Global Medical Plastomer Market

Market Size in USD Billion

CAGR :

%

USD

1,130.71 Billion

USD

1,727.40 Billion

2025

2033

USD

1,130.71 Billion

USD

1,727.40 Billion

2025

2033

| 2026 –2033 | |

| USD 1,130.71 Billion | |

| USD 1,727.40 Billion | |

|

|

|

|

Medical Plastomer Market Size

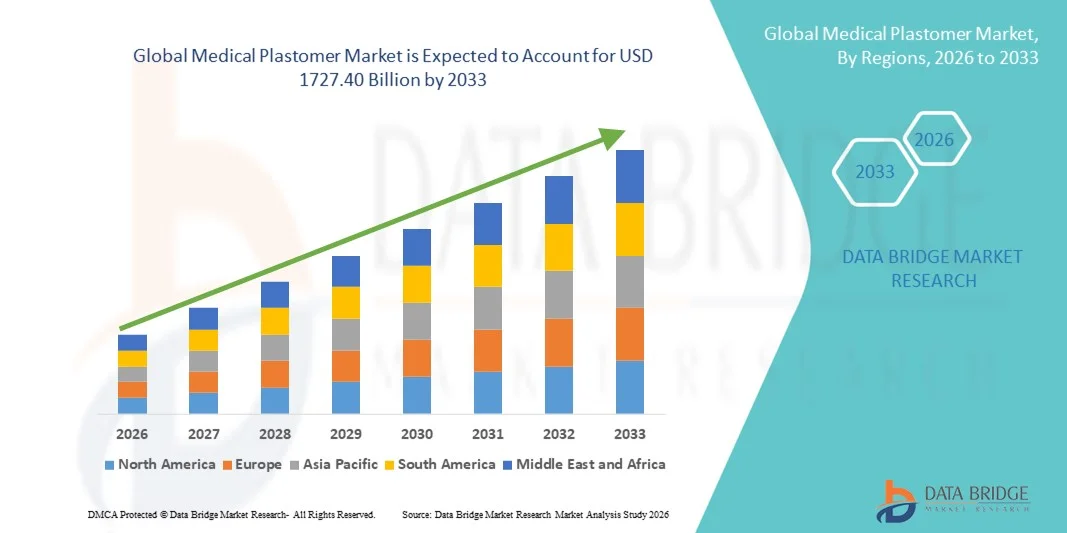

- The global Medical Plastomer market size was valued at USD 1130.71 billion in 2025 and is expected to reach USD 1727.40 billion by 2033, at a CAGR of 5.44% during the forecast period

- The market growth is largely fueled by increasing adoption of advanced medical materials and technological innovations in healthcare, leading to enhanced performance, durability, and biocompatibility of medical devices

- Furthermore, rising demand for lightweight, flexible, and customizable medical components is driving the adoption of Medical Plastomer solutions across medical device manufacturing, drug delivery systems, and disposable medical products. These converging factors are significantly boosting the growth of the Medical Plastomer Market

Medical Plastomer Market Analysis

- Medical Plastomers, offering flexible, biocompatible, and durable polymeric solutions, are increasingly vital components in medical devices, drug delivery systems, and disposable healthcare products due to their versatility, safety, and performance in clinical applications

- The escalating demand for Medical Plastomers is primarily fueled by growing adoption in advanced healthcare applications, increasing R&D in polymer-based medical solutions, and rising need for cost-effective, high-performance materials across hospitals, clinics, and medical device manufacturers

- North America dominated the medical plastomer market with the largest revenue share of 37.8% in 2025, supported by well-established healthcare infrastructure, strong R&D capabilities, high adoption of advanced medical technologies, and the presence of key industry players in polymer-based medical solutions.

