Global Medical Robotic Systems Market

Market Size in USD Billion

CAGR :

%

USD

26.04 Billion

USD

93.84 Billion

2024

2032

USD

26.04 Billion

USD

93.84 Billion

2024

2032

| 2025 –2032 | |

| USD 26.04 Billion | |

| USD 93.84 Billion | |

|

|

|

|

Medical Robotic System Market Size

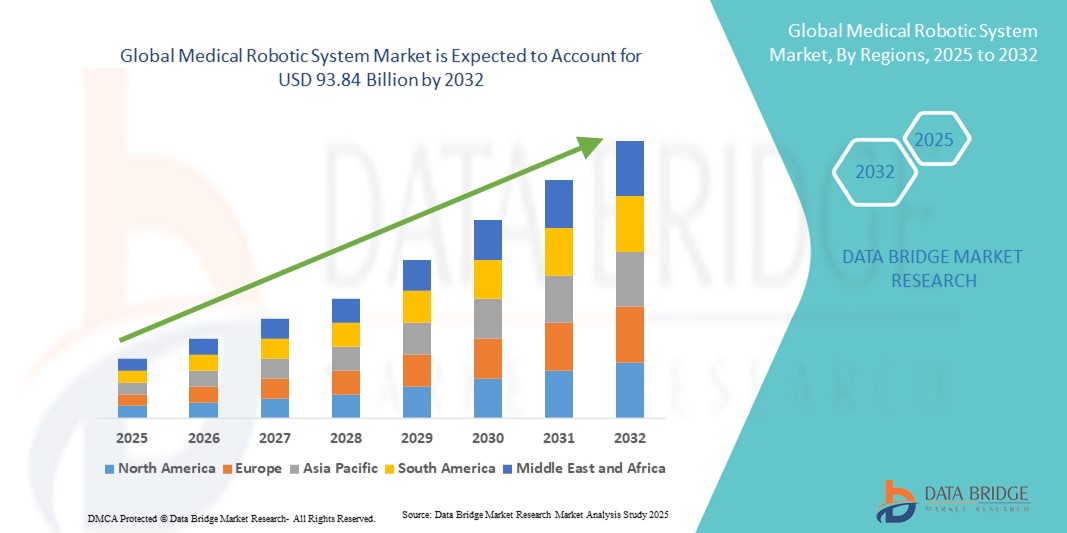

- The global medical robotic system market size was valued at USD 26.04 billion in 2024 and is expected to reach USD 93.84 billion by 2032, at a CAGR of 17.38% during the forecast period

- The market growth is largely driven by the increasing adoption of minimally invasive surgeries, technological advancements in robotic-assisted procedures, and rising integration of AI and machine learning in surgical robots, enhancing precision and outcomes

- Furthermore, the growing demand for improved patient care, shorter recovery times, and reduced surgical complications is positioning medical robotic systems as essential tools in modern healthcare facilities. These factors are collectively accelerating the deployment of robotic solutions, thereby significantly propelling the industry's growth

Medical Robotic System Market Analysis

- Medical robotic systems, enabling precision, automation, and minimally invasive interventions, are increasingly vital components of modern healthcare delivery in both surgical and non-surgical applications due to their enhanced accuracy, reduced human error, and integration with advanced imaging and navigation technologies

- The escalating demand for medical robotic systems is primarily fueled by the rising prevalence of chronic diseases requiring surgical treatment, increasing preference for minimally invasive procedures, and rapid technological progress in robotic-assisted platforms

- North America dominated the medical robotic system market with the largest revenue share of 42% in 2024, supported by advanced healthcare infrastructure, high healthcare spending, and strong adoption of surgical robots, with the U.S. leading in installations across hospitals and specialty clinics driven by major players pioneering AI-assisted and image-guided robotic solutions

- Asia-Pacific is expected to be the fastest growing region in the medical robotic system market during the forecast period due to expanding healthcare infrastructure, rising medical tourism, and increasing demand for advanced robotic-assisted surgeries

