Global Machine Vision Camera Market

Market Size in USD Billion

CAGR :

%

USD

1.67 Billion

USD

3.16 Billion

2024

2032

USD

1.67 Billion

USD

3.16 Billion

2024

2032

| 2025 –2032 | |

| USD 1.67 Billion | |

| USD 3.16 Billion | |

|

|

|

|

Machine Vision Camera Market Size

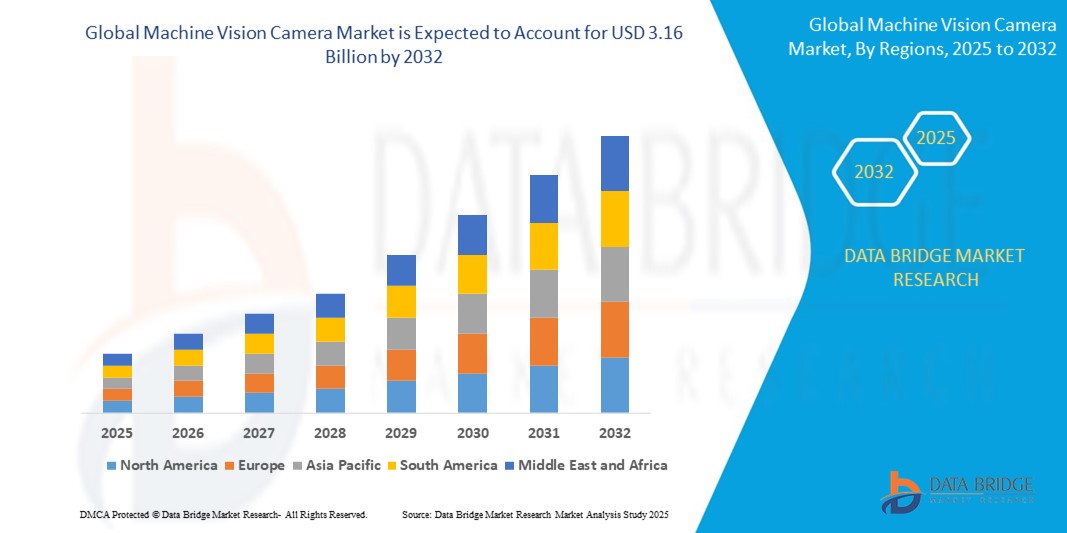

- The global machine vision camera market size was valued at USD 1.67 billion in 2024 and is expected to reach USD 3.16 billion by 2032, at a CAGR of 8.3% during the forecast period

- The market growth is driven by the increasing adoption of automation and Industry 4.0 technologies across manufacturing, automotive, and logistics sectors, coupled with advancements in AI and deep learning for image processing

- Rising demand for high-precision quality control, defect detection, and real-time monitoring in industrial applications is positioning machine vision cameras as critical components in modern automation systems

Machine Vision Camera Market Analysis

- Machine vision cameras, enabling automated image capture and analysis, are integral to industrial automation, quality assurance, and smart manufacturing, offering high-resolution imaging, real-time processing, and integration with AI-driven systems

- The growing demand for machine vision cameras is fueled by the rapid expansion of industrial automation, increasing need for quality inspection in manufacturing, and advancements in sensor technologies such as CMOS and 3D imaging

- North America dominated the machine vision camera market with the largest revenue share of 38.5% in 2024, driven by early adoption of automation technologies, a robust manufacturing sector, and the presence of key players, with the U.S. leading in deployments for automotive and electronics industries

- Asia-Pacific is projected to be the fastest-growing region during the forecast period, propelled by rapid industrialization, increasing investments in smart manufacturing, and rising demand in countries such as China and Japan

- The area scan cameras segment held the largest market revenue share of 45.2% in 2024, driven by their versatility and widespread use in inspection, quality control, and identification applications across industries such as manufacturing, automotive, and electronics

Report Scope and Machine Vision Camera Market Segmentation

|

Attributes |

Machine Vision Camera Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Machine Vision Camera Market Trends

“Increasing Integration of AI and Big Data Analytics”

- The global machine vision camera market is experiencing a significant trend toward integrating artificial intelligence Industry 4.0 (AI) and big data analytics

- These technologies enable advanced image processing and analysis, providing deeper insights into manufacturing processes, quality control, and automation efficiency

- AI-powered machine vision solutions facilitate proactive defect detection, identifying potential issues in production lines before they lead to costly downtime or product recalls

- For instance, companies are developing AI-driven platforms that analyze visual data to optimize robotic guidance, enhance quality inspection, and improve pattern recognition for applications such as semiconductor manufacturing and automotive assembly

- This trend is enhancing the value proposition of machine vision cameras, making them more appealing to industries such as electronics, automotive, and pharmaceuticals

- AI algorithms can process vast datasets from camera inputs, detecting patterns such as surface defects, dimensional inaccuracies, and text or barcode errors with high precision

Machine Vision Camera Market Dynamics

Driver

“Rising Demand for Automation and Industry 4.0 Solutions”

- The increasing demand for automated inspection, robotic guidance, and smart manufacturing systems is a major driver for the global machine vision camera market

- Machine vision cameras enhance production efficiency by enabling features such as real-time quality inspection, precise measurements, and automated object identification

- Industry standards and initiatives, particularly in regions such as Europe and Asia-Pacific, are promoting the adoption of machine vision systems to support Industry 4.0 and smart factory frameworks

- The proliferation of IoT and advancements in high-speed connectivity standards such as 5G are enabling faster data transmission and lower latency, supporting sophisticated machine vision applications

- Manufacturers are increasingly integrating factory-fitted machine vision cameras as standard or optional features to meet industry demands for precision and automation

Restraint/Challenge

“High Cost of Implementation and Data Security Concerns”

- The substantial initial investment required for hardware, software, and integration of machine vision camera systems can be a significant barrier to adoption, particularly for small and medium-sized enterprises in emerging markets

- Integrating machine vision cameras into existing production lines can be complex and costly, requiring specialized expertise and infrastructure upgrades

- Data security and privacy concerns pose a major challenge, as machine vision cameras collect and transmit large volumes of sensitive production and operational data, raising risks of cyberattacks and data breaches

- The fragmented regulatory landscape across countries regarding data collection, storage, and usage complicates compliance for global manufacturers and service providers

- These factors can deter potential adopters and limit market expansion, especially in regions with high cost sensitivity or stringent data privacy regulations

Machine Vision Camera market Scope

The market is segmented on the basis of product, hardware standards, pixel type, type of sensor, process type, spectrum type, detection, lens type, platform type, and applications.

- By Product

On the basis of product, the global machine vision camera market is segmented into line scan cameras, area scan cameras, and 3D cameras. The area scan cameras segment held the largest market revenue share of 45.2% in 2024, driven by their versatility and widespread use in inspection, quality control, and identification applications across industries such as manufacturing, automotive, and electronics. Their ability to capture two-dimensional images in a single exposure cycle makes them ideal for a broad range of applications.

