Global Medical Device Connectivity Market

Market Size in USD Billion

CAGR :

%

USD

4.20 Billion

USD

25.84 Billion

2025

2033

USD

4.20 Billion

USD

25.84 Billion

2025

2033

| 2026 –2033 | |

| USD 4.20 Billion | |

| USD 25.84 Billion | |

|

|

|

|

Medical Device Connectivity Market Size

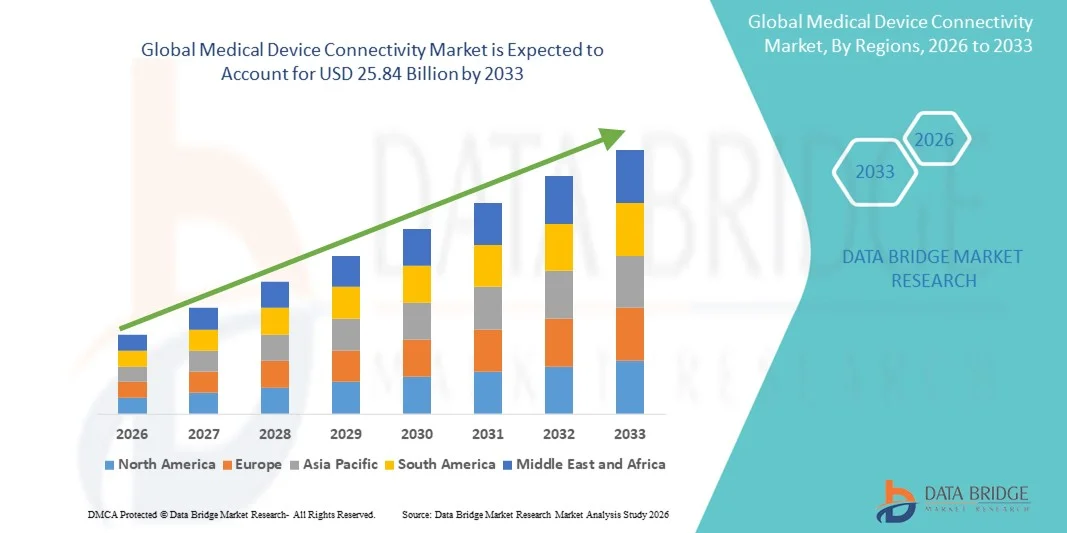

- The global medical device connectivity market size was valued at USD 4.20 billion in 2025 and is expected to reach USD 25.84 billion by 2033, at a CAGR of 25.50% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced healthcare technologies and the growing need for seamless integration of medical devices across hospitals, clinics, and diagnostic centers

- Furthermore, rising demand for real-time patient monitoring, efficient data management, and improved clinical workflow is driving the adoption of connected healthcare solutions. These factors are accelerating the uptake of medical device connectivity solutions, thereby significantly boosting the industry’s growth

Medical Device Connectivity Market Analysis

- Medical Device Connectivity solutions, enabling seamless integration and communication between medical devices, hospital information systems, and healthcare IT platforms, are increasingly vital components of modern healthcare infrastructure in both hospitals and outpatient care settings due to their enhanced efficiency, real-time monitoring capabilities, and data-driven decision support

- The escalating demand for medical device connectivity is primarily fueled by the widespread adoption of electronic health records (EHRs), growing emphasis on patient safety and workflow optimization, and a rising preference for remote monitoring and connected healthcare solutions

- North America dominated the medical device connectivity market with the largest revenue share of 42% in 2025, driven by well-established healthcare infrastructure, high R&D expenditure, and the presence of key industry players. The U.S. experienced substantial growth in Medical Device Connectivity installations across hospitals, clinics, and diagnostic centers, supported by innovations in wireless device integration, cloud-based platforms, and AI-enabled monitoring solutions

- Asia-Pacific is expected to be the fastest-growing region in the medical device connectivity market during the forecast period due to increasing healthcare infrastructure, rising adoption of digital health solutions, growing demand for remote patient monitoring, and expanding disposable incomes in countries such as China, India, and Japan. Technological advancements and government initiatives promoting connected healthcare are further boosting market adoption in the region

- The Medical Device Connectivity Solutions segment dominated the largest market share of 55.6% in 2025, driven by the rising need for integrated platforms that enable seamless data exchange between medical devices and hospital IT systems

