Global Malathion Market

Market Size in USD Billion

CAGR :

%

USD

443.74 Billion

USD

712.61 Billion

2025

2033

USD

443.74 Billion

USD

712.61 Billion

2025

2033

| 2026 –2033 | |

| USD 443.74 Billion | |

| USD 712.61 Billion | |

|

|

|

|

Malathion Market Size

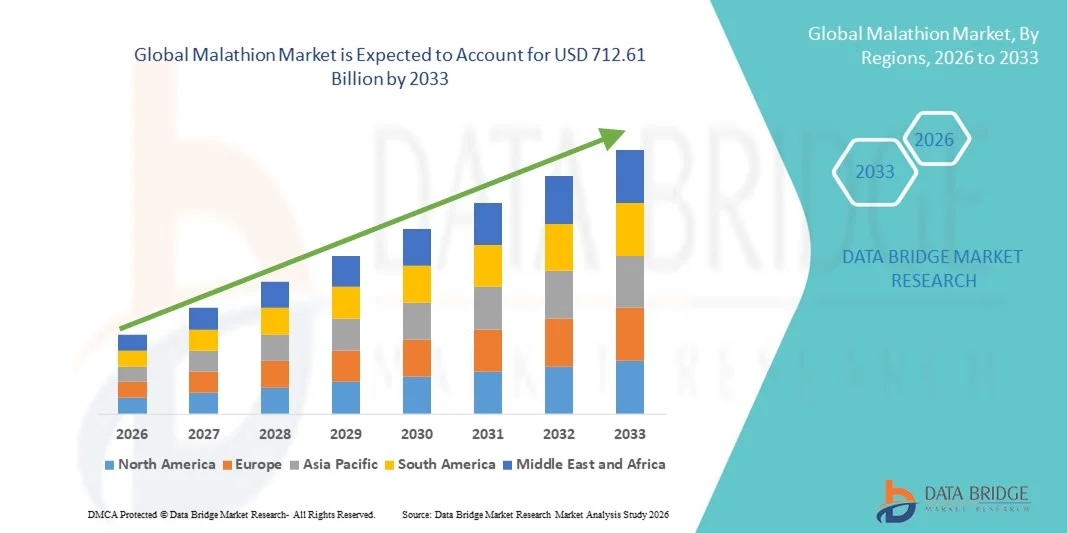

- The global malathion market size was valued at USD 443.74 billion in 2025 and is expected to reach USD 712.61 billion by 2033, at a CAGR of 5.50% during the forecast period

- The market growth is largely fuelled by increasing demand for effective pest control solutions in agriculture to improve crop yield and quality

- In addition, widespread use of malathion in public health programs for mosquito and vector control is supporting market expansion

Malathion Market Analysis

- The market is driven by strong demand from the agriculture sector, particularly in developing regions, where malathion is widely used to control insects in fruits, vegetables, and field crops

- Growing focus on food security, coupled with government-supported pest management initiatives and the cost-effectiveness of malathion compared to alternative insecticides, continues to sustain market growth

- Asia-Pacific dominated the malathion market with the largest revenue share in 2025, driven by extensive agricultural activity, high pest infestation rates, and widespread use of organophosphate insecticides for crop protection

- North America region is expected to witness the highest growth rate in the global malathion market, driven by increased focus on mosquito control, growing awareness of vector-borne diseases, and strong support from government-led pest management programs

- The liquid segment held the largest market revenue share in 2025 driven by its ease of application, uniform coverage, and widespread use in agricultural spraying and public health vector control programs. Liquid malathion formulations are commonly preferred due to their compatibility with standard spraying equipment and their effectiveness in large-scale pest and mosquito control operations across both rural and urban areas

Report Scope and Malathion Market Segmentation

|

Attributes |

Malathion Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Malathion Market Trends

Rising Demand for Effective Pest and Vector Control Solutions

- The growing need to protect agricultural productivity and public health is significantly shaping the malathion market, as farmers and government bodies increasingly rely on cost-effective organophosphate insecticides for pest and vector control. Malathion is gaining traction due to its broad-spectrum efficacy, relatively low mammalian toxicity, and proven performance across crops and public health programs. This trend strengthens its adoption across agriculture and vector control applications, encouraging manufacturers to focus on stable supply and regulatory compliance

- Increasing pressure to improve crop yields and reduce losses caused by insects has accelerated demand for malathion in fruits, vegetables, cereals, and plantation crops. Farmers in developing and emerging economies are actively adopting malathion-based formulations due to their affordability and effectiveness, supporting widespread use in both small-scale and commercial farming systems