The 3D cameras segment is expected to witness the fastest growth rate of 12.5% from 2025 to 2032, fueled by increasing demand for precise 3D measurements and object recognition in industries such as automotive, aerospace, and robotics. Advancements in depth-sensing technology and growing adoption of 3D vision systems for complex applications are key growth drivers.

- By Hardware Standards

On the basis of hardware standards, the global machine vision camera market is segmented into camera link HS, camera link, GigE vision, CoaXPress, USB3 vision, and others. The GigE vision segment dominated the market with a revenue share of 38.7% in 2024, attributed to its high-speed data transfer, cost-effectiveness, and compatibility with Ethernet-based systems, making it a preferred choice for industrial automation and smart factory applications.

The USB3 vision segment is anticipated to experience the fastest growth rate of 14.2% from 2025 to 2032, driven by its plug-and-play functionality, high bandwidth, and increasing adoption in applications requiring fast and reliable image data transfer, such as quality inspection and robotics.

- By Pixel Type

On the basis of pixel type, the global machine vision camera market is segmented into less than 1MP, 1 to 3 MP, 3 to 5 MP, 5 to 8 MP, 8 to 12 MP, and 12 MP and above. The 5 to 8 MP segment held the largest market revenue share of 32.4% in 2024, due to its balance of high resolution and cost-effectiveness, making it suitable for a wide range of applications, including inspection and identification in manufacturing and electronics.

The 12 MP and above segment is projected to grow at the fastest rate of 15.1% from 2025 to 2032, driven by the need for ultra-high-resolution imaging in advanced applications such as semiconductor inspection, medical diagnostics, and autonomous vehicles, where precision and detail are critical.

- By Type of Sensor

On the basis of type of sensor, the global machine vision camera market is segmented into charged coupled device (CCD) technology, complementary metal–oxide–semiconductor (CMOS) technology, modified internal gate (MIG) sensor technology, and n-type metal-oxide-semiconductor (NMOS) sensor technology. The complementary metal–oxide–semiconductor Technology segment dominated with a market revenue share of 60.8% in 2024, owing to its lower power consumption, faster readout speeds, and cost-effectiveness compared to charged coupled device sensors, making it ideal for high-volume industrial applications.

The MIG sensor technology segment is expected to witness the fastest growth rate of 13.8% from 2025 to 2032, driven by its enhanced sensitivity and ability to capture high-quality images in low-light conditions, particularly in hyperspectral imaging applications for manufacturing and surveillance.

- By Process Type

On the basis of process type, the global machine vision camera market is segmented into 1D image sensor, 2D image sensor, and 3D image sensor. The 2D image sensor segment held the largest market revenue share of 55.3% in 2024, driven by its widespread use in applications such as barcode reading, label orientation, and surface defect detection, particularly in manufacturing and logistics.

The 3D image sensor segment is anticipated to grow at the fastest rate of 14.7% from 2025 to 2032, propelled by the rising adoption of 3D vision systems in robotics, automotive, and aerospace for tasks requiring depth perception and precise measurements.

- By Spectrum Type

On the basis of spectrum type, the global machine vision camera market is segmented into infrared spectrum, X-ray spectrum, visible light spectrum, and others. The visible light spectrum segment accounted for the largest market revenue share of 48.6% in 2024, due to its broad applicability in standard inspection, quality control, and identification tasks across industries such as electronics and automotive.

The infrared spectrum segment is expected to witness the fastest growth rate of 13.4% from 2025 to 2032, driven by advancements in shortwave infrared (SWIR) sensors and increasing demand for imaging in low-light conditions and material identification in industries such as agriculture, mining, and surveillance.

- By Detection

On the basis of detection, the global machine vision camera market is segmented into contour detection, color detection, text/barcode detection, and others. The text/barcode detection segment held the largest market revenue share of 40.1% in 2024, driven by its critical role in logistics, retail, and manufacturing for product identification, sorting, and inventory management.

The contour detection segment is projected to grow at the fastest rate of 12.9% from 2025 to 2032, fueled by its increasing use in precision applications such as automotive and aerospace, where accurate shape and edge detection are essential for quality assurance and assembly verification.

- By Lens Type

On the basis of lens type, the global machine vision camera market is segmented into normal lens, tele lens, and wide-angle lens. The wide-angle lens segment dominated with a market revenue share of 39.4% in 2024, driven by its ability to provide a large field of view and high resolution, making it ideal for applications such as mobile mapping, UAV-based inspections, and advanced driver-assistance systems (ADAS).

The tele lens segment is expected to witness the fastest growth rate of 13.6% from 2025 to 2032, driven by its use in applications requiring high magnification and detailed imaging, such as semiconductor inspection and long-range surveillance.

- By Platform Type

On the basis of platform type, the global machine vision camera market is segmented into wireless cameras, smart camera/portable, PC-based cameras, and wearable cameras. The PC-based cameras segment held the largest market revenue share of 52.0% in 2024, due to their superior processing power, scalability, and ability to handle complex algorithms for sophisticated manufacturing applications.

The smart camera/portable segment is anticipated to grow at the fastest rate of 15.3% from 2025 to 2032, driven by their compact size, ease of integration, and growing demand for quality inspection in small and medium-sized enterprises, particularly in industries adopting smart manufacturing solutions.

- By Applications

On the basis of applications, the global machine vision camera market is segmented into guidance, inspection, gauging, identification, and others. The inspection segment dominated with a market revenue share of 42.3% in 2024, driven by its critical role in ensuring product quality and compliance in industries such as manufacturing, automotive, electronics, and pharmaceuticals.

The identification segment is expected to witness the fastest growth rate of 14.0% from 2025 to 2032, fueled by the increasing use of machine vision cameras for barcode reading, pattern recognition, and predictive maintenance in logistics, retail, and smart factory initiatives

Machine Vision Camera Market Regional Analysis

- North America dominates the machine vision camera market with the largest revenue share of 38.5% in 2024, driven by early adoption of automation technologies, a robust manufacturing sector, and the presence of key players, with the U.S. leading in deployments for automotive and electronics industries

- Consumers and industries prioritize machine vision cameras for precision inspection, defect detection, and process automation, particularly in smart manufacturing and Industry 4.0 applications. The need for enhanced productivity and reduced operational costs drives adoption across various sectors

- • Growth is supported by advancements in camera technologies, such as CMOS sensors, 3D imaging, and AI integration, alongside increasing demand in both OEM and aftermarket applications for industrial and non-industrial uses

U.S. Machine Vision Camera Market Insight

The U.S. dominates the North America machine vision camera market with the highest revenue share of 76.4% in 2024, driven by strong demand in automotive, semiconductor, and healthcare industries. Growing investments in automation and quality control, coupled with consumer awareness of machine vision benefits for precision and efficiency, propel market growth. The trend toward smart factories and supportive regulatory frameworks for advanced manufacturing further accelerates adoption.