Report Scope and Medical Device Connectivity Market Segmentation

|

Attributes |

Medical Device Connectivity Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Oracle (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Medical Device Connectivity Market Trends

Enhanced Connectivity and Interoperability Across Medical Devices

- A major and accelerating trend in the global medical device connectivity market is the increasing focus on interoperability among diverse medical devices, enabling seamless data sharing across hospital networks, laboratories, and diagnostic centers. This trend supports integrated patient monitoring, real-time analytics, and improved clinical decision-making

- For instance, in 2024, Philips Healthcare announced enhancements to its IntelliBridge Enterprise platform, allowing real-time integration of vital signs monitors, infusion pumps, and lab devices into hospital EMR systems. Such developments enable clinicians to access comprehensive patient data from a single interface, reducing manual entry errors and improving operational efficiency

- Integration of medical devices with hospital IT systems allows automated alerts, remote monitoring, and analytics-driven patient care. Hospitals increasingly rely on these systems for managing patient data, supporting telemedicine, and ensuring adherence to treatment protocols

- The trend toward standardized communication protocols such as HL7 and FHIR is further facilitating device interoperability, making it easier to integrate new devices into existing hospital infrastructure

- Healthcare institutions are investing in platforms that support multi-vendor environments, enabling seamless coordination between legacy devices and new-generation connected devices

- This trend is shaping hospital IT strategies and encouraging vendors to provide more adaptable, scalable connectivity solutions. Companies such as GE Healthcare and Cerner are focusing on solutions that unify patient monitoring, imaging, and lab results within a single platform

Medical Device Connectivity Market Dynamics

Driver

Growing Need for Real-Time Data and Workflow Optimization

- The rising demand for real-time patient data across hospitals and diagnostic centers is a key driver of market growth. Access to immediate, reliable information helps clinicians make faster, more accurate decisions

- For instance, Hillrom (a Baxter company) in 2023 implemented its connected patient care solutions in several U.S. hospitals to streamline monitoring and reduce manual documentation, boosting staff efficiency

- Healthcare providers are increasingly focusing on data-driven decision-making, requiring integrated connectivity solutions that provide comprehensive insights across devices

- Real-time device monitoring also reduces the risk of errors, improves patient safety, and supports better compliance with treatment protocols

- Operational efficiencies gained through connected medical devices help hospitals reduce costs, improve workflow management, and optimize resource allocation

Restraint/Challenge

Concerns Regarding Data Security and High Initial Costs

- Cybersecurity and data privacy concerns remain a major restraint in the medical device connectivity market. Connected devices are susceptible to cyberattacks, data breaches, and unauthorized access, raising concerns among healthcare providers

- For instance, in 2022, several hospitals in the U.S. reported minor security breaches in networked infusion pumps, highlighting the need for robust encryption and secure authentication

- High initial costs for implementing hospital-wide connectivity solutions can also be a barrier, particularly for smaller hospitals or clinics in developing regions

- Maintaining and updating connected systems require ongoing investment in IT infrastructure and staff training, adding to operational expenses

- Addressing these challenges through enhanced security measures, standardized protocols, and cost-effective solutions is crucial for long-term market growth

Medical Device Connectivity Market Scope

The market is segmented on the basis of product and service, technology, application, and end user.

- By Product and Service

On the basis of product and service, the market is segmented into Medical Device Connectivity Solutions and Medical Device Connectivity Services. The Medical Device Connectivity Solutions segment dominated the largest market share of 55.6% in 2025, driven by the rising need for integrated platforms that enable seamless data exchange between medical devices and hospital IT systems. Hospitals and diagnostic centers increasingly prefer solutions that allow real-time monitoring of patient health, automated alerts, and secure data storage. The segment’s leadership is supported by the widespread adoption of electronic medical records (EMRs) and initiatives to modernize healthcare infrastructure. These solutions enable interoperability between legacy and new-generation medical devices, supporting clinical workflows and enhancing operational efficiency. Integration capabilities across vital signs monitors, infusion pumps, ventilators, and anesthesia machines make this segment particularly attractive. Leading providers focus on developing comprehensive solutions with standardized communication protocols to ensure compatibility across multiple device types. Hospitals also benefit from reduced manual documentation, improved patient safety, and better compliance with treatment protocols. Research and academic institutes utilize these solutions for real-time data capture in clinical trials and experimental studies. The segment’s prominence is further reinforced by increasing investments in digital health and connected hospital initiatives globally. Ongoing technological advancements, including cloud-based solutions and platform scalability, continue to strengthen the dominance of the Medical Device Connectivity Solutions segment.

