Global Material Handling Robotics Market, By Type (Transportation Handling Robots, Positioning, Unit Load Formation Robots, Articulated Robots, Cartesian Robot, SCARA Robots, Storage, Identification, and Control Robots), Function (Assembly, Packaging, Transportation, Distribution, Storage, and Waste Handling), Application (Pick and Place, Palletizing/De-Palletizing, Packing and packaging, Product/Part Transfer, and Machine Tending), End User (Automotive, Chemical, Electrical and Electronics, Industrial Machinery, Food and Beverage, and Others) – Industry Trends and Forecast to 2031.

Material Handling Robotics Market Analysis and Size

In the automotive industry, the application of robots in material handling is extensively used to enhance production efficiency and precision. Robots are employed in various tasks such as assembly line operations, part handling, welding, and transporting heavy components like engines and body panels. These automated systems ensure consistent quality and reduce the risk of human error, leading to improved safety and faster production cycles. Additionally, the application of robots in material handling allows for continuous operation without fatigue, contributing to higher throughput and enabling manufacturers to meet stringent production schedules and demands.

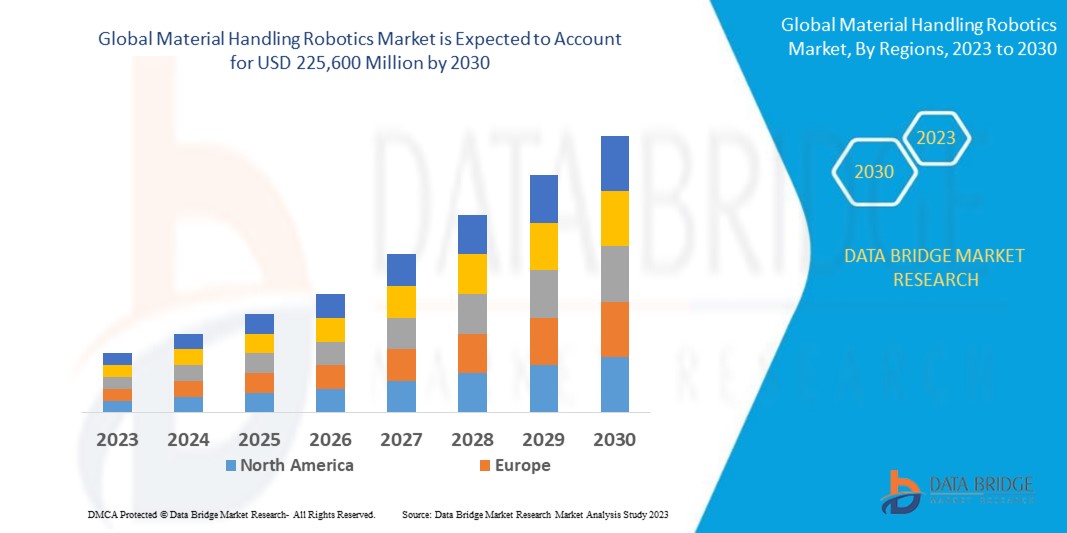

The global material handling robotics market size was valued at USD 100.24 billion in 2023 and is projected to reach USD 253.38 billion by 2031, with a CAGR of 12.29% during the forecast period of 2024 to 2031. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2024-2031

|

|

Base Year

|

2023

|

|

Historic Years

|

2022 (Customizable to 2016-2021)

|

|

Quantitative Units

|

Revenue in USD Billion, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Type (Transportation Handling Robots, Positioning, Unit Load Formation Robots, Articulated Robots, Cartesian Robot, SCARA Robots, Storage, Identification, and Control Robots), Function (Assembly, Packaging, Transportation, Distribution, Storage, and Waste Handling), Application (Pick and Place, Palletizing/De-Palletizing, Packing and packaging, Product/Part Transfer, and Machine Tending), End User (Automotive, Chemical, Electrical and Electronics, Industrial Machinery, Food and Beverage, and Others)

|

|

Countries Covered

|

U.S., Canada, Mexico, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, rest of Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, rest of Asia-Pacific , Saudi Arabia, U.A.E, South Africa, Egypt, Israel, rest of Middle East and Africa, Brazil, Argentina and rest of South America

|

|

Market Players Covered

|

ABB (Switzerland), KUKA AG (Germany), FANUC Corporation (Japan), Yaskawa Electric Corporation (Japan), Kawasaki Heavy Industries Ltd. (Japan), Mitsubishi Electric Corporation (Japan), Universal Robots (Denmark), Denso Corporation (Japan), Epson Robots (Japan), Stäubli International AG (Switzerland), Omron Corporation (Japan), Nachi-Fujikoshi Corporation (Japan), Comau S.p.A. (Italy), Adept Technology, Inc. (U.S.), and Bastian Solutions (U.S.) among others.

|

|

Market Opportunities

|

|

Market Definition

Material handling robotics refers to automated systems that move, transport, and manage materials within manufacturing, warehousing, and distribution environments. These robots are designed to enhance efficiency, accuracy, and safety in tasks such as picking, packing, sorting, and loading, reducing the need for manual labor and minimizing the risk of errors and injuries.

Material Handling Robotics Market Dynamics

Drivers

- Increasing Advancements in Robotics Technology

Innovations in AI, machine learning, and sensor technology have significantly enhanced the capabilities and versatility of material handling robots. These advancements enable robots to perform complex tasks with greater precision, adaptability, and efficiency. Improved software and hardware integration allows for better coordination and control, reducing downtime and increasing productivity. As a result, industries are more inclined to adopt these advanced robotic systems to streamline operations, reduce errors, and maintain a competitive edge.

