Global Melamine Market

Market Size in USD Billion

CAGR :

%

USD

8.93 Billion

USD

11.75 Billion

2024

2032

USD

8.93 Billion

USD

11.75 Billion

2024

2032

| 2025 –2032 | |

| USD 8.93 Billion | |

| USD 11.75 Billion | |

|

|

|

|

Melamine Market Size

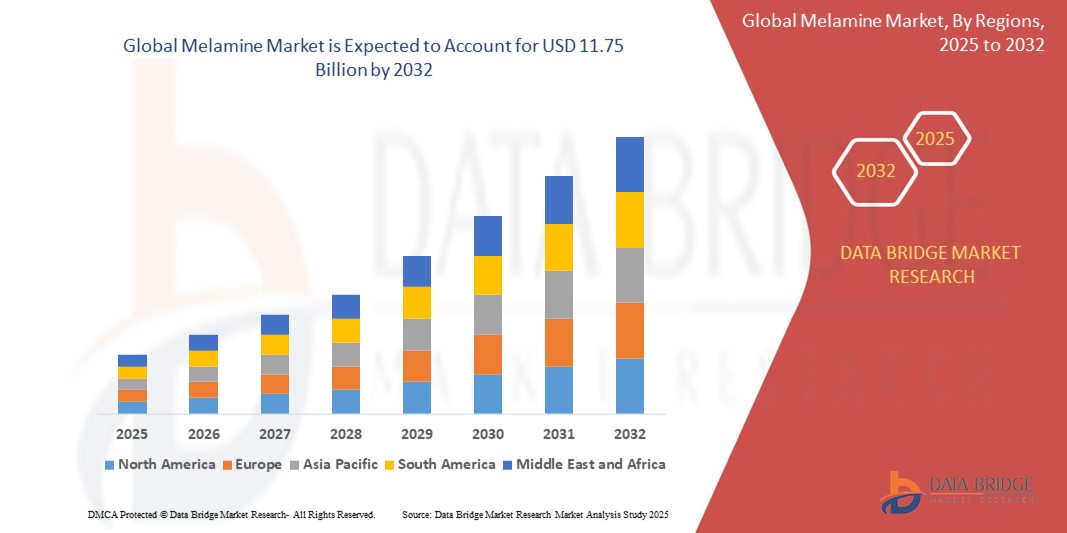

- The global melamine market size was valued at USD 8.93 billion in 2024 and is expected to reach USD 11.75 billion by 2032, at a CAGR of 3.49% during the forecast period

- The market growth is largely fuelled by the rising demand for melamine-based resins in construction and automotive industries, increasing consumption of laminates and wood adhesives, and the expanding furniture and interior design sectors

- Growth in the packaging industry and increasing application of melamine in flame-retardant materials are also contributing to market expansion

Melamine Market Analysis

- The melamine market is witnessing steady growth due to its widespread usage in manufacturing durable and heat-resistant materials used across multiple industries

- This growth trend reflects the consistent demand for high-performance surface solutions in furniture, construction, and home décor sectors

- Asia-Pacific dominated the melamine market with the largest revenue share in 2024, driven by rapid industrialization, expanding construction activities, and growing demand from furniture and automotive industries

- Europe region is expected to witness the highest growth rate in the global melamine market, driven by increasing demand from construction and automotive industries, along with rising investments in sustainable manufacturing practices.

- The melamine resin segment dominated the market with the largest market revenue share in 2024, driven by its extensive use in laminates, adhesives, and molding compounds. Melamine resin is highly favored for its excellent durability, heat resistance, and strong bonding properties, making it suitable for various industrial applications.

Report Scope and Melamine Market Segmentation

|

Attributes |

Melamine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Melamine Market Trends

“Growing Demand for Melamine-Based Decorative Laminates”

- One noticeable trend in the melamine market is the rising demand for melamine-based decorative laminates, widely used in furniture, wall panels, and flooring

- These laminates offer high resistance to scratches, moisture, and heat, making them a preferred choice in both residential and commercial interior applications

- In recent years, consumers have shown greater interest in stylish yet durable interiors, leading to increased adoption of melamine-laminated particle boards and medium-density fiberboards

- For instance, furniture manufacturers in India and Southeast Asia are increasingly using melamine laminates to meet the demand for affordable, modern home furnishings