Europe Machine Vision Camera Market Insight

The Europe machine vision camera market is expected to witness significant growth, supported by a focus on precision engineering and automation in manufacturing. Countries such as Germany, France, and the U.K. show strong uptake due to increasing demand for quality assurance and inspection in automotive and electronics sectors. Regulatory emphasis on safety and environmental sustainability, combined with advancements in 3D and SWIR camera technologies, drives market expansion.

U.K. Machine Vision Camera Market Insight

The U.K. market for machine vision cameras is projected to experience rapid growth, fueled by demand for automation in manufacturing and logistics. Consumers and industries seek cameras that enhance quality control and operational efficiency while meeting stringent safety regulations. The rise in smart manufacturing initiatives and increasing adoption in automotive and pharmaceutical applications support sustained market growth.

Germany Machine Vision Camera Market Insight

Germany is expected to witness the fastest growth rate in the European machine vision camera market, driven by its advanced automotive and manufacturing sectors. High consumer demand for precision inspection and energy-efficient automation solutions boosts adoption. The integration of advanced technologies such as AI and high-resolution CMOS cameras in premium manufacturing processes, along with strong aftermarket demand, supports robust market growth.

Asia-Pacific Machine Vision Camera Market Insight

The Asia-Pacific region is anticipated to exhibit the fastest growth rate, holding a dominant 43.1% market share in 2023, driven by rapid industrialization and automation adoption in countries such as China, Japan, and South Korea. Rising investments in electronics, automotive, and semiconductor industries, along with government initiatives such as China’s Made in China 2025, fuel demand for machine vision cameras. Increasing focus on quality control and smart manufacturing further accelerates growth.

Japan Machine Vision Camera Market Insight

Japan’s machine vision camera market is expected to witness rapid growth, driven by its leadership in precision engineering and automotive manufacturing. Strong consumer preference for high-quality, AI-integrated cameras that enhance automation and quality assurance supports market expansion. The presence of major manufacturers and growing integration of machine vision in OEM and aftermarket applications contribute to sustained growth.

China Machine Vision Camera Market Insight

China holds the largest share of the Asia-Pacific machine vision camera market, propelled by its extensive manufacturing base and rapid adoption of automation technologies. The country’s focus on electronics, automotive, and semiconductor industries, combined with government support for Industry 4.0, drives demand for advanced machine vision cameras. Competitive pricing and strong domestic production capabilities further enhance market accessibility and growth.

Machine Vision Camera Market Share

The machine vision camera industry is primarily led by well-established companies, including:

- Basler AG (Germany)

- Cognex Corporation (U.S.)

- KEYENCE CORPORATION (Japan)

- NATIONAL INSTRUMENTS CORP (U.S.)

- OMRON Corporation (Japan)

- Teledyne Digital Imaging Inc.(U.S.)

- Sony Corporation (Japan)

- SICK AG (Germany)

- Hitachi Kokusai Electric America, Ltd. (U.S.)

- Allied Vision Technologies GmbH (Germany)

- Hermary (Canada)

- ISRA VISION AG (Germany)

- Omron Microscan Systems, Inc. (U.S.)

- Toshiba Teli Corporation (Japan)

- Datalogic S.p.A. (Italy)

What are the Recent Developments in Global Machine Vision Camera Market?

- In April 2024, OMNIVISION introduced the OV9281 and OV9282 CMOS shutter image sensors, designed for machine vision applications such as vision-guided robotics, high-speed inspection, logistics barcode scanning, and intelligent transportation systems. These high-speed global shutter sensors deliver 1-megapixel resolution (1280 x 800) with best-in-class near-infrared (NIR) quantum efficiency, ensuring low-latency and excellent low-light performance. The OV9281 captures images at 120 frames per second (fps), while the OV9282 offers a wider chief ray angle (CRA) of 27 degrees, reinforcing OMNIVISION’s leadership in industrial automation

- In February 2024, Teledyne Imaging announced its acquisition of Adimec Holding B.V., a Netherlands-based developer of high-performance industrial and scientific cameras. This strategic move enhances Teledyne’s machine vision portfolio, strengthening its presence in the EMEA market. The acquisition aligns with Teledyne’s focus on healthcare, global defense, and semiconductor inspection, integrating Adimec’s expertise in precision imaging

- In August 2023, Cognex Corporation announced its acquisition of Moritex Corporation for ¥40 billion (approximately $275 million). This strategic move expands Cognex’s optics component offerings, strengthening its presence in Japan’s high-growth machine vision market. Moritex, a global leader in optical components, has a 50-year history of providing high-accuracy solutions for industrial equipment manufacturers. The acquisition enhances Cognex’s ability to deliver integrated machine vision solutions, combining Moritex’s optics expertise with Cognex’s advanced imaging technologies

- In July 2023, Basler AG strengthened its presence in China’s machine vision market by partnering with Beijing Sanbao Xingye (MVLZ) Image Tech. Co., Ltd.. This collaboration enhances Basler’s distribution network, ensuring greater accessibility to its industrial and manufacturing camera solutions. The partnership integrates MVLZ’s expertise in image processing components, optimizing supply chain efficiency and customer support. By expanding its footprint in Asia’s strategic growth region, Basler aims to deliver cutting-edge machine vision technology tailored to local industry needs

- In May 2023, Zivid launched the Zivid Two+ 3D color camera series, designed for robotic automation applications such as de-palletizing, bin-picking, and assembly. These cameras feature high-speed structured light technology, delivering exceptional depth accuracy and vivid color imaging. The Zivid Two+ R-series enhances machine vision capabilities, enabling precise object recognition even in challenging environments. With optimized field-of-view options, the series supports various industrial automation needs, reinforcing Zivid’s leadership in 3D vision technology

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL MACHINE VISION CAMERA MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL MACHINE VISION CAMERA MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 MULTIVARIATE MODELLING

2.2.6 STANDARDS OF MEASUREMENT

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 VENDOR SHARE ANALYSIS

2.2.9 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.10 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL MACHINE VISION CAMERA MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 INDUSTRY ANALYSIS & FUTURISTIC SCENARIO

5.2 PENETRATION AND GROWTH POSPECT MAPPING

5.3 COMPETITOR KEY PRICING STRATEGIES

5.4 TECHNOLOGY ANALYSIS

5.4.1 KEY TECHNOLOGIES

5.4.2 COMPLEMENTARY TECHNOLOGIES

5.4.3 ADJACENT TECHNOLOGIES

FIGURE 1 TECHNOLOGY MATRIX

Company Product/Service offered

5.5 COMPANY COMPETITIVE ANALYSIS

5.5.1 STRATEGIC DEVELOPMENT

5.5.2 TECHNOLOGY IMPLEMENTATION PROCESS

5.5.2.1. CHALLENGES

5.5.2.2. INHOUSE IMPLEMENTATION/OUTSOURCED (THIRD PARTY) IMPLEMENTATION

5.5.3 TECHNOLOGY SPEND OF COMPANY

5.5.4 CUSTOMER BASE

5.5.5 SERVICE POSITIONING

5.5.6 CUSTOMER FEEDBACK/RATING (B2B OR B2C)

5.5.7 APPLICATION REACH

5.5.8 SERVICE PLATFORM MATRIX

FIGURE 2 COMPANY COMPARATIVE ANALYSIS

Parameters Company A

Market Share

Growth (%)