The Medical Device Connectivity Services segment is expected to witness the fastest growth during the forecast period, recording a CAGR of 12.4% from 2026 to 2033, fueled by increasing demand for managed services, system maintenance, and integration support. Healthcare providers are seeking services that ensure continuous operation of connected devices, facilitate software updates, and provide real-time troubleshooting. Service providers offer remote monitoring, installation support, and consultancy to optimize device connectivity across hospitals, clinics, and diagnostic labs. As hospitals adopt more complex and heterogeneous medical device networks, demand for services that manage interoperability and compliance is rising. Service offerings also include training for hospital staff, cybersecurity support, and data analytics assistance, ensuring safe and efficient utilization of connected devices. Expansion of telehealth and home-based patient monitoring is further boosting the adoption of these services. Providers are offering subscription-based models, making advanced connectivity solutions more accessible to smaller clinics and home healthcare centers. The focus on reducing downtime and improving device lifecycle management enhances the attractiveness of service-oriented solutions. In addition, regulatory compliance requirements, such as HIPAA and MDR, encourage healthcare providers to rely on expert services for connectivity implementation. The segment’s growth is reinforced by increasing awareness about the benefits of professional support in managing complex device networks.

- By Technology

On the basis of technology, the market is segmented into Wired Technologies, Wireless Technologies, and Hybrid Technologies. The Wireless Technologies segment dominated the largest market share of 48.9% in 2025, owing to its flexibility, ease of installation, and ability to support real-time remote monitoring. Hospitals and home healthcare centers prefer wireless connectivity to reduce infrastructure costs, enable mobile device integration, and improve patient mobility. Wireless systems facilitate seamless integration of multiple devices without extensive cabling, allowing faster deployment across hospital units. They support connectivity for vital signs monitors, infusion pumps, ventilators, and anesthesia machines, enabling clinicians to access patient data instantly. The segment’s growth is reinforced by the adoption of standardized communication protocols, ensuring interoperability between different device manufacturers. Wireless technologies also improve scalability, allowing hospitals to add devices to the network without major upgrades. The technology enables advanced analytics, automated alerts, and integration with EMRs, enhancing operational efficiency and patient care. Hospitals benefit from the reduced risk of wiring-related failures and quicker troubleshooting. The segment also supports telemedicine and remote patient monitoring initiatives, which have become increasingly important. The widespread adoption of IoT-enabled medical devices further consolidates wireless technology dominance. Vendors are continuously upgrading wireless protocols to enhance security, reliability, and data accuracy.

The Hybrid Technologies segment is expected to witness the fastest growth, recording a CAGR of 13.1% from 2026 to 2033, combining the stability of wired networks with the flexibility of wireless systems. Hybrid systems are preferred in large hospital networks where critical devices require wired connections for reliability, while mobile and bedside devices benefit from wireless integration. These technologies allow healthcare providers to maintain high uptime, ensure secure data transmission, and expand monitoring capabilities without overhauling existing infrastructure. Hybrid systems facilitate real-time data access for both stationary and portable devices. The growth of hybrid solutions is driven by hospitals and diagnostic centers looking to optimize cost, reduce installation complexity, and improve patient outcomes. Vendors provide customized hybrid platforms to support interoperability, regulatory compliance, and secure data exchange. The flexibility to mix wired and wireless connections allows healthcare institutions to deploy connectivity solutions incrementally. Hybrid technologies also support remote monitoring and telehealth services, catering to the increasing need for decentralized patient care. By combining reliability, scalability, and flexibility, hybrid connectivity solutions are positioned as a preferred choice for complex hospital ecosystems.

- By Application

On the basis of application, the market is segmented into Vital Signs and Patient Monitors, Anesthesia Machines and Ventilators, Infusion Pumps, and Others. The Vital Signs and Patient Monitors segment dominated the largest market share of 46.5% in 2025, driven by the critical need for continuous patient monitoring across hospitals and home care settings. These devices provide real-time data on heart rate, blood pressure, oxygen saturation, and other vital parameters, which is essential for timely clinical interventions. Integration with hospital IT systems ensures automated data recording, reducing errors associated with manual documentation. Hospitals and diagnostic centers leverage connected monitors to improve patient outcomes, enhance workflow efficiency, and enable remote consultations. The segment’s leadership is also supported by the increasing prevalence of chronic diseases and aging populations, which drive the demand for constant patient surveillance. Remote patient monitoring programs and telehealth initiatives further reinforce the segment’s importance. Providers focus on devices that are interoperable, scalable, and compatible with EMR systems, allowing seamless integration across healthcare environments. Enhanced analytics, automated alerts, and predictive insights are additional features that drive adoption in hospital and home care settings. Research institutions also utilize connected vital signs monitors for clinical trials and healthcare studies. The segment’s prominence is further strengthened by technological advancements, including portable and wearable monitoring solutions.

