Global Medical Radiation Shielding Market

Market Size in USD Billion

CAGR :

%

USD

1.00 Billion

USD

1.56 Billion

2025

2033

USD

1.00 Billion

USD

1.56 Billion

2025

2033

| 2026 –2033 | |

| USD 1.00 Billion | |

| USD 1.56 Billion | |

|

|

|

|

Medical Radiation Shielding Market Size

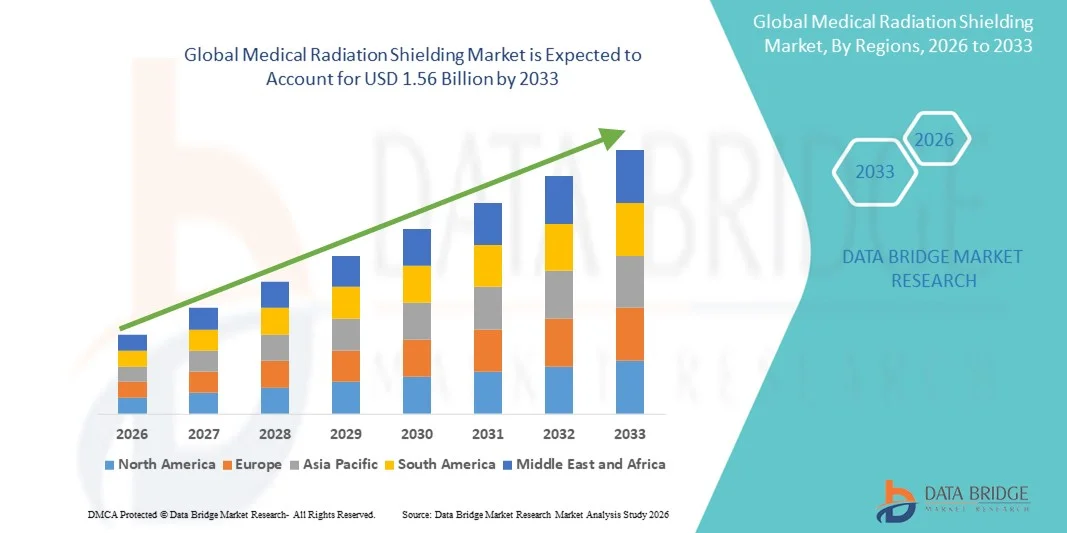

- The global medical radiation shielding market size was valued at USD 1.00 billion in 2025 and is expected to reach USD 1.56 billion by 2033, at a CAGR of 5.75% during the forecast period

- The market growth is largely fueled by rising usage of radiology and diagnostic imaging and increasing demand for radiation therapy, driving the need for shielding materials in hospitals, diagnostic centers, and imaging facilities

- Furthermore, technological advancement in shielding materials and growing regulatory emphasis on radiation safety for patients and healthcare professionals is establishing radiation shielding as a critical safety infrastructure in modern medical facilities

Medical Radiation Shielding Market Analysis

- Medical radiation shielding, encompassing MRI shielding products, shields, barriers, booths, sheet lead, lead glass, and lead bricks, is increasingly vital in modern healthcare facilities including hospitals, diagnostic centers, and oncology centers due to its critical role in patient and staff safety, regulatory compliance, and operational efficiency

- The escalating demand for medical radiation shielding is primarily fueled by the rising number of diagnostic imaging procedures growing prevalence of cancer and chronic diseases, and increasing emphasis on radiation safety for healthcare professionals and patients

- North America dominated the medical radiation shielding market with the largest revenue share of 38.4% in 2025, characterized by advanced healthcare infrastructure, stringent radiation safety regulations, and a strong presence of key industry players, with the U.S. experiencing substantial growth in shielding installations across hospitals and diagnostic centers, driven by innovations in lead-free composites, modular shielding panels, and advanced MRI shielding solutions

