Global Main Landing Gears Market

Market Size in USD Billion

CAGR :

%

USD

5.52 Billion

USD

7.51 Billion

2024

2032

USD

5.52 Billion

USD

7.51 Billion

2024

2032

| 2025 –2032 | |

| USD 5.52 Billion | |

| USD 7.51 Billion | |

|

|

|

|

Main Landing Gears Market Size

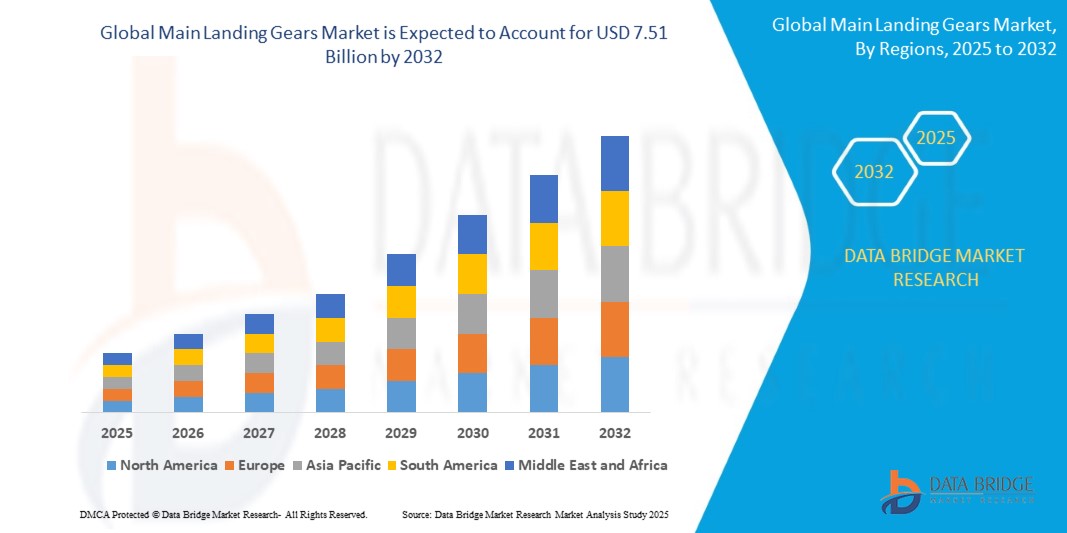

- The global Main Landing Gears market size was valued at USD 5.52 billion in 2024 and is expected to reach USD 7.51 billion by 2032, at a CAGR of 3.93% during the forecast period

- This growth is driven by factors such as the increasing demand for new aircraft, necessitating advanced landing gear systems to ensure safety, performance, and efficiency

Main Landing Gears Market Analysis

- A landing gear is a vital component of an aircraft's landing system, responsible for supporting the weight of the aircraft during landing and taxiing

- It typically consists of wheels, brakes, shock absorbers, and associated structural components. Main landing gears are designed to withstand the stresses and impact forces encountered during landing and provide stability and control on the ground

- The global main landing gears market encompasses the manufacturing, distribution, and maintenance of main landing gear systems for various types of aircraft, including commercial airliners, military aircraft, business jets, and helicopters.

- North America is expected to dominate the Main Landing Gears market due to well-established aerospace industry and the presence of major aircraft manufacturers such as Boeing and numerous aerospace suppliers

- Europe is expected to be the fastest growing region in the Main Landing Gears market during the forecast period due to Increasing investments in aerospace and defense modernization programs contribution

- Main Landing Gear segment is expected to dominate the market with a market share of 65.5% due to its majority of the aircraft's weight during landing, takeoff, and ground operations, requiring robust construction to withstand high impact and stress levels

Report Scope and Main Landing Gears Market Segmentation

|

Attributes |

Main Landing Gears Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Main Landing Gears Market Trends

“Technological Advancements in Main Landing Gears”

- The incorporation of smart sensors into landing gear systems is enhancing real-time monitoring capabilities, allowing for predictive maintenance and improved safety

- Advanced composite materials are being utilized to reduce weight and increase the durability of landing gear components, contributing to overall aircraft efficiency

- The adoption of automation and robotics in manufacturing processes is streamlining production, reducing costs, and improving the precision of landing gear systems.

- Innovations in hydraulic systems are providing more reliable and efficient performance, enhancing the functionality of landing gear during operations.

