Global Medical Oxygen Sensors Market

Market Size in USD Billion

CAGR :

%

USD

2.19 Billion

USD

4.88 Billion

2024

2032

USD

2.19 Billion

USD

4.88 Billion

2024

2032

| 2025 –2032 | |

| USD 2.19 Billion | |

| USD 4.88 Billion | |

|

|

|

|

Medical Oxygen Sensors Market Size

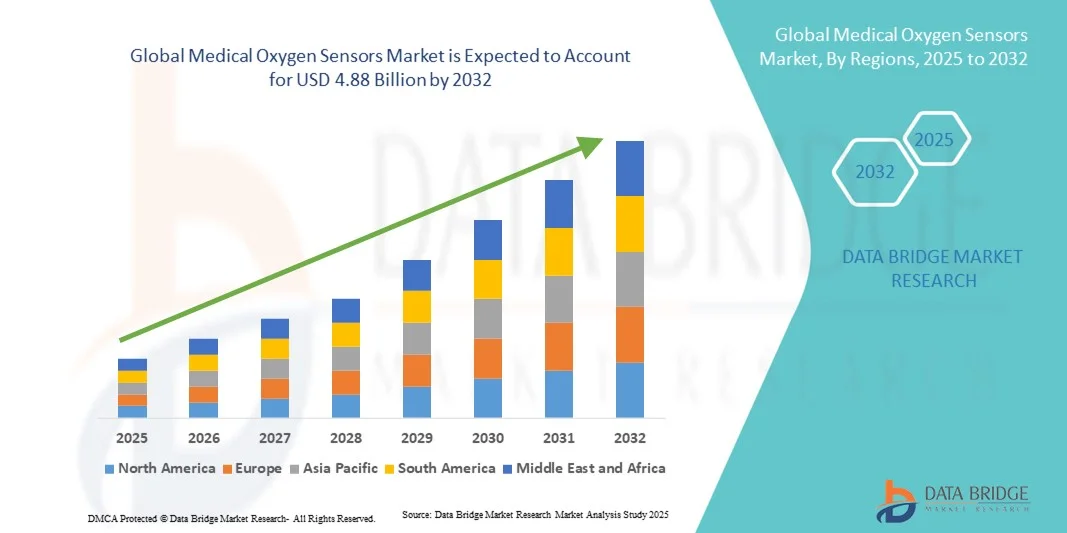

- The global medical oxygen sensors market size was valued at USD 2.19 billion in 2024 and is expected to reach USD 4.88 billion by 2032, at a CAGR of 10.50% during the forecast period

- The market growth is largely fueled by the increasing prevalence of chronic respiratory diseases, such as COPD and asthma, and the rising adoption of home healthcare and portable medical devices, which are expanding the application of oxygen sensors beyond traditional hospital settings

- Furthermore, technological advancements in sensor technologies, including electrochemical, optical, and zirconia-based sensors, are enhancing the accuracy and reliability of medical oxygen monitoring, thereby driving demand for advanced solutions in hospitals, clinics, and homecare environments

Medical Oxygen Sensors Market Analysis

- Medical oxygen sensors, used for monitoring and controlling oxygen levels in respiratory care and medical devices, are increasingly essential in hospitals, clinics, and home healthcare settings due to their critical role in patient safety, accuracy in oxygen delivery, and integration with modern medical monitoring systems

- The rising demand for medical oxygen sensors is primarily driven by the growing prevalence of chronic respiratory diseases, increased adoption of portable and home-based medical devices, and the need for accurate and reliable oxygen monitoring in critical care settings

- North America dominated the medical oxygen sensors market with the largest revenue share of 38.9% in 2024, attributed to advanced healthcare infrastructure, high healthcare expenditure, and a strong presence of leading sensor manufacturers, with the U.S. witnessing significant adoption in hospitals and homecare devices due to innovations in electrochemical, optical, and zirconia-based sensors

- Asia-Pacific is expected to be the fastest-growing region in the medical oxygen sensors market during the forecast period, fueled by increasing healthcare access, rising prevalence of respiratory disorders, and expanding medical device adoption in countries such as China and India

