Global Microbiology Testing Market

Market Size in USD Billion

CAGR :

%

USD

5.47 Billion

USD

10.99 Billion

2024

2032

USD

5.47 Billion

USD

10.99 Billion

2024

2032

| 2025 –2032 | |

| USD 5.47 Billion | |

| USD 10.99 Billion | |

|

|

|

|

Microbiology Testing Market Size

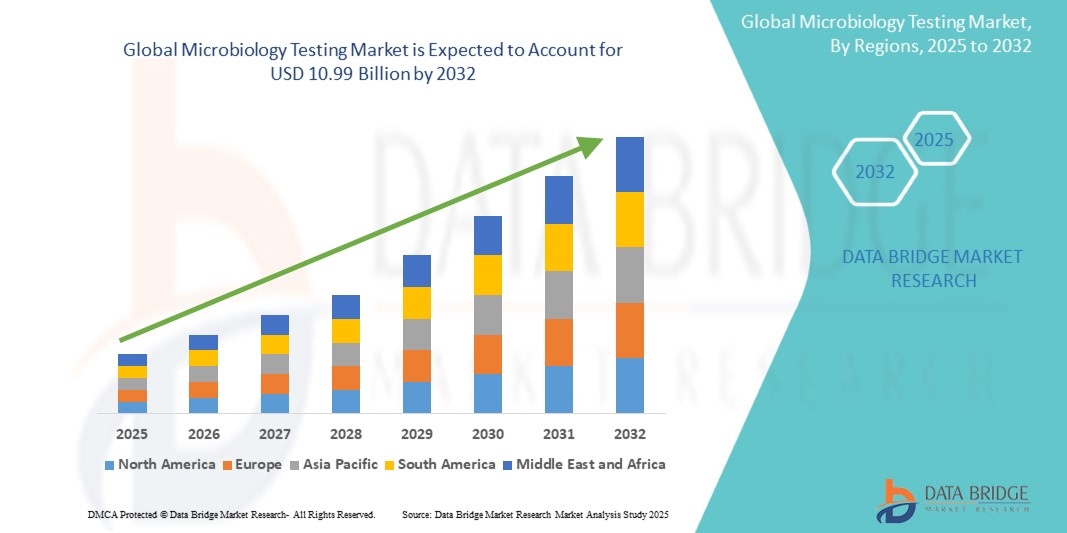

- The global microbiology testing market was valued at USD 5.47 billion in 2024 and is expected to reach USD 10.99 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 9.10%, primarily driven by increasing global healthcare needs

- This growth is driven by rising concerns over infectious diseases and advancements in diagnostic technologies

Microbiology Testing Market Analysis

- The microbiology testing market has gained substantial traction in the healthcare sector, with a growing emphasis on accurate diagnostics for infectious diseases, hospital-acquired infections, and food safety. The market is bolstered by innovations in diagnostic technology, automation, and rapid testing methods that enhance the accuracy and speed of results.

- The market is primarily driven by increasing awareness about the importance of microbiology testing, the rising prevalence of infectious diseases, and the ongoing efforts to prevent outbreaks. Technological advancements, such as the integration of molecular diagnostics and next-generation sequencing, are further accelerating market growth by providing faster and more precise results

- For instance, the global rise in antimicrobial resistance (AMR) concerns has led to increased demand for microbiology testing solutions in both clinical and food industries, fostering innovation in diagnostic methods

- On a global scale, the microbiology testing market is evolving with advancements in automation, AI-based diagnostics, and personalized treatment approaches, ensuring long-term market sustainability and expansion. Strong investments from healthcare providers and diagnostics companies further ensure continuous innovation and broader adoption across regions

Report Scope and Microbiology Testing Market Segmentation

|

Attributes |

Microbiology Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Microbiology Testing Market Trends

“Integration of Artificial Intelligence (AI) in Microbiology Testing”

- The adoption of AI and machine learning algorithms in microbiology testing is enhancing diagnostic accuracy, reducing human error, and speeding up test results, leading to more efficient treatment protocols

- AI-powered solutions are being integrated into automated systems for pathogen detection, enabling rapid identification and quantification of microorganisms in clinical and food safety applications

- Increased focus on AI-based diagnostic tools is fostering the development of smart diagnostics systems that can deliver actionable insights in real-time

For instance,

- In February 2025, Thermo Fisher Scientific launched an AI-based pathogen detection system for foodborne illnesses, improving testing efficiency

- In January 2025, Roche Diagnostics integrated machine learning algorithms into its microbiology platforms to optimize infectious disease testing

- In November 2024, Abbott Laboratories introduced an AI-driven microbiology testing system designed for hospitals and laboratories

- The integration of AI is expected to revolutionize the microbiology testing market, significantly improving diagnostic accuracy and operational efficiency in healthcare and food safety sectors

Microbiology Testing Market Dynamics

Driver

“Growing Demand for Rapid Diagnostics and Point-of-Care Testing”

- The increasing demand for rapid diagnostics and point-of-care (POC) testing is driving the growth of the microbiology testing market, with a focus on reducing diagnostic time and enabling faster treatment decisions

- Advances in portable diagnostic devices are allowing for real-time testing in decentralized healthcare settings, making it easier for healthcare providers to detect infections and diseases in a timely manner

- The global rise in infectious disease outbreaks, including COVID-19 and seasonal flu, has heightened the need for immediate microbiology testing solutions

For instance,

- In March 2025, Cepheid launched a new rapid molecular diagnostic system designed for on-site pathogen detection in healthcare settings

- In February 2025, BD (Becton, Dickinson and Company) introduced a POC microbiology testing system that delivers rapid results for blood infections