- Asia-Pacific is expected to be the fastest-growing region in the medical plastomer market during the forecast period, with a projected CAGR of 8.6%, driven by rising healthcare expenditure, rapid urbanization, increasing number of medical device manufacturers, and growing demand for cost-effective, high-performance polymeric materials

- The Film segment held the largest market revenue share of approximately 41.2% in 2025, owing to its extensive use in medical packaging, sterile pouches, and barrier layers for pharmaceuticals

Report Scope and Medical Plastomer Market Segmentation

|

Attributes |

Medical Plastomer Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Medical Plastomer Market Trends

Rising Adoption in Minimally Invasive and Advanced Medical Applications

- The global Medical Plastomer market is witnessing a significant trend of increasing application in minimally invasive procedures, advanced medical devices, and patient-centric solutions

- These materials are highly valued for their flexibility, durability, chemical resistance, and biocompatibility, making them ideal for use in catheters, tubing, implantable devices, and surgical instruments

- For instance, Medtronic has integrated advanced thermoplastic elastomers into its cardiac catheters, enhancing flexibility while minimizing patient discomfort. B. Braun has adopted plastomer-based tubing for infusion systems to improve kink resistance and ensure sterile fluid delivery. Similarly, Boston Scientific uses specialized plastomers in endoscopic devices to provide precise maneuverability during delicate procedures

- The shift toward single-use, disposable devices is driving adoption, as medical plastomers are easier to sterilize and maintain consistent performance compared to conventional materials

- The trend toward biodegradable and eco-friendly medical devices is also growing, with companies exploring recyclable and medical-grade compostable plastomers to address sustainability concerns

- Medical plastomers are increasingly being used in wearable healthcare devices, such as soft tubing for insulin pumps and flexible components in portable oxygen delivery systems, offering both patient comfort and device reliability

- Growing R&D initiatives to develop high-performance plastomers capable of withstanding extreme sterilization processes (autoclaving, gamma irradiation) are further strengthening their adoption in critical care settings

Medical Plastomer Market Dynamics

Driver

Expanding Healthcare Infrastructure and Rising Medical Device Demand

- The increasing prevalence of chronic diseases, expanding surgical procedures, and rising awareness of advanced healthcare solutions are driving the adoption of medical plastomers globally. Hospitals, outpatient care centers, and specialty clinics are integrating plastomer-based devices for improved patient safety, precision, and ease of use

- For instance, in 2025, Apollo Hospitals in India increased its use of plastomer-based catheters and tubing in cardiac and neonatal care units, improving patient outcomes and device reliability. Philips Healthcare in Europe integrated medical plastomer components into minimally invasive surgical systems, enhancing device flexibility and reducing procedural complications

- The trend of outpatient surgeries and minimally invasive interventions is further accelerating demand, as plastomer-based devices are lightweight, flexible, and compatible with advanced surgical tools

- Government healthcare initiatives in emerging markets, such as India’s National Health Mission and China’s Healthy China 2030 plan, are increasing investments in modern medical infrastructure, indirectly boosting plastomer demand for critical devices and consumables

- Collaborations between material suppliers and OEMs are enabling innovation in device design, with companies like Teknor Apex and Elastomer Solutions providing custom formulations to enhance mechanical strength, chemical resistance, and sterilization tolerance

- The growing middle-class population in Asia-Pacific and Latin America, along with increasing insurance coverage for advanced procedures, is fueling higher adoption of high-performance plastomer-based medical devices

Restraint/Challenge

High Costs, Supply Chain Dependencies, and Regulatory Barriers

- Advanced medical-grade plastomers are generally more expensive than traditional polymers, which can pose challenges for cost-sensitive healthcare providers and smaller OEMs, especially in developing regions

- For instance, Stryker’s plastomer-based orthopedic implants come at a premium price point, while smaller medtech manufacturers in Southeast Asia struggle to procure FDA-approved or CE-marked elastomers in sufficient quantities for high-volume production

- Stringent regulatory standards for medical-grade polymers, including ISO 10993 biocompatibility testing, FDA approvals, and CE certifications, can significantly increase development timelines and costs

- Supply chain dependencies on specialty chemical suppliers can create bottlenecks, particularly for high-performance thermoplastic elastomers with precise chemical and mechanical properties. Delays in sourcing these raw materials may disrupt production cycles and increase costs

- In addition, variations in sterilization requirements across different medical applications (gamma irradiation, autoclaving, ethylene oxide sterilization) require plastomers with highly specific properties, adding complexity to material selection and device design

- Price sensitivity, coupled with lack of awareness among small-scale device manufacturers about the advantages of plastomers over conventional materials, can slow adoption in emerging markets

- Overcoming these challenges involves investment in advanced supply chain management, R&D for cost-effective formulations, regulatory compliance expertise, and educational initiatives to highlight the long-term benefits of medical plastomer adoption in improving patient outcomes and device reliability

Medical Plastomer Market Scope

The market is segmented on the basis of product, type, and processing.

