Global Medical Supplies Market

Market Size in USD Billion

CAGR :

%

USD

184.95 Billion

USD

589.81 Billion

2024

2032

USD

184.95 Billion

USD

589.81 Billion

2024

2032

| 2025 –2032 | |

| USD 184.95 Billion | |

| USD 589.81 Billion | |

|

|

|

|

Medical Supplies Market Size

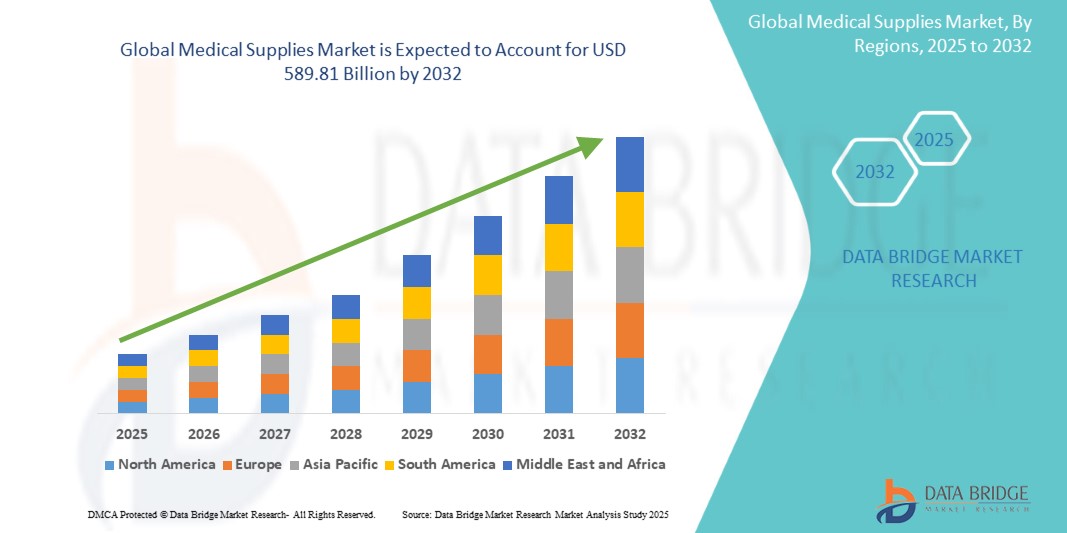

- The global medical supplies market was valued at USD 184.95 billion in 2024 and is expected to reach USD 589.81 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 15.6%, primarily driven by the anticipated launch of novel therapies, technological advancements, and growing healthcare needs

- This growth is driven by factors such as the aging population, increasing prevalence of eye diseases, and advancements in ophthalmic technology

Medical Supplies Market Analysis

- Medical supplies are critical tools used across a wide range of medical procedures, including surgeries, diagnostics, wound care, and infection prevention. They encompass consumables, devices, and equipment essential for patient care in hospitals, clinics, and home settings

- The demand for medical supplies is significantly driven by the increasing prevalence of chronic diseases, an aging global population, and a surge in surgical procedures. Additionally, the growing emphasis on infection control and hygiene standards is propelling the need for disposable and sterile supplies worldwide

- The North America region stands out as one of the dominant regions for the medical supplies market, driven by its advanced healthcare infrastructure, widespread adoption of modern technologies, and strong presence of leading medical device manufacturers

- For instance, the U.S. has consistently seen a rise in surgical procedures and hospital admissions, leading to greater utilization of surgical gloves, gowns, syringes, and diagnostic kits. The region also leads in the adoption of innovations in wound care and diagnostic supplies

- Globally, medical supplies rank as one of the most essential components of healthcare delivery, playing a pivotal role in ensuring patient safety, effective diagnosis, and successful treatment outcomes. Their continued demand across both inpatient and outpatient settings highlights their importance in a rapidly evolving healthcare landscape

Report Scope and Medical Supplies Market Segmentation

|

Attributes |

Medical Supplies Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Medical Supplies Market Trends

“Increasing Demand for Single-Use and Sterile Medical Supplies”