- In addition, companies such as Greenlam Industries and AICA Kogyo are expanding their product portfolios with new melamine-based laminate collections, addressing both aesthetic and functional needs in interior design

Melamine Market Dynamics

Driver

“Rising Demand for Melamine in Construction and Furniture Industries”

- The melamine market is experiencing growth due to its extensive use in laminates, adhesives, and molded plastics essential for modern infrastructure and furniture

- Melamine-coated surfaces are increasingly popular in furniture manufacturing because of their resistance to heat, scratches, and moisture

- For instance, manufacturers in Europe are producing affordable and stylish office furniture using melamine-laminated boards

- The rise in modular furniture and smart interior solutions is creating consistent demand for melamine-based decorative panels

- Decorative laminates and engineered wood panels using melamine are widely used in residential and commercial projects in growing urban areas

- The affordability and performance of melamine products are helping manufacturers meet evolving consumer preferences without increasing production costs

Restraint/Challenge

“Health and Environmental Concerns Related to Melamine Use”

- A significant challenge in the melamine market is the increasing concern over its potential health effects when used in unsafe concentrations

- Past incidents of melamine contamination in food products have led to widespread public concern and stricter global regulations

- For instance, the contamination of baby formula in China prompted international food safety reviews and regulatory actions

- The environmental impact of melamine is also under scrutiny due to its non-biodegradable nature and contribution to plastic waste

- Regulatory agencies in areas such as the European Union and North America have enforced stricter controls on melamine use and disposal

- Growing demand for sustainable and safer alternatives is prompting companies to explore eco-friendly melamine derivatives

Melamine Market Scope

The market is segmented on the basis of form, application, and end-user industry.

- By Form

On the basis of form, the melamine market is segmented into melamine resin, melamine foam, and others. The melamine resin segment dominated the market with the largest market revenue share in 2024, driven by its extensive use in laminates, adhesives, and molding compounds. Melamine resin is highly favored for its excellent durability, heat resistance, and strong bonding properties, making it suitable for various industrial applications.

The melamine foam segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by its increasing use in soundproofing, insulation, and cleaning products due to its lightweight and porous nature. The growing demand for melamine foam in automotive and construction industries is also supporting this growth.

- By Application

On the basis of application, the melamine market is segmented into laminates, wood adhesives, molding compounds, thermoset plastics, surface coating, paints, and others. The laminates segment held the largest market revenue share in 2024, driven by rising demand in furniture, construction, and interior design sectors. Melamine laminates are valued for their scratch resistance, heat tolerance, and ease of maintenance.

The wood adhesives segment is expected to witness the fastest growth from 2025 to 2032, supported by increased usage in engineered wood products such as plywood and particleboards, especially in developing regions where affordable construction materials are in demand.

- By End-User Industry

On the basis of end-user industry, the melamine market is segmented into construction, chemical industry, textile industry, automotive industry, and others. The construction segment accounted for the largest market revenue share in 2024, driven by growing urbanization and infrastructure development that boost demand for melamine-based laminates and adhesives.

The chemical industry segment is expected to witness the fastest growth from 2025 to 2032, propelled by the rising use of melamine in manufacturing flame retardants, fertilizers, and specialty chemicals. Increased industrial activities and strict safety regulations are supporting market expansion in this sector.

Melamine Market Regional Analysis

- Asia-Pacific dominated the melamine market with the largest revenue share in 2024, driven by rapid industrialization, expanding construction activities, and growing demand from furniture and automotive industries

- Countries such as China, India, and Japan are witnessing increased consumption of melamine-based laminates and adhesives, supported by government investments in infrastructure and manufacturing

- The region’s abundant raw material availability and cost-effective manufacturing capabilities further support melamine market growth, making Asia-Pacific a key production and consumption hub globally

China Melamine Market Insight

The China held the largest market revenue share in Asia-Pacific in 2024, fueled by extensive urbanization and industrial growth. The demand for melamine resins in laminates and wood adhesives is particularly strong due to booming real estate and furniture sectors. Increasing adoption of environmentally friendly and durable melamine products also supports the market. Local manufacturers are expanding production capacities to meet both domestic and export demands, strengthening China’s position as a leading melamine market player.