- The surgical robotic systems segment dominated the medical robotic system market with a market share of 45.2% in 2024, attributed to its proven clinical benefits, ability to perform complex procedures with high precision, and expanding use across specialties such as urology, orthopedics, and cardiology

Report Scope and Medical Robotic System Market Segmentation

|

Attributes |

Medical Robotic System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Medical Robotic System Market Trends

Advanced Precision and AI-Driven Surgical Assistance

- A significant and accelerating trend in the global medical robotic system market is the integration of artificial intelligence (AI), machine learning, and advanced imaging technologies into surgical robots, enhancing precision, efficiency, and patient outcomes

- For instance, the da Vinci Xi Surgical System utilizes AI-driven motion scaling and tremor reduction to improve accuracy during complex procedures. Similarly, the Medtronic Hugo RAS System integrates real-time imaging and AI algorithms to assist surgeons in decision-making during minimally invasive surgeries

- AI integration in robotic systems enables features such as predictive analytics for surgical planning, real-time feedback during operations, and automation of repetitive tasks. Some robots can learn from past procedures to optimize instrument movement, reduce surgical errors, and improve recovery times

- The seamless integration of medical robots with hospital IT infrastructure allows centralized monitoring and coordination across surgical suites, enabling better resource utilization and workflow efficiency. Hospitals can track surgical outcomes, instrument usage, and patient recovery metrics through a single platform

- This trend toward intelligent, adaptive, and interconnected robotic systems is fundamentally reshaping expectations for surgical performance and patient care. Consequently, companies such as Stryker and Johnson & Johnson are developing AI-enabled robotic platforms with enhanced analytics, automated instrument control, and real-time decision support

- The demand for AI-driven, precision-enhancing medical robotic systems is growing rapidly across hospitals and specialty clinics, as healthcare providers increasingly prioritize better outcomes, reduced surgical complications, and operational efficiency

Medical Robotic System Market Dynamics

Driver

Rising Adoption Due to Minimally Invasive Surgery and Technological Advancements

- The increasing prevalence of minimally invasive procedures and rising awareness of the benefits of robotic-assisted surgery are key drivers for the growing adoption of medical robotic systems

- For instance, in March 2024, Intuitive Surgical expanded the da Vinci Xi platform to support advanced urological and gynecological procedures, demonstrating the ongoing technological evolution in robotic-assisted surgery

- Surgeons and healthcare providers are increasingly choosing robotic systems for their precision, reduced trauma, shorter recovery times, and lower complication rates compared to traditional surgery

- Furthermore, growing investments in hospital infrastructure, technological advancements in AI, robotics, and imaging, and the expansion of training programs for surgeons are promoting adoption in both developed and emerging markets

- The integration of robotics with telemedicine and remote surgery solutions is also enhancing the appeal of these systems, enabling better access to specialized surgical care in underserved regions

Restraint/Challenge

High Costs and Regulatory Barriers

- The high initial cost of medical robotic systems, including acquisition, maintenance, and training expenses, poses a significant barrier to adoption, particularly for small or budget-constrained hospitals

- For instance, hospitals must invest in specialized training programs, ongoing system maintenance, and infrastructure modifications to accommodate robotic suites, adding to the total cost of ownership

- Regulatory compliance and approvals for new robotic devices can also delay market entry, as systems must meet stringent safety, performance, and clinical validation requirements across multiple regions

- In addition, concerns about the learning curve for surgeons, potential technical malfunctions, and limited insurance coverage for robotic procedures may limit wider adoption

- Overcoming these challenges through cost-effective system designs, leasing or subscription models, and streamlined regulatory approvals will be crucial for sustained market growth, along with increased awareness of the clinical benefits among healthcare providers

Medical Robotic System Market Scope

The market is segmented on the basis of type, product type, deployment type, services, application, and end users.

