Global Metalworking Fluids Market

Market Size in USD Billion

CAGR :

%

USD

12.50 Billion

USD

20.07 Billion

2024

2032

USD

12.50 Billion

USD

20.07 Billion

2024

2032

| 2025 –2032 | |

| USD 12.50 Billion | |

| USD 20.07 Billion | |

|

|

|

|

Metalworking Fluids Market Size

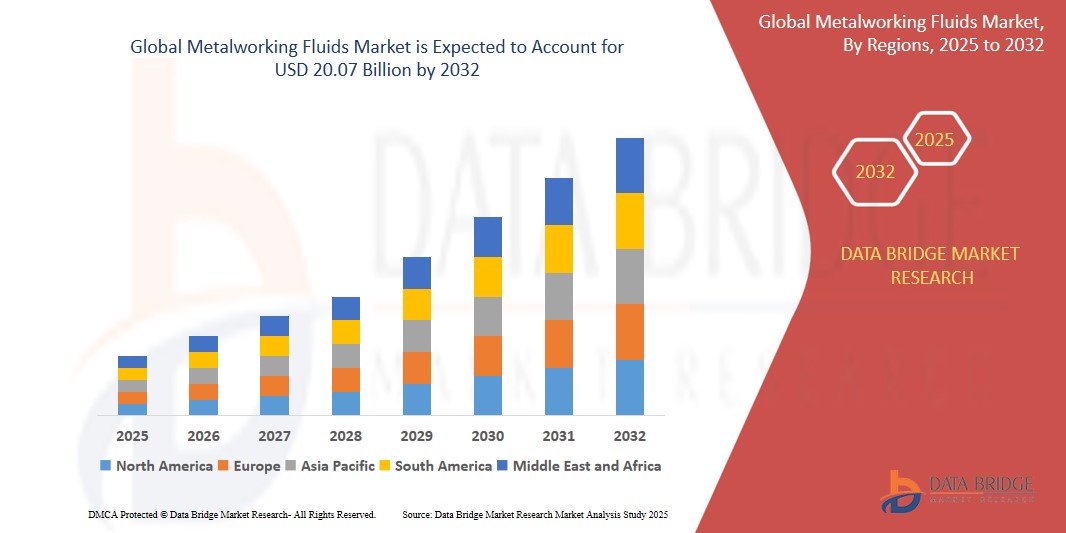

- The Global Metalworking Fluids Market size was valued at USD 12.50 Billion in 2024 and is expected to reach USD 20.07 Billion by 2032, at a CAGR of 5.4% during the forecast period

- The market growth is largely fueled by growth of the heavy machinery industry and increasing demand of these fluids owning to their important role metal removal and forming

- Furthermore, the increase in popularity of these fluids as they comprise of high-performance soluble oil and semi-synthetic emulsion technology and they provide numerous high-performance soluble oil and semi-synthetic emulsion technology, are further anticipated to propel the growth of the Metalworking Fluids Market

Metalworking Fluids Market Analysis

- Metalworking fluids are defined as category of oils and lubricants which are utilized in several fabrication and metal construction processes.

- These fluids are known to reduce the friction thereby reducing the heat caused by the same when the fabrication processing is underway. They are also highly used for removing any extruding chips from the surface of the metal.

- The design of these fluids specifically made for a variety of hard and soft water qualities and offerings by them such as low foam and long-term corrosion protection for machines and components further influence the metalworking fluids market.

- North America dominates the Metalworking Fluids Market with the largest revenue share of 35.03% in 2024, characterized by robust manufacturing sector, particularly in automotive, aerospace, and industrial machinery.