Target Audience

Price Structure

Market Strategies

Customer Feedback

Service Positioning

Customer Feedback/Rating

Strategic Development

Acquisitions & its value (USD Million)

Application Reach

FIGURE 3 COMPANY SERVICE PLATFORM MATRIX

5.6 FUNDING DETAILS—INVESTOR DETAILS , REASON OF INVESTMENT FROM INVESTOR

5.7 USED CASES & ITS ANALYSIS

FIGURE 4 USED CASE ANALYSIS

Company Product/Service offered

6 GLOBAL MACHINE VISION CAMERA MARKET,BY TYPE

6.1 OVERVIEW

6.2 AREA SCAN

6.2.1 PIXEL TYPE

6.2.1.1. LESS THAN 1MP

6.2.1.2. 1 TO 3 MP

6.2.1.3. 3 TO 5 MP

6.2.1.4. 5 TO 10 MP

6.2.1.5. MORE THAN 10 MP

6.2.1.6. OTHERS

6.3 LINE SCAN

6.3.1 PIXEL TYPE

6.3.1.1. LESS THAN 1MP

6.3.1.2. 1 TO 3 MP

6.3.1.3. 3 TO 5 MP

6.3.1.4. 5 TO 8 MP

6.3.1.5. 8 TO 12 MP

6.3.1.6. 12 MP

6.3.1.7. OTHERS

6.4 SHORT-WAVE INFRARED

6.4.1 PIXEL TYPE

6.4.1.1. LESS THAN 1MP

6.4.1.2. 1 TO 3 MP

6.4.1.3. 3 TO 5 MP

6.4.1.4. 5 TO 8 MP

6.4.1.5. 8 TO 12 MP

6.4.1.6. 12 MP

6.4.1.7. OTHERS

6.5 TIME-OF-FLIGHT

6.5.1 PIXEL TYPE

6.5.1.1. LESS THAN 1MP

6.5.1.2. 1 TO 3 MP

6.5.1.3. 3 TO 5 MP

6.5.1.4. 5 TO 8 MP

6.5.1.5. 8 TO 12 MP

6.5.1.6. 12 MP

6.5.1.7. OTHERS

7 GLOBAL MACHINE VISION CAMERA MARKET,BY PRODUCT TYPE

7.1 OVERVIEW

7.2 PC-BASED

7.3 SMART CAMERAS

7.4 OTHERS

8 GLOBAL MACHINE VISION CAMERA MARKET,BY PROCESS TYPE

8.1 OVERVIEW

8.2 1D

8.3 2D

8.4 3D

9 GLOBAL MACHINE VISION CAMERA MARKET,BY COMPONENTS

9.1 OVERVIEW

9.2 CAMERAS

9.3 SENSORS

9.4 PROCESSORS

10 GLOBAL MACHINE VISION CAMERA MARKET, BY LENS TYPE

10.1 OVERVIEW

10.2 TELECENTRIC LENSES

10.3 MACRO LENSES

10.4 FIXED FOCAL LENGTH LENSES

10.5 LARGE FORMAT AND LINE SCAN LENSES

10.6 OTHERS

11 GLOBAL MACHINE VISION CAMERA MARKET, BY DETECTION

11.1 OVERVIEW

11.2 BARCODE/CHARACTER RECOGNITION

11.3 SPOT DETECTION

11.4 COLOUR DETECTION

11.5 OTHERS

12 GLOBAL MACHINE VISION CAMERA MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 MEASUREMENT

12.3 IDENTIFICATION

12.4 POSITIONING

12.5 GUIDANCE

12.6 OTHERS

13 GLOBAL MACHINE VISION CAMERA MARKET,BY END USER

14 OVERVIEW

14.1 OVERVIEW

14.2 AUTOMOTIVE

14.2.1 TYPE

14.2.1.1. AREA SCAN

14.2.1.1.1. PIXEL TYPE

14.2.1.1.1.1 LESS THAN 1MP

14.2.1.1.1.2 1 TO 3 MP

14.2.1.1.1.3 3 TO 5 MP

14.2.1.1.1.4 5 TO 10 MP

14.2.1.1.1.5 MORE THAN 10 MP

14.2.1.2. LINE SCAN

14.2.1.2.1. PIXEL TYPE

14.2.1.2.1.1 LESS THAN 1MP

14.2.1.2.1.2 1 TO 3 MP

14.2.1.2.1.3 3 TO 5 MP

14.2.1.2.1.4 5 TO 8 MP

14.2.1.2.1.5 8 TO 12 MP

14.2.1.2.1.6 12 MP

14.2.1.3. SHORT-WAVE INFRARED

14.2.1.3.1. PIXEL TYPE

14.2.1.3.1.1 LESS THAN 1MP

14.2.1.3.1.2 1 TO 3 MP

14.2.1.3.1.3 3 TO 5 MP

14.2.1.3.1.4 5 TO 8 MP

14.2.1.3.1.5 8 TO 12 MP

14.2.1.3.1.6 12 MP

14.2.1.4. TIME-OF-FLIGHT

14.2.1.4.1. PIXEL TYPE

14.2.1.4.1.1 LESS THAN 1MP

14.2.1.4.1.2 1 TO 3 MP

14.2.1.4.1.3 3 TO 5 MP

14.2.1.4.1.4 5 TO 8 MP

14.2.1.4.1.5 8 TO 12 MP

14.2.1.4.1.6 12 MP

14.3 CONSUMER APPLICATION

14.3.1 TYPE

14.3.1.1. AREA SCAN

14.3.1.1.1. PIXEL TYPE

