Global Metallic Biomaterial Market

Market Size in USD Billion

CAGR :

%

USD

12.21 Billion

USD

20.45 Billion

2025

2033

USD

12.21 Billion

USD

20.45 Billion

2025

2033

| 2026 –2033 | |

| USD 12.21 Billion | |

| USD 20.45 Billion | |

|

|

|

|

Metallic Biomaterial Market Size

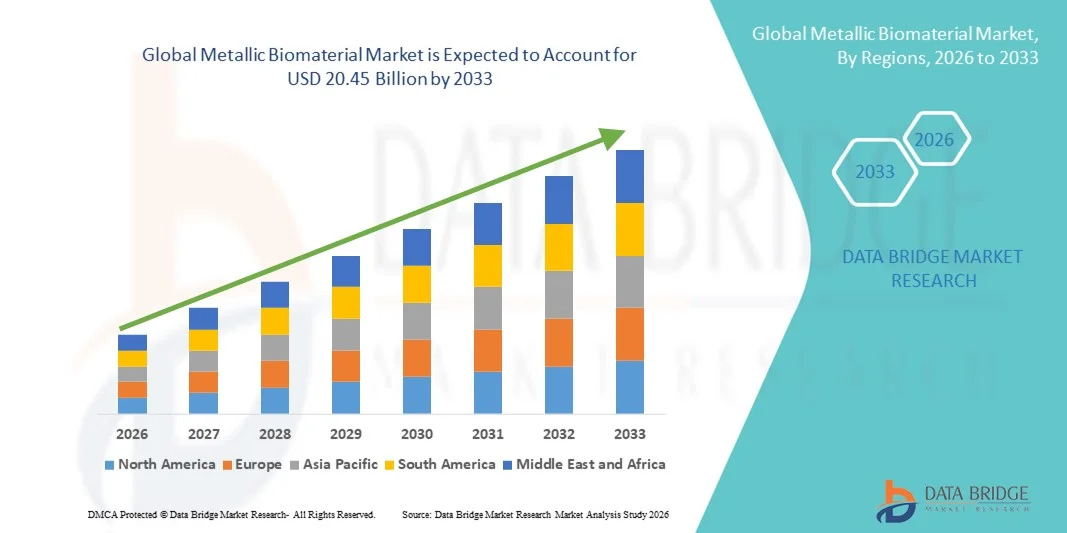

- The global metallic biomaterial market size was valued at USD 12.21 billion in 2025 and is expected to reach USD 20.45 billion by 2033, at a CAGR of 6.66% during the forecast period

- The market growth is largely fueled by the increasing demand for durable, biocompatible, and high-performance materials in orthopedic, dental, cardiovascular, and other medical applications, driving adoption of metallic biomaterials across both emerging and developed regions

- Furthermore, technological advancements in alloy design, surface modification, and additive manufacturing, combined with rising healthcare expenditure and growing preference for minimally invasive and long-lasting implants, are accelerating the uptake of Metallic Biomaterial solutions, thereby significantly boosting the industry's growth

Metallic Biomaterial Market Analysis

- Metallic biomaterials, offering superior strength, corrosion resistance, and biocompatibility, are increasingly vital components in orthopedic, dental, cardiovascular, and other medical implant applications due to their durability, long-term performance, and compatibility with advanced manufacturing techniques such as 3D printing and surface coatings

- The escalating demand for metallic biomaterials is primarily fueled by the growing prevalence of chronic musculoskeletal and cardiovascular conditions, rising adoption of minimally invasive and long-lasting implants, and increasing healthcare expenditure across both developed and emerging markets

- North America dominated the metallic biomaterial market with the largest revenue share of 42.5% in 2025, characterized by advanced healthcare infrastructure, high adoption of innovative implant technologies, and a strong presence of key market players, with the U.S. accounting for the majority of regional revenue driven by advanced research and high patient volumes

- Asia-Pacific is expected to be the fastest-growing region in the metallic biomaterial market during the forecast period, registering a CAGR of approximately 13.2%, driven by increasing orthopedic and cardiovascular procedures, rapid urbanization, rising healthcare expenditure, and growing adoption of advanced metallic implants in countries such as China, India, and Japan

- The orthopedic segment dominated the Metallic Biomaterial market, accounting for nearly 41.3% of the total market revenue in 2025

Report Scope and Metallic Biomaterial Market Segmentation

|

Attributes |

Metallic Biomaterial Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Metallic Biomaterial Market Trends

Advancements in High-Performance Metallic Biomaterials

- A significant and accelerating trend in the global metallic biomaterial market is the growing focus on high-performance, corrosion-resistant, and biocompatible metal alloys for medical implants, surgical tools, and orthopedic applications

