Global Medical Nonwoven Disposables Market

Market Size in USD Billion

CAGR :

%

USD

10.59 Billion

USD

16.43 Billion

2025

2033

USD

10.59 Billion

USD

16.43 Billion

2025

2033

| 2026 –2033 | |

| USD 10.59 Billion | |

| USD 16.43 Billion | |

|

|

|

|

Medical Nonwoven Disposables Market Size

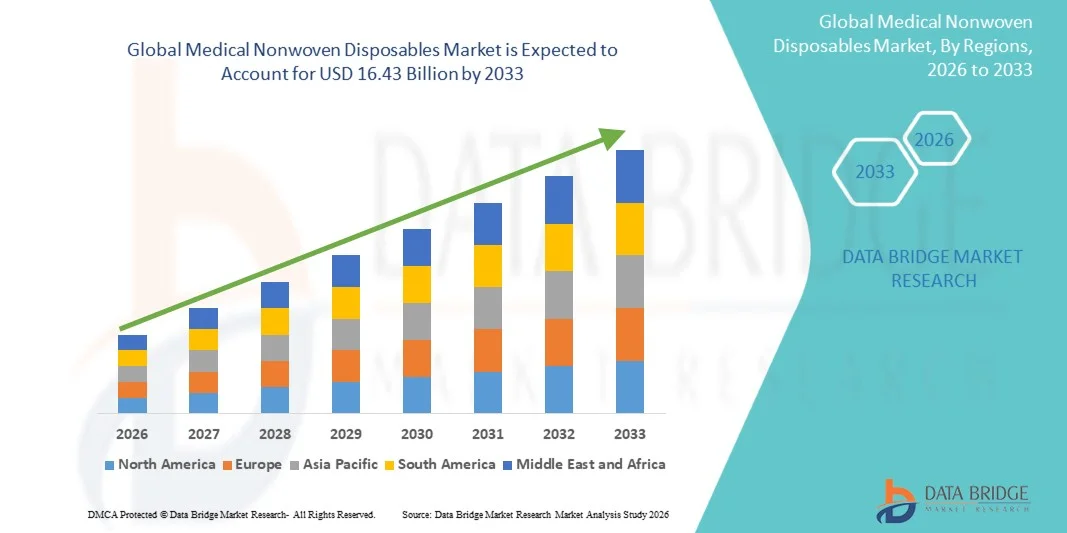

- The global medical nonwoven disposables market size was valued at USD 10.59 billion in 2025 and is expected to reach USD 16.43 billion by 2033, at a CAGR of 5.63% during the forecast period

- The market growth is largely fueled by the increasing demand for infection prevention and hygiene management across healthcare facilities, supported by the rising number of surgical procedures, hospital admissions, and strict regulatory standards for patient safety, leading to expanded adoption of medical nonwoven disposable products in both developed and emerging healthcare systems

- Furthermore, growing awareness regarding cross-contamination risks and the rising preference for single-use protective medical products such as gowns, masks, drapes, and wipes are establishing medical nonwoven disposables as essential healthcare consumables. These converging factors are accelerating the uptake of Medical Nonwoven Disposables solutions, thereby significantly boosting the industry’s growth

Medical Nonwoven Disposables Market Analysis

- Medical nonwoven disposables, including surgical masks, gowns, drapes, and sterilization wraps, are increasingly essential components of modern infection-control protocols across hospitals, ambulatory surgical centers, and diagnostic facilities due to their high barrier protection, cost-effectiveness, and single-use convenience that reduces contamination risks

- The escalating demand for medical nonwoven disposables is primarily fueled by the rising volume of surgical procedures, increasing awareness regarding hospital-acquired infections (HAIs), expanding healthcare infrastructure, and growing preference for disposable protective medical products across both developed and emerging healthcare systems

- North America dominated the medical nonwoven disposables market with the largest revenue share of 36.8% in 2025, characterized by advanced healthcare infrastructure, high healthcare spending, strong regulatory standards for infection prevention, and the presence of major medical consumable manufacturers, with the U.S. witnessing significant demand growth across hospitals and outpatient surgical facilities

- Asia-Pacific is expected to be the fastest-growing region in the medical nonwoven disposables market during the forecast period, registering a CAGR of 8.9%, driven by expanding hospital networks, rising healthcare investments, increasing patient population, and growing awareness of hygiene and infection-control practices in countries such as China, India, and Southeast Asian nations

