Global Mems Microphone Market

Market Size in USD Billion

CAGR :

%

USD

17.85 Billion

USD

30.55 Billion

2024

2032

USD

17.85 Billion

USD

30.55 Billion

2024

2032

| 2025 –2032 | |

| USD 17.85 Billion | |

| USD 30.55 Billion | |

|

|

|

|

Micro-Electro-Mechanical System (MEMS) Microphone Market

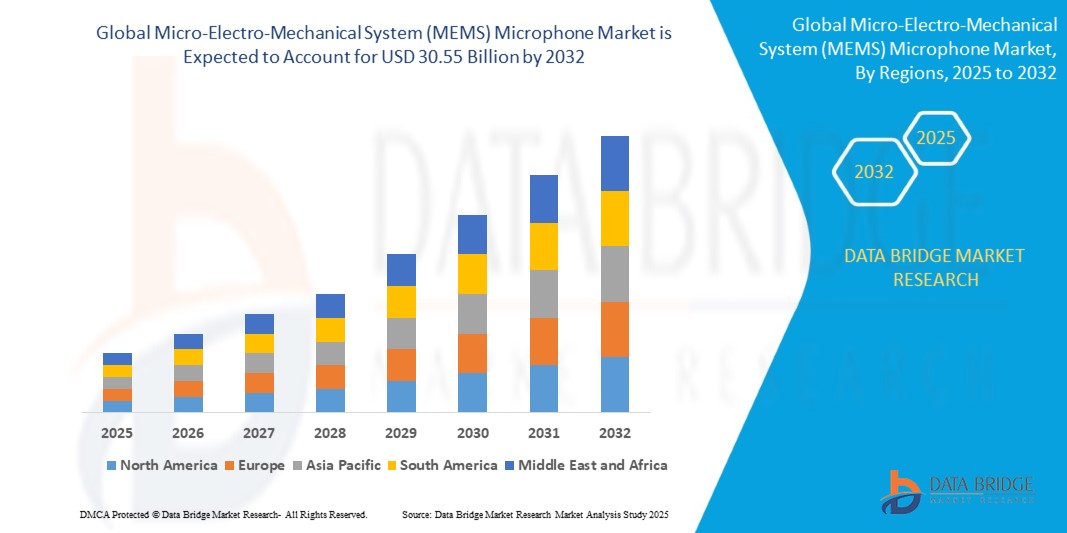

- The Micro-Electro-Mechanical System (MEMS) Microphone Market was valued at USD 17.85 billion in 2025 and is projected to reach USD 30.55 billion by 2032, growing at a CAGR of 8.1% during the forecast period.

- Market growth is primarily fueled by the rising deployment of autonomous robots in defense, construction, and agriculture sectors; increasing demand for robotic systems in hazardous environments; and technological advancements in sensor integration, mobility systems, and AI-driven navigation.

Micro-Electro-Mechanical System (MEMS) Microphone Market Analysis

- MEMS microphones are compact, low-power audio sensors used in smartphones, wearables, hearing aids, and smart devices. Their small size, high sensitivity, and integration capabilities make them ideal for modern electronics requiring reliable sound input.

- The market is driven by growing demand for voice-enabled applications such as virtual assistants (Alexa, Siri), TWS earbuds, and smart speakers. Far-field voice recognition and noise cancellation are now essential in consumer devices.

- In automotive, MEMS microphones are used for voice control, cabin noise monitoring, and driver alertness systems. These applications are increasing due to the trend toward connected and autonomous vehicles.

- Healthcare and industrial sectors are adopting MEMS microphones for diagnostic tools, patient monitoring, and machine sound analysis, where real-time acoustic feedback improves safety and performance.

- Advancements in AI-based sound processing, beamforming, and edge audio analytics are expanding MEMS microphone use in smart homes, surveillance systems, and IoT, enabling devices to detect and respond to complex sound patterns efficiently.

Report Scope and Micro-Electro-Mechanical System (MEMS) Microphone Market Segmentation

|

Attributes |

Micro-Electro-Mechanical System (MEMS) Microphone Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Micro-Electro-Mechanical System (MEMS) Microphone Market Trends

Voice Interfaces, Miniaturization, and AI Integration Fueling Demand

- MEMS microphones are central to smart assistants and voice-controlled systems, with growing demand for far-field voice recognition and noise cancellation.

