Global Low Code Development Platform Market

Market Size in USD Billion

CAGR :

%

USD

37.89 Billion

USD

261.30 Billion

2025

2033

USD

37.89 Billion

USD

261.30 Billion

2025

2033

| 2026 –2033 | |

| USD 37.89 Billion | |

| USD 261.30 Billion | |

|

|

|

|

Low-Code Development Platform Market Size

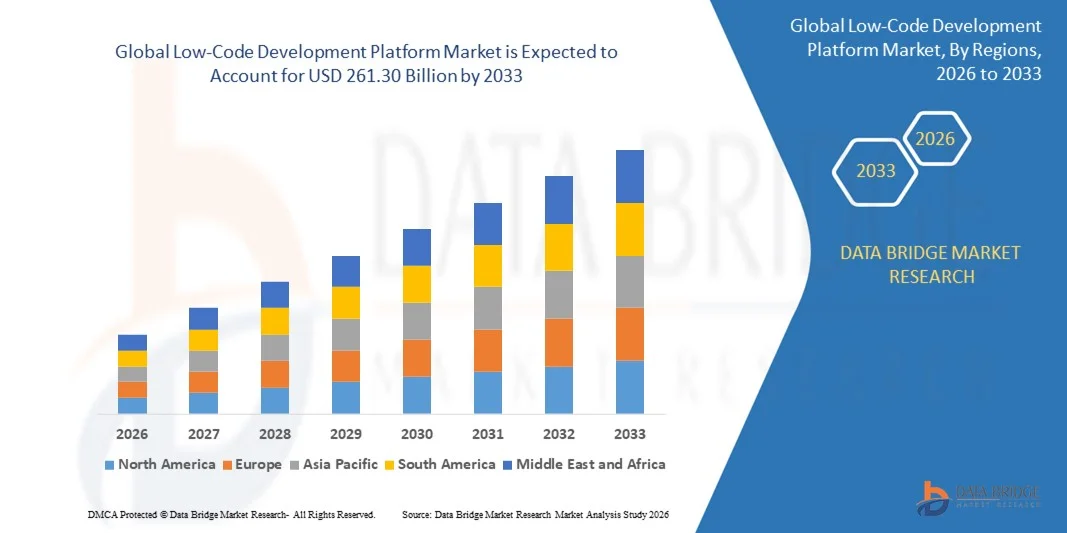

- The global low-code development platform market size was valued at USD 37.89 billion in 2025 and is expected to reach USD 261.30 billion by 2033, at a CAGR of 27.30% during the forecast period

- The market growth is largely driven by the accelerating adoption of digital transformation initiatives and enterprise automation across organizations, leading to increased reliance on rapid application development and process optimization solutions in both public and private sectors

- Furthermore, rising demand for agile, cost-effective, and scalable software development tools that reduce dependency on traditional coding is positioning low-code platforms as a preferred solution for addressing application backlogs and improving business responsiveness, thereby significantly supporting overall market expansion

Low-Code Development Platform Market Analysis

- Low-code development platforms are software solutions that enable users to design, develop, and deploy applications using visual interfaces, reusable components, and minimal hand coding. These platforms support faster application delivery while ensuring integration with existing enterprise systems and cloud environments

- The increasing demand for low-code platforms is primarily driven by shortages of skilled developers, the need for faster time-to-market, and growing adoption of cloud-based enterprise applications, encouraging organizations to embrace low-code solutions for both operational and customer-facing use cases

- North America dominated the low-code development platform market with a share of 34.4% in 2025, due to early adoption of digital transformation strategies, widespread cloud usage, and strong presence of leading low-code platform vendors

- Asia-Pacific is expected to be the fastest growing region in the low-code development platform market during the forecast period due to rapid digitalization, expanding SME adoption, and increasing cloud investments

- Platform segment dominated the market with a market share of 65.5% in 2025, due to growing enterprise focus on rapid application development, visual modeling, and reusable components that reduce dependency on traditional coding. Organizations increasingly adopt low-code platforms to accelerate digital transformation initiatives, modernize legacy systems, and improve developer productivity. The availability of drag-and-drop interfaces, prebuilt templates, and seamless integration capabilities further strengthens platform adoption across multiple business functions

Report Scope and Low-Code Development Platform Market Segmentation

|

Attributes |

Low-Code Development Platform Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Low-Code Development Platform Market Trends

