Global Mass Spectrometry Market

Market Size in USD Billion

CAGR :

%

USD

6.76 Billion

USD

13.06 Billion

2024

2032

USD

6.76 Billion

USD

13.06 Billion

2024

2032

| 2025 –2032 | |

| USD 6.76 Billion | |

| USD 13.06 Billion | |

|

|

|

|

Mass Spectrometry Market Analysis

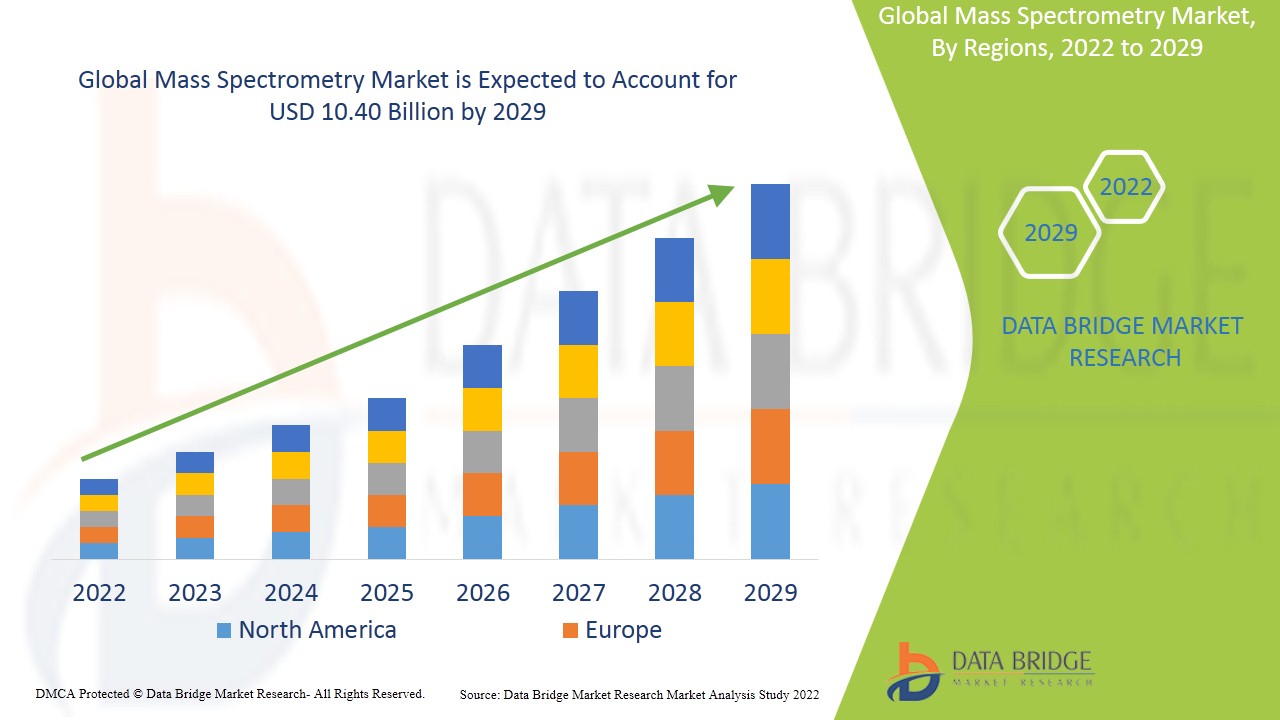

The global mass spectrometry market refers to the industry centered around the development, production, and application of mass spectrometry technologies, which are analytical tools used to identify the composition, structure, and quantity of chemical substances based on their mass-to-charge ratio. The market is driven by the rising demand for advanced analytical tools in pharmaceutical and biotech industries for drug development and quality control, and the growing focus on environmental testing and food safety regulations. However, the high cost of mass spectrometry instruments remains a significant restraint, limiting adoption, particularly among smaller laboratories. An opportunity lies in technological advancements like hybrid and portable mass spectrometers, which are expanding the market’s reach into new applications such as clinical diagnostics. A key challenge is the need for skilled professionals to operate and maintain complex systems, which can hinder efficient use and market growth.

