Global Low Earth Orbit Leo Satellite Payload Market

Market Size in USD Billion

CAGR :

%

USD

17.49 Billion

USD

27.47 Billion

2024

2032

USD

17.49 Billion

USD

27.47 Billion

2024

2032

| 2025 –2032 | |

| USD 17.49 Billion | |

| USD 27.47 Billion | |

|

|

|

|

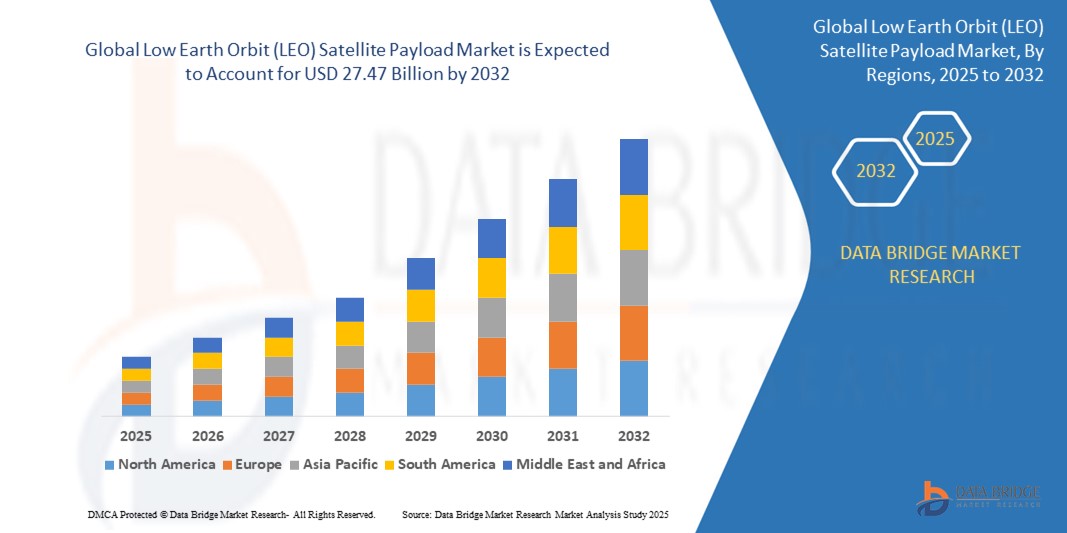

What is the Global Low Earth Orbit (LEO) Satellite Payload Market Size and Growth Rate?

- The global low earth orbit (LEO) satellite payload market size was valued at USD 17.49 billion in 2024 and is expected to reach USD 27.47 billion by 2032, at a CAGR of 5.80% during the forecast period

- The low earth orbit (LEO) satellite payload market is experiencing significant growth, driven by advancements in miniaturization, AI integration, and improved propulsion technologies

- Innovations such as reusable rockets, enhanced satellite communication systems, and cost-effective manufacturing processes are propelling market expansion. Increased demand for high-speed internet, earth observation, and IoT connectivity further fuels this dynamic sector's evolution and potential

What are the Major Takeaways of Low Earth Orbit (LEO) Satellite Payload Market?

- The increased demand for broadband connectivity, especially in remote and underserved regions, is significantly driving the LEO satellite payload market. Satellite constellations such as Starlink and OneWeb exemplify this trend by expanding global broadband networks

- For instance, Starlink's deployment aims to provide high-speed internet access to rural areas worldwide, addressing the digital divide and boosting market growth by meeting the rising connectivity needs of these populations

- North America dominated the low earth orbit (LEO) satellite payload market with the largest revenue share of 32.7% in 2024, driven by growing investments in satellite mega-constellations, advancements in payload miniaturization, and rising demand for high-speed connectivity and Earth observation capabilities

- Asia-Pacific LEO satellite payload market is forecast to grow at the fastest CAGR of 9.8% from 2025 to 2032, propelled by expanding satellite programs, increasing demand for high-speed connectivity, and rapid technological development in countries such as China, India, and Japan

- The Small Satellite segment dominated the low earth orbit (LEO) satellite payload market, capturing the largest revenue share of 46.8% in 2024, driven by increasing demand for cost-efficient, lightweight, and rapid deployment solutions for Earth observation, communication, and scientific missions

Report Scope and Low Earth Orbit (LEO) Satellite Payload Market Segmentation

|

Attributes |

Low Earth Orbit (LEO) Satellite Payload Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Low Earth Orbit (LEO) Satellite Payload Market?