Japan Melamine Market Insight

The Japan’s melamine market is expected to witness the fastest growth from 2025 to 2032, owing to high demand from the automotive and electronics sectors. The country’s advanced manufacturing landscape encourages the use of melamine-based thermoset plastics and coatings, valued for their durability and heat resistance. Japan’s aging population and increasing demand for modular and space-saving furniture also contribute to melamine consumption. Furthermore, government initiatives supporting eco-friendly materials and efficient production processes are driving innovations in melamine resin applications, particularly in surface coatings and molding compounds.

Europe Melamine Market Insight

The Europe melamine market is expected to witness the fastest growth from 2025 to 2032, during the forecast period, driven by rising demand from the construction and automotive industries. Strict environmental regulations and the push for sustainable materials encourage the use of advanced melamine resins and thermoset plastics. Countries such as Germany, France, and the U.K. are focusing on innovation and eco-friendly solutions, which contribute to increased usage of melamine-based coatings and molding compounds across various applications.

Germany Melamine Market Insight

The Germany market is expected to witness the fastest growth from 2025 to 2032, supported by its strong automotive and chemical industries. The country emphasizes sustainability and quality, driving the adoption of melamine products that meet stringent environmental standards. In addition, Germany’s investment in research and development for high-performance melamine materials fosters growth in specialized applications, including automotive components and surface coatings.

U.K. Melamine Market Insight

The U.K. melamine market is expected to witness the fastest growth from 2025 to 2032, driven by rising demand from the construction and furniture industries. Increasing emphasis on sustainability and eco-friendly materials encourages the adoption of advanced melamine-based laminates and adhesives. The U.K.’s expanding residential and commercial building sectors, alongside renovation projects, foster the use of melamine products. In addition, growing consumer preference for durable and easy-to-maintain furniture boosts the market. Local manufacturers are investing in innovative melamine formulations to meet stringent environmental standards and consumer expectations.

North America Melamine Market Insight

The North America shows consistent demand for melamine products, primarily from construction, furniture, and automotive sectors. The U.S. leads the region with an emphasis on durable and cost-effective laminates and adhesives used in residential and commercial projects. Rising consumer awareness about product quality and performance, combined with advancements in melamine resin technology, drives market growth. Moreover, manufacturers in the region are focusing on sustainable production methods to comply with evolving regulations.

U.S. Melamine Market Insight

The U.S. melamine market accounted for a significant share in North America in 2024, fuelled by strong demand from the construction, automotive, and furniture industries. Increasing urbanization and infrastructure development drive the consumption of melamine resins in laminates, adhesives, and molded plastics. The trend toward lightweight, durable, and heat-resistant materials in automotive components further supports growth. In addition, manufacturers in the U.S. are focusing on developing sustainable and non-toxic melamine products to align with regulatory requirements and growing environmental awareness among consumers.

Melamine Market Share

The Melamine industry is primarily led by well-established companies, including:

- China Haohua Chemical Group Co., Ltd (China)

- BASF SE (Germany)

- Cornerstone (U.S.)

- QATAR FERTILISER COMPANY (Qatar)

- Mitsui Chemicals, Inc. (Japan)

- Nissan Chemical Corporation (Japan)

- Proman (Switzerland)

- Borealis AG (Austria)

- Grupa Azoty (Poland)

- Prefere Resins Holding GmbH (Germany)

- Gujarat State Fertilizers & Chemicals Limited (GSFC) (India)

- Hexion (U.S.)

- Xinji JiuYuan Chemical Industry Co., Ltd (China)

Latest Developments in Global Melamine Market

- In March 2022, Borealis AG rejected an acquisition offer from EuroChem for its melamine, nitrogen, and fertilizer business. Despite declining the proposal, Borealis remained open to exploring alternative options specifically for its nitrogen segment. This decision helped Borealis maintain strategic control over its core melamine operations while considering future growth opportunities

- In September 2022, Eurotecnica secured two significant contracts to build high-pressure melamine plants with capacities of 60,000 tons and 80,000 tons per year. These new plants will boost Eurotecnica’s production capacity, enabling the company to better meet increasing global demand. This expansion is expected to strengthen Eurotecnica’s market position and contribute positively to the overall growth of the melamine industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Melamine Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Melamine Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Melamine Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.