Global Medical Superabsorbent Polymers Sap Market

Market Size in USD Billion

CAGR :

%

USD

2.41 Billion

USD

3.64 Billion

2025

2033

USD

2.41 Billion

USD

3.64 Billion

2025

2033

| 2026 –2033 | |

| USD 2.41 Billion | |

| USD 3.64 Billion | |

|

|

|

|

Medical Superabsorbent Polymers (SAP) Market Size

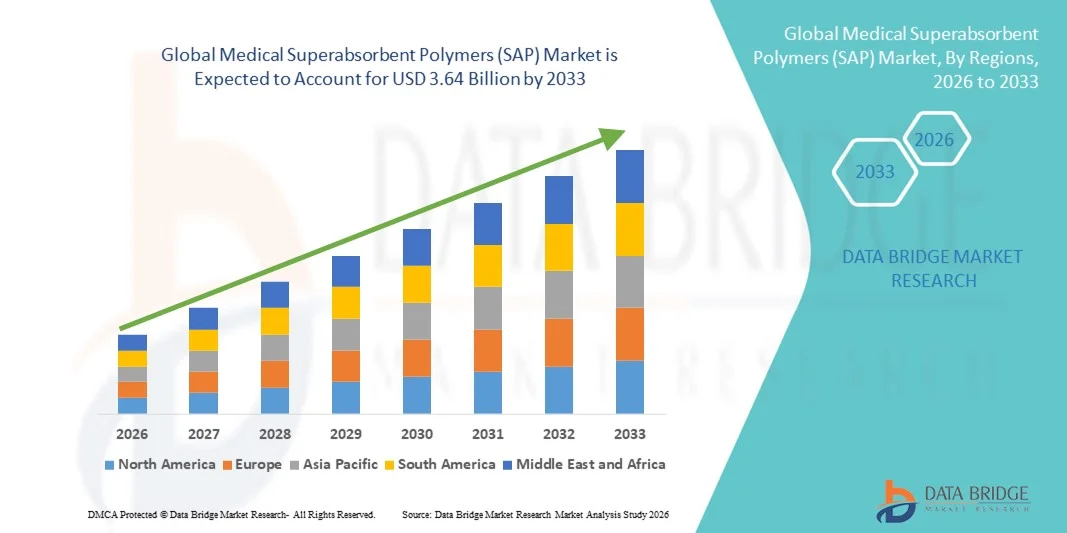

- The global medical superabsorbent polymers (SAP) market size was valued at USD 2.41 billion in 2025 and is expected to reach USD 3.64 billion by 2033, at a CAGR of 5.32% during the forecast period

- The market growth is largely fueled by the increasing demand for advanced wound care and hygiene products, along with continuous technological advancements in superabsorbent polymer materials, leading to improved fluid absorption, biocompatibility, and comfort in medical applications across hospitals and homecare settings

- Furthermore, rising prevalence of chronic wounds, surgical procedures, and age-related health conditions is driving the need for safe, efficient, and high-performance medical absorbent solutions. These converging factors are accelerating the adoption of Medical Superabsorbent Polymers (SAP), thereby significantly boosting overall market growth

Medical Superabsorbent Polymers (SAP) Market Analysis

- Medical superabsorbent polymers (SAPs), which are widely used in wound dressings, surgical pads, and hygiene products, are becoming essential materials in modern healthcare due to their high fluid absorption capacity, biocompatibility, and ability to enhance patient comfort across hospital and homecare settings

- The growing demand for medical SAPs is primarily driven by the rising prevalence of chronic wounds, increasing surgical procedures, and expanding geriatric population, along with continuous advancements in polymer technology that improve safety, performance, and sustainability

- North America dominated the medical superabsorbent polymers (SAP) market with the largest revenue share of approximately 36.8% in 2025, supported by advanced healthcare infrastructure, high adoption of advanced wound care products, strong regulatory standards, and the presence of leading medical material manufacturers, particularly in the U.S.

- Asia-Pacific is expected to be the fastest-growing region in the medical superabsorbent polymers (SAP) market during the forecast period, driven by increasing healthcare expenditure, rising awareness of advanced wound care, expanding medical tourism, and a rapidly aging population in countries such as China, India, and Japan

- The Synthetic SAP segment dominated the largest market revenue share of 72.6% in 2025, driven by its superior absorption capacity, high gel strength, and consistent performance compared to natural alternatives

Report Scope and Medical Superabsorbent Polymers (SAP) Market Segmentation

|

Attributes |

Medical Superabsorbent Polymers (SAP) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Medical Superabsorbent Polymers (SAP) Market Trends