- By Product

On the basis of product, the Medical Plastomer market is segmented into Ethylene Propylene, Ethylene Butene, Ethylene Hexene, and Ethylene Octene. The Ethylene Propylene segment dominated the largest market revenue share of approximately 38.5% in 2025, owing to its superior flexibility, chemical resistance, and biocompatibility, which make it ideal for medical tubing, seals, and gaskets. Its compatibility with sterilization processes such as gamma irradiation and autoclaving ensures widespread adoption in hospitals, clinics, and pharmaceutical packaging. The segment benefits from established supply chains and high availability of raw materials. Medical device manufacturers prefer Ethylene Propylene for its stable physical and mechanical properties, ensuring consistent product performance. Rising demand for disposable medical devices, such as catheters and IV sets, drives consumption. Regulatory approvals in multiple regions support market dominance. High processability and recyclability further strengthen the segment’s position. Global awareness about patient safety and hygiene standards fuels preference. Long-term contracts between OEMs and suppliers stabilize revenues. Integration into complex medical device assemblies reinforces market share. Its broad application across tubing, seals, and flexible packaging continues to support sustained growth.

The Ethylene Hexene segment is expected to witness the fastest CAGR of around 22.8% from 2026 to 2033, driven by increasing demand for high-performance plastomers with superior elasticity and tensile strength. Rising applications in flexible medical packaging, protective films, and advanced tubing boost adoption. Ethylene Hexene’s compatibility with co-extrusion and multi-layer structures allows enhanced barrier properties. Expanding pharmaceutical packaging and single-use medical device markets further accelerate growth. Its use in high-volume production lines reduces operational costs for manufacturers. Innovations in material blends enhance performance for specialized applications. Growing adoption in minimally invasive devices supports expansion. Regulatory compliance for safe use in healthcare settings ensures trust. Development of new extrusion and molding techniques contributes to efficiency. Emerging markets in Asia-Pacific drive additional demand. Continuous R&D on high-performance resins sustains adoption. Rising awareness of plastomer advantages over conventional polymers fuels growth momentum.

- By Type

On the basis of type, the Medical Plastomer market is segmented into Wires and Cables, Film, and Packaging. The Film segment held the largest market revenue share of approximately 41.2% in 2025, owing to its extensive use in medical packaging, sterile pouches, and barrier layers for pharmaceuticals. Films provide excellent flexibility, puncture resistance, and oxygen/moisture barrier properties critical for medical product integrity. High compatibility with sterilization processes, such as ethylene oxide and gamma radiation, further strengthens adoption. Growing demand from hospitals and pharmaceutical industries for safe, single-use packaging drives market dominance. Multi-layer film structures enable advanced performance for medical devices. Regulatory certifications for safe medical contact support industry preference. Film’s adaptability to flexible and rigid applications makes it a key choice. Long shelf-life and product protection enhance commercial appeal. Automated production systems ensure consistent quality and supply. Film manufacturing supports large-scale production needs. Rising focus on patient safety drives higher utilization. Integration into medical device assemblies maintains sustained dominance.

The Packaging segment is expected to witness the fastest CAGR of around 23.5% from 2026 to 2033, fueled by the growing trend of pre-filled syringes, IV sets, and single-use medical kits. Increasing global demand for sterile, tamper-evident, and leak-proof packaging accelerates adoption. Medical Plastomers in packaging offer excellent chemical resistance and high transparency. Rapid growth in pharmaceutical logistics and home healthcare solutions supports market expansion. Enhanced barrier films improve drug stability and shelf-life. Flexible designs enable cost-efficient production and transport. Regulatory emphasis on patient safety encourages outsourcing to specialized packaging manufacturers. Emerging markets with expanding healthcare infrastructure drive additional growth. Increasing focus on eco-friendly and recyclable packaging boosts adoption. New extrusion and lamination techniques enhance performance. Rising outsourcing of packaging operations to specialized vendors sustains momentum. Growth of e-pharmacies and home delivery of healthcare products strengthens segment CAGR.

