Global Medical Imaging Software Market

Market Size in USD Billion

CAGR :

%

USD

6.24 Billion

USD

11.12 Billion

2022

2030

USD

6.24 Billion

USD

11.12 Billion

2022

2030

| 2023 –2030 | |

| USD 6.24 Billion | |

| USD 11.12 Billion | |

|

|

|

|

Medical Imaging Software Market Analysis and Size

According to the WHO, breast cancer is the most common cancer among women, affecting 2.1 million women each year and accounting for the majority of cancer-related deaths among women. Breast cancer was estimated to kill 627,000 women in 2018, accounting for approximately 15% of all cancer deaths in women. While breast cancer rates are higher among women in more developed regions, rates are increasing in nearly every region worldwide.

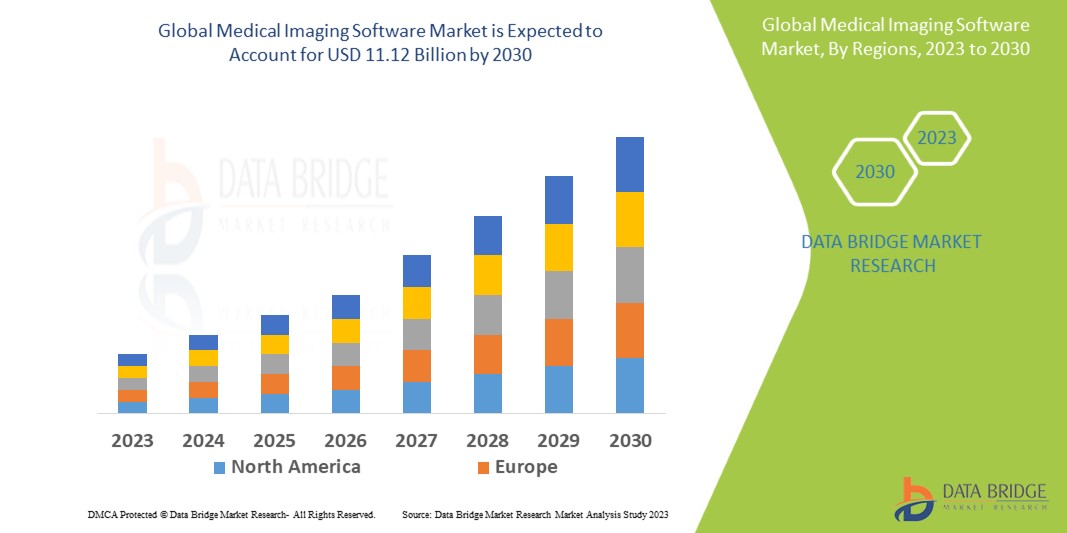

Data Bridge Market Research analyses that the medical imaging software market which was USD 6.24 billion in 2022, is expected to reach USD 11.12 billion by 2030, at a CAGR of 7.5% during the forecast period 2023 to 2030. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Medical Imaging Software Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Imaging Type (2D Imaging, 3D Imaging, 4D Imaging), Application (Dental Applications, Orthopedic Applications, Cardiology Applications, Obstetrics and Gynecology Applications, Mammography Applications, Urology and Nephrology Applications), End-User (Hospitals, Diagnostic Centers) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

Koninklijke Philips N.V. (Netherlands), RamSoft, Inc. (Canada), InHealth Group (U.K.), Radiology Reports online (U.S.), Siemens (Germany), Sonic Healthcare Limited (Australia), RadNet, Inc. (U.S.), General Electric (U.S.), Akumin Inc. (U.S.), Hologic Inc. (U.S.), Shimadzu Corporation (Japan), Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China), CANON MEDICAL SYSTEMS CORPORATION (Japan), Carl Zeiss Ag (Germany), FUJIFILM Corporation (Japan), Hitachi, Ltd. (Japan), MEDNAX Services, Inc. (U.S.), Carestream Health (U.S), Teleradiology Solutions (U.S.), UNILABS (Switzerland), ONRAD, Inc. (U.S.) |

|

Market Opportunities |

|

Market Definition

Medical imaging software is a component of healthcare worldwide that employs cutting-edge software, technological advancements, and cutting-edge equipment to acquire or generate graphical representations of the interior of a body for diagnosis, clinical analysis, and medical intervention. The devices equipped with medical imaging software aid in the diagnosis of tumours and, as well as in the visual representation of the function of certain organs or tissues.