14.3.1.1.1.1 LESS THAN 1MP

14.3.1.1.1.2 1 TO 3 MP

14.3.1.1.1.3 3 TO 5 MP

14.3.1.1.1.4 5 TO 10 MP

14.3.1.1.1.5 MORE THAN 10 MP

14.3.1.2. LINE SCAN

14.3.1.2.1. PIXEL TYPE

14.3.1.2.1.1 LESS THAN 1MP

14.3.1.2.1.2 1 TO 3 MP

14.3.1.2.1.3 3 TO 5 MP

14.3.1.2.1.4 5 TO 8 MP

14.3.1.2.1.5 8 TO 12 MP

14.3.1.2.1.6 12 MP

14.3.1.3. SHORT-WAVE INFRARED

14.3.1.3.1. PIXEL TYPE

14.3.1.3.1.1 LESS THAN 1MP

14.3.1.3.1.2 1 TO 3 MP

14.3.1.3.1.3 3 TO 5 MP

14.3.1.3.1.4 5 TO 8 MP

14.3.1.3.1.5 8 TO 12 MP

14.3.1.3.1.6 12 MP

14.3.1.4. TIME-OF-FLIGHT

14.3.1.4.1. PIXEL TYPE

14.3.1.4.1.1 LESS THAN 1MP

14.3.1.4.1.2 1 TO 3 MP

14.3.1.4.1.3 3 TO 5 MP

14.3.1.4.1.4 5 TO 8 MP

14.3.1.4.1.5 8 TO 12 MP

14.3.1.4.1.6 12 MP

14.4 ELECTRONICES & SEMICONDUCTOR

14.4.1 TYPE

14.4.1.1. AREA SCAN

14.4.1.1.1. PIXEL TYPE

14.4.1.1.1.1 LESS THAN 1MP

14.4.1.1.1.2 1 TO 3 MP

14.4.1.1.1.3 3 TO 5 MP

14.4.1.1.1.4 5 TO 10 MP

14.4.1.1.1.5 MORE THAN 10 MP

14.4.1.2. LINE SCAN

14.4.1.2.1. PIXEL TYPE

14.4.1.2.1.1 LESS THAN 1MP

14.4.1.2.1.2 1 TO 3 MP

14.4.1.2.1.3 3 TO 5 MP

14.4.1.2.1.4 5 TO 8 MP

14.4.1.2.1.5 8 TO 12 MP

14.4.1.2.1.6 12 MP

14.4.1.3. SHORT-WAVE INFRARED

14.4.1.3.1. PIXEL TYPE

14.4.1.3.1.1 LESS THAN 1MP

14.4.1.3.1.2 1 TO 3 MP

14.4.1.3.1.3 3 TO 5 MP

14.4.1.3.1.4 5 TO 8 MP

14.4.1.3.1.5 8 TO 12 MP

14.4.1.3.1.6 12 MP

14.4.1.4. TIME-OF-FLIGHT

14.4.1.4.1. PIXEL TYPE

14.4.1.4.1.1 LESS THAN 1MP

14.4.1.4.1.2 1 TO 3 MP

14.4.1.4.1.3 3 TO 5 MP

14.4.1.4.1.4 5 TO 8 MP

14.4.1.4.1.5 8 TO 12 MP

14.4.1.4.1.6 12 MP

14.5 GLASS

14.5.1 TYPE

14.5.1.1. AREA SCAN

14.5.1.1.1. PIXEL TYPE

14.5.1.1.1.1 LESS THAN 1MP

14.5.1.1.1.2 1 TO 3 MP

14.5.1.1.1.3 3 TO 5 MP

14.5.1.1.1.4 5 TO 10 MP

14.5.1.1.1.5 MORE THAN 10 MP

14.5.1.2. LINE SCAN

14.5.1.2.1. PIXEL TYPE

14.5.1.2.1.1 LESS THAN 1MP

14.5.1.2.1.2 1 TO 3 MP

14.5.1.2.1.3 3 TO 5 MP

14.5.1.2.1.4 5 TO 8 MP

14.5.1.2.1.5 8 TO 12 MP

14.5.1.2.1.6 12 MP

14.5.1.3. SHORT-WAVE INFRARED

14.5.1.3.1. PIXEL TYPE

14.5.1.3.1.1 LESS THAN 1MP

14.5.1.3.1.2 1 TO 3 MP

14.5.1.3.1.3 3 TO 5 MP

14.5.1.3.1.4 5 TO 8 MP

14.5.1.3.1.5 8 TO 12 MP

14.5.1.3.1.6 12 MP

14.5.1.4. TIME-OF-FLIGHT

14.5.1.4.1. PIXEL TYPE

14.5.1.4.1.1 LESS THAN 1MP

14.5.1.4.1.2 1 TO 3 MP

14.5.1.4.1.3 3 TO 5 MP

14.5.1.4.1.4 5 TO 8 MP

14.5.1.4.1.5 8 TO 12 MP

14.5.1.4.1.6 12 MP

14.6 METAL

14.6.1 TYPE

14.6.1.1. AREA SCAN

14.6.1.1.1. PIXEL TYPE

14.6.1.1.1.1 LESS THAN 1MP

14.6.1.1.1.2 1 TO 3 MP

14.6.1.1.1.3 3 TO 5 MP

14.6.1.1.1.4 5 TO 10 MP

14.6.1.1.1.5 MORE THAN 10 MP

14.6.1.2. LINE SCAN

14.6.1.2.1. PIXEL TYPE

14.6.1.2.1.1 LESS THAN 1MP

14.6.1.2.1.2 1 TO 3 MP

14.6.1.2.1.3 3 TO 5 MP

14.6.1.2.1.4 5 TO 8 MP

14.6.1.2.1.5 8 TO 12 MP

14.6.1.2.1.6 12 MP

14.6.1.3. SHORT-WAVE INFRARED

14.6.1.3.1. PIXEL TYPE

14.6.1.3.1.1 LESS THAN 1MP

14.6.1.3.1.2 1 TO 3 MP

14.6.1.3.1.3 3 TO 5 MP

14.6.1.3.1.4 5 TO 8 MP

14.6.1.3.1.5 8 TO 12 MP

14.6.1.3.1.6 12 MP

14.6.1.4. TIME-OF-FLIGHT

14.6.1.4.1. PIXEL TYPE

14.6.1.4.1.1 LESS THAN 1MP