- By Type

On the basis of type, the medical robotic system market is segmented into traditional robots and collaborative robots. The traditional robots segment dominated the market with the largest revenue share in 2024, driven by their extensive adoption in complex surgical procedures requiring high precision and stability. These robots are commonly used in hospitals and specialty surgical centers for minimally invasive surgeries, offering benefits such as tremor reduction, motion scaling, and enhanced visualization. Traditional robotic systems are widely preferred due to established clinical efficacy, surgeon familiarity, and strong support from leading medical robotics manufacturers. Their integration with AI, real-time imaging, and analytics further strengthens procedural accuracy and patient safety. In addition, their deployment in large-scale surgical suites across developed markets ensures steady demand, reinforcing dominance.

The collaborative robots (cobots) segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by increasing adoption in rehabilitation, physiotherapy, and smaller clinical setups where human–robot collaboration enhances safety and efficiency. Collaborative robots are designed to work alongside human operators without safety cages, making them ideal for training, assisted procedures, and low-volume surgical applications. Their flexibility, smaller footprint, and lower cost relative to traditional robots are accelerating adoption in emerging markets and outpatient care settings. Cobots can also integrate AI-driven guidance, motion sensors, and teleoperation capabilities, enhancing their functionality in specialized applications. The growing focus on remote-assisted surgery, patient-specific rehabilitation, and personalized care is further boosting this segment’s adoption globally.

- By Product Type

On the basis of product type, the medical robotic system market is segmented into surgical robotic systems, rehabilitative robotic systems, non-invasive radiosurgery robots, hospital and pharmacy robotic systems, clean room robots, robotic prosthetics, and exo-robots. The surgical robotic systems segment dominated the market with a share of 45.2% in 2024, owing to its proven clinical benefits in performing complex surgeries with high precision and minimal invasiveness. These systems are extensively deployed across specialties such as urology, gynecology, orthopedics, and cardiology, enabling reduced recovery times and lower complication rates. Continuous innovation, such as AI-assisted instrument guidance, 3D visualization, and haptic feedback, enhances procedural accuracy. Hospitals and specialty surgical centers continue to expand their surgical robotic suites to meet rising patient demand. Partnerships between manufacturers and hospitals for training and support services also reinforce this segment’s dominance.

The rehabilitative robotic systems segment is expected to register the fastest growth rate during forecast period, driven by increasing demand for robotic-assisted physical therapy and rehabilitation in neurology, orthopedics, and geriatric care. Rehabilitative robots, including exo-suits and sensor-driven therapy devices, provide consistent, precise, and personalized rehabilitation programs, improving patient mobility and recovery outcomes. Rising incidence of chronic diseases, strokes, and musculoskeletal disorders, coupled with an aging population, is fueling this growth. Healthcare providers are adopting these systems to enhance therapy efficiency and patient compliance. Innovations such as AI-driven exercise adaptation and tele-rehabilitation capabilities are accelerating the adoption rate. Governments and private insurers promoting post-surgical rehabilitation programs further support the rapid expansion of this segment.

- By Deployment Type

On the basis of deployment type, the medical robotic system market is segmented into on-premises and cloud-based systems. The on-premises segment dominated the market in 2024, as hospitals and surgical centers prefer direct control over sensitive patient data, system maintenance, and operational reliability. On-premises deployment ensures compliance with healthcare data regulations, low latency during robotic-assisted surgeries, and seamless integration with hospital IT infrastructure. Large hospitals with advanced operating rooms benefit from higher security and reliability through on-premises deployment. Hospitals also gain operational flexibility, enabling real-time monitoring and efficient system utilization. The established preference for on-premises systems in developed markets continues to reinforce this segment’s dominance.

The cloud-based segment is expected to witness the fastest growth from 2025 to 2032, driven by the increasing adoption of connected healthcare solutions, remote monitoring, and tele-surgery capabilities. Cloud deployment allows centralized management of robotic systems, AI-driven analytics, and remote technical support. Hospitals can track surgical outcomes, instrument usage, and patient recovery data across multiple facilities. The rising popularity of subscription-based and SaaS models for robotic systems is further boosting cloud adoption. Emerging markets with limited local technical expertise are increasingly relying on cloud-based platforms for efficient deployment. Integration with AI and IoT-enabled devices enhances operational efficiency, promoting rapid growth of this segment globally.

