Global Metacarpel Joint Implants Market

Market Size in USD Billion

CAGR :

%

USD

1.06 Billion

USD

1.77 Billion

2024

2032

USD

1.06 Billion

USD

1.77 Billion

2024

2032

| 2025 –2032 | |

| USD 1.06 Billion | |

| USD 1.77 Billion | |

|

|

|

|

Metacarpal Joint Implants Market Size

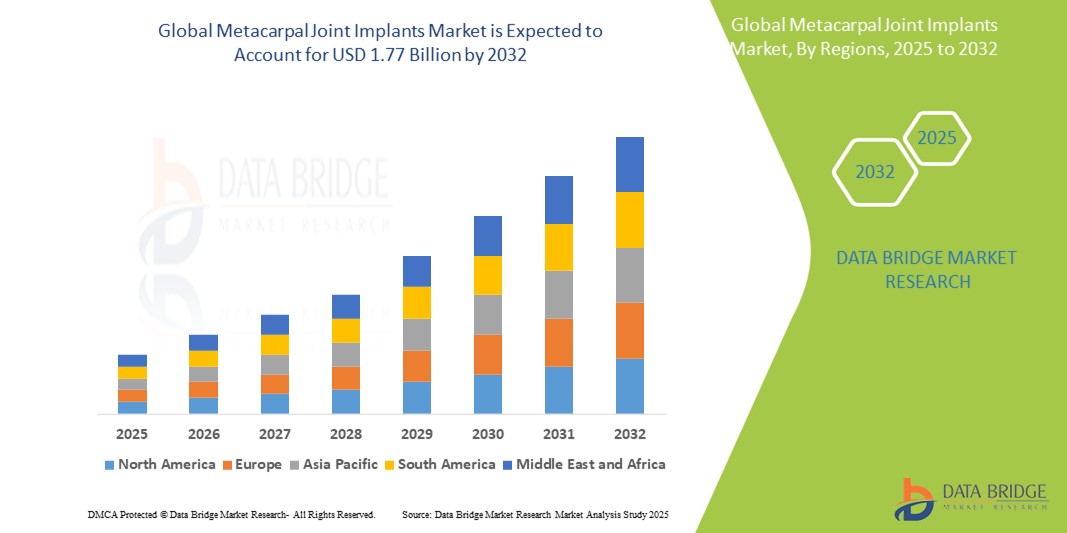

- The global metacarpal joint implants market size was valued at USD 1.06 billion in 2024 and is expected to reach USD 1.77 billion by 2032, at a CAGR of 6.60% during the forecast period

- The market growth is largely driven by the increasing prevalence of arthritis, traumatic injuries, and congenital deformities requiring surgical intervention for metacarpophalangeal joint reconstruction, especially among the aging population

- Furthermore, the rising demand for minimally invasive procedures, advancements in biomaterials, and improved implant designs with enhanced mobility and biocompatibility are significantly contributing to market expansion. These dynamics are encouraging the adoption of metacarpal joint implants globally, reinforcing their role in modern orthopedic care and propelling market growth

Metacarpal Joint Implants Market Analysis

- Metacarpal joint implants, used in the surgical treatment of degenerative joint diseases, trauma, and deformities affecting the metacarpophalangeal joints, are increasingly essential in orthopedic and hand reconstructive surgeries due to their ability to restore function, reduce pain, and improve mobility in affected fingers

- The rising prevalence of osteoarthritis and rheumatoid arthritis, especially among the elderly population, along with growing awareness of hand function restoration, is a primary driver of demand for metacarpal joint implants

- North America dominated the metacarpal joint implants market with the largest revenue share of 39.1% in 2024, characterized by advanced healthcare infrastructure, a high incidence of hand-related conditions, and the presence of major orthopedic device manufacturers, with the U.S. leading due to early adoption of innovative implant technologies

- Asia-Pacific is expected to be the fastest growing region in the metacarpal joint implants market during the forecast period due to expanding geriatric population, increasing access to orthopedic care, and rising healthcare expenditure

- Palmer Ligament segment dominated the metacarpal joint implants market with a market share of 55.2% in 2024, driven by its stabilizing the metacarpophalangeal joint and its frequent involvement in reconstructive procedures following trauma or degeneration

Report Scope and Metacarpal Joint Implants Market Segmentation

|

Attributes |

Metacarpal Joint Implants Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Metacarpal Joint Implants Market Trends

