Global Luxury Watch Market

Market Size in USD Billion

CAGR :

%

USD

8.90 Billion

USD

12.56 Billion

2024

2032

USD

8.90 Billion

USD

12.56 Billion

2024

2032

| 2025 –2032 | |

| USD 8.90 Billion | |

| USD 12.56 Billion | |

|

|

|

|

Luxury Watch Market Size

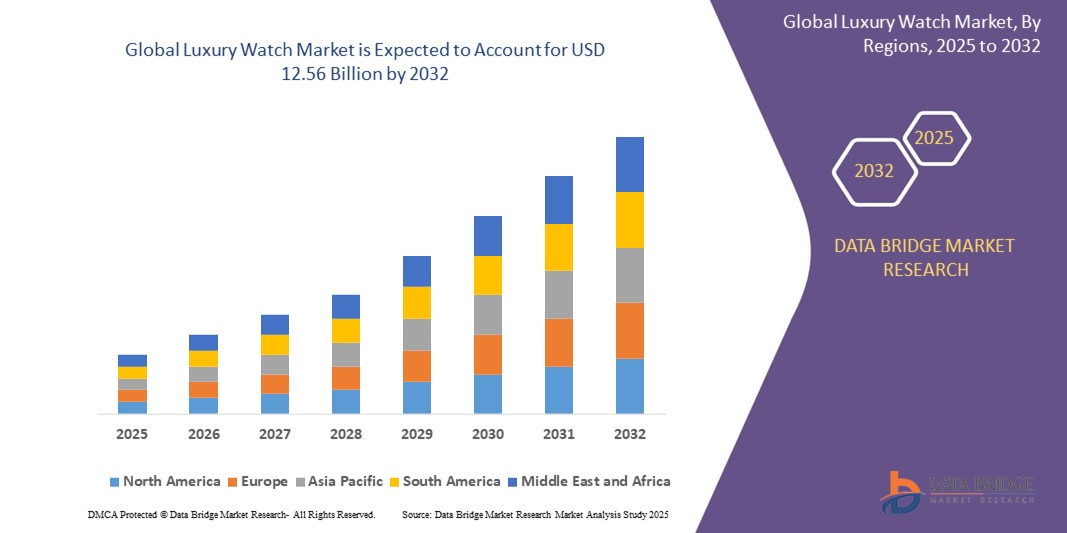

- The global luxury watch market was valued at USD 8.90 billion in 2024 and is expected to reach USD 12.56 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 4.40%, primarily driven by rising disposable incomes

- This growth is driven by growing trend of watches as status symbols and investments enhances consumer interest

Luxury Watch Market Analysis

- The luxury watch market is growing steadily due to rising disposable incomes, increasing demand for premium accessories, and consumer preference for timeless craftsmanship. Digital innovation, sustainable manufacturing, and celebrity endorsements are further boosting global demand for exclusive and high-quality timepieces

- Changing lifestyles, strong influence of social media, and the desire for status symbols among millennials and Gen Z consumers are major drivers. Availability of luxury watches for formal, casual, and sportswear segments continues to broaden the global market appeal

- Europe leads the luxury watch market with strong demand in Switzerland, France, and Italy, driven by iconic brands, exceptional craftsmanship, and a rich heritage of horology. Global watch fairs, flagship boutiques, and a robust retail network sustain regional dominance

- For instance, in Switzerland, brands such as Rolex, Patek Philippe, and Audemars Piguet are expanding their global presence and investing in digital platforms, attracting a wider international audience seeking Swiss luxury watches known for precision, quality, and innovation

- Globally, sustainable luxury watchmaking, smart features integration, and limited-edition collections are shaping the future of the luxury watch market. Continuous innovation in design, eco-friendly production practices, and digital engagement strategies are key to maintaining growth across both traditional and emerging markets

Report Scope and Luxury Watch Market Segmentation

|

Attributes |

Luxury Watch Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Luxury Watch Market Trends

“Surging Demand for Pre-Owned Luxury Watches”

- The pre-owned luxury watch segment is gaining momentum, fueled by consumer interest in vintage timepieces, sustainable consumption habits, and access to rare, discontinued models at more accessible price points

- Brands and specialized platforms are embracing certified pre-owned programs, offering authenticated watches with warranties, enhancing trust, and expanding the customer base beyond traditional buyers

- Digital marketplaces, influencer endorsements, and watch investment trends are driving visibility and popularity of the pre-owned category, especially among younger collectors and first-time luxury buyers

- For instance, in February 2025, Rolex expanded its Certified Pre-Owned program to key markets in Europe and the U.S., reinforcing authenticity and quality assurance for second-hand buyers

- The rise of the pre-owned luxury watch market is reshaping brand strategies, encouraging transparency, sustainability, and new revenue channels, while also introducing a broader demographic to the world of fine watchmaking

Luxury Watch Market Dynamics

Driver

“Innovation in Smart Luxury Watches”

- Growing consumer appetite for technology integration is driving luxury brands to blend traditional craftsmanship with smart features such as fitness tracking, connectivity, and health monitoring

- Leading luxury watchmakers are collaborating with tech companies to develop sophisticated smartwatches that maintain premium aesthetics while offering modern functionalities

- Hybrid models combining analog elegance with digital innovation are particularly resonating with affluent tech-savvy millennials and Gen Z consumers seeking both style and utility

- For instance, in March 2025, TAG Heuer launched the Connected Calibre E4 smartwatch with advanced fitness features and customizable luxury designs, strengthening its tech-luxury appeal

- As wearable technology continues evolving, luxury watch brands incorporating smart innovations are poised to capture new market segments and reinforce brand relevance in a tech-driven world