- The surgical products segment dominated the market and accounted for the largest revenue share of 58.6% in 2025, primarily driven by the continuously rising number of surgical procedures worldwide and the strict infection prevention protocols implemented across healthcare facilities

Report Scope and Medical Nonwoven Disposables Market Segmentation

|

Attributes |

Medical Nonwoven Disposables Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Medical Nonwoven Disposables Market Trends

“Rising Emphasis on Infection Prevention and Single-Use Hygiene Solutions”

- A significant and accelerating trend in the global medical nonwoven disposables market is the growing emphasis on infection prevention, hygiene compliance, and the increased adoption of single-use protective products across healthcare settings

- Hospitals and clinics are increasingly shifting toward disposable nonwoven materials to minimize the risk of cross-contamination and hospital-acquired infections (HAIs)

- For instance, the widespread use of disposable surgical gowns, drapes, masks, caps, and shoe covers in operating rooms and intensive care units has become standard clinical practice, ensuring higher sterility levels and improved patient safety

- Continuous technological advancements in spunbond, meltblown, and SMS (spunbond-meltblown-spunbond) nonwoven manufacturing are enabling the development of lightweight, breathable, and highly protective medical disposables that improve comfort for healthcare workers while maintaining strong barrier protection

- In addition, healthcare institutions are increasingly adopting high-performance antimicrobial and fluid-resistant nonwoven materials to meet stricter infection control guidelines and regulatory standards across developed and emerging markets

- The growing focus on pandemic preparedness, emergency stockpiling of protective supplies, and strengthening hospital hygiene protocols is further accelerating the adoption of medical nonwoven disposable products worldwide

- Consequently, manufacturers are expanding production capacities and introducing innovative biodegradable and sustainable nonwoven materials to meet the rising global demand for safe, hygienic, and environmentally responsible disposable medical products

Medical Nonwoven Disposables Market Dynamics

Driver

“Increasing Surgical Procedures and Expanding Healthcare Infrastructure”

- The rising number of surgical procedures worldwide, driven by the growing prevalence of chronic diseases, aging populations, and expanding access to healthcare services, is a major driver for the demand for medical nonwoven disposables

- For instance, the rapid expansion of hospitals, ambulatory surgical centers, and specialty clinics across emerging economies is increasing the consumption of disposable surgical drapes, gowns, sterilization wraps, and wound care products

- As healthcare providers continue to prioritize infection prevention and operational efficiency, single-use nonwoven products offer cost-effective solutions by reducing sterilization requirements and improving workflow efficiency in clinical environments

- Furthermore, government investments in healthcare modernization, increasing healthcare expenditure, and the strengthening of public health systems are significantly contributing to the steady growth of the medical nonwoven disposables market globally

Restraint/Challenge

“Environmental Concerns and Waste Management Challenges”

- Environmental concerns associated with the growing volume of medical waste generated from disposable nonwoven products present a key challenge to market growth. Large-scale usage of single-use protective equipment and surgical disposables has increased the burden on healthcare waste management systems worldwide

- For instance, in 2024, a report by the World Health Organization highlighted that hospitals in India and Brazil generated over 500,000 tons of biomedical waste annually from single-use nonwoven products, posing significant challenges for proper segregation, treatment, and disposal

- In addition, the reliance on petroleum-based raw materials in conventional nonwoven manufacturing raises sustainability concerns among regulators, healthcare providers, and environmental organizations

- Addressing these challenges through the development of biodegradable nonwoven materials, recycling initiatives, and improved medical waste treatment infrastructure will be essential for ensuring sustainable long-term growth of the medical nonwoven disposables market

Medical Nonwoven Disposables Market Scope

The market is segmented on the basis of product and distribution channel.