- Electrochemical sensors segment dominated the medical oxygen sensors market with a market share of 45.1% in 2024, driven by their high accuracy, reliability, and widespread use in both hospital-grade and portable medical oxygen monitoring devices

Report Scope and Medical Oxygen Sensors Market Segmentation

|

Attributes |

Medical Oxygen Sensors Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Medical Oxygen Sensors Market Trends

Advancements Through IoT and AI Integration

- A significant and accelerating trend in the global medical oxygen sensors market is the growing integration with Internet of Things (IoT) platforms and artificial intelligence (AI) for enhanced monitoring, predictive analysis, and remote patient management

- For instance, Masimo’s Rainbow SET technology integrates AI algorithms to provide continuous and predictive oxygen monitoring, allowing healthcare providers to anticipate patient needs more effectively

- AI integration enables features such as real-time anomaly detection, predictive alerts, and automated calibration adjustments, improving the accuracy and reliability of oxygen monitoring. For instance, Sensirion’s oxygen sensors utilize AI to reduce false readings and enhance data-driven decision-making in critical care

- Integration with IoT-enabled hospital systems and wearable medical devices allows centralized monitoring, enabling clinicians to track oxygen levels across multiple patients through a single interface

- This trend towards intelligent, connected, and automated oxygen sensing systems is reshaping healthcare delivery and patient care expectations. Consequently, companies such as Nonin are developing AI-enabled sensors with features such as predictive alerts and seamless integration with patient monitoring platforms

- The demand for oxygen sensors offering AI and IoT-enabled integration is growing rapidly across hospital, clinic, and homecare settings, as healthcare providers increasingly prioritize accuracy, remote monitoring, and operational efficiency

Medical Oxygen Sensors Market Dynamics

Driver

Increasing Demand Driven by Chronic Respiratory Diseases and Homecare Adoption

- The rising prevalence of chronic respiratory conditions, including COPD and sleep apnea, coupled with the growing adoption of home healthcare devices, is a significant driver of demand for medical oxygen sensors

- For instance, in March 2024, Philips Healthcare introduced IoT-enabled oxygen monitoring devices for homecare patients to enhance remote patient supervision and early intervention

- As patients and healthcare providers seek improved oxygen monitoring, sensors offering accurate real-time readings, alarms, and data logging present a compelling upgrade over traditional manual devices

- Furthermore, the increasing availability of portable oxygen concentrators and wearable devices is expanding sensor applications beyond hospitals to homecare settings, promoting broader adoption

- The convenience of remote monitoring, predictive alerts, and integration with mobile applications for both clinicians and patients is a key factor propelling market growth. The trend towards telemedicine adoption and user-friendly devices further accelerates sensor demand

Restraint/Challenge

Technical Limitations and Regulatory Compliance Hurdles

- Concerns related to sensor calibration accuracy, device reliability, and regulatory compliance pose challenges to wider market adoption. Oxygen sensors must meet stringent medical standards, which can delay product launches and adoption

- For instance, reported discrepancies in sensor readings in low-oxygen environments have made some hospitals cautious about adopting certain portable devices

- Addressing these concerns requires robust sensor design, adherence to ISO and FDA regulations, and regular calibration, which can increase production complexity and costs. Companies such as Teledyne emphasize high-precision sensor technology and regulatory compliance to reassure healthcare providers

- In addition, the relatively high cost of advanced oxygen sensors compared to basic pulse oximeters can limit adoption in budget-constrained hospitals or homecare settings. While simpler devices have become more affordable, features such as continuous monitoring, wireless connectivity, and AI analytics remain premium

- Overcoming these challenges through technological improvements, regulatory compliance, and cost-optimized solutions is critical for sustained market expansion and broader acceptance

Medical Oxygen Sensors Market Scope

The market is segmented on the basis of type, application, end user, sensor placement, and connectivity technology.