- Asia-Pacific is expected to be the fastest growing region in the medical radiation shielding market during the forecast period due to expanding healthcare infrastructure, rising healthcare expenditure, and increasing adoption of advanced imaging and radiotherapy technologies

- Radiation therapy shielding segment dominated the medical radiation shielding market with a market share of 44.8% in 2025, driven by the increasing adoption of radiotherapy procedures, growing cancer prevalence, and the need for comprehensive protection of patients and medical staff during high-dose radiation treatments

Report Scope and Medical Radiation Shielding Market Segmentation

|

Attributes |

Medical Radiation Shielding Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Medical Radiation Shielding Market Trends

Advancements in Lead-Free and Modular Shielding Solutions

- A significant and accelerating trend in the global medical radiation shielding market is the increasing development of lead-free, lightweight, and modular shielding systems, enhancing safety and installation flexibility in healthcare facilities

- For instance, Xstrahl’s modular lead-free shielding panels allow hospitals to retrofit diagnostic and therapy rooms without extensive structural modifications, reducing installation time and costs

- Innovations in material science enable radiation shields to maintain protection efficacy while minimizing weight, making them easier to transport, install, and reposition within hospitals or diagnostic centers

- The integration of modular shielding with advanced imaging and radiotherapy systems allows seamless adaptation to varying room configurations and equipment layouts, optimizing operational efficiency and safety

- Growing adoption of smart and IoT-enabled shielding solutions that monitor radiation exposure in real time is improving operational safety and compliance in high-traffic imaging and therapy rooms

- Manufacturers are increasingly developing customizable shielding products tailored to specific equipment and room layouts, enabling hospitals to optimize protection while minimizing material use and cost

- This trend towards more portable, efficient, and environmentally friendly shielding solutions is driving manufacturers such as Varian and Shielding International to develop next-generation products with improved ergonomics and radiation protection

- The demand for modular, lead-free, and easily deployable shielding solutions is growing rapidly across hospitals, diagnostic centers, and oncology clinics, as facilities prioritize safety, compliance, and operational efficiency

Medical Radiation Shielding Market Dynamics

Driver

Increasing Demand Due to Rising Diagnostic and Radiotherapy Procedures

- The rising number of diagnostic imaging and radiation therapy procedures is a major driver for the growing adoption of medical radiation shielding across healthcare facilities

- For instance, in March 2025, Siemens Healthineers introduced new MRI-compatible shielding solutions for diagnostic centers, aiming to improve radiation safety and operational efficiency

- Healthcare facilities are increasingly focused on protecting patients and staff from ionizing radiation exposure, making shielding products critical for compliance with regulatory safety standards

- The growing prevalence of cancer and chronic diseases globally is expanding the need for radiotherapy shielding in oncology centers and hospitals, fueling consistent market growth

- Demand is also driven by the expansion of imaging and therapy infrastructure in emerging regions, where investments in advanced shielding solutions are increasing to meet international safety norms

- Rising government initiatives and funding for radiation safety and hospital infrastructure upgrades are encouraging healthcare providers to adopt advanced shielding solutions

- Increasing awareness among patients and healthcare professionals about radiation hazards is pushing hospitals and clinics to prioritize the installation of high-quality shielding systems

Restraint/Challenge

High Costs and Regulatory Compliance Complexity

- The relatively high cost of advanced shielding materials and installation can restrict adoption, particularly for smaller hospitals and diagnostic centers in developing regions

- For instance, lead-free composite shields with modular designs often require higher capital investment compared to conventional lead-based systems, limiting their affordability

- Regulatory compliance requirements for radiation protection are complex and vary by region, creating challenges for manufacturers and healthcare facilities in ensuring consistent adherence

- Differences in international safety standards and certification processes can slow down product deployment, particularly in multi-national healthcare chains or cross-border facility expansions

- Overcoming these challenges through cost-effective solutions, standardized compliance frameworks, and education on regulatory requirements is essential for continued market growth

- Limited awareness or technical expertise among healthcare staff about proper installation and maintenance of shielding products can reduce operational effectiveness and safety

- Supply chain disruptions or raw material shortages, particularly for specialized lead or lead-free composites, can delay project implementation and increase overall costs

Medical Radiation Shielding Market Scope

The market is segmented on the basis of product, solution, and end-user.