Mass Spectrometry Market Size

Global mass spectrometry market size was valued at USD 6.76 billion in 2024 and is projected to reach USD 13.06 billion by 2032, with a CAGR of 8.58% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Mass Spectrometry Market Trends

“Rising Adoption in Clinical Diagnostics”

The rising adoption of mass spectrometry in clinical diagnostics is driven by its ability to analyze complex biological samples, advancing personalized medicine and disease diagnostics. In proteomics, it identifies and quantifies proteins linked to diseases like cancer, while in metabolomics, it profiles metabolic changes associated with conditions such as diabetes and neurodegenerative disorders. Mass spectrometry also plays a key role in biomarker discovery, enabling the identification of molecules that signal the presence or progression of diseases, supporting early and accurate diagnosis. This technology enhances personalized treatment by helping tailor therapies to a patient’s unique biological profile and is advancing non-invasive diagnostics through the analysis of fluids like breath, urine, or saliva, improving patient comfort and compliance.

Report Scope and Mass Spectrometry Market Segmentation

|

Attributes |

Mass Spectrometry Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada, and Mexico, Germany, U.K., France, Italy, Spain, Russia, Switzerland, Turkey, Belgium, Netherlands and Rest of Europe, China, India, Japan, South Korea, Indonesia, Thailand, Malaysia, Philippines, Singapore, Australia & New Zealand and Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, South Africa, Saudi Arabia, U.A.E., Egypt, Israel and Rest of Middle East and Africa |

|

Key Market Players |

Thermo Fisher Scientific, Inc. (U.S.), Shimadzu Corporation (Japan), Agilent Technologies, Inc. (U.S.), Bruker Corp (U.S.) , Waters Corporation(U.S.), Danaher Corporation (U.S.), PerkinElmer, Inc. (U.S.), Rigaku Corporation (Japan), JEOL Ltd. (U.S.), LECO Corporation(U.S.), Hiden Analytical (UK), Hitachi Ltd. (Japan), Kore Technology (UK), Ametek. Inc. (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Mass Spectrometry Market Definition

Mass spectrometry (often abbreviated as MS) is an analytical technique used to measure the mass-to-charge ratio of ions, allowing for the identification and quantification of compounds within a sample. The process involves ionizing the sample, typically through methods such as electron impact or electrospray ionization, and then accelerating the ions into a mass analyzer. This analyzer separates the ions based on their mass-to-charge ratios, and the resulting data is used to construct a mass spectrum that reveals the composition, structure, and concentration of the molecules present in the sample. Mass spectrometry is widely used in various fields, including chemistry, biochemistry, and environmental science, for applications such as drug analysis, proteomics, and metabolomics.

Mass Spectrometry Market Dynamics

Drivers

- Technological Advancements in Mass Spectrometry

Technological advancements in mass spectrometry have significantly propelled the growth of the global mass spectrometry market by enhancing the precision, speed, and range of applications in various industries. Innovations like the development of hybrid mass spectrometry systems, improved ionization techniques, and the integration of artificial intelligence (AI) and machine learning have broadened the scope of mass spectrometry in fields such as pharmaceuticals, biotechnology, environmental analysis, and food safety. These advancements allow for faster and more accurate detection of molecules, enabling researchers to perform complex analyses with higher sensitivity and reliability. Also, the miniaturization of mass spectrometry devices has facilitated the use of portable systems in point-of-care diagnostics and field testing, expanding their market reach. Continuous improvements in software and data analysis capabilities have also made the technology more accessible, enabling real-time data processing and automation, which reduces human error and enhances throughput in laboratories, further driving demand.

For instance,

- In June 2023, according to the article published by Bioanalysis zone, innovations like the Orbitrap Astral mass spectrometer have led to greater sensitivity and throughput, particularly benefiting fields like proteomics, diagnostics, and personalized medicine. Also, AI-enhanced data analysis, improved methods for protein interaction studies, and advancements in biomarker quantification. These advancements are driving progress in drug discovery, clinical trials, and disease diagnostics, making mass spectrometry more efficient and scalable. These technological advancements act as a driver in the growth of the market

- In July 2023, according to the article published in Elsevier, Recent advancements in native Mass Spectrometry (nMS) have improved its ability to analyze biomolecules. Enhanced ionization techniques like electrospray ionization preserve the native state of proteins, while high-resolution mass analyzers, such as Orbitrap and FT-ICR, enable accurate mass measurements of larger biomolecules. Ambient mass spectrometry allows for in situ analysis without extensive sample preparation, expanding applications in clinical diagnostics and environmental studies. The integration of nMS with techniques like chromatography enhances data analysis capabilities, while advanced software facilitates the interpretation of complex data. These developments drive progress in fields like proteomics and drug discovery, enabling detailed analysis of biomolecular structures and interactions

