Global Microcontroller Market Segmentation, By Product (8- Bit Microcontrollers, 16- Bit Microcontrollers, 32- Bit Microcontrollers, and 64- Bit Microcontrollers), Architecture (Architecture, AVR Architecture, PIC Architecture, ARM Architecture, and Others), Memory (Embedded Memory Microcontroller and External Memory Microcontroller), Application (Automotive, Consumer Electronics, Industrial, Medical devices, Military and Defence, Communication, Computer, and Others) - Industry Trends and Forecast to 2032

Microcontroller Market Size

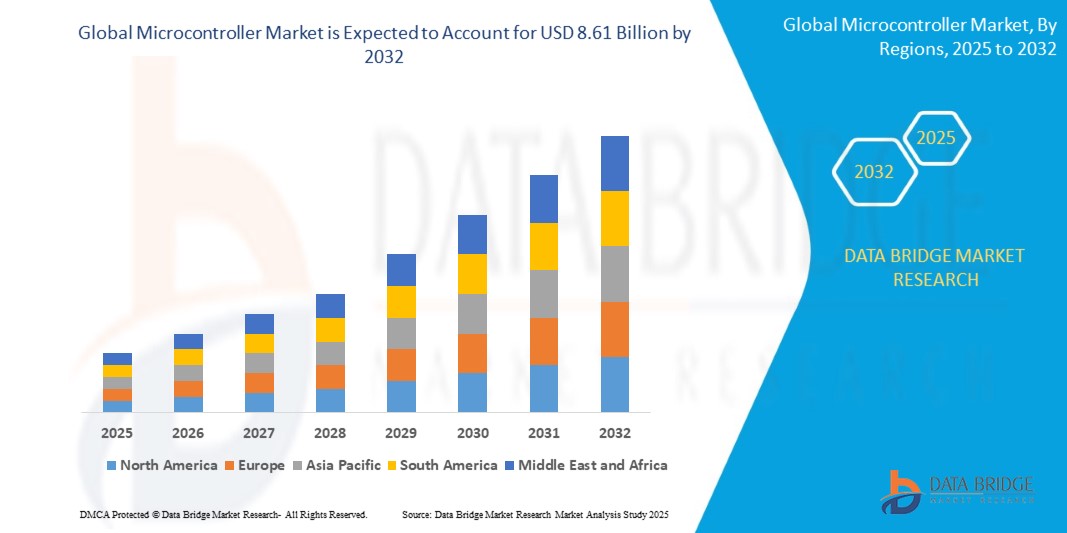

- The global microcontroller market was valued at USD 4.21 billion in 2024 and is expected to reach USD 8.61 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 9.35%, primarily driven by increasing demand for smart devices and IoT applications

- This growth is driven by rise of industrial automation and the growing penetration of consumer electronics such as smartphones, wearables, and home appliances

Microcontroller Market Analysis

- The microcontroller market is experiencing steady growth, driven by the increasing demand for smart consumer electronics, industrial automation, automotive applications, and IoT devices across various industries such as healthcare, automotive, and consumer electronics

- The rapid advancements in semiconductor technology, coupled with the growing adoption of connected devices, are accelerating the demand for more powerful, energy-efficient, and cost-effective microcontrollers in both embedded systems and consumer gadgets

- For instance, in the U.S., companies such as Intel and Qualcomm are making significant investments in developing next-generation microcontroller technologies to support IoT ecosystems and smart home applications

- Emerging trends such as the integration of artificial intelligence (AI) for real-time processing, the adoption of microcontrollers for electric vehicles (EVs) and autonomous driving, and advancements in low-power microcontrollers for wearables are reshaping the market, ensuring more advanced and energy-efficient solutions for diverse applications

