions.

The airborne deployment segment is expected to witness fastest growth rate from 2025 to 2032, backed by evolving air-launch methods for drones and improvements in autonomous navigation and control systems.

- By Application

On the basis of application, the military robots market is segmented into intelligence, surveillance and reconnaissance (ISR), search and rescue, combat support, transportation, explosive ordnance disposal (EOD), mine clearance, firefighting, and others. The ISR segment led the market in 2024, driven by demand for data-driven decision-making and real-time threat analysis.

The combat support segment is expected to witness fastest growth rate from 2025 to 2032, due to the adoption of AI-enabled robots in frontline combat scenarios, enhancing force effectiveness with autonomous weaponry.

- By Payout

On the basis of payout, the military robots market is segmented into sensor, radar, weapon, and others. The sensor segment dominated in 2024, as high-precision sensors are vital for navigation, thermal imaging, and target acquisition in modern combat environments.

The weapon segment is expected to witness fastest growth rate from 2025 to 2032, supported by increased integration of robotic systems with precision-guided munitions and autonomous firing technologies.

- By Mode of Operation

On the basis of mode of operation, the military robots market is segmented into human operated and autonomous. The human operated segment held the highest revenue in 2024, reflecting the reliance on remote-controlled systems in complex tactical environments.

The autonomous segment is expected to witness fastest growth rate from 2025 to 2032, due to the incorporation of machine learning and artificial intelligence that enables robots to operate independently in unpredictable combat scenarios.

- By End User

On the basis of end user, the military robots market is segmented into defense and homeland security. The defense segment captured the majority share in 2024, fuelled by continuous modernization initiatives and increasing robotic investments by major defense agencies such as NATO and the U.S. Department of Defense.

The homeland security segment is expected to witness fastest growth rate from 2025 to 2032, as robots are increasingly used in anti-terrorism, surveillance of critical infrastructure, and disaster response operations.

Military Robots Market Regional Analysis

- North America dominated the global military robots market in 2024, supported by substantial defense budgets and early adoption of robotics and autonomous technologies

- The region is a key hub for development and procurement, particularly in the U.S., where military modernization programs prioritize unmanned systems

- Increased investment in R&D and deployment of land and airborne robots across various missions continue to solidify North America’s leadership in the market

U.S. Military Robots Market Insight

The U.S. held the largest share in North America’s military robots market in 2024, driven by extensive government funding, defense modernization initiatives, and a strong presence of leading defense contractors. The country has actively integrated robotic platforms into border surveillance, reconnaissance, and combat roles. Ongoing innovations in AI and unmanned systems are further accelerating adoption in key military branches.

Europe Military Robots Market Insight

The Europe is expected to witness fastest growth rate from 2025 to 2032 in the military robots market, driven by heightened focus on defense cooperation, rising geopolitical tensions, and adoption of automation in battlefield operations. The Europe Union’s defense programs and increasing demand for border protection technologies are bolstering regional development. The market also benefits from collaborative R&D efforts among NATO members.

U.K. Military Robots Market Insight

The U.K. military robots market is expected to witness fastest growth rate from 2025 to 2032, due to increased focus on strengthening defense capabilities and automation in warfare strategies. Investment in AI-enabled surveillance systems and robotic support units across defense sectors is shaping demand. Key projects, such as the British Army’s autonomous vehicle trials, underscore the country’s commitment to modernization.

Germany Military Robots Market Insight

The Germany’s military robots market is expected to witness fastest growth rate from 2025 to 2032, supported by the country’s emphasis on innovation, defense efficiency, and operational safety. Defense contracts aimed at upgrading robotic fleets for logistics and surveillance missions are gaining momentum. Germany’s role within NATO and rising defense spending further support growth across robotic system applications.

Asia-Pacific Military Robots Market Insight

The Asia-Pacific is expected to witness fastest growth rate from 2025 to 2032 in the military robots market, fueled by rising regional tensions, defense modernization, and increasing defense budgets in countries such as China, India, and Japan. Local manufacturing capabilities, government support for technological self-reliance, and rapid digital transformation contribute to market expansion.

Japan Military Robots Market Insight

The Japan is expected to witness fastest growth rate from 2025 to 2032 in military robotics, influenced by national security policies, technological leadership, and a focus on unmanned systems for border and coastal surveillance. Defense modernization efforts are integrating robots into support and intelligence operations, with government initiatives promoting investment in robotics and AI-based solutions.

China Military Robots Market Insight

The China accounted for the largest market share in Asia-Pacific in 2024, attributed to significant investments in autonomous military platforms, UAV development, and AI integration. The Chinese military emphasizes self-reliance and advanced warfare systems, actively deploying robotic units for intelligence gathering, patrols, and tactical missions across its strategic borders and territories.

Military Robots Market Share

The Military Robots industry is primarily led by well-established companies, including:

- Northrop Grumman (U.S.)

- Lockheed Martin Corporation (U.S.)

- QinetiQ (U.K.)

- Cobham Limited (U.K.)

- General Dynamics Corporation (U.S.)

- Elbit Systems Ltd. (Israel)

- IAI (Israel Aerospace Industries) (Israel)

- AeroVironment, Inc. (U.S.)

- Thales (France)

- BAE Systems (U.K.)

- SAAB (Sweden)

- Boston Dynamics (U.S.)

- Textron Systems (U.S.)

- RTX (U.S.)

- Leonardo S.p.A. (Italy)

- Atlas Elektronik (Germany)

- Roboteam (Israel)

- ICOR Technology (Canada)

- RE2, Inc. (U.S.)

- Oshkosh Corporation (U.S.)

- Kratos Defense & Security Solutions, Inc. (U.S.)

- General Atomics (U.S.)

Latest Developments in Global Military Robots Market

- In October 2023, the U.S. Army initiated a key modernization program to integrate robotic systems with human-operated formations. Spearheaded by the Rapid Capabilities and Critical Technologies Office (RCCTO), this effort aims to unify existing science and technology with operational programs to improve battlefield coordination. The initiative is expected to accelerate the adoption of human-machine teaming, strengthening mission efficiency and situational awareness across combat scenarios, thereby advancing the U.S. military robots market

- In July 2022, Teledyne FLIR Defense secured a USD 62.1 million contract from the U.S. Armed Services to supply 500 Centaur multi-mission ground robots. These robots are designed for tasks such as explosive ordnance disposal (EOD), surveillance, and hazardous material handling. The deployment of these systems enhances tactical support and troop safety, contributing to the growing demand for modular and versatile robotic platforms in the global military robots market

- In January 2022, China unveiled the world’s largest electrically powered quadruped robot, developed for military logistics and reconnaissance operations. Capable of carrying up to 352 pounds and reaching speeds of 10 kilometers per hour, this robot is engineered to traverse rough terrain while supporting supply chain efficiency. Its launch underscores China's focus on robotic autonomy and self-reliant defense technologies, signaling rapid advancements in the Asia-Pacific military robotics sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Military Robots Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Military Robots Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Military Robots Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.