Global Metal Recycling Market

Market Size in USD Billion

CAGR :

%

USD

891.69 Billion

USD

1,307.42 Billion

2024

2032

USD

891.69 Billion

USD

1,307.42 Billion

2024

2032

| 2025 –2032 | |

| USD 891.69 Billion | |

| USD 1,307.42 Billion | |

|

|

|

|

Metal Recycling Market Size

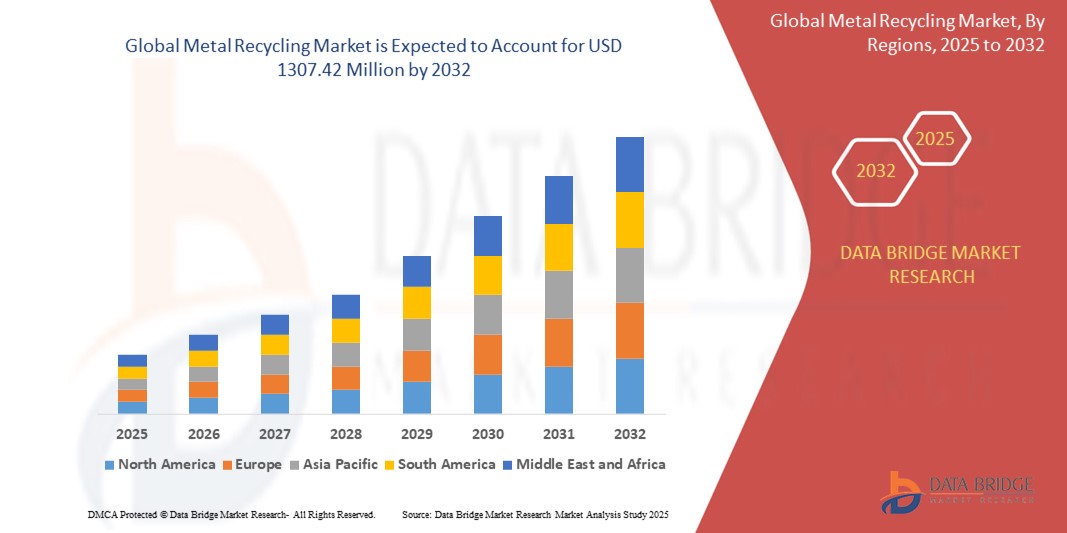

- The global metal recycling market size was valued at USD 891.69 Billion in 2024 and is expected to reach USD 1,307.42 million by 2032, at a CAGR of 4.9% during the forecast period

- Market growth is primarily driven by increasing environmental awareness, stringent government regulations on metal mining, and the rising demand for sustainable materials. This surge is particularly evident in key industries such as construction, automotive, and electronics

- Furthermore, the economic and environmental benefits of recycling metals, such as reduced energy consumption and lower greenhouse gas emissions, are key factors accelerating the adoption of metal recycling practices worldwide

Metal Recycling Market Analysis

- Metal recycling, a specialized silicone rubber with outstanding resistance to fuels, oils, chemicals, and extreme temperatures, are becoming crucial in today's industries. Their superior durability and stability in demanding environments make them increasingly vital for modern applications

- The escalating demand for metal recycling is primarily fueled by the growing needs of the automotive and aerospace industries for reliable sealing and gasketing solutions, alongside global drives for fuel efficiency and emission control

- Asia-Pacific dominated the metal recycling market with a revenue share of approximately 51.5% in 2024, driven by high metal production and consumption in countries such as China and India, supported by robust recycling infrastructure and government policies promoting sustainability

- Europe is expected to be the fastest-growing region during the forecast period, fueled by stringent environmental regulations, a strong focus on circular economy principles, and increasing use of recycled metals in automotive and construction industries.