- By Type

On the basis of type, the medical oxygen sensors market is segmented into zirconia, electrochemical, galvanic, infrared, ultrasonic, and optical sensors. The electrochemical segment dominated the market with the largest market revenue share of 45.1% in 2024, driven by its high accuracy, reliability, and widespread use in both hospital-grade and portable oxygen monitoring devices. Electrochemical sensors are preferred in critical care and anesthesia equipment due to their rapid response time and minimal calibration requirements, making them a trusted choice among healthcare providers. The compatibility of electrochemical sensors with wearable and homecare oxygen devices further strengthens their dominance. These sensors also support continuous monitoring, data logging, and integration with hospital information systems, enhancing patient safety. The well-established supply chain and mature manufacturing processes contribute to their market leadership.

The optical sensors segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by innovations in non-invasive monitoring and wearable medical devices. Optical sensors offer high sensitivity and real-time oxygen saturation measurements without direct blood contact, making them ideal for homecare and remote patient monitoring applications. The increasing adoption of wearable health devices and integration with IoT platforms accelerates the demand for optical sensors. Advancements in miniaturization and low-power consumption further enhance their appeal in portable applications. Their ability to combine oxygen sensing with additional physiological measurements positions optical sensors for rapid market expansion.

- By Application

On the basis of application, the medical oxygen sensors market is segmented into anesthesia equipment, ventilators, oxygen monitors, and analyzers. The ventilator segment dominated the market with the largest revenue share in 2024, owing to the critical need for accurate oxygen monitoring in intensive care units (ICUs) and during mechanical ventilation procedures. Ventilators require sensors that deliver precise, real-time oxygen concentration feedback to maintain patient safety and treatment efficacy. The growing prevalence of respiratory illnesses, such as COPD and COVID-19-related complications, has further strengthened demand. Integration with hospital monitoring systems and automated alarm features makes these sensors indispensable. The segment also benefits from technological improvements, such as sensor miniaturization and enhanced durability, ensuring consistent performance in critical care environments.

The oxygen monitor and analyzer segment is expected to witness the fastest growth, driven by rising adoption of homecare oxygen therapy and portable monitoring devices. These devices require compact, reliable sensors capable of continuous measurement, remote data transmission, and low power consumption. Growing awareness of chronic respiratory conditions and increasing use of telemedicine solutions accelerate their adoption. The ability to provide real-time oxygen saturation readings outside hospital settings makes this application highly attractive. Manufacturers are focusing on integrating AI and IoT capabilities, which further boosts growth in this segment.

- By End User

On the basis of end user, the medical oxygen sensors market is segmented into hospitals and clinics, homecare settings, and others. The hospitals and clinics segment dominated the market with the largest revenue share of 50% in 2024, attributed to the high volume of critical care procedures, surgical interventions, and respiratory treatments that require precise oxygen monitoring. Hospitals demand sensors that comply with stringent regulatory standards and offer reliability under continuous operation. Integration with electronic medical record systems and patient monitoring platforms is a key factor driving adoption. The segment also benefits from the presence of large medical device suppliers and established procurement channels, which facilitate widespread sensor deployment.

The homecare setting segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by the rising prevalence of chronic respiratory diseases and increasing preference for home-based healthcare solutions. Portable oxygen concentrators and wearable monitoring devices are driving the need for compact, easy-to-use sensors. Remote monitoring capabilities and integration with mobile applications enable caregivers and clinicians to track patient oxygen levels in real-time, enhancing safety. Government initiatives supporting homecare and telehealth services further accelerate growth. Rising awareness of non-invasive and patient-friendly solutions contributes to strong adoption in this segment.

- By Sensor Placement

On the basis of sensor placement, the medical oxygen sensors market is segmented into strip sensors, wearable sensors, implantable sensors, invasive/non-invasive sensors, and ingestible sensors. The wearable sensors segment dominated the market in 2024 with the largest revenue share of 42%, driven by the increasing use of wearable oxygen monitors in hospitals, ambulatory care, and homecare settings. Wearable sensors allow continuous, non-invasive monitoring, offering real-time data for patient management and early detection of hypoxia. Their compact size and integration with wireless communication platforms make them highly versatile. Continuous monitoring and portability are key factors driving adoption, particularly in ICU and homecare scenarios. Technological advancements in miniaturization and battery life further support growth.