• By Product

On the basis of product, the Global Medical Nonwoven Disposables market is segmented into Incontinence Products and Surgical Products. The surgical products segment dominated the market and accounted for the largest revenue share of 58.6% in 2025, primarily driven by the continuously rising number of surgical procedures worldwide and the strict infection prevention protocols implemented across healthcare facilities. Hospitals and ambulatory surgical centers increasingly rely on disposable nonwoven surgical drapes, gowns, masks, and sterilization wraps to maintain sterile environments and reduce hospital-acquired infections (HAIs). The expansion of healthcare infrastructure in emerging economies and the growing adoption of minimally invasive surgeries further support sustained demand for surgical nonwoven disposables. In addition, regulatory mandates requiring single-use sterile protective equipment in operating rooms significantly contribute to the strong market position of this segment. Technological advancements in breathable, fluid-resistant, and antimicrobial nonwoven materials are also enhancing product performance and safety, encouraging healthcare providers to shift from reusable textiles to disposable alternatives. The COVID-19 pandemic reinforced long-term institutional procurement strategies focused on maintaining emergency stockpiles of surgical protective products, which continues to sustain segment dominance even in the post-pandemic environment. Increasing outpatient surgeries and the expansion of specialty clinics globally also continue to generate steady product consumption. As surgical volumes continue to rise due to aging populations and chronic disease prevalence, the surgical products segment is expected to maintain its leading market position throughout the forecast period.

The incontinence products segment is anticipated to witness the fastest CAGR of 7.9% from 2026 to 2033, supported by the rapidly expanding geriatric population and increasing awareness regarding personal hygiene and long-term care management. Rising life expectancy across both developed and developing countries has significantly increased the number of individuals experiencing urinary and fecal incontinence conditions, thereby driving sustained demand for disposable incontinence pads, underpads, and protective garments. Growth is further supported by increasing adoption of home healthcare services and assisted living facilities, where disposable hygiene solutions are preferred due to convenience and infection control advantages. Product innovations such as ultra-thin absorbent cores, skin-friendly breathable fabrics, and odor-control technologies are enhancing user comfort and encouraging higher adoption rates. In addition, rising healthcare expenditure and improved insurance coverage for long-term care products in several regions are expanding patient access to incontinence supplies. Growing awareness campaigns and reduced social stigma associated with incontinence management are also contributing to market expansion. The increasing availability of premium adult diaper products through retail pharmacies and online channels is further accelerating segment growth. As the global elderly population continues to grow substantially over the coming decades, the incontinence products segment is expected to emerge as one of the most dynamic revenue contributors in the overall medical nonwoven disposables market.

• By Distribution Channel

On the basis of distribution channel, the Global Medical Nonwoven Disposables market is segmented into Hospital Pharmacies, Retail Pharmacies, and Other Distribution Channels. The hospital pharmacies segment held the largest market revenue share of 49.3% in 2025, driven by the high-volume procurement of surgical gowns, drapes, masks, and other disposable protective products directly by hospitals and large healthcare institutions. Centralized purchasing systems within hospitals enable bulk procurement contracts with manufacturers and distributors, ensuring continuous supply for routine medical procedures and emergency preparedness. The increasing number of hospital admissions, surgical procedures, and infection-control regulations requiring single-use protective materials are major factors supporting segment dominance. Hospitals also maintain long-term supply agreements with medical disposable manufacturers to stabilize pricing and ensure quality compliance, further strengthening the importance of this distribution channel. Growth in multispecialty hospitals, expansion of public healthcare systems in emerging markets, and increasing government healthcare spending continue to boost hospital-based procurement. Furthermore, institutional purchasing departments prioritize certified, high-performance nonwoven products that meet stringent regulatory standards, which drives consistent demand through hospital pharmacy channels. The integration of automated inventory management systems within hospitals also enhances procurement efficiency and replenishment cycles. As surgical volumes and hospital infrastructure continue expanding globally, hospital pharmacies are expected to remain the primary distribution channel for medical nonwoven disposables.

The retail pharmacies segment is projected to witness the fastest CAGR of 8.4% from 2026 to 2033, supported by the increasing demand for home-based healthcare products such as disposable masks, wound care products, adult incontinence supplies, and home nursing consumables. The growing trend toward outpatient care and home recovery following surgeries is encouraging patients and caregivers to purchase medical disposables directly from retail pharmacies and online pharmacy platforms. Rising consumer awareness regarding hygiene, infection prevention, and chronic disease management is further strengthening retail demand. The rapid expansion of organized pharmacy chains in developing countries and improved accessibility to healthcare products in semi-urban and rural areas are also contributing to segment growth. In addition, the availability of private-label medical disposable brands at competitive pricing is attracting cost-conscious consumers and increasing sales volumes. The expansion of e-pharmacy services and same-day delivery models is significantly improving convenience for consumers, particularly elderly patients requiring recurring purchases of hygiene products. Increasing physician recommendations for at-home wound care and long-term patient monitoring are also encouraging retail purchases of disposable medical supplies. As healthcare delivery models increasingly shift toward decentralized and home-based care, the retail pharmacies segment is expected to experience robust expansion over the forecast period.

