Global Micro Server Integrated Circuit Ic Market

Market Size in USD Billion

CAGR :

%

USD

1.06 Billion

USD

2.98 Billion

2021

2029

USD

1.06 Billion

USD

2.98 Billion

2021

2029

| 2022 –2029 | |

| USD 1.06 Billion | |

| USD 2.98 Billion | |

|

|

|

|

Market Analysis and Size

Increased demand for data centres in both developed and developing countries is a major driving force in the global micro server IC market. Data centres necessitate a large number of micro server ICs as well as software for micro server ICs. The size of various application software and multimedia files has grown significantly in recent years. The number of internet users has also increased in recent years. Increased internet traffic necessitates the construction of more data centres. In the near future, increased demand for data centres is expected to drive the global micro server IC market.

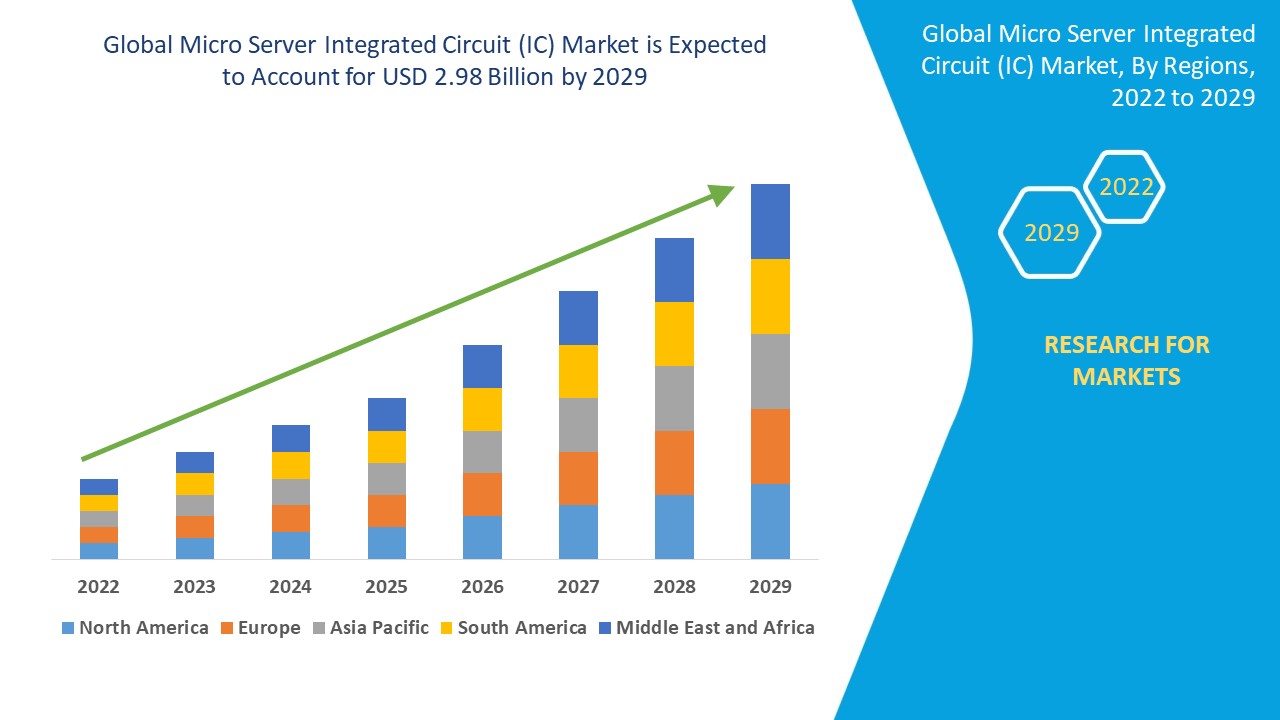

Data Bridge Market Research analyses that the micro server integrated circuit (IC) market was valued at USD 1.06 billion in 2021 and is expected to reach the value of USD 2.98 billion by 2029, at a CAGR of 13.8% during the forecast period of 2022 to 2029.