The implantable sensors segment is expected to witness the fastest growth, driven by the demand for long-term oxygen monitoring in chronic respiratory and cardiovascular disease management. Implantable sensors provide accurate, continuous measurements within the body, reducing the need for frequent device calibration or replacement. Integration with telehealth and remote patient monitoring platforms further enhances clinical value. Rising investments in advanced biomedical research and patient-centric solutions fuel adoption. The segment’s growth is also supported by increasing regulatory approvals for implantable medical devices.

- By Connectivity Technology

On the basis of connectivity technology, the medical oxygen sensors market is segmented into Wi-Fi, Bluetooth Low Energy (BLE), Zigbee, Near Field Communication (NFC), and Cellular. The Wi-Fi segment dominated the market with the largest revenue share in 2024, owing to its widespread use in hospital networks and homecare devices that require reliable, high-speed data transmission. Wi-Fi-enabled sensors allow remote monitoring, integration with hospital information systems, and seamless cloud data storage. The segment benefits from easy installation, compatibility with IoT platforms, and real-time data accessibility, which are critical for patient safety and clinician decision-making. Wi-Fi connectivity supports integration with AI-based analytics tools, enabling predictive insights and remote alerts.

The Bluetooth Low Energy segment is anticipated to witness the fastest growth, driven by low power consumption, ease of pairing with mobile devices, and suitability for wearable oxygen monitors. BLE-enabled sensors facilitate continuous patient monitoring in homecare settings, portable devices, and telehealth applications. The technology supports secure, short-range communication, allowing data to be transmitted to smartphones and healthcare apps efficiently. Its adoption is further boosted by increasing demand for patient-centric, mobile-integrated healthcare solutions. Manufacturers are leveraging BLE to create compact, battery-efficient devices that offer real-time monitoring capabilities.

Medical Oxygen Sensors Market Regional Analysis

- North America dominated the medical oxygen sensors market with the largest revenue share of 38.9% in 2024, attributed to advanced healthcare infrastructure, high healthcare expenditure, and a strong presence of leading sensor manufacturers

- Healthcare providers in the region prioritize accuracy, reliability, and real-time monitoring capabilities, making oxygen sensors essential in hospitals, ICUs, and homecare setups

- This widespread adoption is further supported by high healthcare expenditure, a technologically advanced medical workforce, and increasing integration of sensors with IoT and AI-enabled monitoring platforms, establishing medical oxygen sensors as a critical component of patient care and respiratory management

U.S. Medical Oxygen Sensors Market Insight

The U.S. medical oxygen sensors market captured the largest revenue share of 42% in 2024 within North America, fueled by advanced healthcare infrastructure and the widespread adoption of critical care and homecare respiratory devices. Healthcare providers increasingly prioritize accurate, real-time oxygen monitoring to enhance patient safety and treatment outcomes. The growing use of portable oxygen concentrators, ventilators, and wearable monitoring devices further propels market growth. Moreover, integration of sensors with IoT-enabled platforms and AI-driven analytics is significantly contributing to the expansion of the U.S. market.

Europe Medical Oxygen Sensors Market Insight

The Europe medical oxygen sensors market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent healthcare regulations and the increasing prevalence of chronic respiratory diseases. The rise in urbanization, coupled with growing investment in advanced medical technologies, is fostering the adoption of oxygen sensors. European healthcare providers are also drawn to devices offering real-time monitoring, patient safety, and energy efficiency. The region is witnessing significant growth across hospitals, clinics, and homecare applications, with sensors being integrated into both new installations and equipment upgrades.

U.K. Medical Oxygen Sensors Market Insight

The U.K. medical oxygen sensors market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising demand for advanced patient monitoring and remote healthcare solutions. Concerns regarding respiratory health, particularly among aging populations, are encouraging hospitals and homecare providers to adopt accurate oxygen sensors. In addition, the U.K.’s strong healthcare IT infrastructure and adoption of connected medical devices are expected to continue stimulating market growth. The market is also benefiting from increasing awareness of telehealth solutions and home-based oxygen monitoring systems.