Medical Nonwoven Disposables Market Regional Analysis

- North America dominated the medical nonwoven disposables market with the largest revenue share of 36.8% in 2025, supported by advanced healthcare infrastructure, high healthcare spending, strong regulatory standards for infection prevention, and the presence of major medical consumable manufacturers

- The region is witnessing increasing adoption of disposable surgical gowns, drapes, masks, and sterilization wraps across hospitals, clinics, and ambulatory surgical centers

- Rising awareness of infection prevention, robust healthcare reimbursement frameworks, and continuous product innovations in nonwoven disposables are driving overall market growth

U.S. Medical Nonwoven Disposables Market Insight

The U.S. medical nonwoven disposables market captured a major share of the North American market, driven by high adoption of disposable medical products across hospitals, outpatient surgical facilities, and diagnostic centers. Increasing surgical volumes, growing awareness of hygiene and infection control, and strong regulatory support are key factors supporting demand. Continuous product innovations, such as fluid-resistant gowns, sterilization wraps, and single-use protective covers, are enhancing both patient safety and healthcare provider convenience. The expanding network of hospitals and outpatient surgical centers, coupled with favorable reimbursement policies, is further propelling market growth in the country.

Europe Medical Nonwoven Disposables Market Insight

The Europe medical nonwoven disposables market is projected to expand at a substantial CAGR during the forecast period, driven by stringent infection-control regulations, high surgical volumes, and increasing adoption of disposable protective products in hospitals, clinics, and ambulatory surgical centers. Countries such as Germany, France, and the U.K. are witnessing rising demand for nonwoven surgical gowns, drapes, masks, and sterilization wraps, fueled by regulatory emphasis on hygiene standards, growing hospital capacities, and continuous modernization of healthcare facilities. Increasing awareness of patient safety, combined with the focus on sustainable and eco-friendly nonwoven materials, is further supporting the region’s market expansion.

U.K. Medical Nonwoven Disposables Market Insight

The U.K. medical nonwoven disposables market is anticipated to grow at a noteworthy CAGR due to expanding surgical procedures, high adoption of disposable hygiene products in hospitals and clinics, and growing emphasis on infection prevention and patient safety. Increasing investments in hospital infrastructure and the integration of advanced nonwoven materials with antimicrobial and fluid-resistant properties are driving demand across public and private healthcare sectors.

Germany Medical Nonwoven Disposables Market Insight

Germany medical nonwoven disposables market is expected to expand at a considerable CAGR, supported by its well-developed healthcare infrastructure, strong regulatory framework, and growing adoption of technologically advanced, eco-conscious disposable nonwoven products. Hospitals and specialty care centers are increasingly implementing nonwoven disposables in surgical, diagnostic, and outpatient procedures to enhance hygiene compliance and reduce cross-contamination risks.

Asia-Pacific Medical Nonwoven Disposables Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR of 8.9% during 2026–2033, driven expanding hospital networks, rising healthcare investments, increasing patient populations, and growing awareness of hygiene and infection-control practices. Countries such as China, India, Japan, and Southeast Asian nations are witnessing rapid demand growth due to increasing surgical volumes, development of new hospitals and clinics, and greater adoption of single-use nonwoven products in both public and private healthcare facilities. The emergence of regional manufacturing hubs is enhancing affordability and accessibility of medical nonwoven disposables, enabling wider adoption across urban and rural healthcare settings.

Japan Medical Nonwoven Disposables Market Insight

Japan’s medical nonwoven disposables market growth is fueled by an aging population, high awareness of infection control, and advanced hospital infrastructure. Hospitals and long-term care facilities are increasingly adopting disposable surgical gowns, drapes, and protective covers to maintain high hygiene standards and improve patient safety.