“Advancements in Implant Materials and Minimally Invasive Technique”

- A significant and accelerating trend in the global metacarpal joint implants market is the continuous advancement in implant biomaterials and the growing adoption of minimally invasive surgical techniques, aimed at improving patient outcomes and reducing recovery time

- For instance, newer silicone and pyrocarbon implants are being engineered to offer enhanced durability, biocompatibility, and joint mobility, minimizing wear and immune response while replicating natural joint kinematics. Companies such as Stryker and Wright Medical are at the forefront, introducing innovations that combine flexible materials with anatomical joint replication

- Minimally invasive surgical techniques are gaining traction as they enable faster recovery, lower complication rates, and reduced scarring. Surgeons now increasingly use smaller incisions and image-guided tools to insert implants with high precision, especially for patients with arthritis or trauma-related joint damage

- These developments are complemented by personalized implant solutions, where preoperative imaging and 3D printing are used to design implants tailored to individual anatomy, thereby improving implant fit and long-term success

- This trend toward advanced biomaterials, patient-specific implants, and less invasive procedures is fundamentally transforming the standard of care in hand and joint reconstructive surgeries. Consequently, companies such as Zimmer Biomet are focusing on research and development of next-generation implants that meet these evolving clinical and patient expectations.

Metacarpal Joint Implants Market Dynamics

Driver

“Rising Incidence of Joint Disorders and Demand for Functional Restoration”

- The growing global burden of joint disorders such as osteoarthritis and rheumatoid arthritis, combined with an aging population susceptible to degenerative and traumatic hand conditions, is a key driver for the increasing demand for metacarpal joint implants

- For instance, in January 2024, Wright Medical Group introduced a next-generation silicone-based MCP implant specifically designed to improve joint mobility and reduce post-operative complications in arthritic patients, underscoring the industry's focus on innovation in response to clinical needs

- As more patients seek improved hand function and pain relief, especially after trauma or due to chronic conditions, metacarpal joint implants offer a viable solution for restoring range of motion, grip strength, and overall quality of life

- Furthermore, advancements in surgical techniques and implant design are making hand joint reconstruction more accessible and effective, encouraging both surgeons and patients to opt for implant-based interventions

- The increasing availability of specialized orthopedic care, growing awareness about hand function restoration, and favorable reimbursement scenarios in developed markets further support the rising adoption of metacarpal joint implants. This trend is particularly evident in hospitals and specialty clinics equipped with the expertise and infrastructure to perform these procedures

Restraint/Challenge

“Post-Surgical Complications and Stringent Regulatory Oversight”

- Post-surgical complications such as implant loosening, joint stiffness, and allergic reactions to implant materials pose significant challenges to the broader adoption of metacarpal joint implants. These risks can deter both patients and surgeons from opting for implant-based interventions, particularly in older or comorbid populations

- For instance, clinical reports have highlighted cases of silicone synovitis or foreign body reactions following long-term implantation, especially in patients with high hand usage, contributing to caution in clinical recommendations

- Addressing these concerns requires ongoing innovation in biocompatible materials, improved implant designs, and personalized surgical approaches. Companies such as Zimmer Biomet and Stryker are investing in next-generation biomaterials and techniques aimed at reducing these complications and improving long-term outcomes

- In addition, the stringent regulatory approval process for implantable medical devices, particularly in markets such as the U.S. (FDA) and EU (CE Mark), adds time and cost to product development, which may hinder the timely introduction of innovative products

- These regulatory barriers, combined with high development costs and the need for extensive clinical validation, can be especially challenging for smaller manufacturers. Overcoming these issues through improved clinical trial design, regulatory collaboration, and long-term safety data will be essential for ensuring consistent market growth

Metacarpal Joint Implants Market Scope

The market is segmented on the basis of location, ligament type, end users, and biomaterial.

- By Location

On the basis of location, the metacarpal joint implants market is segmented into wrist, thumb, and hand. The residential segment dominated the market in 2024, driven by the increasing adoption of smart home ecosystems, rising awareness about home security, and the convenience of remote locking/unlocking. Real estate developments and the boom in short-term rentals also encouraged adoption.

The wrist segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the increasing incidence of wrist injuries, rising geriatric population, and growing awareness about preventive and rehabilitative orthotic solutions. Demand for functional, rigid, and soft wrist braces is being fueled by both healthcare providers and consumers seeking support for wrist disorders.