AI-Driven Automation in Low-Code Platforms

- A major trend in the low-code development platform market is the growing integration of AI-driven automation to accelerate application development and improve decision-making across enterprises. AI capabilities are being embedded into low-code platforms to automate workflows, recommend application logic, and enhance user experience through intelligent design assistance

- For instance, Microsoft has integrated AI-powered Copilot features into its Power Platform to support automated app creation, workflow optimization, and data-driven insights. These capabilities help organizations reduce development time while improving accuracy and scalability of enterprise applications

- Low-code platforms are increasingly using AI to support process automation and intelligent orchestration across business operations, enabling organizations to streamline repetitive tasks and improve operational efficiency. This trend is strengthening the role of low-code platforms as core tools for enterprise automation strategies

- The adoption of AI-enabled low-code tools is expanding in regulated industries such as BFSI and healthcare, where automation supports compliance monitoring, reporting, and real-time decision workflows. These capabilities are enabling faster deployment of mission-critical applications with reduced manual intervention

- Enterprises are also leveraging AI-powered low-code platforms to improve collaboration between business users and IT teams by simplifying application logic and reducing development complexity. This is supporting broader citizen developer adoption across organizations

- The increasing convergence of AI, automation, and low-code development is reinforcing the transition toward intelligent enterprise platforms. This trend is reshaping how organizations design, deploy, and scale applications in dynamic digital environments

Low-Code Development Platform Market Dynamics

Driver

Rising Demand for Rapid Application Development

- The growing need for faster application development to support digital transformation initiatives is a key driver of the low-code development platform market. Organizations are under pressure to rapidly deploy applications that support evolving business models, customer engagement, and internal process optimization

- For instance, Appian enables enterprises to rapidly build and deploy workflow-driven applications using its low-code platform, helping organizations reduce development cycles and respond quickly to operational requirements. This capability is particularly valuable in industries requiring frequent process updates

- The increasing application backlog within IT departments is pushing enterprises to adopt low-code platforms that enable faster delivery with minimal coding effort. These platforms allow organizations to address both internal and customer-facing application needs more efficiently

- The shift toward agile and DevOps practices is further reinforcing demand for low-code tools that support continuous development and deployment. Low-code platforms help organizations maintain flexibility while reducing dependency on scarce skilled developers

- The emphasis on speed, efficiency, and cost optimization continues to strengthen rapid application development as a central driver, positioning low-code platforms as essential enablers of enterprise digital agility

Restraint/Challenge

Security and Legacy System Integration Issues

- The low-code development platform market faces challenges related to data security and integration with complex legacy systems. Enterprises operating in regulated environments require strong governance, access control, and compliance mechanisms, which can be difficult to implement consistently across low-code applications

- For instance, large enterprises using Oracle APEX often need extensive customization and security validation to ensure seamless integration with existing on-premises databases and legacy enterprise systems. These requirements can slow deployment and increase implementation complexity

- Integrating low-code platforms with legacy infrastructure often involves compatibility challenges, data synchronization issues, and increased reliance on middleware solutions. These factors can limit flexibility and raise overall implementation costs for organizations

- Security concerns related to data exposure, user access management, and third-party integrations continue to create hesitation among organizations handling sensitive information. Ensuring enterprise-grade security across rapidly developed applications remains a critical challenge

- These security and integration challenges place constraints on market expansion, requiring vendors and enterprises to invest in stronger controls, monitoring, and integration strategies to sustain long-term adoption

Low-Code Development Platform Market Scope

The market is segmented on the basis of component, application type, organization size, and industry vertical.

- By Component

On the basis of component, the low-code development platform market is segmented into platform and services. The platform segment dominated the largest market revenue share of 65.5% in 2025, driven by growing enterprise focus on rapid application development, visual modeling, and reusable components that reduce dependency on traditional coding. Organizations increasingly adopt low-code platforms to accelerate digital transformation initiatives, modernize legacy systems, and improve developer productivity. The availability of drag-and-drop interfaces, prebuilt templates, and seamless integration capabilities further strengthens platform adoption across multiple business functions.

The services segment is anticipated to witness the fastest growth rate from 2026 to 2033, supported by rising demand for consulting, integration, customization, and ongoing support services. Enterprises require specialized services to align low-code solutions with complex workflows, security requirements, and enterprise IT architectures. Increasing large-scale deployments and the need for post-implementation optimization continue to drive strong growth in this segment.