- Innovations in alloy composition, 3D printing, and surface engineering are driving enhanced implant longevity and improved patient outcomes

- For instance, in June 2022, Stryker launched its Tritanium 3D-printed spinal implants, offering patient-specific customization, improved osseointegration, and enhanced mechanical stability, illustrating the rising adoption of additive manufacturing technologies in metallic biomaterials

- Manufacturers are increasingly implementing surface coating technologies, such as hydroxyapatite, titanium nitride, and zirconium oxide, to improve implant bioactivity, reduce infection risk, and enhance wear resistance

- The use of titanium alloys and cobalt-chromium alloys is expanding in cardiovascular stents, dental implants, and orthopedic joint replacements due to their strength-to-weight ratio and biocompatibility.

- Increasing R&D collaborations between material scientists, hospitals, and universities are driving the development of novel alloys and composites tailored for specific clinical applications, such as hip and knee replacements

Metallic Biomaterial Market Dynamics

Driver

Rising Demand Due to Orthopedic, Dental, and Cardiovascular Applications

- The growing prevalence of joint injuries, degenerative bone diseases, and cardiovascular conditions among aging populations is creating a strong demand for metallic biomaterials globally

- For instance, in March 2023, Zimmer Biomet launched the Persona Revision Knee System, designed to enhance mechanical strength and osseointegration in revision knee surgeries, showing how clinical innovations drive metallic biomaterial adoption

- Advances in minimally invasive surgeries, robotic-assisted procedures, and precision medicine require implants with precise mechanical properties and high biocompatibility, pushing manufacturers to develop specialized metallic biomaterials

- The expansion of medical tourism in countries such as India, UAE, and Thailand, where advanced orthopedic and dental procedures are performed, is boosting the adoption of metallic biomaterials

- Supportive government policies and healthcare expenditure in North America and Europe are increasing accessibility to high-quality metallic implants, further stimulating market growth

- Technological advancements in additive manufacturing and alloy engineering allow faster production of patient-specific implants, reducing surgical complications and promoting wider acceptance among surgeons and hospitals

Restraint/Challenge

High Costs, Regulatory Hurdles, and Biocompatibility Concerns

- The relatively high cost of metallic biomaterials compared to polymer or ceramic alternatives can limit adoption in developing regions or in price-sensitive hospitals

- For instance, in September 2021, DePuy Synthes faced FDA regulatory delays for its cobalt-chromium hip implant, highlighting how stringent approval processes and complex regulatory pathways can hinder market growth

- Concerns regarding metal hypersensitivity, ion release, and long-term biocompatibility continue to challenge widespread adoption, especially for patients with pre-existing allergies or sensitivities

- Manufacturers face complexity in scaling production of advanced alloys and 3D-printed implants, which can increase costs and delay delivery timelines

- Limited awareness among healthcare providers in emerging markets about the clinical benefits of advanced metallic biomaterials can slow adoption rates

- Overcoming these challenges through the development of corrosion-resistant and hypoallergenic alloys, cost optimization strategies, and extensive clinical trials will be vital for sustained market expansion globally

Metallic Biomaterial Market Scope

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the Metallic Biomaterial market is segmented into stainless steel, titanium alloys, cobalt-chrome alloys, gold, magnesium, silver, and platinum. The stainless steel segment dominated the Metallic Biomaterial market, accounting for approximately 38.6% of the total market revenue in 2025. Its dominance is attributed to its well-established use in medical devices, orthopedic implants, and surgical instruments due to excellent mechanical strength, corrosion resistance, and cost-effectiveness. Stainless steel offers ease of fabrication, proven biocompatibility, and high reliability in load-bearing applications. Hospitals and surgical centers prefer stainless steel for long-term implant applications. Rising prevalence of orthopedic and spinal disorders further fuels demand. Its compatibility with sterilization procedures and widespread availability supports market leadership. In addition, stainless steel components are extensively used in dental and cardiovascular applications. Continuous innovations in alloy processing improve durability and performance. The high adoption in developing and developed regions strengthens its revenue share. Clinical familiarity and regulatory approvals across multiple countries also reinforce dominance. Strong supply chains and manufacturing scalability further enhance market share.