- Pest management and public health trends are influencing purchasing decisions, with governments and agricultural agencies emphasizing reliable insecticides that meet safety and residue standards. These factors are helping sustain demand for malathion in large-scale spraying programs, while also driving the adoption of standardized application practices and training initiatives to ensure safe usage

- For instance, in 2024, government-led vector control programs in countries such as India and Brazil continued to utilize malathion for mosquito control to combat malaria and dengue outbreaks. These programs were implemented through coordinated public health campaigns and agricultural departments, reinforcing the role of malathion in disease prevention and crop protection strategies

- While demand for malathion remains steady, sustained market growth depends on regulatory acceptance, responsible usage, and competition from alternative insecticides. Manufacturers are focusing on improving formulation efficiency, ensuring compliance with environmental norms, and strengthening distribution networks to maintain market presence

Malathion Market Dynamics

Driver

Growing Need for Crop Protection and Vector Control

- Rising global demand for food security and effective pest control is a major driver for the malathion market. Farmers and agricultural stakeholders continue to rely on malathion to manage a wide range of insect pests, reduce crop damage, and enhance agricultural output, particularly in regions with high pest pressure

- Expanding applications in agriculture and public health are influencing market growth. Malathion is widely used in crop protection programs and mosquito control initiatives, supporting efforts to manage vector-borne diseases and safeguard rural and urban populations

- Governments and agricultural bodies are actively supporting malathion usage through subsidized pest control programs, training initiatives, and public health campaigns. These efforts are supported by the cost-effectiveness and established efficacy of malathion, encouraging continued adoption in both agricultural and non-agricultural settings

- For instance, in 2023, agricultural departments in Southeast Asia and Latin America reported sustained use of malathion in integrated pest management and vector control programs. This followed rising concerns over crop losses and disease outbreaks, reinforcing the role of malathion as a reliable and accessible insecticide

- Although demand for pest and vector control supports market growth, long-term expansion depends on regulatory approvals, resistance management, and responsible application practices. Investment in education, monitoring programs, and improved formulations will be critical for sustaining demand and addressing environmental and safety concerns

Restraint/Challenge

Regulatory Restrictions And Environmental Concerns

- Increasing regulatory scrutiny over organophosphate insecticides remains a key challenge for the malathion market, limiting usage in certain regions. Concerns related to environmental impact, non-target species, and residue levels contribute to tighter regulations and usage restrictions in developed markets

- Awareness of environmental and health risks associated with chemical insecticides is growing among consumers, policymakers, and advocacy groups. This has led to a gradual shift toward bio-based and alternative pest control solutions, affecting malathion adoption in some applications

- Compliance and monitoring challenges also impact market growth, as manufacturers and users must adhere to strict guidelines related to application, storage, and disposal. These requirements increase operational costs and create barriers for small-scale farmers in adopting regulated formulations

- For instance, in 2024, regulatory authorities in parts of Europe and North America imposed stricter controls on organophosphate usage, prompting some distributors and farmers to reduce reliance on malathion and explore alternative insecticides. These measures affected market penetration and slowed growth in regulated regions

- Addressing these challenges will require regulatory alignment, development of safer formulations, and education on responsible usage. Collaboration between manufacturers, governments, and agricultural organizations can help sustain the long-term growth potential of the global malathion market while balancing effectiveness and environmental responsibility

Malathion Market Scope

The market is segmented on the basis of product and application.

- By Product

On the basis of product, the global malathion market is segmented into Liquid, Powder, Emulsion, and Others. The liquid segment held the largest market revenue share in 2025 driven by its ease of application, uniform coverage, and widespread use in agricultural spraying and public health vector control programs. Liquid malathion formulations are commonly preferred due to their compatibility with standard spraying equipment and their effectiveness in large-scale pest and mosquito control operations across both rural and urban areas.

The emulsion segment is expected to witness steady growth from 2026 to 2033, supported by its improved stability, enhanced dispersion in water, and better adhesion on crop surfaces. Emulsion-based malathion products are increasingly adopted in commercial agriculture as they offer efficient pest control, reduced wastage, and consistent performance, making them suitable for diversified crop protection needs.

- By Application

On the basis of application, the global malathion market is segmented into Agriculture, Residential, and Others. The agriculture segment accounted for the largest market share in 2025 due to extensive use of malathion in controlling a wide range of insect pests affecting fruits, vegetables, cereals, and plantation crops. Its cost-effectiveness and proven efficacy continue to support strong adoption among farmers, particularly in developing and emerging economies

The residential segment is expected to witness steady growth from 2026 to 2033, driven by increasing demand for mosquito and household pest control solutions to reduce the spread of vector-borne diseases. Government-led public health initiatives and rising awareness of hygiene and pest management in residential areas are further supporting the use of malathion-based products in community-level and household applications.