- By Processing

On the basis of processing, the Medical Plastomer market is segmented into Blow Film Extrusion, Cast Film Extrusion, Extrusion Coating, Injection Molding, and Others. The Blow Film Extrusion segment dominated the largest market revenue share of approximately 36.8% in 2025, driven by its cost-effectiveness and ability to produce multi-layer medical films for packaging and disposable devices. Blow film extrusion allows consistent thickness control, superior barrier properties, and flexibility, critical for medical applications. Hospitals and pharmaceutical companies rely on this method for high-volume production. The technology supports customization for patient-centric packaging solutions. Integration with automated sterilization and sealing systems enhances efficiency. Long-standing adoption and established expertise strengthen market position. Multi-layer co-extrusions further improve functionality. Compliance with ISO and FDA standards supports segment leadership. Rapid production cycles reduce manufacturing costs. Enhanced mechanical properties maintain reliability in transport and storage. Availability of skilled workforce ensures operational efficiency. Innovation in extrusion dies improves throughput and quality control. High demand in single-use disposables sustains dominance.

The Injection Molding segment is anticipated to witness the fastest CAGR of around 25.2% from 2026 to 2033, driven by the growing demand for complex, high-precision medical components such as syringes, valves, and device housings. The ability to produce intricate geometries with tight tolerances makes it ideal for medical devices. Increasing adoption of automation and robotics in molding operations enhances efficiency. Rising use in implantable devices and surgical instruments fuels growth. Regulatory compliance for biocompatibility supports adoption. Emerging markets are investing in advanced molding facilities. Technological innovation in mold design improves cycle times. Demand for personalized medical devices accelerates production needs. High repeatability and material efficiency reduce costs. Expansion in the diagnostic and drug delivery markets drives volume. OEMs prefer outsourcing injection molding for scalability. Integration with multi-material molding boosts segment CAGR. Continuous focus on precision and quality assurance ensures sustainable growth.

Medical Plastomer Market Regional Analysis

- North America dominated the medical plastomer market with the largest revenue share of 37.8% in 2025, supported by well-established healthcare infrastructure, strong R&D capabilities, and the presence of key industry players offering polymer-based medical solutions. The U.S., in particular, accounts for the majority of the regional revenue due to high adoption of advanced medical technologies and increased demand for disposable and high-performance medical devices. Hospitals and clinics in the region are increasingly using Medical Plastomer components for tubing, seals, films, and packaging materials due to their superior biocompatibility and durability

- High awareness about patient safety, stringent regulatory frameworks, and the availability of skilled workforce further enhance market penetration. The presence of major polymer manufacturers and consistent supply chains ensures the availability of quality materials. Rising investments in innovative healthcare solutions, coupled with a focus on cost-effective manufacturing, strengthen the market. Multi-layer film and injection-molded components see strong adoption in diagnostics and surgical applications

- Long-term collaborations between OEMs and suppliers stabilize revenue streams. The demand for high-performance materials in both implantable and non-implantable devices continues to drive growth. North America remains a hub for product innovation and commercialized Medical Plastomer applications

U.S. Medical Plastomer Market Insight

The U.S. medical plastomer market captured the largest revenue share within North America in 2025, making it the leading contributor to the regional market. Growth is driven by a highly developed healthcare infrastructure, strong R&D capabilities, and early adoption of advanced polymer-based medical technologies. Hospitals, specialty clinics, and outpatient centers increasingly rely on Medical Plastomer components for tubing, films, packaging, and injection-molded devices due to their superior biocompatibility, durability, and chemical resistance. The demand for disposable devices, minimally invasive surgical tools, and high-performance medical packaging fuels market expansion. High consumer awareness, stringent regulatory standards, and focus on patient safety further strengthen market penetration. Collaborations between OEMs and local polymer suppliers ensure consistent material supply. The U.S. market also benefits from innovation in multi-layer film, co-extrusion, and extrusion coating technologies. The rise of home healthcare, telemedicine, and outpatient treatments supports ongoing material demand. In addition, strong investments in healthcare automation and smart medical devices contribute to the market’s revenue growth. Cost-efficiency, high-quality standards, and a robust domestic supply chain further solidify the U.S.’s leading position in Medical Plastomer adoption.