- By Product

On the basis of product, the medical radiation shielding market is segmented into MRI shielding products, shields, barriers, booths, sheet lead, lead glass, lead bricks, and others. The Shields segment dominated the market with the largest market revenue share of 36.8% in 2025, driven by their versatility and widespread adoption across hospitals, diagnostic centers, and oncology clinics. Shields provide reliable protection against X-rays and other ionizing radiation while being relatively easy to install and maintain. They are compatible with various room configurations and imaging equipment, making them a preferred choice for healthcare facilities. Hospitals often prioritize shields due to their balance of cost, protection, and adaptability. The segment’s growth is also supported by technological advancements such as lead-free composite shields, which reduce weight and environmental hazards. Healthcare providers value shields for their long-term durability and regulatory compliance, contributing to consistent demand.

The MRI Shielding Products segment is anticipated to witness the fastest growth rate of 19.5% from 2026 to 2033, fueled by the increasing installation of MRI systems in emerging markets and modern hospitals. These products are designed to minimize electromagnetic interference while ensuring radiation safety, making them critical for both patient safety and accurate imaging. Growing awareness of radiation hazards and stricter safety regulations are driving the adoption of advanced MRI shielding solutions. The demand is further boosted by the trend of retrofitting existing facilities with MRI-compatible shielding. MRI shielding products also offer customization options to fit different scanner models and room designs, enhancing operational efficiency.

- By Solution

On the basis of solution, the market is segmented into radiation therapy shielding and diagnostic shielding. The Radiation Therapy Shielding segment dominated the market with the largest revenue share of 44.8% in 2025, driven by the increasing prevalence of cancer and the expansion of oncology centers worldwide. These shielding solutions protect medical staff and patients from high-dose radiation during radiotherapy procedures. Hospitals and oncology centers prioritize comprehensive shielding in treatment rooms, including walls, barriers, and booths, to ensure compliance with regulatory safety standards. Technological advancements, such as modular and lead-free shielding, have made radiation therapy shielding more adaptable and cost-effective. The segment benefits from growing investments in radiotherapy infrastructure, particularly in emerging economies. Providers also prefer integrated solutions that combine protective barriers with real-time radiation monitoring.

The Diagnostic Shielding segment is expected to witness the fastest CAGR of 18.7% from 2026 to 2033, fueled by the rapid adoption of advanced imaging techniques such as CT scans, X-rays, and nuclear medicine. Diagnostic shielding is essential for protecting staff and patients from repeated low-dose radiation exposure in high-traffic imaging departments. Hospitals and diagnostic centers are increasingly retrofitting rooms with lead glass, sheet lead, and mobile shields to comply with safety standards. Rising awareness about occupational radiation risks and stricter compliance regulations are driving demand. Innovations in lightweight and modular diagnostic shields also enable faster installation and improved space utilization. The segment is gaining traction in outpatient centers and private diagnostic facilities due to its cost-effectiveness and ease of integration.

- By End-User

On the basis of end-user, the market is segmented into hospitals, diagnostic centers, oncology centers, and others. The Hospitals segment dominated the market with the largest revenue share of 42.1% in 2025, driven by the high volume of both diagnostic and therapeutic procedures requiring comprehensive radiation protection. Hospitals are increasingly installing modular shielding panels, booths, and lead glass to safeguard patients, staff, and visitors. The demand is fueled by hospital expansions, adoption of advanced imaging and radiotherapy equipment, and compliance with stringent regulatory standards. Hospitals also invest in customizable shielding solutions for room-specific layouts and equipment configurations. Integration of modular shielding with real-time radiation monitoring systems further enhances safety. Hospitals’ large-scale infrastructure projects and government funding support the continued dominance of this segment.

