Global Lutein Market

Market Size in USD Million

CAGR :

%

USD

379.71 Million

USD

614.40 Million

2024

2032

USD

379.71 Million

USD

614.40 Million

2024

2032

| 2025 –2032 | |

| USD 379.71 Million | |

| USD 614.40 Million | |

|

|

|

|

Lutein Market Size

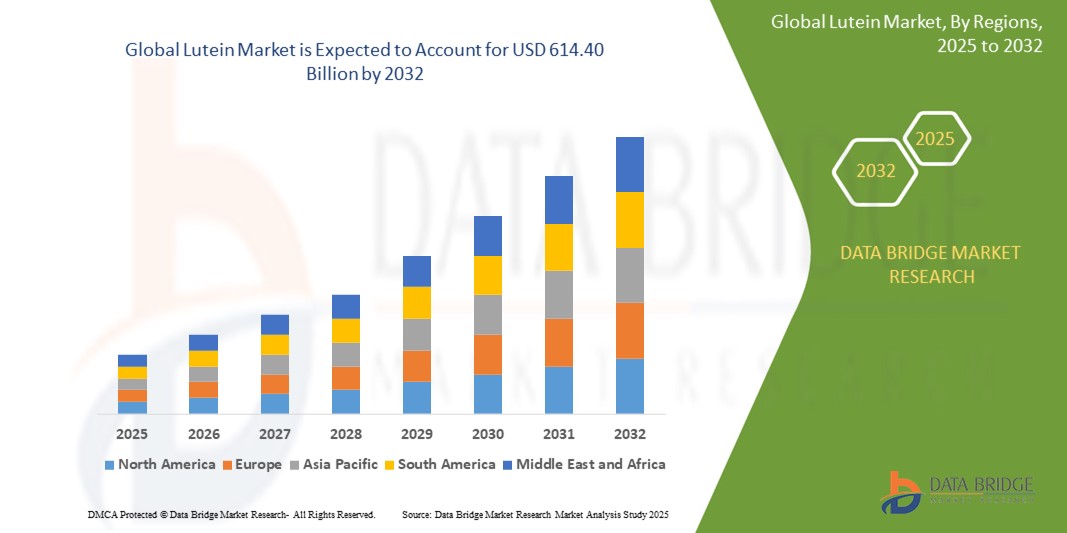

- The global lutein market was valued at USD 379.71 million in 2024 and is expected to reach USD 614.40 million by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 6.20%, primarily driven by rising awareness of eye health

- This growth is driven by growing demand for natural and plant-based ingredients in dietary supplements, food, and personal care products

Lutein Market Analysis

- The lutein market is growing due to rising eye health awareness, demand for natural carotenoids, and preventive healthcare trends. Manufacturers are innovating with plant-based and highly bioavailable lutein formulations, supported by strategic partnerships with research organizations

- E-commerce platforms and digital health channels are making lutein products more accessible. Rising disposable incomes, increased screen time, and the aging population are boosting demand for vegan, clean-label, and skincare applications, with a focus on sustainable sourcing and packaging

- For instance, in May 2024, OmniActive Health Technologies partnered with the Council of Responsible Nutrition (CRN) to promote lutein’s role in prenatal nutrition at the American College of Obstetrics and Gynecology's (ACOG) annual meeting

- Global innovations such as microencapsulation, lipid-based delivery systems, and AI-driven supplement recommendations are reshaping the market. Government eye health initiatives and growing investments are positioning lutein as a key player in the future of preventive healthcare

Report Scope and Lutein Market Segmentation

|

Attributes |

Lutein Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Lutein Market Trends

“Growing Demand for Eye Health Supplements"

- Consumers are becoming increasingly aware of the importance of eye health due to prolonged screen exposure, aging populations, and lifestyle factors, boosting demand for lutein-rich supplements marketed for vision protection and overall ocular wellness

