Global Malt Extracts Market

Market Size in USD Million

CAGR :

%

USD

917.65 Million

USD

1,255.87 Million

2021

2029

USD

917.65 Million

USD

1,255.87 Million

2021

2029

| 2022 –2029 | |

| USD 917.65 Million | |

| USD 1,255.87 Million | |

|

|

|

|

Malt Extracts Market Analysis and Size

The growing popularity of natural sweeteners is expected to fuel the malt extracts market in the coming years. The conventional malt extracts are more preferred type than the organic malt extracts owing to the relatively lower prices of conventional ingredients and easy availability in the market.

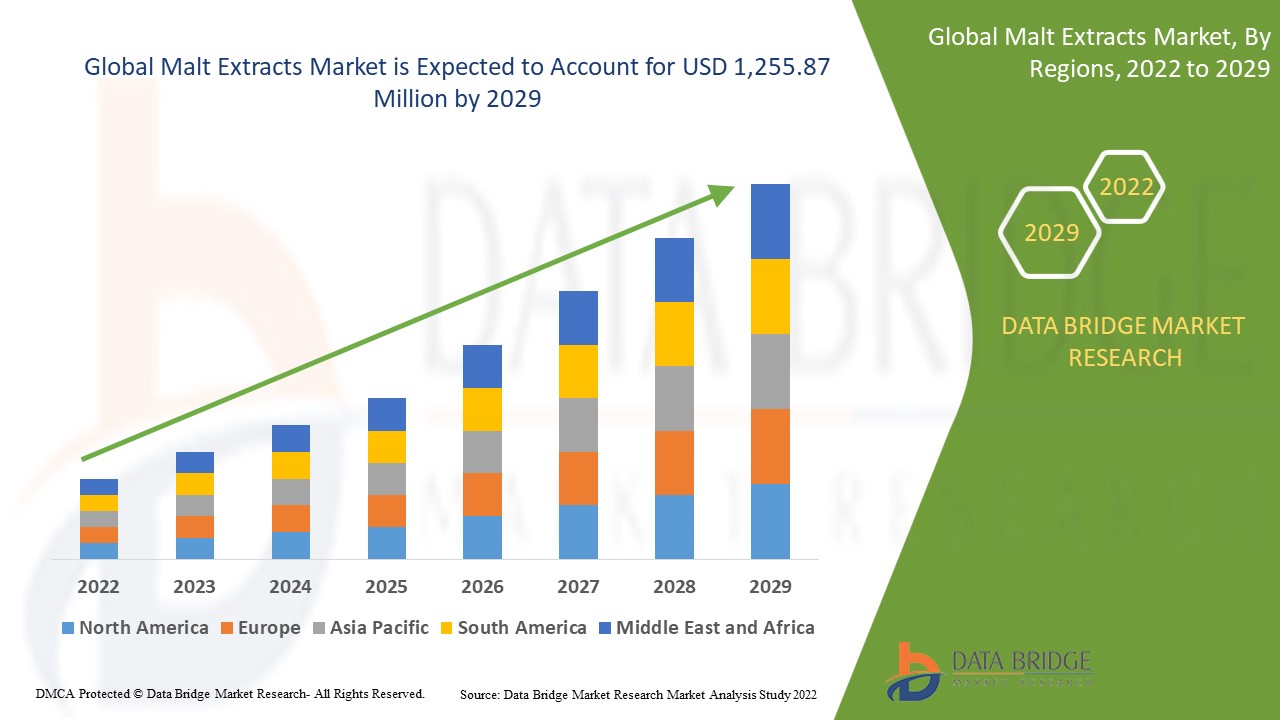

Data Bridge Market Research analyses that the malt extracts market was valued at USD 917.65 million in 2021 and is expected to reach the value of USD 1,255.87 million by 2029, at a CAGR of 4.00% during the forecast period. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Nature (Organic, Conventional), Source (Barley, Wheat, Rice, Rye), Form (Dry, Liquid), Application (Bakery, Confectionary, Beverages, Food) |

|

Countries Covered |

U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (M.E.A.) as a part of Middle East and Africa (M.E.A.) |

