Global Medical Bionic Implantartificial Organs Market

Market Size in USD Billion

CAGR :

%

USD

25.92 Billion

USD

47.28 Billion

2024

2032

USD

25.92 Billion

USD

47.28 Billion

2024

2032

| 2025 –2032 | |

| USD 25.92 Billion | |

| USD 47.28 Billion | |

|

|

|

|

Global Medical Bionic Implant Artificial Organs Market Segmentation, By Product (Vision Bionics, Ear Bionics, Orthopedic Bionics, Heart Bionics, and Neural/Brain Bionics), Method of Fixation (Implantable, and Externally Worn), Technology (Electronic, and Mechanical), End User (Hospitals and Clinics, Research and Academic Institutes, and Others) - Industry Trends and Forecast to 2032

Medical Bionic Implant Artificial Organs Market Size

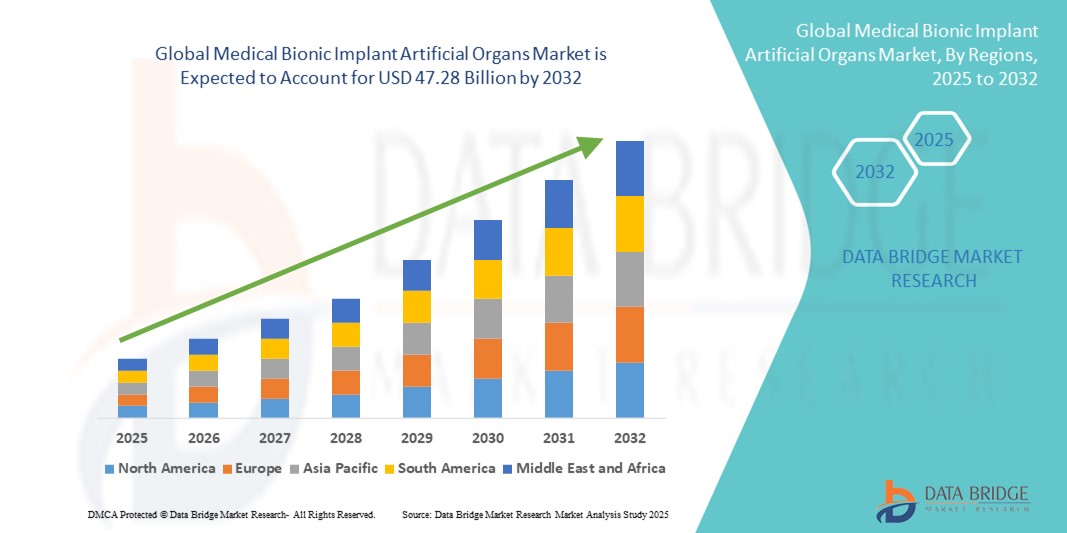

- The global medical bionic implant artificial organs market size was valued at USD 25.92 billion in 2024 and is expected to reach USD 47.28 billion by 2032, at a CAGR of 7.80% during the forecast period

- The market growth is largely fueled by the rising prevalence of chronic diseases, organ failure cases, and the increasing reliance on technological advancements in biomaterials, robotics, and tissue engineering, which are driving higher adoption of bionic implants and artificial organs across global healthcare systems

- Furthermore, growing patient demand for life-enhancing, durable, and minimally invasive solutions is positioning medical bionic implants and artificial organs as critical alternatives to traditional transplants. These converging factors are accelerating the uptake of medical bionic implant artificial organs solutions, thereby significantly boosting the industry's growth

Medical Bionic Implant Artificial Organs Market Analysis

- Medical bionic implants and artificial organs, offering advanced solutions for organ replacement and functional restoration, are becoming vital in modern healthcare systems due to the rising prevalence of chronic diseases, organ failure cases, and the widening gap between organ donors and patients in need

- The escalating demand for artificial organs and bionic implants is primarily fueled by technological advancements in tissue engineering, 3D bioprinting, and bioelectronics, along with the aging global population and increasing healthcare expenditure

- North America dominated the medical bionic implant & artificial organs market with the largest revenue share of 40.51% in 2024, supported by high adoption of advanced healthcare technologies, strong presence of leading industry players, and rising demand for innovative implantable devices. The U.S. witnessed substantial growth in bionic organ implantations, driven by regulatory approvals and strategic collaborations between medtech companies and biotech startups

- Asia-Pacific is expected to be the fastest growing region in the medical bionic implant & artificial organs market during the forecast period, recording a CAGR of around 10.0%, owing to rapid urbanization, increasing disposable incomes, government healthcare investments, and a surge in demand for affordable artificial organ solutions across China, India, and Southeast Asia

