Global Luxury Car Leasing Market

Market Size in USD Billion

CAGR :

%

USD

20.89 Billion

USD

56.73 Billion

2022

2030

USD

20.89 Billion

USD

56.73 Billion

2022

2030

| 2023 –2030 | |

| USD 20.89 Billion | |

| USD 56.73 Billion | |

|

|

|

|

Luxury Car Leasing Market Analysis and Size

The preference for leasing luxury cars over normal cars is expected to grow during the forecast period. Digitization has been one of the major factor for the growth of the market, especially after the COVID-19 pandemic since the offline market became less in demand. Currently, approximately 1149 billionaires reside in the Asia-Pacific region, demanding luxury cars on the rental basis. Leasing luxury cars is one of the evolving businesses in both developed and developing region due to augmented trends during the forecast period.

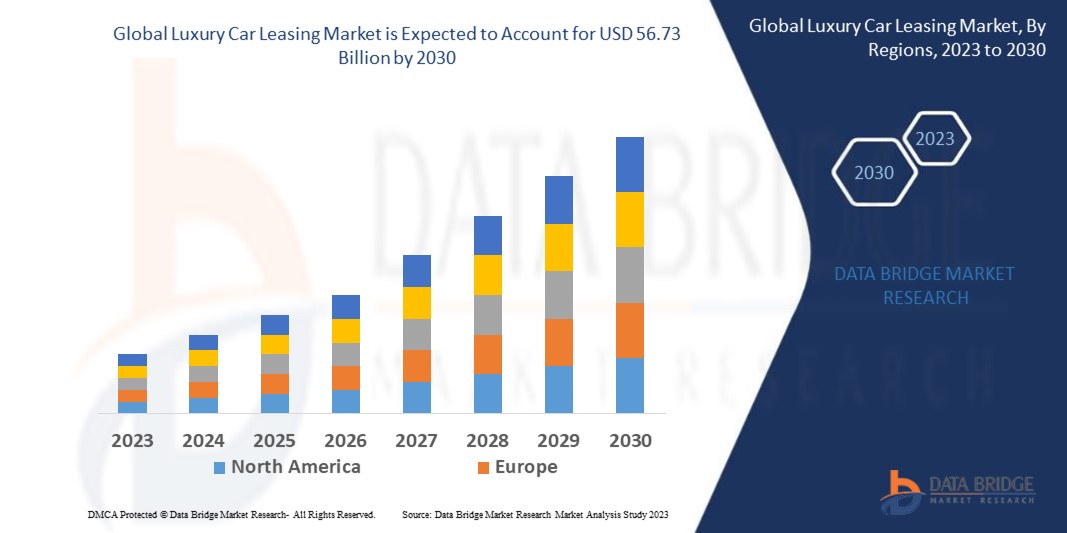

Data Bridge Market Research analyses that the luxury car leasing market is expected to reach USD 56.73 billion by 2030, which is USD 20.89 billion in 2022, at a CAGR of 13.30% during the forecast period. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Luxury Car Leasing Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (Compact, Mid-Size, Full-Size, Luxury Crossovers, Minivans, Luxury SUVs), Rental Type (Business, Leisure), Term (Short-term rental, Long-term rental, Finance leasing), Category (Self-Driven, Chauffeur-Driven), Applications (Airport, Off-airport), End User (Local Usage, Airport Transport, Outstation, Others), Booking Mode (Online, Offline) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (M.E.A.) as a part of Middle East and Africa (M.E.A.), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

Avis budget group (U.S.), SIXT (Germany), Enterprise Holdings, Inc (U.S.), Europcar (France), Localiza (Brazil), The Hertz Corporation (U.S.), Carzonrent India pvt ltd (India), Eco Rent a Car (India), Advantage OPCO, LLC (U.S.), Shenzhen Topone Car Rental Co. Ltd (China), Bettercar Rental (Dubai), National Car Rental (U.S.), LeasePlan (India), ALD Automotive (France), mychoize (India), Zoomcar India Private Limited (India), ORIX (Japan) |

|

Market Opportunities |

|

Market Definition

Luxury car leasing is mainly renting expensive luxury cars which offer unmatched levels of quality, comfort and better performance and also consists of extraordinary lavish interior and of top-end features and a robust security system. These services are generally located near airports or busy areas in the city.

