Global Medical Camera Market

Market Size in USD Billion

CAGR :

%

USD

3.88 Billion

USD

10.37 Billion

2024

2032

USD

3.88 Billion

USD

10.37 Billion

2024

2032

| 2025 –2032 | |

| USD 3.88 Billion | |

| USD 10.37 Billion | |

|

|

|

|

Medical Camera Market Analysis

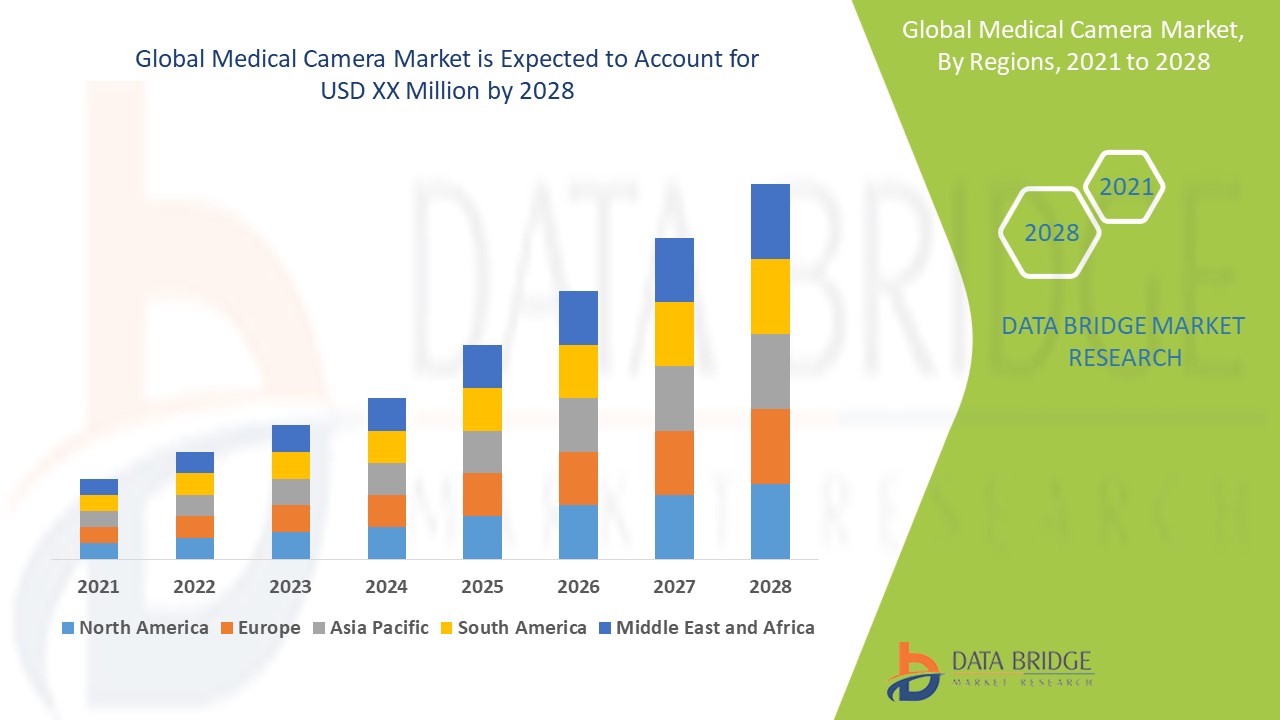

The medical camera market is witnessing significant growth due to continuous advancements in imaging technologies, which are enhancing diagnostic capabilities across various medical specialties. Medical cameras, such as endoscopy, dermatology, ophthalmology, and surgery cameras, are crucial tools for visualizing internal body structures and aiding in the early detection of diseases. Recent innovations, including high-definition (HD) imaging, wireless connectivity, and integration with artificial intelligence (AI), have greatly improved image quality, precision, and ease of use. For instance, advanced endoscopy systems offer real-time high-resolution imaging, aiding in the diagnosis of conditions such as gastrointestinal disorders and cancer. In addition, the development of 3D medical cameras and robotic-assisted surgery cameras is revolutionizing surgical procedures, allowing for more accurate, minimally invasive surgeries. The growing awareness of the importance of early diagnosis, coupled with an increase in healthcare spending and government initiatives to improve healthcare infrastructure, is propelling the demand for medical cameras. North America dominates the market, but the Asia Pacific region is expected to see rapid growth due to advancements in healthcare technology and rising investments in research and development. These factors position the medical camera market for continued expansion in the coming years.