14.6.1.4.1.2 1 TO 3 MP

14.6.1.4.1.3 3 TO 5 MP

14.6.1.4.1.4 5 TO 8 MP

14.6.1.4.1.5 8 TO 12 MP

14.6.1.4.1.6 12 MP

14.7 WOOD & PAPER

14.7.1 TYPE

14.7.1.1. AREA SCAN

14.7.1.1.1. PIXEL TYPE

14.7.1.1.1.1 LESS THAN 1MP

14.7.1.1.1.2 1 TO 3 MP

14.7.1.1.1.3 3 TO 5 MP

14.7.1.1.1.4 5 TO 10 MP

14.7.1.1.1.5 MORE THAN 10 MP

14.7.1.2. LINE SCAN

14.7.1.2.1. PIXEL TYPE

14.7.1.2.1.1 LESS THAN 1MP

14.7.1.2.1.2 1 TO 3 MP

14.7.1.2.1.3 3 TO 5 MP

14.7.1.2.1.4 5 TO 8 MP

14.7.1.2.1.5 8 TO 12 MP

14.7.1.2.1.6 12 MP

14.7.1.3. SHORT-WAVE INFRARED

14.7.1.3.1. PIXEL TYPE

14.7.1.3.1.1 LESS THAN 1MP

14.7.1.3.1.2 1 TO 3 MP

14.7.1.3.1.3 3 TO 5 MP

14.7.1.3.1.4 5 TO 8 MP

14.7.1.3.1.5 8 TO 12 MP

14.7.1.3.1.6 12 MP

14.7.1.4. TIME-OF-FLIGHT

14.7.1.4.1. PIXEL TYPE

14.7.1.4.1.1 LESS THAN 1MP

14.7.1.4.1.2 1 TO 3 MP

14.7.1.4.1.3 3 TO 5 MP

14.7.1.4.1.4 5 TO 8 MP

14.7.1.4.1.5 8 TO 12 MP

14.7.1.4.1.6 12 MP

14.8 PHARMACEUTICLAS

14.8.1 TYPE

14.8.1.1. AREA SCAN

14.8.1.1.1. PIXEL TYPE

14.8.1.1.1.1 LESS THAN 1MP

14.8.1.1.1.2 1 TO 3 MP

14.8.1.1.1.3 3 TO 5 MP

14.8.1.1.1.4 5 TO 10 MP

14.8.1.1.1.5 MORE THAN 10 MP

14.8.1.2. LINE SCAN

14.8.1.2.1. PIXEL TYPE

14.8.1.2.1.1 LESS THAN 1MP

14.8.1.2.1.2 1 TO 3 MP

14.8.1.2.1.3 3 TO 5 MP

14.8.1.2.1.4 5 TO 8 MP

14.8.1.2.1.5 8 TO 12 MP

14.8.1.2.1.6 12 MP

14.8.1.3. SHORT-WAVE INFRARED

14.8.1.3.1. PIXEL TYPE

14.8.1.3.1.1 LESS THAN 1MP

14.8.1.3.1.2 1 TO 3 MP

14.8.1.3.1.3 3 TO 5 MP

14.8.1.3.1.4 5 TO 8 MP

14.8.1.3.1.5 8 TO 12 MP

14.8.1.3.1.6 12 MP

14.8.1.4. TIME-OF-FLIGHT

14.8.1.4.1. PIXEL TYPE

14.8.1.4.1.1 LESS THAN 1MP

14.8.1.4.1.2 1 TO 3 MP

14.8.1.4.1.3 3 TO 5 MP

14.8.1.4.1.4 5 TO 8 MP

14.8.1.4.1.5 8 TO 12 MP

14.8.1.4.1.6 12 MP

14.9 FOOD & BEVERAGES

14.9.1 TYPE

14.9.1.1. AREA SCAN

14.9.1.1.1. PIXEL TYPE

14.9.1.1.1.1 LESS THAN 1MP

14.9.1.1.1.2 1 TO 3 MP

14.9.1.1.1.3 3 TO 5 MP

14.9.1.1.1.4 5 TO 10 MP

14.9.1.1.1.5 MORE THAN 10 MP

14.9.1.2. LINE SCAN

14.9.1.2.1. PIXEL TYPE

14.9.1.2.1.1 LESS THAN 1MP

14.9.1.2.1.2 1 TO 3 MP

14.9.1.2.1.3 3 TO 5 MP

14.9.1.2.1.4 5 TO 8 MP

14.9.1.2.1.5 8 TO 12 MP

14.9.1.2.1.6 12 MP

14.9.1.3. SHORT-WAVE INFRARED

14.9.1.3.1. PIXEL TYPE

14.9.1.3.1.1 LESS THAN 1MP

14.9.1.3.1.2 1 TO 3 MP

14.9.1.3.1.3 3 TO 5 MP

14.9.1.3.1.4 5 TO 8 MP

14.9.1.3.1.5 8 TO 12 MP

14.9.1.3.1.6 12 MP

14.9.1.4. TIME-OF-FLIGHT

14.9.1.4.1. PIXEL TYPE

14.9.1.4.1.1 LESS THAN 1MP

14.9.1.4.1.2 1 TO 3 MP

14.9.1.4.1.3 3 TO 5 MP

14.9.1.4.1.4 5 TO 8 MP

14.9.1.4.1.5 8 TO 12 MP

14.9.1.4.1.6 12 MP

14.1 RUBBER & PLASTIC

14.10.1 TYPE

14.10.1.1. AREA SCAN

14.10.1.1.1. PIXEL TYPE

14.10.1.1.1.1 LESS THAN 1MP

14.10.1.1.1.2 1 TO 3 MP

14.10.1.1.1.3 3 TO 5 MP

14.10.1.1.1.4 5 TO 10 MP

14.10.1.1.1.5 MORE THAN 10 MP

14.10.1.2. LINE SCAN

14.10.1.2.1. PIXEL TYPE

14.10.1.2.1.1 LESS THAN 1MP

14.10.1.2.1.2 1 TO 3 MP

14.10.1.2.1.3 3 TO 5 MP

14.10.1.2.1.4 5 TO 8 MP

14.10.1.2.1.5 8 TO 12 MP

14.10.1.2.1.6 12 MP

14.10.1.3. SHORT-WAVE INFRARED

14.10.1.3.1. PIXEL TYPE