Medical Imaging Software Market Dynamics

Drivers

- Rising prevalence of lifestyle-related diseases

The rising prevalence of lifestyle-related disorders, increasing demand for early detection tools, technological advancements to reduce time period, increased government investment and reimbursement initiatives, and expansions of new facilities by market players in developing countries are expected to drive market growth. For instance, in June 2021, the Indian government launched X-Ray Setu, a free Artificial Intelligence (AI)-based platform designed to assist doctors with early COVID-19 interventions. Siemens Healthineers opened a new CT scanner production unit in India in 2022 to meet the growing demand for CT scanners and strengthen its market position.

- Increasing demand for cutting-edge imaging modalities

The increasing demand for cutting-edge imaging modalities by teaching hospitals and universities to provide advanced technology training is expected to significantly impact market growth during the forecast period. Furthermore, the use of AI to automate image quantification and identification is expected to drive market growth. For instance, Google's AI platform, Deepmind, collaborated with Moorfields Eye Hospital to read all optical CT scan eye scans to ensure early detection of age-related macular degeneration. Furthermore, the introduction of 3D MRI and CT scans allows radiologists to analyse scans more quickly, reducing analysis time and improving efficacy.

Opportunities

- Advancements in imaging technology

Continuous advancements in imaging technology, such as Computer-aided Diagnosis (CAD), are expected to boost demand for the medical imaging and radiology software market. This computer-aided diagnosis (CAD) method aims to provide a method of data interpretation using computerised software. Computer-aided Diagnosis combines image processing, computer vision, mathematics, physics, and statistics into computerized techniques that aid radiologists in analysing and making decisions. Image enhancement, initial detection, and image feature extraction, including segmentation, are all steps in CAD imaging or image analysis. The rising prevalence of chronic diseases such as orthopaedic disorders, cardiovascular diseases, and cancer creates a demand for effective diagnostics solutions, which drives up demand for medical imaging software.

Restraints/Challenges

- Unskilled medical professionals

A lack of skilled medical professionals and the high equipment cost will obstruct market growth and further challenge the growth of the medical imaging software market during the forecast period.

This medical imaging software market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the medical imaging software market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Developments

- In 2021, Philips announced the launch of an AI-enabled MR imaging portfolio, aiming to improve radiology operations' efficiency and sustainability by speeding up MR exams. Such technological advancements are said to exponentially boost market growth.

- In 2019, Canon was awarded the U.S. Patent and Trademark Office. FDA approval for its Advanced Intelligent Clear-IQ Engine (AiCE), an artificial intelligence (AI) technology for use with its Aquilion Precision scanner. The technology aids in achieving precision diagnostics without increasing the dose.

Global Medical Imaging Software Market Scope

The medical imaging software market is segmented on the basis of imaging type, application and end-user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Imaging Type

- 2D Imaging

- 3D Imaging

- 4D Imaging

Application

- Dental Applications

- Orthopedic Applications

- Cardiology Applications

- Obstetrics and Gynecology Applications

- Mammography Applications

- Urology and Nephrology Applications

End-User

- Hospitals

- Diagnostic Centers

Medical Imaging Software Market Regional Analysis/Insights

The medical imaging software market is analyzed and market size insights and trends are provided by country, imaging type, application and end-user as referenced above.

The countries covered in the medical imaging software market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the medical imaging software market because of improved healthcare infrastructure, increased awareness, advanced facilities, greater technological penetration, and increased citizen spending on healthcare.

Asia-Pacific is expected to grow at the highest growth rate in the forecast period of 2023 to 2030 owing to the rising administration initiatives for enhancing healthcare infrastructure.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure Growth Installed base and New Technology Penetration

The medical imaging software market also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for medical imaging software market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on the medical imaging software market. The data is available for historic period 2011-2021.

Competitive Landscape and Medical Imaging Software Market Share Analysis

The medical imaging software market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to medical imaging software market.

Some of the major players operating in the medical imaging software market are:

- Koninklijke Philips N.V. (Netherlands)

- RamSoft, Inc. (Canada)

- InHealth Group (U.K.)

- Radiology Reports online (U.S.)

- Siemens (Germany)

- Sonic Healthcare Limited (Australia)

- RadNet, Inc. (U.S.)

- General Electric (U.S.)

- Akumin Inc. (U.S.)

- Hologic Inc. (U.S.)

- Shimadzu Corporation (Japan)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- Carl Zeiss Ag (Germany)

- FUJIFILM Corporation (Japan)

- Hitachi, Ltd. (Japan)

- MEDNAX Services, Inc. (U.S.)

- Carestream Health (U.S.)

- Teleradiology Solutions (U.S.)

- UNILABS (Switzerland)

- ONRAD, Inc. (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.