Global Managed Mobility Services Market

Market Size in USD Billion

CAGR :

%

USD

48.47 Billion

USD

243.39 Billion

2024

2032

USD

48.47 Billion

USD

243.39 Billion

2024

2032

| 2025 –2032 | |

| USD 48.47 Billion | |

| USD 243.39 Billion | |

|

|

|

|

Managed Mobility Services Market Size

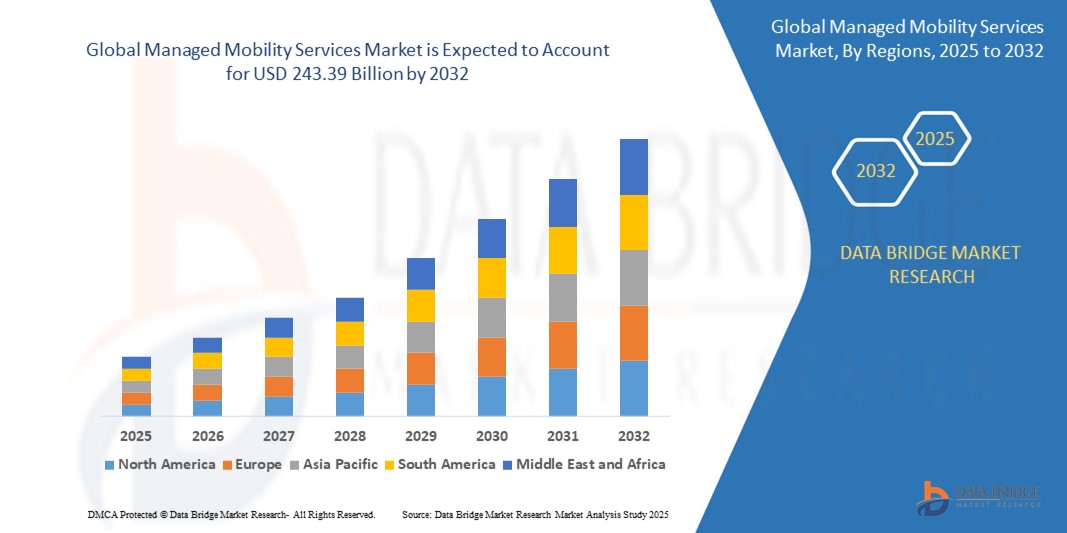

- The global managed mobility services market size was valued at USD 48.47 billion in 2024 and is expected to reach USD 243.39 billion by 2032, at a CAGR of 22.35% during the forecast period

- The market growth is primarily driven by the increasing adoption of mobile devices in workplaces, the rise of bring-your-own-device (BYOD) policies, and the growing need for secure and efficient management of mobile ecosystems across enterprises

- In addition, the demand for cost-effective, scalable, and secure mobility solutions to enhance productivity and streamline operations is positioning managed mobility services as a critical component for modern businesses. These factors are significantly accelerating market expansion

Managed Mobility Services Market Analysis

- Managed mobility services (MMS) encompass solutions for managing mobile devices, applications, and security within organizations, offering centralized control, enhanced security, and seamless integration with enterprise systems. These services are pivotal in enabling digital transformation and supporting remote and hybrid work environments

- The escalating demand for MMS is fueled by the proliferation of mobile devices, growing cybersecurity threats, and the need for efficient management of enterprise mobility to ensure compliance and productivity

- North America dominated the managed mobility services market with the largest revenue share of 42.5% in 2024, driven by early adoption of advanced technologies, robust IT infrastructure, and the presence of major market players

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, attributed to rapid digitalization, increasing smartphone penetration, and rising investments in IT infrastructure in countries such as China, India, and Japan

- The Mobile Device Management segment dominated the largest market revenue share of approximately 34.7% in 2024, driven by the massive proliferation of connected mobile devices such as smartphones, tablets, and laptops in enterprises

