Global Medical Bio Adhesives Market

Market Size in USD Billion

CAGR :

%

USD

1.21 Billion

USD

2.25 Billion

2025

2033

USD

1.21 Billion

USD

2.25 Billion

2025

2033

| 2026 –2033 | |

| USD 1.21 Billion | |

| USD 2.25 Billion | |

|

|

|

|

Medical Bio-Adhesives Market Size

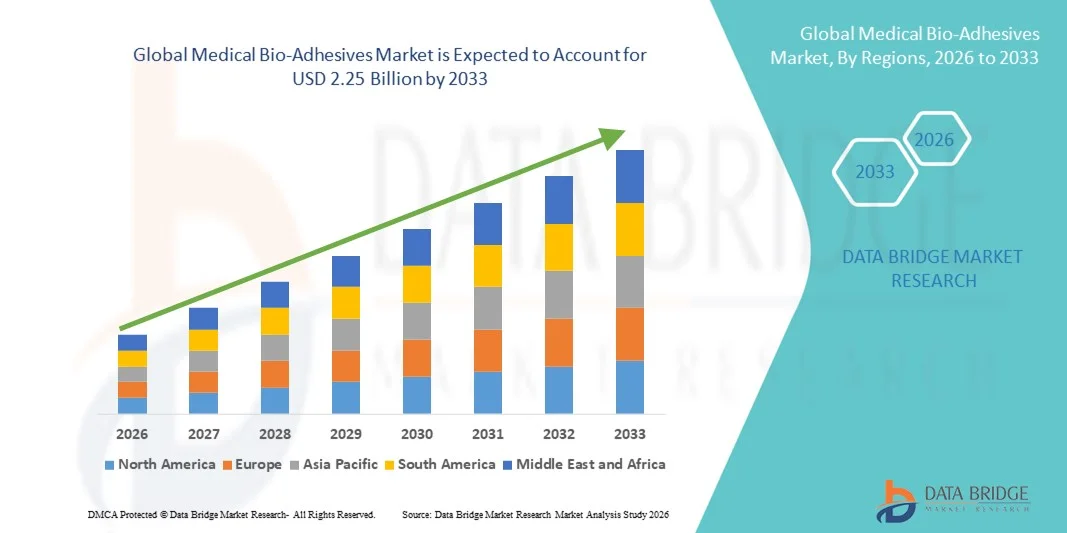

- The global medical bio-adhesives market size was valued at USD 1.21 billion in 2025 and is expected to reach USD 2.25 billion by 2033, at a CAGR of 8.11% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced medical adhesives in surgical procedures, wound care, and medical device assembly, along with continuous technological advancements in bio-based and synthetic adhesive formulations that improve bonding strength, biocompatibility, and healing outcomes across healthcare settings

- Furthermore, rising demand for minimally invasive procedures, improved wound closure techniques, and safe, user-friendly alternatives to sutures and staples is accelerating the adoption of Medical Bio-Adhesives solutions, thereby significantly boosting overall market growth

Medical Bio-Adhesives Market Analysis

- Medical bio-adhesives, which are used for wound closure, tissue sealing, hemostasis, and medical device bonding, are increasingly vital components of modern healthcare due to their ability to improve healing outcomes, reduce surgical time, and support minimally invasive procedures across hospitals and specialty clinics

- The growing demand for medical bio-adhesives is primarily driven by the rising number of surgical procedures, increasing prevalence of chronic wounds, and continuous advancements in biocompatible and biodegradable adhesive technologies that enhance safety, strength, and ease of application

- North America dominated the medical bio-adhesives market with the largest revenue share of approximately 35.7% in 2025, supported by advanced healthcare infrastructure, high adoption of minimally invasive surgeries, strong reimbursement frameworks, and the presence of major medical device and biomaterial manufacturers, particularly in the U.S.