Europe Medical Plastomer Market Insight

The Europe medical plastomer market held a significant share in 2025 and is projected to expand at a robust CAGR over the forecast period, driven by a growing emphasis on healthcare quality, regulatory compliance, and technological advancements in medical devices. Germany, France, and the U.K. are key contributors, with demand stemming from advanced hospitals, specialty clinics, and pharmaceutical packaging applications. The adoption of polymer-based solutions in catheters, tubing, films, and packaging ensures product safety and flexibility. European manufacturers are increasingly integrating sustainable, eco-conscious materials in line with regulatory guidelines. The growing prevalence of chronic diseases and expansion of minimally invasive surgeries support material adoption. Multi-layer films for sterile packaging and injection-molded components for surgical devices are particularly in demand. Hospitals and medical device OEMs are emphasizing patient safety, driving standardized use of Medical Plastomer components. Advanced R&D and collaborations with global polymer producers support product innovation. Consumer awareness and the adoption of new medical technologies further stimulate growth. The region’s strong healthcare spending and focus on precision medicine contribute to ongoing market expansion.

U.K. Medical Plastomer Market Insight

The U.K. medical plastomer market is anticipated to grow at a noteworthy CAGR, supported by the country’s adoption of advanced medical devices and polymer-based components for both hospitals and specialty clinics. Rising investments in healthcare infrastructure, coupled with increased focus on disposable and sterile medical products, drive demand. The U.K. market emphasizes biocompatibility, safety, and regulatory compliance, encouraging widespread use in diagnostics, surgical devices, and medical packaging. Growing outpatient and home healthcare services expand the need for cost-effective and high-performance plastomer components. The presence of leading polymer and medical device manufacturers ensures a robust supply chain. Focus on sustainable and recyclable materials aligns with regulatory and consumer expectations. Increased adoption of injection-molded devices, multi-layer films, and tubing solutions fuels demand. The market also benefits from a growing number of ambulatory surgical centers and clinics requiring high-quality materials. Collaboration with global suppliers enhances product innovation. The rise of e-health and home monitoring devices contributes to increasing plastomer usage. Continued urbanization and technological adoption maintain steady market growth.

Germany Medical Plastomer Market Insight

The Germany medical plastomer market is expected to expand at a considerable CAGR, driven by technological advancements, strong healthcare infrastructure, and a focus on eco-friendly and high-performance polymeric materials. Germany’s hospitals and specialty clinics prioritize safety, biocompatibility, and material reliability, promoting widespread adoption of Medical Plastomer components. Injection-molded devices, tubing, films, and packaging are widely used across diagnostics, surgical, and drug delivery applications. The region benefits from established R&D centers collaborating with polymer producers to innovate high-performance materials. Regulatory compliance with EU and local standards ensures safety and reliability. Adoption of minimally invasive surgeries, home care solutions, and outpatient services increases material demand. Multi-layer films, co-extrusions, and extrusion coating technologies are becoming standard for medical packaging. Industrial partnerships support large-scale production. Continuous innovation and material upgrades drive consistent revenue. Awareness about hygiene, patient safety, and sustainable solutions further reinforces market adoption. Germany continues to be a hub for high-quality Medical Plastomer applications in Europe.

Asia-Pacific Medical Plastomer Market Insight

The Asia-Pacific medical plastomer market is expected to be the fastest-growing region with a projected CAGR of 8.6% during 2026–2033. Growth is fueled by rising healthcare expenditure, rapid urbanization, and the increasing number of medical device manufacturers across China, Japan, and India. Expanding hospitals, specialty clinics, and diagnostic centers are driving demand for cost-effective, high-performance polymeric materials. Medical Plastomers are increasingly used in tubing, seals, films, packaging, and disposable devices, supported by local manufacturing hubs that enhance affordability and accessibility. Government initiatives promoting healthcare infrastructure and digitalization contribute to market growth. Rapid adoption of minimally invasive devices, home care solutions, and disposable medical products accelerates demand. Expansion of domestic polymer producers ensures a steady supply. Investment in R&D supports product customization and innovation for local needs. Regulatory improvements and safety awareness encourage adoption of high-quality materials. Multi-layer films, extrusion coating, and injection-molded components are increasingly utilized. The Asia-Pacific market benefits from cost advantages, large patient populations, and growing medical device export opportunities.