Rising Adoption of Advanced Absorbent Materials in Medical Applications

- A significant and accelerating trend in the global medical superabsorbent polymers (SAP) market is the increasing use of high-performance absorbent materials in advanced medical and healthcare applications, including wound care, surgical dressings, adult incontinence products, and medical hygiene solutions. This trend is driven by the growing need for materials that offer superior fluid absorption, retention, and leakage prevention while maintaining patient comfort

- For instance, leading healthcare material manufacturers are increasingly incorporating medical-grade SAP into wound dressings and disposable medical products to enhance exudate management and reduce the risk of infection, particularly in chronic wound and post-surgical care settings

- Continuous advancements in polymer chemistry are enabling the development of SAP with improved biocompatibility, faster absorption rates, and enhanced gel strength, making them suitable for sensitive medical applications. These innovations support better moisture control and improved healing outcomes, especially in long-term patient care

- The growing emphasis on patient-centric healthcare and improved quality of care is encouraging hospitals and healthcare providers to adopt advanced absorbent medical products that rely on SAP for consistent performance and reliability

- This trend toward more efficient, hygienic, and high-performance absorbent materials is reshaping product development strategies within the medical supplies industry, with manufacturers focusing on customized SAP formulations tailored for specific medical uses

- The demand for medical SAP is expanding steadily across hospitals, long-term care facilities, and home healthcare settings as healthcare systems increasingly prioritize hygiene, infection control, and patient comfort

Medical Superabsorbent Polymers (SAP) Market Dynamics

Driver

Growing Demand from Healthcare, Wound Care, and Incontinence Management Applications

- The rising prevalence of chronic diseases, aging populations, and increasing rates of hospitalization are major drivers for the growing demand for Medical Superabsorbent Polymers (SAP). These factors have significantly increased the need for effective wound management and incontinence care products

- For instance, the expanding global geriatric population has led to higher consumption of adult incontinence products, where SAP plays a critical role in ensuring high absorbency, odor control, and patient comfort, thereby driving sustained market growth

- The increasing number of surgical procedures worldwide is further fueling demand for advanced wound dressings and surgical disposables that incorporate medical-grade SAP to manage fluids efficiently and reduce infection risks

- In addition, rising healthcare expenditure and improved access to medical services in developing regions are supporting the adoption of high-quality disposable medical products that rely on SAP for performance and safety

- The growing focus on hygiene standards, infection prevention, and patient safety in hospitals and care facilities continues to reinforce the demand for medical SAP across a wide range of healthcare applications

Restraint/Challenge

High Production Costs and Environmental Concerns

- High production costs associated with medical-grade superabsorbent polymers pose a significant challenge to market growth, particularly in cost-sensitive healthcare systems and emerging economies. The need for stringent quality control and regulatory compliance further adds to manufacturing expenses

- For instance, fluctuations in raw material prices, especially petroleum-based inputs used in SAP production, can impact overall product costs and limit adoption among budget-constrained healthcare providers

- Environmental concerns related to the disposal and non-biodegradable nature of conventional SAP materials also present challenges, as healthcare systems increasingly focus on sustainability and waste reduction

- Regulatory scrutiny surrounding the use of synthetic polymers in medical products can increase approval timelines and compliance costs for manufacturers, potentially slowing product launches

- Overcoming these challenges through the development of cost-effective, bio-based, and environmentally friendly SAP solutions, along with improved recycling initiatives, will be crucial for ensuring long-term growth and wider adoption of Medical Superabsorbent Polymers (SAP)

Medical Superabsorbent Polymers (SAP) Market Scope

The market is segmented on the basis of type, product, and method.

- By Type

On the basis of type, the Global Superabsorbent Polymers (SAP) market is segmented into Synthetic and Natural. The Synthetic SAP segment dominated the largest market revenue share of 72.6% in 2025, driven by its superior absorption capacity, high gel strength, and consistent performance compared to natural alternatives. Synthetic SAPs, primarily acrylic-acid-based polymers, are extensively used in medical applications such as wound dressings, surgical pads, and disposable hygiene products due to their reliability and long shelf life. Their ability to absorb fluids many times their own weight enhances patient comfort and infection control. Large-scale commercial production and well-established supply chains further support dominance. Strong demand from hospitals and healthcare facilities boosts consumption. Compatibility with advanced manufacturing processes enables cost-effective mass production. High thermal and chemical stability improves clinical usability. Regulatory approvals and proven safety profiles reinforce adoption. Continuous product innovation improves absorbency and softness. Growing aging population increases usage in incontinence products. Overall, synthetic SAPs remain the backbone of the medical SAP market.