The titanium alloys segment is expected to witness the fastest growth, with a CAGR of 14.2% from 2026 to 2033. This growth is driven by titanium’s superior strength-to-weight ratio, corrosion resistance, and excellent biocompatibility for orthopedic, dental, and spinal applications. Titanium alloys are increasingly used in load-bearing implants and cardiovascular stents. Rising adoption in minimally invasive surgeries and complex reconstructive procedures accelerates growth. The demand for lighter, longer-lasting implants in aging populations supports expansion. Advances in additive manufacturing and surface treatment technologies further propel adoption. Titanium’s use in dental and craniofacial reconstruction is also expanding. Increasing healthcare infrastructure and surgical volumes in emerging regions drive further growth. Surgeons’ preference for titanium implants due to reduced risk of implant rejection strengthens market penetration. Supportive reimbursement policies and higher patient awareness enhance adoption. Growing R&D in alloy enhancements ensures ongoing market expansion.

- By Application

On the basis of application, the Metallic Biomaterial market is segmented into orthopedic, spinal, dental, cardiovascular, and others. The orthopedic segment dominated the Metallic Biomaterial market, accounting for nearly 41.3% of the total market revenue in 2025. This dominance is driven by the high incidence of musculoskeletal disorders, trauma cases, and joint replacements globally. Orthopedic implants such as plates, screws, and joint prostheses rely heavily on metallic biomaterials for their mechanical stability and long-term performance. Hospitals and ambulatory surgical centers are key end-users. The segment benefits from ongoing innovations in implant design, minimally invasive techniques, and modular implant systems. Stainless steel, titanium, and cobalt-chrome alloys are extensively used for hip, knee, and shoulder replacements. Increasing aging population and sports-related injuries boost demand. Favorable reimbursement policies for orthopedic surgeries further enhance growth. Surgical centers prefer metallic implants for durability and clinical familiarity. Continuous clinical success and regulatory approvals in developed markets solidify dominance. The integration of advanced biomaterials with imaging and navigation systems improves surgical outcomes, strengthening market share. Rising awareness about post-surgical quality of life drives patient preference for durable metallic implants.

The dental segment is expected to witness the fastest CAGR, registering 13.8% from 2026 to 2033. Growth is driven by increasing prevalence of dental disorders, rising cosmetic dentistry procedures, and higher patient awareness in emerging markets. Titanium and stainless steel are widely used in dental implants, crowns, and orthodontic devices due to their biocompatibility and corrosion resistance. Innovations in additive manufacturing, surface coatings, and CAD/CAM technologies enhance precision and patient-specific customization. Expanding dental care infrastructure in Asia-Pacific and Latin America supports rapid adoption. Rising disposable incomes and medical tourism further accelerate growth. Dental clinics and hospitals are increasingly adopting metallic implants for long-term restorative treatments. The demand for minimally invasive and aesthetically superior dental solutions also boosts adoption. Regulatory approvals and improved procedural success rates enhance market confidence. Ongoing R&D in hybrid metallic-ceramic implants increases versatility. Integration with digital dentistry and imaging technologies is expected to further fuel the segment’s growth.

Metallic Biomaterial Market Regional Analysis

- North America dominated the metallic biomaterial market with the largest revenue share of 42.5% in 2025, characterized by advanced healthcare infrastructure, high adoption of innovative implant technologies, and a strong presence of key market players

- Healthcare providers and hospitals in the region highly value the superior biocompatibility, mechanical strength, and longevity offered by advanced metallic implants in orthopedic, cardiovascular, and dental applications

- This widespread adoption is further supported by high patient volumes, strong R&D initiatives, and continuous innovation in metallic biomaterials, establishing North America as a hub for both clinical application and technological advancement

U.S. Metallic Biomaterial Market Insight

The U.S. metallic biomaterial market captured the majority of revenue within North America in 2025, driven by advanced research, high patient volumes, and the increasing adoption of next-generation orthopedic and cardiovascular implants. Rising awareness among patients and surgeons regarding long-lasting, biocompatible implants, combined with the expansion of minimally invasive surgical procedures, is fueling growth. In addition, collaborations between research institutes and implant manufacturers are accelerating the development of patient-specific metallic implants and 3D-printed solutions for orthopedic and dental applications.

Europe Metallic Biomaterial Market Insight

- Europe metallic biomaterial market is projected to expand at a substantial CAGR during the forecast period

- Supported by stringent healthcare regulations, rising investments in advanced surgical procedures, and a focus on patient safety and improved clinical outcomes

- Growing adoption of metallic implants in orthopedic, cardiovascular, and dental segments, alongside technological upgrades in hospital infrastructure, is driving the market across key European countries

U.K. Metallic Biomaterial Market Insight

The U.K. metallic biomaterial market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing prevalence of orthopedic and cardiovascular disorders, adoption of advanced implant technologies, and growing patient awareness. Investments in hospitals and specialty clinics, along with strong regulatory support for innovative surgical solutions, are further contributing to market growth.