Medical Camera Market Size

The global medical camera market size was valued at USD 3.88 billion in 2024 and is projected to reach USD 10.37 billion by 2032, with a CAGR of 13.05% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Medical Camera Market Trends

“Increasing Adoption of 3D Imaging and Augmented Reality (AR) technologies”

A significant trend in the medical camera market is the increasing adoption of 3D imaging and augmented reality (AR) technologies, particularly in surgery and diagnostic applications. These advancements are revolutionizing the precision and efficiency of medical procedures. For instance, the integration of 3D cameras in minimally invasive surgeries allows surgeons to view enhanced, multi-dimensional images of internal organs, improving surgical outcomes and reducing recovery times. In addition, AR technologies are being used to overlay critical patient information in real time during procedures, providing surgeons with detailed, contextual insights. The rise of AI-powered diagnostic tools is also driving this trend, as these technologies can analyze images for abnormalities such as tumors or lesions, assisting clinicians in making more accurate diagnoses. As healthcare facilities continue to adopt these advanced tools, the demand for high-quality medical cameras, including 3D and AR-enabled devices, is expected to rise, significantly shaping the future growth of the medical camera market.

Report Scope and Medical Camera Market Segmentation

|

Attributes |

Medical Camera Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Olympus Corporation (Japan), Sony Group Corporation (Japan), Carestream Health (U.S.), Stryker (U.S.), Richard Wolf GmbH (Germany), Smith + Nephew (U.K.), Leica Biosystems Nussloch GmbH (Germany), Carl Zeiss Meditec AG (Germany), Hamamatsu Photonics K.K. (Japan), TOPCON CORPORATION (Japan), CANON MEDICAL SYSTEMS CORPORATION (Japan), Nikon Corporation (Japan), JOEL Ltd. (Japan), SPOT Imaging (U.S.), Allied Vision Technologies GmbH (Germany), MEGIDUS (Israel), IMPERX, Inc. (U.S.), STEMMER IMAGING AG (Germany), KARL STORZ (Germany), and 3DMedivision Co.Ltd. (China) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Medical Camera Market Definition

A medical camera is a specialized imaging device used in the healthcare industry to capture high-resolution images or videos of internal body structures for diagnostic, surgical, and therapeutic purposes. These cameras are utilized across various medical fields, including endoscopy, ophthalmology, dermatology, surgery, and dentistry, to visualize and assess conditions such as tumors, infections, fractures, or abnormalities in organs and tissues.

Medical Camera Market Dynamics

Drivers

- Rising Aging Population

The aging population is a significant driver of the medical camera market, as the growing number of elderly individuals contributes to a higher incidence of chronic diseases and joint disorders, conditions that often require advanced diagnostic imaging tools. According to the United Nations, the global population aged 60 and older is expected to double from 1 billion in 2020 to 2.1 billion by 2050, with the most rapid growth occurring in developing countries. As people age, they become more susceptible to conditions such as arthritis, osteoporosis, and cardiovascular diseases, all of which require diagnostic imaging for early detection and effective treatment. For instance, advanced medical cameras, such as endoscopy and ophthalmology cameras, are frequently used to detect and monitor diseases such as colorectal cancer and age-related macular degeneration. This increasing demand for early and accurate diagnostics is driving the adoption of high-quality medical imaging systems, making the aging population a crucial market driver for the medical camera industry.