- Brands are expanding their nutraceutical portfolios with lutein blends featuring zeaxanthin, omega-3s, and bilberry extracts. Packaging highlights claims such as "Blue Light Defense," "Vision Support," and "Healthy Aging" to target tech-savvy and senior consumers

- Health campaigns and endorsements from eye care professionals are amplifying the focus on preventive eye care, encouraging consumers to proactively incorporate lutein-based supplements into their daily wellness routines

For instance,

- In 2024, OmniActive Health Technologies launched "Lutemax Kids," a chewable supplement supporting children's eye health amid rising concerns over digital screen exposure

- Bausch + Lomb expanded its "PreserVision" line in 2025, focusing on blue light filtration and macular health

- Herbalife Nutrition introduced a new vision health range fortified with lutein and zeaxanthin in early 2025

- As digital lifestyles grow globally, lutein-based eye health supplements will become essential, driving continuous innovation and widening consumer adoption

Lutein Market Dynamics

Driver

“Expansion of Plant-Based and Vegan Supplements"

- The global shift toward plant-based lifestyles is boosting demand for vegan-friendly lutein supplements derived from marigold flowers, avoiding synthetic or animal-based sources traditionally used in nutritional products

- Brands are capitalizing on clean-label trends, offering lutein products certified as vegan, non-GMO, and sustainably sourced, ensuring appeal to ethically conscious consumers

- Advances in extraction technologies and botanical research are enhancing the potency and purity of plant-based lutein offerings, aligning with consumer expectations for transparency and natural health solutions

For instance,

- In 2024, DSM launched a 100% plant-based lutein line under its life’s™OMEGA brand, promoting sustainable eye and skin health solutions

- Kemin Industries expanded its "FloraGLO Lutein" product to include a vegan-certified variant in late 2024

- Nutrafol introduced a plant-based vision support supplement featuring lutein in early 2025

- The continued rise of plant-based diets will firmly position vegan lutein supplements as a mainstream wellness essential, broadening their reach across demographics

Opportunity

“Integration of Lutein in Functional Skincare and Cosmetics"

- Lutein’s antioxidant properties are driving its incorporation into skincare and cosmetic formulations to protect against oxidative stress, blue light exposure, and premature aging

- Beauty brands are positioning lutein-infused creams, serums, and oral beauty supplements as multifunctional solutions for radiant skin, enhanced hydration, and skin barrier protection

- Clean beauty movements, emphasizing natural ingredients and holistic wellness, are boosting consumer demand for skincare products enriched with lutein and other carotenoids

For instance,

- In 2024, Murad launched a new "City Skin" range featuring lutein to defend against blue light and environmental aggressors

- DSM introduced "BeautiFerm Lutein" in early 2025 for use in functional skincare and nutraceutical beauty blends

- Amway’s Artistry brand expanded into lutein-enriched beauty supplements promoting skin vibrancy in 2025

- As the beauty-from-within trend accelerates, lutein’s multifunctional benefits will create lucrative opportunities in both skincare and cosmetic industries

Restraint/Challenge

“Regulatory Challenges and Health Claim Restrictions"

- Stringent global regulatory frameworks often limit the type of health claims that can be made about lutein supplements, creating compliance hurdles for manufacturers targeting broader consumer segments

- Inconsistent labeling requirements and regional differences in approved claims (e.g., eye health vs. general antioxidant support) complicate global marketing strategies for lutein product launches

- Brands face increased pressure to back claims with robust clinical evidence, driving up research and documentation costs, especially for small- and mid-sized companies seeking international expansion

For instance,

- In 2024, EFSA rejected a lutein health claim related to general eye protection due to insufficient supporting evidence

- U.S. FDA issued warning letters in 2025 to several supplement brands for unauthorized structure/function claims on lutein products

- Australia's TGA updated its guidelines in 2024, tightening regulations on supplement claims around blue light protection

- Overcoming regulatory complexities will require strategic investments in clinical research and compliant marketing, challenging lutein brands to differentiate responsibly