Luxury Car Leasing Market Dynamics

Drivers

- Growing implementation of an integrated car rental system

The rise in the implementation of integrated car rental system due to the increasing demand for high-quality, reliable and familiar travel services during travel further influence the growth of the market. Some major car leasing operators are highlighting leveraging the trend to develop their brand and distribution platforms. Therefore, increasing implementation of an integrated car rental system is expected to drive the growth of the market.

- Increasing digitization in the luxury car leasing market

Increasing digitization in the luxury car leasing industry will drive the market growth during the forecast period. The adoption of autonomous vehicles on a large scale by consumers is accelerating. All the market players are offering various discounts for their services which will help increase the bookings for renting luxury cars. Most companies are focusing on providing autonomous vehicles to improve their profitability. Autonomous vehicles have helped improve the customer experience. Thus, increasing digitization in the luxury car leasing market is expected to propel the market growth during the forecast period of 2023 to 2030.

Opportunities

- Continuous technological advancements in luxury cars

Continuous technological advancements have offered better opportunities for the growth and expansion of the business in the coming years. Using various automation and software in these luxury cars has improved the satisfaction of customer. The use of applications has made bookings reliable and easy. All of these factors will increase the growth of the market during the forecast period of 2023 to 2030.

Restraints

- Lack of awareness regarding luxury car leasing facilities

Since many people are unaware of the availability of luxury car leasing facilities, this is projected to challenge the market growth during the forecast period. These facilities are not widely accessible in the world's underdeveloped nations, and there are not many options available in terms of automobile models. Therefore, all these factors are expected to obstruct the luxury car leasing market growth during the forecast period.

This luxury car leasing market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the luxury car leasing market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Recent Development

- In 2021, GoAir started its partnership with Eco Europcar. With this partnership, these companies aim to launch the services for leasing cars across around 100 different locations in India, including around 25 airports on GoAir's domestic network as a part of Value Added Services (VAS).

Global Luxury Car Leasing Market Scope

The luxury car leasing market is segmented based on the type, rental type, term, category, applications, end user and booking mode. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Compact

- Mid-Size

- Full-Size

- Luxury Crossovers,

- Minivans

- Luxury SUVs

Rental Type

- Business

- Leisure

Term

- Short-term rental

- Long-term rental

- Finance leasing

Category

- Self-Driven

- Chauffeur-Driven

Applications

- Airport

- Off-airport

End User

- Local Usage

- Airport Transport

- Outstation

- Others

Booking Mode

- Online

- Offline

Luxury Car Leasing Market Regional Analysis/Insights

The luxury car leasing market is analyzed and market size insights and trends are provided by country, type, rental type, term, category, applications, end user and booking mode as referenced above.

The countries covered in the luxury car leasing market report are report U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (M.E.A.) as a part of Middle East and Africa (M.E.A.), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the luxury car leasing market in terms of revenue growth and market share due to the prevalence of advanced technologies and the presence of large number of luxury car companies in this region.

Europe is projected to be the fastest developing region during the forecast period of 2023-2030. This is mainly increasing investments in this region's numerous commercial and military aviation programs.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Luxury Car Leasing Market Share Analysis

The luxury car leasing market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to luxury car leasing market.

Some of the major players operating in the luxury car leasing market are:

- Avis budget group (U.S.)

- SIXT (Germany)

- Enterprise Holdings, Inc (U.S.)

- Europcar (France)

- Localiza (Brazil)

- The Hertz Corporation (U.S.)

- Carzonrent India pvt ltd (India)

- Eco Rent a Car (India)

- Advantage OPCO, LLC (U.S.)

- Shenzhen Topone Car Rental Co. Ltd (China)

- Bettercar Rental (Dubai)

- National Car Rental (U.S.)