- By Services

On the basis of services, the medical robotic system market is segmented into instrument and accessories and medical services. The instrument and accessories segment dominated the market in 2024 due to the recurring demand for high-precision instruments, consumables, and specialized tools required for surgical and rehabilitative procedures. Hospitals continually invest in updated instruments to ensure procedural accuracy, maintain hygiene standards, and expand the scope of robotic-assisted procedures. Manufacturers provide extensive portfolios of instruments tailored for different specialties, strengthening adoption. The recurring need for replacements and upgrades contributes to consistent revenue generation. Advanced instrumentation, including AI-enhanced surgical tools, ensures higher adoption rates. The reliability and longevity of instruments provided by leading vendors reinforce this segment’s market dominance.

The medical services segment is expected to witness the fastest growth during forecast period, as healthcare providers increasingly rely on training, maintenance, and technical support for effective utilization of complex robotic systems. Service offerings include on-site technical support, remote troubleshooting, and surgeon training programs. As robotic adoption expands across hospitals and rehabilitation centers, the demand for continuous support increases. Ongoing software updates, calibration, and integration services are essential for optimal system performance. Hospitals value comprehensive service packages that minimize downtime and maximize efficiency. The growing complexity of robotic systems and increasing deployment in emerging markets are accelerating this segment’s expansion globally.

- By Application

On the basis of application, the medical robotic system market is segmented into neurology, cardiology, orthopedics, urology, pharmacy, physical rehabilitation, gynecology, laparoscopy, radiation therapy, and special education. The laparoscopy segment dominated the market in 2024 due to the rising preference for minimally invasive procedures that reduce hospital stays, lower surgical risks, and improve recovery outcomes. Robotic-assisted laparoscopic procedures are widely adopted across gynecology, urology, and general surgery. AI-guided imaging and 3D visualization enhance precision and reduce human error. Hospitals increasingly invest in laparoscopic robotic systems to address patient demand for faster recovery and safer procedures. Continuous technological innovations and training programs support surgeon proficiency. The clinical benefits of minimally invasive laparoscopic surgery ensure continued dominance of this segment.

The physical rehabilitation segment is expected to register the fastest growth during the forecast period, driven by rising prevalence of stroke, musculoskeletal disorders, and neurological conditions. Robotic rehabilitation systems, including exo-robots and sensor-driven therapy devices, provide repeatable, precise, and personalized therapy sessions. Patients experience faster recovery and improved mobility compared to conventional therapy. The expanding geriatric population and increasing awareness of post-injury rehabilitation programs are accelerating adoption. Tele-rehabilitation and AI-enabled adaptive therapy further enhance growth prospects. Healthcare providers are increasingly adopting robotic rehabilitation systems for efficiency and better patient outcomes, ensuring rapid segment expansion.

- By End Users

On the basis of end users, the medical robotic system market is segmented into hospitals, ambulatory surgical centers, rehabilitation centers, pharmacy, and others. The hospitals segment dominated the market with the largest revenue share in 2024, as hospitals serve as primary sites for advanced surgeries and high-end robotic system deployment. Hospitals invest heavily in surgical and rehabilitative robotic systems to enhance procedural accuracy, reduce complications, and improve patient satisfaction. Large multi-specialty hospitals benefit from economies of scale in system maintenance, instrument management, and staff training. Hospitals also act as key testing grounds for new robotic technologies, reinforcing market dominance. Continuous adoption of AI-assisted and advanced robotic platforms in hospitals sustains revenue growth for this segment.