- By Application Type

On the basis of application type, the low-code development platform market is segmented into web-based, mobile-based, and desktop and server-based applications. The web-based segment dominated the market in 2025, owing to widespread adoption of browser-accessible enterprise applications and cloud-native architectures. Organizations favor web-based low-code applications for their scalability, ease of deployment, and compatibility across devices, enabling faster rollout of internal and customer-facing solutions. The ability to integrate with existing web services and APIs further supports segment dominance.

The mobile-based segment is expected to register the fastest growth during the forecast period, driven by increasing demand for mobile workforce solutions and customer engagement applications. Enterprises are leveraging low-code platforms to rapidly develop secure mobile apps that support real-time data access and remote operations. Rising smartphone penetration and mobile-first business strategies continue to accelerate adoption.

- By Organization Size

On the basis of organization size, the low-code development platform market is segmented into small and medium-sized enterprises and large enterprises. The large enterprises segment held the largest revenue share in 2025, supported by extensive digital transformation programs and high demand for enterprise-grade application development. Large organizations use low-code platforms to streamline complex processes, reduce application backlogs, and enhance collaboration between IT and business teams. Strong investment capacity and integration needs across multiple departments further reinforce adoption.

The SMEs segment is projected to grow at the fastest rate from 2026 to 2033, driven by the need for cost-effective and rapid application development tools. SMEs increasingly adopt low-code platforms to overcome limited IT resources while maintaining operational agility. Ease of use, lower development costs, and faster time-to-market make low-code solutions highly attractive for smaller organizations.

- By Industry Vertical

On the basis of industry vertical, the low-code development platform market is segmented into BFSI, retail and ecommerce, government and defense, healthcare, IT, energy and utilities, manufacturing, and others. The IT segment dominated the market in 2025, driven by continuous demand for internal tools, workflow automation, and rapid software deployment. IT organizations leverage low-code platforms to improve development efficiency, support DevOps practices, and respond quickly to changing business requirements. Strong alignment with cloud and integration technologies supports sustained dominance.

The BFSI segment is expected to witness the fastest growth over the forecast period, fueled by rising demand for digital banking, customer onboarding, and compliance-driven applications. Financial institutions increasingly use low-code platforms to accelerate innovation while maintaining security and regulatory standards. The need for rapid customization and frequent application updates continues to drive adoption in this vertical.

Low-Code Development Platform Market Regional Analysis

- North America dominated the low-code development platform market with the largest revenue share of 34.4% in 2025, driven by early adoption of digital transformation strategies, widespread cloud usage, and strong presence of leading low-code platform vendors

- Enterprises across the region increasingly rely on low-code platforms to accelerate application development, modernize legacy systems, and address skilled developer shortages

- This dominance is further supported by high IT spending, strong adoption across BFSI, healthcare, and government sectors, and a mature ecosystem for cloud, AI, and enterprise software solutions

U.S. Low-Code Development Platform Market Insight

The U.S. low-code development platform market captured the largest revenue share within North America in 2025, fueled by rapid enterprise digitalization and strong demand for agile software development tools. Organizations increasingly adopt low-code platforms to streamline workflows, enhance customer experience, and reduce development timelines. The strong presence of major technology providers, high cloud penetration, and widespread adoption across BFSI, IT, and government sectors continue to drive market growth. Moreover, the growing focus on automation and AI-enabled application development further strengthens adoption in the U.S.

Europe Low-Code Development Platform Market Insight

The Europe low-code development platform market is projected to expand at a steady CAGR during the forecast period, primarily driven by increasing emphasis on digital government initiatives and enterprise automation. Organizations across the region are adopting low-code platforms to comply with regulatory requirements while improving operational efficiency. Rising investments in cloud infrastructure and growing adoption across manufacturing, healthcare, and public sector organizations are supporting market expansion.

U.K. Low-Code Development Platform Market Insight

The U.K. low-code development platform market is anticipated to grow at a notable CAGR over the forecast period, supported by strong adoption of cloud-based enterprise applications and digital transformation programs. Businesses are increasingly leveraging low-code solutions to improve agility and reduce reliance on traditional software development. The country’s advanced IT infrastructure and strong focus on innovation continue to encourage adoption across BFSI, retail, and public services.