Germany Metallic Biomaterial Market Insight

Germany’s metallic biomaterial market is expected to expand at a considerable CAGR, fueled by advanced healthcare infrastructure, high adoption of biocompatible and corrosion-resistant metallic implants, and increasing emphasis on eco-conscious and precision surgical solutions. Hospitals are increasingly incorporating patient-specific implants and 3D-printed metallic biomaterials, aligning with the country’s focus on innovation and high-quality patient care.

Asia Pacific Metallic Biomaterial Market Insight

- Asia-Pacific metallic biomaterial market is poised to grow at the fastest CAGR of approximately 13.2% during the forecast period

- Driven by increasing orthopedic and cardiovascular procedures, rising healthcare expenditure, rapid urbanization, and growing adoption of advanced metallic implants in countries such as China, India, and Japan

- The region benefits from expanding hospital infrastructure, rising disposable incomes, and government initiatives supporting modern healthcare technologies, which are accelerating the penetration of advanced metallic biomaterials

Japan Metallic Biomaterial Market Insight

The Japan metallic biomaterial market is gaining momentum due to rapid urbanization, a technologically advanced healthcare ecosystem, and high adoption of minimally invasive and patient-specific surgical solutions. The growing aging population is driving demand for durable and biocompatible metallic implants in orthopedic and cardiovascular applications.

China Metallic Biomaterial Market Insight

The China metallic biomaterial market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, increasing healthcare infrastructure, and strong domestic manufacturing capabilities for metallic biomaterials. Rising awareness of advanced implants and increasing hospital capacity for orthopedic and cardiovascular procedures are key factors propelling market growth. Government initiatives promoting modern healthcare technologies and affordable implant options further support the expansion of the metallic biomaterial market in China.

Metallic Biomaterial Market Share

The Metallic Biomaterial industry is primarily led by well-established companies, including:

- Zimmer Biomet (U.S.)

- Stryker (U.S.)

- Medtronic (Ireland)

- Smith & Nephew (U.K.)

- NuVasive (U.S.)

- Conmed (U.S.)

- Orthofix (U.S.)

- Globus Medical (U.S.)

- Arthrex (U.S.)

- B. Braun Melsungen AG (Germany)

- Heraeus Holding (Germany)

- Tecomet (U.S.)

- BioMet (U.S.)

- Aesculap (Germany)

- Invibio (U.K.)

- Cook Medical (U.S.)

- Essilor (France)

- Wego (China)

Latest Developments in Global Metallic Biomaterial Market

- In June 2023, Timet introduced a new titanium alloy orthopedic screw with enhanced fatigue resistance and improved strength‑to‑weight ratio, resulting in a reported service life increase of approximately 30% compared to earlier products, supporting improved clinical outcomes in load‑bearing applications. This development reflects ongoing innovation in biocompatible metal materials designed for orthopedic and trauma implants, and highlights the focus on durability and surgeon preference in metallic biomaterials

- In June 2023, Baoti developed a cobalt‑chromium dental bridge material with approximately 22% higher corrosion resistance, enabling reduced polishing time and improved patient comfort, which subsequently increased regional adoption in Eastern Europe by an estimated 28%. This advancement underscores efforts by metal biomaterial suppliers to improve the performance of dental alloys and expand usage into high‑growth regional markets

- In April 2024, Boston Micro Fabrication (BMF) received clearance from the U.S. Food and Drug Administration (FDA) for its UltraThineer material intended for medical implants, offering new capabilities in high‑precision additive manufacturing of metallic biomaterial components. This regulatory clearance supports advanced manufacturing approaches for producing thinner, stronger implant structures suitable for complex surgical applications

- In October 2025, Johnson & Johnson (DePuy Synthes) launched the INHANCE INTACT™ Total Shoulder Replacement System, featuring optimized metallic components designed for tissue‑sparing implantation and improved early mobility outcomes in joint replacement patients. This product launch represents a major step in next‑generation metallic implant design, emphasizing patient comfort and functional recovery

- In September 2025, Maxx Orthopedics received U.S. FDA 510(k) clearance for its titanium‑based revision knee system incorporating surface‑hardening technology to address metal allergy concerns, marking a regulatory and product milestone in the knee implant segment of metallic biomaterials. This clearance supports expanded options for patients with hypersensitivity to traditional implant metals

- In July 2025, Syntellix AG secured approval from China’s National Medical Products Administration (NMPA) for its MAGNEZIX magnesium‑based bioabsorbable metallic implants, paving the way for expanded use in one of the world’s largest orthopedic markets and validating clinical acceptance of degradable metal biomaterials. The commercialization of magnesium alloys in major markets indicates significant progress in next‑generation resorbable metallic implants

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.