Report Scope and Managed Mobility Services Market Segmentation

|

Attributes |

Managed Mobility Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Managed Mobility Services Market Trends

Increasing Integration of AI and IoT Technologies

- The Global Managed Mobility Services (MMS) market is experiencing a significant trend toward the integration of Artificial Intelligence (AI) and Internet of Things (IoT) technologies

- These technologies enable advanced data analytics and real-time device management, providing deeper insights into device performance, user behavior, and security vulnerabilities

- AI-driven MMS platforms facilitate proactive issue resolution, such as identifying potential security threats or optimizing device configurations before they impact operations

- For instances, companies are leveraging AI-powered analytics to monitor employee device usage patterns, enabling tailored security policies or optimizing resource allocation for enterprise mobility

- IoT integration enhances real-time monitoring and predictive maintenance of mobile devices, improving operational efficiency and reducing downtime for enterprises

- This trend is increasing the appeal of MMS solutions for both small and medium enterprises (SMEs) and large enterprises, driving adoption across various industries

Managed Mobility Services Market Dynamics

Driver

Rising Demand for BYOD Policies and Secure Mobility Solutions

- The growing adoption of Bring Your Own Device (BYOD) and Choose Your Own Device (CYOD) policies is a major driver for the Global Managed Mobility Services market

- MMS solutions enhance enterprise security by offering features such as mobile device management (MDM), application management, and real-time security monitoring, ensuring compliance with regulatory standards such as GDPR and HIPAA

- Government regulations and industry standards in regions such as North America and Europe are promoting the adoption of MMS to secure corporate data on personal and enterprise devices

- The proliferation of 5G technology and IoT devices is enabling faster and more reliable data transmission, supporting advanced MMS applications such as remote device management and real-time analytics

- Enterprises are increasingly opting for cloud-based MMS solutions to meet the demand for scalable, flexible, and cost-efficient mobility management, particularly in industries such as IT and telecom

Restraint/Challenge

High Implementation Costs and Data Privacy Concerns

- The high initial costs associated with deploying MMS solutions, including hardware, software, and integration, pose a significant barrier, particularly for SMEs in emerging markets

- Integrating MMS into existing IT infrastructure can be complex and resource-intensive, requiring specialized expertise and ongoing maintenance

- Data security and privacy concerns are major challenges, as MMS solutions collect and process sensitive employee and corporate data, raising risks of breaches or misuse

- The fragmented global regulatory landscape, with varying data protection laws across countries, complicates compliance for MMS providers operating internationally

- These factors can limit market growth in regions with high cost sensitivity or stringent data privacy awareness, potentially deterring adoption among smaller organizations

Managed Mobility Services market Scope

The market is segmented on the basis of Technology, Organization Size, and End-User.

- By Technology

On the basis of technology, the Global Managed Mobility Services Market is segmented into Mobile Device Management (MDM), Application Management, Security Management, and Support and Maintenance. The Mobile Device Management segment dominated the largest market revenue share of approximately 34.7% in 2024, driven by the massive proliferation of connected mobile devices such as smartphones, tablets, and laptops in enterprises. MDM ensures secure and efficient management of these devices, supporting compliance with organizational policies and enhancing productivity.

The Application Management segment is expected to witness the fastest growth rate from 2025 to 2032, propelled by the rising demand for optimized and secure mobile applications. Advancements in cloud-based solutions and the need for seamless integration with enterprise systems are key drivers, enhancing user experience and operational efficiency.

- By Organization Size

On the basis of organization size, the Global Managed Mobility Services Market is segmented into Small and Medium Enterprises (SMEs) and Large Enterprises. The Large Enterprises segment dominated the market with a revenue share of approximately 67.49% in 2024, attributed to their extensive mobile device deployments and the need to enhance productivity across dispersed workforces. Large enterprises benefit from MMS solutions that offer scalability, centralized visibility, and control, particularly through cloud-based deployments.

