Global Medical Coatings For Implants Market

Market Size in USD Billion

CAGR :

%

USD

1.85 Billion

USD

4.02 Billion

2024

2032

USD

1.85 Billion

USD

4.02 Billion

2024

2032

| 2025 –2032 | |

| USD 1.85 Billion | |

| USD 4.02 Billion | |

|

|

|

|

What is the Global Medical Coatings for Implants Market Size and Growth Rate?

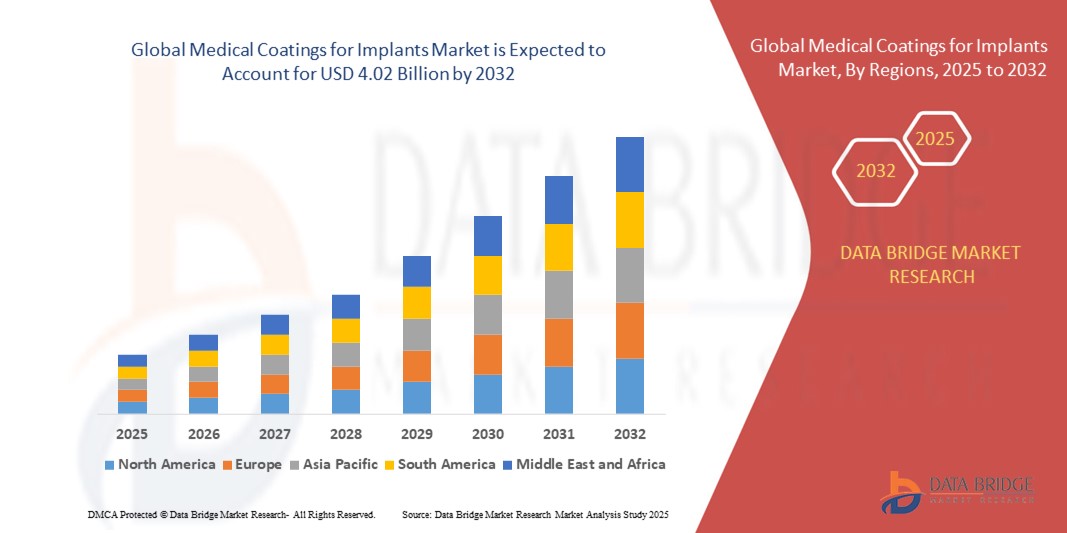

- The global medical coatings for implants market size was valued at USD 1.85 billion in 2024 and is expected to reach USD 4.02 billion by 2032, at a CAGR of 10.20% during the forecast period

- The global medical coating for implants market is witnessing robust growth driven by increasing demand for enhanced biocompatibility and durability of implants. Advancements in coating technologies, such as polymer and metal coatings, are catering to diverse applications, including orthopedic, cardiovascular, and dental implants

- With a focus on improving patient outcomes and reducing post-operative complications, the market is poised for continuous innovation and expansion across various medical disciplines. On the other hand, complex regulatory requirements and stringent approval processes is anticipated to challenges the global medical coatings for implants market growth

What are the Major Takeaways of Medical Coatings for Implants Market?

- There is a correlated surge in medical interventions such as orthopedic and cardiovascular implants, as the global demographic landscape evolves, characterized by a significant increase in the elderly demographic

- The aging population, often associated with higher incidence of chronic diseases and degenerative conditions, necessitates advanced medical coatings to enhance the performance and longevity of implants, addressing the specific needs of this demographic segment

- Medical coatings that enhance biocompatibility, reduce friction, and improve implant integration become essential for addressing the unique challenges posed by aging-related health issues

- Strategic positioning and innovation in coatings tailored for the specific needs of an older demographic are pivotal for companies aiming to capitalize on this demographic-driven growth in the medical coating market

- North America dominated the medical coatings for implants market with the largest revenue share of 41.2% in 2024, driven by a surge in orthopedic and cardiovascular implant procedures and favorable reimbursement policies

- Asia-Pacific is projected to witness the fastest CAGR of 13.4% from 2025 to 2032, driven by a large patient pool, growing healthcare investments, and increasing implant surgeries

- The Hydroxyapatite (HA) segment dominated the market with the largest revenue share of 38.9% in 2024, owing to its superior biocompatibility, osteoconductivity, and ability to enhance the integration of implants with bone tissues

Report Scope and Medical Coatings for Implants Market Segmentation

|

Attributes |

Medical Coatings for Implants Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Medical Coatings for Implants Market?

Rise of Antimicrobial and Drug-Eluting Coatings for Enhanced Patient Outcomes

- A prominent trend shaping the medical coatings for implants market is the increasing use of antimicrobial, antithrombogenic, and drug-eluting coatings to reduce infection risks and improve implant integration

- These coatings deliver localized therapeutic effects, minimize post-operative complications, and reduce the need for systemic drugs aligning with value-based care and patient-centric healthcare models

- For instance, in March 2024, DSM Biomedical launched ComfortCoat Antimicrobial Coatings, offering infection control properties for vascular and orthopedic implants

- Advancements in surface modification and nanocoating techniques have allowed better adhesion, drug-release control, and biocompatibility, particularly in cardiovascular and orthopedic implant applications

- As hospitals push for reduced infection rates and faster recovery, the demand for advanced medical coatings will grow, solidifying their role in the next-generation implant ecosystem

What are the Key Drivers of Medical Coatings for Implants Market?