- Asia-Pacific is expected to be the fastest-growing region in the medical bio-adhesives market during the forecast period, driven by expanding healthcare infrastructure, rising surgical volumes, growing medical tourism, and increasing awareness of advanced wound care solutions in countries such as China, India, and Japan

- The synthetic polymers segment dominated the largest market revenue share of 61.4% in 2025, driven by its superior bonding strength, controlled degradation, and consistent performance in various medical applications

Report Scope and Medical Bio-Adhesives Market Segmentation

|

Attributes |

Medical Bio-Adhesives Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Medical Bio-Adhesives Market Trends

Advancement in Biocompatible and Bio-Based Adhesive Technologies

- A significant and accelerating trend in the global medical bio-adhesives market is the growing development and adoption of biocompatible, bio-based, and tissue-friendly adhesive formulations designed for internal and external medical applications. These innovations aim to improve wound closure, reduce infection risks, and enhance patient comfort while minimizing inflammatory responses

- For instance, several manufacturers are advancing cyanoacrylate- and fibrin-based bio-adhesives that are increasingly used in surgical sealants, wound closure, and tissue bonding, offering faster healing and reduced reliance on traditional sutures and staples

- Technological progress in polymer chemistry has enabled medical bio-adhesives to provide strong adhesion under wet conditions, controlled degradation, and compatibility with sensitive tissues. These properties are particularly important in cardiovascular, orthopedic, and soft tissue surgeries

- The integration of natural polymers such as collagen, gelatin, chitosan, and polysaccharides is gaining traction, as these materials support tissue regeneration and reduce the risk of adverse immune reactions

- This shift toward advanced and bio-inspired adhesive solutions is reshaping clinical practices by enabling minimally invasive procedures and improving post-operative outcomes. Consequently, companies are investing heavily in R&D to develop next-generation medical bio-adhesives suitable for complex surgical and wound care applications

- The demand for innovative medical bio-adhesives is growing across hospitals, ambulatory surgical centers, and specialty clinics, as healthcare providers increasingly seek safer, faster, and more efficient alternatives to conventional wound closure methods

Medical Bio-Adhesives Market Dynamics

Driver

Rising Surgical Procedures and Growing Demand for Advanced Wound Care

- The increasing volume of surgical procedures worldwide, driven by aging populations and rising prevalence of chronic diseases, is a major driver for the Medical Bio-Adhesives market. These adhesives are widely used in wound closure, hemostasis, and tissue sealing applications across multiple surgical specialties

- For instance, the growing adoption of minimally invasive and cosmetic surgeries has significantly increased demand for medical bio-adhesives that offer faster healing, reduced scarring, and improved aesthetic outcomes compared to traditional suturing techniques

- As healthcare providers focus on improving patient recovery times and reducing hospital stays, medical bio-adhesives provide effective solutions by minimizing bleeding, lowering infection risks, and enhancing wound stability

- Furthermore, the expanding use of bio-adhesives in advanced wound care products, such as chronic wound dressings and burn treatments, is strengthening market growth, particularly in hospital and home healthcare settings

- The increasing awareness among clinicians regarding the clinical benefits of medical bio-adhesives, combined with technological advancements in formulation and delivery systems, continues to propel market expansion globally

Restraint/Challenge

High Development Costs and Stringent Regulatory Requirements

- One of the key challenges facing the medical bio-adhesives market is the high cost associated with product development, clinical testing, and regulatory approval. Medical bio-adhesives must meet strict safety, efficacy, and biocompatibility standards before receiving approval for clinical use

- For instance, extensive preclinical studies and clinical trials are required to demonstrate tissue compatibility and long-term safety, which can significantly increase time-to-market and overall development costs for manufacturers

- Regulatory frameworks governing medical devices and surgical materials vary across regions, adding complexity to global product commercialization and increasing compliance costs for companies operating internationally

- In addition, some medical bio-adhesives face limitations related to shelf life, storage conditions, and handling requirements, which may affect adoption in resource-constrained healthcare settings

- Overcoming these challenges through streamlined regulatory pathways, continued innovation in cost-effective formulations, and improved clinician education will be essential for sustained growth of the Medical Bio-Adhesives market

Medical Bio-Adhesives Market Scope

The market is segmented on the basis of material, application, type, and end users.

