Global Material Handling Robotics Market

Market Size in USD Billion

CAGR :

%

USD

29.54 Billion

USD

74.66 Billion

2024

2032

USD

29.54 Billion

USD

74.66 Billion

2024

2032

| 2025 –2032 | |

| USD 29.54 Billion | |

| USD 74.66 Billion | |

|

|

|

|

Material Handling Robotics Market Size

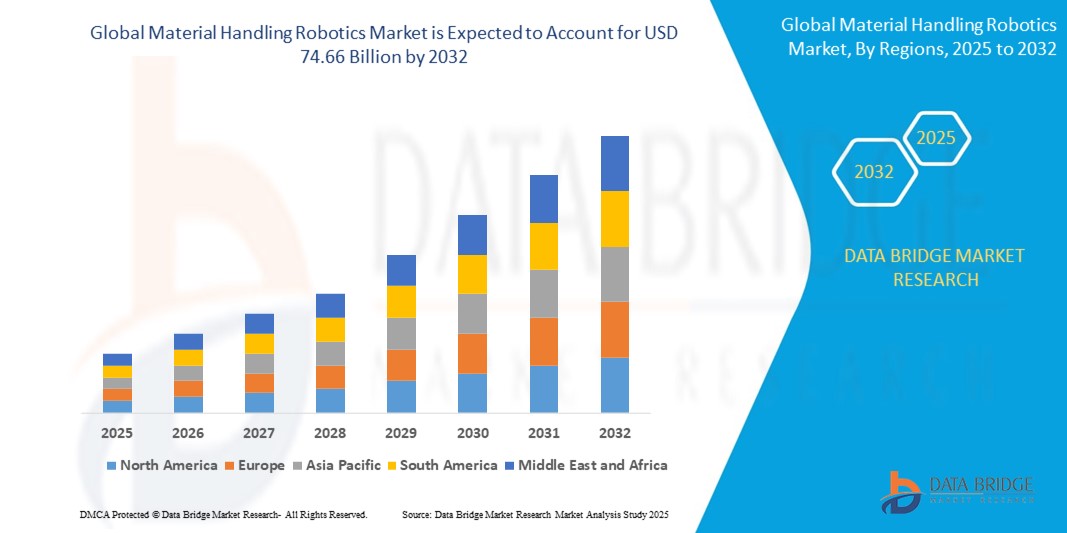

- The global material handling robotics market size was valued at USD 29.54 billion in 2024 and is expected to reach USD 74.66 billion by 2032, at a CAGR of 12.29% during the forecast period

- This growth is driven by factors such as rising automation demand across industries to improve efficiency, reduce labor costs, and address workforce shortages

Material Handling Robotics Market Analysis

- Material handling robotics refers to the use of automated robotic systems to move, sort, store, and manage materials within industrial and commercial environments, improving productivity, accuracy, and safety in operations

- The material handling robotics market is witnessing robust growth, fueled by increasing demand for automation, the rapid expansion of e-commerce, labor shortages, technological advancements in robotics and AI, and supportive government initiatives aimed at boosting industrial automation and smart manufacturing

- Asia-Pacific is expected to dominate the material handling robotics market due to the rapid economic growth, which are fueling the demand for automation across various industries such as manufacturing, logistics, and retail

- Europe is expected to be the fastest growing region in the material handling robotics market during the forecast period due to strong demand from its established manufacturing and automotive sectors, where automation is critical for maintaining high efficiency and precision in production

- Unit load formation robots segment is expected to dominate the market with a market share of 63.4% due to their efficiency in handling bulk materials, reducing manual labor, and improving warehouse throughput. These robots are widely adopted in logistics, e-commerce, and manufacturing industries for palletizing and depalletizing tasks, which are critical for optimizing supply chain operations and minimizing handling time and errors

Report Scope and Material Handling Robotics Market Segmentation

|

Attributes |

Material Handling Robotics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Material Handling Robotics Market Trends

“Increasing Number of Manufacturing Facilities”

- One prominent trend in the global material handling robotics market is the Increasing Number of Manufacturing Facilities

- This trend is driven by the rapid industrialization, rising global demand for goods, and the need for streamlined, automated processes to enhance production efficiency and reduce operational costs

- For instance, emerging economies such as India, Vietnam, and Indonesia are witnessing a surge in new manufacturing setups, particularly in automotive, electronics, and consumer goods sectors. These facilities are increasingly integrating material handling robotics to optimize logistics, improve precision, and meet growing output demands