- Growing prevalence of chronic conditions such as osteoporosis, cardiovascular disease, and diabetes is increasing the number of surgical implants, which in turn is driving demand for durable and biocompatible coatings

- In February 2025, Hydromer Inc. partnered with a major U.S.-based orthopedic firm to supply hydrophilic coatings for joint implants, enhancing lubrication and reducing friction post-surgery

- Rising adoption of minimally invasive surgeries and implantable medical devices across emerging markets is also boosting the use of coatings that support better biofunctionality and healing

- Regulatory emphasis on biocompatibility, non-toxicity, and long-term safety of implant materials, especially in the U.S. and Europe, is further pushing innovation in coating formulations

- The combined pressure of performance, compliance, and patient outcomes is accelerating R&D into multifunctional coatings that combine drug delivery, antimicrobial properties, and improved osseointegration

Which Factor is challenging the Growth of the Medical Coatings for Implants Market?

- A significant challenge is the high R&D cost and regulatory burden involved in developing coatings that meet clinical, mechanical, and safety requirements across global markets

- Complex testing protocols and extended approval timelines from bodies such as the FDA and EMA increase time-to-market, especially for novel coating formulations with drug-eluting properties

- For instance, Accentus Medical highlighted regulatory delays in CE Mark approvals for its silver-based antimicrobial coatings, despite strong in-vitro efficacy results

- In addition, ensuring long-term stability, uniform application, and compatibility with diverse implant substrates (e.g., titanium, PEEK, ceramics) is technically demanding

- To address these barriers, manufacturers are investing in AI-driven formulation modeling, automated coating systems, and collaborative trials with hospitals and research institutes

- Regulatory harmonization and government-backed medtech innovation funds are such asly to ease development hurdles and support broader market adoption in the coming years

How is the Medical Coatings for Implants Market Segmented?

The market is segmented on the basis of material, type, coating type, application, and end user.

- By Product

On the basis of product, the Medical Coatings for Implants market is segmented into Hydroxyapatite (HA), Titanium Plasma Spray, Nanoparticle, Silicon, and Others. The Hydroxyapatite (HA) segment dominated the market with the largest revenue share of 38.9% in 2024, owing to its superior biocompatibility, osteoconductivity, and ability to enhance the integration of implants with bone tissues. HA coatings are extensively used in orthopedic and dental implants to improve long-term fixation and reduce healing time.

Meanwhile, the Nanoparticle coatings segment is expected to grow at the fastest CAGR from 2025 to 2032, driven by rising interest in nano-scale modifications for better cellular response and antimicrobial properties.

- By Technology

On the basis of technology, the market is categorized into Plasma Spray, Vacuum Spray, Thermal Spray, Physical Vapor Deposition (PVD), Chemical Vapor Deposition (CVD), and Others. The Plasma Spray segment held the dominant market share of 41.2% in 2024, attributed to its widespread use for applying thick, durable, and bioactive coatings—especially Hydroxyapatite—on orthopedic and dental implants.

However, the PVD segment is anticipated to grow at the highest CAGR during the forecast period due to its increasing application in high-precision implants requiring ultra-thin, uniform, and wear-resistant coatings.

- By Coating Type

On the basis of coating type, the market is segmented into Polymer Coatings, Metal Coatings, Ceramic Coatings, and Others. The Ceramic Coatings segment dominated the market with an estimated revenue share of 36.5% in 2024, driven by their excellent biocompatibility, corrosion resistance, and effectiveness in reducing metal ion release.

Polymer Coatings are expected to witness notable growth due to rising demand for anti-thrombogenic and drug-eluting surfaces, especially in cardiovascular and neurological implants.

- By Application

On the basis of application, the market is segmented into Orthopedic Implants, Cardiovascular Implants, Dental Implants, Neurological Implants, and Others. The Orthopedic Implants segment led the market in 2024, accounting for a revenue share of 44.7%, fueled by the growing prevalence of musculoskeletal disorders, rising geriatric population, and increased joint replacement surgeries. Coatings in these implants enhance osseointegration and extend implant longevity.

The Cardiovascular Implants segment is projected to grow rapidly, driven by increasing adoption of stents and pacemakers, where coatings help reduce thrombosis and improve biocompatibility.

- By End Users

On the basis of end users, the Medical Coatings for Implants market is segmented into Hospitals, Ambulatory Surgical Centers, Specialty Clinics, and Others. The Hospitals segment captured the largest market share of 52.6% in 2024, supported by the high volume of surgical procedures and extensive use of advanced coated implants in large healthcare settings.

The Ambulatory Surgical Centers segment is expected to witness significant growth owing to the rise in minimally invasive procedures and faster patient recovery times, increasing the demand for pre-coated and ready-to-use implants.