- AI-powered audio processing and machine learning-based noise filtering are revolutionizing microphone functionality in harsh environments.

- Miniaturization of sensors is driving their use in hearing aids, earbuds, and compact IoT devices.

- The rise of smart homes and industrial automation is accelerating deployment of MEMS audio and environmental sensors.

- Innovations in multi-microphone arrays and beamforming enhance voice command precision in automotive infotainment and public interaction systems.

Micro-Electro-Mechanical System (MEMS) Microphone Market Dynamics

Driver

Surging Demand for Voice-Activated and Miniaturized Consumer Electronics

- The increasing penetration of voice assistants, smart home devices, and hearables (TWS earbuds, hearing aids) is significantly driving demand for compact, high-performance MEMS microphones with noise cancellation and voice recognition capabilities.

- Smartphones and wearables continue to dominate MEMS microphone consumption due to consumer preference for voice commands, video calling, and spatial audio, which require multi-mic arrays and advanced acoustic processing.

- MEMS microphones are increasingly being used in automotive cabins for noise monitoring, hands-free communication, and voice-based infotainment controls—aligning with the rise in connected and electric vehicles.

- Healthcare and industrial adoption is growing due to the need for small, reliable audio sensors for diagnostic tools, patient monitoring, machine learning-based anomaly detection, and predictive maintenance via sound analysis.

Restraint/Challenge

Complexity in Fabrication and Integration

- The miniaturization of MEMS microphones poses technical challenges during fabrication, requiring cleanroom environments, precise etching, and advanced wafer-level packaging—driving up manufacturing costs and limiting scalability for new entrants.

- Integration with multiple chipsets in compact devices (e.g., wearables, TWS earbuds, and smartphones) demands tight tolerance, EMI shielding, and thermal optimization, complicating system design and increasing R&D burden.

- Ensuring audio fidelity in challenging acoustic environments—such as wind noise, vibration, or multi-source interference—requires advanced DSP (digital signal processing) and AI-based filtering, adding cost and processing complexity.

- Dependence on foundry capacity and semiconductor supply chains can hinder consistent production, especially during global shortages of silicon or MEMS-specific fabrication tools.

Micro-Electro-Mechanical System (MEMS) Microphone Market Scope

The market is segmented on the basis of by sensor type, actuator type and application.

- By Sensor Type

The MEMS Microphone Market includes various sensor types such as Inertial, Pressure, Microphone, Microspeaker, Environmental, Optical, and Others. Microphones lead the segment in 2025 due to the widespread integration in smartphones, earbuds, and voice-enabled devices. Environmental sensors are gaining traction in wearable and industrial IoT systems, while inertial and pressure sensors play a key role in automotive safety and industrial automation.

- By Actuator Type

Actuator types include Optical, Microfluidics, Inkjet Head, and Radio Frequency (RF). Inkjet heads dominate due to their use in high-precision printing and biochip dispensing, whereas RF actuators are critical in antenna tuning and wireless communication modules. Microfluidic actuators are expanding rapidly in lab-on-chip medical diagnostics and drug delivery applications.

- By Application

Applications span Automotive, Consumer Electronics, Defense & Aerospace, Industrial, Healthcare, and Telecom. Consumer electronics dominate due to MEMS microphone demand in smart speakers, mobile devices, and TWS earbuds. Automotive follows closely with increasing adoption in cabin noise cancellation, voice assistance, and ADAS. The healthcare segment is growing due to use in hearing aids, diagnostic equipment, and wearable health monitors.

Micro-Electro-Mechanical System (MEMS) Microphone Market Regional Analysis

North America

North America dominates the Micro-Electro-Mechanical System (MEMS) Microphone Market with the largest revenue share in 2025, driven by high defense budgets, advanced robotics R&D, and increasing adoption in mining, agriculture, and rescue operations. The U.S. leads regional growth due to widespread use of unmanned ground vehicles (UGVs) in military applications, alongside rising investments in autonomous systems and AI-driven robotics platforms.

Additionally, government contracts for surveillance and border patrol, coupled with commercial investments in agriculture robotics and construction automation, are boosting market expansion. The region’s strong presence of robotics startups and tech giants contributes to continued innovation and deployment of all-terrain robots across diverse sectors.

U.S.

The U.S. Micro-Electro-Mechanical System (MEMS) Microphone Market captured the largest share in North America in 2025. Growth is driven by high military demand for unmanned ground systems, increasing investment in robotics for disaster response and surveillance, and rising adoption in precision agriculture and remote construction operations. Robust defense budgets and private sector innovation reinforce market dominance.