The Infusion Pumps segment is expected to witness the fastest growth, recording a CAGR of 12.9% from 2026 to 2033, driven by the increasing use of connected pumps in hospitals, ambulatory care centers, and home healthcare. Connected infusion pumps allow precise control of medication delivery, automated alerts for occlusions or dosage errors, and integration with patient EMRs for real-time monitoring. Hospitals prefer connected pumps to reduce medication errors, improve workflow efficiency, and enhance patient safety. The adoption of smart infusion pumps is growing due to regulatory requirements, the push for automated medication management, and the rising prevalence of chronic illnesses. Service providers are increasingly offering remote monitoring, maintenance, and software updates for infusion pump networks. The growth of telemedicine and home healthcare is further fueling demand, as patients can receive automated treatment with minimal clinical supervision. Vendors are focusing on connectivity solutions that enable interoperability, secure data transfer, and predictive analytics for infusion therapy management.

- By End User

On the basis of end user, the market is segmented into Hospitals, Home Healthcare Centers, Diagnostic Centers, and Ambulatory Care Centers. The Hospitals segment dominated the largest market share of 52.8% in 2025, as large hospital networks require advanced device connectivity for patient monitoring, clinical workflow optimization, and regulatory compliance. Hospitals are increasingly implementing centralized systems to manage multiple devices, including monitors, ventilators, infusion pumps, and anesthesia machines, through a single interface. This allows real-time patient tracking, automated alerts, and improved decision-making. The segment is reinforced by the adoption of EMRs, telehealth programs, and digital health initiatives. Leading hospitals are focusing on interoperability, cybersecurity, and scalable connectivity solutions to enhance patient care and operational efficiency. Investments in hospital IT infrastructure, digital transformation programs, and remote patient monitoring are driving market dominance. Hospitals also benefit from predictive analytics, workflow optimization, and improved clinical outcomes enabled by connected devices.

The Home Healthcare Centers segment is expected to witness the fastest growth, recording a CAGR of 13.3% from 2026 to 2033, driven by rising demand for remote monitoring, chronic disease management, and telehealth services. Connected devices in home healthcare allow patients to monitor vital parameters, receive medication through connected infusion systems, and transmit data to clinicians in real time. The trend is fueled by aging populations, increasing prevalence of chronic diseases, and growing adoption of telemedicine. Home healthcare centers leverage device connectivity to reduce hospital readmissions, improve patient compliance, and enhance overall care quality. Vendors are developing solutions specifically for home use, focusing on ease of installation, reliability, and secure data transmission. Expansion of home care services, government initiatives, and insurance reimbursements for remote monitoring are further driving the adoption of connected medical devices in this segment.

Medical Device Connectivity Market Regional Analysis

- North America dominated the medical device connectivity market with the largest revenue share of 42% in 2025, driven by well-established healthcare infrastructure, high R&D expenditure, and the presence of key industry players. The region’s advanced medical ecosystem, coupled with strong adoption of connected healthcare solutions, has created a favorable environment for market growth

- Consumers and healthcare providers in North America highly value the convenience, real-time monitoring capabilities, and seamless integration offered by connected medical devices with hospital information systems, electronic health records, and cloud-based platforms

- This widespread adoption is further supported by increasing demand for remote patient monitoring, telehealth services, and AI-enabled diagnostic tools, establishing medical device connectivity as a critical component in modern healthcare delivery

U.S. Medical Device Connectivity Market Insight

The U.S. medical device connectivity market captured the largest revenue share within North America in 2025, fueled by substantial growth in installations across hospitals, clinics, and diagnostic centers. Innovations in wireless device integration, cloud-based platforms, and AI-enabled monitoring solutions are driving adoption. Healthcare providers are increasingly prioritizing connected systems that improve patient outcomes, enable efficient workflow, and allow real-time access to vital data. Furthermore, government initiatives promoting digital health adoption and the integration of Internet of Medical Things (IoMT) devices are accelerating market expansion.