- The ferrous metal segment dominated the market with a share of 60.5% in 2024, driven by the high recyclability of steel and iron, which are widely used in construction, automotive, and consumer goods

Report Scope and Metal Recycling Market Segmentation

|

Attributes |

Metal Recycling Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Metal Recycling Market Trends

“Growing Demand for Emphasis on Circular Economy and Sustainable Manufacturing”

- A significant and accelerating trend in the global metal recycling market is the increasing emphasis on the circular economy model and the adoption of sustainable manufacturing practices across industries. This shift is driven by growing environmental awareness, the need to reduce carbon footprints, and the depletion of virgin metal reserves

- For instance, major automotive manufacturers are increasingly incorporating recycled content into new vehicles to meet sustainability targets and reduce energy consumption. Similarly, the construction sector is expanding its use of recycled steel and aluminum for building infrastructure, with recycled steel accounting for a significant portion of global steel production

- This approach not only conserves valuable resources but also contributes to a more sustainable industrial landscape by minimizing environmental impact and promoting efficient material utilization

- Governments and organizations worldwide are actively promoting recycling initiatives through regulations, subsidies, and public awareness campaigns. This top-down support, coupled with increasing corporate social responsibility, is driving both public and private sectors to invest more in metal recycling infrastructure and technology

- The demand for recycled metals is growing rapidly across various end-use industries, including automotive, construction, packaging, and electronics, as manufacturers seek to lower production costs and enhance their environmental profiles

Metal Recycling Market Dynamics

Driver

“Increasing Demand for Metals and Environmental Sustainability Goals”

- The escalating global demand for metals, coupled with a heightened focus on environmental sustainability and resource conservation, is a significant driver for the growth of the metal recycling market. Industries are increasingly recognizing the economic and ecological benefits of using recycled metals over virgin materials.

- For instance, in May 2024, the automotive sector remains a significant consumer of recycled metals, with approximately 25% of materials in vehicles sourced from recycled components. The ongoing production of automobiles, particularly the expanding electric vehicle market, sustains a consistent demand for recycled steel, aluminum, and copper

- As environmental concerns rise, there is a strong push to reduce greenhouse gas emissions and minimize the environmental impact of mining and metal production. Metal recycling offers a viable solution by significantly lowering energy consumption and pollution associated with primary production

- Government regulations and policies promoting waste management and recycling are also playing a crucial role. Many countries have implemented targets for recycling rates and offer incentives for industries to adopt recycled content, further propelling market growth.

- The cost-effectiveness of recycled metals, which can be 30-40% cheaper than virgin metals, provides a strong economic incentive for manufacturers. This, combined with the ability of metals to be recycled repeatedly without losing their intrinsic properties, makes metal recycling an increasingly attractive and integral part of various industrial supply chains.

Restraint/Challenge

“High Operational Costs and Regulatory Compliance Issues”

- High operational costs in metal recycling, including transportation and processing, reduce profitability. Bulky scrap logistics in underdeveloped regions increase expenses, hindering market growth and scalability

- For instance, volatile global metal prices, as reported in 2023 by industry sources, have created uncertainty for recyclers, impacting the economic feasibility of large-scale recycling operations.

- In addition, stringent environmental regulations, such as the EU’s Waste Framework Directive, increase compliance costs

- Addressing these challenges necessitates investment in automated sorting and processing technologies to reduce operational costs. Companies such as ArcelorMittal and Sims Metal Management are adopting AI-based sorting systems to improve efficiency and reduce costs.

- Overcoming these challenges through government incentives, streamlined regulations, and technological advancements in recycling processes will be critical for sustained market growth.

Metal Recycling Market Scope

The market is segmented on the basis of type, scrap type, equipment, and end-user.

- By Type

On the basis of type, the metal recycling market is segmented into ferrous metal and non-ferrous metal. The ferrous metal segment dominated the market with a largest market share of 60.5% in 2024, driven by the widespread use of steel and iron in construction, automotive, and consumer goods industries. The high recyclability of steel, which accounts for 40% of global steel production, further strengthens this segment.