- By Ligament Type

On the basis of ligament type, the metacarpal joint implants market is segmented into palmar ligament and collateral ligament. The palmar ligament segment dominated the market with a share of 55.2% in 2024, owing to its central role in joint stabilization and its frequent involvement in surgical repair and reconstruction following trauma or degeneration. Surgical techniques often focus on restoring palmar ligament integrity to ensure implant stability and long-term joint functionality.

The collateral ligament segment is expected to witness the fastest CAGR from 2025 to 2032, period due to increasing surgical attention on lateral joint stability in MCP joint procedures, especially for trauma-related dislocations.

- By End Users

On the basis of end users, the metacarpal joint implants market is segmented into hospitals and specialty orthopedic clinics. Hospitals held the largest revenue share of 62.9% in 2024, attributed to the higher volume of surgeries, access to advanced surgical equipment, and presence of specialized orthopedic departments. Hospital settings are also preferred for complex joint reconstruction procedures requiring multidisciplinary care.

Specialty orthopedic clinics are anticipated to grow at a significant CAGR from 2025 to 2032, driven by the rise in outpatient arthroplasty procedures, cost-efficiency, and growing demand for focused hand and upper limb care in specialized setups.

- By Biomaterials

On the basis of biomaterial, the metacarpal joint implants market is segmented into metallic, ceramic, polymeric, and others. The polymeric segment, particularly silicone implants, dominated the market with a 45.3% share in 2024, due to their long-standing use in MCP arthroplasty, cost-effectiveness, and favorable biocompatibility. These implants are widely adopted for their flexibility, ease of implantation, and satisfactory functional outcomes.

The metallic segment is expected to witness the fastest CAGR from 2025 to 2032, driven by demand for more durable and wear-resistant implant materials, especially in high-demand or revision cases. Titanium and cobalt-chromium alloys are increasingly utilized for their strength and longevity in newer implant designs.

Metacarpal Joint Implants Market Regional Analysis

- North America dominated the metacarpal joint implants market with the largest revenue share of 39.1% in 2024, driven by advanced healthcare infrastructure, a high incidence of hand-related conditions, and the presence of major orthopedic device manufacturers

- Patients and healthcare providers in the region increasingly prefer implant-based solutions for restoring joint functionality, particularly due to improved surgical techniques and favorable reimbursement policies for joint arthroplasty procedures

- The region’s leadership is further reinforced by strong R&D activity, early adoption of innovative implant materials, and a growing aging population seeking effective treatments for mobility restoration, making metacarpal joint implants a widely accepted orthopedic intervention

U.S. Metacarpal Joint Implants Market Insight

The U.S. metacarpal joint implants market captured the largest revenue share of 79% in 2024 within North America, fueled by the high prevalence of arthritis, a well-established orthopedic healthcare system, and increased awareness of hand function restoration. Patients are increasingly opting for surgical intervention to regain mobility and alleviate chronic pain. Strong presence of leading implant manufacturers, ongoing R&D efforts, and supportive reimbursement policies further enhance market growth. Moreover, a growing elderly population and the early adoption of advanced implant technologies are accelerating demand for metacarpal joint implants

Europe Metacarpal Joint Implants Market Insight

The Europe metacarpal joint implants market is projected to expand at a substantial CAGR throughout the forecast period, driven by rising incidences of rheumatoid arthritis and trauma-related hand conditions. Advancements in surgical techniques, increasing access to specialized orthopedic care, and supportive healthcare infrastructure are encouraging the adoption of joint implants. European countries are also investing in geriatric care and mobility preservation, which promotes the use of MCP implants in both elective and reconstructive surgeries. The market is seeing strong adoption across both public and private healthcare sectors.

U.K. Metacarpal Joint Implants Market Insight

The U.K. metacarpal joint implants market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by growing demand for hand function restoration and the rise in outpatient joint procedures. Increased awareness of early treatment for hand conditions and a focus on maintaining quality of life in elderly populations are contributing factors. NHS investment in orthopedic care, along with the presence of research institutions and clinical innovation hubs, is fostering domestic adoption of new implant technologies.

Germany Metacarpal Joint Implants Market Insight

The Germany metacarpal joint implants market is expected to expand at a considerable CAGR during the forecast period, driven by the country's advanced medical infrastructure and strong emphasis on precision surgery. High awareness of musculoskeletal disorders, particularly among the elderly, and demand for innovative, biocompatible implants support market growth. German manufacturers and hospitals are increasingly collaborating to develop and trial new implant materials that reduce complications and extend implant longevity.