|

Market Players Covered |

GrainCorp (Australia), Malteurop (France), Rahr Corporation (U.S.), Boortmalt (Belgium), Groupe Soufflet (France), Malt Products Corporation (U.S.), Holland Malt (Netherlands), Maltexco (Chile), Barmalt (India), IREKS Group (Germany, Muntons plc (U.K.), Viking Malt (Finland), EDME (England), Diastatische Producten (Netherlands), Laihian Mallas (Finland) |

|

Opportunities |

|

Market Definition

Malt extract is a natural sweetener made by soaking malted cereal grains in water at a controlled temperature, allowing natural enzymes found in the grains to convert starch into fermentable sugars. After removing the insoluble fiber, the mixture is filtered and heated, yielding a viscous, sweet, and flavorful malt extract.

Global Malt Extracts Market Dynamics

Drivers.

- Expansion of alcohol industry and rising consumption is augmenting malt extracts market

The key drivers associated with alcohol consumption among this age group are expected to be developmental transitions such as puberty and increasing independence. Furthermore, changing taste and preference patterns have resulted in an increase in demand for low alcohol content beverages, such as beer. Furthermore, the growing number of female drinkers around the world is increasing demand for alcoholic beverages and, as a result, the malt extracts market is growing.

- Rising demand for nutritious food products

Malt extracts are minimally processed, clean-label ingredients that offer the ideal balance in bakery foods. They not only add colour and flavour to the bread, but they also contain antioxidants, essential amino acids, vitamins, and minerals. Furthermore, malt extracts derived from sprouted grains can be used as a sugar substitute in bakery foods, allowing them to be labelled as sugar-free. Rapidly rising population, changing food consumption habits, rising demand for go-to foods, and rising socialisation are expected to be key drivers for the bakery industry, contributing significantly to the malt industry.

Opportunities

The emergence of new food and beverage-related markets, an increase in demand for organic malt ingredients and extracts, and the growing popularity of craft beer all contribute to the expansion of profitable opportunities for the malt extracts market.

Restraints

The fluctuation of the beer market and the quality of barley due to weather conditions, are factors that are expected to impede market growth. Pricing pressure on manufacturers due to distribution network complications and the supply of counterfeit malt and equipment are factors that are expected to challenge the malt extracts market.

This malt extracts market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the malt extracts market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

COVID-19 Impact on Malt Extracts Market

The Covid-19 pandemic has had a negative impact on the malt extracts market. Because of the outbreak, which caused a lockdown and production disruptions, malt grains were left untreated for months after harvest. Farmers and the malt extracts industry suffered significant losses as a result of this. The global lockdowns forced the closure of bars and pubs, which account for a large portion of beer consumption. Bars and pubs account for nearly half of total beer consumption in Europe, and the closure of these establishments resulted in a double-digit drop in consumption volume.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Recent Development

- B.S.G. announced a partnership with Leopold Bros. (U.S.) in February 2020 to distribute a new line of small-batch, handmade malts. It will be able to enter the emerging craft brewing and handmade beer markets as a result of this

- Axereal acquired Cargill's malt business on behalf of its subsidiary, Boortmalt, in November 2019

- Malteurop broke ground on a new malthouse facility in Meoqui, Chihuahua, Mexico, in September 2019, which was in operation by 2021

- Groupe Soufflet opened a malt house in Addis Abeba, Ethiopia, in March 2019. It aims to develop a local industry capable of increasing production capacity to 110,000 tonnes

- B.S.G. released NZH-107, a proprietary experimental release, in December 2019. It was created in collaboration with New Zealand Hops (New Zealand), Ltd.

Global Malt Extracts Market Scope

The malt extracts and ingredients market is segmented on the basis of nature, source, product type, form and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Nature

- Organic

- Conventional

Source

- Barley

- Wheat

- Rye

- Rice

Product type

- Standard malt

- Speciality malt

Application

- Bakery

- Confectionary

- Beverages

- Food

Form

- Dry

- Liquid

Malt Extracts Market Regional Analysis/Insights

The malt extracts market is analysed and market size insights and trends are provided by country, source, product type, form and application as referenced above.