- The Implantable segment dominated the medical bionic implant & artificial organs market with a share of 68.5% in 2024, supported by its ability to provide long-term functionality and closer mimicry of natural organ performance compared to external devices

Report Scope and Medical Bionic Implant Artificial Organs Market Segmentation

|

Attributes |

Medical Bionic Implant Artificial Organs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Medical Bionic Implant Artificial Organs Market Trends

Advancements Driving Medical Bionic Implant & Artificial Organs Market Growth

- A significant and accelerating trend in the global medical bionic implant & artificial organs market is the integration of advanced biomaterials, bioelectronics, and tissue engineering techniques, enabling devices that more closely mimic natural organ functions and improve patient outcomes

- For instance, the development of next-generation artificial hearts and ventricular assist devices has substantially enhanced survival rates in patients with end-stage heart failure. Similarly, artificial kidneys under clinical trials aim to provide more efficient blood filtration, reducing dependence on traditional dialysis

- Continuous innovation in bionic implants has expanded their use in neurology and orthopedics. For instance, advanced cochlear implants are restoring near-natural hearing to patients, while robotic prosthetics with sensory feedback are offering improved mobility and dexterity to amputees.

- The seamless integration of artificial organs and implants into healthcare delivery systems has been supported by regulatory approvals and government initiatives, particularly in the U.S. and Europe, where frameworks encourage innovation while ensuring safety and efficacy

- This trend towards more sophisticated, biocompatible, and functional devices is reshaping patient care standards. Companies such as Medtronic, Abbott, and Össur are investing heavily in R&D, focusing on personalized solutions that adapt to patient-specific needs

- The demand for medical bionic implants and artificial organs is growing rapidly across both developed and emerging markets, driven by rising cases of organ failure, an aging population, and the persistent global shortage of donor organs

Medical Bionic Implant Artificial Organs Market Dynamics

Driver

Growing Need Due to Rising Chronic Diseases and Organ Failure Cases

- The increasing prevalence of chronic conditions such as cardiovascular diseases, kidney failure, and neurological disorders, coupled with the rising global burden of organ failure, is a significant driver for the heightened demand for medical bionic implants and artificial organs

- For instance, in March 2024, BiVACOR announced positive clinical progress with its total artificial heart program, highlighting the industry’s growing focus on developing advanced bionic solutions to address the critical shortage of donor organs. Such developments by leading companies are expected to drive the medical bionic implant artificial organs industry growth during the forecast period

- As patients and healthcare providers seek advanced, life-saving alternatives to traditional organ transplantation, bionic implants and artificial organs provide a viable solution with improved functionality, reduced dependency on donors, and enhanced long-term survival outcomes

- Furthermore, advancements in materials science, robotics, and bioelectronics are making these devices more durable, biocompatible, and reliable, encouraging their adoption across global healthcare systems

- The convenience of reduced transplant wait times, improved rehabilitation outcomes, and the ability to restore near-natural organ function are key factors propelling the uptake of medical bionic implants and artificial organs in hospitals and clinics worldwide. The growing availability of user-friendly and technologically advanced devices further contributes to market expansion

Restraint/Challenge

Concerns Regarding High Costs and Regulatory Complexities

- The relatively high initial costs associated with advanced bionic implants and artificial organs pose a significant challenge to broader adoption, particularly in price-sensitive regions and among healthcare institutions with limited budgets. These devices often involve cutting-edge technologies and specialized surgical procedures, increasing the overall treatment expenditure

- For instance, several reports have highlighted how the high cost of artificial hearts and advanced neural bionics limits their accessibility, especially in developing nations where reimbursement frameworks are underdeveloped

- Addressing these cost-related barriers through government support programs, public-private partnerships, and cost-efficient manufacturing will be crucial for scaling adoption. Leading companies are also exploring modular designs and localized production to reduce costs and improve affordability

- In addition, the stringent regulatory approval process for medical implants and artificial organs can delay product launches and hinder patient access. Securing approvals requires extensive clinical testing and compliance with safety standards, making the pathway to commercialization both time-consuming and resource-intensive

- While innovation is accelerating, overcoming these challenges through policy support, streamlined regulatory pathways, and broader insurance coverage will be vital for ensuring sustained growth in the medical bionic implant artificial organs market

- Despite advancements, there remains a risk of device malfunction, infection, or rejection after implantation. Complications such as blood clotting, immune response, or mechanical wear can limit patient confidence and slow adoption rates

Medical Bionic Implant Artificial Organs Market Scope

The market is segmented on the basis of product, method of fixation, technology, and end user.