- Growing Demand for Minimally Invasive Procedures

The growing demand for minimally invasive procedures is a major driver of the medical camera market, as these surgeries often rely heavily on advanced medical imaging tools for visualization. Minimally invasive surgeries, such as laparoscopic and robotic-assisted procedures, have gained popularity due to their advantages, including shorter recovery times, reduced risk of infection, and smaller incisions compared to traditional open surgeries. For instance, laparoscopic surgery, which is commonly used for gallbladder removal, hernia repair, and diagnostic procedures, requires high-quality cameras to provide surgeons with real-time, detailed images of internal organs. This trend is further supported by the rise in outpatient surgeries and the preference for quicker recovery, particularly among patients seeking less disruptive treatments. As the demand for such procedures continues to grow, healthcare providers are increasingly investing in advanced medical cameras, thus driving market growth. This shift towards minimally invasive techniques is expected to continue fueling the demand for medical imaging devices, making it a key market driver.

Opportunities

- Increasing Technological Advancements in Medical Imaging

Technological advancements in medical imaging are a major market opportunity, as continuous improvements in technologies such as high-definition (HD) imaging, 3D imaging, artificial intelligence (AI), and augmented reality (AR) are significantly enhancing the precision, quality, and effectiveness of medical cameras. For instance, the integration of AI algorithms into medical cameras allows for automated image analysis, enabling quicker and more accurate diagnoses, particularly in fields such as radiology and dermatology. In ophthalmology, 3D imaging systems provide detailed visualizations of the eye's internal structures, improving the detection of diseases such as glaucoma and macular degeneration. AR integration is also revolutionizing surgery by overlaying critical patient information onto real-time images, guiding surgeons with greater accuracy. These technological advancements are expanding the capabilities of medical cameras, driving the development of innovative diagnostic tools and enabling minimally invasive procedures with higher precision. As healthcare providers continue to adopt these advanced technologies, the medical camera market is poised for significant growth, creating valuable opportunities for manufacturers to offer cutting-edge solutions.

- Rising Global Healthcare Expenditures

Increasing healthcare expenditure presents a significant market opportunity for the medical camera industry, as rising investments globally, particularly in regions such as North America and Europe, are driving demand for advanced medical imaging systems. Governments and private sectors are prioritizing healthcare infrastructure, allocating funds for the adoption of state-of-the-art diagnostic tools and medical cameras. For instance, the U.S. government has made substantial investments in healthcare reform through initiatives such as the Affordable Care Act, which has expanded access to advanced healthcare services, including imaging technologies. Similarly, European countries are investing in healthcare modernization, with a focus on improving diagnostic capabilities through the integration of cutting-edge medical devices such as 4K and 3D imaging cameras in hospitals and diagnostic centers. These increased expenditures on healthcare infrastructure are improving patient care and fueling demand for advanced medical imaging solutions, positioning the medical camera market for substantial growth as healthcare providers look to enhance their diagnostic and treatment capabilities.

Restraints/Challenges

- High Cost of Medical Cameras

The high cost of medical cameras is a significant challenge in the market, as these devices often require substantial investment for both acquisition and maintenance. Advanced medical cameras, such as surgical microscopes, endoscopic systems, or 3D imaging cameras, can range from tens of thousands to over a million dollars, depending on the technology and specifications. For instance, a high-end 3D laparoscopic camera system can cost upwards of a million USD, which can be prohibitive for smaller hospitals, clinics, or healthcare systems in low-resource areas. In addition, the ongoing maintenance, calibration, and potential upgrades of these systems add to the overall financial burden. This high cost limits access to the latest medical imaging technology, especially in developing countries or smaller healthcare facilities that may struggle with budgeting for such advanced equipment. As a result, the market's growth is constrained, and the adoption of cutting-edge medical camera technologies is slower, making cost a major barrier to market expansion and accessibility. This financial challenge creates a significant market hurdle for both healthcare providers and device manufacturers.