Malathion Market Regional Analysis

- Asia-Pacific dominated the malathion market with the largest revenue share in 2025, driven by extensive agricultural activity, high pest infestation rates, and widespread use of organophosphate insecticides for crop protection

- Farmers across the region rely on malathion for its cost-effectiveness and broad-spectrum efficacy against insects affecting fruits, vegetables, and cash crops

- Strong dependence on agriculture, supportive government pest control programs, and rising demand for food security continue to position malathion as a widely used solution across both farming and public health applications.

China Malathion Market Insight

The China malathion market held a substantial share in Asia-Pacific in 2025, driven by large-scale agricultural operations and extensive pest management needs. Malathion is commonly applied in crop protection and urban pest control programs. Strong domestic production capabilities, coupled with the need to safeguard crop yields and manage insect populations, remain key factors supporting market growth in China.

Japan Malathion Market Insight

The Japan malathion market is expected to witness moderate growth from 2026 to 2033, characterized by regulated and selective usage, primarily in agriculture and vector control applications. Market demand is driven by the country’s strong emphasis on food safety, crop protection efficiency, and adherence to stringent environmental regulations. The adoption of malathion in Japan remains steady due to its proven effectiveness, while ongoing regulatory reviews and preference for low-toxicity formulations are influencing product development and application practices.

North America Malathion Market Insight

The North America malathion market is expected to witness moderate growth from 2026 to 2033, supported by its continued use in agricultural pest control and public health programs such as mosquito abatement. Demand in the region is influenced by strict regulatory oversight, which encourages controlled application and compliance with safety standards. The growing focus on integrated pest management practices and the gradual shift toward environmentally responsible usage are shaping market trends across the U.S. and Canada.

U.S. Malathion Market Insight

The U.S. malathion market is expected to witness moderate growth from 2026 to 2033, supported by its extensive use in agricultural pest control and mosquito abatement programs. Malathion is commonly applied in fruit and vegetable farming, as well as in public health initiatives aimed at controlling vector-borne diseases. Regulatory approvals for controlled usage, combined with established distribution networks and integrated pest management practices, continue to support market demand. The emphasis on crop yield optimization and vector control further strengthens malathion consumption across the country.

Europe Malathion Market Insight

The Europe malathion market is expected to witness moderate growth from 2026 to 2033, primarily influenced by stringent regulatory frameworks governing pesticide usage. While the region is gradually shifting toward bio-based alternatives, malathion continues to be utilized in specific agricultural and public health applications where permitted. Demand is supported by the need for effective insect control in horticulture and orchard farming, along with controlled mosquito management programs in select countries.

U.K. Malathion Market Insight

The U.K. malathion market is expected to witness moderate growth from 2026 to 2033, driven by its limited but essential application in agriculture and public health sectors. Regulatory oversight ensures cautious usage, while demand is supported by the need for reliable pest control solutions in crop protection and disease vector management. Ongoing monitoring and compliance with safety standards remain key factors shaping market dynamics in the country.

Germany Malathion Market Insight

The Germany malathion market is expected to experience stable growth from 2026 to 2033, supported by controlled applications in agriculture and research-based pest management programs. Germany’s strong focus on regulatory compliance and environmental safety influences the selective use of malathion. The market benefits from advanced agricultural practices and the need for effective insect control solutions in specific farming applications.

Malathion Market Share

The Malathion industry is primarily led by well-established companies, including:

- Akzo Nobel N.V. (Netherlands)

- Dow (U.S.)

- Suven Life Sciences Limited (India)

- Paramount Pesticides Ltd. (India)

- Lingyun Group (China)

- Xinyi Taisong Chemical Co., Ltd. (China)

- Sinochem (China)

- Biostadt India Limited (India)

- Coromandel International (India)

- Shivalik Rasayan Limited (India)

- Russell IPM Ltd (U.K.)

- Gowan Company (U.S.)

- Suterra (U.S.)

- Agralan Ltd (U.K.)

- Rentokil Initial plc (U.K.)

- DuPont (U.S.)

- Valent BioSciences LLC (U.S.)

- Marrone Bio Innovations (U.S.)

- ISAGRO S.p.A. (Italy)

- Koppert B.V. (Netherlands)

- Bayer AG (Germany)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.