Opportunity

“Growing Affluence in Emerging Markets”

- Rapid economic growth, rising middle-class populations, and increasing appetite for luxury goods in emerging markets such as India, Brazil, and Southeast Asia are unlocking significant opportunities for luxury watchmakers

- Brands are strategically entering new markets through localized collections, celebrity collaborations, and tailored marketing to appeal to culturally diverse and aspirational consumers

- Expanding digital infrastructure and e-commerce channels are enabling brands to reach affluent consumers in emerging economies without heavy reliance on physical stores

- For instance, in November 2024, Patek Philippe announced its entry into the Indian market with exclusive boutiques in Mumbai and New Delhi, aiming to cater to growing luxury demand

- In October 2024, Breitling partnered with regional e-commerce platforms to boost its online luxury watch sales across Southeast Asia

- In September 2024, Audemars Piguet hosted exclusive pop-up exhibitions in São Paulo, Brazil to connect with a new generation of collectors

- As emerging economies mature, luxury watch brands investing early in market development and cultural resonance are set to capture substantial long-term growth

Restraint/Challenge

“High Import Duties and Regulatory Barriers”

-

The luxury watch market faces significant challenges from high import tariffs, stringent regulations, and complex certification processes in key emerging and established markets

- Elevated duties inflate retail prices, limiting affordability and demand among broader customer bases, particularly in price-sensitive regions

- Regulatory barriers around certifications, hallmarking, and taxes create operational hurdles for brands looking to expand into new markets quickly and efficiently

- For instance, in January 2025, the Indian government maintained a 20% import duty on luxury watches, prompting brands to reconsider expansion strategies or explore local manufacturing partnerships

- In December 2024, Brazil introduced stricter import regulations on luxury goods, affecting watch imports and sales timelines

- In October 2024, new European Union regulations on sustainability labeling impacted Swiss watch exports, requiring additional compliance measures

- To overcome regulatory challenges, luxury watch brands must adapt pricing strategies, invest in local partnerships, and streamline compliance processes to sustain profitable global expansion

Luxury Watch Market Scope

The market is segmented on the basis of type, gender type, and sales channel.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Gender Type |

|

|

By Sales Channel |

|

Luxury Watch Market Regional Analysis

“Asia-Pacific is the Dominant Region in the Luxury Watch Market”

- Asia Pacific is projected to dominate the luxury watch market due to shifting consumer behavior and rising disposable income, especially in countries such as China, India, and Japan

- The growing middle class in Asia Pacific is fueling demand for premium products, with consumers increasingly seeking status, exclusivity, and superior quality

- Major luxury brands are expanding their presence in Asia Pacific, with companies such as Rolex and Omega tailoring strategies to suit local preferences and boost their regional appeal

- The luxury watch market in Asia Pacific is expected to witness robust growth in the coming years, driven by evolving consumer dynamics and strategic brand investments

“Europe is projected to register the Highest Growth Rate”

- Europe is poised to become the fastest-growing luxury watch market due to its rich heritage in watchmaking and the presence of prestigious brands such as Rolex, Patek Philippe, and Omega

- The region’s deep-rooted tradition of craftsmanship and innovation continues to attract high-end consumers who prioritize quality, prestige, and timeless design

- Rising interest in luxury goods among affluent millennials and Gen Z consumers is further accelerating market growth, supported by a shift toward sustainable and customized products

- Europe’s luxury watch market is expected to strengthen its global position by blending traditional excellence with evolving consumer preferences, ensuring long-term competitive advantage

Luxury Watch Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Rolex (Switzerland)

- OMEGA SA (Switzerland)

- Patek Philippe SA (Switzerland)

- Audemars Piguet (Switzerland)

- TAG Heuer (Switzerland)

- Breitling (Switzerland)

- Cartier (France)

- Jaeger-LeCoultre (Switzerland)

- IWC Schaffhausen (Switzerland)

- Hublot (Switzerland)

- PANERAI P.I. (Italy)

- Vacheron Constantin (Switzerland)

- Richard Mille (Switzerland)

- A. Lange & Söhne (Germany)

- Chopard (Switzerland)

Latest Developments in Global Luxury Watch Market

- In January 2024, The Swatch Group, headquartered in Biel/Bienne, Switzerland, expanded its product portfolio by collaborating with its subsidiary brands, Blancpain and Swatch, to launch a new ocean-inspired watch, complementing its existing five models representing different oceans, further strengthening its brand innovation in thematic luxury watches

- In August 2023, Breitling, based in Grenchen, Switzerland, introduced a limited edition of ultralight sports watches to commemorate the 2023 IRONMAN World Championship and IRONMAN 70.3 World Championship triathlon events, reinforcing its commitment to high-performance luxury timepieces

- In April 2023, LVMH, headquartered in Paris, France, through its subsidiary brands Hublot, TAG Heuer, and Zenith, showcased its latest luxury timepieces at the 2023 Watches and Wonders fair in Geneva, Switzerland, boosting the group’s visibility among elite watch enthusiasts globally

- In March 2023, PATEK PHILIPPE SA, a Geneva, Switzerland-based brand, unveiled a new addition to its Calatrava collection featuring a rose-gold case, navy blue dial, and the Travel Time dual time zone function powered by the caliber 31-260 PS FUS 24H self-winding movement, solidifying its leadership in classic yet innovative watch design

- In January 2022, Seiko Watch Corporation, based in Tokyo, Japan, reintroduced the King Seiko Collection with five new mechanical timepieces, making them available globally at Seiko Boutiques and selected retailers, revitalizing the brand’s traditional craftsmanship for modern luxury consumers

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.