- A prominent trend in the global medical supplies market is the rising demand for single-use and sterile products to minimize the risk of hospital-acquired infections (HAIs) and cross-contamination

- This trend is driven by increasing awareness of infection control protocols, stringent hygiene standards in healthcare settings, and the need to prevent the spread of infectious diseases

- For instance, the heightened focus on infection control following the COVID-19 pandemic has significantly increased the demand for disposable personal protective equipment (PPE) such as masks, gloves, and gowns in hospitals and clinics globally

- Advancements in material science and manufacturing processes are leading to the development of more effective and cost-efficient single-use medical devices and consumables

- This shift towards disposables is transforming the medical supplies market, emphasizing safety and hygiene in patient care

Medical Supplies Market Dynamics

Driver

“Growing Need Due to Rising Prevalence of Chronic and Infectious Diseases”

- The increasing global prevalence of chronic diseases such as diabetes, cardiovascular diseases, and respiratory disorders, alongside the persistent threat of infectious disease outbreaks, is a significant driver for the medical supplies market

- The management and treatment of these conditions require a wide range of medical supplies for diagnostics, monitoring, therapy, and patient care

For instance,

- In 2024, as per WHO, the number of people living with diabetes rose from 200 million in 1990 to 830 million in 2022. This rise was more rapid in low- and middle-income countries than in high-income countries. Diabetes caused over 2 million deaths in 2021, with significant complications like kidney failure and heart disease

- In March 2024, as per NCBI, diabetes prevalence has significantly increased, with 537 million adults affected in 2021, representing 10.5% of the population. By 2030, this number is projected to rise to 643 million (11.3%). Diabetes-related healthcare costs were $966 billion in 2021, expected to exceed USD 1054 billion by 2045

- Furthermore, public health emergencies and pandemics necessitate a surge in demand for diagnostic tests, PPE, and other essential medical supplies. This growing burden of diseases globally is a key factor fueling the expansion of the medical supplies market

Opportunity

“Integration of Digital Health Technologies and Smart Medical Supplies”

- The increasing convergence of digital health technologies with medical supplies presents a significant opportunity for market growth and enhanced patient care

- Smart medical devices and supplies, integrated with IoT (Internet of Things) and AI (Artificial Intelligence), can enable real-time monitoring, data analytics, and improved connectivity between patients and healthcare providers

For instance,

- In January 2022, according to an article published by the Australian Research Council, Smart wound dressings with sensors can continuously monitor key wound parameters such as temperature, pH, moisture levels, exudate, and even detect signs of infection

- In June 2024, according to an article published by the University of Southern California, the data collected by smart dressings can provide valuable insights into the individual healing process, potentially leading to more personalized and effective treatment plans

- The development of user-friendly digital platforms and mobile applications that complement medical supplies can enhance patient engagement, medication adherence, and remote patient monitoring

- This integration of digital health solutions into medical supplies is expected to drive innovation and create new market opportunities

Restraint/Challenge

“Stringent Regulatory Requirements and Quality Standards”

- The medical supplies market is subject to stringent regulatory requirements and quality standards imposed by various authorities worldwide to ensure patient safety and product efficacy

- Compliance with these regulations, including pre-market approvals, manufacturing standards (GMP), and post-market surveillance, can be a complex and costly process for manufacturers

For instance,

- The obtaining CE marking in Europe or FDA approval in the U.S. for new medical devices requires rigorous testing, clinical trials, and extensive documentation, which can be time-consuming and expensive

- Varying regulatory landscapes across different countries can also create challenges for companies seeking to market their products globally

- Navigating these complex regulatory pathways and ensuring consistent quality standards across the supply chain remains a significant challenge for the medical supplies market

Medical Supplies Market Scope

The market is segmented on the basis type, application, and end-users.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Application |

|

|

By End User |

|

Medical Supplies Market Regional Analysis

“North America is the Dominant Region in the Medical Supplies Market”

- North America leads the global medical supplies market, primarily due to its well-established healthcare infrastructure, widespread use of advanced medical devices, and presence of major industry players