The SMEs segment is anticipated to experience the fastest growth rate from 2025 to 2032, with a CAGR of around 17.5%. This growth is driven by SMEs' agility in adopting new technologies without requiring extensive IT infrastructure. MMS enables SMEs to leverage mobile technology cost-effectively, leveling the playing field with larger competitors.

- By End-User

On the basis of end-user, the Global Managed Mobility Services Market is segmented into Travel and Hospitality, Media and Entertainment, I.T. and Telecommunication, Transportation and Consumer Utility Services, Healthcare, Entertainment, Retail, Hospitality, and Others. The I.T. and Telecommunication segment held the largest market revenue share of approximately 21% in 2024, driven by high technological adoption and widespread implementation of Bring-Your-Own-Device (BYOD) policies. This sector relies on MMS for streamlined device management and secure data access.

The Healthcare segment is expected to witness significant growth from 2025 to 2032, fueled by the need for compliance with regulations such as HIPAA and the increasing use of mobile devices for patient care and operational efficiency. MMS supports real-time data access, secure communication, and efficient management of medical devices, enhancing healthcare delivery.

Managed Mobility Services Market Regional Analysis

- North America dominated the managed mobility services market with the largest revenue share of 42.5% in 2024, driven by early adoption of advanced technologies, robust IT infrastructure, and the presence of major market players

- Consumers and businesses prioritize managed mobility services for enhancing device security, streamlining mobile device management, and ensuring compliance with regulatory standards, particularly in industries with high mobile workforce demands

- Growth is supported by advancements in technology, including AI-driven analytics, IoT integration, and 5G network management, alongside rising adoption in both large enterprises and SMEs

U.S. Managed Mobility Services Market Insight

The U.S. smart lock market captured the largest revenue share of 81.9% in 2024 within North America, fueled by strong demand for mobile device management and security solutions, as well as growing consumer awareness of operational efficiency and data protection benefits. The trend towards Bring Your Own Device (BYOD) policies and increasing regulations promoting secure mobile ecosystems further boost market expansion. Major service providers’ presence and innovative solutions, such as IBM’s MaaS360, complement enterprise adoption, creating a robust market ecosystem.

Europe Managed Mobility Services Market Insight

The Europe Managed Mobility Services Market is expected to witness significant growth, supported by a strong emphasis on data privacy, security, and regulatory compliance. Businesses seek services that enhance mobile workforce productivity while ensuring secure data management. The growth is prominent in both large enterprises and SMEs, with countries such as Germany and France showing significant uptake due to increasing digital transformation initiatives and stringent regulations such as GDPR.

U.K. Managed Mobility Services Market Insight

The U.K. market for managed mobility services is expected to witness rapid growth, driven by demand for secure and efficient mobile device management in urban and corporate settings. Increased interest in operational flexibility and rising awareness of cybersecurity benefits encourage adoption. Evolving regulations, such as those ensuring compliance with data protection standards, influence business choices, balancing security with operational efficiency.

Germany Managed Mobility Services Market Insight

Germany is expected to witness rapid growth in managed mobility services, attributed to its advanced technological sector and high business focus on operational efficiency and data security. German enterprises prefer technologically advanced services that streamline mobile device management and contribute to secure data environments. The integration of these services in large enterprises and growing SME adoption supports sustained market growth.

Asia-Pacific Managed Mobility Services Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by rapid digital transformation, expanding smartphone penetration, and rising adoption of BYOD policies in countries such as China, India, and Japan. Increasing awareness of mobile security, device management, and operational efficiency is boosting demand. Government initiatives promoting digitalization and cybersecurity further encourage the use of advanced managed mobility services.

Japan Managed Mobility Services Market Insight

Japan’s Managed Mobility Services Market is expected to witness rapid growth due to strong business preference for high-quality, technologically advanced services that enhance mobile workforce productivity and security. The presence of major technology vendors and integration of managed mobility services in enterprise solutions accelerate market penetration. Rising interest in customized solutions also contributes to growth.