Report Scope and Microcontroller Market Segmentation

|

Attributes

|

Microcontroller Key Market Insights

|

|

Segments Covered

|

|

|

Countries Covered

|

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players

|

|

|

Market Opportunities

|

|

|

Value Added Data Infosets

|

In addition to tfhe insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand

|

Microcontroller Market Trends

“Growing Demand for Low-Power, High-Performance Microcontrollers”

- A major trend reshaping the microcontroller market is the growing demand for low-power, high-performance microcontrollers, driven by the increasing number of battery-powered and energy-efficient applications in IoT devices, wearables, and automotive systems

- Manufacturers are focusing on developing microcontrollers with enhanced processing power, improved power management features, and longer battery life to meet the needs of these increasingly power-sensitive applications

- For instance, in February 2024, Texas Instruments introduced a new low-power microcontroller series designed to extend battery life in connected devices such as wearables and IoT sensors

- Technological advances such as integrated low-power modes, energy harvesting capabilities, and improved sleep/wake cycles are increasing the efficiency of microcontrollers in energy-conscious applications

- This trend is driving the microcontroller market toward a new generation of ultra-low-power devices, fueling growth in applications requiring extended battery life and increased energy efficiency

Microcontroller Market Dynamics

Driver

“Rising Adoption of IoT and Smart Devices”

- The microcontroller market is experiencing robust growth fueled by the increasing adoption of IoT devices and smart consumer electronics

- Microcontrollers are essential components in IoT devices, providing processing capabilities, power management, and connectivity for applications ranging from home automation to industrial systems

- For instance, in January 2024, Arm Ltd. announced the development of a new series of microcontrollers designed specifically for IoT applications, enhancing connectivity and data processing capabilities

- The expansion of 5G networks and the growing demand for connected devices are contributing to the rapid adoption of microcontrollers, particularly in industrial automation, smart cities, and healthcare systems

- As IoT applications proliferate, the microcontroller market will continue to experience strong growth, driven by the need for more efficient and capable microcontroller solutions

Opportunity

“Expansion of Electric Vehicles (EVs) and Autonomous Driving”

- The microcontroller market stands to benefit from the growth of the electric vehicle (EV) industry and advancements in autonomous driving technologies.

- Microcontrollers are used extensively in EVs for battery management systems (BMS), motor control, infotainment systems, and safety features, as well as in autonomous driving systems for real-time data processing and decision-making

- For instance, in March 2024, Renesas Electronics introduced a new microcontroller optimized for use in EV battery management systems, improving energy efficiency and performance

- As the demand for electric vehicles and autonomous driving technologies continues to rise, microcontrollers will play a critical role in improving performance, safety, and efficiency, driving further market growth

- This opportunity is expected to create significant demand for microcontrollers in the automotive sector, contributing to the continued expansion of the market

Restraint/Challenge

“Supply Chain Disruptions and Semiconductor Shortages”

- The microcontroller market faces significant challenges due to ongoing supply chain disruptions and semiconductor shortages, which are affecting the production and availability of critical microcontroller components.

- Manufacturers are struggling to meet the rising demand for microcontrollers, leading to longer lead times and increased production costs

- For instance, in February 2024, Microchip Technology Inc. announced production delays due to semiconductor shortages, impacting the timely delivery of microcontroller solutions to customers in various industries

- These challenges are exacerbated by the complexity of global supply chains and the reliance on limited semiconductor fabrication plants, making it difficult to scale up production

- Addressing these challenges is critical for microcontroller manufacturers to ensure a steady supply of components, maintain market competitiveness, and meet growing demand in key industries such as automotive, IoT, and consumer electronics

Microcontroller Market Scope

The market is segmented on the basis of product, architecture, memory, and application.

|

Segmentation

|

Sub-Segmentation

|

|

By Product

|

|

|

By Architecture

|

|

|

By Memory

|

|

|

By Application

|

|

Microcontroller Market Regional Analysis

“North America is the Dominant Region in the Microcontroller Market”

- North America leads the microcontroller market and is expected to maintain its dominant position throughout the forecast period