- There is a growing emphasis on developing environmentally friendly landing gear solutions, aligning with the aviation industry's sustainability goals

Main Landing Gears Market Dynamics

Driver

“Rising Demand for Air Travel”

- Increasing disposable incomes and economic development are leading to higher demand for air travel, necessitating more aircraft and, consequently, landing gear systems

- Urbanization is contributing to greater mobility needs, further driving the demand for efficient air transportation options

- The expansion of the global tourism industry is increasing the number of flights, thereby boosting the need for aircraft and landing gear systems

- Rising international business activities are leading to more frequent air travel, increasing the demand for commercial aircraft and landing gear systems

- Airlines are modernizing their fleets to meet passenger expectations and regulatory requirements, driving the need for advanced landing gear systems

Opportunity

“Expansion in Emerging Markets”

- The Asia-Pacific region is experiencing rapid economic growth and urbanization, leading to increased demand for air travel and, consequently, aircraft and landing gear systems

- Investments in airport and aviation infrastructure in emerging markets are creating opportunities for landing gear manufacturers

- Government policies promoting aviation growth and modernization in emerging economies are providing a favorable environment for landing gear market expansion

- Establishing local manufacturing facilities in emerging markets can reduce costs and improve supply chain efficiency for landing gear systems

- Collaborations with local firms in emerging markets can facilitate market entry and expansion for landing gear manufacturers

Restraint/Challenge

“High Initial Investment and Regulatory Compliance”

- The development and certification of main landing gear systems require significant investment, posing challenges for new entrants and smaller manufacturers

- Compliance with rigorous safety and quality standards set by aviation authorities increases development costs and time to market

- Global supply chain challenges, including raw material shortages and logistical issues, can delay production and increase costs for landing gear systems

- Fluctuations in the global economy can impact airline profitability, leading to reduced budgets for fleet expansion and maintenance, affecting the demand for landing gear systems.

- Intense competition among landing gear manufacturers can lead to price wars and margin erosion, challenging profitability and market sustainability

Main Landing Gears Market Scope

The market is segmented on the basis type, platform, and application.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Platform |

|

|

By Application |

|

In 2025, the main landing gear is projected to dominate the market with a largest share in type segment

The main landing gear segment is expected to dominate the ophthalmic operational microscope market with the largest share of 65.6% in 2025 due to bearing the majority of the aircraft's weight during landing, takeoff, and ground operations, requiring robust construction to withstand high impact and stress levels and the increasing number of air passengers and the expansion of commercial fleets are major factors driving the demand for main landing gear systems.

The hybrid microscopes is expected to account for the largest share during the forecast period in platform market

In 2025, the fixed-wing segment is expected to dominate the market with the largest market share of 76.5% due to including commercial airliners, military jets, and business aircraft, all of which require main landing gear systems and also The rise in global air travel and the expansion of airline fleets are significantly contributing to the growth of the fixed-wing aircraft segment.

Main Landing Gears Market Regional Analysis

“North America Holds the Largest Share in the Main Landing Gears Market”

- North America held the largest market share in the global main landing gears market in 2023, driven by its well-established aerospace industry and the presence of major aircraft manufacturers such as Boeing and numerous aerospace suppliers

- The region's emphasis on technological advancements, such as lightweight materials and smart landing gear systems, supports growth

- The presence of a well-established maintenance, repair, and overhaul (MRO) industry further boosts the market

- Increased defense spending and the modernization of military fleets drive demand for advanced landing gear systems

- North America's strong economic position and investment in aerospace infrastructure contribute to its dominance in the market

“Europe is Projected to Register the Highest CAGR in the Main Landing Gears Market”

- Europe is expected to be the fastest-growing region in the main landing gears market during the forecast period

- Increasing investments in aerospace and defense modernization programs contribute to the region's growth

- The expanding commercial aviation sector and growing demand for business jets and helicopters across Europe further drive market expansion

- Europe's focus on advancing aircraft technology and meeting stringent safety and performance standards supports the demand for high-quality landing gear systems

- The region's investment in eco-friendly and technologically advanced landing gear solutions contributes to its rapid growth

Main Landing Gears Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Safran (France)

- Aeroservices Ltd. (U.K.)

- Triumph Group (U.S.)

- Liebherr Group (Germany)

- Magellan Aerospace (Canada)

- GKN Aerospace (U.K.)

- SPP Canada Aircraft, Inc. (Canada)

- CIRCOR AEROSPACE PRODUCTS GROUP (U.S.)

- Héroux-Devtek (Canada)

- Collins Aerospace (U.S.)

Latest Developments in Global Main Landing Gears Market

- In February 2024, Liebherr Aerospace announced signed a long term service contract with Japan Airlines (JAL) for the overhaul of aircraft landing systems. Liebherr would offer its extensive service and product portfolio for the maintenance, repair, and overhaul of landing systems for JAL’s operational fleet

- In October 2023, Safran Landing Systems announced that the company signed a five year contract with airline company Wizz Air where the company would be provided with MRO operations for 57 aircrafts

- In March 2023, Lufthansa Technik was awarded with a MRO service contract dealing with the repair and maintenance of landing gears of the operational aircraft fleet from Emirates. The companies signed a long term contract with extending its services for up to 13 years

- In July 2022, Boeing Airlines announced that the company signed 787 landing gear exchange agreement with Ethiopian Airlines. According to the contract, the companies would be exchanging 19 787-8 landing gear equipment

- In August 2021, Alliance Airlines received USD 60 million in Jobs and Regional Growth funding to establish a new MRO facility at Rockhampton. This will create a spur of new opportunities for avionics, wheels, tyres, brakes and landing gear, engine maintenance, interiors and cabin accessories suppliers and vendors in the supply chain

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Main Landing Gears Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Main Landing Gears Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Main Landing Gears Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.