- By Material

On the basis of material, the Medical Bio-Adhesives market is segmented into natural polymers and synthetic polymers. The synthetic polymers segment dominated the largest market revenue share of 61.4% in 2025, driven by its superior bonding strength, controlled degradation, and consistent performance in various medical applications. Synthetic bio-adhesives such as cyanoacrylates and polyurethane-based adhesives are widely used in surgical procedures due to fast curing and high tensile strength. These materials provide enhanced durability, moisture resistance, and extended shelf life compared to natural polymers. Their compatibility with minimally invasive surgeries and wound closure applications increases adoption. Large-scale manufacturing and cost efficiency further support growth. Strong regulatory approvals and clinical acceptance reinforce dominance. Hospitals and clinics prefer synthetic polymers for predictable outcomes. Rising adoption in tissue engineering and drug delivery boosts market share. Continuous innovations in polymer chemistry sustain leadership.

The natural polymers segment is expected to witness the fastest CAGR of 10.8% from 2026 to 2033, fueled by rising demand for biocompatible and biodegradable adhesives. Derived from fibrin, collagen, and chitosan, these adhesives are preferred in tissue repair and regenerative medicine. They reduce post-surgical complications, promote natural healing, and improve patient outcomes. Increasing R&D investments in bio-based materials support growth. Regulatory incentives for eco-friendly medical products accelerate adoption. Use in wound care, hemostasis, and mucosal applications is expanding rapidly. Rising awareness among healthcare providers about safer, natural alternatives contributes to market growth. Hospitals and specialty clinics are gradually integrating natural adhesives into standard care. Enhanced biocompatibility and low immunogenicity strengthen adoption. Growth in personalized medicine further drives demand.

- By Application

On the basis of application, the Medical Bio-Adhesives market is segmented into drug delivery, tissue repair, tissue substitutes, packaging, construction, woodworking, personal care, medical, and others. The tissue repair segment accounted for the largest market revenue share of 38.7% in 2025, due to its extensive use in wound closure, internal tissue bonding, and hemostasis. Bio-adhesives reduce suturing time, minimize scarring, and improve surgical efficiency. Rising trauma injuries and chronic wounds increase adoption. Technological advancements enhance bonding strength and flexibility. Hospitals and surgical centers are primary end users. Clinical preference for tissue repair adhesives remains high due to proven outcomes. Strong physician acceptance supports dominance. Use in cardiovascular and orthopedic surgeries contributes to market share. Favorable reimbursement policies further support growth. The segment benefits from increasing surgical volumes globally. High reliability and consistent performance reinforce leadership.

The drug delivery segment is projected to grow at the fastest CAGR of 12.3% from 2026 to 2033, driven by targeted and controlled delivery systems. Bio-adhesives improve drug retention and efficacy at administration sites. Growing prevalence of chronic diseases fuels adoption. Expansion in transdermal, mucosal, and localized drug delivery supports growth. Pharmaceutical companies are investing in bio-adhesive-based platforms. Improved patient compliance accelerates adoption. Hospitals, clinics, and homecare settings increasingly use these adhesives. Continuous innovations in formulation enhance performance. Biodegradable adhesives enable safer repeated dosing. R&D in nanotechnology-based drug delivery further supports growth. Ethical and regulatory advantages of bio-adhesives increase preference. Global awareness about precision medicine accelerates market expansion.

- By Type

On the basis of type, the Medical Bio-Adhesives market is segmented into plant-based and animal-based adhesives. The animal-based segment dominated the largest market revenue share of 55.9% in 2025, owing to strong adhesive properties and proven clinical effectiveness. Fibrin and collagen adhesives are widely used in surgical sealants and tissue bonding. They offer excellent biocompatibility and promote natural healing. High adoption in cardiovascular, orthopedic, and general surgeries supports dominance. Established manufacturing processes and regulatory approvals boost adoption. Hospitals prefer animal-based adhesives due to predictable performance. Longstanding clinical trust sustains market leadership. Widespread availability of products strengthens penetration. Continuous product improvements reinforce position. Their versatility across medical procedures increases usage. Clinician familiarity further supports the segment.

The plant-based segment is expected to register the fastest CAGR of 11.6% from 2026 to 2033, fueled by ethical concerns and demand for non-animal alternatives. Plant-derived adhesives offer reduced disease transmission risk and allergic reactions. Adoption is growing in wound care, tissue engineering, and personal medical applications. Innovations in bio-based polymers improve adhesive strength and performance. Favorable patient perception and regulatory encouragement accelerate growth. Hospitals, dental clinics, and homecare settings are key end users. Biodegradable and eco-friendly characteristics enhance appeal. Rising R&D in plant polymers strengthens the segment. Use in cosmetic and minimally invasive procedures supports expansion. Sustainable production methods further boost adoption. Global awareness about vegan medical products accelerates growth.