The Diagnostic Centers segment is anticipated to witness the fastest growth rate of 20.3% from 2026 to 2033, driven by the rapid expansion of outpatient diagnostic facilities and imaging centers, particularly in urban areas of emerging economies. These centers require compact, portable, and cost-effective shielding solutions due to space constraints and budget limitations. Increasing patient volumes, growing preventive healthcare initiatives, and rising awareness of radiation safety are driving demand. Diagnostic centers prefer modular and lead-free shielding products for quick setup and compliance with local safety regulations. Technological advancements, such as customizable shields and booths, allow these centers to adopt modern imaging techniques safely. The trend of standalone diagnostic centers offering multiple imaging services is further accelerating market growth in this segment.

Medical Radiation Shielding Market Regional Analysis

- North America dominated the medical radiation shielding market with the largest revenue share of 38.4% in 2025, characterized by advanced healthcare infrastructure, stringent radiation safety regulations, and a strong presence of key industry players

- Healthcare providers in the region prioritize advanced shielding solutions to protect patients and medical staff from ionizing radiation during imaging and therapeutic procedures, ensuring compliance with safety standards

- This widespread adoption is further supported by well-established hospitals and oncology centers, high awareness of radiation hazards, and growing demand for lead-free and modular shielding solutions, establishing medical radiation shielding as a critical safety component in modern healthcare facilities

U.S. Medical Radiation Shielding Market Insight

The U.S. medical radiation shielding market captured the largest revenue share of 82% in 2025 within North America, fueled by the rapid expansion of hospitals, diagnostic centers, and oncology facilities. Healthcare providers are increasingly prioritizing advanced shielding solutions to ensure patient and staff safety from ionizing radiation. The growing adoption of modular, lead-free, and MRI-compatible shielding systems further propels the market. Moreover, stringent federal and state regulations regarding radiation protection and occupational safety are significantly contributing to market expansion. The demand for retrofitting existing facilities with advanced shielding solutions also supports sustained growth in the U.S.

Europe Medical Radiation Shielding Market Insight

The Europe medical radiation shielding market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent radiation safety regulations and the rising need for protection in hospitals, diagnostic centers, and oncology clinics. Increasing urbanization and expansion of advanced medical facilities are fostering the adoption of shielding solutions. European healthcare providers are focusing on safety-compliant, lead-free, and modular shielding systems to enhance operational efficiency. The region is experiencing significant growth across diagnostic and therapeutic applications, with shielding solutions being integrated into both new constructions and renovation projects.

U.K. Medical Radiation Shielding Market Insight

The U.K. medical radiation shielding market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the increasing trend of healthcare modernization and the need for enhanced radiation protection. Concerns regarding occupational exposure and patient safety are encouraging hospitals and diagnostic centers to adopt advanced shielding solutions. The U.K.’s strong healthcare infrastructure, robust regulatory framework, and increasing adoption of lead-free and modular shields are expected to continue stimulating market growth. Integration of shielding with advanced imaging and therapy systems is becoming increasingly prevalent, meeting local compliance and safety expectations.

Germany Medical Radiation Shielding Market Insight

The Germany medical radiation shielding market is expected to expand at a considerable CAGR during the forecast period, fueled by rising awareness of radiation hazards and the growing demand for technologically advanced and eco-friendly shielding solutions. Germany’s well-developed healthcare infrastructure and focus on innovation promote adoption in hospitals, diagnostic centers, and oncology facilities. Modular shielding systems and MRI-compatible products are gaining traction due to their ease of installation and operational flexibility. Providers also prioritize safety-compliant, sustainable solutions, aligning with both environmental standards and local consumer expectations.