- Strict Regulatory Requirements

Medical cameras are subject to strict regulatory requirements to ensure patient safety and device effectiveness, which can create significant delays in bringing new technologies to market. The approval process for medical devices often involves multiple stages, including clinical trials, safety evaluations, and rigorous documentation, all of which must comply with standards set by organizations such as the U.S. Food and Drug Administration (FDA) or the European Medicines Agency (EMA). For instance, the approval process for a new endoscopic camera system can take several years, with additional time required for post-market surveillance and compliance with evolving standards. Regulatory challenges can be further compounded by differing requirements across various countries, which can slow down global distribution. Navigating these complex regulatory landscapes often leads to delays in market entry and increased development costs, posing a significant barrier for manufacturers seeking to introduce innovative medical cameras. These hurdles hinder the timely availability of new technologies and limit market growth, making regulatory approval a major challenge in the medical camera market.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Medical Camera Market Scope

The market is segmented on the basis of camera type, resolution, sensor, and end users. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Camera Type

- Endoscopy Cameras

- Surgery Cameras

- Dermatology Cameras

- Ophthalmology Cameras

- Dental Cameras

Resolution

- High-definition Cameras (HD)

- Standard-definition Cameras (SD)

Sensor

- Complementary Metal-oxide-semiconductor (CMOS)

- Charge Coupled Device (CCD)

End Users

- Hospitals

- Diagnostic Centers

- Speciality Clinics

- Ambulatory Surgery Centers

Medical Camera Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, camera type, resolution, sensor, and end users as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the medical camera market, driven by significant technological advancements and the presence of key market players. In addition, the rapid adoption of the latest equipment, rising per capita healthcare spending, and increased investments in research and development are expected to further fuel the growth of the medical camera market in the region during the forecast period.

The Asia Pacific region is expected to experience highest growth in the medical camera market, driven by continuous advancements in imaging technology and increased awareness about the importance of timely diagnosis and treatment. In addition, government initiatives aimed at modernizing healthcare infrastructure, along with rising investments in research and development, are anticipated to further accelerate the growth of the medical camera market in the region in the coming years.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Medical Camera Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Medical Camera Market Leaders Operating in the Market Are:

- Olympus Corporation (Japan)

- Sony Group Corporation (Japan)

- Carestream Health (U.S.)

- Stryker (U.S.)

- Richard Wolf GmbH (Germany)

- Smith + Nephew (U.K.)

- Leica Biosystems Nussloch GmbH (Germany)

- Carl Zeiss Meditec AG (Germany)

- Hamamatsu Photonics K.K. (Japan)

- TOPCON CORPORATION (Japan)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- Nikon Corporation (Japan)

- JOEL Ltd. (Japan)

- SPOT Imaging (U.S.)

- Allied Vision Technologies GmbH (Germany)

- MEGIDUS (Israel)

- IMPERX, Inc. (U.S.)

- STEMMER IMAGING AG (Germany)

- KARL STORZ (Germany)

- 3DMedivision Co.Ltd. (China)

Latest Developments in Medical Camera Market

- In September 2024, Stryker, a medical technology company, introduced the '1788 Advanced Imaging Platform' in India. This visualization system is designed for use across multiple specialties, offering enhanced imaging capabilities to improve patient outcomes

- In November 2023, Olympus Corporation launched its next-generation EVIS X1 endoscopy system in China, aiming to assist physicians in visualizing abnormalities such as Celiac disease, Crohn’s disease, ulcers, acid reflux, and colorectal cancer (CRC)

- In September 2023, Stryker announced the launch of its next-generation 1788 platform, a series of minimally invasive medical cameras that are set to advance surgery across various specialties

- In June 2022, Casio Computer Co., Ltd. launched the DZ-D100 dermatology camera and DZ-S50 dermatology scope in Europe, enhancing diagnostic capabilities in dermatology

- In March 2022, Endoluxe introduced a high-definition wireless endoscopy camera. The TowerTech camera device is equipped with all the necessary visualization features required during endoscopic surgical procedures

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.