- LeasePlan (India)

- ALD Automotive (France)

- mychoize (India)

- Zoomcar India Private Limited (India)

- ORIX (Japan)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL LUXURY CAR LEASING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL LUXURY CAR LEASING MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 STANDARDS OF MEASUREMENT

2.2.9 VENDOR SHARE ANALYSIS

2.2.10 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.11 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL LUXURY CAR LEASING MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PORTERS FIVE FORCES

5.2 REGULATORY STANDARDS

5.3 TECHNOLOGICAL TRENDS

5.4 COMPANY COMPARITIVE ANALYSIS

5.5 KEY STRATEGIC INITIATIVES

5.6 PATENT ANALYSIS

5.7 CONSUMER BEHAVIOUR ANALYSIS

6 GLOBAL LUXURY CAR LEASING MARKET, BY TYPE

6.1 OVERVIEW

6.2 OPEN END LEASE

6.3 CLOSE END LEASE

7 GLOBAL LUXURY CAR LEASING MARKET, BY LEASING SOLUTION

7.1 OVERVIEW

7.2 ELECTRIC CAR LEASING

7.3 PRIVATE CAR LEASING

8 GLOBAL LUXURY CAR LEASING MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 BUSINESS

8.3 LEISURE

8.4 GOVERNMENT

9 GLOBAL LUXURY CAR LEASING MARKET, BY BOOKING TYPE

9.1 OVERVIEW

9.2 OFFLINE

9.2.1 BY APPLICATION

9.2.1.1. BUSINESS

9.2.1.2. LEISURE

9.2.1.3. GOVERNMENT

9.3 ONLINE

9.3.1 BY APPLICATION

9.3.1.1. BUSINESS

9.3.1.2. LEISURE

9.3.1.3. GOVERNMENT

10 GLOBAL LUXURY CAR LEASING MARKET, BY ASSISTANCE

10.1 OVERVIEW

10.2 SELF-DRIVE

10.3 CHAUFFEUR DRIVE

11 GLOBAL LUXURY CAR LEASING MARKET, BY LEASING PERIOD

11.1 OVERVIEW

11.2 SHORT TERM

11.3 LONG TERM

12 GLOBAL LUXURY CAR LEASING MARKET, BY USAGE

12.1 OVERVIEW

12.2 LOCAL USAGE

12.3 AIRPORT

12.4 TRANSPORT

12.5 OUTSTATION

12.6 OTHERS

13 GLOBAL LUXURY CAR LEASING MARKET, BY VEHICLE TYPE

13.1 OVERVIEW

13.2 SEDAN

13.2.1 BY APPLICATION

13.2.1.1. BUSINESS

13.2.1.2. LEISURE

13.2.1.3. GOVERNMENT

13.2.2 BY TYPE

13.2.2.1. OPEN END LEASE

13.2.2.2. CLOSE END LEASE

13.3 HATCHBACK

13.3.1 BY APPLICATION

13.3.1.1. BUSINESS

13.3.1.2. LEISURE

13.3.1.3. GOVERNMENT

13.3.2 BY TYPE

13.3.2.1. OPEN END LEASE

13.3.2.2. CLOSE END LEASE

13.4 CROSSOVER

13.4.1 BY APPLICATION

13.4.1.1. BUSINESS

13.4.1.2. LEISURE

13.4.1.3. GOVERNMENT

13.4.2 BY TYPE

13.4.2.1. OPEN END LEASE

13.4.2.2. CLOSE END LEASE

13.5 SUV

13.5.1 BY APPLICATION

13.5.1.1. BUSINESS

13.5.1.2. LEISURE

13.5.1.3. GOVERNMENT

13.5.2 BY TYPE

13.5.2.1. OPEN END LEASE

13.5.2.2. CLOSE END LEASE

13.6 OTHERS

14 GLOBAL LUXURY CAR LEASING MARKET, BY GEOGRAPHY

GLOBAL LUXURY CAR LEASING MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

14.2 EUROPE

14.2.1 GERMANY

14.2.2 FRANCE

14.2.3 U.K.

14.2.4 ITALY

14.2.5 SPAIN

14.2.6 RUSSIA

14.2.7 TURKEY

14.2.8 BELGIUM

14.2.9 NETHERLANDS

14.2.10 SWITZERLAND

14.2.11 SWEDEN

14.2.12 DENMARK

14.2.13 POLAND

14.2.14 REST OF EUROPE

14.3 ASIA PACIFIC

14.3.1 JAPAN

14.3.2 CHINA

14.3.3 SOUTH KOREA

14.3.4 INDIA

14.3.5 AUSTRALIA AND NEW ZEALAND

14.3.6 SINGAPORE

14.3.7 THAILAND

14.3.8 MALAYSIA

14.3.9 INDONESIA

14.3.10 PHILIPPINES

14.3.11 TAIWAN

14.3.12 VIETNAM

14.3.13 REST OF ASIA PACIFIC

14.4 SOUTH AMERICA

14.4.1 BRAZIL

14.4.2 ARGENTINA

14.4.3 REST OF SOUTH AMERICA

14.5 MIDDLE EAST AND AFRICA

14.5.1 SOUTH AFRICA

14.5.2 EGYPT

14.5.3 SAUDI ARABIA