- The demand for material handling robotics is expanding across both developed regions such as North America and Europe, where industries are upgrading legacy systems, and developing markets, where new factories are being designed with automation in mind

- As global manufacturing capacity continues to rise and competition intensifies, the deployment of robotics for material handling will remain a key strategy to boost productivity and maintain operational agility

Material Handling Robotics Market Dynamics

Driver

“Increasing Advancements in Robotics Technology”

- Technological progress in robotics is a key driver of growth in the material handling robotics market, as industries increasingly seek smarter, faster, and more adaptable automation solutions to enhance productivity and operational efficiency

- These advancements are gaining global momentum, with strong support from research institutions, robotics companies, and industrial automation initiatives focused on developing high-performance robotic systems equipped with AI, machine vision, and real-time analytics

- As industrial operations become more complex, there is a clear shift toward adopting intelligent robots that can handle diverse material handling tasks with greater accuracy, flexibility, and minimal human intervention

- Companies are investing in next-generation robots that feature improved sensors, enhanced mobility, predictive maintenance capabilities, and seamless integration with existing supply chain and manufacturing systems

- Furthermore, the growing emphasis on smart factories and Industry 4.0 frameworks is accelerating the deployment of technologically advanced robotics across sectors such as automotive, e-commerce, and electronics

For instance,

- ABB is developing AI-enabled material handling robots that enhance autonomous decision-making and adapt to dynamic environments without manual programming

- FANUC has launched collaborative and high-speed robots equipped with machine vision and connectivity tools to support flexible, data-driven warehouse and factory operations

- As robotics technology continues to evolve and become more cost-effective, its adoption in material handling is expected to increase significantly, making it a core component of modern industrial strategies

Opportunity

“Increasing Automation in Manufacturing”

- The growing shift toward automation in manufacturing environments offers a significant opportunity for the material handling robotics market, as businesses seek to enhance efficiency, reduce labor dependency, and maintain high production standards

- Robotics solution providers are leveraging this trend by developing highly adaptable, scalable, and intelligent systems designed to streamline material movement, storage, and logistics across automated factories

- This opportunity aligns with the global movement toward smart manufacturing, where industries are upgrading to robotics-integrated production lines capable of real-time monitoring, predictive analytics, and minimal human intervention

For instance,

- KUKA and Yaskawa are introducing flexible robotic solutions specifically built for automated manufacturing facilities, featuring modular designs and AI-driven functionalities for real-time adaptability

- Siemens is integrating robotics with its digital manufacturing platforms to offer end-to-end automation, from material handling to quality control, helping manufacturers accelerate production and ensure precision

- As industries across sectors such as automotive, electronics, and consumer goods continue to embrace automation to stay competitive, the demand for advanced material handling robotics is expected to rise sharply. This positions the market to capitalize on the accelerating push toward fully automated, high-performance manufacturing ecosystems

Restraint/Challenge

“Compliance with Regulatory Standards”

- Navigating complex and varied regulatory standards presents a significant challenge for the material handling robotics market, as differing safety, quality, and integration requirements across countries hinder the seamless deployment of robotic systems

- Meeting these diverse compliance mandates often requires manufacturers to customize their robots for specific regional guidelines, increasing production complexity, time-to-market, and overall costs

- Adapting to strict safety standards, especially in sectors such as automotive and pharmaceuticals, demands advanced testing, certification processes, and continuous monitoring, which can delay implementation and affect scalability

For instance,

- In the U.S., OSHA and ANSI regulations require manufacturers to integrate advanced safety features and conduct extensive risk assessments, adding to development and deployment burdens

- Without streamlined regulatory alignment or global standardization, the challenge of navigating compliance will continue to impact market expansion, particularly for manufacturers aiming to scale across multiple international markets

Material Handling Robotics Market Scope

The market is segmented on the basis of type, function, application, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Function |

|

|

By Application |

|

|

By End User

|

|

In 2025, the unit load formation robots is projected to dominate the market with a largest share in type segment

The unit load formation robots segment is expected to dominate the material handling robotics market with the largest share of 63.4% in 2025 due to their efficiency in handling bulk materials, reducing manual labor, and improving warehouse throughput. These robots are widely adopted in logistics, e-commerce, and manufacturing industries for palletizing and depalletizing tasks, which are critical for optimizing supply chain operations and minimizing handling time and errors.

The hybrid microscopes is expected to account for the largest share during the forecast period in function segment

In 2025, the storage segment is expected to dominate the market with the largest market share of 34.5% due to rising demand for automated storage and retrieval systems (AS/RS) that enhance space utilization, inventory accuracy, and operational efficiency in warehouses and distribution centers. The surge in e-commerce and just-in-time inventory practices further drives the need for advanced storage solutions to manage high volumes of goods with speed and precision.