The non-ferrous metal segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the increasing demand for aluminum and copper in automotive, electronics, and packaging applications due to their high recyclability and value.

- By Scrap Type

On the basis scrap type, the metal recycling market is segmented into old scrap and new scrap. The old scrap segment dominated the market with the largest revenue in 2024, primarily because of the increased use of end-of-life products. This trend is fueled by the desire to reduce production costs and is further supported by significant advancements in sorting technologies. These innovations make it more efficient and economical to recycle, solidifying old scrap's leading position in the market.

The new scrap segment is projected for the highest compound annual growth rate due to surging metal demand. This growth is further fueled by the significant economic and environmental advantages of recycling scrap metal generated during manufacturing. Utilizing this readily available material reduces waste, conserves resources, and offers a cost-effective solution for meeting the escalating need for metals.

- By Equipment

On the basis equipment, the metal recycling market is segmented into shredders, shears, granulating machines, and briquetting machines. The shredders segment accounted for the largest revenue share in 2024, driven by their essential role in efficiently managing vast amounts of scrap metal. Their ability to streamline processing, enhance recycling efforts, and optimize material reuse solidified their market dominance. Rising demand for sustainable solutions further contributed to their strong revenue performance throughout the year.

The granulating machines segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by continuous improvements in granulation technology. Enhanced material efficiency and reduced processing costs drive this rapid growth, positioning granulating machines as essential in modern industrial operations. Their evolving capabilities support sustainable practices and optimize production processes effectively.

- By End-User

On the basis scrap type, the metal recycling market is segmented into construction, automotive, equipment manufacturing, shipbuilding, consumer appliances, and others. The construction segment dominated the market in 2024, driven by rising steel and aluminum demand for infrastructure development. Rapid urbanization in emerging economies fueled growth, reinforcing construction as a key industry player. Expanding projects and technological advancements further strengthened its market position, ensuring sustained prominence in the global landscape throughout the year.

The automotive segment is expected to witness the fastest CAGR from 2025 to 2032, propelled by the growing adoption of recycled metals in vehicle production. The shift toward lightweight, fuel-efficient designs drives demand, enhancing sustainability and cost-effectiveness. Advancements in material technology further accelerate this trend, reinforcing the sector's rapid expansion globally

Metal Recycling Market Regional Analysis

- Asia-Pacific dominated the metal recycling market with the largest revenue share of 51.5% in 2024, fueled by high metal production and consumption in countries such as China and India. Robust recycling infrastructure and government policies promoting sustainability drive its leading position.

- The region's rapid industrialization, increasing investments in automotive and construction sectors, and the presence of major manufacturing hubs significantly contribute to its substantial market share. This growth is supported by a strong demand for recycled metals to meet industrial needs.

Japan Metal Recycling Market Insight

The Japan metal recycling market is gaining momentum due to its advanced waste segregation systems and high demand for recycled metals in automotive and electronics sectors. Companies such as Daiki Aluminum Industry Co., Ltd. lead in aluminum recycling, supported by stringent quality standards and government sustainability policies. The 2023 expansion of recycling facilities reflects Japan’s growing market potential and focus on resource efficiency.

China Metal Recycling Market Insight

The China metal recycling market accounts for the largest revenue share in Asia-Pacific in 2024, driven by its massive steel production and extensive manufacturing base. Government policies such as the Circular Economy Promotion Law and plans to increase electric arc furnace production to 15% by 2025 fuel growth. The rising demand for recycled metals in automotive and construction sectors solidifies China’s dominance.

Europe Metal Recycling Market Insight

The European metal recycling market is projected to grow at the fastest CAGR from 2025 to 2032, driven by well-established automotive and construction industries in Germany, France, and the U.K. Stringent EU regulations, such as the Waste Framework Directive, promote eco-friendly recycling practices. The adoption of advanced sorting technologies and recycled metals in industrial applications supports steady market expansion.

