Global Mass Spectrometry Food Testing Market

Market Size in USD Billion

CAGR :

%

USD

4.30 Billion

USD

9.62 Billion

2025

2033

USD

4.30 Billion

USD

9.62 Billion

2025

2033

| 2026 –2033 | |

| USD 4.30 Billion | |

| USD 9.62 Billion | |

|

|

|

|

What is the Global Mass Spectrometry Food Testing Market Size and Growth Rate?

- The global mass spectrometry food testing market size was valued at USD 4.3 Billion in 2025 and is expected to reach USD 9.62 Billion by 2033, at a CAGR of10.6% during the forecast period

- Rise in the government enterprises for pollution control and environmental testing is the vital factor escalating the market growth, also rise in the expenditure on pharmaceutical research and development, government guidelines on drug security and increase in the emphasis on the quality of food products are the major factors among others driving the mass spectrometry food testing market

What are the Major Takeaways of Mass Spectrometry Food Testing Market?

- Rise in the demand from emerging economies will further create new opportunities for mass spectrometry food testing market

- However, rise in the dearth of skilled professionals is the major factor among others which will obstruct the market growth, and will further challenge the growth of mass spectrometry food testing market

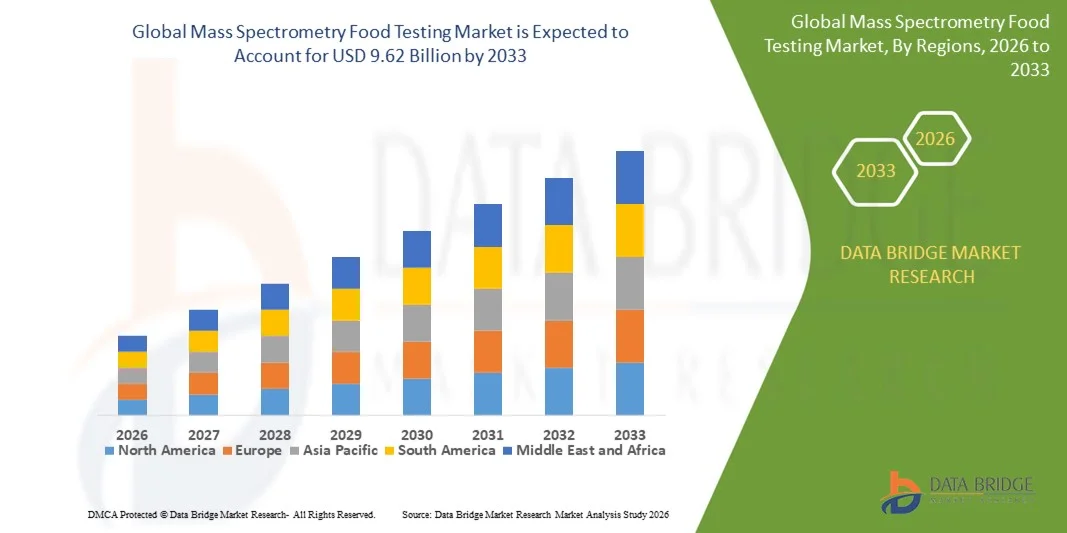

- North America dominated the mass spectrometry food testing market with an estimated 41.19% revenue share in 2025, driven by stringent food safety regulations, high adoption of advanced analytical technologies, and strong presence of accredited food testing laboratories across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of around 9.89% from 2026 to 2033, driven by rapid growth in food processing industries, expanding export-oriented agriculture, and tightening food safety regulations across China, Japan, India, South Korea, and Southeast Asia

- The Hybrid Mass Spectrometry segment dominated the market with an estimated ~58% revenue share in 2025, owing to its superior sensitivity, high resolution, and ability to perform complex multi-residue analysis in food samples

Report Scope and Mass Spectrometry Food Testing Market Segmentation

|

Attributes |

Mass Spectrometry Food Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Mass Spectrometry Food Testing Market?

Increasing Shift Toward High-Speed, Compact, and Automated Mass Spectrometry Solutions for Food Safety Testing

- The mass spectrometry food testing market is witnessing growing adoption of high-speed, compact, and automated MS systems designed for rapid detection of contaminants, residues, and adulterants in food products

- Manufacturers are introducing advanced LC-MS/MS, GC-MS, and high-resolution mass spectrometry platforms with improved sensitivity, faster analysis times, and enhanced data processing capabilities

- Rising demand for portable, cost-efficient, and field-deployable food testing solutions is driving adoption across food processing plants, quality control labs, regulatory agencies, and contract testing laboratories

- For instance, companies such as Thermo Fisher Scientific, Agilent Technologies, Bruker, SCIEX, and Waters Corporation have launched next-generation MS systems with improved throughput, automated workflows, and AI-enabled data interpretation

- Increasing need for real-time food safety monitoring, rapid screening, and compliance with stringent food safety regulations is accelerating the shift toward advanced mass spectrometry-based testing

- As food supply chains become more complex and regulatory scrutiny increases, Mass Spectrometry Food Testing will remain essential for accurate, rapid, and reliable food quality and safety analysis

What are the Key Drivers of Mass Spectrometry Food Testing Market?