“Enhanced Payload Performance through AI and Autonomous Systems”

- A significant and fast-evolving trend in the global low earth orbit (LEO) satellite payload market is the growing integration of artificial intelligence (AI), autonomous decision-making, and smart onboard processing to enhance satellite performance and mission flexibility. These advancements are transforming how payloads handle real-time data, optimize communication, and support critical operations in space

- For instance, Northrop Grumman has deployed AI-enabled technologies to optimize payload data processing in orbit, reducing the need for ground intervention and enhancing operational responsiveness. Similarly, Lockheed Martin's SmartSat™ platform integrates autonomous systems that allow payloads to adapt to mission demands in real-time, improving overall efficiency

- AI-powered LEO satellite payloads offer capabilities such as real-time threat detection, optimized signal processing, and enhanced data compression, which are vital for applications in defense, Earth observation, and global connectivity. Autonomous technologies also allow satellites to reconfigure payload functions dynamically, supporting a wider range of tasks with greater operational flexibility

- Seamless integration with ground stations, cloud-based analytics, and secure communication protocols further enhances the utility of smart payloads, enabling faster, reliable data transfer and improved system coordination

- Companies such as SpaceX and Airbus are leading the development of intelligent LEO payloads that utilize AI for autonomous operations, advanced imaging, and efficient spectrum utilization, addressing the rising demand for high-capacity, resilient space systems

- The widespread adoption of AI and autonomous payload technologies is redefining the capabilities of LEO satellites, accelerating innovation in Earth observation, broadband internet, defense surveillance, and global communications

What are the Key Drivers of Low Earth Orbit (LEO) Satellite Payload Market?

- The escalating demand for global connectivity, high-resolution Earth observation, and secure defense communications is a primary driver fueling growth in the low earth orbit (LEO) satellite payload market

- For instance, in March 2024, SpaceX expanded its Starlink constellation with enhanced LEO payloads aimed at improving broadband speed, latency, and global coverage, supporting connectivity in remote regions

- Rising investments in LEO mega-constellations by both private and government entities are driving market expansion, with applications across telecommunications, disaster monitoring, defense surveillance, and scientific research

- The shift towards miniaturized, high-performance payloads, enabled by advancements in electronics, materials, and AI, is enhancing mission affordability, flexibility, and rapid deployment of satellite constellations

- In addition, growing demand for near-real-time data for climate monitoring, maritime surveillance, and agricultural management is pushing the adoption of advanced payload systems

- The ability of modern LEO satellite payloads to deliver low-latency communication, high-resolution imagery, and continuous global coverage makes them indispensable for emerging sectors, including autonomous vehicles, IoT networks, and smart cities

Which Factor is challenging the Growth of the Low Earth Orbit (LEO) Satellite Payload Market?

- Concerns regarding space congestion, orbital debris, and regulatory limitations pose significant challenges to the LEO satellite payload market's long-term growth and sustainability

- The increasing number of satellites launched, particularly from mega-constellations, raises the risk of collisions and debris accumulation, prompting stricter regulatory oversight and international coordination efforts

- Companies such as OneWeb and Amazon's Project Kuiper face operational constraints due to evolving space traffic management protocols and the need for reliable de-orbiting solutions to mitigate debris risks

- Moreover, the high development and launch costs associated with next-generation LEO payloads, especially those with AI and autonomous functionalities, can limit adoption among smaller space agencies or emerging economies

- Geopolitical tensions, export restrictions on advanced satellite technologies, and cybersecurity vulnerabilities linked to satellite communications further complicate market expansion

- Overcoming these obstacles through robust debris mitigation strategies, international cooperation, technological standardization, and cost-reduction initiatives will be critical to ensuring the sustainable growth of the LEO Satellite Payload market in the coming years

How is the Low Earth Orbit (LEO) Satellite Payload Market Segmented?

The market is segmented on the basis of type, frequency, application, sub-system, and end-use.

• By Type

On the basis of type, the low earth orbit (LEO) satellite payload market is segmented into Small Satellite, Medium Satellite, Large Satellite, and Cube Satellite. The Small Satellite segment dominated the low earth orbit (LEO) satellite payload market, capturing the largest revenue share of 46.8% in 2024, driven by increasing demand for cost-efficient, lightweight, and rapid deployment solutions for Earth observation, communication, and scientific missions. Small satellites are preferred for their affordability, versatility, and suitability for mega-constellations, making them a critical component of modern LEO satellite projects.

The Cube Satellite segment is projected to witness the fastest growth rate from 2025 to 2032, fueled by advancements in miniaturization, lower launch costs, and increasing academic, research, and commercial applications. CubeSats are increasingly utilized for technology demonstrations, remote sensing, and communication missions, particularly among startups, universities, and emerging space programs.