Europe

Europe Micro-Electro-Mechanical System (MEMS) Microphone Market is projected to grow steadily during the forecast period, supported by growing defense modernization programs, industrial automation, and public safety initiatives. Increasing integration of autonomous robots in mining and utility sectors, along with EU research grants for robotics development, is boosting regional adoption.

Germany

Germany leads the European Micro-Electro-Mechanical System (MEMS) Microphone Market due to its advanced manufacturing capabilities, defense robotics R&D, and deployment of autonomous robots in mining and infrastructure inspection. The country is also exploring use cases in agriculture and energy with growing investment in sensor-integrated, AI-enabled terrain robots.

France

France’s Micro-Electro-Mechanical System (MEMS) Microphone Market is expanding due to increased public sector funding for robotics innovation, especially in homeland security, environmental surveying, and archaeological mapping. The defense sector is actively deploying terrain robots for surveillance and EOD tasks, while academic partnerships promote smart mobility solutions in rugged environments.

Asia-Pacific

Asia-Pacific is poised to grow at the fastest CAGR through 2032 due to urban infrastructure growth, industrial automation, and strong investments in border security and disaster management. Countries like China, Japan, South Korea, and India are rapidly deploying all-terrain robots in sectors ranging from agriculture and logistics to defense and mining.

Japan

Japan’s market is driven by its leadership in robotics innovation, aging workforce challenges, and need for unmanned systems in hazardous terrain. All-terrain robots are widely used in nuclear facility monitoring, agriculture, and autonomous exploration missions. The country also sees increasing demand for AI-powered robots in emergency response applications.

China

China dominates the Asia-Pacific Micro-Electro-Mechanical System (MEMS) Microphone Market in 2025, fueled by large-scale defense procurement, infrastructure development in remote areas, and robust investments in AI and robotics. The government’s push for military-civil fusion and industrial automation is leading to rapid deployment of all-terrain robotic systems across sectors.

Micro-Electro-Mechanical System (MEMS) Microphone Market Share

The Micro-Electro-Mechanical System (MEMS) Microphone Market is primarily led by a combination of global robotics manufacturers, defense contractors, and autonomous system innovators. These companies are actively investing in AI-enabled mobility, ruggedized hardware, and autonomous navigation systems to cater to a wide range of applications across defense, mining, agriculture, and disaster response sectors:

- Robert Bosch GmbH (Germany)

- Broadcom (U.S.)

- Qorvo, Inc. (U.S.)

- STMicroelectronics (Switzerland)

- Texas Instruments Incorporated (U.S.)

- Goertek (China)

- Hewlett Packard Enterprise Development LP (U.S.)

- TDK Corporation (Japan)

- Infineon Technologies AG (Germany)

- Honeywell International Inc. (U.S.)

- Analog Devices, Inc. (U.S.)

- TE Connectivity (Switzerland)

- NXP Semiconductors (Netherlands)

- Panasonic Corporation (Japan)

- Murata Manufacturing Co., Ltd. (Japan)

Latest Developments in Micro-Electro-Mechanical System (MEMS) Microphone Market

- In May 2025, Analog Devices launched the ADMP521, a high-performance, ultra‑low‑noise MEMS microphone featuring a digital PDM output, 65 dBA SNR, sleep‑mode capability (<1 µA), and bottom‑port packaging—targeting smartphones, wearables, and IoT products

- In June 2025, Analog Devices introduced the ADMP441, the industry’s first I²S‑output digital MEMS microphone with 61 dBA SNR and flat 100 Hz–15 kHz response—simplifying integration in non‑mobile audio applications

- In April 2025, Broadcom expanded its MEMS offering, reinforcing its RF‑MEMS strength (now #1 globally), and hinted at future voice‑smart mic solutions for 5G devices—underlining its market leadership.

- In June 2025, Infineon unveiled a breakthrough in ultra‑miniaturized acoustic sensors—achieving high performance in a compact size suitable for AR/VR and IoT devices, reflecting the push for miniaturization

- In early 2025, STMicroelectronics saw a slowdown, with strong competition from Apple and Broadcom impacting its audio MEMS growth—highlighting market consolidation and supplier dependency.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Mems Microphone Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Mems Microphone Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Mems Microphone Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.