Lutein Market Scope

The market is segmented on the basis of form, source, application, and production process.

|

Segmentation |

Sub-Segmentation |

|

By Form |

|

|

By Source |

|

|

By Application |

|

|

By Production Process |

|

Lutein Market Regional Analysis

“Europe is the Dominant Region in the Lutein Market”

- Europe’s aging population drives high demand for lutein-based eye health supplements, with increased awareness about age-related macular degeneration (AMD)

- Leading companies such as Kemin Industries and BASF SE have strong operations and distribution networks across Europe, supporting market dominance

- The European Food Safety Authority (EFSA) approvals for lutein in food supplements and fortified products further boost market growth

- With a well-informed consumer base, strong regulatory support, and major industry players, Europe is expected to maintain its leadership position in the global lutein market over the coming years

“Asia-Pacific is projected to register the Highest Growth Rate”

- Growing awareness about eye health, skin care, and dietary supplements among consumers in countries such as China, India, and Japan is driving lutein demand

- Rapid growth of the middle-class segment is increasing spending power, leading to higher consumption of nutraceuticals and functional foods enriched with lutein

- Companies such as OmniActive Health Technologies and Divi’s Laboratories are expanding their production capacities and marketing efforts across the Asia-Pacific region

- With rising disposable incomes, increasing health consciousness, and active investments by leading players, Asia-Pacific is poised to register the highest growth rate in the global lutein market in the coming years

Lutein Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- FENCHEM (China)

- Divi's Nutraceuticals (India)

- Lycored (Israel)

- Piveg, Inc. (U.S.)

- VITAE NATURALS (Spain)

- Digestive Disease Week (DDW) (U.S.)

- Chr. Hansen Holding A/S (Denmark)

- Chenguang Biotech Group Co., Ltd (China)

- FMC Corporation (U.S.)

- BASF (Germany)

- Kemin Industries, Inc. (U.S.)

- OmniActive Health Technologies (India)

- Allied Biotech Corporation (Taiwan)

- Katra Phytochem Pvt Ltd. (India)

- Döhler GmbH (Germany)

- E.I.D. - Parry (India) Limited (India)

- Synthite Industries Ltd (India)

- Natural Grocers by Vitamin Cottage, Inc. (U.S.)

- Nature's Bounty (U.S.)

Latest Developments in Global Lutein Market

- In May 2024, OmniActive Health Technologies and the Council of Responsible Nutrition (CRN) entered a strategic partnership to promote the significance of lutein and zeaxanthin isomers for prenatal nutrition at the American College of Obstetrics and Gynecology's (ACOG) annual meeting, aiming to enhance awareness about the role of these essential nutrients for expectant mothers, strengthening the focus on maternal health innovation

- In November 2023, HELM and Allied Biotech established a groundbreaking partnership to revolutionize the natural color industry by introducing crystal-clear colors derived from pure lutein, enabling food and beverage manufacturers to meet consumer demand for clean-label, natural ingredients, further driving innovation in the natural pigment sector

- In June 2021, OmniActive Health Technologies launched Integrative Actives, a platform designed to deliver multiple actives in concentrated smaller doses, with Nutritears being the first product developed using this technology, reinforcing the company’s commitment to providing multifunctional, clinically backed health solutions

- In May 2021, PharmaLinea introduced a line of preventative eye health supplements in consumer-friendly formats, such as Vision Orosticks and Vision Liquid Sticks, based on highly sought-after carotenoids lutein and zeaxanthin, responding to rising eye health concerns caused by increased screen time, and cementing its leadership in innovative eye care offerings

- In March 2021, Ashland expanded its nutraceutical product portfolio by launching a soy-free GPM lutein to address the growing consumer preference for plant-based and allergen-free supplements, underlining its dedication to developing targeted, consumer-centric health solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Lutein Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Lutein Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Lutein Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.