Global Mass Spectrometry Devices Market

Market Size in USD Billion

CAGR :

%

USD

7.40 Billion

USD

12.04 Billion

2024

2032

USD

7.40 Billion

USD

12.04 Billion

2024

2032

| 2025 –2032 | |

| USD 7.40 Billion | |

| USD 12.04 Billion | |

|

|

|

|

Mass Spectrometry Devices Market Size

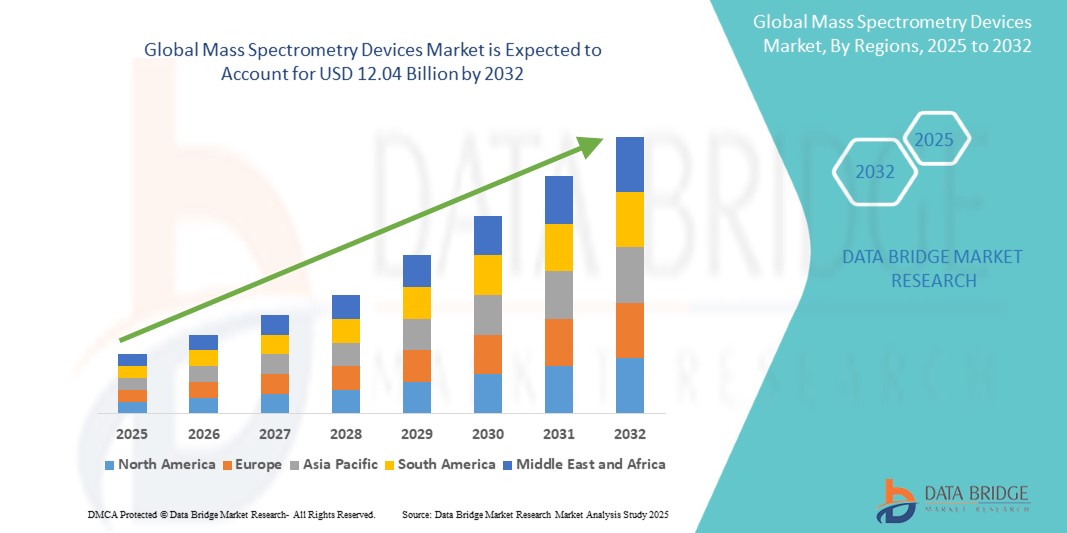

- The global mass spectrometry devices market size was valued at USD 7.40 billion in 2024 and is expected to reach USD 12.04 billion by 2032, at a CAGR of 6.27% during the forecast period

- This growth is driven by surge in health expenditure

Mass Spectrometry Devices Market Analysis

- Mass spectrometry devices are crucial analytical tools used in various applications, such as medical diagnostics, drug discovery, environmental testing, and food safety. These devices help in identifying and quantifying biomolecules, proteins, and other compounds with high sensitivity and precision

- The demand for mass spectrometry devices is driven by the growing need for accurate and rapid diagnostics, advancements in personalized medicine, and the increasing adoption of mass spectrometry for research and clinical applications, including cancer diagnosis and proteomics research

- North America dominates the mass spectrometry devices market with the largest market share of 42.12%, due to presence of key market players, established academic institutions, pharmaceutical companies, and research centers, coupled with robust funding opportunities for R&D in biotechnology and drug discovery and development

- Asia-Pacific is expected to experience the highest growth rate in the mass spectrometry devices market, driven by rapid advancements in healthcare infrastructure, increased adoption of high-tech diagnostic tools, and expanding research and development in pharmaceutical and biotechnology sectors

- The hybrid mass spectrometry segment is expected to dominate the market with a largest market share of 62.54%, due to due to its superior sensitivity, selectivity, and quantification capabilities compared to other mass spectrometry technologies

Report Scope and Mass Spectrometry Devices Market Segmentation

|

Attributes |

Mass Spectrometry Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Mass Spectrometry Devices Market Trends

“Integration of Artificial Intelligence and Machine Learning in Mass Spectrometry”