14.10.1.3.1.1 LESS THAN 1MP

14.10.1.3.1.2 1 TO 3 MP

14.10.1.3.1.3 3 TO 5 MP

14.10.1.3.1.4 5 TO 8 MP

14.10.1.3.1.5 8 TO 12 MP

14.10.1.3.1.6 12 MP

14.10.1.4. TIME-OF-FLIGHT

14.10.1.4.1. PIXEL TYPE

14.10.1.4.1.1 LESS THAN 1MP

14.10.1.4.1.2 1 TO 3 MP

14.10.1.4.1.3 3 TO 5 MP

14.10.1.4.1.4 5 TO 8 MP

14.10.1.4.1.5 8 TO 12 MP

14.10.1.4.1.6 12 MP

14.11 PRITING

14.11.1 TYPE

14.11.1.1. AREA SCAN

14.11.1.1.1. PIXEL TYPE

14.11.1.1.1.1 LESS THAN 1MP

14.11.1.1.1.2 1 TO 3 MP

14.11.1.1.1.3 3 TO 5 MP

14.11.1.1.1.4 5 TO 10 MP

14.11.1.1.1.5 MORE THAN 10 MP

14.11.1.2. LINE SCAN

14.11.1.2.1. PIXEL TYPE

14.11.1.2.1.1 LESS THAN 1MP

14.11.1.2.1.2 1 TO 3 MP

14.11.1.2.1.3 3 TO 5 MP

14.11.1.2.1.4 5 TO 8 MP

14.11.1.2.1.5 8 TO 12 MP

14.11.1.2.1.6 12 MP

14.11.1.3. SHORT-WAVE INFRARED

14.11.1.3.1. PIXEL TYPE

14.11.1.3.1.1 LESS THAN 1MP

14.11.1.3.1.2 1 TO 3 MP

14.11.1.3.1.3 3 TO 5 MP

14.11.1.3.1.4 5 TO 8 MP

14.11.1.3.1.5 8 TO 12 MP

14.11.1.3.1.6 12 MP

14.11.1.4. TIME-OF-FLIGHT

14.11.1.4.1. PIXEL TYPE

14.11.1.4.1.1 LESS THAN 1MP

14.11.1.4.1.2 1 TO 3 MP

14.11.1.4.1.3 3 TO 5 MP

14.11.1.4.1.4 5 TO 8 MP

14.11.1.4.1.5 8 TO 12 MP

14.11.1.4.1.6 12 MP

14.12 MACHINERY

14.12.1 TYPE

14.12.1.1. AREA SCAN

14.12.1.1.1. PIXEL TYPE

14.12.1.1.1.1 LESS THAN 1MP

14.12.1.1.1.2 1 TO 3 MP

14.12.1.1.1.3 3 TO 5 MP

14.12.1.1.1.4 5 TO 10 MP

14.12.1.1.1.5 MORE THAN 10 MP

14.12.1.2. LINE SCAN

14.12.1.2.1. PIXEL TYPE

14.12.1.2.1.1 LESS THAN 1MP

14.12.1.2.1.2 1 TO 3 MP

14.12.1.2.1.3 3 TO 5 MP

14.12.1.2.1.4 5 TO 8 MP

14.12.1.2.1.5 8 TO 12 MP

14.12.1.2.1.6 12 MP

14.12.1.3. SHORT-WAVE INFRARED

14.12.1.3.1. PIXEL TYPE

14.12.1.3.1.1 LESS THAN 1MP

14.12.1.3.1.2 1 TO 3 MP

14.12.1.3.1.3 3 TO 5 MP

14.12.1.3.1.4 5 TO 8 MP

14.12.1.3.1.5 8 TO 12 MP

14.12.1.3.1.6 12 MP

14.12.1.4. TIME-OF-FLIGHT

14.12.1.4.1. PIXEL TYPE

14.12.1.4.1.1 LESS THAN 1MP

14.12.1.4.1.2 1 TO 3 MP

14.12.1.4.1.3 3 TO 5 MP

14.12.1.4.1.4 5 TO 8 MP

14.12.1.4.1.5 8 TO 12 MP

14.12.1.4.1.6 12 MP

14.13 TEXTLES

14.13.1 TYPE

14.13.1.1. AREA SCAN

14.13.1.1.1. PIXEL TYPE

14.13.1.1.1.1 LESS THAN 1MP

14.13.1.1.1.2 1 TO 3 MP

14.13.1.1.1.3 3 TO 5 MP

14.13.1.1.1.4 5 TO 10 MP

14.13.1.1.1.5 MORE THAN 10 MP

14.13.1.2. LINE SCAN

14.13.1.2.1. PIXEL TYPE

14.13.1.2.1.1 LESS THAN 1MP

14.13.1.2.1.2 1 TO 3 MP

14.13.1.2.1.3 3 TO 5 MP

14.13.1.2.1.4 5 TO 8 MP

14.13.1.2.1.5 8 TO 12 MP

14.13.1.2.1.6 12 MP

14.13.1.3. SHORT-WAVE INFRARED

14.13.1.3.1. PIXEL TYPE

14.13.1.3.1.1 LESS THAN 1MP

14.13.1.3.1.2 1 TO 3 MP

14.13.1.3.1.3 3 TO 5 MP

14.13.1.3.1.4 5 TO 8 MP

14.13.1.3.1.5 8 TO 12 MP

14.13.1.3.1.6 12 MP

14.13.1.4. TIME-OF-FLIGHT

14.13.1.4.1. PIXEL TYPE

14.13.1.4.1.1 LESS THAN 1MP

14.13.1.4.1.2 1 TO 3 MP

14.13.1.4.1.3 3 TO 5 MP

14.13.1.4.1.4 5 TO 8 MP

14.13.1.4.1.5 8 TO 12 MP

14.13.1.4.1.6 12 MP

14.14 OTHERS

15

16 GLOBAL MACHINE VISION CAMERA MARKET, BY REGION

GLOBAL MACHINE VISION CAMERA MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