The countries covered in the malt extracts market report are .S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (M.E.A.) as a part of Middle East and Africa (M.E.A.).

Europe dominates the malt extracts market due to the highest growth, rising consumer awareness of healthy eating habits, increased beer consumption, and the rise of craft breweries.

North America is expected to grow during the forecast period of 2022 to 2029 due to the high demand for functional food and rising health-consciousness among the consumers.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Malt Extracts Market Share Analysis

The malt extracts market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to malt extracts market.

Some of the major players operating in the malt extracts market are:

- GrainCorp (Australia)

- Malteurop (France)

- Rahr Corporation (U.S.)

- Boortmalt (Belgium)

- Groupe Soufflet (France)

- Malt Products Corporation (U.S.)

- Holland Malt (Netherlands)

- Maltexco (Chile)

- Barmalt (India)

- IREKS Group (Germany)

- Muntons plc (U.K.)

- Viking Malt (Finland)

- EDME (England)

- Diastatische Producten (Netherlands)

- Laihian Mallas (Finland)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL MALT EXTRACTS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 ARRIVING AT THE GLOBAL MALT EXTRACTS MARKET

2.3 VENDOR POSITIONING GRID

2.4 TECHNOLOGY LIFE LINE CURVE

2.5 MARKET GUIDE

2.6 COMPANY POSITIONING GRID

2.7 COMAPANY MARKET SHARE ANALYSIS

2.8 MULTIVARIATE MODELLING

2.9 DEMAND AND SUPPLY-SIDE VARIABLES

2.1 CONSUMPTION TREND OF END PRODUCTS

2.11 TOP TO BOTTOM ANALYSIS

2.12 STANDARDS OF MEASUREMENT

2.13 VENDOR SHARE ANALYSIS

2.14 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.15 DATA POINTS FROM KEY SECONDARY DATABASES

2.16 GLOBAL MALT EXTRACTS MARKET : RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 VALUE CHAIN ANALYSIS

5.2 SUPPLY CHAIN ANALYSIS

5.3 IMPORT-EXPORT ANALYSIS

5.4 PORTER’S FIVE FORCES ANALYSIS

5.4.1 BARGAINING POWER OF SUPPLIERS

5.4.2 BARGAINING POWER OF BUYERS/CONSUMERS

5.4.3 THREAT OF NEW ENTRANTS

5.4.4 THREAT OF SUBSTITUTE PRODUCTS

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

5.5 RAW MATERIAL SOURCING ANALYSIS

5.6 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

5.7 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

5.8 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

5.9 FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

6 IMPACT OF ECONOMIC SLOW DOWN ON MARKET

6.1 IMPACT ON PRICE

6.2 IMPACT ON SUPPLY CHAIN

6.3 IMPACT ON SHIPMENT

6.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

7 REGULATORY FRAMEWORK AND GUIDELINES

8 PRICING ANALYSIS

9 PRODUCTION CAPACITY OF KEY MANUFACTURERES

10 GLOBAL MALT EXTRACTS MARKET, BY SOURCE, 2022-2031, (USD MILLION) (KILO TONS)

(ASP, VALUE AND VOLUME WILL BE PROVIDED FOR ALL THE SEGMENTS)