- In December 2024, Bio-Rad Laboratories expanded its rapid diagnostics portfolio to include microbiology testing for infectious diseases

- With the growing need for quick, on-the-spot testing solutions, the market for rapid diagnostics and POC testing is expected to expand rapidly, fueling market growth

Opportunity

“Advancements in Microbiome Research and Personalized Medicine”

- The expanding field of microbiome research is creating new opportunities for microbiology testing, focusing on personalized healthcare and treatments based on individual microbiomes

- Understanding the role of microbiomes in diseases such as cancer, autoimmune disorders, and gut health is driving the development of microbiology tests aimed at analyzing microbial composition and diversity

- Personalized medicine approaches that rely on microbiome data are enabling more effective and tailored treatments, potentially revolutionizing healthcare

For instance,

- In April 2025, Exact Sciences announced a new microbiome-based diagnostic test for detecting colorectal cancer, showcasing the potential of microbiome testing

- In March 2025, Seres Therapeutics launched a microbiome-based product to treat Clostridium difficile infections, supported by microbiology testing

- In February 2024, Microbiome Insights entered into a partnership with a pharmaceutical company to develop microbiome-based diagnostics for chronic diseases

- As research in microbiome continues to grow, the development of personalized microbiology tests will create new opportunities for treatments, diagnostics, and overall healthcare improvement

Restraint/Challenge

“Challenges with Standardization and Regulatory Approval”

- The lack of standardized methods for microbiology testing remains a challenge, as varying protocols and testing techniques can lead to inconsistent results, particularly in clinical diagnostics

- Regulatory hurdles for new microbiology testing methods and devices, such as delays in approvals and lack of clear guidelines, slow down market entry and product commercialization

- The complexity of establishing globally accepted standards for microbiology testing can impede market growth and hinder the adoption of novel technologies in healthcare

For instance,

- In January 2025, the European Medicines Agency (EMA) issued new guidelines for microbiology testing, causing delays in product approvals for some diagnostic companies

- In November 2024, the U.S. FDA requested additional clinical trial data from a microbiology testing device manufacturer before approval

- In October 2024, WHO recommended stricter standards for clinical microbiology testing, leading to increased regulatory compliance costs for companies

- To overcome these challenges, stakeholders need to focus on achieving global standardization, streamlining regulatory processes, and ensuring consistency in testing protocols to accelerate market growth

Microbiology Testing Market Scope

The market is segmented on the basis of test type, product, indication, application, and end-users.

|

Segmentation |

Sub-Segmentation |

|

By Test Type |

|

|

By Product |

|

|

By Indication |

|

|

By Application |

|

|

By End User

|

|

Microbiology Testing Market Regional Analysis

“North America is the Dominant Region in the Microbiology Testing Market”

- North America leads the microbiology testing market, backed by a vast network of healthcare facilities that ensures widespread access to advanced diagnostic services

- Significant investments from key industry players in the development of advanced testing devices are fueling innovation and expanding market capabilities

- The region benefits from well-established distribution channels for clinical microbiology products and an increasing volume of research activities, further strengthening market growth

- These factors combine to solidify North America's position as a dominant force in the microbiology testing sector, ensuring continued leadership and innovation in the years ahead

“Asia-Pacific is projected to register the Highest Growth Rate”

- Asia-Pacific is poised for substantial growth in the microbiology testing market, driven by increased government initiatives aimed at raising awareness and promoting favorable regulatory policies

- The region is witnessing a rise in the use of advanced diagnostic techniques, enhancing the accuracy and efficiency of microbiology testing

- Growing demand for high-quality healthcare services is further boosting the adoption of modern microbiology testing methods across various countries

- These factors collectively position Asia-Pacific as a rapidly evolving and high-potential market for microbiology testing, expected to drive significant innovation and expansion in the near future

Microbiology Testing Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Medtronic (Ireland)

- Masimo (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- General Electric Company (U.S.)

- Stryker (U.S.)

- iHealth Labs Inc. (U.S.)

- Cisco Systems, Inc. (U.S.)

- Silicon & Software Systems Ltd. (Ireland)

- Spectrum Medical Devices (U.K.)

- Hill-Rom Services Inc. (U.S.)

- Iatric Systems Inc. (U.S.)

- Silex Technology America, Inc. (Japan)

- Digi International Inc. (U.S.)

- Baxter (U.S.)

- TE Connectivity (Switzerland)

- Medicollector (U.S.)

Latest Developmentss in Global Microbiology Testing Market

- In December 2023, Danaher Corporation (U.S.) completed the acquisition of Abcam (U.K.), a company specializing in providing validated antibodies, reagents, biomarkers, and assays critical for drug discovery, life sciences research, and diagnostics, strengthening Danaher’s footprint in scientific research solutions and boosting its diagnostic capabilities

- In May 2023, bioMérieux SA (France) secured a U.S. Food and Drug Administration (FDA) Clinical Laboratory Improvement Amendments (CLIA) waiver for its fast and accurate multiplex PCR-based BIOFIRE SPOTFIRE Respiratory (R) Panel Mini, enhancing the company’s position in the respiratory diagnostics market and reinforcing its commitment to accessible testing

- In November 2022, IDEXX expanded its water microbiology testing portfolio by acquiring Tecta-PDS, a Canadian company known for its automation-driven water testing technology, allowing IDEXX to strengthen its laboratory and on-site testing solutions and support broader market reach

- In November 2022, Archer Daniels Midland (ADM) inaugurated a new microbiology laboratory at its ADM Specialty Manufacturing facility in Decatur, Illinois, effectively doubling the laboratory space and advancing the site's testing capabilities, positioning ADM for greater innovation and efficiency in microbiology operations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.