- By Product

On the basis of product, the medical bionic implant & artificial organs market is segmented into vision bionics, ear bionics, orthopedic bionics, heart bionics, and neural/brain bionics. The orthopedic bionics segment dominated the market with a revenue share of 32.5% in 2024, primarily due to the rising incidence of musculoskeletal disorders, joint degeneration, and trauma-related injuries worldwide. Orthopedic implants, including prosthetic limbs, joint replacements, and robotic exoskeletons, are witnessing strong demand owing to their ability to restore mobility and improve quality of life for patients. Advancements in material science, including lightweight alloys and biocompatible polymers, have enhanced the durability and efficiency of these devices, further fueling adoption. Increased investments in rehabilitation technologies, along with the growing aging population prone to orthopedic issues, continue to strengthen this segment’s dominance. Moreover, favorable reimbursement policies in developed regions and the availability of customized orthopedic solutions have reinforced its leadership position in the global market.

The neural/brain bionics segment is projected to grow at the fastest CAGR of 12.5% from 2025 to 2032, driven by rapid advancements in neuroprosthetics, brain-computer interfaces, and deep brain stimulation therapies. The increasing global prevalence of neurological conditions such as Parkinson’s disease, epilepsy, and paralysis is creating strong demand for innovative neural implants. Research in neuro-engineering and the integration of AI-driven brain signal processing are expanding the potential applications of these devices in restoring lost functions. Clinical trials showing promising results in restoring motor control and cognitive functions have further boosted adoption. The growing focus on personalized medicine and precision healthcare also supports the growth of this segment. Rising government and private sector funding for neuroscience research, along with collaborations between medtech companies and academic institutes, are accelerating commercialization of brain bionics.

- By Method of Fixation

On the basis of fixation, the medical bionic implant & artificial organs market is segmented into implantable and externally worn. The implantable segment dominated the market with a share of 68.5% in 2024, supported by its ability to provide long-term functionality and closer mimicry of natural organ performance compared to external devices. Implantable devices such as artificial hearts, cochlear implants, and joint replacements are preferred for their effectiveness and patient convenience. Advancements in surgical techniques and minimally invasive procedures have improved the safety and success rates of implantation, driving higher adoption. Patients benefit from improved lifestyle and reduced dependency on frequent external interventions, further solidifying implantables as the leading segment. Strong clinical evidence supporting their outcomes and favorable reimbursement frameworks in many regions contribute significantly to their market dominance. Moreover, the rising aging population and the increase in organ failure cases continue to sustain high demand for implantable solutions worldwide.

The externally worn segment is projected to grow at the fastest CAGR of 11.3% between 2025 and 2032, fueled by the demand for non-invasive and cost-effective prosthetic solutions. These devices are particularly appealing to patients who are not ideal candidates for invasive surgeries or prefer temporary solutions before implant adoption. Technological advancements in lightweight materials, 3D printing, and customizable designs have improved comfort, durability, and patient satisfaction with externally worn devices. Increasing adoption in low- and middle-income countries, where affordability and accessibility are critical, is further supporting this segment’s growth. In addition, externally worn devices offer the advantage of easier replacement and upgrade without surgical intervention, making them more attractive in certain healthcare settings. Expanding rehabilitation programs and rising awareness about assistive devices are also driving their rapid adoption.

- By Technology

On the basis of technology, the medical bionic implant & artificial organs market is segmented into electronic and mechanical. The electronic segment dominated the market with a 55.5% revenue share in 2024, owing to the widespread adoption of bioelectronic implants such as cochlear implants, retinal prosthetics, and neuromodulation devices. These devices offer superior programmability, precision, and real-time adaptability to patient needs, making them highly effective across various therapeutic areas. The integration of advanced electronics with biomedical science has revolutionized treatment for sensory and neurological impairments. Growing clinical success rates, along with rising patient acceptance of electronic implants, continue to strengthen this segment’s position. Furthermore, increasing investment in research and commercialization of next-generation electronic implants, supported by strong regulatory approvals, is ensuring their sustained dominance. The rising prevalence of sensory impairments globally further underpins the robust growth of this segment.