10.1 OVERVIEW

10.2 BARLEY

10.2.1 ASP (USD)

10.2.2 MARKET VALUE (USD MILLION)

10.2.3 MARKET VOLUME (KILO TONS)

10.3 WHEAT

10.3.1 ASP (USD)

10.3.2 MARKET VALUE (USD MILLION)

10.3.3 MARKET VOLUME (KILO TONS)

10.4 RYE

10.4.1 ASP (USD)

10.4.2 MARKET VALUE (USD MILLION)

10.4.3 MARKET VOLUME (KILO TONS)

10.5 RICE

10.5.1 ASP (USD)

10.5.2 MARKET VALUE (USD MILLION)

10.5.3 MARKET VOLUME (KILO TONS)

10.6 CORN

10.6.1 ASP (USD)

10.6.2 MARKET VALUE (USD MILLION)

10.6.3 MARKET VOLUME (KILO TONS)

10.7 SOY

10.7.1 ASP (USD)

10.7.2 MARKET VALUE (USD MILLION)

10.7.3 MARKET VOLUME (KILO TONS)

10.8 OTHERS

11 GLOBAL MALT EXTRACTS MARKET, BY NATURE, 2022-2031, (USD MILLION)

11.1 OVERVIEW

11.2 CONVENTIONAL

11.3 ORGANIC

12 GLOBAL MALT EXTRACTS MARKET, BY FORM, 2022-2031, (USD MILLION)

12.1 OVERVIEW

12.2 LIQUID

12.3 POWDER

13 GLOBAL MALT EXTRACTS MARKET, BY GRADE, 2022-2031, (USD MILLION)

13.1 OVERVIEW

13.2 STANDARD MALT

13.3 SPECIALTY MALT

13.3.1 CRYSTAL

13.3.2 ROASTED

13.3.3 DARK

13.3.4 OTHERS

14 GLOBAL MALT EXTRACTS MARKET, BY APPLICATION, 2022-2031, (USD MILLION)

14.1 OVERVIEW

14.2 FOOD

14.2.1 FOOD, BY TYPE

14.2.1.1. BAKERY PRODUCTS

14.2.1.2. BREAKFAST CEREALS

14.2.1.3. CONFECTIONERY

14.2.1.4. DAIRY PRODUCTS

14.2.1.5. NUTRITIONAL SUPPLEMENTS

14.2.1.6. SAUCES AND DRESSINGS

14.2.1.7. SNACKS

14.2.1.8. OTHERS

14.2.2 FOOD, BY MALT SOURCE

14.2.2.1. BARLEY

14.2.2.2. WHEAT

14.2.2.3. RYE

14.2.2.4. RICE

14.2.2.5. CORN

14.2.2.6. SOY

14.2.2.7. OTHERS

14.3 BEVERAGES

14.3.1 BEVERAGES, BY TYPE

14.3.1.1. ALCOHOLIC BEVERAGES

14.3.1.1.1. ALCOHOLIC BEVERAGES, BY TYPE

14.3.1.1.1.1 BEER

14.3.1.1.1.1.1. ALE

14.3.1.1.1.1.2. LAGER

14.3.1.1.1.1.3. CRAFT BEERS

14.3.1.1.1.1.4. OTHERS

14.3.1.1.1.2 WHISKEY

14.3.1.1.1.3 FLAVORED ALCOHOLIC BEVERAGES

14.3.1.1.1.4 OTHERS

14.3.1.2. NON-ALCOHOLIC BEVERAGES

14.3.1.2.1. NON-ALCOHOLIC BEVERAGES, BY TYPE

14.3.1.2.1.1 MALT DRINKS

14.3.1.2.1.2 ENERGY DRINKS

14.3.1.2.1.3 NUTRITIONAL DRINKS

14.3.1.2.1.4 PROTEIN SHAKES

14.3.1.2.1.5 MEAL REPLACEMENT DRINKS

14.3.1.2.1.6 DAIRY BASED BEVERAGES

14.3.1.2.1.6.1. FLAVORED MILK

14.3.1.2.1.6.2. MALTED MILK

14.3.1.2.1.7 COFFEE AND TEA

14.3.1.2.1.8 FERMENTED BEVERAGES

14.3.1.2.1.8.1. KOMBUCHA

14.3.1.2.1.8.2. KVASS

14.3.1.2.1.9 OTHERS

14.3.2 BEVERAGES, BY MALT SOURCE

14.3.2.1. BARLEY

14.3.2.2. WHEAT

14.3.2.3. RYE

14.3.2.4. RICE

14.3.2.5. CORN

14.3.2.6. SOY

14.3.2.7. OTHERS

14.4 PHARMACEUTICALS

14.4.1 PHARMACEUTICALS, BY TYPE

14.4.1.1. TABLETS

14.4.1.2. SYRUPS

14.4.1.3. TONICS

14.4.1.4. COUGH AND COLD REMEDIES

14.4.1.5. SKIN CARE PRODUCTS

14.4.1.6. OTHERS

14.4.2 PHARMACEUTICALS, BY MALT SOURCE

14.4.2.1. BARLEY