Market Definition

Micro servers are small pieces of equipment that are used in low-power microprocessor chips and other places where space is limited. With the exception of DRAM, boot FLASH, and power circuits, the majority of the server motherboard capacities are integrated on a single microprocessor. A micro server integrated circuit (IC) contains thousands or millions of semiconductors such as resistors, transistors, and capacitors. Micro server integrated circuits (ICs) are used as a chip to perform calculations. Transistors in micro server ICs are extremely small, measuring in nanometers.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Component (Hardware and Software), Processor Type (x86 and ARM), Application (Web Hosting & Enterprise, Analytics & Cloud Computing, and Edge Computing), and End User (Enterprises and Data Centers) |

|

Countries Covered |

U.S., Canada, Mexico, U.K., Germany, France, Spain, Italy, Netherlands, Switzerland, Russia, Belgium, Turkey, Rest of Europe, China, South Korea, Japan, India, Australia, Singapore, Malaysia, Indonesia, Thailand, Philippines, Rest of Asia-Pacific, South Africa, Saudi Arabia, U.A.E., Israel, Egypt, Rest of Middle East and Africa, Brazil, Argentina and Rest of South America |

|

Market Players Covered |

Google (US), Amazon Web Services, Inc. (US), Advanced Micro Devices, Inc (US), BitMain Technologies Holding Company (China), Intel Corporation (US), Xilinx (US), SAMSUNG (South Korea), Qualcomm Technologies, Inc. (US), NVIDIA Corporation (US), Wave Computing, Inc. (US), Graphcore (UK), IBM Corporation (US), Taiwan Semiconductor Manufacturing Company Limited (Taiwan), and Micron Technology, Inc. (US), among others |

|

Opportunities |

|

Micro Server IC Market Dynamics

Drivers

- Less power consumption and space compared to traditional servers

Micro servers use less power and take up less space than traditional high-end servers. Micro servers rely on low-power integrated circuits (ICs) similar to those found in commercial personal computers. Furthermore, stripped-down silicon in micro servers consumes significantly less power than the 90-W-plus TDP of processors inside high-end servers, with micro server chips often having a TDP of less than 45 W and plummeting to sub-10-W levels. Because of micro servers' minimal power and space needs, businesses may cram more processing power into a given amount of space while using less electricity than standard server solutions.This contributes to lower electricity bills and, as a result, lowers data centre operating costs significantly.

- The increased demand for cloud computing and web hosting

Another important factor driving the micro server IC market is increased demand for cloud computing and web hosting. Demand for web hosting and cloud computing has surged as the cost of online web hosting and cloud storage has reduced in recent years. Cloud computing necessitates increased data processing, storage, and security for cloud service providers. Several cloud computing service providers are competing to provide cloud computing services at a reasonable cost. Because micro server ICs require less initial investment, many small and medium-sized businesses are likely to choose them over traditional full-fledged enterprise-class servers.

Opportunity

Micro server ICs are becoming more popular in data centre applications because they are less expensive, use less power, and take up less physical space than enterprise-class rack servers. Growing demand for data centres in various business domains such as IT & telecommunications, banking, healthcare, agriculture, and government is expected to aid in market growth. The number of internet users has increased over the previous year, which has resulted in increased internet traffic, necessitating the need for more data centres. The increasing number of data centres would provide opportunities for micro servers to grow.

Restraints

The micro server integrated circuit (IC) market is hampered by a lack of storage capacity. The majority of large enterprises must store and process a large amount of data. Because of their small data storage capacities, micro servers ICs are not suitable for handling large volumes of data. Many large enterprises are likely to choose traditional enterprise class servers over micro server ICs because they are better suited to handling large volumes of data.

