Global Mhealth Solutions Market

Market Size in USD Billion

CAGR :

%

USD

171.45 Billion

USD

4,394.07 Billion

2024

2032

USD

171.45 Billion

USD

4,394.07 Billion

2024

2032

| 2025 –2032 | |

| USD 171.45 Billion | |

| USD 4,394.07 Billion | |

|

|

|

|

Mobile Health (mhealth) Solutions Market Size

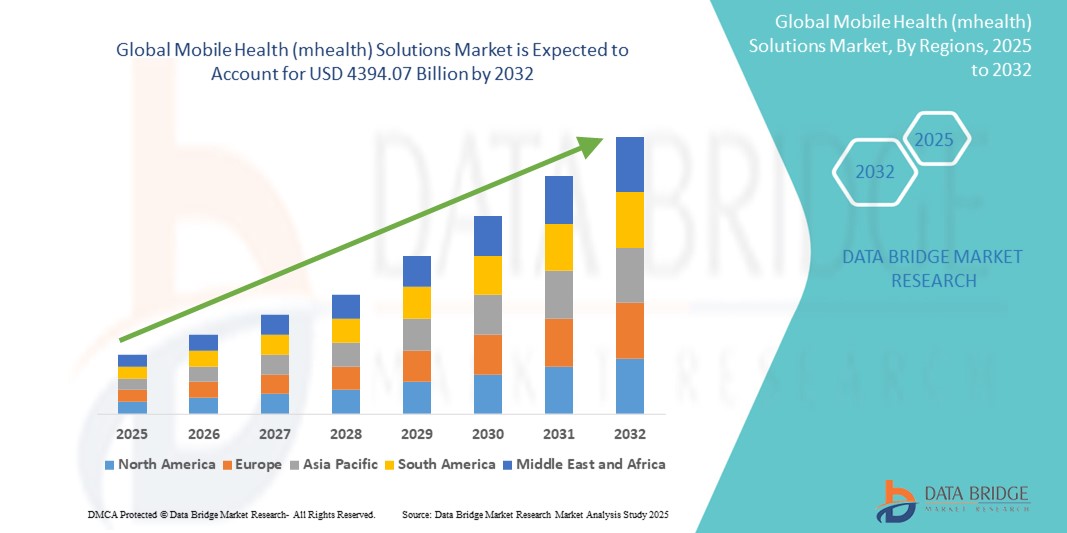

- The global mobile health (mhealth) solutions market size was valued at USD 171.45 billion in 2024 and is expected to reach USD 4,394.07 billion by 2032, at a CAGR of 50.00% during the forecast period

- This growth is driven by growing demand for wearables in mobile health

Mobile Health (mhealth) Solutions Market Analysis

- Mobile health (mHealth) technologies are transforming healthcare delivery by offering real-time patient monitoring, teleconsultations, and health management through smartphones, wearables, and connected medical devices, thus improving accessibility and patient outcomes

- The demand for mHealth solutions is rising rapidly due to the increasing prevalence of chronic diseases, growing smartphone penetration, and a surge in consumer interest in preventive healthcare and wellness tracking applications

- North America is expected to dominate the mobile health (mhealth) solutions market with the largest market share of 41.87%, due to the presence of leading digital health companies, robust healthcare IT infrastructure, and strong adoption of remote monitoring and telehealth platforms

- Asia-Pacific is projected to register the highest growth rate in the mobile health (mhealth) solutions market during the forecast period, due to rising healthcare digitization, government-led health initiatives, and increasing demand for mobile-based medical services in rural and urban areas

- The healthcare apps segment is expected to dominate the material segment with the largest market share of 51.96% in 2025, due to the growing adoption of smartphones, increasing consumer demand for convenient health tracking and management tools, and the rising prevalence of chronic diseases requiring continuous monitoring

Report Scope and Mobile Health (mhealth) Solutions Market Segmentation

|

Attributes |

Mobile Health (mhealth) Solutions Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Mobile Health (mhealth) Solutions Market Trends

“Surge in Consumer Health and Wellness Apps”

- A rising trend in the mobile health (mHealth) solutions market is the widespread use of health and wellness applications, which empower users to monitor fitness, diet, mental health, sleep quality, and vital statistics in real time

- These apps offer personalized health insights, behavioral nudges, and goal-setting features, creating a more engaged and health-conscious user base

- The trend reflects increasing public interest in preventive healthcare and the use of digital tools for self-management of chronic conditions

- For instance, in 2024, MyFitnessPal reported over 200 million downloads globally, highlighting its popularity as a mobile platform for diet and exercise tracking

- This shift toward consumer-centric health management is expanding the scope of mHealth beyond clinical care to include lifestyle and wellness optimization

Mobile Health (mhealth) Solutions Market Dynamics

Driver

“Expansion of 5G and Mobile Network Infrastructure”

- The rollout of 5G networks is accelerating the adoption of mobile health (mHealth) solutions by enabling faster data transmission, lower latency, and real-time connectivity between mobile devices and healthcare systems

- Improved mobile bandwidth supports more stable video consultations, remote diagnostics, and seamless streaming of high-resolution medical imaging data

- This infrastructure upgrade is especially beneficial for rural and underserved regions where traditional healthcare access is limited

- For instance, in 2023, Verizon and Medivis launched a 5G-powered augmented reality platform to support remote surgical planning and virtual healthcare collaboration

- The proliferation of 5G is expected to enhance mHealth application performance, reliability, and scalability across global markets

Opportunity

“Rising Demand for Mental Health and Behavioral Therapy Apps”

- Growing global awareness around mental health is fueling demand for digital platforms that offer counseling, stress management, and cognitive behavioral therapy (CBT) via mobile devices