- In August 2023, according to the article published in Academic Research, the technological advancements of mass spectrometry (MS) in omics technologies, emphasizing its impact on genomics, proteomics, metabolomics, and lipidomics. Key developments include high-resolution mass analyzers, such as Orbitrap and FT-ICR, which enhance sensitivity and accuracy in molecular analysis. Improved ionization techniques, like MALDI and electrospray ionization, facilitate the analysis of diverse biomolecules in their native states. Data-independent acquisition (DIA) allows for comprehensive data collection, improving reproducibility and quantification in complex mixtures. The integration of MS with other omics technologies, along with advancements in microfluidics and automation, streamlines sample preparation and enhances efficiency. Sophisticated software for data analysis aids in interpreting complex datasets, making MS a pivotal tool in omics research and driving innovations in biomarker discovery and personalized medicine.

Advancements in mass spectrometry have significantly boosted its market by improving accuracy, speed, and versatility across multiple industries. Enhanced detection capabilities, portable systems, and smarter data processing have made the technology more accessible and efficient, expanding its use in research, diagnostics, and industrial applications, ultimately driving market growth.

- Growing Applications of Mass Spectrometry (MS) In Pharmaceuticals And Biotechnology

The growing applications of mass spectrometry (MS) in pharmaceuticals and biotechnology are key drivers in the expansion of the global mass spectrometry market. As the pharmaceutical industry increasingly focuses on drug discovery and development, the demand for advanced analytical techniques has surged. MS plays a vital role in various stages of the drug development process, including the analysis of small molecules, biopharmaceuticals, and complex biological matrices, enabling researchers to identify and quantify drugs, metabolites, and impurities with high sensitivity and specificity. Furthermore, advancements in MS technology, such as the integration of high-resolution mass spectrometry and innovative ionization techniques, have facilitated high-throughput screening and metabolomics studies, thereby streamlining workflows and accelerating time-to-market for new therapeutics. Regulatory bodies have also recognized the reliability of mass spectrometry, leading to its acceptance in compliance with stringent safety and efficacy standards. The rise of personalized medicine, which requires detailed biomarker analysis and patient-specific drug profiling, has further amplified the demand for mass spectrometry in the biotech sector. This convergence of technological advancements, regulatory support, and evolving healthcare needs continues to propel the growth of the global mass spectrometry market, positioning it as an indispensable tool for innovation in pharmaceuticals and biotechnology.

For instance,

- In March 2023, according to the article published in Technology Networks, there is a growing significance of mass spectrometry (MS) in pharmaceutical and biotech applications. Mass spectrometry has an essential role in drug development, quality control, and the analysis of biopharmaceuticals. The technology provides detailed insights into molecular structure and composition, which are crucial for ensuring product efficacy and safety. The demand for more sophisticated analytical methods drives innovation in mass spectrometry, contributing to its expanding use in characterizing biomolecules and bioproducts

- In September 2023, according to the article published in Elsevier, Quantitative Mass spectrometry allows precise measurement of biomolecules, improving the characterization of proteins, peptides, and metabolites. It optimizes processes like purification and formulation, ensuring higher yields and consistency. Increasing recognition from regulatory agencies further supports its use for method validation. Applications of Mass spectrometry technology, such as high-resolution capabilities and data analysis software, enhance sensitivity and throughput, while integration with other analytical techniques expands its application scope. Overall, quantitative Mass spectrometry is transforming biopharmaceutical development and manufacturing

- In July 2023, according to the article published in NCBI, Mass spectrometry (MS) is crucial in pharmaceutical analysis, enhancing sensitivity and specificity for detecting low-abundance compounds in complex biological samples. It is utilized across drug development stages and supports applications like metabolomics and proteomics. There is growing significance of mass spectrometry (MS) in pharmaceutical and biotech applications, particularly in drug discovery, development, and quality control. It emphasizes the technology's ability to analyse complex biomolecules, providing accurate and sensitive data essential for modern biopharmaceuticals. Additionally, advancements in MS techniques and instrumentation are accelerating research and enhancing productivity, making it a pivotal tool in ensuring drug safety and efficacy

The rising use of mass spectrometry (MS) in pharmaceuticals and biotechnology is a key factor driving the global mass spectrometry market. Its ability to accurately identify and quantify drugs and metabolites, coupled with advancements in technology for high-throughput screening, has streamlined drug development. Regulatory support and the shift towards personalized medicine further enhance the demand for MS, emphasizing its crucial role in innovation within these sectors.