Which Region Holds the Largest Share of the Medical Coatings for Implants Market?

- North America dominated the medical coatings for implants market with the largest revenue share of 41.2% in 2024, driven by a surge in orthopedic and cardiovascular implant procedures and favorable reimbursement policies

- The region’s strong presence of medical device manufacturers, rising aging population, and advancements in coating technologies are major growth catalysts

- Growing demand for antimicrobial, hydrophilic, and drug-eluting coatings across applications is reinforcing North America's market leadership

U.S. Medical Coatings for Implants Market Insight

The U.S. led the North American market in 2024, owing to its advanced healthcare infrastructure and early adoption of innovative coating technologies. Surgeons and OEMs are increasingly using coatings to improve implant biocompatibility, reduce infections, and extend implant life. The FDA’s support for coated implants is further encouraging R&D and clinical deployment.

Canada Medical Coatings for Implants Market Insight

Canada is witnessing moderate growth, backed by increased orthopedic surgeries, expanding geriatric population, and public healthcare funding. The country is also focusing on nanotechnology and antimicrobial coatings to improve patient outcomes. Strategic collaborations between academia and manufacturers are fostering innovation in implant surface treatments.

Mexico Medical Coatings for Implants Market Insight

Mexico’s market is gaining momentum, supported by growing medical tourism, expanding local manufacturing, and improving healthcare access. Demand for cost-effective and high-performance coatings for joint replacements and dental implants is rising. Government efforts to promote domestic production are further propelling growth.

Which Region is the Fastest Growing in the Medical Coatings for Implants Market?

Asia-Pacific is projected to witness the fastest CAGR of 13.4% from 2025 to 2032, driven by a large patient pool, growing healthcare investments, and increasing implant surgeries. The rise of minimally invasive surgeries and focus on advanced surface coatings are fostering rapid market expansion. Increased R&D spending, favorable regulations, and international collaborations are further boosting regional growth.

China Medical Coatings for Implants Market Insight

China is leading Asia-Pacific growth, thanks to rapid healthcare infrastructure development, a growing elderly population, and expanding orthopedic implant production. Domestic companies are innovating bioactive and antibacterial coatings to improve post-operative outcomes. Government support for medical innovation is further elevating the market.

Japan Medical Coatings for Implants Market Insight

Japan’s mature healthcare system and strong focus on precision and quality in implants make it a key market. High adoption of ceramic and hydroxyapatite coatings in dental and orthopedic implants is driving demand. Emphasis on biocompatibility and advanced surgical techniques supports continued growth.

India Medical Coatings for Implants Market Insight

India is emerging as a lucrative market, supported by rising joint replacement surgeries, increasing disposable income, and local manufacturing expansion. Initiatives such as "Make in India" and improving health insurance coverage are increasing implant accessibility, while growing awareness is boosting demand for coated implants.

Which are the Top Companies in Medical Coatings for Implants Market?

The medical coatings for implants industry is primarily led by well-established companies, including:

- HiMED (Japan)

- Hydromer (U.S.)

- DOT GmbH (Germany)

- Lincotek Group S.p.A (Italy)

- Medicoat AG (Switzerland)

- CAM Bioceramics B.V. (Netherlands)

- APS Materials, Inc. (U.S.)

- Biovac (Turkey)

- TeroLab Surface Group (Germany)

- ENS Technology (U.S.)

- Accentus Medical (U.K.)

- Orchid MPS Holdings, LLC (U.S.)

What are the Recent Developments in Global Medical Coatings for Implants Market?

- In January 2025, Hydromer introduced PFAS-free hydrophilic coatings specifically developed for medical devices, reflecting the company's commitment to safer and environmentally conscious innovations. This marks a significant move toward sustainability and compliance with emerging global health regulations

- In June 2024, Hydromer launched HydroThrombX, a next-generation thromboresistant coating building upon the company’s legacy F200t technology, offering improved biocompatibility and performance. This innovation positions Hydromer at the forefront of thromboresistant medical coating technologies

- In August 2023, Asep Inc. entered into an exclusive global licensing agreement with the University of British Columbia through its subsidiary SafeCoat Medical Inc., granting full rights to develop and commercialize an advanced infection-fighting medical coating. This deal empowers Asep Inc. to scale the adoption of anti-infective coatings and reduce healthcare-associated complications

- In June 2023, Bio-Gate AG expanded the market reach of its HyProtect coating in collaboration with long-term partner OSSIS Ltd., especially for orthopedic revision implants in compassionate care cases. This move strengthens Bio-Gate’s global footprint in high-precision medical coatings

- In September 2023, Hariand Medical Systems established a new office in Caesarea, Israel, reinforcing its international growth and operational presence in strategic healthcare markets. This expansion supports the company’s global service capability and customer proximity

- In March 2022, Biocoat, Inc. diversified its offerings by launching the EMERSE product line, enabling the design and delivery of hydrophilic dip coating equipment. This expansion enhances Biocoat’s turnkey solutions and supports growing demand for custom coating capabilities

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Medical Coatings For Implants Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Medical Coatings For Implants Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Medical Coatings For Implants Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.