The Natural SAP segment is expected to witness the fastest CAGR of 9.8% from 2026 to 2033, driven by rising demand for biodegradable and eco-friendly medical materials. Increasing environmental regulations encourage the adoption of bio-based SAPs derived from cellulose and starch. Healthcare providers are increasingly prioritizing sustainable materials in disposable medical products. Natural SAPs reduce environmental burden without compromising essential absorption performance. Growing awareness of sustainability among manufacturers accelerates R&D investments. Technological advancements are improving the absorbency and durability of natural SAPs. Adoption is increasing in wound care and disposable medical textiles. Supportive government policies promote green materials. Emerging markets show strong uptake due to cost competitiveness. Collaboration between biotech firms and polymer manufacturers boosts innovation. Natural SAPs are gaining clinical acceptance. These factors collectively support rapid growth.

- By Product

On the basis of product, the Global Superabsorbent Polymers (SAP) market is segmented into Woven and Non-woven. The Non-woven SAP segment accounted for the largest market revenue share of 65.4% in 2025, driven by its extensive use in medical disposables such as diapers, surgical drapes, wound dressings, and absorbent pads. Non-woven structures provide excellent fluid distribution and rapid absorption, essential for medical and hygiene applications. Their lightweight nature enhances patient comfort during prolonged use. Cost-efficient manufacturing supports large-scale adoption. High breathability reduces skin irritation and infection risks. Compatibility with synthetic SAPs improves performance consistency. Hospitals prefer non-woven products due to ease of disposal and hygiene control. Strong demand from elderly care facilities further drives growth. Rising surgical procedures increase consumption. Technological improvements enhance softness and durability. Established supply chains ensure stable availability. These factors firmly position non-woven SAPs as the market leader.

The Woven SAP segment is projected to grow at the fastest CAGR of 8.6% from 2026 to 2033, driven by increasing use in specialized medical textiles requiring higher mechanical strength. Woven SAP products offer enhanced durability and structural integrity for long-term applications. They are increasingly used in reusable medical supports and advanced wound care solutions. Growing demand for reinforced absorbent materials supports adoption. Innovation in fiber weaving techniques improves absorption efficiency. Rising focus on high-performance medical fabrics boosts growth. Woven products provide better load-bearing capability. Expanding applications in orthopedic and post-surgical care accelerate uptake. Higher resistance to tearing improves safety. Increasing healthcare infrastructure investments support market expansion. Premium medical textile demand favors woven SAPs. These factors contribute to strong growth momentum.

- By Method

On the basis of method, the Global Superabsorbent Polymers (SAP) market is segmented into Suspension Polymerization, Solution Polymerization, and Gel Polymerization. The Gel Polymerization segment dominated the market with a revenue share of 58.9% in 2025, driven by its ability to produce high-performance SAPs with superior absorbency and gel strength. This method is widely adopted for manufacturing medical-grade SAPs due to consistent quality output. It allows precise control over polymer structure and absorption rate. Gel polymerization supports large-scale industrial production. High efficiency reduces material waste and cost. Medical manufacturers prefer this method for compliance with quality standards. Strong demand from hygiene and wound care products fuels growth. Compatibility with synthetic polymers enhances performance. Proven reliability supports long-term contracts. Advanced processing technologies improve yield. Established infrastructure reinforces dominance. These factors make gel polymerization the preferred method.

The Solution Polymerization segment is expected to grow at the fastest CAGR of 10.2% from 2026 to 2033, driven by increasing demand for customized and specialty SAP formulations. This method enables better control over polymer composition for specific medical applications. Rising demand for tailored absorption properties supports adoption. Growth in advanced wound care products accelerates usage. Solution polymerization offers flexibility in production scale. Increasing R&D activities boost innovation. Emerging medical applications require specialized SAP characteristics. Improved solvent recovery technologies reduce environmental impact. Growing investments in pharmaceutical-grade polymers support expansion. Adoption is rising in niche medical products. Cost optimization enhances competitiveness. These factors collectively drive rapid growth.

Medical Superabsorbent Polymers (SAP) Market Regional Analysis

- North America dominated the medical superabsorbent polymers (SAP) market with the largest revenue share of approximately 36.8% in 2025, supported by advanced healthcare infrastructure, high adoption of advanced wound care and hygiene products, strong regulatory standards for medical materials, and the presence of leading SAP manufacturers, particularly in the U.S.

- Healthcare providers across the region place strong emphasis on high-performance absorbent materials for wound management, surgical dressings, and incontinence care, driving sustained demand for medical-grade SAP in hospitals, long-term care facilities, and home healthcare settings

- This strong market position is further reinforced by high healthcare spending, widespread use of disposable medical products, and continuous innovation in absorbent material technologies aimed at improving patient comfort, safety, and clinical outcomes

U.S. Medical Superabsorbent Polymers (SAP) Market Insight

The U.S. medical superabsorbent polymers (SAP) market captured the largest revenue share in 2025 within North America, driven by the country’s well-established healthcare system and high consumption of advanced wound care and adult incontinence products. The growing prevalence of chronic wounds, diabetes, and an aging population has significantly increased the use of SAP-based medical products across hospitals and homecare environments. In addition, strong regulatory oversight and continuous investment in medical material innovation by domestic manufacturers continue to support market expansion in the U.S.