- Rising demand for accurate, sensitive, and reliable analytical techniques to detect pesticides, toxins, allergens, antibiotics, and chemical residues in food products

- For instance, in 2025, leading players such as Agilent, Thermo Fisher Scientific, and Shimadzu upgraded their food testing portfolios with high-resolution MS systems and automated sample preparation solutions

- Growing focus on food safety regulations, traceability requirements, and quality assurance standards across the U.S., Europe, and Asia-Pacific is boosting adoption of MS-based food testing

- Advancements in ionization techniques, mass analyzers, software analytics, and high-throughput workflows have significantly improved testing accuracy and operational efficiency

- Increasing use of mass spectrometry in routine food inspection, export-import compliance, and contamination investigation is creating sustained demand across public and private laboratories

- Supported by rising investments in food testing infrastructure, regulatory enforcement, and analytical innovation, the Mass Spectrometry Food Testing market is expected to witness strong long-term growth

Which Factor is Challenging the Growth of the Mass Spectrometry Food Testing Market?

- High costs associated with advanced mass spectrometry instruments, maintenance, and skilled personnel limit adoption among small food processors and regional testing labs

- For instance, during 2024–2025, supply chain disruptions, component price volatility, and longer lead times increased system and service costs for MS equipment manufacturers

- Complexity of method development, data interpretation, and multi-residue analysis increases dependency on trained analysts and specialized expertise

- Limited awareness and adoption of advanced MS techniques in emerging economies restrict market penetration

- Competition from alternative testing methods such as rapid immunoassays and spectroscopy-based techniques creates pricing pressure in routine testing applications

- To overcome these challenges, companies are focusing on cost-optimized systems, automated workflows, user-friendly software, and training programs to expand global adoption of mass spectrometry food testing

How is the Mass Spectrometry Food Testing Market Segmented?

The market is segmented on the basis of technology and end user.

- By Technology

On the basis of technology, the mass spectrometry food testing market is segmented into Hybrid Mass Spectrometry, Single Mass Spectrometry, and Other Technologies. The Hybrid Mass Spectrometry segment dominated the market with an estimated ~58% revenue share in 2025, owing to its superior sensitivity, high resolution, and ability to perform complex multi-residue analysis in food samples. Hybrid systems such as LC-MS/MS and GC-MS/MS are widely used for detecting pesticides, contaminants, toxins, and adulterants with high accuracy, making them the preferred choice for regulatory and commercial food testing laboratories. Their compatibility with automated workflows and advanced data analytics further strengthens adoption.

The Single Mass Spectrometry segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for cost-effective, easy-to-operate instruments for routine food screening, especially among small laboratories and emerging markets. Growing focus on rapid testing and affordability is supporting segment expansion.

- By End User

On the basis of end user, the market is segmented into the Pharmaceutical Industry, Biotechnology Industry, Research and Academic Institutes, Environmental Testing Industry, Food and Beverage Testing Industry, Petrochemical Industry, and Other End Users. The Food and Beverage Testing Industry segment dominated the market with approximately 46% share in 2025, driven by stringent food safety regulations, increasing food contamination incidents, and rising demand for quality assurance across global supply chains. Mass spectrometry is extensively used for compliance testing, export certification, and routine quality control in processed and packaged foods.

The Research and Academic Institutes segment is projected to witness the fastest growth during the forecast period, supported by rising investments in analytical research, food chemistry studies, and method development. Increasing collaboration between academia, government agencies, and industry players is further accelerating adoption of advanced mass spectrometry solution.

Which Region Holds the Largest Share of the Mass Spectrometry Food Testing Market?