Japan Medical Plastomer Market Insight

The Japan medical plastomer market is gaining momentum due to rapid urbanization, high-tech healthcare adoption, and demand for innovative medical solutions. Hospitals and specialty clinics emphasize safety, reliability, and biocompatibility, boosting demand for tubing, films, packaging, and injection-molded devices. Aging population and home care solutions increase the need for disposable and easy-to-use medical products. Integration of Medical Plastomer components in diagnostics, surgical, and drug delivery devices continues to rise. Government incentives and technological innovation support material adoption. Regulatory compliance ensures high-quality, safe usage. Collaboration with local polymer manufacturers enhances efficiency and product development. Continuous innovation in blow film and cast film extrusion technologies improves production. Adoption of eco-friendly and recyclable solutions strengthens market appeal. Expansion of healthcare networks and outpatient services supports growth. Rising medical device exports further contribute to demand. Japan maintains strong adoption of advanced polymer-based solutions in the healthcare sector.

China Medical Plastomer Market Insight

The China medical plastomer market accounted for the largest market revenue share in Asia-Pacific in 2025, supported by rapid urbanization, expanding healthcare infrastructure, and growing medical device manufacturing. The country is a major hub for polymer-based medical solutions, including tubing, films, packaging, and injection-molded devices. Rising domestic demand for cost-effective, high-performance materials drives adoption. Government initiatives for healthcare improvement and smart hospital infrastructure fuel growth. Strong presence of local polymer manufacturers ensures steady material availability. The market benefits from a large patient population and increasing outpatient and home healthcare services. Rapid adoption of minimally invasive surgeries and disposable devices enhances demand. Multi-layer films and co-extrusion technologies improve packaging performance. Regulatory improvements boost confidence in product safety. Expansion of domestic and international medical device exports supports production growth. Continuous innovation and R&D investment sustain market momentum. China is expected to maintain leadership in APAC due to scale, cost efficiency, and technological advancement.

Medical Plastomer Market Share

The Medical Plastomer industry is primarily led by well-established companies, including:

- ExxonMobil Chemical (U.S.)

- INEOS (U.K.)

- LyondellBasell Industries (Netherlands)

- Dow Chemical Company (U.S.)

- SABIC (Saudi Arabia)

- Borealis AG (Austria)

- Chevron Phillips Chemical (U.S.)

- W. R. Grace & Co. (U.S.)

- Repsol SA (Spain)

- Formosa Plastics Corp. (Taiwan)

- Japan Polychem Corp. (Japan)

- LCY Chemical Corp. (Taiwan)

- Arkema S.A. (France)

- DSM Engineering Materials (Netherlands)

- Mitsui Chemicals (Japan)

Latest Developments in Global Medical Plastomer Market

- In April 2023, BASF SE announced expanded medical‑grade thermoplastic polyurethane (TPU) and plastomer formulations designed for use in flexible medical devices and components, aiming to improve biocompatibility, sterilization performance, and mechanical properties in critical healthcare applications

- In January 2024, BASF opened its largest thermoplastic polyurethane production line at the Zhanjiang Verbund site in China to meet rising demand for medical elastomers and plastomer‑related materials used in medical tubing, catheters, and wearable devices — enabling higher capacity supply for the healthcare sector

- In July 2025, DuPont and Medline Industries announced a strategic partnership to co‑develop and supply advanced medical elastomer and plastomer formulations for single‑use medical devices, standardizing high‑performance biocompatible materials across device families and expanding global material availability

- In March 2025, Zeon Corporation introduced a new medical‑grade silicone elastomer (a class of plastomer‑related material) specifically engineered for catheter applications with enhanced biocompatibility and sterilization stability, broadening high‑performance options for critical care devices

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.