• By Frequency

On the basis of frequency, the low earth orbit (LEO) satellite payload market is segmented into L-Band, S-Band, X-Band, C-Band, Ka-Band, Ku-Band, and Others. The Ku-Band segment held the largest market revenue share of 31.4% in 2024, attributed to its widespread use for high-throughput satellite communications, broadband internet, and video broadcasting services. The Ku-Band offers an optimal balance between bandwidth capacity, coverage area, and resistance to atmospheric interference, making it highly suitable for LEO satellite constellations.

The Ka-Band segment is anticipated to register the fastest CAGR from 2025 to 2032, driven by the growing demand for high-capacity, low-latency communication services and its role in enabling next-generation broadband, 5G backhaul, and defense applications.

• By Application

On the basis of application, the low earth orbit (LEO) satellite payload market is segmented into Communication and Navigation, Earth Observation and Remote Sensing, Surveillance, Scientific, and Others. The Communication and Navigation segment dominated the market with the largest revenue share of 42.9% in 2024, propelled by rising global connectivity demands, the expansion of LEO broadband constellations, and increased reliance on satellite-enabled navigation services.

The Earth Observation and Remote Sensing segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by growing environmental monitoring initiatives, disaster management needs, and the rising adoption of satellite imagery for agriculture, urban planning, and resource management.

• By Sub-System

On the basis of sub-system, the low earth orbit (LEO) satellite payload market is segmented into Payload, Telecommunication, Power System, Propulsion System, Satellite Bus, and Others. The Payload segment captured the largest market revenue share of 37.6% in 2024, owing to the critical role payload systems play in satellite functionality, mission-specific operations, and data transmission. Increasing demand for high-performance, AI-enabled, and autonomous payloads is driving significant investment in this segment.

The Propulsion System segment is expected to exhibit the fastest CAGR from 2025 to 2032, supported by the need for precise orbital adjustments, de-orbiting capabilities, and efficient maneuverability in crowded LEO environments.

• By End-Use

On the basis of end-use, the low earth orbit (LEO) satellite payload market is segmented into Commercial, Government and Military, Civil, and Others. The Commercial segment dominated the market with the largest revenue share of 55.1% in 2024, driven by the rapid growth of private-sector satellite operators, increased investment in broadband internet, and demand for Earth observation and satellite-enabled IoT services.

The Government and Military segment is anticipated to grow at the fastest CAGR from 2025 to 2032, driven by rising defense modernization efforts, increased surveillance needs, and growing reliance on secure satellite communications and remote sensing for national security.

Which Region Holds the Largest Share of the Low Earth Orbit (LEO) Satellite Payload Market?

- North America dominated the low earth orbit (LEO) satellite payload market with the largest revenue share of 32.7% in 2024, driven by growing investments in satellite mega-constellations, advancements in payload miniaturization, and rising demand for high-speed connectivity and Earth observation capabilities

- The region's strong ecosystem of aerospace companies, defense programs, and private space operators significantly contributes to LEO payload innovation, particularly in the U.S

- Favorable government policies, high levels of R&D spending, and a well-developed commercial space sector further solidify North America's position as a global leader in the LEO Satellite Payload market

U.S. Low Earth Orbit (LEO) Satellite Payload Market Insight

U.S. accounted for the largest revenue share within North America in 2024, supported by significant initiatives from leading players such as SpaceX, Lockheed Martin, and Northrop Grumman, as well as growing defense and commercial satellite deployments. The country's focus on global broadband coverage, Earth observation, and secure military communications is fueling demand for advanced LEO satellite payloads. In addition, the rise of public-private partnerships and NASA's continued investment in LEO technologies are contributing to sustained market expansion.

Europe Low Earth Orbit (LEO) Satellite Payload Market Insight

The Europe LEO satellite payload market is expected to grow at a steady CAGR during the forecast period, driven by strong support for space exploration, defense modernization, and environmental monitoring initiatives. The region's collaborative space programs, led by the European Space Agency (ESA), and investments in satellite broadband services are accelerating payload development. Europe also places significant emphasis on Earth observation, disaster management, and scientific research, which is boosting demand for high-performance LEO payloads.

U.K. Low Earth Orbit (LEO) Satellite Payload Market Insight

The U.K. LEO satellite payload market is anticipated to grow at a notable CAGR, supported by increased government funding for space infrastructure, a thriving satellite manufacturing sector, and strategic partnerships with global space agencies. The U.K.'s focus on autonomous payload technologies, climate monitoring, and satellite communications aligns with rising global demand for LEO satellite services, enhancing market potential.