Opportunities

- Advancements in Automation and Artificial Intelligence (AI) in Mass Spectrometry

The integration of automation and Artificial Intelligence (AI) in mass spectrometry presents a transformative opportunity for the global market. Advances in automation streamline sample processing and analysis, enhancing throughput and efficiency in laboratories. This allows researchers to handle larger sample volumes and obtain results more quickly, thereby accelerating research timelines. AI-driven data analysis tools can significantly improve the accuracy and speed of interpretation, enabling more complex data sets to be processed with greater precision. Furthermore, machine learning algorithms can optimize experimental conditions, leading to better instrument performance and reduced operational costs. As laboratories increasingly adopt these technologies, the demand for advanced mass spectrometry systems that incorporate automation and AI will grow, driving innovation and market expansion in diverse fields such as pharmaceuticals, environmental testing, and clinical diagnostics.

For instance,

- In July 2024, according to the article published in Science Direct, the application of AI in interpreting spectroscopic data is rapidly evolving, enabling the extraction of valuable insights from complex datasets. This technological advancement creates a significant opportunity for the global mass spectrometry market by enhancing data analysis capabilities. Improved efficiency and accuracy in results will drive demand for advanced mass spectrometry systems, supporting innovation across various sectors, including pharmaceuticals and environmental testing

- In June 2024, according to the article published on the Separation Science, Mass spectrometry presents a unique opportunity for machine learning and AI to enhance data interpretation. Due to the complexity of mass spectra, expert analysis is often required to extract meaningful insights, with many details remaining unclear. However, AI excels in identifying patterns in this data. Tools like Prosit have demonstrated the potential of AI in predicting and detecting peptides, highlighting significant market opportunities

In Feb 2024, according to the article published in NCBI, The integration of machine learning (ML) into mass spectrometry (MS) analysis has gained momentum, with innovative approaches emerging across the field. As deep learning and artificial neural networks (ANNs) are increasingly utilized, it becomes crucial to assess and compare these ML methods. This convergence presents a significant opportunity for the global mass spectrometry market, fostering advancements and enhancing analytical capabilities

In January 2024, according to the article published on Science Direct, Machine learning leverages computational models to extract information directly from data, transforming raw inputs into actionable insights without relying on predefined equations. Applying various AI models to mass spectrometry data yields accurate results in a short timeframe, which is particularly valuable for future in-flight processing of mass spectrometry data. This advancement represents a significant opportunity for the global mass spectrometry market

The rise of automation and artificial intelligence (AI) in mass spectrometry offers significant opportunities for market growth. Automation enhances sample processing and analysis, increasing efficiency and throughput in laboratories. This capability allows for quicker results and the handling of larger sample sizes, thereby speeding up research efforts. AI-powered data analysis improves the accuracy and speed of interpretation, enabling researchers to work with complex datasets more effectively. Additionally, machine learning can optimize experimental conditions, enhancing instrument performance and reducing costs. As more labs adopt these technologies, the demand for advanced mass spectrometry systems that incorporate automation and AI will grow, driving innovation across sectors such as pharmaceuticals, environmental testing, and clinical diagnostics.

- Rising Adoption of Compact and Portable Mass Spectrometers

The increasing adoption of compact and portable mass spectrometers presents a significant opportunity for the global mass spectrometry market. These advanced devices facilitate on-site analysis in diverse applications, such as environmental monitoring, food safety testing, and clinical diagnostics. Their small size and user-friendly design make them ideal for use in the field or in remote locations, allowing for immediate results without the need for extensive laboratory infrastructure. As industries seek greater efficiency and rapid data acquisition, the demand for portable mass spectrometry solutions is expected to rise. This trend not only enhances diagnostic capabilities but also promotes innovation in analytical techniques. By catering to the growing need for accessible and efficient testing methods, compact mass spectrometers are poised to play a crucial role in the future of the mass spectrometry market.