The rehabilitation centers segment is expected to witness the fastest growth from 2025 to 2032 due to increasing demand for robotic-assisted therapy for post-surgical recovery, neurological rehabilitation, and geriatric care. Robotic rehabilitation devices provide consistent, precise, and repeatable therapy sessions, reducing dependency on manual intervention. Rising awareness about the clinical benefits of robotic-assisted recovery programs is accelerating adoption. Rehabilitation centers are investing in AI-driven exo-robots and sensor-based therapy systems to improve patient outcomes. The growing geriatric population and rising incidence of chronic illnesses further drive demand. Increasing government support and insurance coverage for robotic rehabilitation therapies also contribute to the rapid growth of this segment

Medical Robotic System Market Regional Analysis

- North America dominated the medical robotic system market with the largest revenue share of 42% in 2024, supported by advanced healthcare infrastructure, high healthcare spending, and strong adoption of surgical robots

- Hospitals and specialty surgical centers in the region are increasingly investing in robotic-assisted systems to improve procedural precision, reduce surgical complications, and enhance patient outcomes

- The widespread adoption is further supported by strong R&D capabilities, the presence of key industry players such as Intuitive Surgical, Stryker, and Medtronic, and a growing focus on minimally invasive procedures across multiple specialties

U.S. Medical Robotic System Market Insight

The U.S. medical robotic system market captured the largest revenue share in 2024 within North America, driven by early adoption of advanced surgical technologies and high healthcare expenditure. Hospitals and specialty surgical centers are increasingly investing in robotic-assisted systems for minimally invasive procedures across urology, gynecology, and orthopedics. Growing patient awareness regarding the benefits of robotic-assisted surgeries, such as reduced recovery time and lower complication rates, is further fueling demand. The rising trend of outpatient surgical centers integrating robotic systems, alongside strong support from manufacturers such as Intuitive Surgical and Medtronic, is boosting market growth. Moreover, favorable reimbursement policies for robotic procedures and robust R&D initiatives contribute significantly to the expansion of the U.S. market.

Europe Medical Robotic System Market Insight

The Europe medical robotic system market is projected to expand at a substantial CAGR during the forecast period, primarily driven by increasing healthcare infrastructure investments and stringent regulatory standards promoting high-quality surgical care. The growing need for precision in complex procedures, combined with rising adoption of minimally invasive surgeries, is supporting market growth. Countries such as France, Germany, and Italy are witnessing increasing integration of robotic systems in both public and private hospitals. Technologically advanced solutions and the adoption of AI-assisted robotics further encourage deployment. In addition, healthcare providers in Europe are investing in robotic rehabilitation and pharmacy automation systems, broadening the market across multiple applications.

U.K. Medical Robotic System Market Insight

The U.K. medical robotic system market is anticipated to grow at a noteworthy CAGR, driven by the increasing adoption of robotic-assisted surgeries and the government’s support for advanced medical technologies. Rising awareness about surgical precision, faster recovery times, and reduced post-operative complications is encouraging both public and private hospitals to adopt robotic solutions. The U.K.’s robust healthcare infrastructure, alongside strong training programs for surgeons on robotic platforms, is further stimulating market growth. In addition, integration with AI, imaging systems, and hospital IT networks enhances the efficiency of robotic systems, positioning them as essential tools in modern healthcare delivery.

Germany Medical Robotic System Market Insight

The Germany medical robotic system market is expected to expand at a considerable CAGR, fueled by growing awareness of minimally invasive procedures and precision surgery. Germany’s advanced healthcare infrastructure, emphasis on technological innovation, and strong focus on patient safety promote adoption of robotic systems in hospitals and specialty clinics. The integration of AI-assisted and imaging-guided robotic solutions is becoming increasingly prevalent, particularly in surgical, rehabilitative, and pharmacy automation applications. In addition, rising demand for hospital efficiency, reduced surgical errors, and improved patient outcomes aligns with the preferences of German healthcare providers, further driving market growth.

Asia-Pacific Medical Robotic System Market Insight

The Asia-Pacific medical robotic system market is poised to grow at the fastest CAGR of 23% during the forecast period of 2025 to 2032, driven by rising healthcare expenditure, expanding hospital infrastructure, and growing awareness about minimally invasive surgeries. Countries such as China, Japan, and India are increasingly adopting robotic-assisted surgical systems and rehabilitative robots to improve patient outcomes. Government initiatives supporting digital health and smart hospitals, along with collaborations with global medical robotics manufacturers, are accelerating adoption. Furthermore, APAC is emerging as a manufacturing hub for robotic systems and components, improving affordability and accessibility for hospitals and rehabilitation centers across the region.