The mechanical segment is anticipated to grow at the fastest CAGR of 9.8% during 2025–2032, driven by increasing adoption of artificial hearts, ventricular assist devices, and prosthetic limbs. Mechanical devices are gaining traction due to improvements in structural design, enhanced durability, and material strength that allow them to function reliably for extended periods. Their importance is particularly significant in life-saving interventions such as heart replacements, where immediate availability of mechanical solutions reduces dependence on donor organs. Advancements in biocompatible coatings and miniaturization of mechanical pumps have improved patient safety and usability. The growing global burden of cardiovascular diseases and organ failures is directly supporting the expansion of this segment. In addition, increasing adoption in emerging markets due to cost-effectiveness and easier availability compared to high-end electronic implants is fueling its growth.

- By End User

On the basis of end user, the market is segmented into hospitals and clinics, research and academic institutes, and others. The hospitals and clinics segment dominated the market with a share of 46.5% in 2024, owing to their advanced infrastructure, skilled professionals, and high patient inflow for surgeries involving artificial organs and implants. Hospitals are the primary setting for complex implantation procedures, making them the central hub of market activity. Availability of multidisciplinary care, advanced diagnostic facilities, and post-operative rehabilitation programs in hospitals ensures better patient outcomes and higher success rates for implantation. Favorable reimbursement policies and insurance coverage for implant surgeries further boost adoption in this segment. The rising prevalence of chronic diseases requiring surgical intervention, along with the availability of cutting-edge medical technologies, continues to reinforce the dominance of hospitals and clinics. Moreover, strategic collaborations with medtech companies often enable hospitals to be early adopters of the latest innovations in medical bionics.

The research and academic institutes segment is expected to grow at the fastest CAGR of 10.7% from 2025 to 2032, driven by the increasing focus on developing next-generation bionic solutions. These institutes play a crucial role in conducting preclinical and clinical studies, pushing forward innovations in neural interfaces, tissue engineering, and advanced biomaterials. Rising government and private funding for translational research is significantly accelerating progress in this segment. Collaborations between universities, biotech firms, and healthcare providers are helping to move experimental bionic devices toward commercialization. Academic institutes are also fostering the development of personalized implants tailored to patient-specific requirements through 3D bioprinting and AI-assisted design. Furthermore, the presence of specialized research centers dedicated to neuroscience, cardiovascular, and regenerative medicine is boosting their role in advancing the medical bionics field. The increasing global emphasis on innovation-led growth makes this segment pivotal for the future of the market.

Medical Bionic Implant Artificial Organs Market Regional Analysis

- North America dominated the medical bionic implant artificial organs market with the largest revenue share of 40.51% in 2024, supported by the high adoption of advanced healthcare technologies, the strong presence of leading industry players, and rising demand for innovative implantable devices

- The region benefits from robust R&D activity, favorable reimbursement policies, and significant clinical trial pipelines, making it a global leader in medical bionic adoption

- Advanced healthcare infrastructure and rising awareness of organ replacement therapies further solidify its dominant position

U.S. Medical Bionic Implant Artificial Organs Market Insight

The U.S. medical bionic implant artificial organs market captured the largest revenue share of 76% in 2024 within North America, fueled by a surge in organ failure cases and growing reliance on implantable bionic devices as alternatives to transplants. Rapid approvals by the FDA, increasing investments in regenerative medicine, and early adoption of next-generation solutions such as neural and heart bionics are strengthening market expansion. The presence of global leaders like Medtronic, Stryker, and Zimmer Biomet, along with ongoing partnerships between academia and industry, positions the U.S. at the forefront of innovation in artificial organs.

Europe Medical Bionic Implant Artificial Organs Market Insight

The Europe medical bionic implant artificial organs market is projected to expand at a steady CAGR throughout the forecast period, supported by strong healthcare policies, rising prevalence of chronic conditions, and growing demand for technologically advanced treatments. Increasing adoption of orthopedic bionics, cochlear implants, and artificial hearts is driven by an aging population and high incidence of degenerative disorders. Europe’s well-established research ecosystem, supported by academic and industrial collaborations, is fostering innovations and accelerating adoption across hospitals, clinics, and rehabilitation centers.

U.K. Medical Bionic Implant Artificial Organs Market Insight

The U.K. medical bionic implant artificial organs market is anticipated to grow at a noteworthy CAGR during the forecast period, backed by government support for healthcare innovation and rising cases of cardiovascular and neurological diseases. Strong clinical trial activity, combined with the country’s advanced healthcare facilities, is creating favorable conditions for increased adoption of bionic implants. Growing demand for minimally invasive procedures and advanced rehabilitation services further boosts the U.K. market outlook.