This micro server integrated circuit (IC) market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the Micro Server Integrated Circuit (IC) market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Micro Server Integrated Circuit (IC) Market

The global micro server IC was significantly impacted by the COVID-19 outbreak. Due to the worldwide downturn and labour constraints, electronic and semiconductor manufacturing facilities have been shut down. The COVID-19 outbreak has resulted in a major and long-term decline in production utilisation, and travel bans and facility closures have kept workers out of their factories, causing the growth of the micro server integrated circuit (IC) industry to decelerate in 2020. The pandemic, on the other hand, has accelerated existing trends in remote work, e-commerce, and automation, creating enormous opportunities for micro server IC post-pandemic.

Recent Development

- Intel Corporation will introduce its software guard extension confidential computing technology to the company's xeon scalable portfolio for the first time in October 2020, with increased capabilities and additional security features, with the next ice lake server CPUs.

- AMD will acquire Xilinx in an all-stock transaction valued at USD 35.0 billion in October 2020. The merger will create the industry's leading high-performance computing company, significantly expanding AMD's product portfolio and customer base across diverse growth markets where Xilinx is a market leader.

- NVIDIA will launch DPUs, a new type of processor, DOCA, a unique data-center-infrastructure-on-a-chip architecture that provides breakthrough networking, storage, and security performance, will support the launch in October 2020. It includes the new NVIDIA BlueField-2 DPU family as well as the NVIDIA DOCA software development kit for developing applications on DPU-accelerated data centre infrastructure services.

- NVIDIA and SoftBank Group Corp. (SBG) announced a definitive agreement in September 2020 under which NVIDIA will acquire ARM Limited from SoftBank for USD 40.0 billion. The combination of NVIDIA's leading AI computing platform and ARM's vast ecosystem will result in the formation of a premier computing company for the age of AI, accelerating innovation while expanding into large, high-growth markets.

Global Micro Server Integrated Circuit (IC) Market Scope

The micro server integrated circuit (IC) market is segmented on the basis of component, processor type, application and end-users. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Component

- Hardware

- Software

Processor type

- X86

- ARM

Application

- Web Hosting & Enterprise

- Analytics & Cloud Computing

- Edge Computing),

End users

- Enterprises

- Data centers

Micro Server Integrated Circuit (IC) Market Regional Analysis/Insights

The micro server integrated circuit (IC) market is analysed and market size insights and trends are provided by country, component, processor type, application and end-users as referenced above.

The countries covered in the micro server integrated circuit (IC) market report are U.S., Canada, Mexico, U.K., Germany, France, Spain, Italy, Netherlands, Switzerland, Russia, Belgium, Turkey, Rest of Europe, China, South Korea, Japan, India, Australia, Singapore, Malaysia, Indonesia, Thailand, Philippines, Rest of Asia-Pacific, South Africa, Saudi Arabia, U.A.E., Israel, Egypt, Rest of Middle East and Africa, Brazil, Argentina and Rest of South America.

North America dominated the global market and is expected to continue to do so throughout the forecast period. Increasing R&D investments in miniaturised ICs are expected to drive demand for micro server IC systems in this region. On the other hand, Asia-Pacific is expected to grow the fastest during the forecast period. One of the major factors driving market growth is the increased deployment of data centres in developing countries.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Micro Server Integrated Circuit (IC) Market Share Analysis

The micro server integrated circuit (IC) market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to micro server integrated circuit (IC) market.

Some of the major players operating in the micro server integrated circuit (IC) market are:

- Google (US)

- Amazon Web Services, Inc. (US)

- Advanced Micro Devices, Inc (US)

- BitMain Technologies Holding Company (China)

- Intel Corporation (US)

- Xilinx (US)

- SAMSUNG (South Korea)

- Qualcomm Technologies, Inc. (US)

- NVIDIA Corporation (US)

- Wave Computing, Inc. (US)

- Graphcore (UK)

- IBM Corporation (US)

- Taiwan Semiconductor Manufacturing Company Limited (Taiwan)

- Micron Technology, Inc. (US)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Micro Server Integrated Circuit Ic Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Micro Server Integrated Circuit Ic Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Micro Server Integrated Circuit Ic Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.