- The U.S. holds a significant share owing to a high prevalence of chronic diseases, growing elderly population, and continuous adoption of innovative medical supplies for wound care, infection prevention, surgical procedures, and diagnostic needs

- Strong reimbursement frameworks, favorable healthcare policies, and government initiatives supporting medical innovations further enhance regional growth

- Moreover, the increase in outpatient surgical centers, focus on value-based healthcare, and high healthcare expenditure are contributing factors in maintaining North America’s market dominance

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is projected to grow at the fastest CAGR in the medical supplies market due to rapid healthcare infrastructure development, increasing government and private investments, and growing demand for affordable and accessible healthcare solutions

- Countries like China, India, Japan, and South Korea are key contributors, with large patient pools, increasing geriatric populations, and higher incidence of lifestyle-related diseases requiring medical interventions

- India and China are witnessing a surge in medical tourism, expansion of hospital networks, and increased focus on domestic manufacturing of medical supplies under initiatives like "Make in India."

- Japan, with its aging population and healthcare innovations, continues to invest heavily in advanced surgical consumables, diagnostic kits, and infection control supplies

- Improved healthcare access in rural and underserved areas, faster regulatory approvals, and strategic partnerships with international players are further fueling regional growth

Medical Supplies Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- enVista, LLC. (U.S.)

- American Orthodontics (U.S.)

- 3M (U.S.)

- Danaher (U.S.)

- Henry Schein, Inc. (U.S.)

- Dentsply Sirona (U.S.)

- Align Technology, Inc. (U.S.)

- ORTHOMERICA PRODUCTS, INC. (U.S.)

- G&H Orthodontics (U.S.)

- TP Orthodontics, Inc. (U.S.)

- DENTAURUM GmbH & Co. KG (Germany)

- Great Lakes Dental Technologies (U.S.)

- DB Orthodontics Limited (U.K.)

- Institut Straumann AG (Switzerland)

- Ultradent Products, Inc. (U.S.)

- TOMY Inc. (U.S.)

- 3Shape A/S (Denmark)

- Leone S.p.A. (Italy)

Latest Developments in Global Medical Supplies Market

- In January 2024, GE Healthcare announced its agreement to acquire MIM Software, a prominent provider of medical imaging analysis and AI solutions. MIM Software specializes in key areas, including radiation oncology, molecular radiotherapy, diagnostic imaging, and urology across diverse healthcare environments. This acquisition will enhance GE Healthcare's capabilities in medical imaging and analytics, reinforcing its commitment to advancing patient care through innovative technologies

- In January 2024, Medtronic received U.S. FDA approval for its Percept RC Deep Stimulation System, featuring advanced BrainSense technology. This innovative system is designed to provide personalized treatment for patients with conditions such as Parkinson's disease and epilepsy. The approval underscores Medtronic's commitment to enhancing patient outcomes through cutting-edge neurostimulation solutions tailored to individual needs

- In April 2022, Boston Scientific Corporation obtained FDA 510(k) clearance for the EMBOLD Fibered Detachable Coil, designed to obstruct or diminish blood flow in the peripheral vasculature. This regulatory approval highlights the company's commitment to advancing medical technology in vascular treatments. The EMBOLD coil aims to enhance clinical outcomes by providing a reliable solution for managing blood flow-related conditions

- In June 2022, BD completed the acquisition of Parata Systems, a leading provider of pharmacy automation solutions. This strategic move enhances BD's portfolio by integrating Parata's innovative technologies, aimed at streamlining pharmacy operations. The acquisition is expected to bolster BD's commitment to improving medication management and patient safety through advanced automation solutions in the healthcare sector

- In April 2020, Scoutbee introduced a free tool designed to assist organizations in sourcing hospital supplies related to COVID-19. This initiative aimed to facilitate the procurement of essential medical equipment and supplies during the pandemic. By providing a streamlined search capability, Scoutbee contributed to addressing urgent healthcare needs and enhancing supply chain efficiency in the fight against COVID-19

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.