- By End Users

On the basis of end users, the Medical Bio-Adhesives market is segmented into hospitals, dental clinics, and others. The hospitals segment dominated the largest market revenue share of 64.2% in 2025, driven by high surgical volumes and advanced medical infrastructure. Hospitals perform most wound closure and tissue repair procedures. Availability of skilled personnel enhances product utilization. Strong investment in medical adhesives supports adoption. Integration with advanced surgical techniques improves outcomes. High procurement capacity ensures consistent supply. Clinical acceptance and reliability reinforce dominance. Multidisciplinary hospital setups encourage adoption. Continuous innovations in adhesive technology support growth. Global increase in surgical procedures further strengthens market share.

The dental clinics segment is projected to grow at the fastest CAGR of 13.1% from 2026 to 2033, fueled by rising dental procedures worldwide. Bio-adhesives are increasingly used in implants, restorations, and surgeries. Growing awareness of minimally invasive dental care supports adoption. Technological advancements improve adhesive performance in dentistry. Cosmetic dentistry demand accelerates growth. Rising number of specialized dental clinics globally drives expansion. Patient preference for non-invasive procedures encourages adoption. Continuous R&D in dental adhesive formulations supports growth. Accessibility and cost-effectiveness of dental clinics boost adoption. Increasing dental insurance coverage further supports segment growth.

Medical Bio-Adhesives Market Regional Analysis

- North America dominated the medical bio-adhesives market with the largest revenue share of approximately 35.7% in 2025, supported by advanced healthcare infrastructure, high adoption of minimally invasive surgeries, strong reimbursement frameworks, and the presence of major medical device and biomaterial manufacturers, particularly in the U.S.

- Hospitals and surgical centers in the region are increasingly adopting bio-adhesives for wound closure, tissue sealing, and hemostasis applications, driving steady market growth

- The market expansion is further supported by high healthcare expenditure, widespread clinical awareness of bio-adhesive benefits, and continuous investments in R&D, establishing North America as the most mature market globally

U.S. Medical Bio-Adhesives Market Insight

The U.S. medical bio-adhesives market captured the largest revenue share within North America in 2025, fueled by the growing adoption of advanced surgical techniques, including minimally invasive and laparoscopic procedures. Hospitals are increasingly replacing traditional sutures and staples with bio-adhesive solutions for faster healing and reduced risk of infection. Additionally, rising awareness of bio-compatible wound closure solutions and supportive reimbursement policies are driving rapid adoption across both private and public healthcare facilities.

Europe Medical Bio-Adhesives Market Insight

Europe Medical bio-adhesives market is projected to expand at a substantial CAGR during the forecast period, primarily driven by increasing demand for advanced wound care products and the adoption of minimally invasive surgical procedures. Countries such as Germany, France, and Italy are witnessing a shift toward bio-adhesives in cardiovascular, orthopedic, and cosmetic surgeries, supported by strong healthcare infrastructure and stringent regulatory standards. The market is experiencing robust growth across hospitals, specialty clinics, and outpatient surgical centers, with bio-adhesives increasingly integrated into new treatment protocols and post-operative care strategies

U.K. Medical Bio-Adhesives Market Insight

The U.K. medical bio-adhesives market is anticipated to grow steadily during the forecast period, driven by rising surgical volumes, government initiatives supporting advanced healthcare technologies, and a strong presence of hospitals equipped with minimally invasive surgical facilities. Increasing awareness of the clinical benefits of bio-adhesives, such as reduced scarring and faster recovery, is further supporting demand.

Germany Medical Bio-Adhesives Market Insight

Germany medical bio-adhesives market is expected to expand at a considerable CAGR, fueled by growing investments in surgical research, advanced wound care adoption, and a healthcare system focused on innovation and patient safety. Hospitals are increasingly employing bio-adhesives for complex procedures requiring precise tissue bonding and hemostasis, aligning with the country’s emphasis on high-quality surgical outcomes.