16.1 NORTH AMERICA

16.1.1 U.S.

16.1.2 CANADA

16.1.3 MEXICO

16.2 EUROPE

16.2.1 GERMANY

16.2.2 U.K.

16.2.3 FRANCE

16.2.4 ITALY

16.2.5 SPAIN

16.2.6 THE NETHERLANDS

16.2.7 SWITZERLAND

16.2.8 TURKEY

16.2.9 BELGIUM

16.2.10 RUSSIA

16.2.11 SWEDEN

16.2.12 FINLAND

16.2.13 DENMARK

16.2.14 NORWAY

16.2.15 POLAND

16.2.16 REST OF EUROPE

16.3 ASIA-PACIFIC

16.3.1 CHINA

16.3.2 JAPAN

16.3.3 SOUTH KOREA

16.3.4 INDIA

16.3.5 SINGAPORE

16.3.6 AUSTRALIA AND NEW ZEALAND

16.3.7 MALAYSIA

16.3.8 PHILIPPINES

16.3.9 THAILAND

16.3.10 INDONESIA

16.3.11 REST OF ASIA-PACIFIC

16.4 SOUTH AMERICA

16.4.1 BRAZIL

16.4.2 ARGENTINA

16.4.3 REST OF SOUTH AMERICA

16.5 MIDDLE EAST AND AFRICA

16.5.1 SOUTH AFRICA

16.5.2 EGYPT

16.5.3 SAUDI ARABIA

16.5.4 U.A.E

16.5.5 ISRAEL

16.5.6 REST OF MIDDLE EAST AND AFRICA

16.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

17 GLOBAL MACHINE VISION CAMERA MARKET,COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: GLOBAL

17.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

17.3 COMPANY SHARE ANALYSIS: EUROPE

17.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

17.5 MERGERS & ACQUISITIONS

17.6 NEW PRODUCT DEVELOPMENT & APPROVALS

17.7 EXPANSIONS

17.8 REGULATORY CHANGES

17.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

18 GLOBAL MACHINE VISION CAMERA MARKET, SWOT AND DBMR ANALYSIS

19 GLOBAL MACHINE VISION CAMERA MARKET, COMPANY PROFILE

19.1 BASLER AG

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUE ANALYSIS

19.1.3 GEOGRAPHIC PRESENCE

19.1.4 PRODUCT PORTFOLIO

19.1.5 RECENT DEVELOPMENTS

19.2 COGNEX CORPORATION

19.2.1 COMPANY SNAPSHOT

19.2.2 REVENUE ANALYSIS

19.2.3 GEOGRAPHIC PRESENCE

19.2.4 PRODUCT PORTFOLIO

19.2.5 RECENT DEVELOPMENTS

19.3 KEYENCE CORPORATION

19.3.1 COMPANY SNAPSHOT

19.3.2 REVENUE ANALYSIS

19.3.3 GEOGRAPHIC PRESENCE

19.3.4 PRODUCT PORTFOLIO

19.3.5 RECENT DEVELOPMENTS

19.4 NATIONAL INSTRUMENTS CORP

19.4.1 COMPANY SNAPSHOT

19.4.2 REVENUE ANALYSIS

19.4.3 GEOGRAPHIC PRESENCE

19.4.4 PRODUCT PORTFOLIO

19.4.5 RECENT DEVELOPMENTS

19.5 OMRON CORPORATION

19.5.1 COMPANY SNAPSHOT

19.5.2 REVENUE ANALYSIS

19.5.3 GEOGRAPHIC PRESENCE

19.5.4 PRODUCT PORTFOLIO

19.5.5 RECENT DEVELOPMENTS

19.6 TELEDYNE TECHNOLOGIES INC.

19.6.1 COMPANY SNAPSHOT

19.6.2 REVENUE ANALYSIS

19.6.3 GEOGRAPHIC PRESENCE

19.6.4 PRODUCT PORTFOLIO

19.6.5 RECENT DEVELOPMENTS

19.7 SONY CORPORATION

19.7.1 COMPANY SNAPSHOT

19.7.2 REVENUE ANALYSIS

19.7.3 GEOGRAPHIC PRESENCE

19.7.4 PRODUCT PORTFOLIO

19.7.5 RECENT DEVELOPMENTS

19.8 SICK AG

19.8.1 COMPANY SNAPSHOT

19.8.2 REVENUE ANALYSIS

19.8.3 GEOGRAPHIC PRESENCE

19.8.4 PRODUCT PORTFOLIO

19.8.5 RECENT DEVELOPMENTS

19.9 HITACHI KOKUSAI ELECTRIC AMERICA, LTD.

19.9.1 COMPANY SNAPSHOT

19.9.2 REVENUE ANALYSIS

19.9.3 GEOGRAPHIC PRESENCE

19.9.4 PRODUCT PORTFOLIO

19.9.5 RECENT DEVELOPMENTS

19.1 ALLIED VISION TECHNOLOGIES GMBH

19.10.1 COMPANY SNAPSHOT

19.10.2 REVENUE ANALYSIS

19.10.3 GEOGRAPHIC PRESENCE

19.10.4 PRODUCT PORTFOLIO

19.10.5 RECENT DEVELOPMENTS

19.11 HERMARY.

19.11.1 COMPANY SNAPSHOT

19.11.2 REVENUE ANALYSIS

19.11.3 GEOGRAPHIC PRESENCE

19.11.4 PRODUCT PORTFOLIO

19.11.5 RECENT DEVELOPMENTS

19.12 ISRA VISION AG

19.12.1 COMPANY SNAPSHOT

19.12.2 REVENUE ANALYSIS

19.12.3 GEOGRAPHIC PRESENCE

19.12.4 PRODUCT PORTFOLIO

19.12.5 RECENT DEVELOPMENTS

19.13 OMRON MICROSCAN SYSTEMS, INC.

19.13.1 COMPANY SNAPSHOT

19.13.2 REVENUE ANALYSIS

19.13.3 GEOGRAPHIC PRESENCE

19.13.4 PRODUCT PORTFOLIO

19.13.5 RECENT DEVELOPMENTS

19.14 TOSHIBA TELI CORPORATION,

19.14.1 COMPANY SNAPSHOT

19.14.2 REVENUE ANALYSIS

19.14.3 GEOGRAPHIC PRESENCE

19.14.4 PRODUCT PORTFOLIO

19.14.5 RECENT DEVELOPMENTS

19.15 DATASENSING S.P.A.

19.15.1 COMPANY SNAPSHOT

19.15.2 REVENUE ANALYSIS

19.15.3 GEOGRAPHIC PRESENCE

19.15.4 PRODUCT PORTFOLIO

19.15.5 RECENT DEVELOPMENTS

19.16 LMI TECHNOLOGIES INC.

19.16.1 COMPANY SNAPSHOT

19.16.2 REVENUE ANALYSIS

19.16.3 GEOGRAPHIC PRESENCE

19.16.4 PRODUCT PORTFOLIO

19.16.5 RECENT DEVELOPMENTS

19.17 MVTEC SOFTWARE GMBH

19.17.1 COMPANY SNAPSHOT

19.17.2 REVENUE ANALYSIS

19.17.3 GEOGRAPHIC PRESENCE

19.17.4 PRODUCT PORTFOLIO

19.17.5 RECENT DEVELOPMENTS

19.18 CANON U.S.A., INC

19.18.1 COMPANY SNAPSHOT

19.18.2 REVENUE ANALYSIS

19.18.3 GEOGRAPHIC PRESENCE

19.18.4 PRODUCT PORTFOLIO

19.18.5 RECENT DEVELOPMENTS

19.19 NIKON CORPORATION

19.19.1 COMPANY SNAPSHOT

19.19.2 REVENUE ANALYSIS

19.19.3 GEOGRAPHIC PRESENCE

19.19.4 PRODUCT PORTFOLIO

19.19.5 RECENT DEVELOPMENTS

19.2 JAI A/S

19.20.1 COMPANY SNAPSHOT

19.20.2 REVENUE ANALYSIS

19.20.3 GEOGRAPHIC PRESENCE

19.20.4 PRODUCT PORTFOLIO

19.20.5 RECENT DEVELOPMENTS

19.21 TELEDYNE LIMITED

19.21.1 COMPANY SNAPSHOT

19.21.2 REVENUE ANALYSIS

19.21.3 GEOGRAPHIC PRESENCE

19.21.4 PRODUCT PORTFOLIO

19.21.5 RECENT DEVELOPMENTS

19.22 BAUMER

19.22.1 COMPANY SNAPSHOT

19.22.2 REVENUE ANALYSIS

19.22.3 GEOGRAPHIC PRESENCE

19.22.4 PRODUCT PORTFOLIO

19.22.5 RECENT DEVELOPMENTS

19.23 TELEDYNE FLIR LLC

19.23.1 COMPANY SNAPSHOT

19.23.2 REVENUE ANALYSIS

19.23.3 GEOGRAPHIC PRESENCE

19.23.4 PRODUCT PORTFOLIO

19.23.5 RECENT DEVELOPMENTS

19.24 VIEWORKS CO., LTD

19.24.1 COMPANY SNAPSHOT

19.24.2 REVENUE ANALYSIS

19.24.3 GEOGRAPHIC PRESENCE

19.24.4 PRODUCT PORTFOLIO

19.24.5 RECENT DEVELOPMENTS

19.25 IDS IMAGING DEVELOPMENT SYSTEMS GMBH

19.25.1 COMPANY SNAPSHOT

19.25.2 REVENUE ANALYSIS

19.25.3 GEOGRAPHIC PRESENCE

19.25.4 PRODUCT PORTFOLIO

19.25.5 RECENT DEVELOPMENTS

20 CONCLUSION

21 QUESTIONNAIRE

22 RELATED REPORTS

23 ABOUT DATA BRIDGE MARKET RESEARCH

Global Machine Vision Camera Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Machine Vision Camera Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Machine Vision Camera Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.