China Medical Nonwoven Disposables Market Insight

China medical nonwoven disposables market accounted for the largest market revenue share in Asia-Pacific in 2025, driven by rapid urbanization, rising healthcare expenditure, and expansion of hospital networks. The growing middle class, increasing awareness of infection prevention, and government initiatives to improve healthcare hygiene practices are driving strong demand for disposable medical nonwoven products. Local manufacturers are scaling up production and introducing innovative nonwoven materials, including fluid-resistant and biodegradable options, to meet the rising market needs.

Medical Nonwoven Disposables Market Share

The Medical Nonwoven Disposables industry is primarily led by well-established companies, including:

- 3M Company (U.S.)

- Cardinal Health, Inc. (U.S.)

- Medline Industries, LP (U.S.)

- Mölnlycke Health Care AB (Sweden)

- Paul Hartmann AG (Germany)

- Kimberly-Clark Corporation (U.S.)

- Owens & Minor, Inc. (U.S.)

- Halyard Health (Owens & Minor) (U.S.)

- Ansell Limited (Australia)

- Thermo Fisher Scientific Inc. (U.S.)

- Dynarex Corporation (U.S.)

- Steris plc (Ireland)

- Lohmann & Rauscher GmbH & Co. KG (Germany)

- Medicom Group (Canada)

- Winner Medical Co., Ltd. (China)

- Zhende Medical Co., Ltd. (China)

- Suzhou Kanger Medical Co., Ltd. (China)

- Surgichem Pvt. Ltd. (India)

- Paul Hartmann Ltd. (U.K.)

- Hengan International Group Company Ltd. (China)

Latest Developments in Global Medical Nonwoven Disposables Market

- In July 2023, Berry Global introduced SustainaMed, a biodegradable nonwoven fabric line for medical gowns and face masks designed to reduce environmental impact while maintaining clinical performance, addressing increasing demand for sustainable disposable medical solutions. The new line targets hospitals seeking greener alternatives without compromising hygiene protection standards

- In August 2024, Manjushree Spntek launched Hightex hybrid nonwoven fabrics specifically designed for chemotherapy gowns, offering enhanced barrier protection against hazardous drugs and chemicals while ensuring healthcare worker comfort. Hightex received global laboratory certification to meet rigorous ASTM safety criteria, strengthening its adoption in clinical settings

- In January 2024, Owens & Minor completed the expansion of its surgical drape manufacturing facility in Thailand, significantly increasing production capacity for Halyard AERO nonwoven disposable products to meet rising demand in the Asia‑Pacific region.* The expansion aims to enhance local supply resilience and reduce lead times for medical institutions

- In February 2024, 3M announced the sale of its Healthcare business to Bain Capital for approximately USD 6.3 billion, a strategic move affecting its portfolio of nonwoven disposable surgical products, including gowns, drapes, and other PPE, reshaping the competitive landscape of the global medical nonwoven disposables market

- In May 2024, Stryker entered a strategic collaboration with Medline Industries to co‑develop and co‑market a new line of nonwoven surgical drapes and gowns, leveraging Stryker’s surgical systems expertise and Medline’s extensive distribution network to accelerate global adoption in hospitals

- In June 2024, Kimberly‑Clark announced a strategic collaboration with Medline Industries to co‑develop next‑generation disposable nonwoven surgical gowns, expanding supply capabilities and targeting improved infection control performance

- In March 2025, Molnlycke Health Care unveiled a next‑generation disposable surgical gown using proprietary nonwoven fabric that enhances barrier performance and wearer comfort, reinforcing the company’s competitive position in global medical nonwoven products

- In February 2025, Berry Global announced a strategic partnership with Medline Industries to co‑develop and manufacture a wide range of disposable medical nonwoven products, aimed at expanding supply resilience and reducing lead times across North America and Europe

- In April 2025, Intco Medical launched its Syntex Synthetic Disposable Latex Gloves worldwide, engineered to provide enhanced protection and comfort for healthcare professionals during medical procedures. These gloves added to the global medical nonwoven disposables portfolio, expanding the availability of protective nonwoven medical PPE

- In September 2025, Lohmann & Rauscher acquired a 49% stake in the ADA Group, a Portuguese manufacturer of gauze, nonwoven products, and other medical disposables, strengthening Lohmann & Rauscher’s footprint in the medical nonwoven disposables sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.