14.4.2.2. WHEAT

14.4.2.3. RYE

14.4.2.4. RICE

14.4.2.5. CORN

14.4.2.6. SOY

14.4.2.7. OTHERS

14.5 OTHERS

15 GLOBAL MALT EXTRACTS MARKET, BY REGION, (2022-2031), (USD MILLION) (KILO TONS)

GLOBAL MALT EXTRACTS MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

15.1 NORTH AMERICA

15.1.1 U.S.

15.1.2 CANADA

15.1.3 MEXICO

15.2 EUROPE

15.2.1 ERMANY

15.2.2 U.K.

15.2.3 ITALY

15.2.4 FRANCE

15.2.5 SPAIN

15.2.6 RUSSIA

15.2.7 SWITZERLAND

15.2.8 TURKEY

15.2.9 BELGIUM

15.2.10 NETHERLANDS

15.2.11 DENMARK

15.2.12 SWEDEN

15.2.13 POLAND

15.2.14 NORWAY

15.2.15 FINLAND

15.2.16 REST OF EUROPE

15.3 ASIA-PACIFIC

15.3.1 JAPAN

15.3.2 CHINA

15.3.3 SOUTH KOREA

15.3.4 INDIA

15.3.5 SINGAPORE

15.3.6 THAILAND

15.3.7 INDONESIA

15.3.8 MALAYSIA

15.3.9 PHILIPPINES

15.3.10 AUSTRALIA

15.3.11 NEW ZEALAND

15.3.12 VIETNAM

15.3.13 TAIWAN

15.3.14 REST OF ASIA-PACIFIC

15.4 SOUTH AMERICA

15.4.1 BRAZIL

15.4.2 ARGENTINA

15.4.3 REST OF SOUTH AMERICA

15.5 MIDDLE EAST AND AFRICA

15.5.1 SOUTH AFRICA

15.5.2 EGYPT

15.5.3 BAHRAIN

15.5.4 UNITED ARAB EMIRATES

15.5.5 KUWAIT

15.5.6 ISRAEL

15.5.7 OMAN

15.5.8 QATAR

15.5.9 SAUDI ARABIA

15.5.10 REST OF MEA

16 GLOBAL MALT EXTRACTS MARKET, COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: GLOBAL

16.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

16.3 COMPANY SHARE ANALYSIS: EUROPE

16.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

16.5 MERGERS AND ACQUISITIONS

16.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

16.7 EXPANSIONS

16.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

17 GLOBAL MALT EXTRACTS MARKET, SWOT AND DBMR ANALYSIS

18 GLOBAL MALT EXTRACTS MARKET , COMPANY PROFILES

18.1 GRAINCORP LTD.

18.1.1 COMPANY OVERVIEW

18.1.2 REVENUE ANALYSIS

18.1.3 PRODUCTION CAPACITY OVERVIEW

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT UPDATES

18.2 MALTEUROP

18.2.1 COMPANY OVERVIEW

18.2.2 REVENUE ANALYSIS

18.2.3 PRODUCTION CAPACITY OVERVIEW

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT UPDATES

18.3 MALT PRODUCTS CORPORATION

18.3.1 COMPANY OVERVIEW

18.3.2 REVENUE ANALYSIS

18.3.3 PRODUCTION CAPACITY OVERVIEW

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT UPDATES

18.4 DIFAL

18.4.1 COMPANY OVERVIEW

18.4.2 REVENUE ANALYSIS

18.4.3 PRODUCTION CAPACITY OVERVIEW

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT UPDATES

18.5 BARMALT

18.5.1 COMPANY OVERVIEW

18.5.2 REVENUE ANALYSIS

18.5.3 PRODUCTION CAPACITY OVERVIEW

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT UPDATES

18.6 IREKS GMBH

18.6.1 COMPANY OVERVIEW

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCTION CAPACITY OVERVIEW

18.6.4 PRODUCT PORTFOLIO