Germany Medical Oxygen Sensors Market Insight

The Germany medical oxygen sensors market is expected to expand at a considerable CAGR during the forecast period, fueled by growing awareness of respiratory health and demand for technologically advanced, reliable monitoring solutions. Germany’s well-developed healthcare infrastructure, coupled with its focus on innovation and regulatory compliance, promotes the adoption of medical oxygen sensors, particularly in hospitals and critical care units. Integration with hospital monitoring platforms and emphasis on accurate, real-time patient data further enhance market growth. The preference for secure, high-precision devices aligns with local clinical standards and patient safety requirements.

Asia-Pacific Medical Oxygen Sensors Market Insight

The Asia-Pacific medical oxygen sensors market is poised to grow at the fastest CAGR during 2025 to 2032, driven by increasing prevalence of respiratory diseases, expanding healthcare access, and rising adoption of portable oxygen monitoring devices in countries such as China, Japan, and India. Government initiatives promoting digital health and telemedicine are supporting market growth. Furthermore, the region’s emergence as a manufacturing hub for medical sensors improves affordability and accessibility, expanding the user base across hospitals, homecare, and clinics.

Japan Medical Oxygen Sensors Market Insight

The Japan medical oxygen sensors market is gaining momentum due to the country’s advanced healthcare infrastructure, high adoption of connected medical devices, and aging population. Adoption of oxygen sensors is driven by the growing number of homecare patients and critical care facilities requiring continuous monitoring. Integration with IoT and AI-based platforms allows real-time alerts and predictive analytics, enhancing patient outcomes. Japan’s emphasis on safety, convenience, and technological innovation supports increasing demand in both residential and clinical healthcare settings.

India Medical Oxygen Sensors Market Insight

The India medical oxygen sensors market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s rising incidence of respiratory diseases, expanding middle class, and growing homecare and hospital infrastructure. India is becoming a key market for affordable, portable oxygen monitoring devices. The push toward smart healthcare initiatives, increasing adoption of telemedicine, and strong domestic manufacturing capabilities are key factors driving market growth in both hospital and homecare applications.

Medical Oxygen Sensors Market Share

The Medical Oxygen Sensors industry is primarily led by well-established companies, including:

- Maxtec (U.S.)

- Medtronic (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- GE HealthCare (U.S.)

- Honeywell International Inc. (U.S.)

- Siemens Healthineers AG (Germany)

- Drägerwerk AG & Co. KGaA (Germany)

- Masimo (U.S.)

- Nonin (U.S.)

- NIHON KOHDEN CORPORATION (Japan)

- Mindray Bio-Medical Electronics Co., Ltd. (China)

- Welch Allyn, Inc. (U.S.)

- Contec Medical Systems Co., Ltd. (China)

- Omron Healthcare Co., Ltd. (Japan)

- Schiller AG (Switzerland)

- Spacelabs Healthcare (U.S.)

- Fisher & Paykel Healthcare Limited (New Zealand)

- Teledyne Technologies Incorporated (U.S.)

What are the Recent Developments in Global Medical Oxygen Sensors Market?

- In May 2025, DD-Scientific introduced the OXLFF, a revolutionary lead-free oxygen sensor that sets a new benchmark in performance, ease of integration, and value proposition for gas instrument manufacturers. This innovation addresses environmental concerns while maintaining high accuracy and reliability in oxygen measurement

- In May 2025, a wearable pulse oximeter and connected software platform were introduced, showing promise for monitoring obstructive sleep apnea (OSA) and other sleep-related breathing diseases. This innovation aims to provide continuous, non-invasive monitoring, improving patient care and management of respiratory conditions

- In April 2025, Emerson launched the Rosemount 490A Optical Dissolved Oxygen Sensor. This digital Modbus-enabled sensor is designed to enhance operational flexibility, simplify installation, and reduce maintenance costs across various industrial applications, including water/wastewater treatment and biopharmaceutical manufacturing

- In March 2025, Maxtec announced the discontinuation of its lead-based oxygen sensors, transitioning to lead-free galvanic cell-type sensors. This move aligns with global environmental standards and showcases Maxtec's commitment to sustainability in medical device manufacturing

- In February 2025, the Murdoch Children's Research Institute (MCRI) partnered with 12 countries in the Pacific and Southeast Asia under a USD 10 million initiative to improve child and adolescent health. This collaboration includes efforts to enhance medical oxygen access and utilization in these regions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.