Germany Low Earth Orbit (LEO) Satellite Payload Market Insight

The Germany LEO satellite payload market is projected to expand at a steady pace, fueled by the country's technological expertise, emphasis on advanced aerospace solutions, and growing investments in defense and research satellite missions. Germany's leadership in satellite component manufacturing, coupled with its support for sustainable space operations and space traffic management, is driving demand for reliable, high-performance LEO payloads across both commercial and governmental sectors.

Which Region is the Fastest Growing in the Low Earth Orbit (LEO) Satellite Payload Market?

Asia-Pacific LEO satellite payload market is forecast to grow at the fastest CAGR of 9.8% from 2025 to 2032, propelled by expanding satellite programs, increasing demand for high-speed connectivity, and rapid technological development in countries such as China, India, and Japan. Government initiatives promoting space exploration, communication infrastructure upgrades, and growing commercial satellite investments are key factors driving the region's growth. The rise of emerging space startups and domestic satellite manufacturers is making LEO payloads more accessible across the region.

Japan Low Earth Orbit (LEO) Satellite Payload Market Insight

The Japan LEO satellite payload market is experiencing strong growth, supported by its advanced technological landscape, government-backed space programs, and increasing demand for disaster management, Earth observation, and connectivity services. Japan's focus on developing autonomous satellite systems, efficient payloads, and integrating AI for real-time data processing is accelerating market adoption, particularly for scientific and defense applications.

China Low Earth Orbit (LEO) Satellite Payload Market Insight

The China LEO satellite payload market held the largest revenue share in Asia-Pacific in 2024, driven by the country's rapid satellite deployment under initiatives such as Beidou Navigation System and LEO broadband mega-constellations. China's significant investment in advanced payload technologies, strong domestic manufacturing capabilities, and strategic focus on global connectivity and defense surveillance are major factors propelling market growth. The nation's ambitions for smart cities, autonomous systems, and environmental monitoring further support the expanding demand for LEO payload solutions.

Which are the Top Companies in Low Earth Orbit (LEO) Satellite Payload Market?

The low earth orbit (LEO) satellite payload industry is primarily led by well-established companies, including:

- AIRBUS (France)

- RTX (U.S.)

- Thales (France)

- Lockheed Martin Corporation (U.S.)

- Honeywell International Inc. (U.S.)

- L3Harris Technologies, Inc. (U.S.)

- Boeing (U.S.)

- Viasat, Inc. (U.S.)

- SpaceX (U.S.)

- MDA (Canada)

- LUCIX CORPORATION (U.S.)

- Mitsubishi Electric Corporation (Japan)

- ISRO (India)

- General Dynamics Mission Systems, Inc. (U.S.)

- Northrop Grumman Corporation (U.S.)

What are the Recent Developments in Global Low Earth Orbit (LEO) Satellite Payload Market?

- In October 2024, Northrop Grumman (U.S.) secured a contract from the U.S. Space Development Agency (SDA) to design and manufacture 38 data transport satellites for the Tranche 2 Transport Layer - Alpha (T2TL-Alpha) of the Proliferated Warfighter Space Architecture (PWSA). These satellites, operating in Low Earth Orbit (LEO), will enhance military communication capabilities, with operations planned to begin by December 2026. This deal, valued at USD 732 million, strengthens Northrop Grumman’s presence in the defense space sector

- In October 2024, the European Space Agency (ESA) placed an order with Thales Alenia Space (France) for six additional satellites to expand Italy’s IRIDE Earth observation constellation. The initiative is aimed at enhancing Europe’s observation and environmental monitoring capabilities through advanced LEO satellite deployment, reinforcing Thales’ role in European space programs

- In January 2024, L3Harris Technologies, Inc. (U.S.) was awarded a USD 919 million contract to deliver 18 infrared space vehicles under the U.S. SDA’s Tranche 2 Tracking Layer. These systems will boost the U.S. military's missile detection and hypersonic threat tracking capabilities, cementing L3Harris’ reputation as a key defense technology provider

- In October 2023, the U.S. Space Development Agency (SDA) granted Northrop Grumman (U.S.) a contract worth USD 732 million to build 38 LEO data transport satellites for the T2TL-Alpha network under the PWSA program. These satellites are expected to enhance secure military communications, with operations set to begin by December 2026, reinforcing Northrop Grumman’s strategic defense role

- In October 2023, the U.S. Space Force awarded SpaceX (U.S.) a USD 70 million contract through the Space Systems Command, providing Starlink internet services for military operations. The one-year contract, which commenced on September 1, includes undisclosed specifications from the U.S. Department of Defense (DoD), reflecting SpaceX’s growing role in secure defense communications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.