18.6.5 RECENT UPDATES

18.7 IMPERIAL MALTS LIMITED

18.7.1 COMPANY OVERVIEW

18.7.2 REVENUE ANALYSIS

18.7.3 PRODUCTION CAPACITY OVERVIEW

18.7.4 PRODUCT PORTFOLIO

18.7.5 RECENT UPDATES

18.8 MUNTONS MALTED INGREDIENTS INC

18.8.1 COMPANY OVERVIEW

18.8.2 REVENUE ANALYSIS

18.8.3 PRODUCTION CAPACITY OVERVIEW

18.8.4 PRODUCT PORTFOLIO

18.8.5 RECENT UPDATES

18.9 BAIRDS MALT LTD

18.9.1 COMPANY OVERVIEW

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCTION CAPACITY OVERVIEW

18.9.4 PRODUCT PORTFOLIO

18.9.5 RECENT UPDATES

18.1 RAHR CORPORATION

18.10.1 COMPANY OVERVIEW

18.10.2 REVENUE ANALYSIS

18.10.3 PRODUCTION CAPACITY OVERVIEW

18.10.4 PRODUCT PORTFOLIO

18.10.5 RECENT UPDATES

18.11 BOORTMALT

18.11.1 COMPANY OVERVIEW

18.11.2 REVENUE ANALYSIS

18.11.3 PRODUCTION CAPACITY OVERVIEW

18.11.4 PRODUCT PORTFOLIO

18.11.5 RECENT UPDATES

18.12 MALTERIES SOUFFLET

18.12.1 COMPANY OVERVIEW

18.12.2 REVENUE ANALYSIS

18.12.3 PRODUCTION CAPACITY OVERVIEW

18.12.4 PRODUCT PORTFOLIO

18.12.5 RECENT UPDATES

18.13 MALTEXO S.A.

18.13.1 COMPANY OVERVIEW

18.13.2 REVENUE ANALYSIS

18.13.3 PRODUCTION CAPACITY OVERVIEW

18.13.4 PRODUCT PORTFOLIO

18.13.5 RECENT UPDATES

18.14 HOLLAND MALT

18.14.1 COMPANY OVERVIEW

18.14.2 REVENUE ANALYSIS

18.14.3 PRODUCTION CAPACITY OVERVIEW

18.14.4 PRODUCT PORTFOLIO

18.14.5 RECENT UPDATES

18.15 SIMPSONS MALT

18.15.1 COMPANY OVERVIEW

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCTION CAPACITY OVERVIEW

18.15.4 PRODUCT PORTFOLIO

18.15.5 RECENT UPDATES

18.16 IKING MALT

18.16.1 COMPANY OVERVIEW

18.16.2 REVENUE ANALYSIS

18.16.3 PRODUCTION CAPACITY OVERVIEW

18.16.4 PRODUCT PORTFOLIO

18.16.5 RECENT UPDATES

18.17 AGRARIA

18.17.1 COMPANY OVERVIEW

18.17.2 REVENUE ANALYSIS

18.17.3 PRODUCTION CAPACITY OVERVIEW

18.17.4 PRODUCT PORTFOLIO

18.17.5 RECENT UPDATES

18.18 PUREMALT

18.18.1 COMPANY OVERVIEW

18.18.2 REVENUE ANALYSIS

18.18.3 PRODUCTION CAPACITY OVERVIEW

18.18.4 PRODUCT PORTFOLIO

18.18.5 RECENT UPDATES

18.19 CEREX

18.19.1 COMPANY OVERVIEW

18.19.2 REVENUE ANALYSIS

18.19.3 PRODUCTION CAPACITY OVERVIEW

18.19.4 PRODUCT PORTFOLIO

18.19.5 RECENT UPDATES

18.2 EDME LIMITED

18.20.1 COMPANY OVERVIEW

18.20.2 REVENUE ANALYSIS

18.20.3 PRODUCTION CAPACITY OVERVIEW

18.20.4 PRODUCT PORTFOLIO

18.20.5 RECENT UPDATES

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

19 CONCLUSION

20 REFERENCE

21 QUESTIONNAIRE

22 RELATED REPORTS

23 ABOUT DATA BRIDGE MARKET RESEARCH

Global Malt Extracts Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Malt Extracts Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Malt Extracts Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.