Material Handling Robotics Market Regional Analysis

“Asia-Pacific Holds the Largest Share in the Material handling robotics Market”

- Asia-Pacific dominates the material handling robotics market, driven by the rapid economic growth, which are fueling the demand for automation across various industries such as manufacturing, logistics, and retail

- China holds a significant share due to its position as the world's manufacturing hub, massive investments in automation technologies, and a strong push towards Industry 4.0

- The market is further bolstered by increased demand for efficiency, precision, and cost-effectiveness in handling materials, along with growing labor shortages in key industries. The government's favorable policies towards automation and smart manufacturing also play a significant role

- With continuous technological advancements and the expansion of industries such as e-commerce, automotive, and electronics, Asia-Pacific is expected to continue its dominance in the material handling robotics market through 2032

“Europe is Projected to Register the Highest CAGR in the Material handling robotics Market”

- Europe is expected to witness the highest growth rate in the material handling robotics market, driven by strong demand from its established manufacturing and automotive sectors, where automation is critical for maintaining high efficiency and precision in production

- Germany holds a significant share due to its advanced manufacturing technologies, particularly in automotive production, which is one of the largest adopters of material handling robotics

- This growth is fueled by the automotive industry’s continuous drive for innovation in production processes, along with the need for flexible and scalable solutions to meet the growing demand for customized products

- The rising focus on Industry 4.0, the adoption of AI-powered robots, and sustainability initiatives across European industries are expected to support the region's rapid growth and position Europe as the fastest-growing region in the market through 2032

Material Handling Robotics Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- ABB (Switzerland)

- KUKA AG (Germany)

- FANUC Corporation (Japan)

- Mitsubishi Electric Corporation (Japan)

- Universal Robots (Denmark)

- Denso Corporation (Japan)

- Epson Robots (Japan)

- Yaskawa Electric Corporation (Japan)

- Kawasaki Heavy Industries Ltd. (Japan)

- Stäubli International AG (Switzerland)

- Omron Corporation (Japan)

- Nachi-Fujikoshi Corporation (Japan)

- Comau S.p.A. (Italy)

- Adept Technology, Inc. (U.S.)

- Bastian Solutions (U.S.)

Latest Developments in Global Material Handling Robotics Market

- In April 2025, Cartken, a leading autonomous robotics company, launched the Cartken Hauler, a highly maneuverable robot with enhanced payload capacity designed for material handling across mixed indoor and outdoor environments. This strategic expansion beyond last-mile delivery marks a significant step in strengthening Cartken’s position in the material handling robotics market, addressing a critical industry need for seamless automation across complex terrains, multi-level facilities, and diverse industrial settings

- In May 2024, KION North America (KION NA), a manufacturer of Linde Material Handling equipment, entered into a non-exclusive partnership with Fox Robotics to manufacture and assemble FoxBot autonomous trailer loaders/unloaders (ATLs) at its Summerville, South Carolina facility. This collaboration is expected to boost KION NA’s presence in the material handling robotics market by expanding its autonomous solutions portfolio and supporting the growing demand for automation in logistics operations

- In January 2024, Accio Robotics announced the upcoming launch of its autonomous, mobile material-handling robot, a move expected to strengthen its position in the material handling robotics market by addressing growing demand for flexible, intelligent automation solutions across warehouses and manufacturing environments

- In May 2022, ABB launched the IRB 5710 and 5720 robots tailored for material handling in EV battery production. These robots enhance productivity with improved speed, precision, and durability, offering higher uptime and flexibility. Equipped with ABB's OmniCore controller V250XT, they handle various manufacturing and EV-specific procedures with optimal precision and consistency. The integration of ABB's LeanID Integrated DressPack ensures better protection and reduced maintenance costs, extending the robots' service life and supporting faster, more adaptable material handling processes

- In January 2021, OMRON Corporation launched the i4 series SCARA robot, designed for automating high-speed and high-precision assembly and transportation processes. The series includes the high-performance i4H model for medium to large-sized tasks and the compact i4L model for lightweight applications. These robots integrate and control peripheral devices, enabling automation of complex tasks previously unattainable with conventional SCARA robots. OMRON aims to provide a comprehensive solution combining their advanced control equipment and industrial robots to drive innovation and efficiency in manufacturing

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Material Handling Robotics Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Material Handling Robotics Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Material Handling Robotics Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.