Europe Medical Device Connectivity Market Insight

The Europe medical device connectivity market is projected to expand at a significant CAGR throughout the forecast period, driven by the increasing adoption of connected healthcare technologies, stringent regulatory standards, and rising awareness about patient safety and operational efficiency. European hospitals and diagnostic centers are integrating medical devices with electronic health records and telehealth platforms, thereby enhancing patient care and workflow efficiency.

U.K. Medical Device Connectivity Market Insight

The U.K. medical device connectivity market is expected to grow steadily during the forecast period, supported by investments in digital healthcare infrastructure, adoption of remote patient monitoring solutions, and growing emphasis on preventive care. Healthcare facilities in the U.K. are increasingly deploying interoperable medical devices to improve data accuracy, patient safety, and clinical decision-making.

Germany Medical Device Connectivity Market Insight

The Germany medical device connectivity market is anticipated to witness substantial growth, driven by high adoption of digital health solutions, well-developed healthcare infrastructure, and increasing integration of IoMT devices. German hospitals and research institutes are leveraging connected solutions to optimize workflow, reduce errors, and support advanced clinical research initiatives.

Asia-Pacific Medical Device Connectivity Market Insight

The Asia-Pacific medical device connectivity market is expected to be the fastest-growing region during the forecast period, driven by increasing healthcare infrastructure, rising adoption of digital health solutions, growing demand for remote patient monitoring, and expanding disposable incomes in countries such as China, India, and Japan. Government initiatives promoting connected healthcare, combined with technological advancements and affordability of modern devices, are fueling adoption across hospitals, clinics, and home care settings.

Japan Medical Device Connectivity Market Insight

The Japan medical device connectivity market is gaining momentum due to a strong focus on high-tech healthcare solutions, an aging population, and increasing demand for remote monitoring and home-based care. The integration of IoMT devices with hospital management systems and mobile health applications is facilitating efficient patient management and proactive healthcare delivery.

China Medical Device Connectivity Market Insight

The China medical device connectivity market accounted for the largest market revenue share in Asia-Pacific in 2025. Growth is driven by rapid urbanization, expanding healthcare infrastructure, government initiatives for digital health, and rising adoption of connected healthcare devices in hospitals and clinics. The push towards smart hospitals and the availability of cost-effective connected medical devices are major factors propelling the market.

Medical Device Connectivity Market Share

The Medical Device Connectivity industry is primarily led by well-established companies, including:

• Oracle (U.S.)

• Philips Healthcare (Netherlands)

• GE Healthcare (U.S.)

• Siemens Healthineers (Germany)

• Medtronic (Ireland)

• BD (U.S.)

• Tyler Technologies (U.S.)

• Cardinal Health (U.S.)

• Drägerwerk (Germany)

• Spacelabs Healthcare (U.S.)

• Carestream Health (U.S.)

• Hill-Rom Holdings (U.S.)

• Welch Allyn (U.S.)

• Connexall (France)

• McKesson Corporation (U.S.)

• Haemonetics (U.S.)

• Stryker Corporation (U.S.)

• Teladoc Health (U.S.)

• Medicomp Systems (U.S.)

Latest Developments in Global Medical Device Connectivity Market

- In July 2025, Philips entered into a strategic partnership with leading medical device companies, including Dräger, Hamilton Medical, Getinge, and B. Braun, to advance Service-Oriented Device Connectivity (SDC) interoperability in critical care settings. This initiative focuses on creating a unified healthcare environment where devices can seamlessly exchange data, enabling real-time monitoring, better workflow efficiency, and enhanced patient safety across hospital networks

- In May 2025, the IEEE Standards Association published the “IEEE 2621 Series” of standards for medical device cybersecurity. These standards provide a framework for manufacturers to design secure and interoperable devices that safely transmit patient data across hospital IT systems. The initiative aims to reduce cyber risks and enhance the integration of connected medical devices in hospitals

- In March 2023, the U.S. Food and Drug Administration (FDA) launched the “Diagnostic Data Program” under its SHIELD initiative. This program is designed to standardize and improve the capture, harmonization, and interoperability of data from medical devices and diagnostic laboratories. It supports real-time data sharing, early detection of clinical issues, and more efficient integration of medical devices into hospital networks

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.