- A major trend in the mass spectrometry devices market is the integration of artificial intelligence (AI) and machine learning (ML) to enhance data analysis, improve accuracy, and speed up the process of identifying compounds in complex samples

- AI-driven algorithms are used to analyze mass spectrometry data faster and more efficiently, reducing human error and enabling the detection of patterns and correlations that may not be immediately visible

- This trend is revolutionizing fields such as clinical diagnostics, drug discovery, and environmental monitoring, allowing for more accurate and faster results, thus improving overall research productivity

- For instance, in 2024, Thermo Fisher Scientific introduced an AI-powered software solution that helps researchers in proteomics analysis by automating the identification and quantification of proteins in complex biological samples

- The integration of AI and ML in mass spectrometry is expected to accelerate data processing times and improve the overall sensitivity and specificity of results, driving further adoption of mass spectrometry technologies across various industries

Mass Spectrometry Devices Market Dynamics

Driver

“Advancements in Proteomics and Genomics Research”

- One key driver for the mass spectrometry devices market is the growing demand for proteomics and genomics research, particularly in the fields of personalized medicine and cancer research

- As the need for more precise, individualized treatments increases, mass spectrometry devices are playing a central role in biomarker discovery, drug development, and clinical diagnostics

- Advances in technologies such as next-generation sequencing (NGS) and CRISPR are further boosting the adoption of mass spectrometry in genomic and proteomic research, enabling researchers to explore complex biological systems at a much deeper level

- For instance, in 2023, scientists used mass spectrometry to identify a novel biomarker for early-stage cancer detection, demonstrating the importance of the technology in medical research

- The growing focus on precision medicine and molecular research is expected to drive the demand for mass spectrometry devices, which are crucial for characterizing proteins, metabolites, and other biomolecules in clinical and research settings

Opportunity

“Expansion of Mass Spectrometry Applications in Environmental and Food Safety Testing”

- A significant opportunity in the mass spectrometry devices market lies in the expansion of applications in environmental monitoring, food safety, and forensic analysis

- With growing concerns over environmental pollution, foodborne illnesses, and contamination, mass spectrometry is being increasingly used to detect pollutants, toxins, and contaminants in air, water, and food products

- Regulatory bodies are also adopting stricter standards for food safety and environmental protection, driving demand for accurate and reliable analytical techniques such as mass spectrometry

- For instance, in 2024, the U.S. Environmental Protection Agency (EPA) adopted new mass spectrometry-based protocols for detecting PFAS (per- and polyfluoroalkyl substances) in water, spurring the adoption of advanced mass spectrometry devices for environmental testing

- The expansion of mass spectrometry applications in environmental and food safety testing is expected to drive the growth of the market, with significant opportunities in regulatory compliance and environmental monitoring

Restraint/Challenge

“Complexity and High Skill Requirements for Operation”

- One of the main challenges facing the mass spectrometry devices market is the complexity of operating advanced mass spectrometry systems, which require skilled operators and extensive training.

- The need for specialized knowledge to interpret mass spectrometry data accurately is a barrier to the widespread adoption of these devices, particularly in small or underfunded laboratories

- Moreover, the advanced features and capabilities of mass spectrometers require continuous training and support, which can be resource-intensive for healthcare providers and research institutions

- For instance, a report from the International Society for Mass Spectrometry (ISMS) in 2023 highlighted the shortage of trained mass spectrometry professionals, which hampers the broader implementation of these devices in emerging markets

- While advancements in user-friendly software and automation are improving the accessibility of mass spectrometry devices, the need for highly skilled personnel remains a challenge that may slow the growth of the market, especially in resource-limited regions

Mass Spectrometry Devices Market Scope

The market is segmented on the basis of technology, application, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Technology |

|

|

By Application |

|

|

By End User |

|

In 2025, the hybrid mass spectrometry is projected to dominate the market with a largest share in product type segment

The hybrid mass spectrometry segment is expected to dominate the mass spectrometry devices market with the largest share of 62.54% in 2025 due to its superior sensitivity, selectivity, and quantification capabilities compared to other mass spectrometry technologies. This makes it highly effective in applications that require high-performance analysis, such as pharmaceutical and biotechnology research.