- Asia-Pacific is expected to be the fastest growing region in the Metalworking Fluids Market during the forecast period due to by region's expanding industrial base, particularly in automotive

- The mineral segment is expected to dominate the Metalworking Fluids Market with a market share of 38.5% in 2024, driven by its cost-effectiveness, superior lubricating properties, and widespread usage in cutting, grinding, and milling operations

Report Scope and Metalworking Fluids Market Segmentation

|

Attributes |

Metalworking Fluids Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Metalworking Fluids Market Trends

“Expansion of EV and Lightweight Manufacturing Driving Fluid Innovation”

- A growing trend reshaping the metalworking fluids market is the expansion of electric vehicle (EV) production and the broader shift toward lightweight manufacturing materials.

- Automakers are increasingly adopting lightweight materials such as aluminum, magnesium alloys, and composites to enhance vehicle efficiency and meet regulatory emission targets.

- These materials require specialized metalworking fluids that offer superior lubrication, cooling, and corrosion protection without reacting adversely with soft or reactive metals.

- Companies like Quaker Houghton and ExxonMobil are investing in R&D to develop fluids specifically tailored for EV drivetrains and battery component machining, which demand tighter tolerances and cleaner operations.

- This trend is expected to drive innovation in formulation technologies, especially for synthetic and semi-synthetic fluids designed to operate effectively in high-speed, high-precision machining environments.

Metalworking Fluids Market Dynamics

Driver

“Rising Demand from Automotive and Aerospace Industries”

- The growth of the automotive and aerospace sectors is a primary driver for the metalworking fluids market.

- In 2023, global vehicle production reached approximately 93.5 million units, indicating a substantial demand for metal components requiring machining and lubrication.

- Similarly, the aerospace industry's expansion necessitates high-performance fluids for machining complex materials like titanium alloys, ensuring precision and surface quality.

- The increasing production volumes in these industries are directly contributing to the heightened consumption of metalworking fluids.

Restraint/Challenge

“Stringent Environmental Regulations and High Operational Costs”

- The metalworking fluids industry faces challenges due to strict environmental regulations concerning emissions, waste disposal, and worker safety.

- Compliance with these regulations often requires significant investment in fluid recycling systems and waste treatment facilities, increasing operational costs.

- Additionally, the high cost of developing and implementing advanced, eco-friendly fluids can be a barrier for small and medium-sized enterprises.

- These factors may hinder market growth, especially in developing regions where regulatory frameworks are evolving.

Metalworking Fluids Market Scope

The market is segmented on the basis of category, product type, application, function, and end-use industry.

- By Category

On the basis of category, the Metalworking Fluids Market is segmented into Synthetic, Semi-Synthetic, Bio-Based, Straight Oil, Mineral, and Emulsified. The Mineral segment dominates the largest market revenue share of 38.5% in 2025, driven by its cost-effectiveness, superior lubricating properties, and widespread usage in cutting, grinding, and milling operations. These fluids provide high cooling efficiency and are compatible with a variety of metal types and machining processes, supporting their extensive adoption. Additionally, their ease of formulation and availability support continued market leadership.

The Bio-Based segment is anticipated to witness the fastest growth rate of 9.2% from 2025 to 2032, fueled by rising environmental regulations and the shift toward sustainable manufacturing practices. Bio-based metalworking fluids offer reduced toxicity and biodegradability, making them attractive alternatives in regulated markets. Increasing demand for green lubricants from end users in automotive and aerospace sectors is further accelerating growth.

- By Product Type

On the basis of product type, the Metalworking Fluids Market is segmented into Removal Fluids, Protection Fluids, Forming Fluids, and Treating Fluids. The Removal Fluids segment held the largest market revenue share in 2025, driven by their essential role in machining operations such as drilling, milling, and turning. These fluids enhance cutting precision, reduce friction, and extend tool life, making them indispensable in high-volume metalworking operations across automotive and general engineering industries.

The Protection Fluids segment is expected to witness the fastest CAGR from 2025 to 2032, driven by increasing demand for corrosion prevention in finished and semi-finished metal parts. These fluids form a protective barrier against oxidation and humidity, ensuring product integrity during storage and transit. Growth is supported by global demand in sectors such as marine, transportation, and energy.