Germany Low-Code Development Platform Market Insight

The Germany low-code development platform market is expected to expand at a considerable CAGR during the forecast period, driven by growing demand for process automation and Industry 4.0 initiatives. German enterprises increasingly deploy low-code platforms to support manufacturing digitalization and enterprise application modernization. The emphasis on data security, compliance, and integration with existing enterprise systems further supports market growth.

Asia-Pacific Low-Code Development Platform Market Insight

The Asia-Pacific low-code development platform market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rapid digitalization, expanding SME adoption, and increasing cloud investments. Governments and enterprises across the region are accelerating application development to support digital services and customer engagement. The rising availability of cost-effective low-code solutions is further broadening adoption across emerging economies.

Japan Low-Code Development Platform Market Insight

The Japan low-code development platform market is gaining traction due to strong demand for enterprise automation and workforce efficiency. Japanese organizations increasingly adopt low-code platforms to address labor shortages and improve software development productivity. The integration of low-code platforms with enterprise systems and cloud infrastructure is contributing to steady market growth across manufacturing and service industries.

China Low-Code Development Platform Market Insight

The China low-code development platform market accounted for the largest revenue share in Asia-Pacific in 2025, supported by rapid enterprise digitalization and strong government focus on smart technologies. Chinese organizations increasingly use low-code platforms to accelerate application development and support large-scale digital ecosystems. The presence of domestic platform providers and high adoption across IT, manufacturing, and e-commerce sectors continue to propel market expansion.

Low-Code Development Platform Market Share

The low-code development platform industry is primarily led by well-established companies, including:

- Microsoft Corporation (U.S.)

- Oracle Corporation (U.S.)

- Salesforce.com, Inc. (U.S.)

- Appian Corporation (U.S.)

- Pegasystems Inc. (U.S.)

- Magic Software Enterprises Ltd. (Israel)

- AgilePoint, Inc. (U.S.)

- OutSystems (U.S.)

- Mendix Tech BV (Netherlands)

- Zoho Corporation Pvt. Ltd. (India)

- Quickbase, Inc. (U.S.)

- LANSA Inc. (Australia)

- Fujitsu RunMyProcess (France)

- Netcall Plc (U.K.)

- WaveMaker, Inc. (U.S.)

- K2 Software Inc. (U.S.)

- TrackVia, Inc. (U.S.)

- Thinkwise Software BV (Netherlands)

- MicroPact, Inc. (U.S.)

- Karnataka Municipal Data Society (India)

- PwC (U.K.)

Latest Developments in Global Low-Code Development Platform Market

- In January 2024, ServiceNow partnered with Visa to strengthen the low-code development platform market by introducing ServiceNow Disputes Management, Built with Visa, which enhances automation and efficiency in payment dispute resolution. This collaboration expands the use of low-code platforms in the financial services ecosystem by enabling issuers to deploy secure, scalable, and compliant dispute management workflows, reinforcing low-code adoption in mission-critical BFSI applications

- In December 2023, EY collaborated with Appian to accelerate enterprise adoption of low-code platforms for large-scale digital transformation initiatives. By combining Appian’s low-code capabilities with EY’s consulting and industry expertise, the partnership supports businesses in simplifying complex processes, improving operational agility, and integrating AI-driven automation, thereby expanding low-code usage across regulated and process-intensive industries

- In November 2023, Oracle Corporation strengthened its position in the low-code development platform market with the general availability of Oracle APEX 23.2, enabling organizations to build scalable enterprise-grade mobile, cloud, and SaaS applications. The release enhances developer productivity through advanced collaboration, process automation, and UI components, supporting broader enterprise adoption of low-code solutions for mission-critical applications

- In October 2023, Mendix launched Mendix 10.4 to accelerate end-to-end application development and increase the role of AI and machine learning in low-code workflows. The enhanced collaboration features, upgraded logic editors, and AI-assisted development tools improve development speed and quality, reinforcing Mendix’s competitiveness and driving increased adoption of low-code platforms among enterprises

- In August 2023, OutSystems expanded its Developer School program by launching specialized low-code development schools to address the global shortage of skilled developers. This initiative strengthens the low-code ecosystem by upskilling professionals in AI-enabled and high-performance application development, supporting long-term

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.