U.K. Metal Recycling Market Insight

The U.K. metal recycling market is anticipated to grow at a notable CAGR, driven by its strong automotive and construction sectors and increasing demand for sustainable materials. Government-led sustainability initiatives and urban mining programs foster innovation in eco-conscious recycling solutions. The U.K.’s robust recycling infrastructure and focus on circular economy principles position it for continued growth

Germany Metal Recycling Market Insight

The German metal recycling market is expected to expand at a considerable CAGR, fueled by its advanced manufacturing infrastructure and focus on high-performance recycled metals in automotive and construction sectors. Germany’s commitment to sustainability and circular economy goals drives the integration of eco-friendly recycling solutions, aligning with the nation’s emphasis on innovative and environmentally conscious practices.

Metal Recycling Market Share

The Metal Recycling industry is primarily led by well-established companies, including:

- DOWA HOLDINGS CO., LTD (Japan)

- Tata Steel (India)

- Baosteel Co., Ltd. (China)

- REMONDIS SE & Co. KG (Germany)

- Novelis Inc. (U.S.)

- Norton Aluminium Ltd (U.K.)

- Kuusakoski (Finland)

- REAL ALLOY (U.S.)

- Tom Martin & Company Ltd. (U.K.)

- TMS International (U.S.)

- Ferrous Processing & Trading (U.S.)

- PSC Metals (U.S.)

- AMG Resources Corporation (U.S.)

- Alter Trading Inc. (U.S.)

- Mervis Industries (U.S.)

- OmniSource, LLC (U.S.)

- AMERICAN IRON & METAL (Canada)

Latest Developments in Global Metal Recycling Market

- In February 2024, Germany-based Hydro revealed plans to invest EUR 180 million in a new aluminum recycling plant in Torija, Spain. The facility will have a 120,000-ton capacity, recycling 70,000 tons of old scrap annually. It aims to supply secondary aluminum billet to key European industries, including automotive, transportation, construction, renewable energy, and consumer durables

- In November 2023, ArcelorMittal and Schneider Electric announced a strategic partnership to advance sustainable manufacturing. Under this collaboration, ArcelorMittal will supply XCarb recycled and renewably produced steel for Schneider Electric’s electrical cabinets and enclosures. Produced at ArcelorMittal’s Sestao, Spain facility, this steel incorporates a high proportion of recycled material and is powered by 100% renewable electricity, significantly reducing CO₂ emissions. The initiative aligns with Schneider Electric’s commitment to sustainability and innovation in energy management.

- In October 2023, Nucor Corporation’s recycling subsidiary, River Metals Recycling (RMR), successfully acquired all assets of Cincinnati-based Garden Street Iron & Metal. This strategic move expanded RMR’s recycling network to 19 facilities, incorporating one feeder and one shredder yard. The acquisition aligns with Nucor’s raw materials strategy, reinforcing its commitment to sustainable steel production. By integrating Garden Street’s operations, RMR enhances its ability to supply high-quality recycled materials, supporting regional steelmaking efforts.

- In July 2023, CMC announced that it had secured a permit from the West Virginia Department of Environmental Protection, allowing the initiation of construction for its fourth advanced micro mill. This milestone marks a crucial step in the Steel West Virginia micro mill project, reinforcing CMC’s commitment to innovation and sustainable steel production. With the permit granted, the company can proceed with its plans to enhance manufacturing capabilities and meet growing industry demands. The facility is expected to contribute significantly to regional economic growth

- In January 2023, ArcelorMittal completed the acquisition of Riwald Recycling, a leading ferrous scrap metal recycling company in the Netherlands, as part of its decarbonization strategy. This move strengthens its commitment to sustainable steel production by securing access to high-quality recycled materials. Additionally, ArcelorMittal acquired Italpannelli Germany, a German insulation panel manufacturer, expanding its geographic presence and enhancing the product portfolio of its Downstream Solutions construction division. These acquisitions align with the company’s broader sustainability goals and market expansion efforts

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Metal Recycling Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Metal Recycling Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Metal Recycling Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.