Japan Medical Robotic System Market Insight

The Japan medical robotic system market is gaining momentum due to the country’s advanced healthcare infrastructure, aging population, and high demand for precision surgeries. The adoption of surgical robots and rehabilitation robots is driven by the increasing number of smart hospitals and technology-enabled healthcare facilities. Integration with AI, imaging systems, and hospital IT networks enhances operational efficiency and patient care. Japan’s focus on robotic-assisted care for elderly patients further supports growth in both residential and clinical applications. Moreover, strong R&D capabilities and collaborations with leading global manufacturers continue to expand the availability of advanced medical robotic solutions.

India Medical Robotic System Market Insight

The India medical robotic system market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s expanding healthcare infrastructure, increasing number of private hospitals, and rising patient awareness about robotic-assisted surgeries. India is witnessing growing adoption of surgical robotic systems, rehabilitative robots, and pharmacy automation solutions. Government initiatives promoting digital health, smart hospitals, and telemedicine are driving market expansion. The presence of cost-effective robotic solutions, coupled with partnerships between domestic and international manufacturers, further propels adoption. Rising urbanization, increasing disposable income, and the demand for high-quality healthcare services are key factors accelerating growth in India.

Medical Robotic System Market Share

The Medical Robotic System industry is primarily led by well-established companies, including:

- Intuitive Surgical Operations, Inc. (U.S.)

- Medtronic (U.S.)

- Stryker (U.S.)

- Zimmer Biomet. (U.S.)

- Johnson & Johnson and its affiliates (U.S.)

- Smith + Nephew (U.K.)

- Titan Medical Inc. (Canada)

- TransEnterix, Inc. (U.S.)

- Asensus Surgical, Inc. (U.S.)

- Accuray Incorporated (U.S.)

- Brainlab AG (Germany)

- Medivators Inc. (U.S.)

- Mazor Robotics Ltd. (Israel)

- Orthospace Ltd. (Israel)

- ReWalk Robotics Ltd. (Israel)

- Verb Surgical Inc. (U.S.)

- Vicarious Surgical Inc. (U.S.)

- Virtual Incision Corporation (U.S.)

What are the Recent Developments in Global Medical Robotic System Market?

- In July 2025, Olympus Corporation has entered into a strategic partnership with Revival Healthcare Capital to co-found Swan EndoSurgical, a company dedicated to developing an innovative endoluminal robotic system. This system aims to provide less invasive therapeutic treatments for gastrointestinal (GI) conditions. Olympus will take a significant equity stake in Swan EndoSurgical, with a combined initial investment of at least USD 65 million

- In April 2025, Johnson & Johnson MedTech announced the completion of the first clinical cases using its OTTAVA robotic surgical system. This marks a significant step in the development of a next-generation surgical platform designed to enhance surgical precision and flexibility, potentially setting a new standard in robotic-assisted surgeries

- In March 2025, Medtronic plc, a global leader in healthcare technology, has introduced its Hugo robotic-assisted surgery (RAS) system for the first time in Korea at Seoul National University Hospital. This marks a significant milestone as the system is now adopted into patient treatment, research, and education in Korea. It is expected to be widely used in various surgical procedures in the future, including urological surgery, gynecological surgery, and a wide variety of General Surgery

- In March 2025, Stryker a global leader in medical technologies, showcases the latest advancements in Mako SmartRobotics across hip, knee, spine and shoulder procedures at the American Academy of Orthopaedic Surgeons’ (AAOS) 2025 Annual Meeting in San Diego. With over 1.5 million Mako procedures performed globally across 45 countries, Mako is a market-leading technology in orthopaedics

- In April 2024, Zimmer Biomet successfully performed the world's first robotic-assisted shoulder replacement surgery using its ROSA Shoulder System. This milestone demonstrates the system's capability to assist surgeons in planning and executing complex shoulder procedures with enhanced precision and personalized car

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.