Asia Pacific Medical Bio-Adhesives Market Insight

Asia-Pacific medical bio-adhesives market is poised to grow at the fastest CAGR during the forecast period, driven by expanding healthcare infrastructure, rising surgical volumes, growing medical tourism, and increasing awareness of advanced wound care solutions in countries such as China, India, and Japan. Rising government healthcare spending, a growing number of hospitals, and increased adoption of minimally invasive surgical procedures are key factors accelerating market growth. The region is also witnessing the establishment of local bio-adhesive manufacturers, making advanced medical adhesives more accessible and affordable, which is further boosting adoption.

Japan Medical Bio-Adhesives Market Insight

The Japanese medical bio-adhesives market is gaining momentum due to high clinical adoption of bio-adhesives in surgeries, an aging population requiring advanced wound care, and strong investments in healthcare technologies. Bio-adhesives are increasingly used in hospitals for cardiovascular and cosmetic procedures, contributing to market growth.

China Medical Bio-Adhesives Market Insight

China medical bio-adhesives market accounted for the largest revenue share in Asia-Pacific in 2025, driven by rapid urbanization, growing healthcare infrastructure, and increasing surgical volumes. The adoption of bio-adhesives in hospitals and private clinics is rising, supported by expanding medical tourism and the availability of cost-effective local products. Strong government initiatives promoting advanced healthcare solutions are also propelling market growth in the country.

Medical Bio-Adhesives Market Share

The Medical Bio-Adhesives industry is primarily led by well-established companies, including:

- 3M Company (U.S.)

- B. Braun S.E. (Germany)

- Medtronic (Ireland)

- Henkel AG & Co. KGaA (Germany)

- Cryolife, Inc. (U.S.)

- Confluent Surgical, Inc. (U.S.)

- Stryker (U.S.)

- Sunstar Suisse SA (Switzerland)

- Advanced BioMatrix, Inc. (U.S.)

- Medi-Tate, Inc. (U.S.)

- Coseal Medical Adhesives (France)

- DSM Biomedical (Netherlands)

- Integra LifeSciences Corporation (U.S.)

- Aesculap AG (Germany)

- Gore & Associates, Inc. (U.S.)

Latest Developments in Global Medical Bio-Adhesives Market

- In January 2023, H.B. Fuller Company announced the launch of Swiftmelt 1515-I, a new bio-compatible adhesive for medical applications designed for stick-to-skin use in medical tapes and bandages across India, Middle East, and Africa. The adhesive delivers secure bonding under high heat and humidity and is certified non-cytotoxic according to ISO 10993-5 standards, supporting safer and more reliable medical bonding performance

- In March 2023, Axio Biosolutions, an India-based medtech company, introduced the Ax-Surgi Surgical Hemostat, a bioadhesive-based hemostatic device that controls severe internal bleeding by adhering to the bleeding site. This product received U.S. FDA 510(k) clearance, becoming the first chitosan-based hemostat approved for this purpose, advancing the adoption of bioadhesive technology in surgical care

- In July 2024, 3M Company launched its Bio-Based Medical Adhesive platform, featuring marine-inspired bioadhesives engineered for surgical applications that deliver significantly improved bonding strength and complete biodegradability. This platform underscores the trend toward sustainable, high-performance medical bio-adhesive solutions

- In June 2024, Arkema S.A. completed the acquisition of Functional Biopolymers Inc. (Canadian bioadhesives specialist) in a strategic move to expand its renewable bioadhesive portfolio for medical device applications, accelerating innovation in bio-based medical adhesives

- In November 2024, Johnson & Johnson’s Ethicon division secured a major contract to supply Dermabond surgical adhesives across a nationwide network of U.S. hospitals, reinforcing the company’s position in clinical bioadhesive markets and expanding commercial adoption of its medical adhesive products

- In March 2025, Smith & Nephew announced a strategic partnership with Henkel AG to co-develop next-generation medical bioadhesive sealants specifically for surgical applications, targeting enhanced performance and adoption in complex tissue repair settings

- In July 2025, 3M Company launched AdheSeal, a next-generation bioadhesive surgical sealant designed to reduce operating times and improve tissue adhesion strength during surgical procedures, reflecting ongoing innovation in bioadhesive technologies tailored for clinical efficiency

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.