For instance,

- In November 2022, according to the article published in NCBI, Mass spectrometry (MS) is a highly informative analytical method essential for various ‘omics studies. However, traditional mass spectrometers are often bulky and require high vacuum conditions, limiting their accessibility and field use. The development of portable mass spectrometers can greatly broaden the application range and user base for MS analysis, representing a significant opportunity for the global mass spectrometry market

- In May 2022, according to the article published on Research Gate, the rapid advancement of science and technology has made portable mass spectrometers essential analytical instruments for research. The miniaturization and applications of four types—magnetic sector, time-of-flight, quadrupole, and ion trap mass spectrometers—showcase their compact design and ease of use. This trend highlights a significant opportunity for the global mass spectrometry market

The rising use of compact and portable mass spectrometers creates a valuable opportunity for the global mass spectrometry market. These innovative devices enable on-site analysis across various fields, including environmental monitoring, food safety, and clinical diagnostics. Their small size and ease of use make them perfect for remote locations, providing quick results without needing extensive lab setups. As industries prioritize efficiency and rapid data collection, the demand for these portable solutions is likely to grow. This trend enhances diagnostic capabilities and drives innovation in analytical methods, positioning compact mass spectrometers as vital tools for the future of the mass spectrometry market.

Restraints/Challenges

- High Cost of Mass Spectrometry

The high cost of mass spectrometry systems and their associated operational expenses act as a significant restraint in the global mass spectrometry market, limiting accessibility for many laboratories, especially in emerging economies and smaller research institutions. The initial investment required for advanced mass spectrometry instruments is substantial, encompassing not only the purchase price but also expenses related to installation, maintenance, and the need for specialized personnel to operate and interpret the results. Additionally, the ongoing costs of consumables, such as reagents and calibration standards, can further strain budgets, making it challenging for organizations with limited resources to adopt or upgrade their mass spectrometry capabilities. This financial barrier can hinder the adoption of mass spectrometry technologies, particularly in fields that require cost-effective analytical solutions, thereby slowing down advancements in research and clinical applications. Consequently, despite the growing demand for mass spectrometry in various industries, the high cost associated with these technologies continues to pose a significant challenge, potentially limiting market growth and the overall utilization of mass spectrometry in critical applications.

For instance,

- In August 2019, according to the article published in American Chemical Society, a triple quadrupole mass spectrometer typically costs around USD 350,000, although this can vary based on its features. A high-resolution time-of-flight instrument generally ranges from USD 350,000 to USD 400,000, while an Orbitrap extended-mass-range model can be priced between approximately USD 400,000 and USD 800,000. The high cost of modern mass spectrometry acts as a restraint in the market growth

- In July 2019, according to the article published by Journal of Infectiology & Epidemiology, MALDI-TOF mass spectrometry offers significant advantages in the rapid and accurate identification of microorganisms but its high cost remains a substantial limitation. The expense of acquiring and maintaining mass spectrometry equipment, along with the need for specialized training and infrastructure, poses a barrier to widespread adoption, particularly in resource-limited settings

The prohibitive costs of mass spectrometry systems and their ongoing operational expenses serve as a notable obstacle in the global mass spectrometry market. The substantial initial investment required for advanced instruments, coupled with high maintenance, consumables, and the need for skilled personnel, limits access for many research institutions and smaller labs, particularly in developing regions. This financial burden can deter organizations from adopting or enhancing their mass spectrometry capabilities, ultimately slowing progress in research and clinical applications.

- Skilled Workforce Shortage

The mass spectrometry market faces a significant challenge due to the shortage of skilled professionals capable of operating advanced mass spectrometry systems and interpreting complex data. The intricate nature of mass spectrometry demands specialized training and expertise, which can be challenging to find. This shortage not only limits the adoption of mass spectrometry technology, as organizations may hesitate to invest without qualified personnel, but it can also lead to inconsistent results due to variability in data quality and interpretation. Additionally, companies may incur increased training costs to upskill existing staff, further straining operational budgets. The lack of skilled workers can stifle innovation, as new techniques and applications may go unexplored, while limited expertise creates bottlenecks in workflows, slowing down research and analysis processes. Addressing this workforce shortage is crucial for the continued growth and advancement of the mass spectrometry market.

For instance,

- In February 2023, according to the article published on Biomedical Research Network , the Healthcare is facing a critical shortage of essential medical laboratory professionals who work behind the scenes. This lack of skilled technicians limits the effective operation and analysis capabilities of mass spectrometry systems. As a result, this shortage acts as a significant challenge, hindering the growth and widespread adoption of mass spectrometry in healthcare settings

- In October 2022, according to the article published by THG PUBLISHING PVT LTD, The Regional Chemical Examiner’s Lab in Kakkanad is experiencing operational challenges due to a shortage of staff and inadequate modern equipment. This situation reflects a broader issue affecting the global mass spectrometry market, where similar constraints can hinder laboratory efficiency and effectiveness. As a result, this staff and equipment deficiency acts as a significant challenge on market growth