Asia-Pacific Medical Radiation Shielding Market Insight

The Asia-Pacific medical radiation shielding market is poised to grow at the fastest CAGR of 23% during the forecast period of 2026 to 2033, driven by increasing hospital and diagnostic center expansions in countries such as China, Japan, and India. Rapid urbanization, rising healthcare expenditure, and government initiatives promoting hospital safety and radiation protection are driving adoption. Moreover, the region is emerging as a manufacturing hub for shielding systems, improving affordability and accessibility. Advanced modular and lead-free shielding solutions are increasingly being deployed in both new constructions and retrofitting projects, expanding market penetration.

Japan Medical Radiation Shielding Market Insight

The Japan medical radiation shielding market is gaining momentum due to the country’s focus on healthcare modernization, patient safety, and advanced medical imaging adoption. The market growth is driven by rising demand for MRI-compatible and modular shielding systems in hospitals and diagnostic centers. Integration with other medical safety technologies, such as real-time radiation monitoring, is fueling adoption. Furthermore, Japan’s aging population and high-tech healthcare environment are expected to spur demand for safer, more efficient shielding solutions in both residential and commercial medical facilities.

India Medical Radiation Shielding Market Insight

The India medical radiation shielding market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s rapidly expanding healthcare infrastructure, urbanization, and increasing installation of diagnostic and radiotherapy centers. India is emerging as a key market for lead-free, modular, and cost-effective shielding solutions. Government initiatives supporting hospital safety and radiation protection, combined with a growing middle class and increasing awareness of radiation hazards, are key factors propelling market growth. The availability of affordable shielding options and domestic manufacturing capabilities further support the market expansion in India.

Medical Radiation Shielding Market Share

The Medical Radiation Shielding industry is primarily led by well-established companies, including:

- Marswell Group of Companies (Canada)

- Ultraray Radiation Protection (U.S.)

- Ray Bar Engineering Corp (U.S.)

- MAVIG GmbH (Germany)

- Nuclear Shields Ltd. (Netherlands)

- Radiation Protection Products, Inc. (U.S.)

- ZHENGZHOU RAYSHIELD MEDICAL CO LTD (China)

- Rayprotec (U.K.)

- Corning Incorporated (U.S.)

- SCHOTT AG (Germany)

- Nippon Electric Glass Co., Ltd. (Japan)

- A&L Shielding (U.S.)

- Veritas Medical Solutions LLC (U.S.)

- AmRay Medical (U.S.)

- Gaven Industries Inc. (U.S.)

- Nelco Inc (U.S.)

- Wardray Premise Ltd. (U.K.)

- Envirotect Ltd. (U.K.)

- Mayco Industries (U.S.)

- Barrier Technologies (U.S.)

What are the Recent Developments in Global Medical Radiation Shielding Market?

- In August 2025, Changzhou Jinruifu Shielding Equipment Co., LTD launched a new MRI Shielding Room solution, custom-built for MRI equipment, designed to isolate external radio‑frequency signals and ensure interference‑free MRI imaging in hospitals and diagnostic centers

- In June 2025, MarShield released a new series of lead‑free composite barriers and curtains, targeting hospitals seeking sustainable, lightweight alternatives to conventional lead shielding reflecting growing demand for environmentally safer shielding materials

- In October 2023, Specialist Door Solutions Ltd. (SDS) introduced its Shieldoor lead‑lined X‑ray doors, engineered specifically for healthcare settings to provide effective radiation protection for X‑ray rooms, offering customizable lead thickness options for compliance with safety standards

- In August 2023, MXR Imaging Inc. acquired Spartan Shielding LLC (a company specializing in shielding for MRI rooms), enhancing MXR’s manufacturing and testing capabilities for RF, magnetic, and radiation protection systems strengthening the supply chain for shielding solutions globally

- In February 2023, Specialist Door Solutions Ltd. (UK) launched its “Shieldoor lead‑lined X‑ray door” for radiology facilities providing hospitals and diagnostic centers with customizable, lead-lined doors to improve room-level radiation containment during X-ray procedures

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.