Germany Medical Bionic Implant Artificial Organs Market Insight

The Germany medical bionic implant artificial organs market is expected to expand at a considerable CAGR during the forecast period, fueled by a strong emphasis on precision medicine, healthcare innovation, and patient safety. Germany’s advanced medical infrastructure and focus on sustainability are promoting adoption of high-quality, durable bionic devices such as neural and orthopedic implants. The integration of bionic implants into rehabilitation and post-surgical care programs is further driving market penetration across the country.

Asia-Pacific Medical Bionic Implant Artificial Organs Market Insight

The Asia-Pacific medical bionic implant artificial organs market is expected to be the fastest-growing region in the Medical Bionic Implant Artificial Organs market during the forecast period, recording a CAGR of around 10.0%, owing to rapid urbanization, increasing disposable incomes, and rising healthcare investments. Countries such as China, India, and Southeast Asia are witnessing a surge in demand for affordable artificial organ solutions, supported by local manufacturing capabilities and government-backed initiatives for healthcare accessibility. The region’s expanding patient pool for cardiovascular, renal, and neurological diseases is further boosting adoption, while medical tourism hubs in India and Thailand are positioning APAC as a key growth driver.

Japan Medical Bionic Implant Artificial Organs Market Insight

The Japan medical bionic implant artificial organs market is gaining momentum due to the country’s aging population and strong focus on advanced healthcare solutions. Adoption of artificial organs and bionic implants is being driven by government support for innovation, combined with a cultural emphasis on precision and technology-driven healthcare. The increasing use of neural and vision bionics to address age-related disorders highlights Japan’s position as a technology leader in the region.

China Medical Bionic Implant Artificial Organs Market Insight

The China medical bionic implant artificial organs market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to the expanding middle class, rapid urbanization, and growing investments in healthcare modernization. Strong domestic manufacturing, combined with government support for innovation in medtech, is boosting the availability of cost-effective artificial organ solutions. Rising prevalence of chronic diseases and increasing focus on digital healthcare and smart hospitals are further propelling China’s dominance in the APAC market.

Medical Bionic Implant Artificial Organs Market Share

The medical bionic implant artificial organs industry is primarily led by well-established companies, including:

- CONMED Corporation (U.S.)

- Stryker (U.S.)

- Medtronic (Ireland)

- Smith+Nephew (UK)

- Zimmer Biomet (U.S.)

- Integra LifeSciences Corporation (U.S.)

- B. Braun SE (Germany)

- Arthrex, Inc. (U.S.)

- Baxter (U.S.)

- Globus Medical (U.S.)

- DJO, LLC (U.S.)

- NuVasive, Inc. (U.S.)

- The Orthopaedic Implant Company, Inc. (U.S.)

- Aesculap Inc. (U.S.)

- Flexicare (Group) Limited (U.K.)

- Agilent Technologies, Inc. (U.S.)

- Narang Medical Limited (India)

- Auxein (India)

- uteshiyamedicare (India)

Latest Developments in Global Medical Bionic Implant Artificial Organs Market

- In January 2024, Neuralink — Elon Musk’s neurotechnology company — successfully implanted its Telepathy brain-computer interface into its first human subject, Noland Arbaugh, a 29-year-old quadriplegic, at the Barrow Neurological Institute in Phoenix. The patient reportedly recovered without cognitive impairments and could initially control a computer cursor using only his thoughts

- In March 2024, Neuralink publicly introduced Noland Arbaugh during a livestream on X (formerly Twitter), where he demonstrated the ability to play games like chess and control system functions with his mind via the implanted chip

- In May 2024, reports emerged that the Neuralink implant experienced a technical issue: many of its thin electrode “threads” had retracted, reducing signal transmission. However, software updates were deployed to compensate, restoring much of the device’s functionality—for example, enabling Arbaugh to continue using the interface

- In May 2023, the U.S. Food and Drug Administration cleared the Beta Bionics iLet ACE Pump and Dosing Decision Software, forming the iLet Bionic Pancreas system for use by individuals aged six and older with type 1 diabetes. This automated insulin-delivery solution requires only a user’s body weight for initialization and simplifies mealtime management with a “meal announcement” feature instead of carb counting

- In November 2023, the iLet Bionic Pancreas received further recognition for its clinical efficacy when the FDA granted clearance — marked by data showing significant reductions in HbA1c and increased time-in-range glucose control

- In September 2024, Neuralink’s Blindsight implant, designed to restore vision by stimulating the visual cortex, received the FDA’s Breakthrough Device Designation — a regulatory acknowledgement accelerating development for this experimental prosthetic

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.