The mass spectrometry market is significantly hindered by a shortage of skilled professionals capable of operating advanced systems and analyzing complex data. This lack of expertise restricts technology adoption, as organizations may be reluctant to invest without qualified personnel. Additionally, inconsistent results may arise from varying data interpretations, and companies face increased training costs to develop existing staff. This skills gap can stifle innovation and create workflow bottlenecks, ultimately slowing research and analysis. Addressing the shortage of skilled workers is essential for the continued growth of the mass spectrometry market.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Mass Spectrometry Market Scope

The market is segmented on the basis of technology, modality, application, end user, and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Technology

- Hybrid Mass Spectrometry

- Orbitrap-MS

- FT-MS

- Others

- Single Mass Spectrometry

- Time of Flight

- Quadrupole

- Others

- Others

Modality

- Benchtop

- Standalone

Application

- Pharmaceutical Industry

- Research and Academic Institutes

- Food & Beverage Industry

- Petrochemical Industry

- Others

Distribution CHannel

- Direct Tenders

- Retail Sales

- Others

Mass Spectrometry Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, technology, modality, application, end user, and distribution channel as referenced above.

The countries covered in the market are U.S., Canada, Mexico, Germany, France, U.K., Italy, Spain, Russia, Netherland, Switzerland, Turkey, Rest of Europe, China, Japan, India, Australia, South Korea, Thailand, Indonesia, Malaysia, Singapore, Vietnam, Philippines, Rest of APAC, Brazil, Argentina, Rest of South America, Saudi Arabia, South Africa, Egypt, U.A.E., Israel, Rest of MEA.

North America is expected to dominate the market due to its advanced research infrastructure, significant investments in healthcare and life sciences, and high adoption of cutting-edge technologies like hybrid and tandem mass spectrometry. Strong support from government initiatives and regulatory agencies fosters innovation and drives market growth in the region.

Asia-Pacific is expected to be the fastest growing due to rapid advancements in healthcare infrastructure and increased investments in research and development across the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Mass Spectrometry Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Mass Spectrometry Market Leaders Operating in the Market Are:

- Thermo Fisher Scientific, Inc. (U.S.)

- Shimadzu Corporation (Japan)

- Agilent Technologies, Inc. (U.S.)

- Bruker Corp (U.S.)

- Waters Corporation (U.S.)

- Danaher Corporation (U.S.)

- PerkinElmer, Inc.

- Rigaku Corporation

- JEOL Ltd. (Japan)

- LECO Corporation

- Hiden Analytical (England)

- Hitachi Ltd. (Japan)

- Kore Technology (UK)

- Ametek. Inc. (U.S.)

Latest Developments in Mass Spectrometry Market

- In October 2024, Waters Corporation launched new LC-MS-grade reagents, enzymes, and software to enhance RNA analysis for mRNA vaccines and therapies. The tools simplify sequence confirmation and improve sensitivity, accelerating development while ensuring safety and efficacy for RNA-based pharmaceuticals

- In June 2024, Agilent Technologies unveiled the 7010D Triple Quadrupole GC/MS System and the ExD Cell for the 6545XT AdvanceBio LC/Q-TOF at ASMS 2024, enhancing sensitivity, structural characterization, and analytical efficiency in food safety, environmental testing, and biopharma research

- In May 2024, The Bruker Corp completed its acquisition of NanoString Technologies, acquiring key assets including the nCounter, GeoMx, CosMx, and AtoMx™ product lines for approximately USD 392.6 million. This strategic move enhanced Bruker's capabilities in gene expression profiling and spatial transcriptomics for research

- In October 2023, Waters Corporation has partnered with the University of San Agustin to establish the Philippines' first mass spectrometry imaging center. Equipped with the SYNAPT HDMS, the center aims to advance natural medicine drug discovery for cancer and infectious diseases

- In June 2023, Agilent Technologies introduced the 6495D LC/TQ and Revident LC/Q-TOF mass spectrometry systems at ASMS 2023, enhancing sensitivity and efficiency for targeted analyses. New MassHunter Explorer and ChemVista software streamline data exploration and identification, revolutionizing workflows in various scientific fields

- In May 2023, Thermo Fisher and BRIN have partnered to enhance research capabilities in Indonesia, focusing on advancing scientific innovation and collaboration in life sciences, biotechnology, and environmental studies for local researchers

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.