Asia-Pacific Metacarpal Joint Implants Market Insight

The Asia-Pacific metacarpal joint implants market is poised to grow at the fastest CAGR during 2025 to 2032, driven by increasing geriatric population, expanding healthcare access, and greater awareness of orthopedic treatments in countries such as China, Japan, and India. Government healthcare initiatives and investments in surgical infrastructure are improving early diagnosis and intervention. The affordability and rising domestic production of orthopedic implants in the region are also expanding access and accelerating market penetration across urban and semi-urban areas.

Japan Metacarpal Joint Implants Market Insight

The Japan metacarpal joint implants market is gaining momentum due to the country’s aging demographic and its emphasis on maintaining mobility and independence in later life. A technologically advanced healthcare system, combined with a culture of early medical intervention, supports the widespread use of joint implants. Surgeons in Japan increasingly adopt minimally invasive techniques and precision-designed implants, and the growing integration of digital diagnostics in hand surgery is further fueling demand for high-performance MCP implants.

India Metacarpal Joint Implants Market Insight

The India metacarpal joint implants market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s expanding middle class, increased orthopedic care access, and growing incidence of trauma and arthritis. As awareness about hand reconstructive surgery rises, both urban and tier-2 cities are witnessing increased demand for implants. The growth of specialty orthopedic clinics, local manufacturing of cost-effective implants, and the influence of public healthcare initiatives are key factors accelerating the market in India.

Metacarpal Joint Implants Market Share

The Metacarpal Joint Implants industry is primarily led by well-established companies, including:

- Zimmer Biomet (U.S.)

- Stryker (U.S.)

- Integra LifeSciences Corporation (U.S.)

- Smith+Nephew (U.K.)

- Acumed LLC, (U.S.)

- DePuy Synthes (U.S.)

- Arthrex (U.S.)

- Exactech (U.S.)

- Medartis (Switzerland)

- Biotechni (France)

- TEKNIMED (France)

- MatOrtho (U.K.)

- KeriMedical (Switzerland)

- Additive Orthopaedics (U.S.)

- LimaCorporate (Italy)

- Corin Group (U.K.)

- ChM (Poland)

- BioPro Implants (U.S.)

- B. Braun SE (Germany)

What are the Recent Developments in Global Metacarpal Joint Implants Market?

- In April 2023, Zimmer Biomet Holdings, Inc. announced the expansion of its hand and wrist implant portfolio with the launch of a next-generation silicone metacarpophalangeal (MCP) joint implant. This product, designed for enhanced flexibility and biocompatibility, aims to reduce complications such as implant wear and fracture, improving long-term outcomes for arthritis and trauma patients. The development underscores Zimmer Biomet’s focus on addressing unmet clinical needs through material innovation and ergonomic design

- In March 2023, Stryker Corporation introduced an advanced 3D-printed titanium metacarpal joint implant, engineered for optimal bone integration and personalized fit. This innovation leverages additive manufacturing and patient-specific modeling, allowing orthopedic surgeons to tailor implants for better alignment and joint mobility restoration. The launch reflects the company’s commitment to precision-based orthopedics and next-generation implant solutions

- In February 2023, Wright Medical Group N.V., a subsidiary of Stryker, launched clinical trials for a pyrocarbon MCP implant aimed at improving joint durability and reducing long-term inflammation. The study, conducted across key orthopedic centers in the U.S. and Europe, highlights the company's investment in advanced materials that replicate the mechanical properties of natural joints, addressing both pain and functional limitations in degenerative hand conditions

- In January 2023, Integra LifeSciences Holdings Corporation partnered with leading hand surgeons to develop an enhanced surgical kit for MCP joint implant procedures. The kit includes minimally invasive tools designed to reduce operative time and post-operative complications. This development represents Integra’s strategic focus on simplifying complex hand surgeries and supporting broader adoption of MCP implants through surgical innovation

- In January 2023, Additive Orthopaedics, LLC, known for its work in 3D-printed orthopedic solutions, announced its entry into the metacarpal joint implants space with customizable implant prototypes. These designs aim to meet the specific anatomical needs of patients with severe joint deformities, and the company is actively pursuing regulatory clearance. This move illustrates the growing trend of applying 3D printing technologies in small joint arthroplasty to improve patient outcomes

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.