- Rapid Expansion of E-Commerce

The demand for efficient warehousing and logistics operations grows as online shopping increases that necessitates the adoption of automated systems. Material handling robots streamline processes such as picking, packing, sorting, and shipping, enabling faster order fulfillment and reducing operational costs. These robots also enhance accuracy and productivity, helping e-commerce businesses manage high volumes and meet customer expectations for quick and reliable deliveries. This surge in e-commerce activities propels the need for advanced robotic solutions in material handling.

Opportunities

- Increasing Automation in Manufacturing

As industries strive for higher efficiency, productivity, and cost-effectiveness, automation becomes essential. Material handling robots play a crucial role in this automation trend by streamlining various processes such as picking, packing, sorting, and transporting materials. These robots offer advantages such as speed, precision, and consistency, which are difficult to achieve through manual labor alone. Furthermore, automation allows for continuous operation without breaks or fatigue, leading to improved throughput and reduced operational costs. Consequently, manufacturers across industries are increasingly investing in material handling robotics to stay competitive in today's rapidly evolving market landscape.

- High Demand for Workplace Safety

Industries prioritize the safety of their workers, especially in environments with hazardous tasks such as heavy lifting, repetitive motions, or exposure to harmful substances. Material handling robots offer a solution, taking over these dangerous tasks and reducing the risk of workplace injuries and illnesses. Automating these processes creates safer work environments and helps companies comply with stringent safety regulations. Minimizing the risk of accidents and injuries leads to decreased downtime and associated costs, further incentivizing the adoption of material handling robotics.

Restraints/Challenges

- High Initial Investment

High upfront costs associated with purchasing robotic systems, including hardware, software, and integration, can be substantial, especially for smaller businesses with limited capital resources. Additionally, the need for specialized training and expertise to operate and maintain these systems further adds to the financial burden. This financial barrier may deter some companies from investing in material handling robotics, opting instead for traditional manual methods or less costly alternatives.

- Compliance with Regulatory Standards

The stringent regulatory landscape governing workplace safety, product quality, and environmental protection imposes specific requirements on the design, implementation, and operation of robotic systems. Ensuring compliance often involves significant time, resources, and expertise, leading to higher costs and longer deployment timelines. Additionally, varying regulations across different regions or industries can further complicate the process and inhibit the widespread adoption of material handling robotics.

This market, report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market, contact data bridge market research for an analyst brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Recent Developments

- In May 2022, ABB launched the IRB 5710 and 5720 robots tailored for material handling in EV battery production. These robots enhance productivity with improved speed, precision, and durability, offering higher uptime and flexibility. Equipped with ABB's OmniCore controller V250XT, they handle various manufacturing and EV-specific procedures with optimal precision and consistency. The integration of ABB's LeanID Integrated DressPack ensures better protection and reduced maintenance costs, extending the robots' service life and supporting faster, more adaptable material handling processes

- In January 2021, OMRON Corporation launched the i4 series SCARA robot, designed for automating high-speed and high-precision assembly and transportation processes. The series includes the high-performance i4H model for medium to large-sized tasks and the compact i4L model for lightweight applications. These robots integrate and control peripheral devices, enabling automation of complex tasks previously unattainable with conventional SCARA robots. OMRON aims to provide a comprehensive solution combining their advanced control equipment and industrial robots to drive innovation and efficiency in manufacturing

Material Handling Robotics Market Scope

The market is segmented on the basis of type, function, application, and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Transportation Handling Robots

- Positioning

- Unit Load Formation Robots

- Articulated Robots

- Cartesian Robots

- SCARA Robot

- Storage

- Identification

- Control Robots

Function

- Assembly

- Packaging

- Transportation

- Distribution

- Storage

- Waste Handling

Application

- Pick and Place

- Palletizing/De-Palletizing

- Packing and packaging

- Product/Part Transfer

- Machine Tending

End User

- Automotive

- Chemical

- Electrical and Electronics

- Industrial Machinery

- Food and Beverage

- Others

Material Handling Robotics Market Analysis/Insights

The market is analyzed and market size insights and trends are provided by region, type, function, application, and end user as referenced above.

The countries covered in the market report are U.S., Canada, Mexico, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, rest of Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, rest of Asia-Pacific , Saudi Arabia, U.A.E, South Africa, Egypt, Israel, rest of Middle East and Africa, Brazil, Argentina and rest of South America.

Asia-Pacific region is expected to dominate the market due to its rapidly growing economies such as China and India. This economic expansion is fueling demand for material handling robotics across diverse industries such as manufacturing, logistics, and retail, driven by the need for increased efficiency and automation.

Europe is the fastest-growing region in the market due to its robust manufacturing sector, which drives high demand for these robots. The automotive industry plays a crucial role, contributing significantly to the Europe material-handling robotics market. This industry's extensive use of automation for efficiency and precision in production processes propels the growth of material handling robotics in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Material Handling Robotics Market Share Analysis

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Some of the major players operating in the market are

- ABB (Switzerland)

- KUKA AG (Germany)

- FANUC Corporation (Japan)

- Yaskawa Electric Corporation (Japan)

- Kawasaki Heavy Industries Ltd. (Japan)

- Mitsubishi Electric Corporation (Japan)

- Universal Robots (Denmark)

- Denso Corporation (Japan)

- Epson Robots (Japan)

- Stäubli International AG (Switzerland)

- Omron Corporation (Japan)

- Nachi-Fujikoshi Corporation (Japan)

- Comau S.p.A. (Italy)

- Adept Technology, Inc. (U.S.)

- Bastian Solutions (U.S.)

SKU-