- By Application

On the basis of application, the Metalworking Fluids Market is segmented into Neat Cutting Oils, Water Cutting Oils, Corrosion Preventive Oils, and Others. The Neat Cutting Oils segment dominates the largest market revenue share of 41.7% in 2025, driven by their usage in high-speed machining and heavy-duty metal cutting. These oils offer superior lubrication, reduce heat buildup, and improve surface finish, making them the preferred choice in precision machining across critical industries.

The Corrosion Preventive Oils segment is anticipated to witness the fastest growth rate of 8.9% from 2025 to 2032, fueled by increasing export-oriented manufacturing and longer storage cycles. These oils help protect metal surfaces from atmospheric corrosion and chemical attack. Their adoption is rising in steel processing, automotive components, and industrial machinery preservation.

- By Function

On the basis of function, the Metalworking Fluids Market is segmented into Metal Fabrication, Transportation Equipment, Machinery, and Others. The Metal Fabrication segment held the largest market revenue share in 2025, driven by the high fluid demand in processes such as forging, stamping, and forming. These operations rely on fluids to reduce tool wear and improve output quality, particularly in construction and appliance manufacturing industries.

The Transportation Equipment segment is expected to witness the fastest CAGR from 2025 to 2032, driven by rising demand for lightweight and complex components. Metalworking fluids play a vital role in producing intricate geometries and surface finishes in the aerospace and automotive sectors. Growth is supported by production expansion, material advancements, and precision machining requirements.

- By End-Use Industry

On the basis of end-use industry, the Metalworking Fluids Market is segmented into Construction, Electrical and Power, Agriculture, Automobile, Aerospace, Rail, Marine, Telecommunications, and Healthcare. The Automobile segment dominates the largest market revenue share of 35.6% in 2025, driven by fluid-intensive operations in vehicle manufacturing, engine assembly, and component machining. Metalworking fluids support high-volume production lines and stringent quality demands, sustaining high consumption rates across global automotive hubs.

The aerospace segment is anticipated to witness the fastest growth rate of 10.1% from 2025 to 2032, fueled by demand for precision parts, lightweight alloys, and increased aircraft production. Fluids used in aerospace machining must meet stringent performance and cleanliness standards. Adoption is rising across OEMs and MROs focusing on efficiency, safety, and environmental compliance.

Metalworking Fluids Market Regional Analysis

- North America dominates the Metalworking Fluids Market with the largest revenue share of 35.03% in 2024, driven by a robust manufacturing sector, particularly in automotive, aerospace, and industrial machinery.

- The region's emphasis on sustainable manufacturing practices and the adoption of advanced machining technologies contribute to market growth.

U.S. Metalworking Fluids Market Insight

The U.S. Metalworking Fluids Market captured the largest revenue share of 81.27% in 2025 within Asia-Pacific, fueled by its strong presence in automotive manufacturing and high demand for advanced machining technologies. The aerospace sector’s rapid growth and increasing automation adoption further expand the market.

Europe Metalworking Fluids Market Insight

The European Metalworking Fluids Market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by strong automotive industry and a well-established aerospace sector, both requiring high-performance metalworking fluids. The increasing focus on sustainability and eco-friendly products drives demand for biodegradable and low-toxicity fluids.

U.K. Metalworking Fluids Market Insight

The U.K. Metalworking Fluids Market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the country's advanced manufacturing and automotive sectors. The government's push for green procurement and consumer demand for clean technologies support the adoption of eco-friendly metalworking fluids.

Germany Metalworking Fluids Market Insight

The German Metalworking Fluids Market is expected to expand at a considerable CAGR during the forecast period, fueled by the country's strong industrial base and commitment to sustainability. Germany’s stringent biodegradability standards and support for renewable raw material innovations position the country as a key hub for bio-based lubricant R&D and adoption.

Asia-Pacific Metalworking Fluids Market Insight

The Asia-Pacific Metalworking Fluids Market is poised to grow at the fastest CAGR of over 17.3% during the forecast period of 2025 to 2032, driven by region's expanding industrial base, particularly in automotive and machinery manufacturing, significantly contributes to market expansion. Asia-Pacific is projected to hold a significant share of the global market in 2024.