Europe Medical Superabsorbent Polymers (SAP) Market Insight

The Europe medical superabsorbent polymers (SAP) market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent healthcare regulations, rising focus on patient hygiene, and increasing adoption of advanced wound care solutions. Growing demand for high-quality disposable medical products across hospitals, nursing homes, and outpatient facilities is supporting SAP usage. The region is witnessing steady growth across wound management, surgical care, and incontinence applications, with SAP increasingly incorporated into both conventional and advanced medical products.

U.K. Medical Superabsorbent Polymers (SAP) Market Insight

The U.K. medical superabsorbent polymers (SAP) market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by rising healthcare expenditure, increasing awareness of advanced wound care practices, and expanding elderly care services. The strong presence of public healthcare services and growing demand for infection-control solutions are encouraging the use of SAP-based medical disposables across hospitals and community care settings.

Germany Medical Superabsorbent Polymers (SAP) Market Insight

The Germany medical superabsorbent polymers (SAP) market is expected to expand at a considerable CAGR during the forecast period, fueled by a strong emphasis on medical innovation, high standards for patient care, and increasing use of advanced wound treatment products. Germany’s robust healthcare infrastructure and growing focus on precision treatment and long-term care are driving demand for high-quality absorbent materials. The adoption of SAP in medical textiles and hygiene products is gaining traction across both clinical and homecare applications.

Asia-Pacific Medical Superabsorbent Polymers (SAP) Market Insight

The Asia-Pacific medical superabsorbent polymers (SAP) market is expected to be the fastest-growing region during the forecast period, driven by increasing healthcare expenditure, rising awareness of advanced wound care, expanding medical tourism, and a rapidly aging population. Improving access to healthcare services and growing demand for disposable medical products are accelerating SAP adoption across the region.

Japan Medical Superabsorbent Polymers (SAP) Market Insight

The Japan medical superabsorbent polymers (SAP) market is gaining momentum due to the country’s aging population, high standards of healthcare delivery, and strong demand for advanced incontinence and wound care products. The emphasis on patient comfort and hygiene is encouraging the use of high-performance SAP in medical applications, particularly in elderly care and long-term treatment settings.

China Medical Superabsorbent Polymers (SAP) Market Insight

The China medical superabsorbent polymers (SAP) market accounted for the largest revenue share in Asia-Pacific in 2025, supported by rapid expansion of healthcare infrastructure, rising healthcare awareness, and increasing demand for medical hygiene products. Growth in hospital capacity, rising chronic disease prevalence, and strong domestic manufacturing capabilities are driving the adoption of SAP-based medical products across both urban and rural healthcare facilities.

Medical Superabsorbent Polymers (SAP) Market Share

The Medical Superabsorbent Polymers (SAP) industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Evonik Industries AG (Germany)

- Nippon Shokubai Co., Ltd. (Japan)

- LG Chem Ltd. (South Korea)

- Sumitomo Seika Chemicals Co., Ltd. (Japan)

- Kao Corporation (Japan)

- SABIC (Saudi Arabia)

- United Polymer Group (U.S.)

- Sekisui Specialty Chemicals Co., Ltd. (Japan)

- Reliance Industries Limited (India)

- Sinopec Shanghai Petrochemical (China)

- DSM Biomedical (Netherlands)

- Fiberweb (U.K.)

- TotalEnergies (France)

- Asahi Kasei Corporation (Japan)

- Wanhua Chemical Group Co., Ltd. (China)

- Henkel AG & Co. KGaA (Germany)

- Lubrizol Corporation (U.S.)

- Clariant AG (Switzerland)

- Sumitomo Bakelite Co., Ltd. (Japan)

Latest Developments in Global Medical Superabsorbent Polymers (SAP) Market

- In March 2021, BASF SE announced a EUR 25 million investment to build a Superabsorbent Excellence Center at its Verbund site in Antwerp, Belgium, aimed at strengthening research, improving production capabilities, and accelerating innovation in high-performance SAP materials used across hygiene and medical applications

- In September 2023, Sanyo Chemical Industries disclosed that its subsidiary SDP Global Co. developed an eco-friendly plant-based SAP, certified by the Japan Organics Recycling Association’s Biomass Mark, reflecting rising industry focus on sustainable polymer production

- In October 2024, BASF completed a USD 19.2 million upgrade of its SAP manufacturing facility in Freeport, Texas, enhancing capacity and production efficiency for SAP products used in hygiene and medical absorbent applications

- In July 2025, Ontex Group NV introduced bio-based SAP materials in selected diaper product lines, replacing conventional fossil-based SAP components and advancing sustainability initiatives in high-absorbency consumer and medical hygiene products

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.