The pharmaceutical is expected to account for the largest share during the forecast period in application segment

In 2025, the pharmaceutical segment is expected to dominate the market with the largest market share of 23.56% due to increasing focus on personalized medicine and precision healthcare. Mass spectrometry plays a key role by measuring specific biomarkers, metabolites, and drug compounds in patient samples, allowing for tailored treatment strategies.

Mass Spectrometry Devices Market Regional Analysis

“North America Holds the Largest Share in the Mass Spectrometry Devices Market”

- North America is expected to dominate the mass spectrometry devices market with the largest market share of 42.12%, due to presence of key market players, established academic institutions, pharmaceutical companies, and research centers, coupled with robust funding opportunities for R&D in biotechnology and drug discovery and development

- U.S. accounts for a largest share due to technological innovations, rising demand from the pharmaceutical and biotechnology sectors, increased investment in drug discovery and development, and the growing use of mass spectrometry in disease diagnostics

- Significant investment in proteomics and related fields is anticipated to create numerous growth opportunities in the market

“Asia-Pacific is Projected to Register the Highest CAGR in the Mass Spectrometry Devices Market”

- Asia-Pacific is expected to experience the highest growth rate in the mass spectrometry devices market, driven by rapid advancements in healthcare infrastructure, increased adoption of high-tech diagnostic tools, and expanding research and development in pharmaceutical and biotechnology sectors

- Countries such as China, India, and Japan are emerging as key markets due to the increasing demand for advanced analytical technologies, growing investment in healthcare, and the rising focus on personalized medicine and drug development

- Japan, known for its cutting-edge scientific and healthcare innovations, is seeing significant adoption of mass spectrometry devices across pharmaceutical, clinical, and research sectors, supported by strong government funding for medical technologies

- China and India, with their large populations and expanding healthcare markets, are benefiting from increased government investments in healthcare infrastructure, growing pharmaceutical research activities, and greater access to advanced diagnostic technologies

Mass Spectrometry Devices Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Agilent Technologies, Inc. (U.S.)

- Danaher (U.S.)

- Waters Corporation (U.S.)

- Bruker (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- PerkinElmer (U.S.)

- Shimadzu Corporation (Japan)

- KORE TECHNOLOGY (Japan)

- LECO Corporation (U.S.)

- JEOL Ltd. (Japan)

- Eurofins Scientific (Luxembourg)

- Ion Science USA (U.K.)

- Teledyne FLIR LLC (U.S.)

- AMETEK, Inc. (U.S.)

- Hiden Analytical (U.K.)

Latest Developments in Global Mass Spectrometry Devices Market

- In June 2023, Thermo Fisher Scientific, Inc. launched the Thermo Scientific™ Orbitrap™ Astral mass spectrometer. This state-of-the-art analyzer enables precise protein identification, which is essential for groundbreaking advancements in clinical biomarkers, disease research, and therapeutic development, further pushing the boundaries of medical discoveries

- In June 2023, Agilent Technologies, Inc. introduced the Inspirational LC/TQ and LC/Q-TOF Mass Spectrometry Solutions. The Agilent 6495 Triple Quadrupole LC/MS offers exceptional sensitivity for targeted analysis, while the Agilent Revident Quadrupole Time-of-Flight LC/MS (LC/QTOF) System incorporates intelligent architecture to enhance operational efficiency and overall productivity, making it a leading choice in high-performance mass spectrometry

- In June 2022, Shimadzu Scientific Instruments launched the LCMS-2050 liquid chromatography quadrupole mass spectrometer. Compact in design, it delivers high-speed and high-sensitivity analysis, enabling precise measurements in various analytical applications

- In March 2022, Waters Corporation released the Xevo TQ Absolute system, a compact benchtop tandem mass spectrometer. Offering up to 15 times greater sensitivity for quantifying negatively ionizing compounds compared to its predecessor, it also reduces its size by 45% and cuts electricity and gas consumption by up to 50%, marking a significant step toward more energy-efficient mass spectrometry solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.