- North America dominated the mass spectrometry food testing market with an estimated 41.19% revenue share in 2025, driven by stringent food safety regulations, high adoption of advanced analytical technologies, and strong presence of accredited food testing laboratories across the U.S. and Canada. Regulatory frameworks enforced by agencies such as the FDA, USDA, and CFIA are accelerating the use of mass spectrometry for pesticide residue analysis, contaminant detection, allergen testing, and food authenticity verification across the region

- Leading players in North America are continuously launching high-resolution, high-throughput mass spectrometry systems integrated with automation, AI-based data analysis, and advanced chromatography techniques, strengthening regional technological leadership

- Strong R&D infrastructure, availability of skilled analytical professionals, and sustained investments in food quality monitoring further reinforce North America’s market dominance

U.S. Mass Spectrometry Food Testing Market Insight

The U.S. is the largest contributor in North America, supported by strict food compliance standards, a high volume of food imports and exports, and extensive use of mass spectrometry across commercial labs, government agencies, and food manufacturers. Rising concerns over food fraud, contaminants, and traceability are further boosting market demand.

Canada Mass Spectrometry Food Testing Market Insight

Canada contributes significantly due to increasing food safety enforcement, growing processed food exports, and strong adoption of advanced analytical testing in government and private laboratories. Investment in food quality assurance and academic research continues to support market growth.

Asia-Pacific Mass Spectrometry Food Testing Market

Asia-Pacific is projected to register the fastest CAGR of around 9.89% from 2026 to 2033, driven by rapid growth in food processing industries, expanding export-oriented agriculture, and tightening food safety regulations across China, Japan, India, South Korea, and Southeast Asia. Rising urbanization, increasing packaged food consumption, and higher awareness of food quality are accelerating demand for mass spectrometry-based testing solutions.

China Mass Spectrometry Food Testing Market Insight

China leads Asia-Pacific due to large-scale food production, increasing regulatory scrutiny, and government initiatives aimed at improving food safety standards. Growing investment in advanced testing infrastructure is driving widespread adoption.

Japan Mass Spectrometry Food Testing Market Insight

Japan shows steady growth supported by high food quality standards, advanced analytical capabilities, and strong demand for precision testing in seafood, processed foods, and imported products.

India Mass Spectrometry Food Testing Market Insight

India is emerging as a high-growth market, driven by expanding food exports, stricter FSSAI regulations, and increasing adoption of advanced testing technologies across public and private laboratories.

South Korea Mass Spectrometry Food Testing Market Insight

South Korea contributes notably due to rising demand for food safety compliance, advanced laboratory infrastructure, and growing focus on detecting contaminants and food adulteration, supporting sustained regional growth.

Which are the Top Companies in Mass Spectrometry Food Testing Market?

The mass spectrometry food testing industry is primarily led by well-established companies, including:

- Agilent Technologies, Inc. (U.S.)

- Danaher (U.S.)

- Waters Corporation (U.S.)

- Bruker (U.S.)

- Thermo Fisher Scientific (U.S.)

- PerkinElmer, Inc. (U.S.)

- Shimadzu Corporation (Japan)

- Kore Technologies, Ltd. (U.K.)

- Dani Instruments S.p.A. (Italy)

- LECO Corporation (U.S.)

- JEOL Ltd. (Japan)

- Eurofins Scientific (Luxembourg)

- Ion Science (U.K.)

- FLIR Systems, Inc. (U.S.)

- AMETEK Inc. (U.S.)

- Hitachi, Ltd. (Japan)

- High Technologies Solutions (Italy)

- SCIEX (U.S.)

- Analytik Jena GmbH (Germany)

- Rigaku Corporation (Japan)

- Hiden Analytical (U.K.)

- Extrel CMS, LLC (U.S.)

- MassTech (U.S.)

- MKS Instruments (U.S.)

- Advion (U.S.)

What are the Recent Developments in Global Mass Spectrometry Food Testing Market?

- In September 2024, PerkinElmer formed a partnership with Emphor DLAS to provide comprehensive analytical laboratory solutions across the U.A.E. and Qatar, including mass spectrometry, atomic spectroscopy, chromatography, thermal analysis, and other advanced techniques, strengthening regional laboratory capabilities

- In June 2024, SCIEX (Danaher Corporation) announced a collaboration to introduce artificial intelligence quantitation (AI Quant) software for processing data from the ZenoTOF 7600 system and SCIEX 7500+ mass spectrometers, enhancing accuracy, automation, and efficiency in mass spectrometry data analysis

- In June 2024, Thermo Fisher Scientific Inc. launched the Thermo Scientific Stellar Mass Spectrometer (MS) as an advanced solution to accelerate translational omics research, offering high throughput, superior sensitivity, and easy operation, enabling faster and more efficient scientific discoveries

- In May 2024, Waters Corporation unveiled the ACQUITY QDa II Mass Detector, an upgraded compact mass detection instrument, delivering high-quality mass spectral data for chromatographic separations, providing a robust, energy-efficient, and cost-effective solution for diverse chemical analyses

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Mass Spectrometry Food Testing Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Mass Spectrometry Food Testing Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Mass Spectrometry Food Testing Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.