Japan Metalworking Fluids Market Insight

The Japan Metalworking Fluids Market is gaining momentum due to technological innovation and a strong culture of environmental responsibility. Japan’s machinery and precision tools industries are turning to high-performance bio-lubricants for efficiency and lower toxicity.

China Metalworking Fluids Market Insight

China Metalworking Fluids Market accounted for the largest market revenue share in Asia Pacific in 2025, driven by massive industrial output and supportive green manufacturing policies. The government's focus on reducing pollution and the availability of local raw materials are boosting domestic production.

Metalworking Fluids Market Share

The Metalworking Fluids Industry is primarily led by well-established companies, including:

- Italmatch Chemicals S.p.A. (Italy)

- Croda International Plc (U.K.)

- Chevron Corporation (U.S.)

- Quaker Chemical Corporation (U.S.)

- Veedol International Limited (U.K.)

- oelheld GmbH (Germany)

- FUCHS (Germany)

- Master Fluid Solutions (U.S.)

- Hardcastle Petrofer (India)

- Illinois Tool Works Inc. (U.S.)

- JXTG Holdings, Inc. / ENEOS Holdings (Japan)

- Blaser Swisslube (Switzerland)

- Exxon Mobil Corporation (U.S.)

- BP p.l.c. (U.K.)

- CIMCOOL Fluid Technology, LLC (U.S.)

- TotalEnergies (France)

- Eni (Italy)

- Henkel AG & Co. KGaA (Germany)

- China Petroleum & Chemical Corporation – Sinopec (China)

- Apar Industries Ltd. (India)

- MORESCO Corporation (Japan)

- Kuwait Petroleum Corporation – KPC (Kuwait)

- Petroliam Nasional Berhad – PETRONAS (Malaysia)

- Indian Oil Corporation Ltd (India)

- QualiChem, Inc. (U.S.)

- Yushiro Chemical Industry Co., Ltd. (Japan)

- Pennine Lubricants (U.K.)

- LUKOIL (Russia)

- The Lubrizol Corporation (U.S.)

- HPCL – Hindustan Petroleum Corporation Limited (India)

- Chem Arrow Corporation (U.S.)

- Idemitsu Kosan Co., Ltd. (Japan)

- Metalworking Lubricants Company (U.S.)

- Royal Dutch Shell (U.K.)

Latest Developments in Global Metalworking Fluids Market

- In June 2024, Castrol, part of the BP Group and a significant player in the metalworking fluids sector, invested US$ 50 million in Gogoro, a Taiwanese electric scooter company.

- In May 2024, Integrated Power Services (IPS), a North American firm specializing in the servicing and remanufacturing of electrical and mechanical systems, acquired the UK-based Houghton International, a well-known name in the metalworking fluids market.

- In February 2024, Castrol, a leading contributor to the metalworking fluids industry, launched Transaqua SP-HC—a new addition to its Transaqua hydraulic control fluid range. This fluid is engineered for use in subsea production control systems, offering robust protection for such offshore operations.

- In October 2023, Chevron Corporation, via its subsidiary Chevron Brands International LLC, signed a long-term partnership agreement with Hindustan Petroleum Corporation Limited (HPCL).

- In December 2022, SKF collaborated with Castrol to promote circular usage of industrial lubricants, giving Castrol’s industrial clients access to SKF’s integrated RecondOil Double Separation Technology (DST) systems.

- In October 2022, Quaker Houghton, a global leader in process fluid solutions, showcased an extensive range of industrial products at FABTECH 2022, Booth B5159.

- In October 2022, CF Industries and ExxonMobil entered into a major commercial agreement to capture and permanently store up to 2 million metric tons of carbon dioxide annually from CF Industries' manufacturing facility in Louisiana.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Metalworking Fluids Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Metalworking Fluids Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Metalworking Fluids Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.