- These apps provide confidential, 24/7 support through AI chatbots, telepsychiatry, and self-assessment tools, making mental healthcare more accessible and destigmatized

- The shift toward holistic wellness is encouraging developers to integrate mental health modules into broader mHealth ecosystems

- For instance, in 2024, Headspace partnered with healthcare systems in the U.K. and U.S. to provide app-based mindfulness and therapy content for patients with anxiety and depression

- This opportunity positions mHealth as a critical tool in bridging gaps in mental healthcare delivery and supporting emotional well-being

Restraint/Challenge

“Data Privacy and Regulatory Compliance Concerns”

- A significant challenge in the mobile health (mHealth) solutions market is ensuring data privacy, user consent, and compliance with regional regulations such as HIPAA (U.S.), GDPR (Europe), and other health data laws

- mHealth apps and connected devices collect sensitive personal information, which makes them targets for cybersecurity threats, data breaches, and misuse

- Developers must invest heavily in data encryption, secure APIs, and legal compliance frameworks, which can slow down product deployment and scalability

- For instance, in 2023, Babylon Health faced scrutiny in the U.K. for a security lapse that exposed users' video consultations to unauthorized viewers

- Addressing these concerns is crucial to building user trust and ensuring sustainable adoption of mHealth platforms globally

Mobile Health (mhealth) Solutions Market Scope

The market is segmented on the basis of connected devices, apps, and services.

|

Segmentation |

Sub-Segmentation |

|

By Connected Devices |

|

|

By Apps |

|

|

By Services |

|

In 2025, the healthcare apps is projected to dominate the market with a largest share in apps segment

The healthcare apps segment is expected to dominate the mobile health (mhealth) solutions market with the largest market share of 51.96% in 2025, due to the growing adoption of smartphones, increasing consumer demand for convenient health tracking and management tools, and the rising prevalence of chronic diseases requiring continuous monitoring.

The remote monitoring services segment is expected to account for the largest share during the forecast period in services segment

In 2025, the remote monitoring services segment is expected to dominate the market, due to increasing demand for continuous patient monitoring, especially for chronic disease management, and the integration of these services with wearable devices and mobile applications.

Mobile Health (mhealth) Solutions Market Regional Analysis

“North America Holds the Largest Share in the Mobile Health (mhealth) Solutions Market”

- North America is expected to dominate the global mobile health (mHealth) solutions market with the largest market share of 41.87% in 2025, supported by widespread adoption of mobile technologies, robust healthcare IT infrastructure, and strong regulatory support for digital health innovations

- The U.S. dominates the region, driven by high smartphone penetration, increased usage of mHealth apps for chronic disease management, and strong investments in telemedicine and remote monitoring services

- Continued growth in wearable health devices, expansion of digital health reimbursement models, and integration of AI and analytics into mobile platforms are expected to sustain North America’s market dominance through the forecast period

“Asia-Pacific is Projected to Register the Highest CAGR in the Mobile Health (mhealth) Solutions Market”

- Asia-Pacific is expected to witness the highest compound annual growth rate (CAGR) in the mobile health (mHealth) solutions market, fueled by expanding mobile connectivity, increasing healthcare access in rural areas, and government-backed digital health initiatives

- Countries such as China, India, and Japan are key drivers, with programs such as “Digital India”, “Healthy China 2030”, and growing private sector investment promoting the development and adoption of mHealth applications

- The surge in smartphone users, coupled with growing awareness of preventive healthcare and remote consultations, is positioning Asia-Pacific as the fastest-growing region in the global mHealth landscape

Mobile Health (mhealth) Solutions Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Koninklijke Philips N.V. (Netherlands)

- Abbott (U.S.)

- Medtronic (Ireland)

- Johnson & Johnson Services Inc. (U.S.)

- Apple, Inc. (U.S.)

- AirStrip Technologies Inc. (U.S.)

- AliveCor Inc. (U.S.)

- Nike, Inc. (U.S.)

- Omron Corporation (Japan)

- BioTelemetry (U.S.)

- Philips Company (U.S.)

- athenahealth, Inc. (U.S.)

- AgaMatrix (U.S.)

- Withings (France)

- iHealth Labs, Inc. (U.S.)

- Cerner Corporation (U.S.)

- ZTE Corporation (China)

- Nokia (Finland)

- Cisco Systems, Inc. (U.S.)

- AT&T Intellectual Property (U.S.)

- Qualcomm Technologies, Inc. (U.S.)

Latest Developments in Global Mobile Health (mhealth) Solutions Market

- In October 2023, Cedars-Sinai launched the Cedars-Sinai Connect app, a mobile health application powered by artificial intelligence, designed to deliver virtual care for various clinical needs, including same-day primary care scheduling and 24/7 virtual specialist access for urgent treatment. This launch reinforces Cedars-Sinai’s commitment to expanding digital health capabilities and enhancing patient convenience

- In November 2022, Hartford HealthCare entered a long-term collaboration with Google Cloud aimed at improving healthcare systems through advanced data analytics, digital transformation, and enhanced delivery and access to care. This partnership marks a strategic step toward integrating cloud-based technologies in health service delivery

- In April 2022, AirStrip Technologies, Inc. partnered with FifthEye to integrate and commercialize the FDA-approved AHI System, which detects and forecasts hemodynamic instability in real time. This collaboration underscores the growing importance of predictive analytics in critical care

- In March 2022, Epic Systems Corporation introduced Garden Plot, a solution that offers small and independent healthcare practices access to Epic's software ecosystem and interoperability network. This initiative expands access to digital health infrastructure among smaller providers

- In March 2022, Vocera Communications, a Stryker subsidiary, launched Minibadge, a wearable, voice-activated device that integrates with healthcare workflows and supports hands-free communication in clinical settings. This innovation enhances operational efficiency and communication in healthcare environments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.