- The presence of major semiconductor players in the region is a key factor driving the market's growth

- Increasing penetration of smartphones, tablets, and other consumer electronic devices is contributing to market expansion

- With rising industrial automation, North America's microcontroller market is poised for sustained growth, reinforcing its leading role globally

““Asia-Pacific is projected to register the Highest Growth Rate”

- Asia-Pacific is expected to register the highest compound annual growth rate (CAGR) during the forecast period

- The growing demand for smart home electronic appliances is driving market growth in the region

- Increased adoption of cloud-based solutions and the rising demand for internet of things (IoT) technology are major growth factors

- The expansion of semiconductor and electronics industries further propels the microcontroller market in Asia-Pacific, positioning it for strong future growth

Microcontroller Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Infineon Technologies AG (Germany)

- Microchip Technology Inc. (U.S.)

- NXP Semiconductors (Netherlands)

- Renesas Electronics Corporation (Japan)

- STMicroelectronics (Switzerland)

- TE Connectivity (Switzerland)

- Texas Instruments Incorporated (U.S.)

- Zilog, Inc. (U.S.)

- Panasonic Corporation (Japan)

- Arm Limited (U.K.)

- Analog Devices, Inc. (U.S.)

- TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION (Japan)

- Parallax Inc. (U.S.)

- Semiconductor Components Industries, LLC (U.S.)

- LAPIS Semiconductor Co., Ltd. (Japan)

- Intel Corporation (U.S.)

- Danfoss (Denmark)

- EM Microelectronic (Switzerland)

- Silicon Laboratories (U.S.)

Latest Developments in Global Microcontroller Market

- In May 2023, STMicroelectronics launched the second generation of its STM32 MPUs (microprocessors), featuring an enhanced architecture within the existing ecosystem to deliver elevated performance and security for industrial and IoT edge applications. The STM32MP2 Series devices featured 64-bit Arm Cortex-A35 cores operating at 1.5GHz, complemented by a 400MHz Cortex-M33 embedded core for real-time processing, offering a powerful and efficient solution. This development bolstered the company's position in the industrial and IoT markets

- In April 2023, Renesas Electronics Corporation revealed the successful manufacturing of its inaugural microcontroller (MCU) using cutting-edge 22-nm process technology. This advanced process enabled improved performance, reduced power consumption through lower core voltages, and seamless integration of a diverse feature set, including RF capabilities, providing customers with a superior product offering. This technological breakthrough highlights Renesas' commitment to innovation in the microcontroller market

- In March 2023, NXP Semiconductors released the MCUXpresso toolset, empowering developers with enhanced scalability, usability, and portability for faster development of complex embedded applications. The toolset included a custom-built MCUXpresso extension for Microsoft's Visual Studio Code (VS Code), open-source hardware abstraction for code reuse, streamlined partner code delivery via Open-CMSIS-Packs, and an intuitive Application Launch Pad for easy access to application software and NXP documentation. This release significantly accelerated embedded development, improving efficiency for developers

- In January 2023, STMicroelectronics unveiled the STM32C0 series, a cost-effective lineup of 32-bit microcontrollers designed for applications in home appliances, industrial pumps, fans, and smoke detectors, traditionally served by simpler 8-bit and 16-bit MCUs. The modern design of the STM32C0 provided enhanced performance, faster response, additional functionalities, and network connectivity, while maintaining comparable cost and power consumption. This product launch expanded STMicroelectronics' offerings in the mid-range MCU market

- In January 2022, Infineon Technologies AG introduced the latest iteration of its AURIX microcontroller family, the AURIX TC4x series, engineered to address evolving trends in the automotive industry, including eMobility, advanced driver assistance systems (ADAS), automotive electric-electronic (E/E) architectures, and cost-effective artificial intelligence (AI) applications. The AURIX TC4x series marked a significant milestone in automotive MCU development

SKU-