14.5.4 U.A.E

14.5.5 ISRAEL

14.5.6 KUWAIT

14.5.7 QATAR

14.5.8 REST OF MIDDLE EAST AND AFRICA

14.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

15 GLOBAL LUXURY CAR LEASING MARKET,COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: GLOBAL

15.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

15.3 COMPANY SHARE ANALYSIS: EUROPE

15.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

15.5 MERGERS & ACQUISITIONS

15.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

15.7 EXPANSIONS

15.8 REGULATORY CHANGES

15.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

16 GLOBAL LUXURY CAR LEASING MARKET, SWOT & DBMR ANALYSIS

17 GLOBAL LUXURY CAR LEASING MARKET, COMPANY PROFILE

17.1 ALD AUTOMOTIVE

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENTS

17.2 ARVAL SERVICE LEASE.

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT DEVELOPMENTS

17.3 AUTOFLEX‚ LEASING.

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENTS

17.4 AVIS BUDGET GROUP INC.

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENTS

17.5 BAYERISCHE MOTOREN WERKE AG.

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENTS

17.6 CALDWELL LEASING.

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENTS

17.7 CARSHOP (PENSKE.)

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENTS

17.8 DEUTSCHE SPARKASSEN LEASING AG AND CO. KG.

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENTS

17.9 ENTERPRISE HOLDINGS INC.

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENTS

17.1 EUROPCAR

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT DEVELOPMENTS

17.11 EXECUTIVE CAR LEASING CO.

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENTS

17.12 EXPATRIDE INTERNATIONAL INC.

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENTS

17.13 HERTZ GLOBAL HOLDINGS INC.

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT DEVELOPMENTS

17.14 INTERNATIONAL CAR LEASE HOLDING

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENTS

17.15 LEASEPLAN CORP. NV

17.15.1 COMPANY SNAPSHOT

17.15.2 REVENUE ANALYSIS

17.15.3 PRODUCT PORTFOLIO

17.15.4 RECENT DEVELOPMENTS

17.16 MASTERLEASE GROUP

17.16.1 COMPANY SNAPSHOT

17.16.2 REVENUE ANALYSIS

17.16.3 PRODUCT PORTFOLIO

17.16.4 RECENT DEVELOPMENTS

17.17 MAZDA MOTOR CORP

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT DEVELOPMENTS

17.18 MERCEDES BENZ GROUP AG

17.18.1 COMPANY SNAPSHOT

17.18.2 REVENUE ANALYSIS

17.18.3 PRODUCT PORTFOLIO

17.18.4 RECENT DEVELOPMENTS

17.19 MOVIDA.

17.19.1 COMPANY SNAPSHOT

17.19.2 REVENUE ANALYSIS

17.19.3 PRODUCT PORTFOLIO

17.19.4 RECENT DEVELOPMENTS

17.2 ORIX CORP.

17.20.1 COMPANY SNAPSHOT

17.20.2 REVENUE ANALYSIS

17.20.3 PRODUCT PORTFOLIO

17.20.4 RECENT DEVELOPMENTS

17.21 SIXT SE

17.21.1 COMPANY SNAPSHOT

17.21.2 REVENUE ANALYSIS

17.21.3 PRODUCT PORTFOLIO

17.21.4 RECENT DEVELOPMENTS

17.22 TERBERG BUSINESS LEASE GROUP BV

17.22.1 COMPANY SNAPSHOT

17.22.2 REVENUE ANALYSIS

17.22.3 PRODUCT PORTFOLIO

17.22.4 RECENT DEVELOPMENTS

17.23 VOLKSWAGEN AG

17.23.1 COMPANY SNAPSHOT

17.23.2 REVENUE ANALYSIS

17.23.3 PRODUCT PORTFOLIO

17.23.4 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

18 CONCLUSION

19 RELATED REPORTS

20 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.