China Managed Mobility Services Market Insight

China holds the largest share of the Asia-Pacific Managed Mobility Services Market, propelled by rapid urbanization, rising mobile device adoption, and increasing demand for secure and efficient mobility solutions. The country’s growing business sector and focus on digital transformation support the adoption of advanced managed mobility services. Strong domestic service providers and competitive pricing enhance market accessibility.

Managed Mobility Services Market Share

The managed mobility services industry is primarily led by well-established companies, including:

- Deutsche Telekom AG (Germany)

- Maxis Bhd (Malaysia)

- IBM Corp. (U.S.)

- Vodafone Group PLC (U.K.)

- Singtel (Singapore)

- StarHub (Singapore)

- Wipro (India)

- Telefónica S.A. (Spain)

- PLDT (Philippines)

- Orange S.A (France)

- Fujitsu Ltd, AT&T Inc. (U.S.)

- Hewlett Packard Enterprise Co. (U.S.)

- Celcom Axiata (Malaysia)

- Accenture (U.S.)

What are the Recent Developments in Global Managed Mobility Services Market?

- In March 2025, Tangoe was featured in the 2025 Gartner® Market Guide for Managed Mobility Services (MMS), recognizing its dedication to delivering innovative, full-spectrum mobility solutions. Tangoe manages over 14 million devices globally, offering lifecycle services from procurement to decommissioning. In 2024, the company enhanced its mobile store experience and launched Standalone Unified Endpoint Management (UEM) services to bolster mobile security and compliance. These developments reflect Tangoe’s commitment to automation, AI-driven insights, and global carrier integration—empowering enterprises to optimize costs, improve visibility, and secure their mobile ecosystems

- In December 2024, Fujitsu deepened its Open RAN partnership with AT&T, supplying advanced radio units to support AT&T’s nationwide network modernization. These O-RAN compliant radios, including C-band and dual-band models, are designed for deployment on urban infrastructure such as utility poles—enhancing coverage and performance in high-traffic areas. Managed via Ericsson’s Intelligent Automation Platform (EIAP), the radios integrate seamlessly into AT&T’s multi-vendor Open RAN architecture. This collaboration boosts both companies’ capabilities in delivering flexible, scalable, and high-speed mobile connectivity, aligning with AT&T’s goal to shift 70% of its 5G traffic to open hardware by late 2026

- In October 2024, AT&T unveiled a strategic initiative to expand its wireless and 5G services to better serve small and midsize businesses (SMBs). This move reflects a shift from focusing primarily on Fortune 1000 clients to engaging a broader enterprise base. By scaling distribution and partnering with key stakeholders, AT&T aims to accelerate the adoption of next-generation mobile solutions—including 5G connectivity, integrated gateways, and managed services—among SMBs. The initiative supports digital transformation and positions AT&T as a key enabler of reliable, high-speed connectivity for growing businesses across diverse sectors

- In September 2024, myTVS launched a pan-India Mobility-as-a-Service (MaaS) platform tailored for EV fleet operators. This comprehensive digital ecosystem integrates services such as leasing, real-time fleet management, charging infrastructure, telematics, insurance, spare parts, and vehicle refurbishment—all under one umbrella. The platform is designed to streamline operations and reduce costs for last-mile delivery and quick commerce businesses

- In May 2024, HCLTech and Cisco launched Pervasive Wireless Mobility-as-a-Service, a secure, low-latency wireless backhaul solution tailored for enterprise and industrial sectors. By integrating HCLTech’s managed network services with Cisco’s Ultra-Reliable Wireless Backhaul (URWB) technology, the service delivers robust connectivity for vehicles, fleets, and mobile workers across industries such as automotive, mining, retail, and healthcare. It enhances operational visibility and mobility in mission-critical environments, supporting next-gen applications and expanding India’s digital Mobility-as-a-Service (MaaS) infrastructure. The flexible consumption model also simplifies network transformation, boosting efficiency and user experience

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.